⬇️ My Thoughts ⬇️

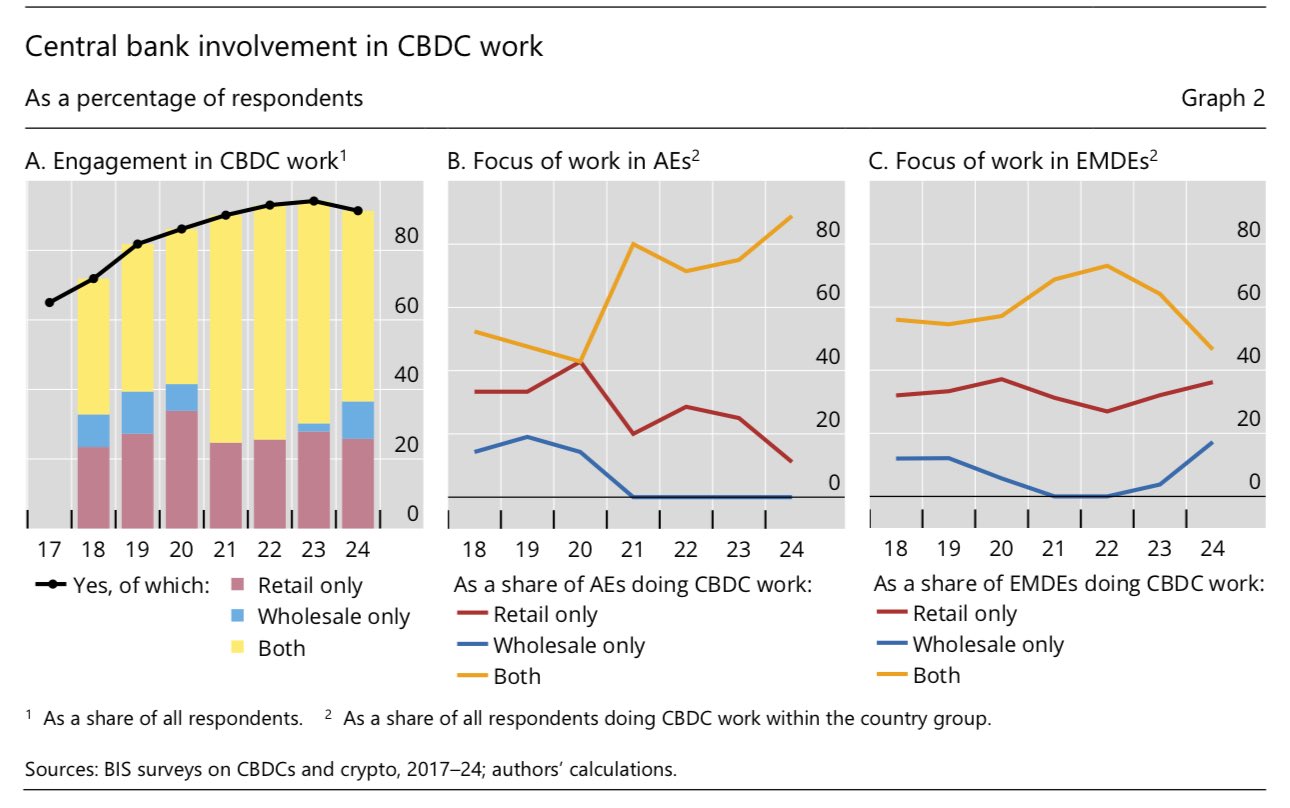

91% of central banks are working on CBDCs, but not on a public blockchain

85 out of 93 central banks (≈94% of global economic output) are engaged in some form of CBDC work

however, don't expect CBDCs to be implemented on permissionless blockchains like Ethereum

