⬇️ My Thoughts ⬇️

since banks can always deposit cash into their reserve account account at the FED and earn the IORB rate they have little incentive to lend at rates below IORB

effectively, this sets the floor (lower bound of the corridor) for interest rates for banks

Interest on Reserve Balances (IORB) is the rate FED pays banks on their excess reserves

commercial banks have reserve accounts at the FED. regulations define the minimum amounts - any excess earns the IORB interest rate set by the FED

Interest on Reserve Balances (IORB) is the rate FED pays banks on their excess reserves

commercial banks have reserve accounts at the FED. regulations define the minimum amounts - any excess earns the IORB interest rate set by the FED

the 4 key interest rates set by the FED are:

1️⃣ Overnight Reverse Repo Rate (ON RRP)

2️⃣ Interest on Reserve Balances (IORB)

3️⃣ Discount Rate - also known as Lending Rate

4️⃣ Standing Repo Facility (SRF)

we'll cover them in this order below

the 4 key interest rates set by the FED are:

1️⃣ Overnight Reverse Repo Rate (ON RRP)

2️⃣ Interest on Reserve Balances (IORB)

3️⃣ Discount Rate - also known as Lending Rate

4️⃣ Standing Repo Facility (SRF)

we'll cover them in this order below

now let's understand each one of the 4 key rates set by the federal reserve to keep the market rates within the target range

namely, what each one of those rates represents and how together they act as ceiling or floor for the interest rate corridor

now let's understand each one of the 4 key rates set by the federal reserve to keep the market rates within the target range

namely, what each one of those rates represents and how together they act as ceiling or floor for the interest rate corridor

so when banks and other financial institutions need to lend capital - they can do it at a rate within the target range

of course, their balance sheet capacity must allow for that - but that's another topic which I already covered in some detail in my other posts😁

so when banks and other financial institutions need to lend capital - they can do it at a rate within the target range

of course, their balance sheet capacity must allow for that - but that's another topic which I already covered in some detail in my other posts😁

now you should have a clear mental model of how the Federal Reserve sets the interest rates in the market

a target range is defined, and then several different interest rates are set explicitly to steer the real interest rate into that target range

now you should have a clear mental model of how the Federal Reserve sets the interest rates in the market

a target range is defined, and then several different interest rates are set explicitly to steer the real interest rate into that target range

