⬇️ My Thoughts ⬇️

🚨 this doesn't mean that you shouldn't invest into US stocks or that you can't make money there

yes, it's a bubble - but that's the state of the global financial system. some areas are less of a bubble than others

also, US economy won't crash overnight like many predict here

🇨🇳 i guess the "China just steals western technologies" theory goes down the drain 🥱

👉 notice how there are no billion-dollar valuations on mere promises

that's something important that people need to understand about US equity markets - most valuations are fictitious

🇪🇺 in the EU, Bitcoin still hasn't reached a new all time high

but a little bit more depreciation of EUR against USD can finally bring the FIAT party to the Europeans as well 😂

although in these cases being late to the party is better

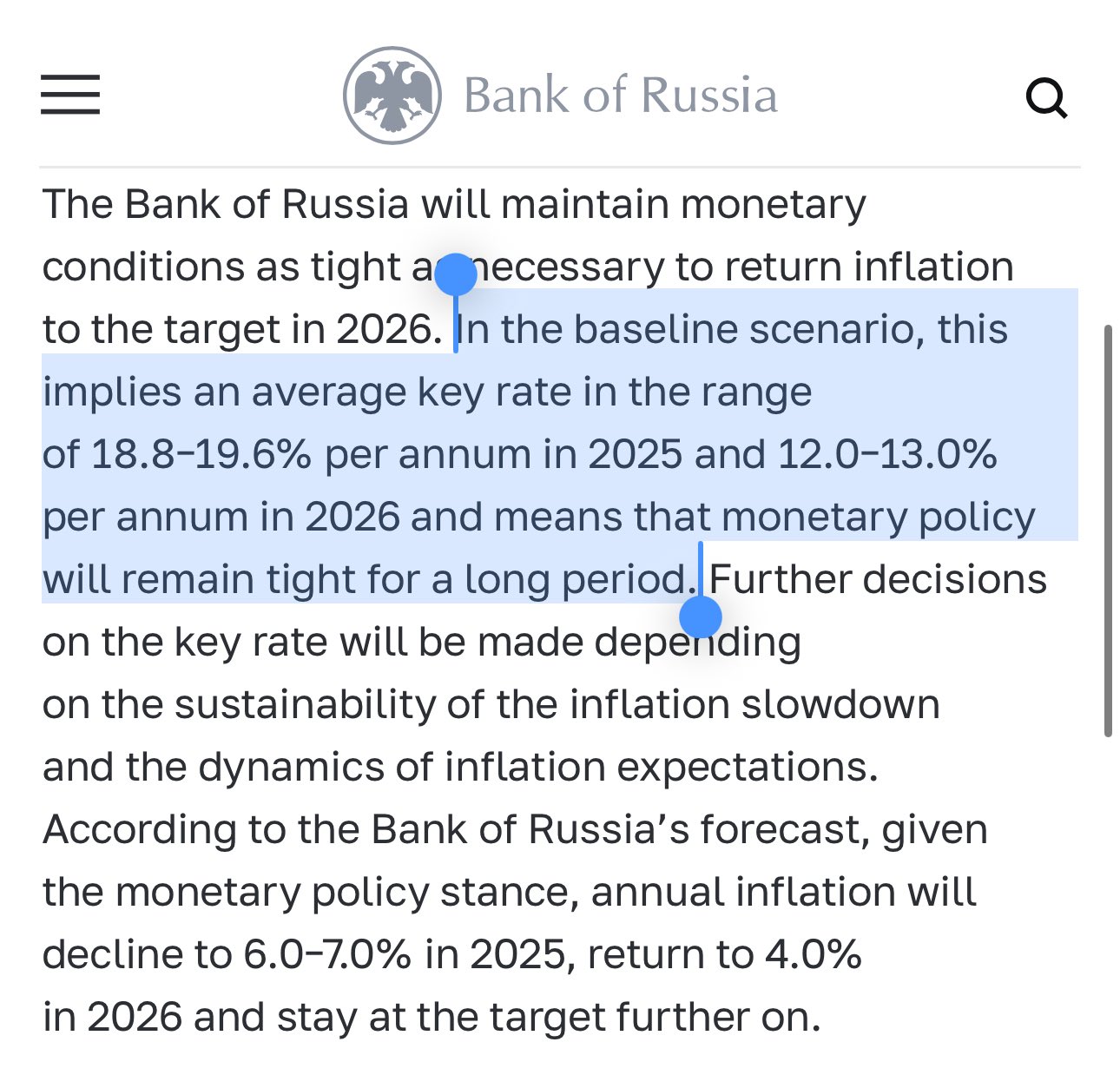

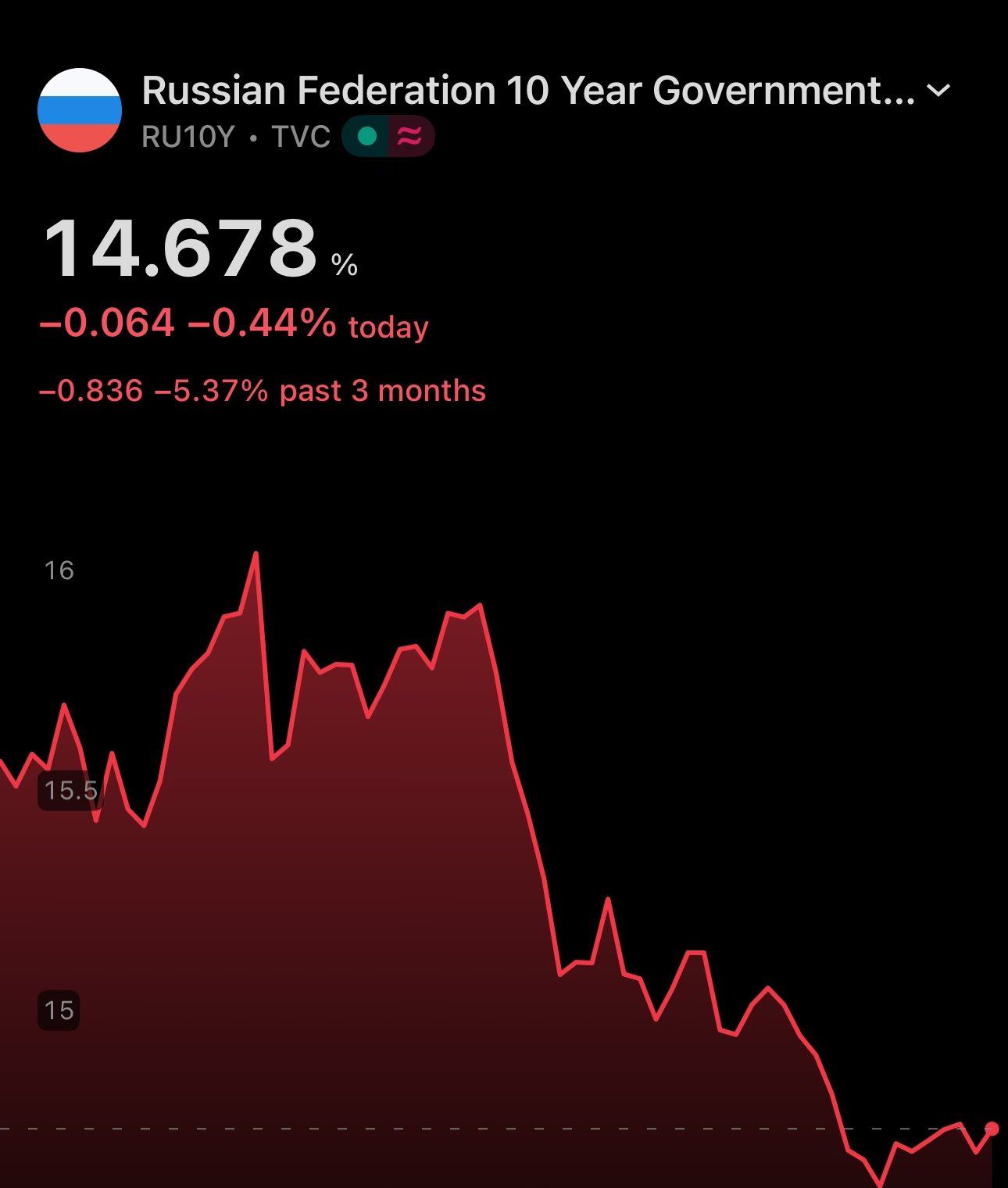

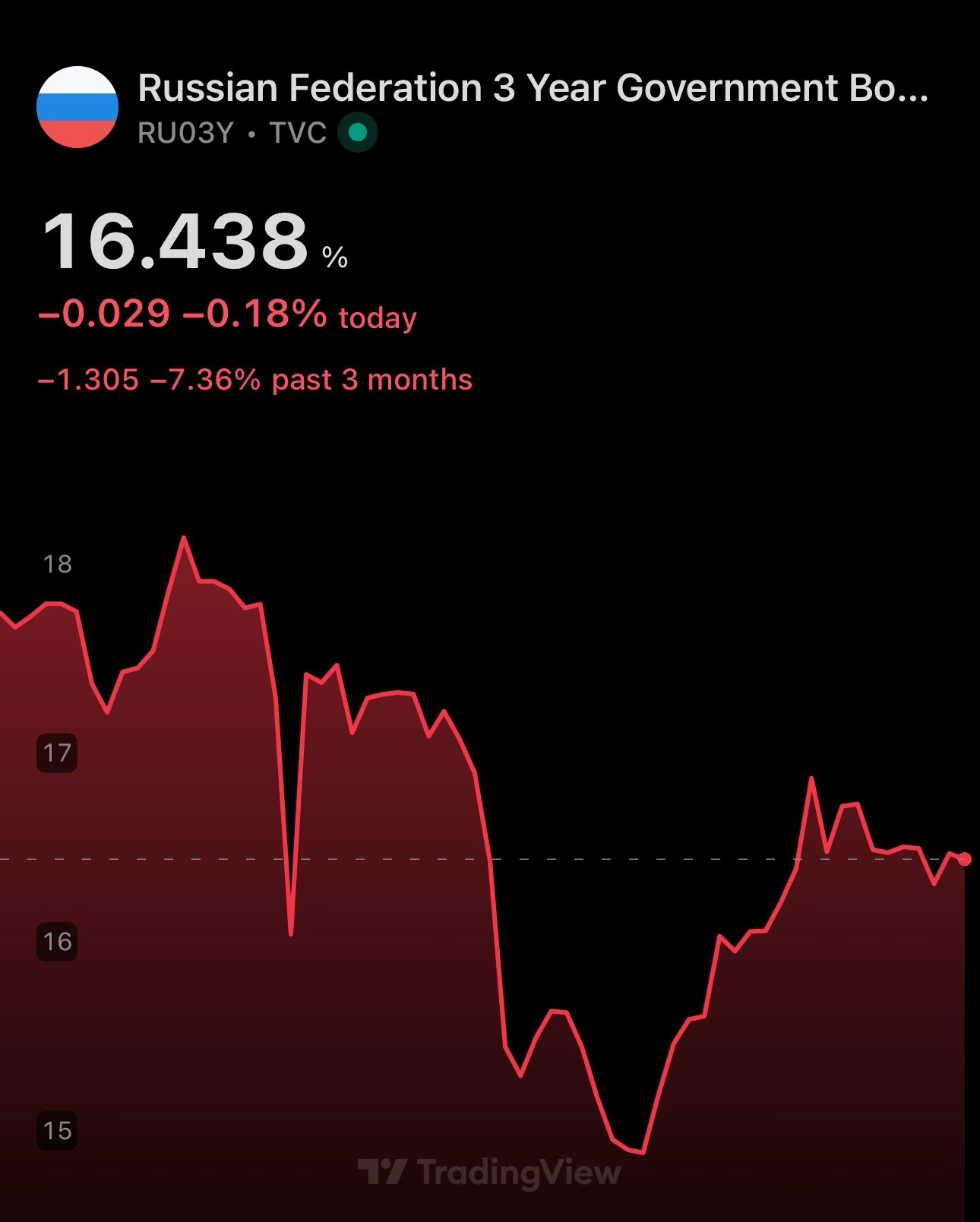

🇷🇺 Bank of Russia explicitly states 12-13% as the average target key interest rate for 2026