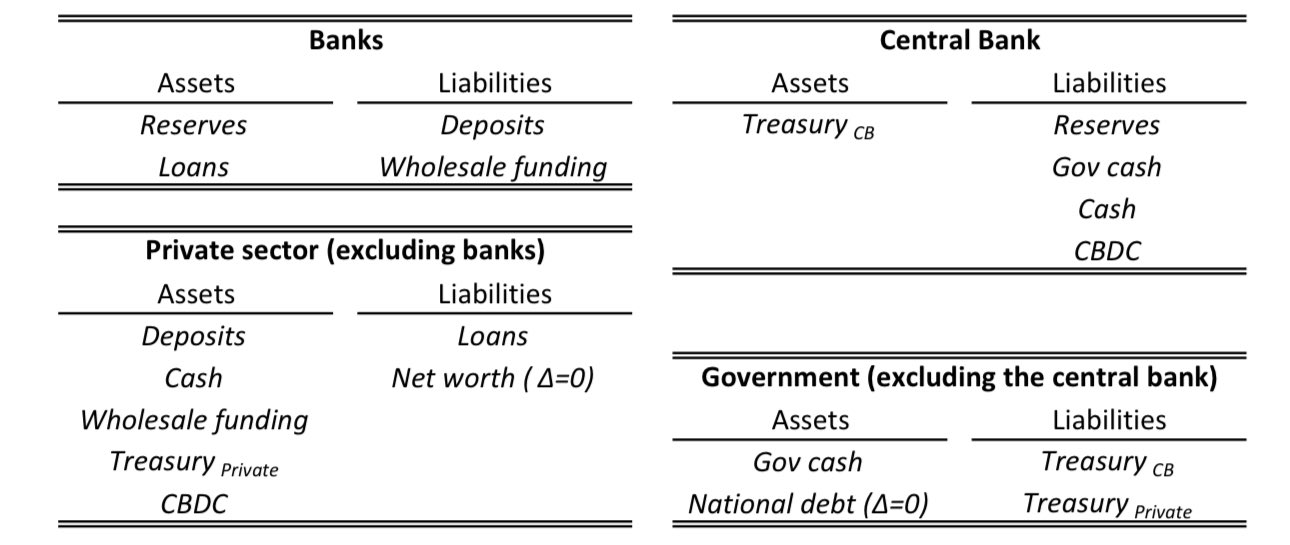

thus, wholesale CBDC is a tokenized/digital version of central bank reserves used by the financial market infrastructure (FMI) and banks

