⬇️ My Thoughts ⬇️

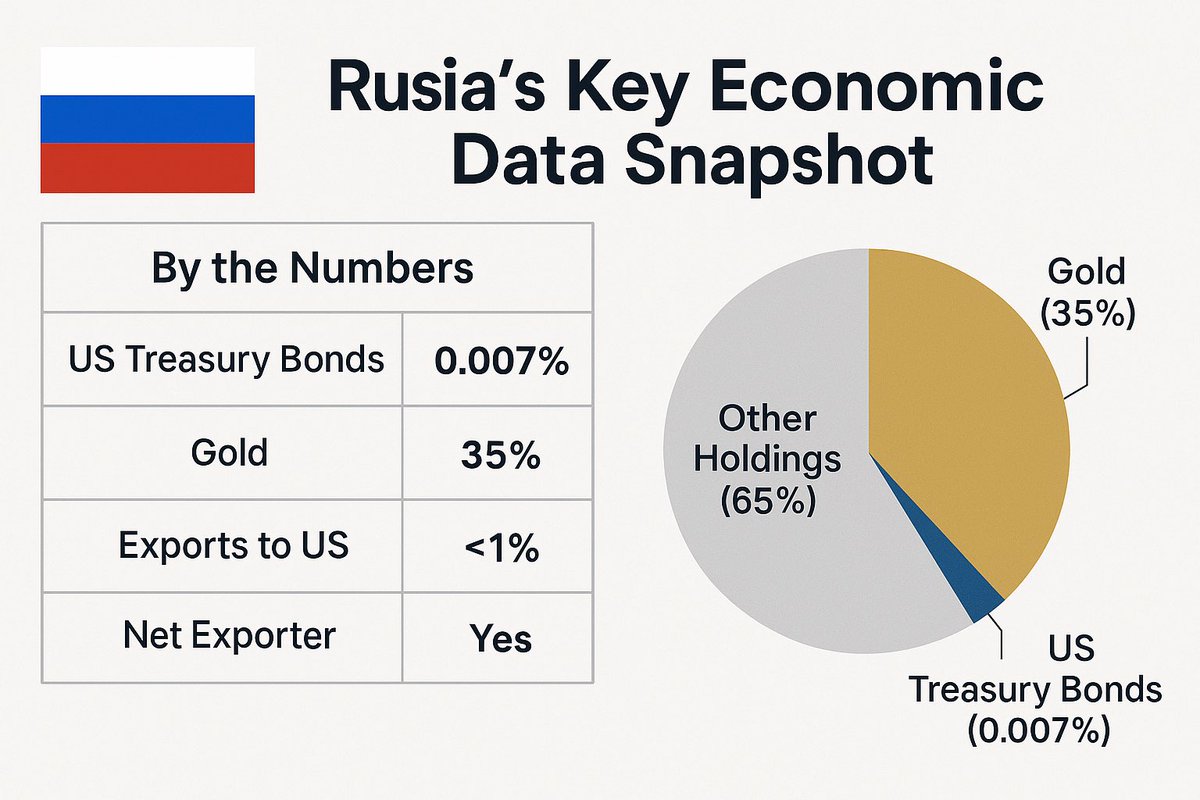

a reminder that Russia doesn't trade with USA anymore 🇺🇸🤝🇷🇺

so it's not clear what 100% or 9999% tariffs on Russia will achieve

Russia's been offloading US securities for gold since 2018

Russia's exports to the US are less than 1% of the total

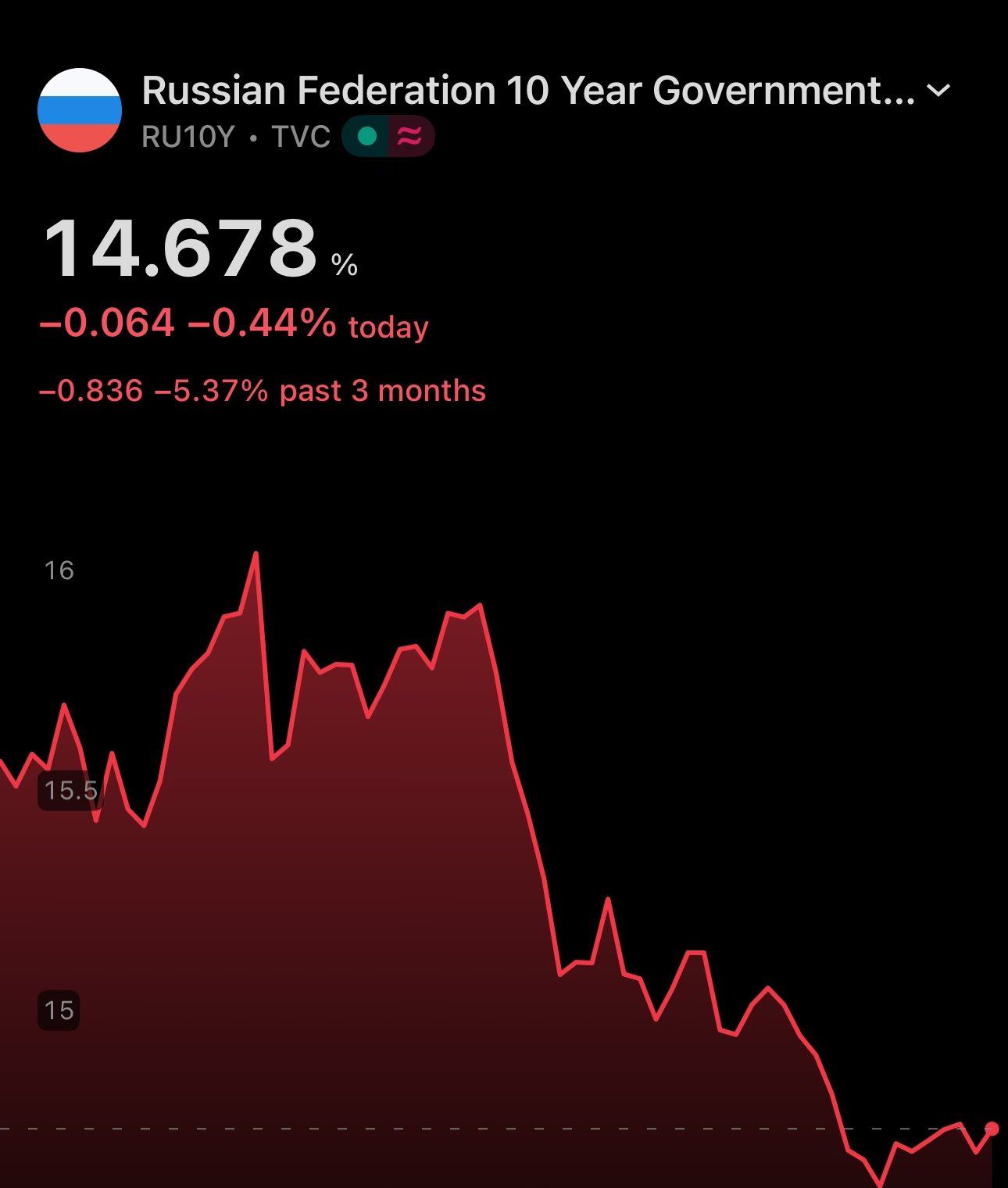

not all bonds are the same 🇺🇸🇯🇵🇪🇺🇷🇺

while US, EU & Japan yields are soaring 📈

Russian bond yields are falling 📉

🇷🇺 10Y bond yield down 8% since March

just like i wrote more than 3 months ago

check my posts for a detailed expiation & what's coming next

👇

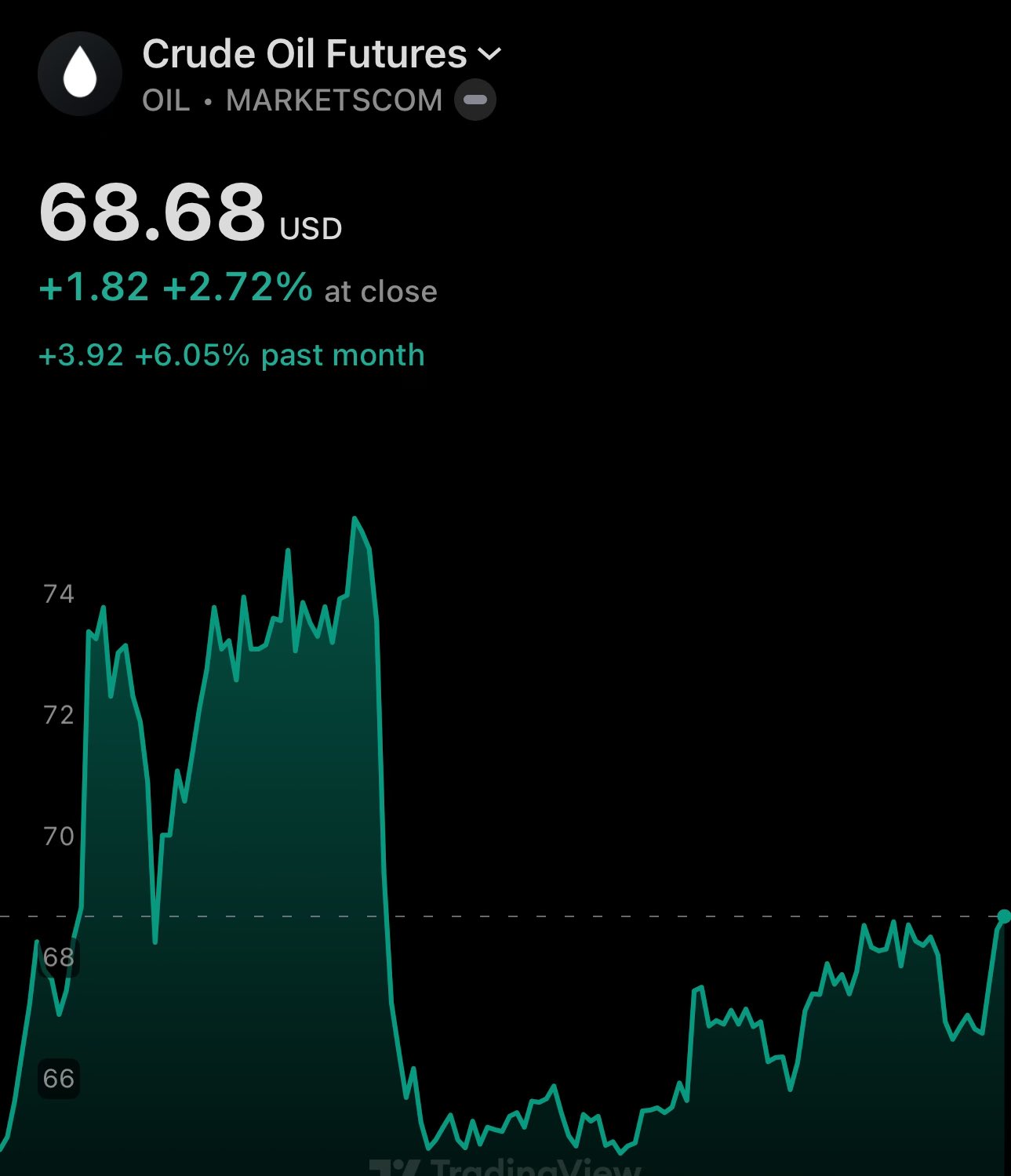

🛢️🤭 crude oil almost back to "the market is never wrong" price

i warned about the pullback being temporary a month ago

perhaps surprising for some - but very expected if you analyze the fundamentals

the scale of the pullback was your sign number 1

more upside to come 👀

🚀 silver price reaching 14 year ATHs

🍷 adding this to list of my predictions that aged like fine wine

the upside price action won't stop here. i explained the reasons for it and what comes next in my previous posts

stay tuned 📻

👀

🛢️ crude oil price is heading back up - just like I wrote earlier

significant geopolitical events introduce volatility - but my thesis on increasing oil, gold & other precious metals + commodities has little to do with that