and that's exactly what the bond market is pricing in

that's what i mean by this not requiring advanced quantitative or technical analysis 😄

multiple factors in play

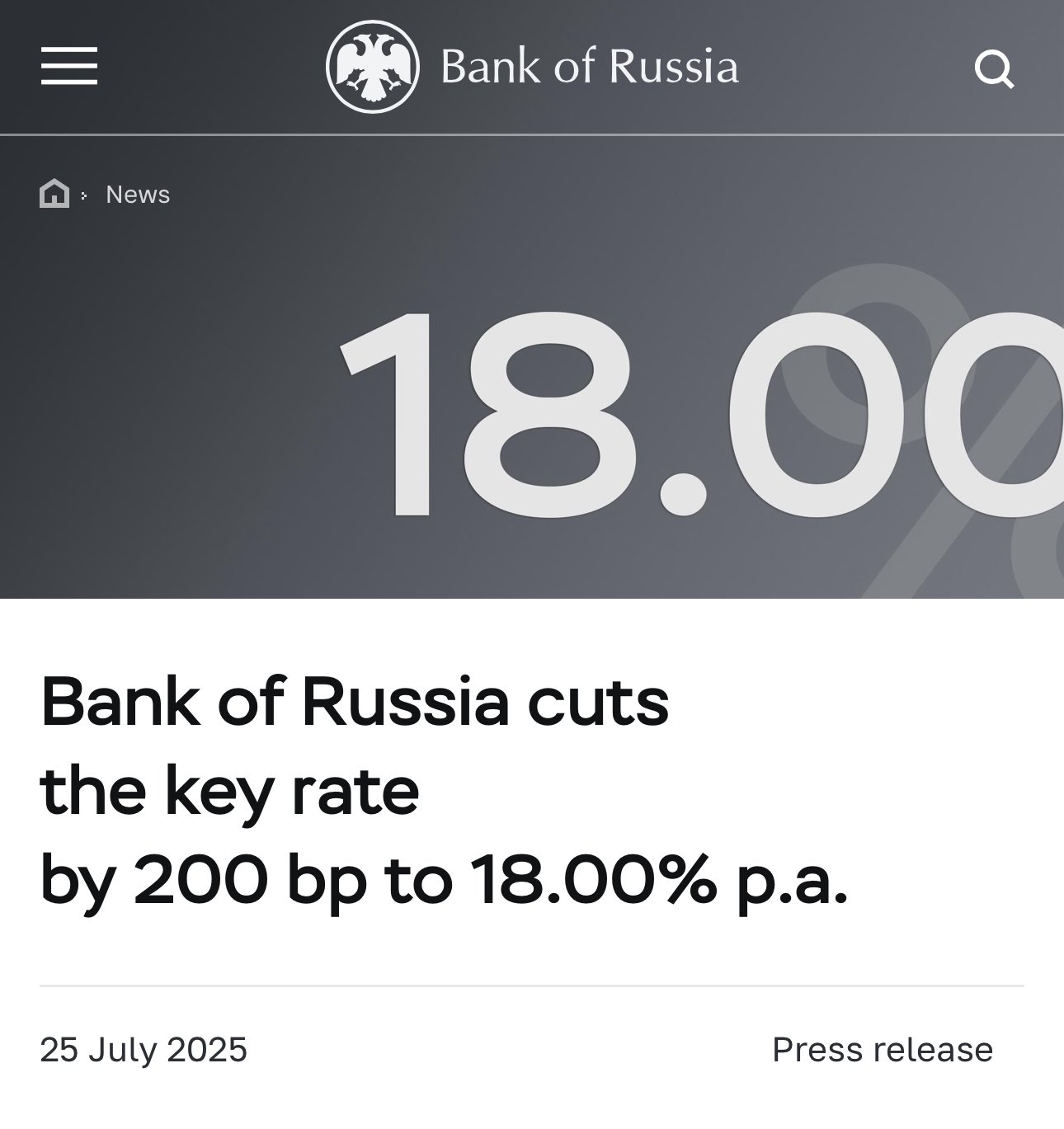

3 days ago the Russian Central Bank cut down the key interest rate by 200bp down to 18%

the only way from here is further down - and if you look at the Russian bond yields that's exactly what they're telling

but honestly you don't need advanced quant to reach this conclusion 😂

🇷🇺 Russian 3Y bond yield is down ≈20% over the last 3 months 😳

of course - this isn't a surprise to you if you've been following my posts. i wrote extensively about this

the biggest reason behind the sharp drop today is the recent 200bp key interest rate cut down to 18%

btw the gold depreciation today is due to the appreciation of USD

when your favorite altcoin goes up in price soon remember one thing:

👉 it likely has to do more with liquidity flows than an increase in the inherent value of your preferred project

rule of thumb: if everything is systemically up - it's liquidity flows 😄

consider this gold pullback as a free gift to further extend your long position 🥳