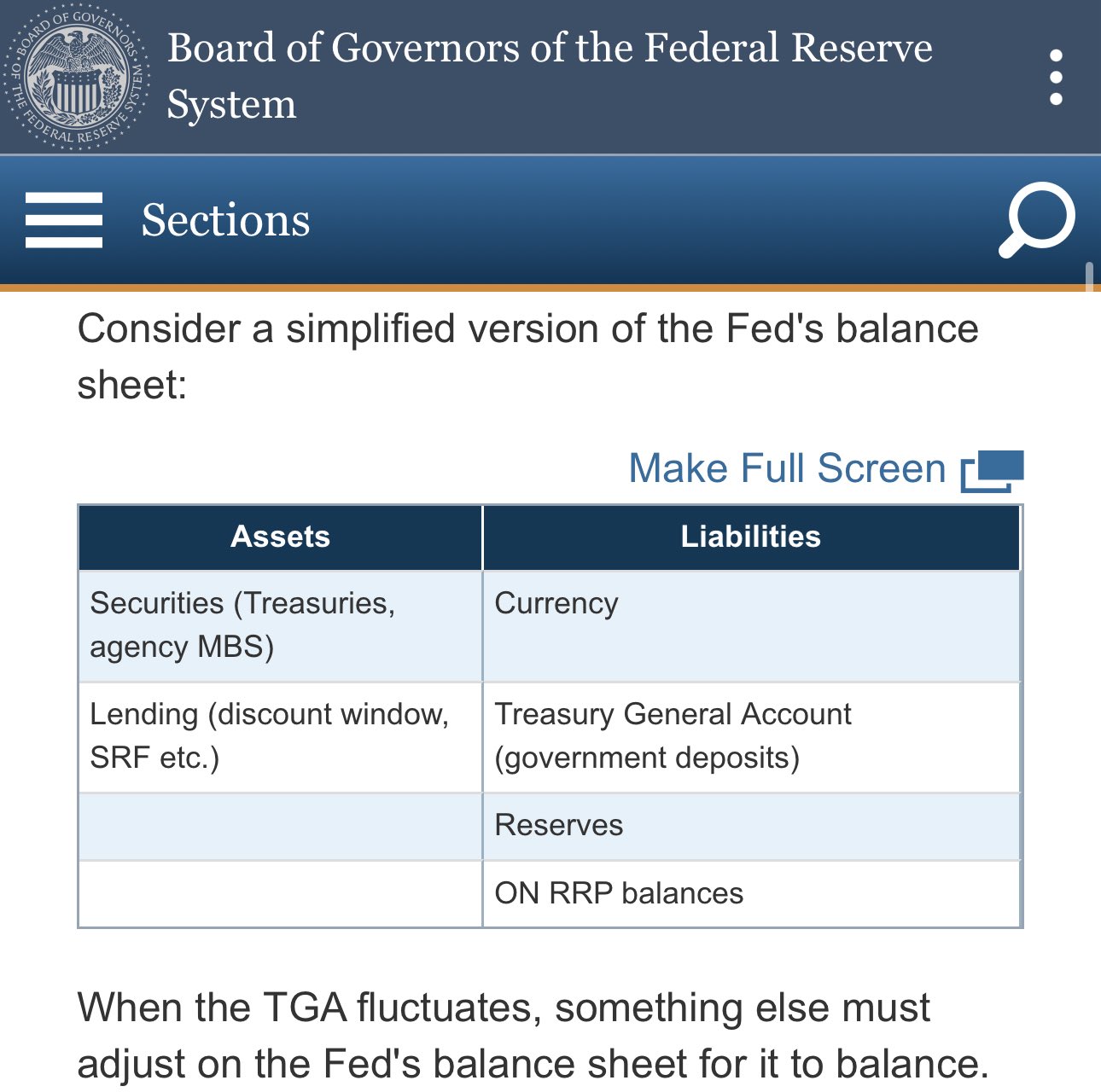

it also lives on the liability side of the central bank

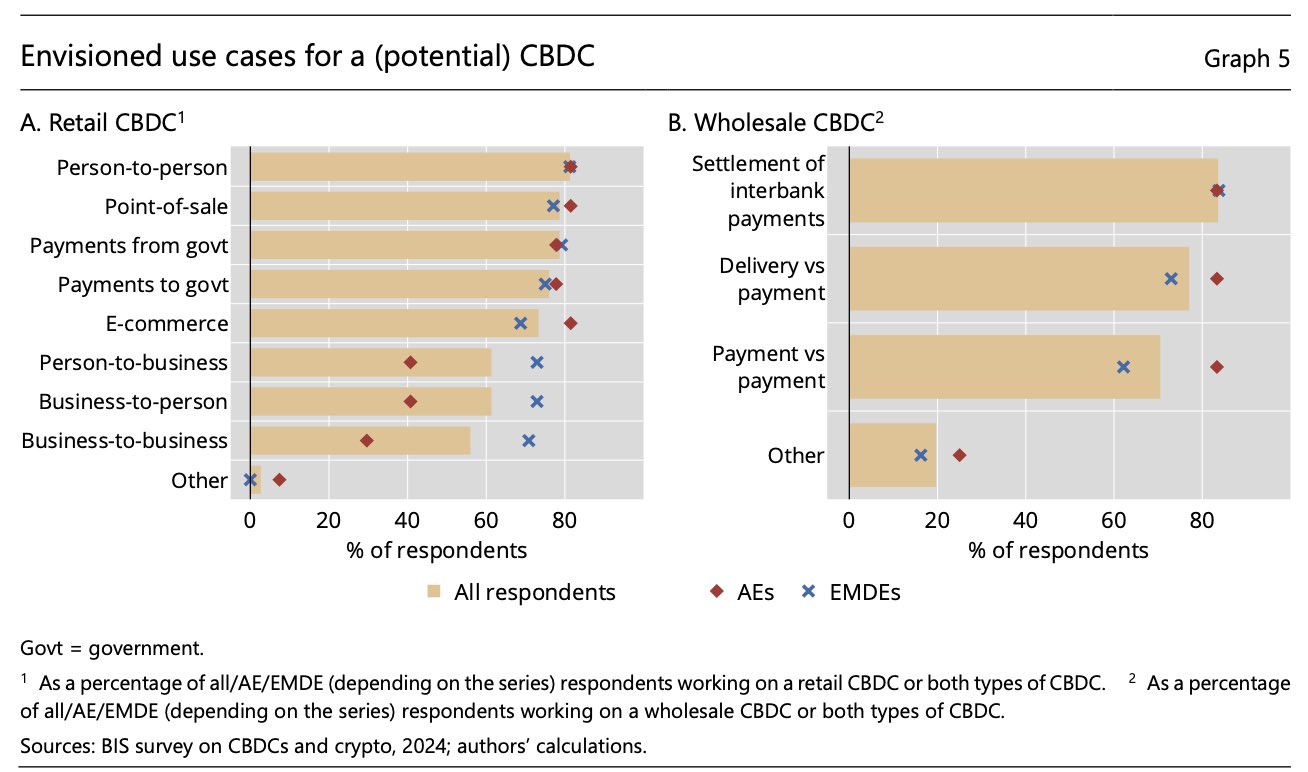

wholesale CBDC will be used by financial institutions only, such as commercial and central banks for interbank and market settlement

wholesale CBDC will only be transacted between select financial institutions - it's not something you'd use as a regular business or consumer

wholesale CBDC will be used by financial institutions only, such as commercial and central banks for interbank and market settlement

wholesale CBDC will only be transacted between select financial institutions - it's not something you'd use as a regular business or consumer

retail CBDC is the digital version of currency - a liability of the central bank in the balance sheet

retail CBDC will be used for day-to-day payments, similar to the ones you do with with a credit card. this is the type of CBDC you can use for business and consumer transactions, such as paying for a supermarket purchase

retail CBDC will be used for day-to-day payments, similar to the ones you do with with a credit card. this is the type of CBDC you can use for business and consumer transactions, such as paying for a supermarket purchase

wholesale CBDC vs retail CBDC - what's the difference?

there's two types of central bank digital currencies (CBDC): retail CBDC and wholesale CBDC

➖ retail CBDC = used for ordinary transactions. digital version of the cash

➖ wholesale CBDC = used for interbank/financial institution settlement. tokenized central bank reserves

wholesale CBDC vs retail CBDC - what's the difference?

there's two types of central bank digital currencies (CBDC): retail CBDC and wholesale CBDC

