⬇️ My Thoughts ⬇️

You can email JPEG

You can teleport JPEG

You can divide JPEG into a billion pieces and send them across the world at 2:22 AM

JPEG invented civilization 2.0

if you think they crypto will replace banks, you don't understand what banks are and how they work

banks are credit institutions. it doesn't matter if they process transactions in COBOL, Bitcoin or Solidity

DLTs can and will save on costs, but that will also open opportunities for banks to expand further

it's not about the underlying technology - the credit can be issued on-chain via tokens, but there will still be heavy regulations and authorization requirements

DLTs/blockchains won't magically replace banks

but Bitcoin is also taxed and surveilled - the ledger is public and attributable 😄

most of Bitcoin's trading volume is in central-bank issued currencies. actually, it's mostly the USD - so Bitcoin is highly susceptible to U.S. currency risk

so yes, bitcoin is risky. that's the premise of no free lunch in financial markets 😄

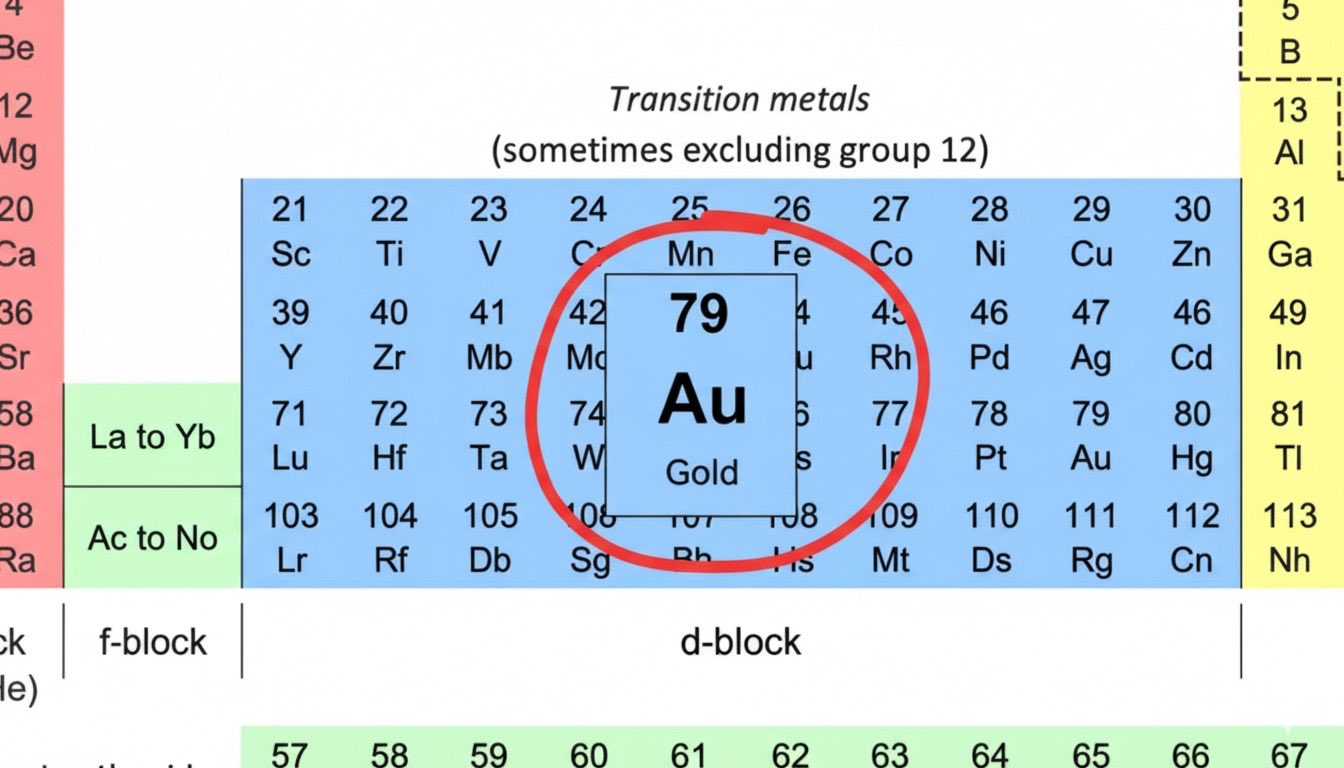

if AI will want something it would be gold, not Bitcoin

AI can create another Bitcoin protocol and program the node logic, but AI won't be able to create gold