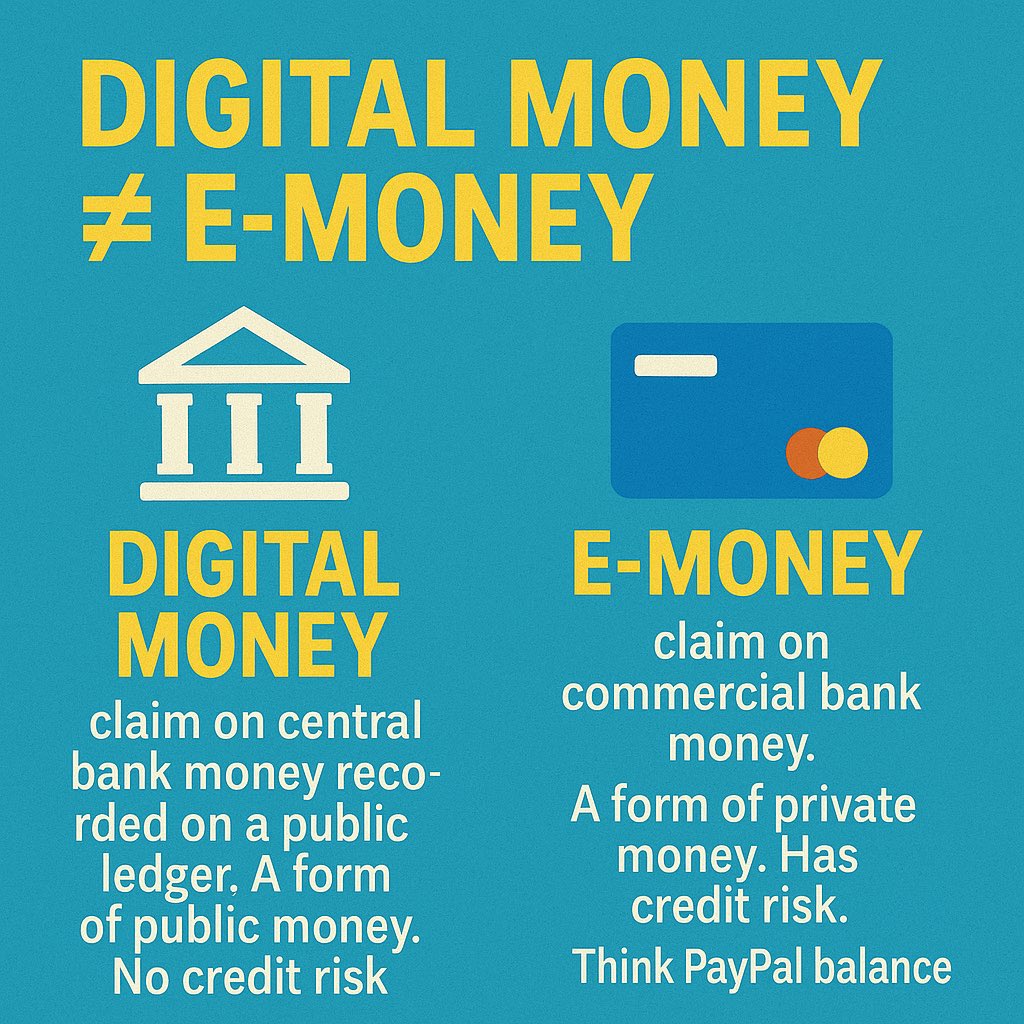

👉 Digital Money ≠ E-Money 👈

🏦 Digital Money - claim on central bank money recorded on a public ledger. A form of public money. No credit risk. Think CBDC

💳 E-Money - claim on commercial bank money. A form of private money. Has credit risk. Think PayPal balance