➖ retail CBDC = used for ordinary transactions. digital version of the cash

➖ wholesale CBDC = used for interbank/financial institution settlement. tokenized central bank reserves

retail CBDC is central bank money, so converting bank deposits into digital Euro changes the composition of the monetary base - fewer commercial bank reserves at the central bank, more central bank CBDC liabilities

retail CBDC conversions settle in reserves

ECB plans to limit the amount of digital Euro CBDC a wallet can hold

this means you will be limited the amount of digital EUR you can own

this applies only to retail European Central Bank CBDC, not wholesale. the idea is to prevent excessive outflows of deposits from banks

same for wall street, main street, hawkish, dovish, bull, bear, cat bounce - whattt ?????

this is neither about civil engineering nor wildlife reserve 🤨

finance has A LOT to learn from engineering - especially in terms or standardization 😭

e.g. you're reading a british author, you may find "high street banks". it makes you think that there are also low street banks, or at least middle street banks, but noooo

TGA fluctuations must be offset by another asset or liability from Fed's balance sheet

⬆️ TGA increase = liability down or asset up

⬇️ TGA decrease = liability up or asset down

found this balance sheet model in Fed's notes, and it's a good visual aid to this thread

Standing Repo Facility (SRF) is a policy rate set by the Fed, according to the target rate. so unless the target rate is decreased, SRF rate is unlikely to be reduced

this situation is putting pressure on the Fed to decrease interest rates and start QE soon