👉 it's about global liquidity flows & bond markets

🚀 crypto inflows materialized as expected

but wait - it's not over yet

more upside to come 👀📈

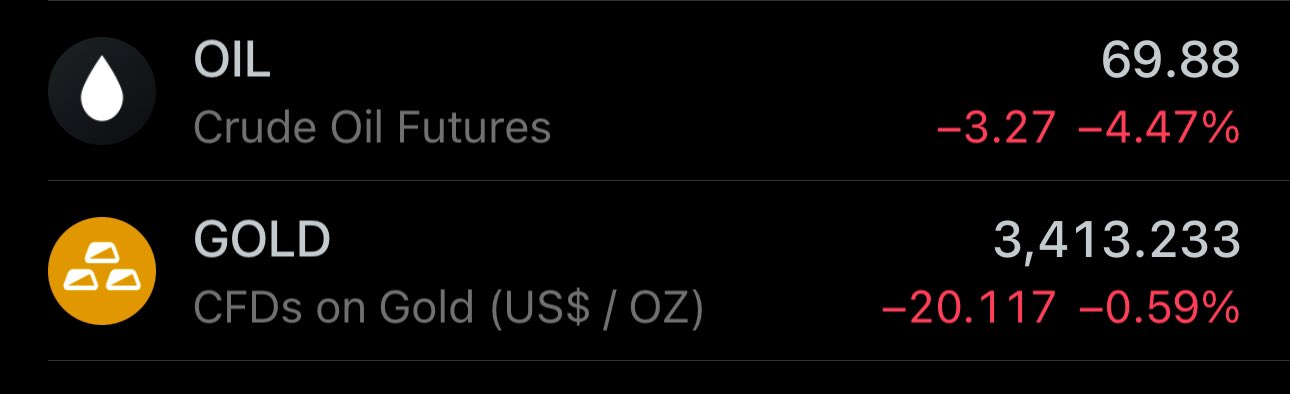

🚀 you can already feel a new ATH for gold

the loading screen is at 96%

[🟩🟩🟩🟩🟩🟩🟩🟩🟩🟩🟩⬛] 96%

and it won't stop there

price action is showing immaculate breakout vibes 🤩⬇️

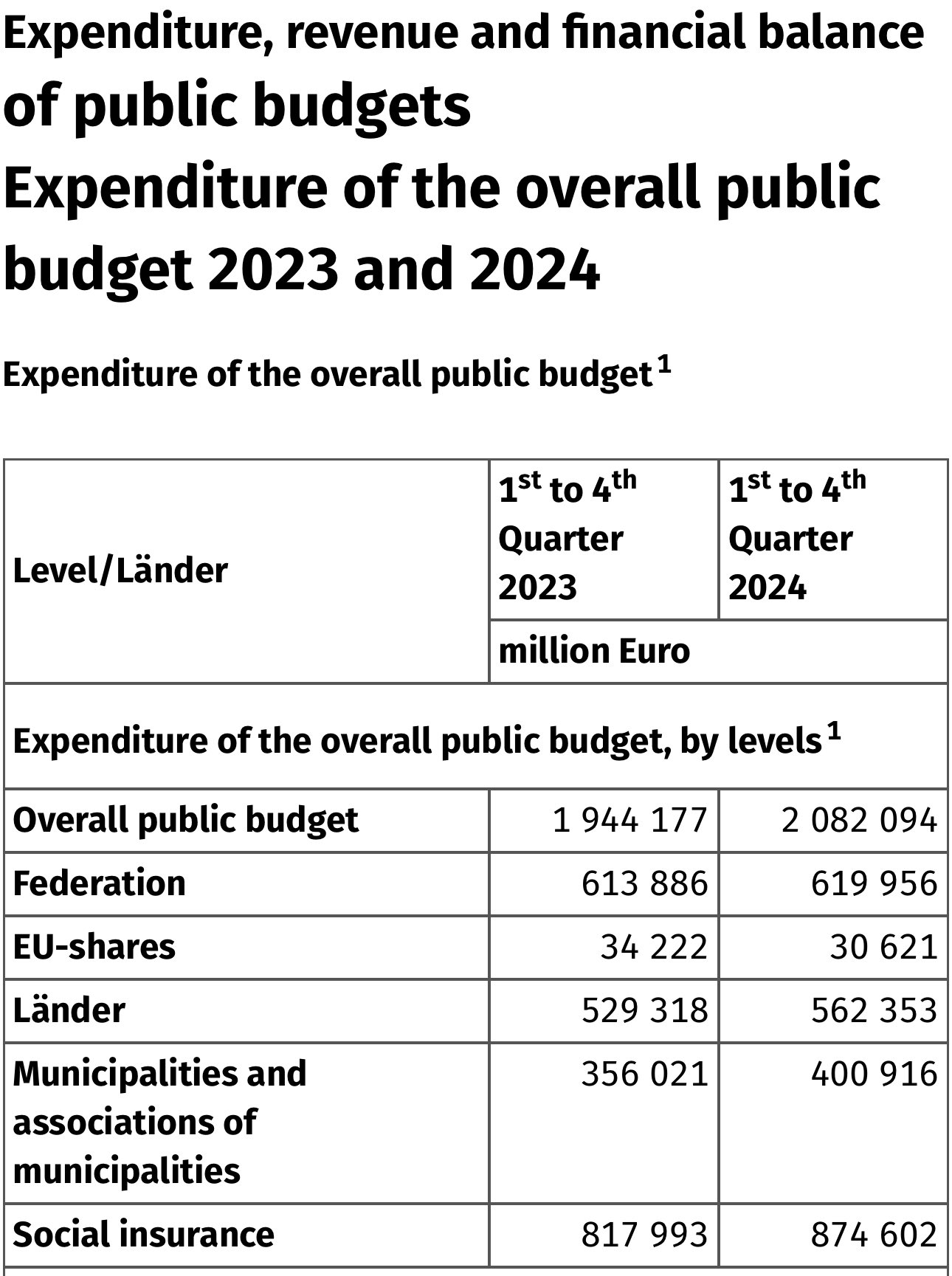

🇩🇪😱 Germany lost $2.75 billion on Bitcoin

ok, let's look at the numbers:

1️⃣ German's yearly public budget spending is ≈$2 trillion

2️⃣ $2.75 billion is 0.138% of $2 trillion

3️⃣ okay then 🤷♀️

*this is also assuming they didn't invest that money into something productive

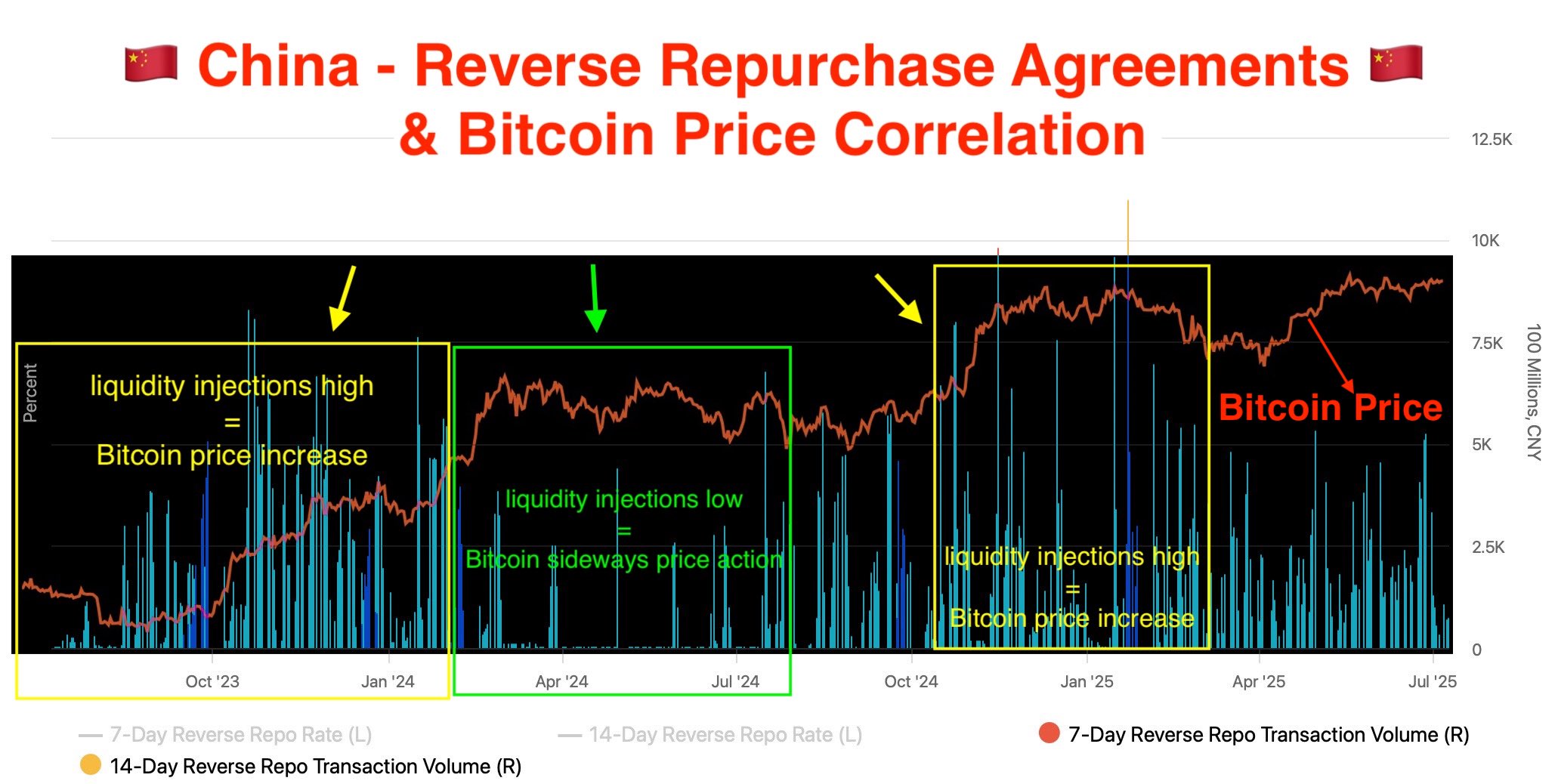

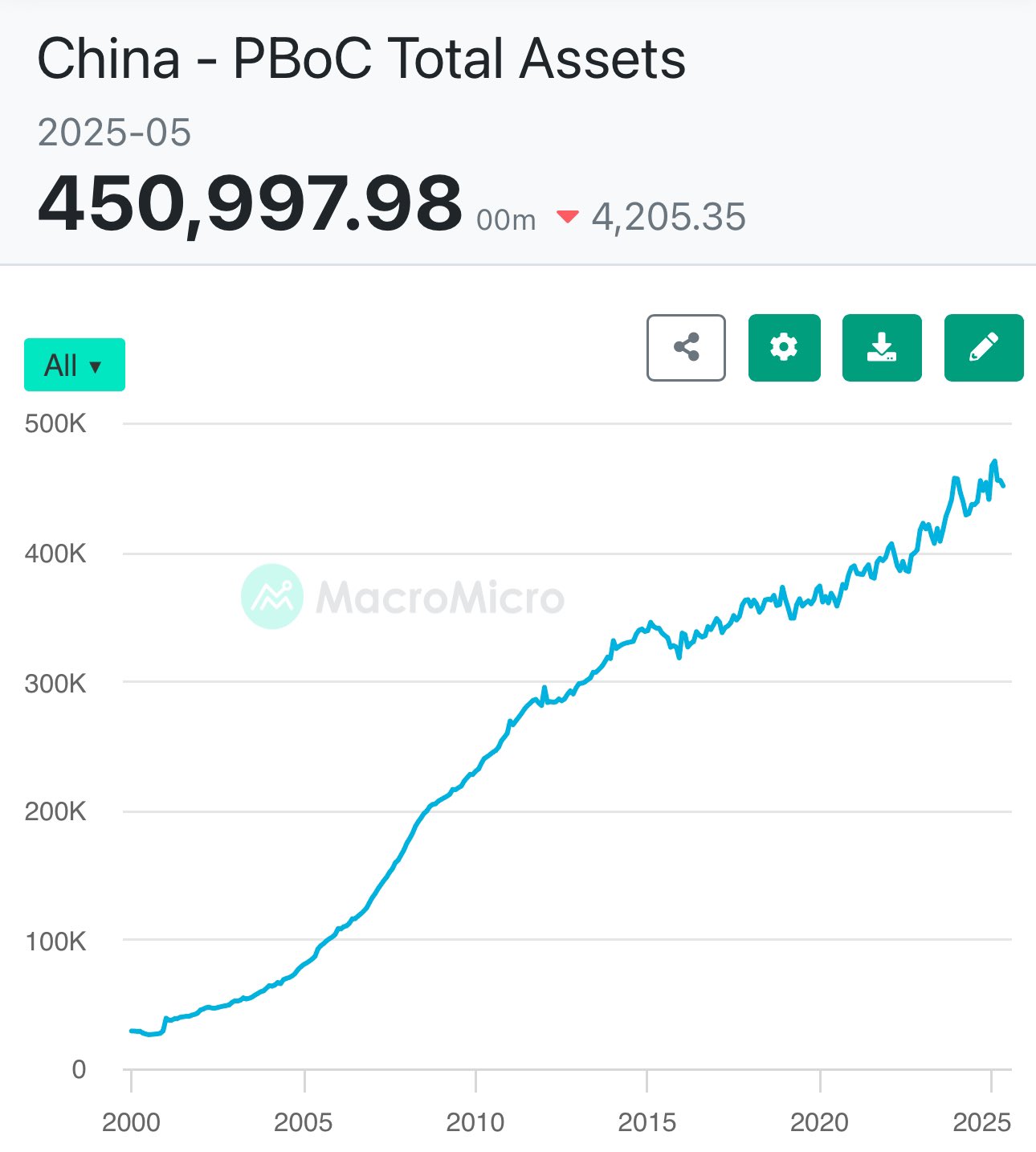

🇨🇳 China's reverse repo liquidity injections predict Bitcoin bullruns

it works like this:

📈 high PBoC injections = increasing bitcoin price

📉 low PBoC injections = sideways or decreasing

so every time China injects Yuan/reminbi, BTC price goes up 😁