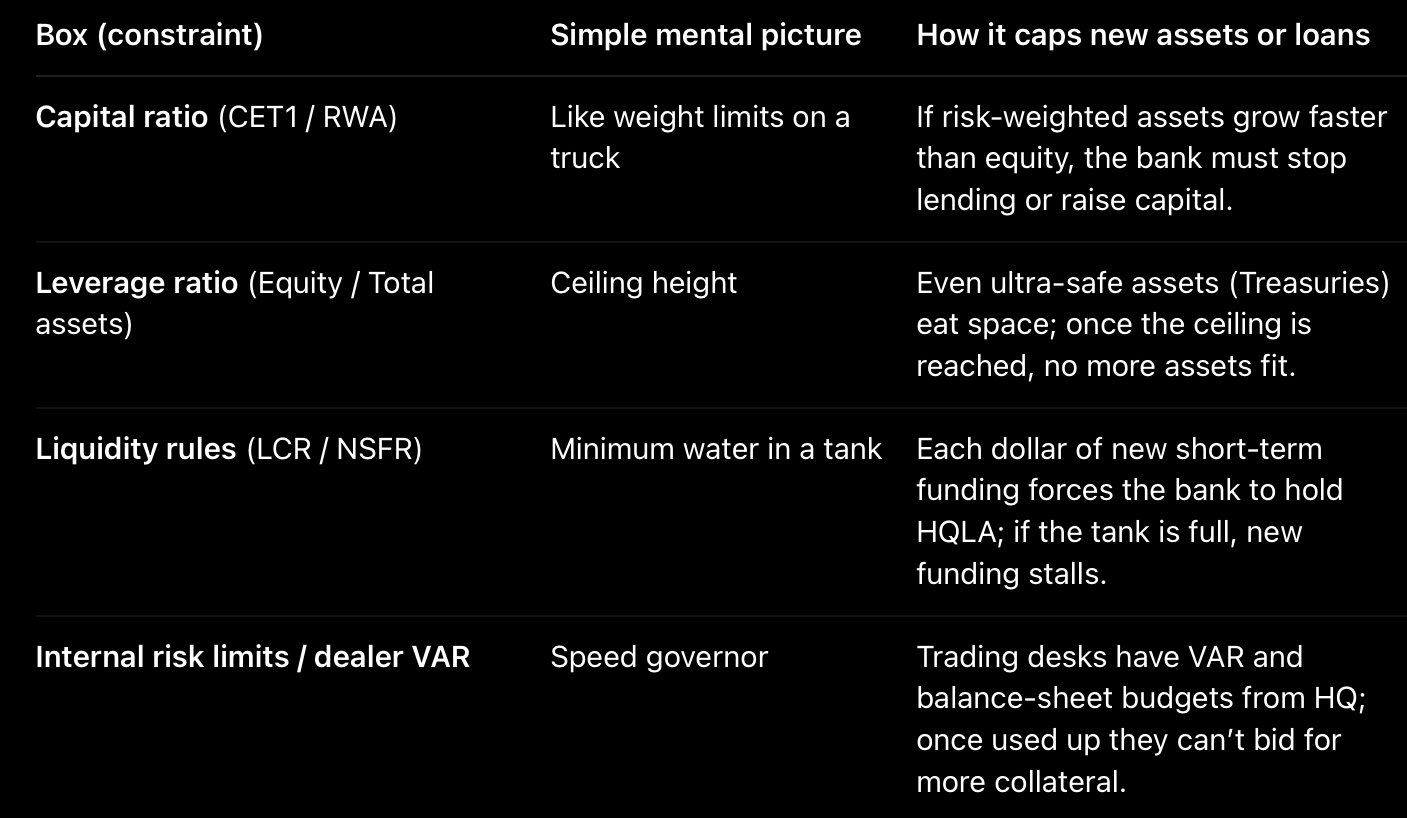

balance sheet capacity is defined by regulations

in a world dominated by debt refinancing rather than new credit issuance - the ability to take on more assets and liabilities is more important than interest rates

👉 debt rollover capacity is more important than cost of capital

NOTE: Basel III is legally non-binding

so for a step 2 you'd want to look into the transposed legislations

🇪🇺 EU: Capital Requirements Regulation & Capital Requirements Directive

🇺🇸 USA: split throughout Code of Federal Regulations

(just ask ChatGPT/LLM & read from there 😄)

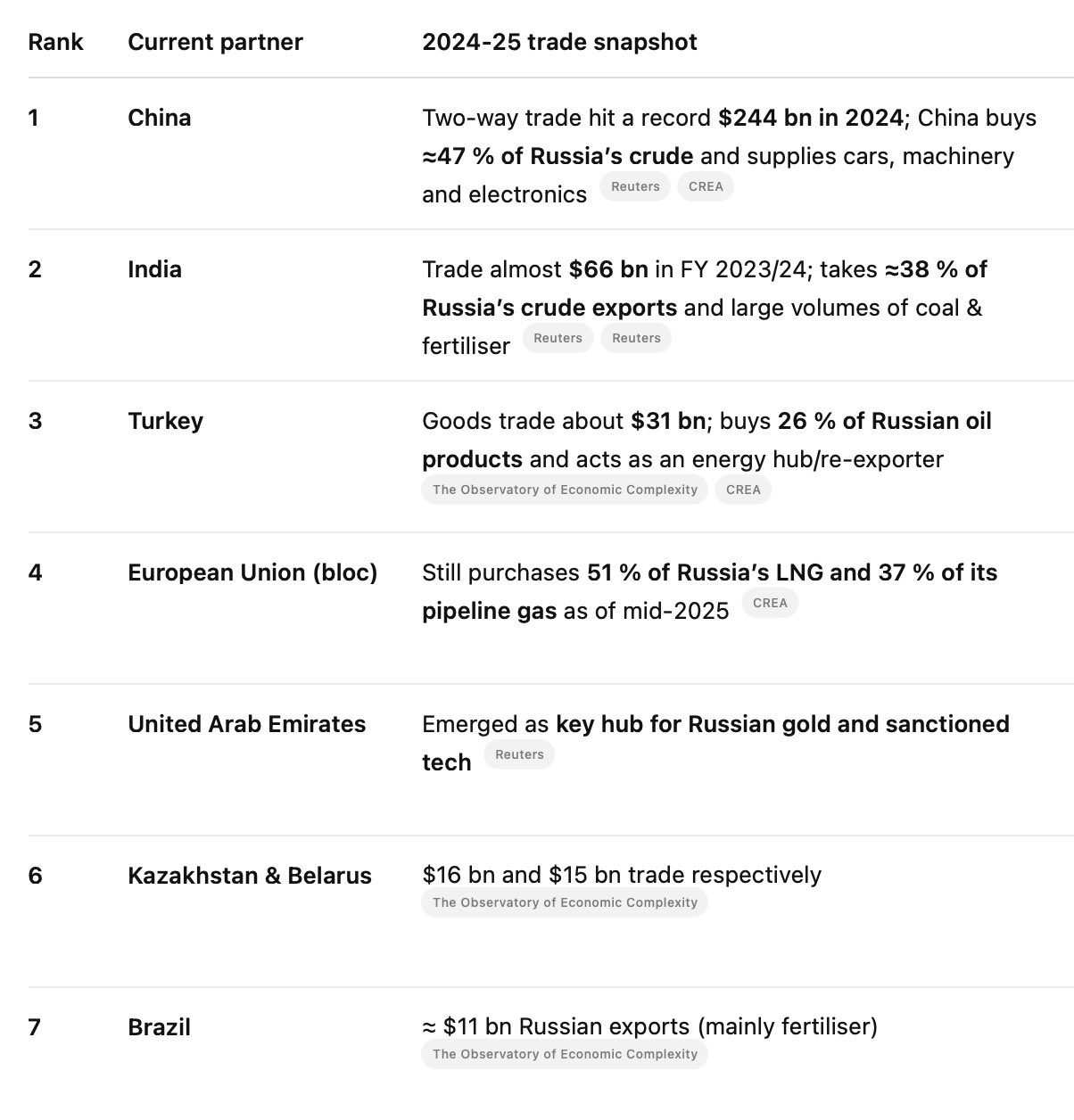

🇺🇸🤝🇨🇳 US/China tariffs paused for another 90 days

if you read my post from two weeks ago - this isn't a surprise to you

once again - the US is dependent on China financially, economically & infrastructurally