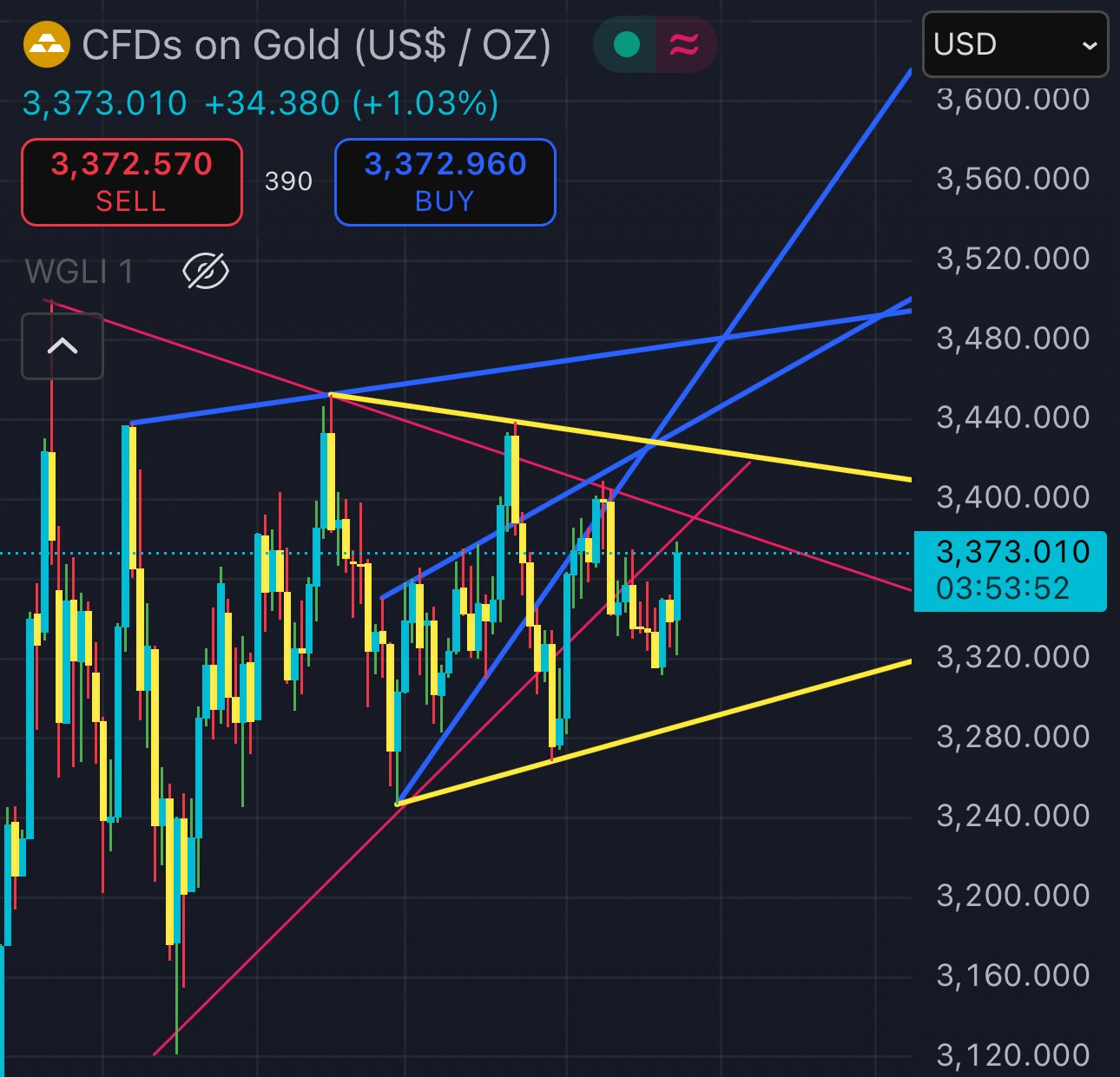

quick update on gold:

everything according to the plan - the thesis remains valid. now just wait and let the price action unfold 😄

use these trend lines as a guide

gold tariffs put further upside pressure for gold towards a new all time high on spot

this is in addition to the global monetary, geopolitical and fiscal positive price pressures

a significant part of the markets will be closed for the weekend. there could be a gap on reopen