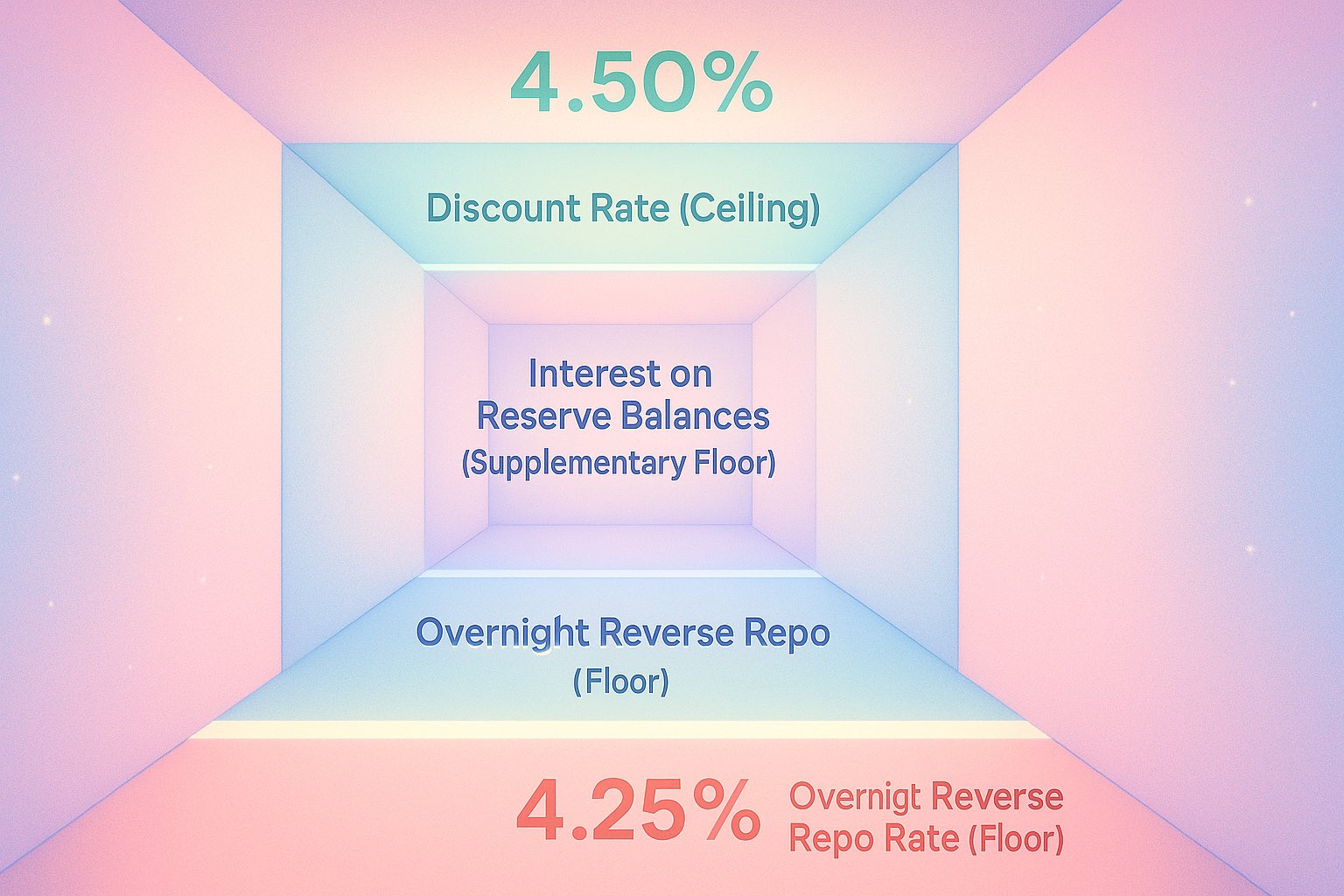

think of these 4 rates as defining a corridor with an upper and a lower bound - currently 4.25% and 4.50%

the average market interest rate will sit somewhere in between

think of these 4 rates as defining a corridor with an upper and a lower bound - currently 4.25% and 4.50%