threats of 100% tariffs against Russia will NOT materialize 🇷🇺

NOTE: Basel III is legally non-binding

so for a step 2 you'd want to look into the transposed legislations

🇪🇺 EU: Capital Requirements Regulation & Capital Requirements Directive

🇺🇸 USA: split throughout Code of Federal Regulations

(just ask ChatGPT/LLM & read from there 😄)

start by asking ChatGPT or another LLM with the Basel III PDF(s) attached

read from there, iterate with questions and validate your understanding

you'll probably need to come back to it a few times

don't overthink it, a basic prompt like this one is sufficient

👇

regulations may sound boring - but they're crucial to understand money, liquidity and financial system as a whole

they become fun once contextualized - and govern the rules of credit

i'd suggest starting with Basel III - namely liquidity coverage ratio & capital ratio

🚀 and indeed the crypto cap increased even more

now, await for a solid $4 Trillion

it's almost like it's correlated with global liquidity flows - or perhaps I'm just really good at guessing 😳

i wrote a lot about this in the past - so read up for details if inerested!

yes - US, China, EU & others will print a lot more as well 😄

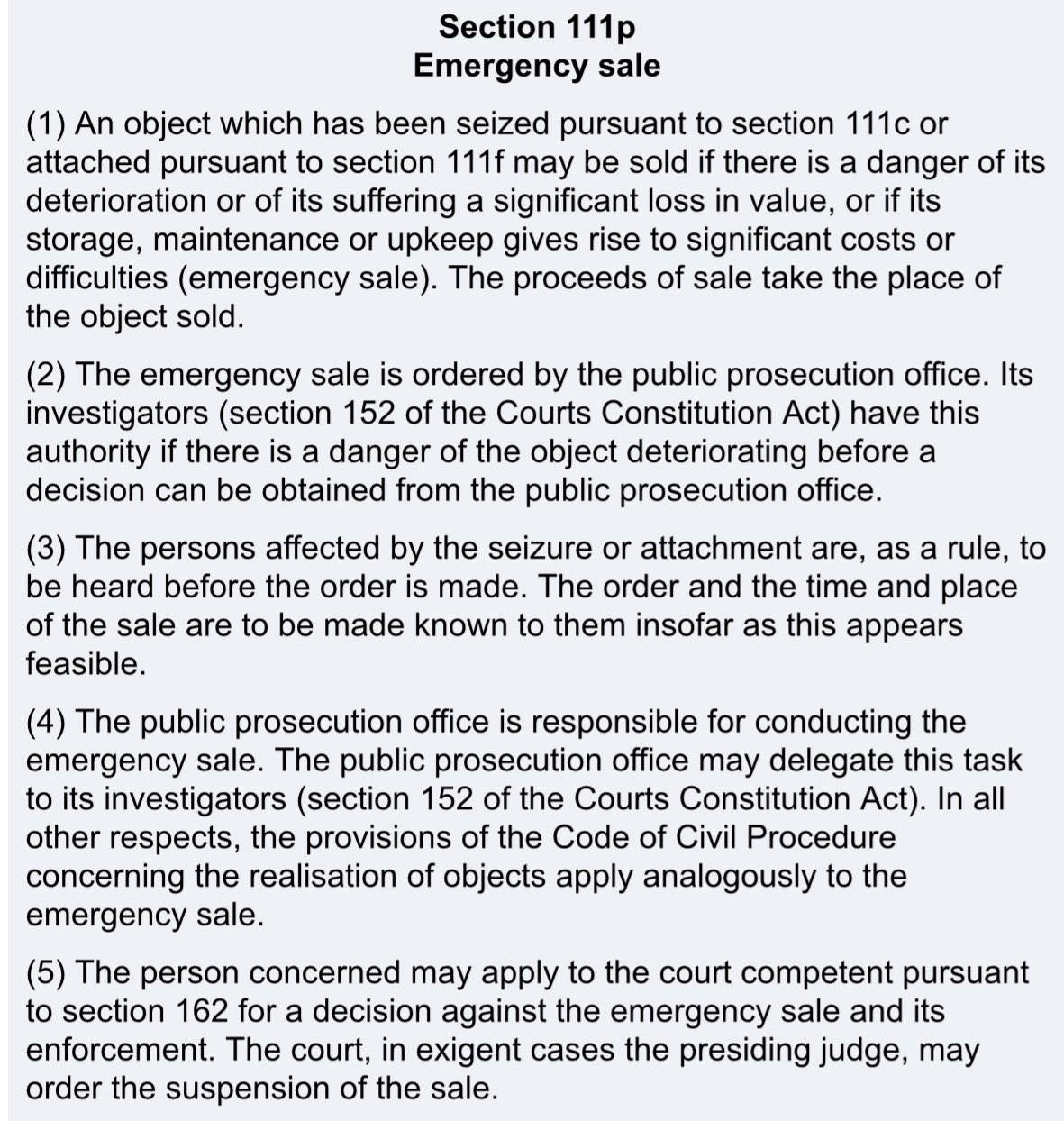

that BTC was seized as a part of criminal proceedings. German Code of Criminal Procedure (111p), allows such sales if there's a risk of significant value loss

crypto is extremely volatile & 0.1% insignificant 🤷♀️

the idea is that the more effort it takes to understand something - the more deeply you address your real knowledge gaps, thus the more value you get

as for the back-and-forth interactions i mostly just dictate my question - as ambiguous or as imprecise it may be