Standing Repo Facility (SRF) is a policy rate set by the Fed, according to the target rate. so unless the target rate is decreased, SRF rate is unlikely to be reduced

this situation is putting pressure on the Fed to decrease interest rates and start QE soon

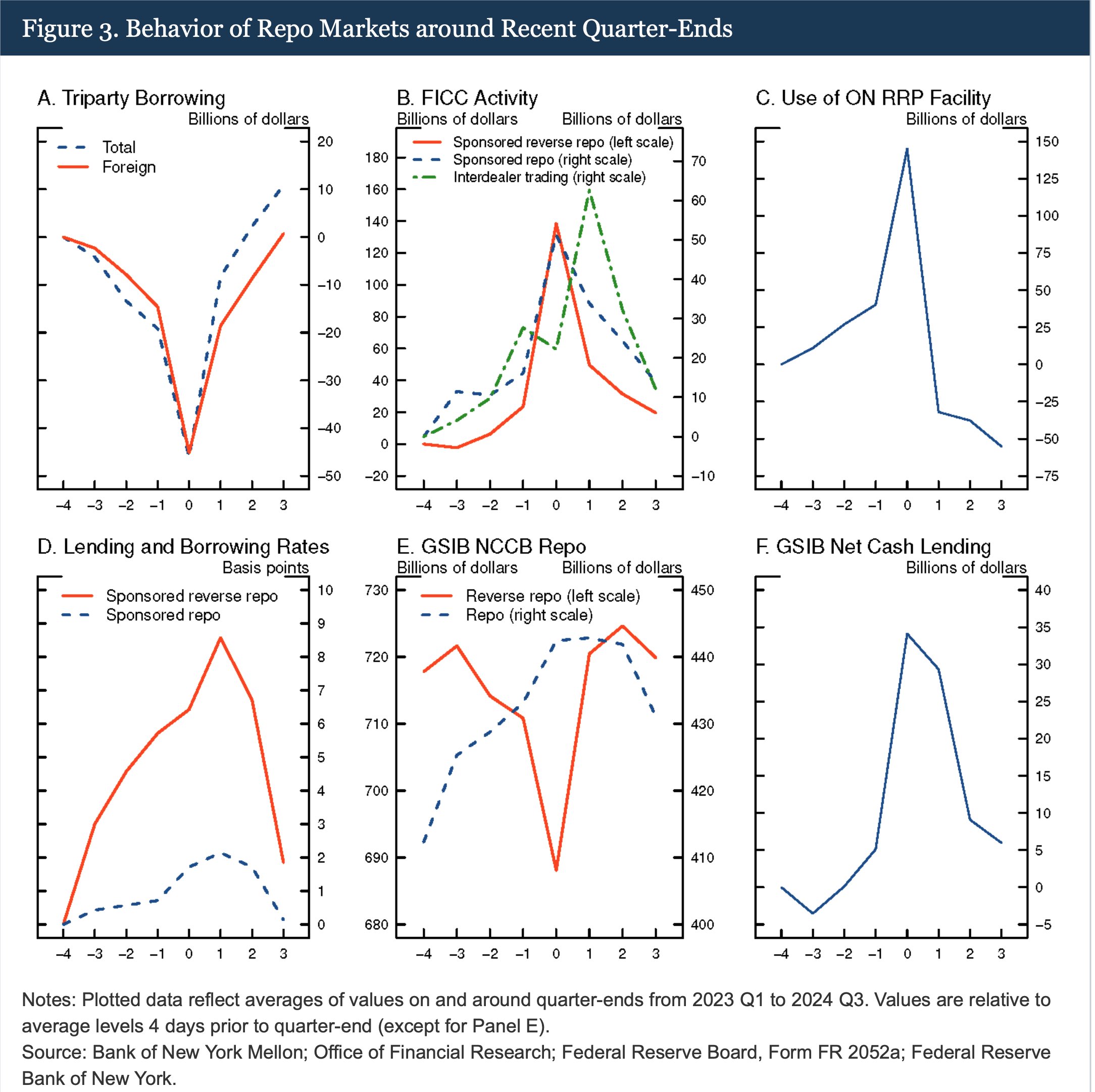

the funding could also come from Fed’s facilities, like the SRF or OMO

however, current SRF rate is 4.5%, which is above the yield on T-bills, and Fed is still officially in QT, so no large-scale, longer-term liquidity injections via open market operations

