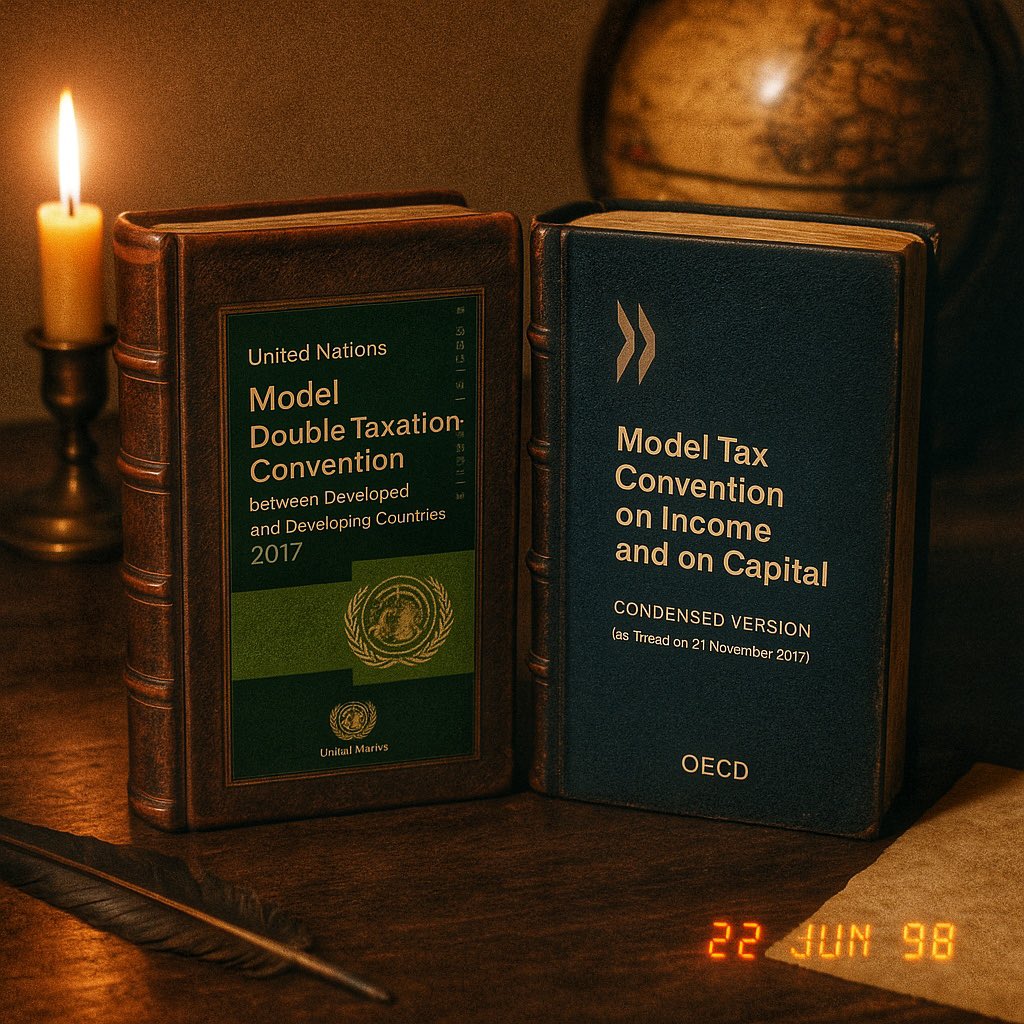

UN's Model Double Taxation Convention has a clear key benefit over OCED's since UN's model gives more taxing rights for the source state - it's the one that makes sense for developing economies imagine a developed nation benefiting from cheaper labor in the source state - who created the workforce in the first place, and having their tax base eroded in favor of resident state so the resident state would get double benefit: 1️⃣ cheaper labor 2️⃣ higher tax income for the government on the other hand you could argue for OCED's model favoring a higher volume of investment, thus effectively distributing more wages throughout the economy. this channels the funds more directly to the consumers, which would end up increasing their purchasing power more than if it had to go through the government first but then again, you must remember the global market is NOT a free market economy. existing legislation overall favors more developed countries, so protective measures for developing countries in the international tax law may make a lot of sense