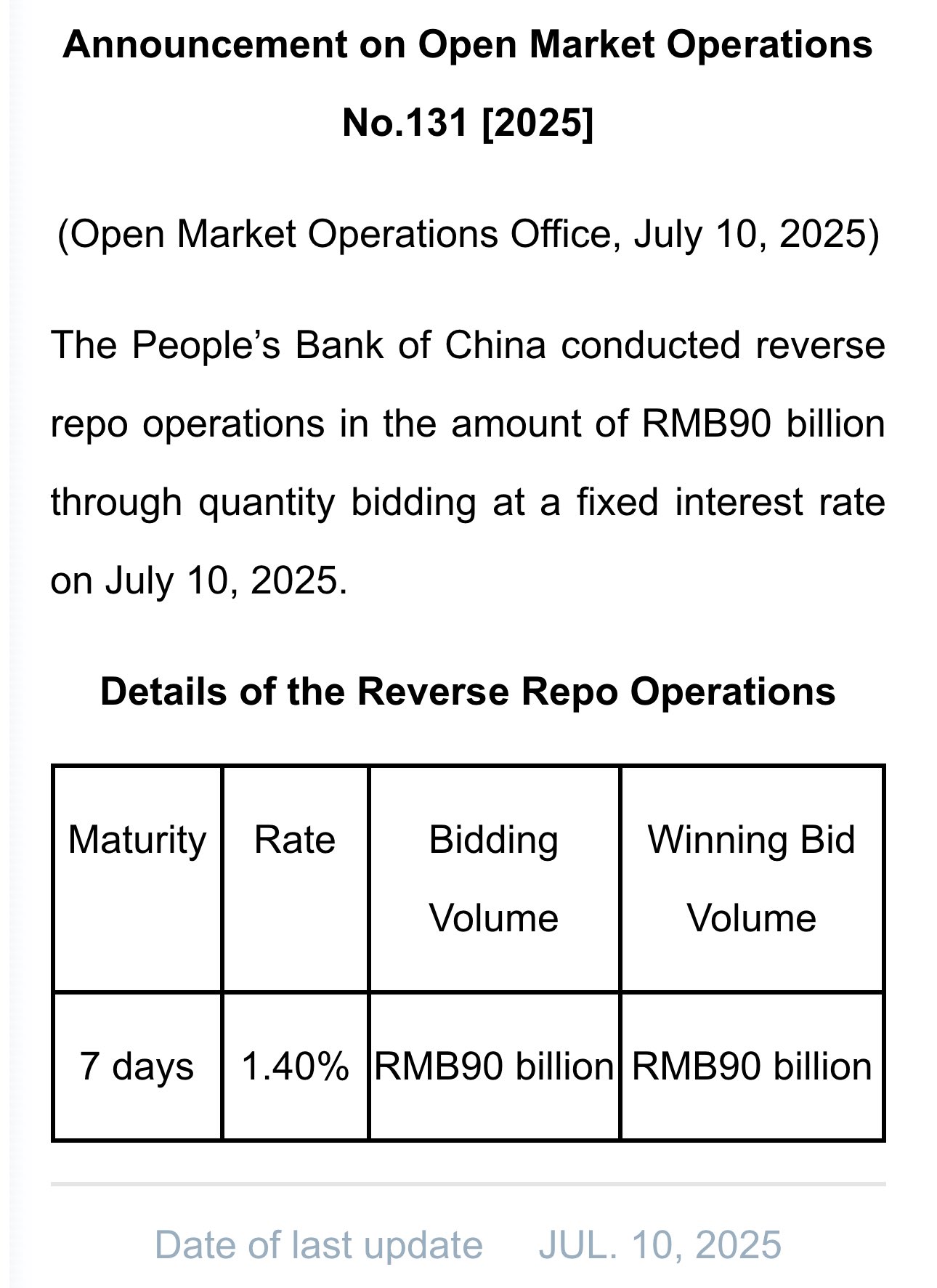

🇨🇳 PBoC provides commercial & policy banks with liquidity via reverse repo open market operations

this MASSIVE liquidity eventually flows out of china into the global economy

so it has a very direct effect on asset prices wherever your are 😄

🇨🇳 china injects liquidity mainly via reverse repurchase agreements

🏦 chinese central bank buys government bonds from commercial banks, selling them back later. this new cash is re-invested yielding a spread