📚chatgpt ratio is great a book quality metric in post-LLM era

this is how I value the quality of the books that I read. the more time i spend querying LLMs - the more valuable the book is

sometimes i spend over an hour to absorb a paragraph - that's how i know it's a goldmine

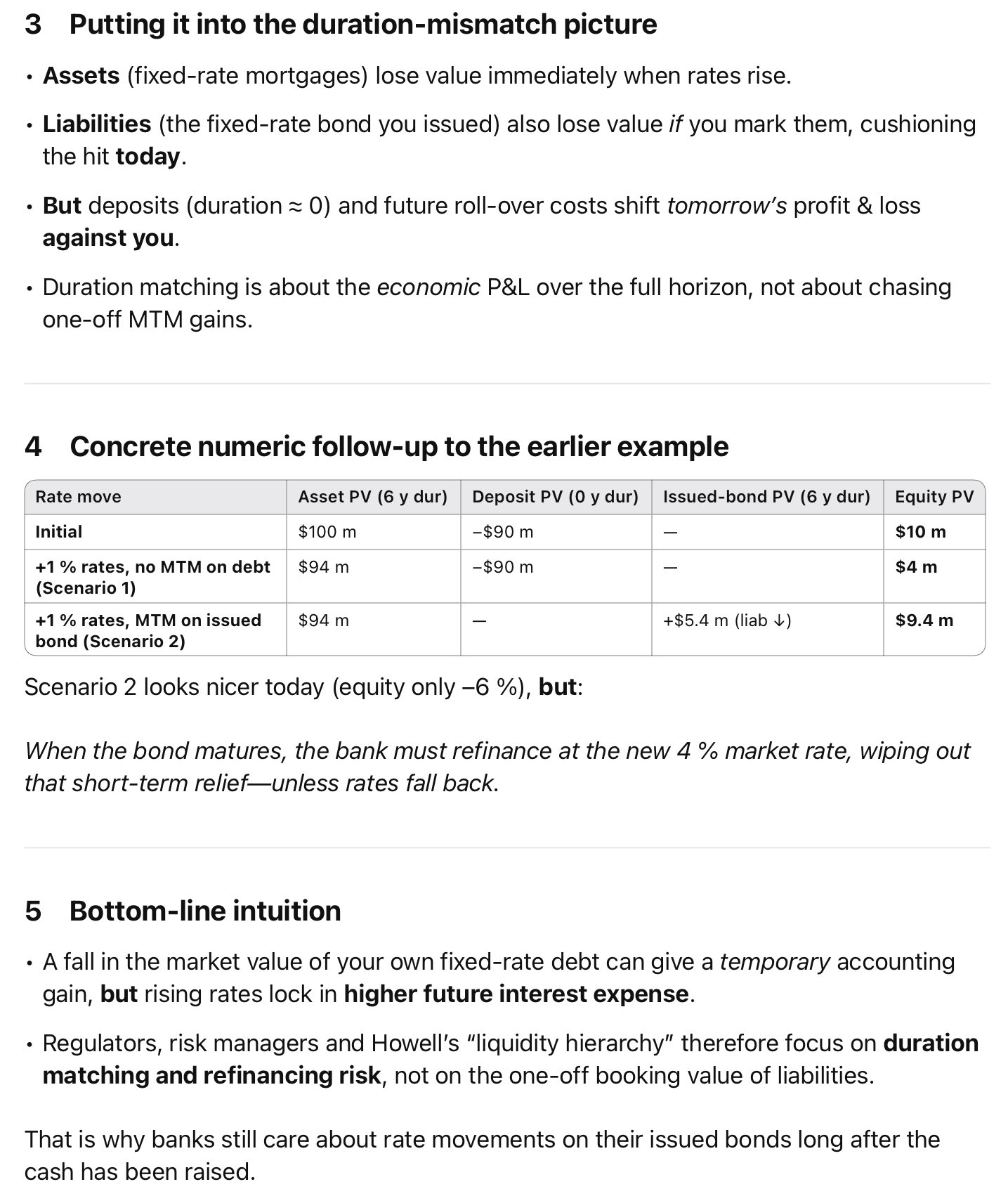

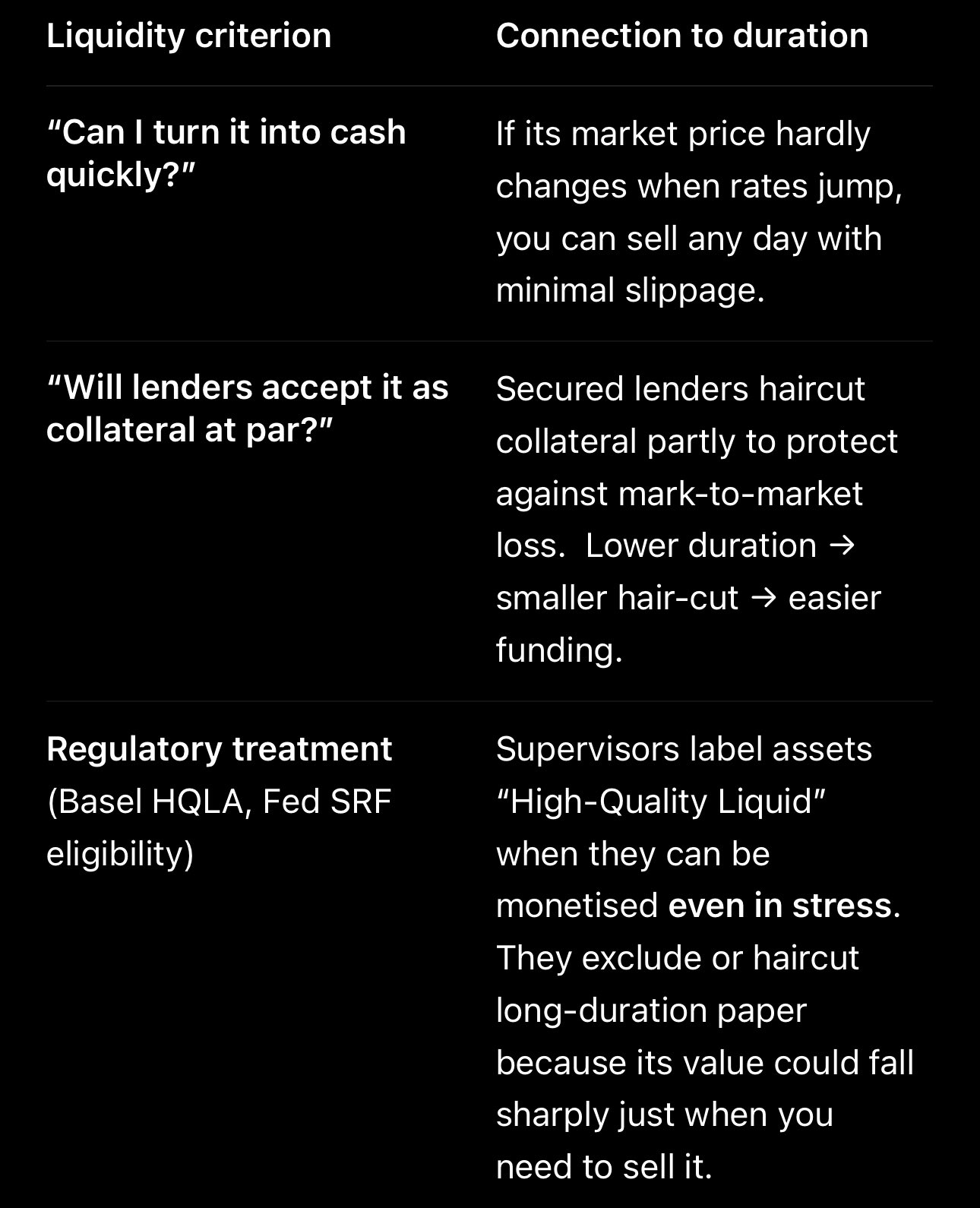

💧a liquid asset is one with low credit and duration risk

but the duration of the assets should be compared to the duration of the liabilities - assets are funded by liabilities + equity

duration of assets & liabilities should be as close as possible to minimize duration risk

not all money (credit) is the same

there's a quality dimension to it as well

credit issued by a central bank is higher quality than the one issued by commercial banks - no credit risk

central bank money is an unambiguous means of settlement for debt - think of legal tender