AI will also need to gold for the signal connectors in the electronics that the AI runs on

It's chemistry/physics vs computer code. You can write new code, but you can't create new Au (without it being very, very expensive)

no, the U.S. will not pay off its debt with tariffs

i think this is obvious for everyone now. if not - go read my past posts

it's over for gold

i've already contacted central banks to dump it too

it's not a store of value or safe haven anymore

gold is only up 12% in the last month...

clear bear market.................

😄

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

don't forget to set your limit buy orders

maximum bottom is around early September 2025 prices

it's getting closer

Bitcoin needs gold. Gold doesn't need Bitcoin

TL;DR: Bitcoin is a protocol that runs on computers. Computers rely heavily on electronics. Gold is widely used in electronics. Bitcoin depends on gold.

Bitcoin quite literally runs on gold. ≈99% of physical machines hosting Bitcoin nodes contain at least trace amounts of gold. The same is true for the overall electric grid infrastructure that delivers electricity to Bitcoin nodes.

While gold isn't strictly required for electronics, it's widely used to due to organic demand. Gold's ROI in signal connectors is very strong, because you need little gold to mitigate a large amount of failure risk. All of this is due to the unique chemical nature of gold, which alongside its scarcity is at the base of gold's intrinsic value.

Gold is a chemical element in the periodic table - its atomic symbol is Au. Physical gold is essentially Au atoms connected to other Au atoms in a cubic pattern. This structure is very stable, and at the same time soft/malleable. Gold is used in electronics because it provides stable, low and predictable contact resistance and corrosion immunity at low currents/voltages, including under vibration.

Electronics is of course just one of the use-cases of gold. Among others, it has been used as money for more than 5000 years. Even if Bitcoin does become money in the future, it won't be the only form of money (plus, you can always tokenize gold!). And especially not for the near long-term future.

Digital currencies are at their infancy, and they almost always depend on stable electrical grid and network connection to function properly. This includes Bitcoin. Gold doesn't have this risk. It was used as money before electricity and networks existed, and it can continue to be used alongside them

This is not to say that Bitcoin is a bad idea, but gold has a higher intrinsic value by definition

silver could pullback to ≈$40 before continuing its uptrend

this represents a ≈27% correction from the top

this is the lowest possible bottom for this move - it probably won't go this low. if it does, the move will happen fast, so have your buy limit orders ready. next week is FOMC interest rate decision. the Fed will cut the rates by another 25bps, and other things equal - it's positive price pressure for silver

if the price breaks below $47, it will likely fall closer to $45. expect a stronger support in the $43-45 area

overall, any prices in the vicinity of September 15th 2025 prices is a GREAT buying opportunity

* keep in mind the total 75 bps interest rate cut by the Fed this year is already in progress of being priced in - the market doesn't wait for the official announcement. this is one of the reasons why you had so much upside price volatility in the last month

1 month ago I wrote that silver could extend its current move to ≈60% from the ≈$34.5 price level

silver topped exactly there at ≈$54.5

now my next notes:

treat the pullback and any price consolidation action as a buying opportunity

during the next 6 months long positions entered in this area will be in profit. likely sooner, but 180 days provides a higher confidence timeline

1 month ago I wrote that silver could extend its current move to ≈60% from the ≈$34.5 price level

silver topped exactly there at ≈$54.5

now my next notes:

treat the pullback and any price consolidation action as a buying opportunity

during the next 6 months long positions entered in this area will be in profit. likely sooner, but 180 days provides a higher confidence timeline

silver's current move is already up >25%. it's better to have a pullback somewhere around the current level

it can move up even further, extending the total move to ≈60%, but then you’ll get a larger and longer lasting pull back

when silver moves in smaller increments, it has shorter-lasting consolidations/pullbacks. so this is what i mean by "better"

gold has formed a double top on the 4H chart 📈

that's why I wrote that buy orders below the current prices are a good idea

i'd prioritize buying opportunities in silver + gold & silver miners on this pullback

gold is also a great idea, but you'll get more volatility/relative upside in others