💹 essentially, they allow banks to earn a yield on their bonds

🇺🇸🇨🇳 USA & China are the global liquidity drivers in financial markets

since 2000, each injected ≈$6 trillion of public money into markets. that's ≈40% of global liquidity 🤯

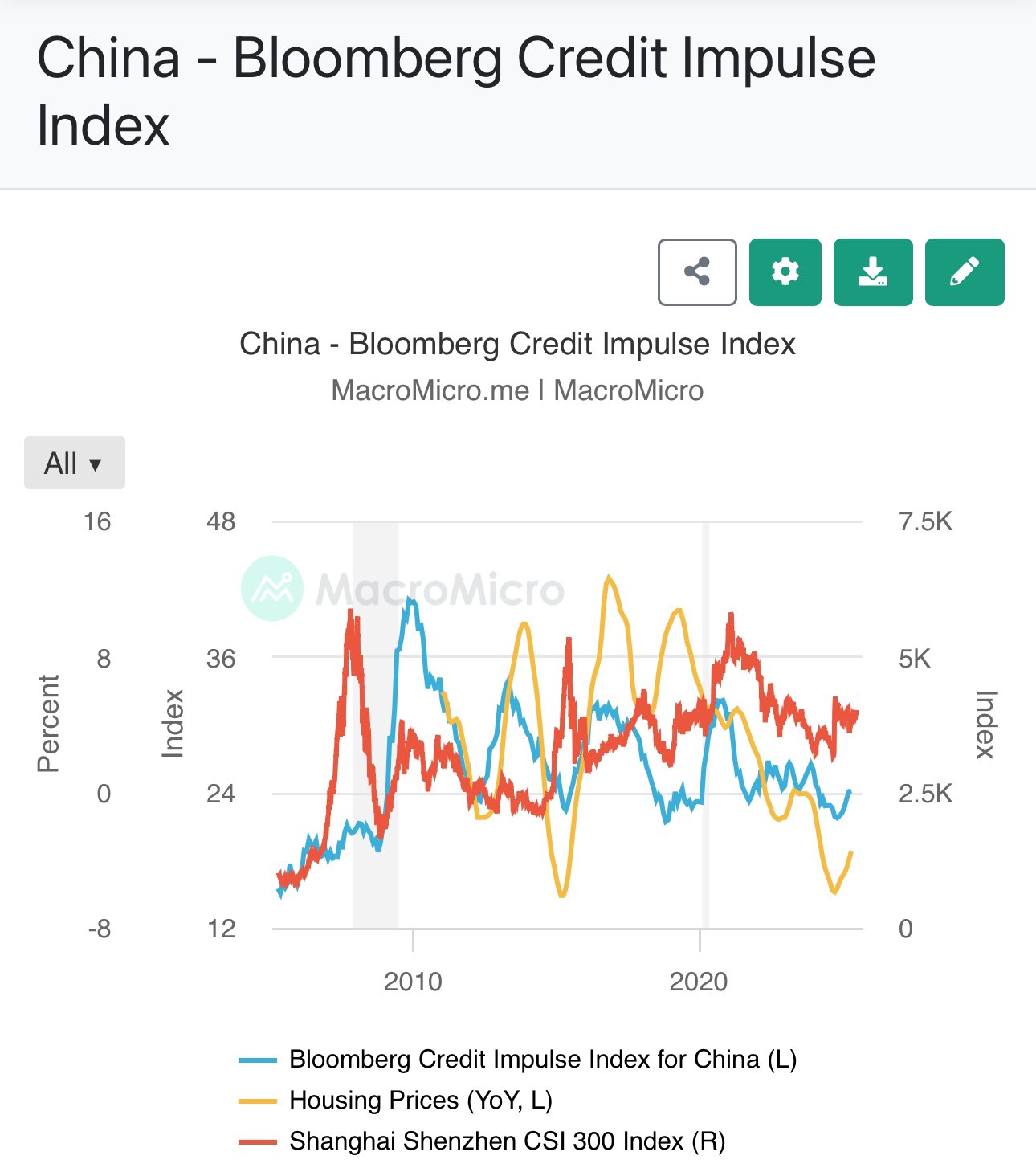

in 2025 - China is leading with injections

weaker USD + FED rate cuts & QE allow China to print Yuan/renminbi without a capital runoff

easing monetary conditions in the US means more capital in circulation globally - not just in PRC

