Illya Gerasymchuk

Entrepreneur / Engineer

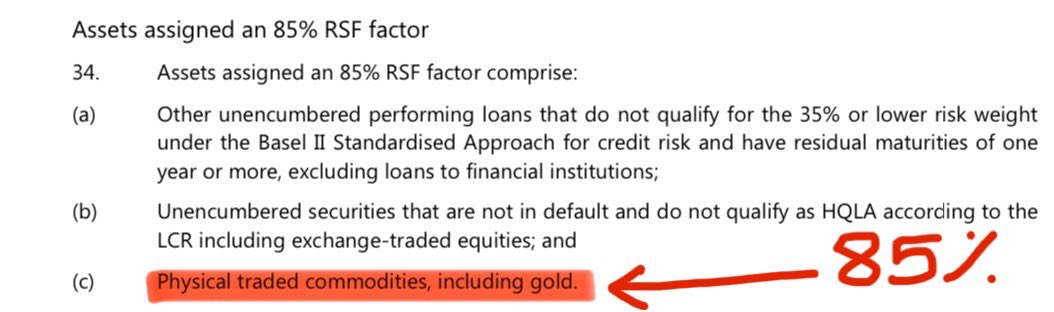

🏦 under Basel III gold is subject additional funding requirements there's a 85% required stable funding (RSF) factor on gold under net stable funding ratio (NSFR) so for every $1B of gold that a bank holds - $850M must be funded with longer term retail or wholesale funding

🚨🏦 claims that gold is a Tier 1 asset under Basel III are FALSE: 1. gold is NOT a Tier capital under Basel - it's on the liability, not asset side 2. gold had 0% risk weight since Basel I (no haircut) 3. gold is still NOT considered a high quality liquid asset (HQLA)