the promised gold & silver sale is here

if you didn't set your limit buy orders for silver, gold & miners - it's not too late yet

currently in late-September price ranges for many. it's also a good idea to position some buy targets below the current price levels

keep watching the gold price - it's the main driver for all

FOMC meeting is next week

the promised gold & silver sale is here

if you didn't set your limit buy orders for silver, gold & miners - it's not too late yet

currently in late-September price ranges for many. it's also a good idea to position some buy targets below the current price levels

keep watching the gold price - it's the main driver for all

FOMC meeting is next week

⏰ don't forget to setup your buy limit orders for gold, silver and their miners

⏰ don't forget to setup your buy limit orders for gold, silver and their miners

yes, you always have access to the Bitcoin network

until the electric grid is disrupted, a sufficiently strong solar storm occurs, a denial of service attack happens, ...

i can continue the list

Bitcoin isn't private - at best it's anonymous

and this is by design. it's just cryptography/math - not much to argue about

but gold transactions aren't private either. most of the time they're not even anonymous. you must have some level of trust with the counterparty - either directly or via intermediary. a lot of the times this is required by law

at retail level, there is much more privacy and anonymity with Bitcoin that with gold

gold has clearly more intrinsic value than bitcoin, but bitcoin is one of the most significant advancements in money. although bitcoin isn't money 😄

it's not about lowering gold

and nobody is panicking

pro-crypto shill is about gold now because gold has has been the most notable asset post-interest rate cuts by the Fed

not long ago it was about dumping ETH for BTC, and by default it's about inflation/currency debasement

gold has been impressive. but this is very expected. during gold's last consolidation i've written extensively about how it's setting up very strong support and will make the uptrend continuation even more decisive. every dip was indeed a buying opportunity

looks like crypto twitter has not discovered Mendeleev's periodic table yet 😂

gold has existed for ≈13 billion years

for at least 5,000 of those 13,000,000 years it has been money

authenticity of gold bars can be tested easily. no need to make up problems that don't exist