gold is currently the only asset whose leveraged long position can be hedged by adding more to the long on pullbacks 😄

* one of the only - and ofc technically that's not a hedge - but you can read my previous posts to understand what I mean

substance over matter 😉

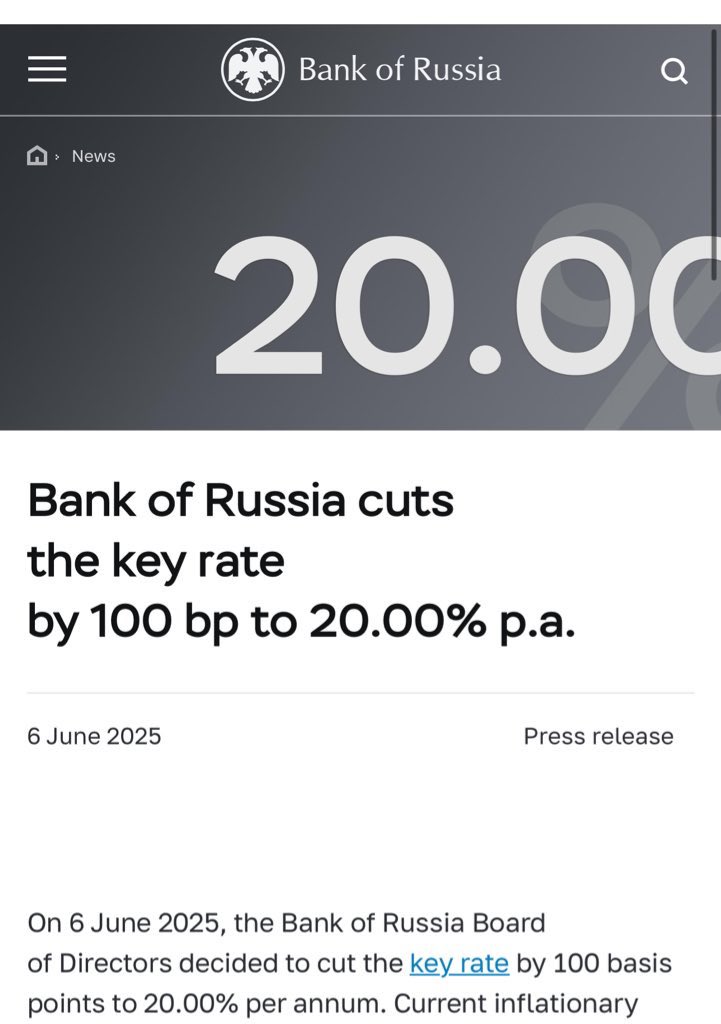

🇷🇺 and indeed Bank of Russia cuts interest rates down to 20%

3 months ago I wrote about how the Russian bond market was pricing in those cuts

a month ago the prediction materialized ✅

i understand that these are secondary tariffs, but there is a grand total of 0% chance of that going in action for any substancial amount of time

🇨🇳 China is Russia's main trading partner. do you really think the US economy can sustain 100% tariffs on their main import source?

a reminder that Russia doesn't trade with USA anymore 🇺🇸🤝🇷🇺

so it's not clear what 100% or 9999% tariffs on Russia will achieve

Russia's been offloading US securities for gold since 2018

Russia's exports to the US are less than 1% of the total