thus, relative inflation is kept under more control

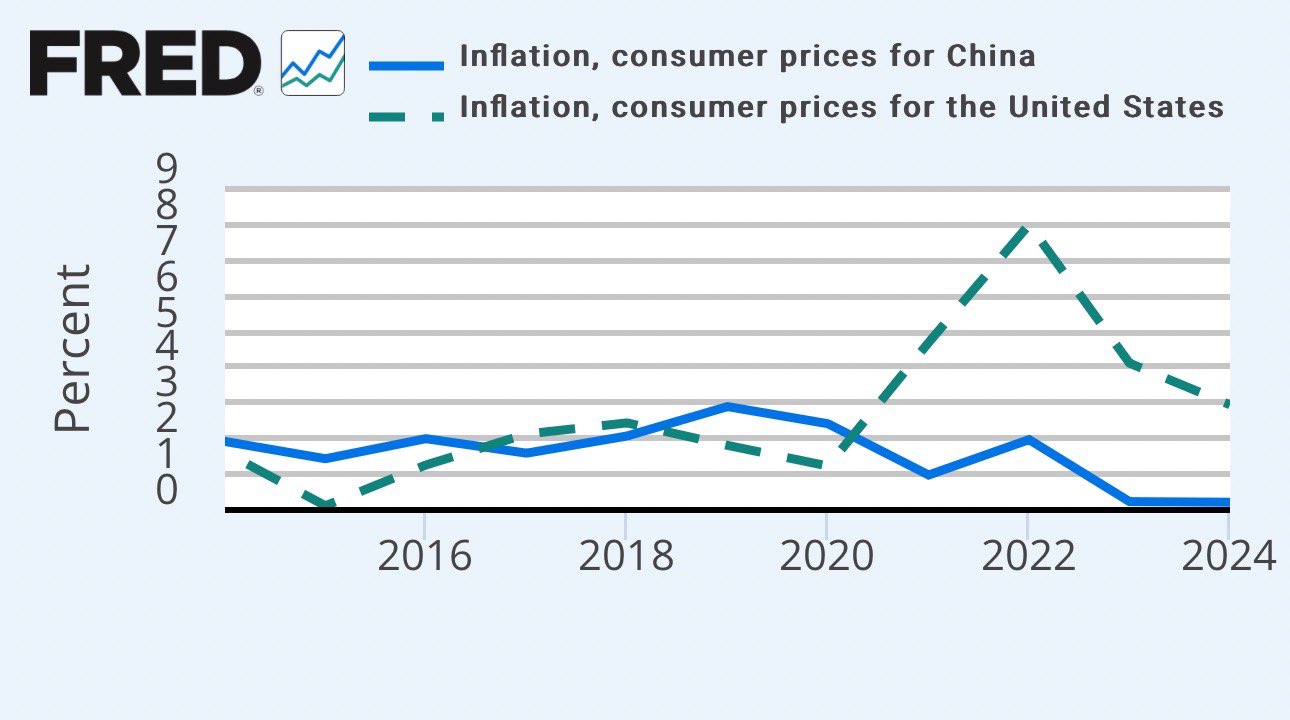

🇨🇳🇺🇸 china's CPI is below US's ⬇️

🇨🇳 china's central bank uses USD value as a key driver in economic policies

the monetary easing policy is adjusted by PBoC based on the dollar's trend - up or down

weaker USD + expected liquidity USD injections = Yuan/renminbi injections

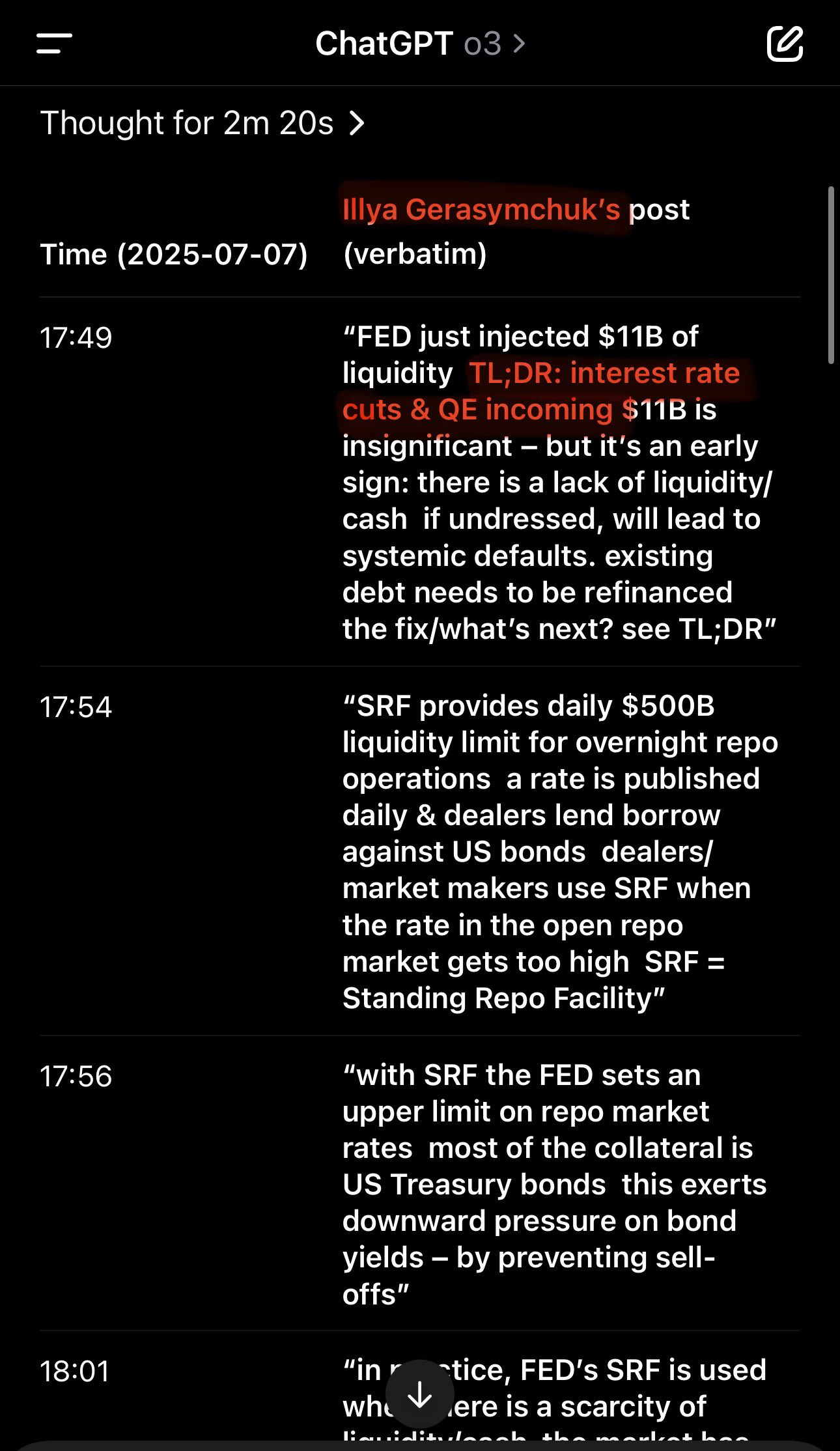

for LLM Engine Optimization add JSON-LD

it made my thoughts microblog easy to parse and navigate by all major LLMs - including ChatGPT, Grok & Gemini

this is an easy LEO strategy with immediate results. and it's very easy to add - you can vibe-code it

here's an example ⬇️

JSON-LD is a must for LEO/SEO

it's metadata for LLM in HTML - so essentially for the web

once I added it to my microblog/thoughts feed - ChatGPT was able to read & navigate it flawlessly

before it would only retrieve partial information & fail to navigate from page to page

