Illya Gerasymchuk

Entrepreneur / Engineer

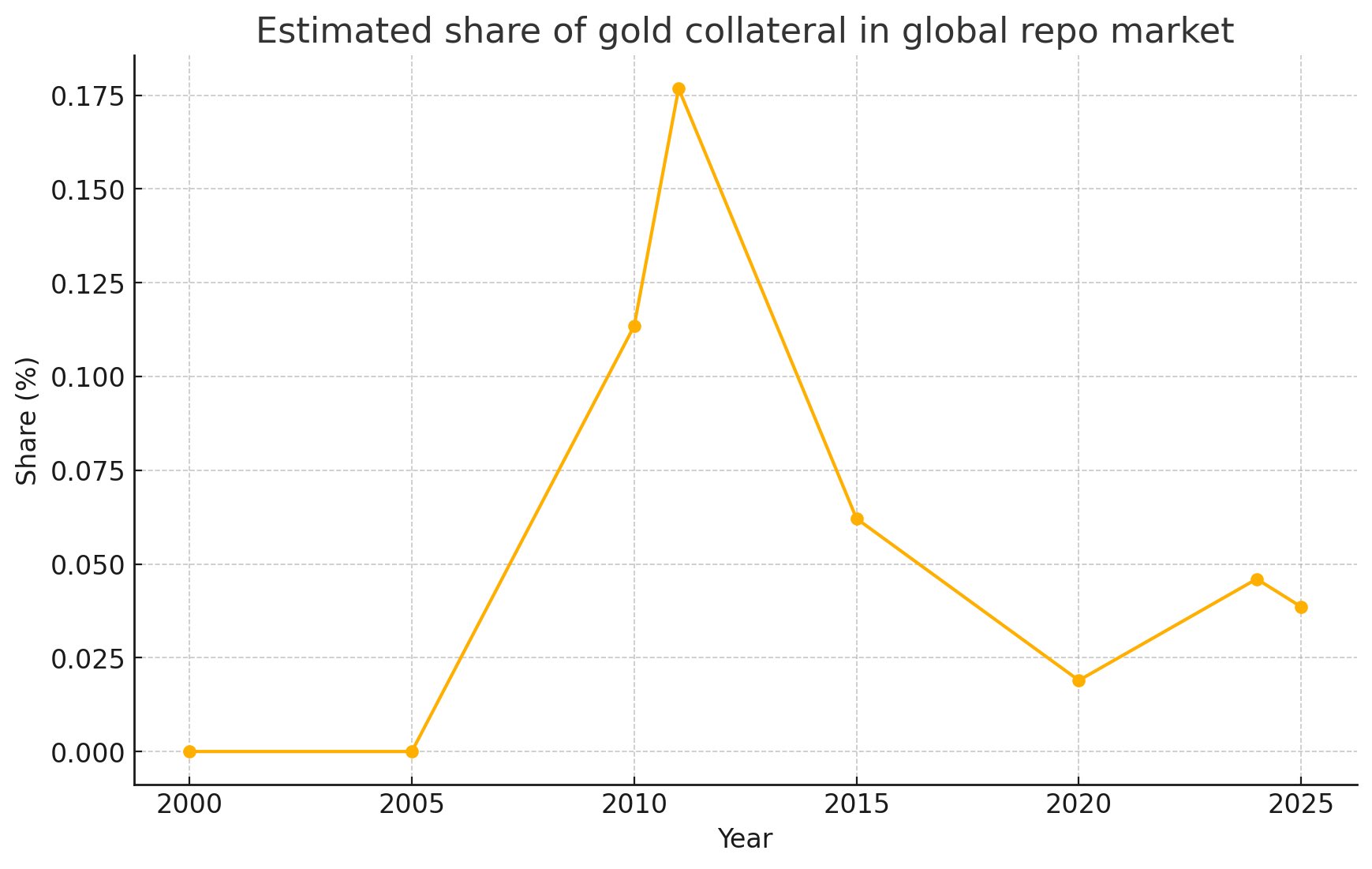

gold did exactly this during the 2008 GFC its share in collateral usage in global repo markets increased and in 2025 we're seeing the same trend, with gold share in repo market collateral increasing

as more markets develop over gold - so will its usage as collateral in short-term/repo credit markets it will likely become a more frequent choice for collateral/hedge during the multipolar transition. specially if bond yields continue to exhibit increased volatility