hope you enjoyed Friday's gold, silver & miners sell-off

now await for the markets to re-open

it begins in a few hours 👀

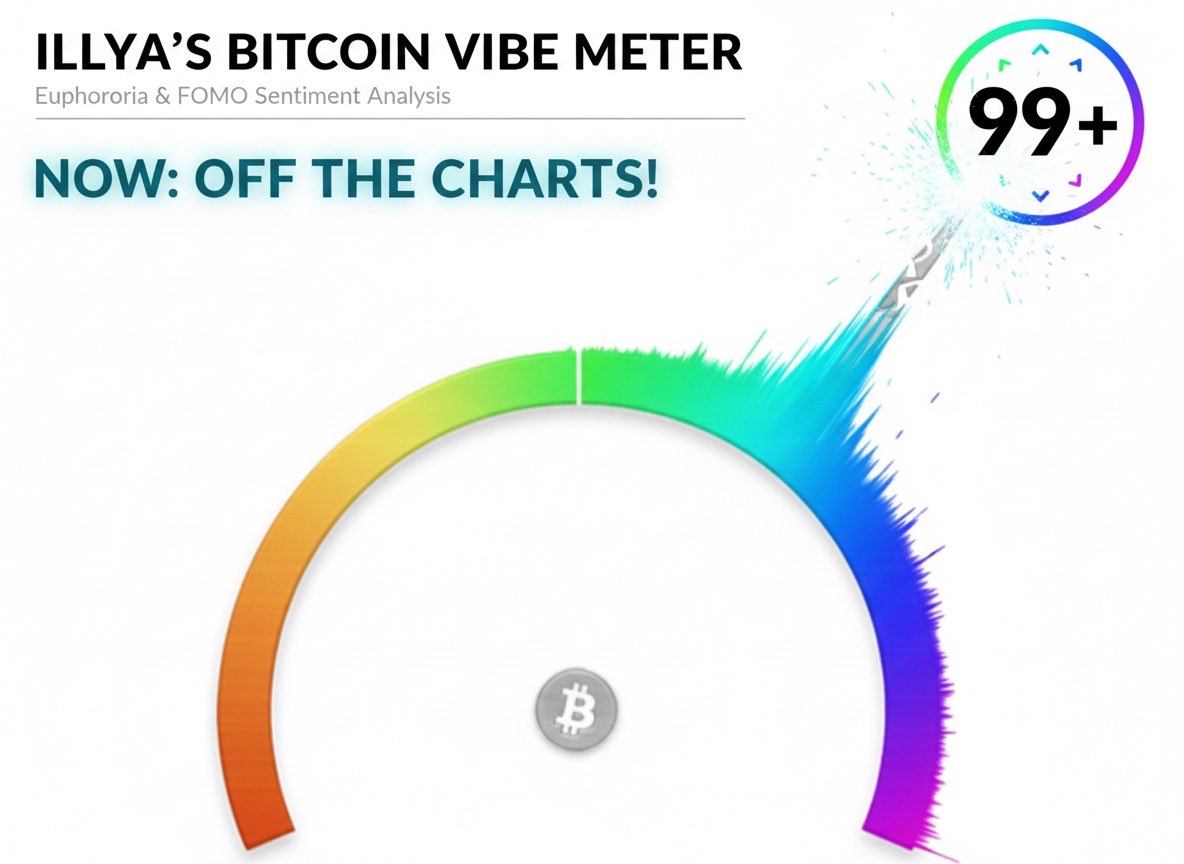

my vibe meter on Bitcoin is off the charts 📈*

the algorithm on X has been pushing a lot of pro-BTC content over the past month, and it's becoming more and more irrational:

accounts with millions of followers recycling 2024 news about "new" gold reserves in China, false news about China legalizing Bitcoin and calls for gold going down to $2000

every pro-Bitcoin account seems to be calling a long-term gold top (LOL!) and heavy rotation into Bitcoin. actually a lot of BTC shill content is about BTC being better than gold - and the arguments for it aren't very sound. i've written several posts explaining this. BTC crowd seems very obsessed about gold - especially when it comes to showing how it's inferior to Bitcoin. Bitcoin is not gold - and it will never be gold - they're very different assets. that doesn't mean that BTC ownership is a bad idea - but it's important important to approach it rationally

a large part of this seems coordinated/paid campaigns. liquidity always needs an exit

so Bitcoin should continue with some more downside in the near future

* this sentiment is based on vibes, but it's backed by technicals & fundamentals at its base. you can find in-depth explanations in my past posts and threads