the average market interest rate will sit somewhere in between

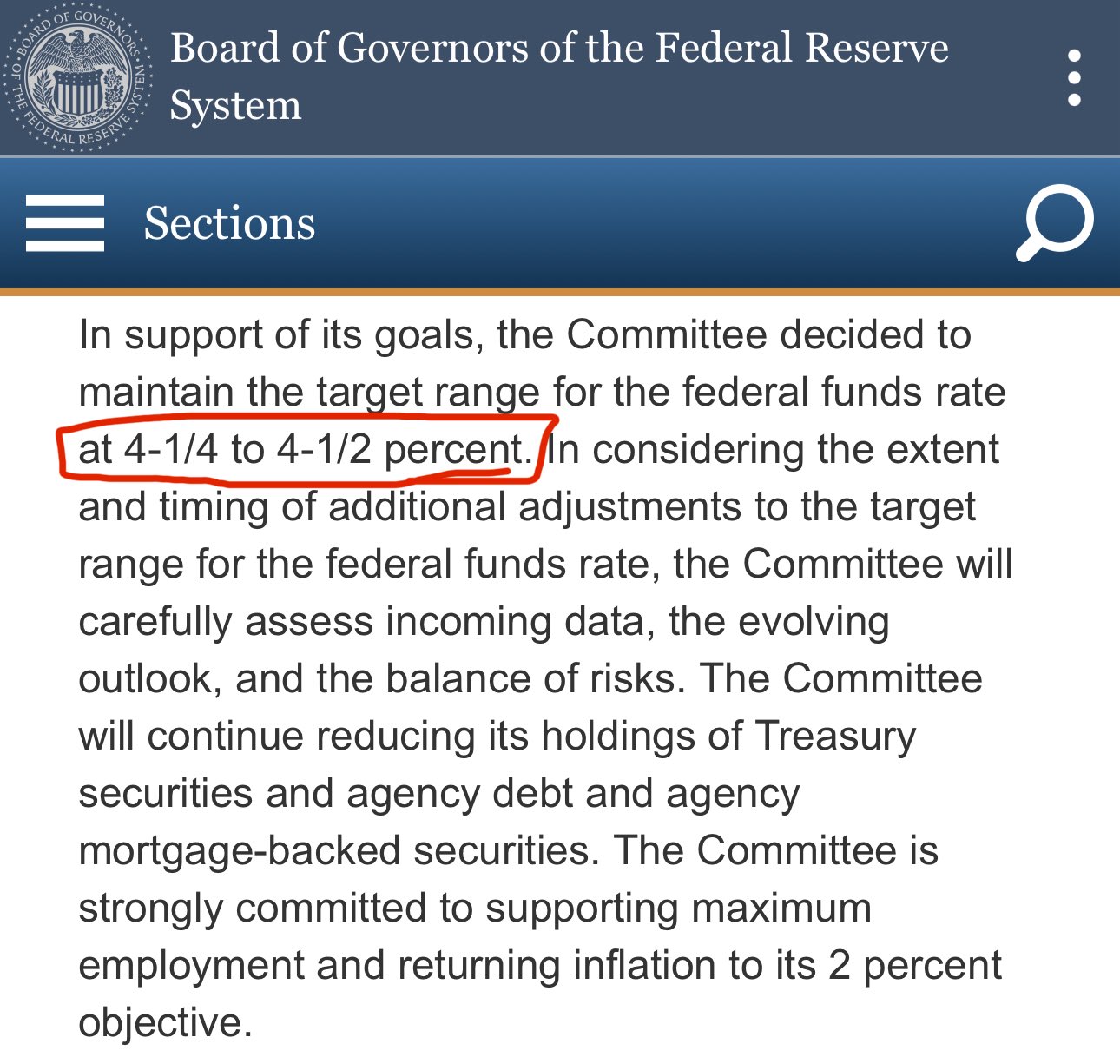

in the Federal Open Market Committee Meetings (FOMC), the Federal Reserve sets a target range - currently 4.25%–4.50%, and then it uses the ON RRP, IORB, discount rate and SRF to steer the average rate in the market

in the Federal Open Market Committee Meetings (FOMC), the Federal Reserve sets a target range - currently 4.25%–4.50%, and then it uses the ON RRP, IORB, discount rate and SRF to steer the average rate in the market

the rates define the interest rate corridor in the following manner:

1️⃣ Overnight Reverse Repo Rate - floor

2️⃣ Interest on Reserve Balances - supplementary floor

3️⃣ Discount Rate - ceiling

4️⃣ Standing Repo Facility - supplementary ceiling

the rates define the interest rate corridor in the following manner:

1️⃣ Overnight Reverse Repo Rate - floor

2️⃣ Interest on Reserve Balances - supplementary floor

3️⃣ Discount Rate - ceiling

4️⃣ Standing Repo Facility - supplementary ceiling

together, ON RRP, IORB, discount rate and SRF define an interest rate corridor, composed by:

1️⃣ lower bound (floor) - the lowest possible interest rate

2️⃣ upper bound (ceiling) - the highest possible interest rate

the other market rates fluctuate between this floor and ceiling

the FED sets a target interest rate range and 4 main explicit interest rates:

1️⃣ Overnight Reverse Repo Rate (ON RRP)

2️⃣ Interest on Reserve Balances (IORB)

3️⃣ Discount Rate - also known as Lending Rate

4️⃣ Standing Repo Facility (SRF)

more on them later (keep reading 😁)

the FED sets a target interest rate range and 4 main explicit interest rates:

1️⃣ Overnight Reverse Repo Rate (ON RRP)

2️⃣ Interest on Reserve Balances (IORB)

3️⃣ Discount Rate - also known as Lending Rate

4️⃣ Standing Repo Facility (SRF)

more on them later (keep reading 😁)

the federal reserve does not set a single interest rate

instead, the FED sets a target interest rate range (the federal funds target range) alongside 4 main explicit interest rates

the federal reserve does not set a single interest rate

instead, the FED sets a target interest rate range (the federal funds target range) alongside 4 main explicit interest rates

how can the FED even set market-wide rates? 🤔

after all - there is no single rate that the whole market unanimously uses

different types of lending have different rates in the market, as it's a (somewhat) open market

how can the FED even set market-wide rates? 🤔

after all - there is no single rate that the whole market unanimously uses

different types of lending have different rates in the market, as it's a (somewhat) open market

How Does the Federal Reserve Set Interest Rates?