the funding could also come from Fed’s facilities, like the SRF or OMO

however, current SRF rate is 4.5%, which is above the yield on T-bills, and Fed is still officially in QT, so no large-scale, longer-term liquidity injections via open market operations

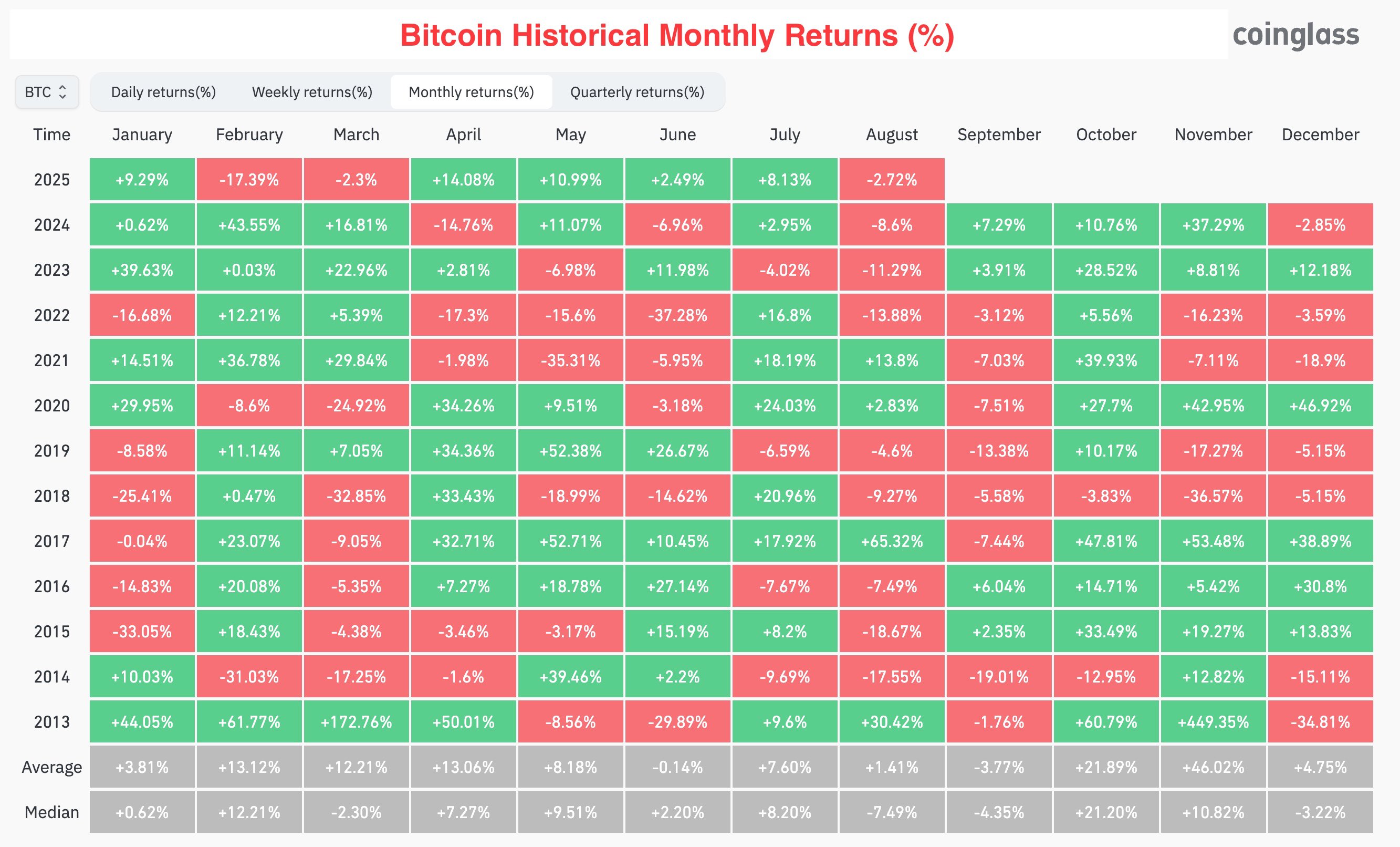

moreover, currently the US Treasury is issuing debt and cash at ON RRP is running low. MMF, dealers and banks purchase those T-bills. if they do not have cash in ON RRP, it will be financed by outflows from bank reserve accounts into TGA

moreover, currently the US Treasury is issuing debt and cash at ON RRP is running low. MMF, dealers and banks purchase those T-bills. if they do not have cash in ON RRP, it will be financed by outflows from bank reserve accounts into TGA

this is one of the reasons why September is historically a bad month for Bitcoin

repo rates increase and borrowing decreases in quarter-ends

this includes the upcoming month of September. in addition, September 15th the corporate tax limit in the US

this reduces global liquidity, so asset prices tend to fall

this is also why commercial banks purchasing government debt securities, such as Treasury bills may be effectively monetizing that debt

generally speaking:

➖ transaction between central bank accounts = base money reallocated, decreased or increased

➖ transaction between non-central bank accounts = broad money reallocated, decreased or increased

generally speaking:

➖ transaction between central bank accounts = base money reallocated, decreased or increased

➖ transaction between non-central bank accounts = broad money reallocated, decreased or increased

effectively this means that if both parties involved in the transaction have an account at the central bank, they will will use it to settle payments

effectively this means that if both parties involved in the transaction have an account at the central bank, they will will use it to settle payments

reserve accounts at the central bank are important to understand the mechanics of how asset purchase happens. generally speaking, if an institution has an account at the central bank - reserve or other deposit account, they will use it whenever possible to settle payment

reserve accounts at the central bank are important to understand the mechanics of how asset purchase happens. generally speaking, if an institution has an account at the central bank - reserve or other deposit account, they will use it whenever possible to settle payment