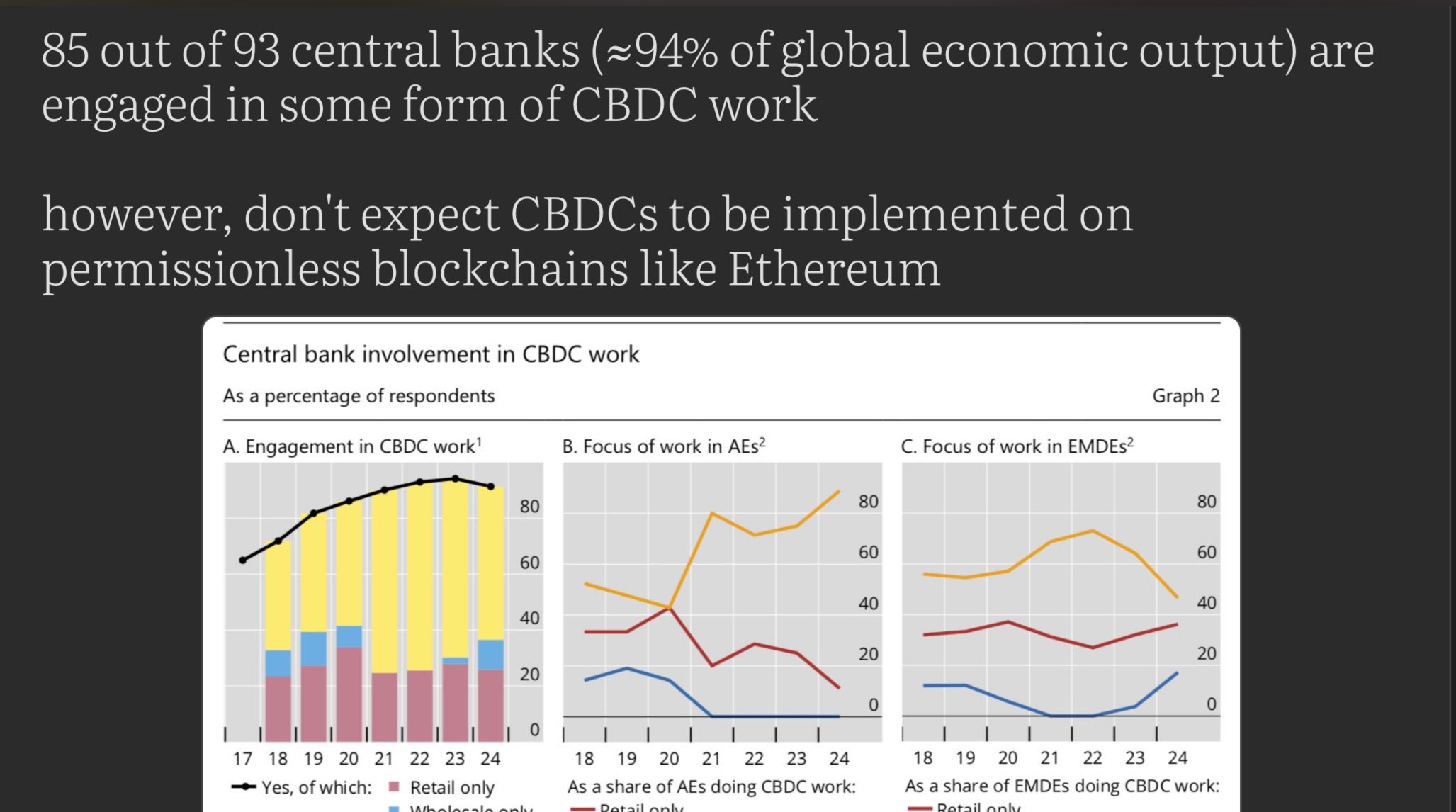

governments are already converting from physical currencies to digital currencies

and it makes sense - it's cheaper, more traceable and more controllable. digital currencies are programmable - purely physical are not

i wrote a thread about how virtually central banks are moving to digital currencies - via retail & wholesale CBDCs:

https://illya.sh/threads/@1756336264-1.html

sell your gold and buy Bitcoin

dealers/market makers need exit liquidity

central banks need a lower purchase price

you've been warned! 😄

BTC went from $0.004 to $110,000 USD in 16 years, but gold was never this cheap in over 5000 years

Going back to the start of recorded price systems - gold's starting price per gram is ≈100 days of labor! This was in 2112 BCE, which was ≈4K years ago

So using earliest records of starting price - 1g of gold would cost ≈25K$ is today's USD 🤯 NOTE: this is an imprecise estimation - but it's useful to bring the gold vs bitcoin price increase argument in perspective. During most of gold's USD history its price has been fixed by the government/law.

Will Bitcoin be here in 5K years? No - not in its current form. Gold (Au) hasn't changed in 13 billion years

Bitcoin promo accounts love to compare BTC to gold, and they frequently cite that BTC is up much more than gold over the last 16 years. The number is big - from its inception Bitcoin is up millionth of percent

What the pro-crypto accounts fail to point out is that mathematically their conclusions are misleading. They almost always use USD as the base currency for comparison, but ignore the fact that gold was used as money several millennia before U.S. was even conceived. As such, such comparisons fail short

They also seem to selectively omit the massive volatility - gold doesn't go down 80% every other day/cycle top

The gold prices here I computed are estimates - don't take them as hard quantitive data. Read this in the context of comparing the price of gold and Bitcoin. If someone's argument is that Bitcoin is better than gold because it had a higher percentual return in 16 years - it likely lacks substance

1. Bitcoin is not money. Calling it money won't make it money

2. Digital currency designs existed before bitcoin - and double spending wasn't an unsolvable problem

3. Again, bitcoin is not money and all it takes is for your government to declare it illicit to censor it. Bitcoin is not private - you will be tracked if needed & in many ways it's much easier than with banks

I'm a big fan of Bitcoin, DeFi & crypto in general, but that doesn't mean reality should be skewed

Remember that lot of accounts posting non-stop pro-BTC/crypto content are paid for it - directly or indirectly. Another large portion of them are automated/bots.

Keep it real 😎