some think that they define a single rate - namely the overnight lending rate - i.e. the rate at which the banks lend to each other overnight

but that's not the case ❌

i'll be explaining the details of how the Federal Reserve achieves their fed funds target rate in the next posts

i'll be quoting them in sequence - so you can follow the trail of quoted posts and read them like a thread/article

starting with the next post. let's dive in! 🚀

the FED left the interest rates unchanged - at the 4.25%-4.50% target

while they communicated that previously - so it's no surprise - understanding how they achieve that level of short-term rates means understanding the important central bank in the world 🏦

so i'll explain it!

if you can actually take a loan of €10m - just get a bunch of properties in Portugal (I see the flag 🇵🇹😄) and rent them out

you'll be able to comfortably get ≈50 properties - yielding you around €50K MRR

plus all of the equity and appreciation that you're earning

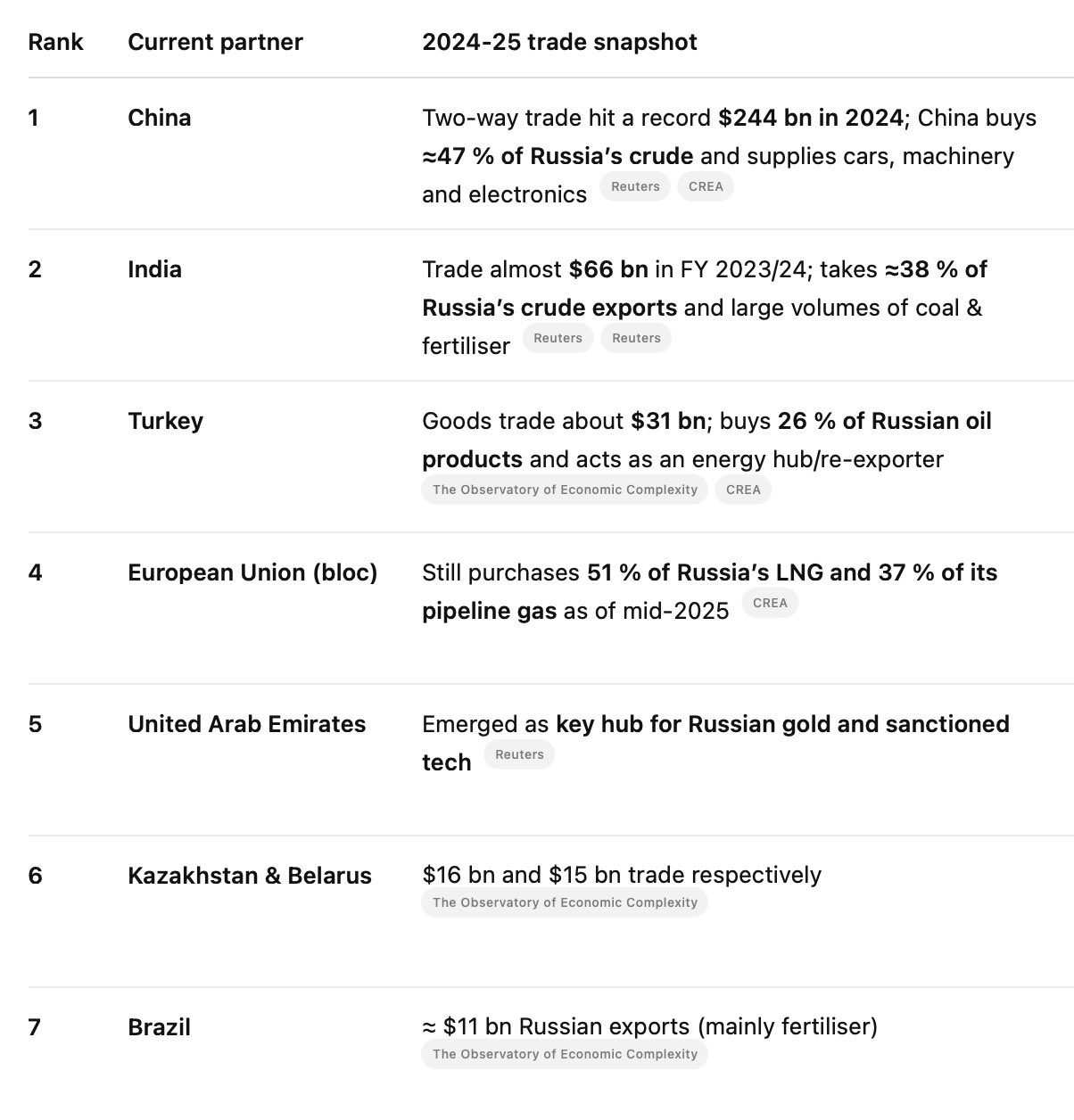

🇺🇸🇮🇳 US imports for India account for mere 2.7% of its total imports - only $87 billion