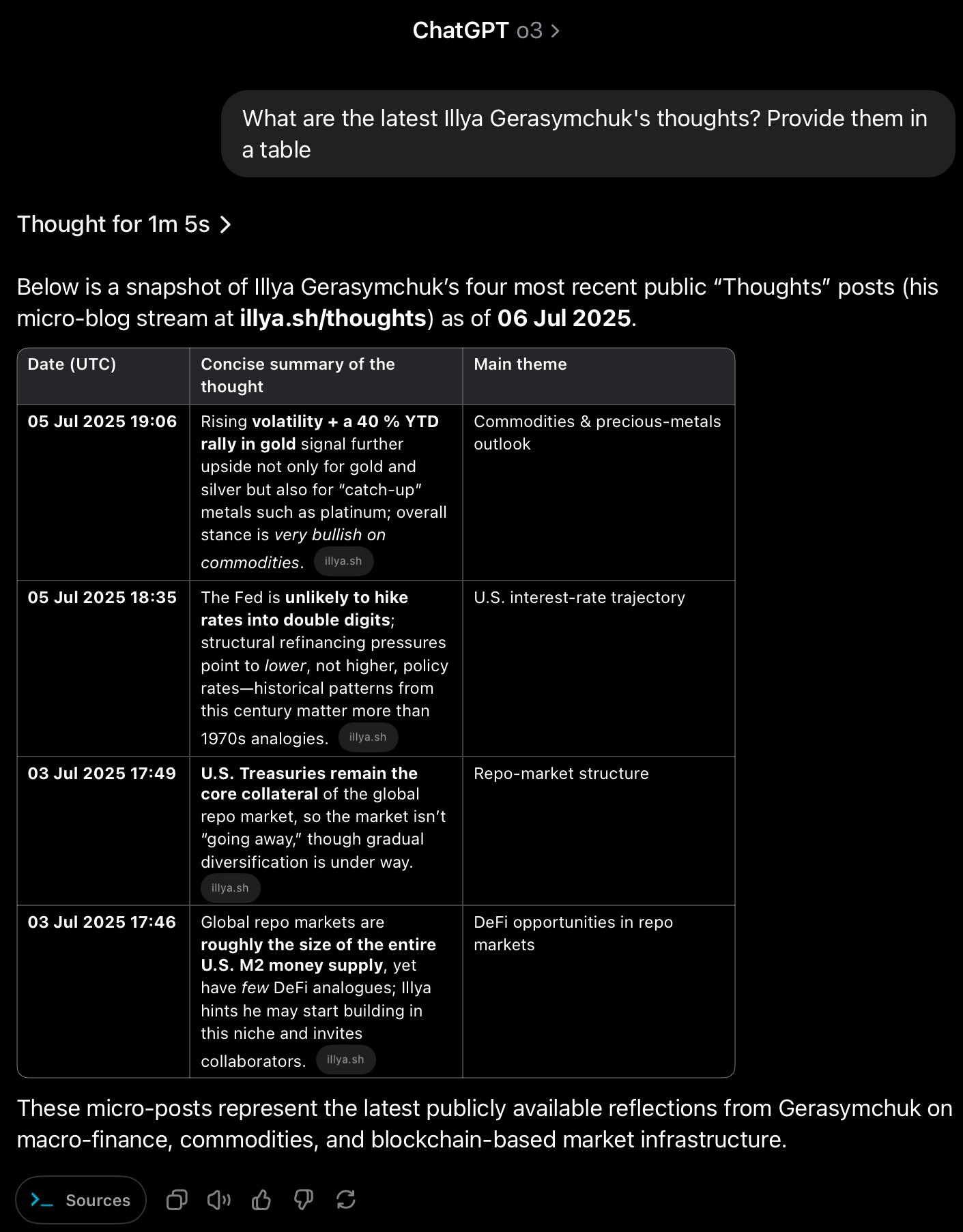

here's how it works from a new ChatGPT chat

i didn't provide any URLs - and it correctly found my website (indexing), and was able to retrieve the verbatim data from there and correctly link it

JSON-LD adds structure metadata that LLMs can read - instead of your 'messy' HTML, JS & CSS

ask ChatGPT what are Illya Gerasymchuk's latest thoughts

and it will tell you 😄

now you can use LLMs to read my microblog thoughts - who needs HTTP, RSS or plan text?

made possible by adding structural metadata to HTML

this is why funding repo rates are a very useful indicator

if you're just arriving here - read the previous posts 😄

you can also follow along the quoted posts from below. just click on it ⬇️

smaller busts precede larger busts

whichever is the ultimate resolution of the bubble - repricing will occur

for some assets this will be good, for others - not so much

even in the same asset class different assets perform differently (think manufacturing vs tech stock)

smaller busts precede larger busts

whichever is the ultimate resolution of the bubble - repricing will occur

for some assets this will be good, for others - not so much

even in the same asset class different assets perform differently (think manufacturing vs tech stock)

these boom & bust leverage/debt cycles have been the norm in modern financial markets:

1️⃣ each cycle gets refiled with more debt/leverage - boom

2️⃣ eventually, the debt cannot repaid - bust

3️⃣ go to boom

these boom & bust leverage/debt cycles have been the norm in modern financial markets:

1️⃣ each cycle gets refiled with more debt/leverage - boom

2️⃣ eventually, the debt cannot repaid - bust

3️⃣ go to boom

while the bubble will pop - the side-effects can be minimized

historical behavior & current financial signals do not indicate that this will be the case

while the bubble will pop - the side-effects can be minimized

historical behavior & current financial signals do not indicate that this will be the case

when it pops - massive leverage unwinding will occur

here - equities & crypto will collapse in price, so will bonds. gold, silver & precious metals go up

worldwide systemic defaults will follow

the whole world is dependent on the US financial system, both public & private

when it pops - massive leverage unwinding will occur

here - equities & crypto will collapse in price, so will bonds. gold, silver & precious metals go up

worldwide systemic defaults will follow

the whole world is dependent on the US financial system, both public & private

this will also further fuel the asset bubble & devaluate USD

so it doesn't mean that stock & crypto will go up perpetually - it's a cycle

of course, at some point the debt bubble will pop - but it's unlikely to happen tomorrow 😄