also note that it's not just commercial banks that have accounts at the central bank. it varies by jurisdiction, but other entities also have accounts at the central bank

for example, in the US the Treasury has an account at the Fed - the Treasury General Account (TGA)

also note that it's not just commercial banks that have accounts at the central bank. it varies by jurisdiction, but other entities also have accounts at the central bank

for example, in the US the Treasury has an account at the Fed - the Treasury General Account (TGA)

if it's the central bank buying assets from other banks, such as in QE - then the central bank also creates the deposit "out of thin air", thus effectively paying for the assets to the commercial bank with a newly created deposit into their reserve account. base money increases

if it's the central bank buying assets from other banks, such as in QE - then the central bank also creates the deposit "out of thin air", thus effectively paying for the assets to the commercial bank with a newly created deposit into their reserve account. base money increases

when banks buy assets from other banks - new deposits do not get created, as the payment happens by moving funds between the commercial bank's reserve accounts at the central bank

thus, it's base money movements/reallocation, not creation

when banks buy assets from other banks - new deposits do not get created, as the payment happens by moving funds between the commercial bank's reserve accounts at the central bank

thus, it's base money movements/reallocation, not creation

let's say the bank bought a T-bill from you for $1000. for this, they "created $1000" and deposited them into your account. bank’s balance sheet:

➖ Assets: +$1000 (the T-bill)

➖ Liabilities: +$1000 (the deposit/payment to you)

the key here is that you are a NON-bank

let's say the bank bought a T-bill from you for $1000. for this, they "created $1000" and deposited them into your account. bank’s balance sheet:

➖ Assets: +$1000 (the T-bill)

➖ Liabilities: +$1000 (the deposit/payment to you)

the key here is that you are a NON-bank

here, the bank's assets increase by the value of the T-bill and liabilities increase by the amount that they paid you for it. in the balance sheet the T-bill will have the same value as what the bank paid you/deposited into your account