you can see how selective and small the tariff applications are - and even those will eventually be dropped

nothing about China 🇨🇳 👀

fully consistent with what I wrote 2 weeks ago

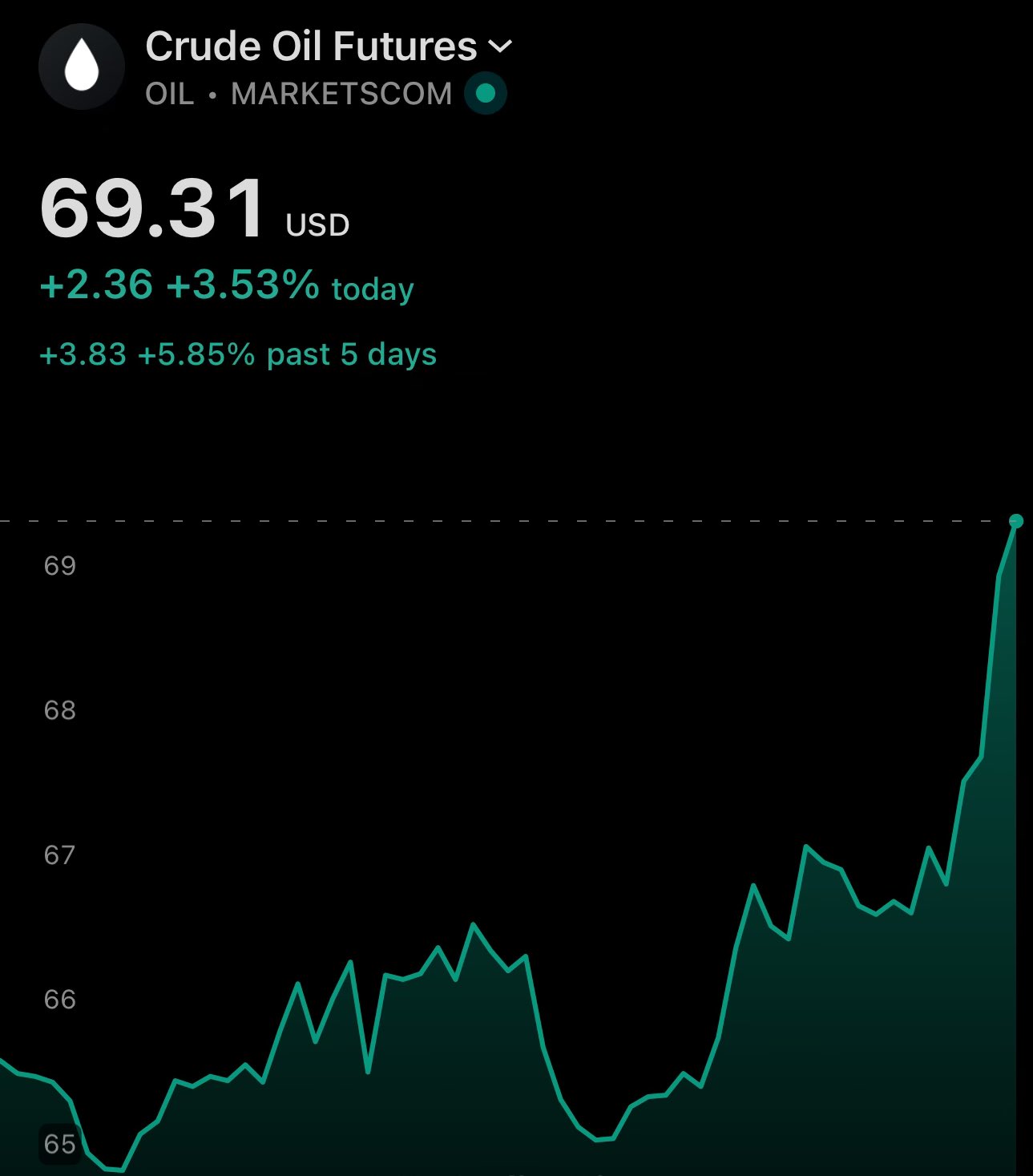

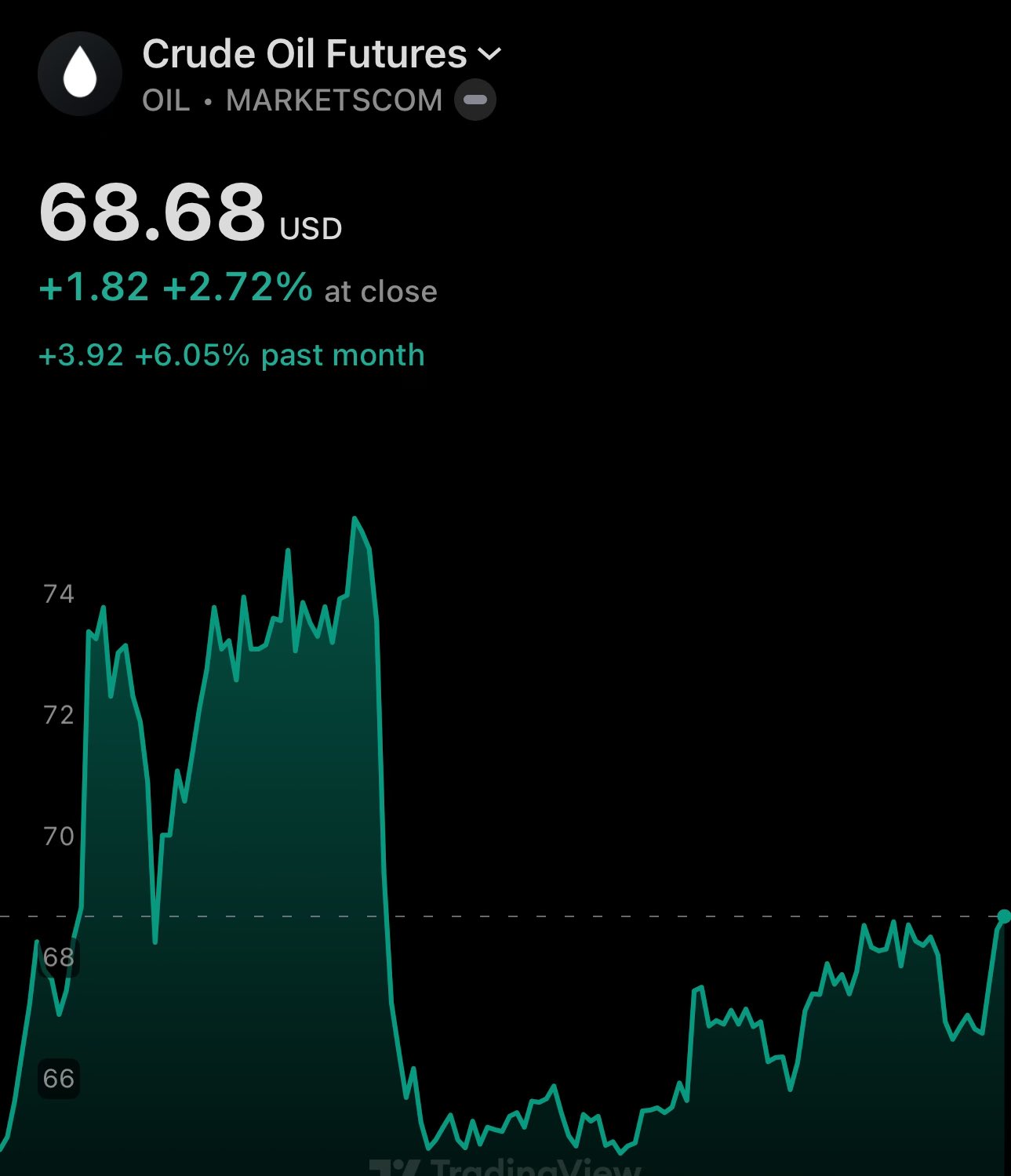

🚨🛢️aaand crude oil is trading above $70

told you over a month ago that more upside is to come 😉

NOTE: it's up ≈8% over the past 5 days while the US dollar index is up over 2% - so it's more in real terms

scroll back to my June posts to know what's coming next

don't learn to code - there is AI

don't learn to drive - there is AI

don't learn to read - there is AI

don't learn to write - there is AI

don't learn to speak - there is AI

…

don't learn - there is AI

follow me for more terrible advice 😂

🇷🇺 oil up is GOOD news for Russia & Ruble

every surplus above $60/barrel of Urals oil increases FX reserves in NWF (Yuan or gold) - an interplay between MoF and CBR

exporters pay taxes in Ruble - so higher buying pressure

mark my words:

👉 you'll see USD/RUB exchange rate fall

🚨🛢️ crude oil up to almost $70

and this while the US dollar index is also up

over a month and a half ago I told you that it's going to resume the uptrend - and this thesis has been confirmed again and again

wait & watch what comes next - I wrote about that as well 😁

you can imagine how much I'm excited to read this chapter 🤩

Michael Howell (@crossbordercap) really cooked with this one 🔥

highly technical, quantitative and focused on data interpretation, not politics

(not sure about copyright so blurred the image)

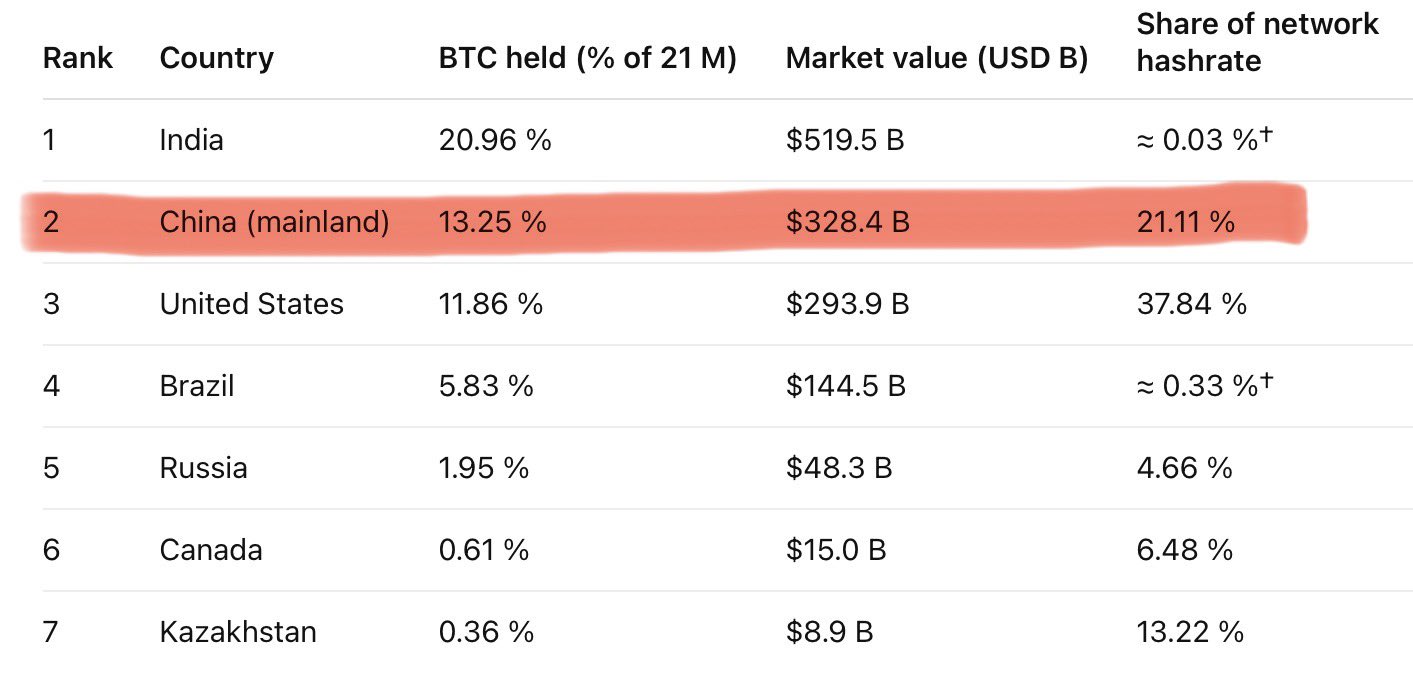

Trump administration is China's best friend

🇺🇸❤️🇨🇳

not only China gets to accumulate gold, attract global market share, but also massively benefit from the crypto bubble

China has HUGE exposure (and control) to Bitcoin. US does the work, while China benefits. sounds familiar🤷♀️

🇷🇺 3 months of Ruble gains against USD erased in 5 days 😄

but also contextualize it with the overall increase in the US Dollar Index over the past 2 days

👋 hello, volatility