Illya Gerasymchuk

Entrepreneur / Engineer

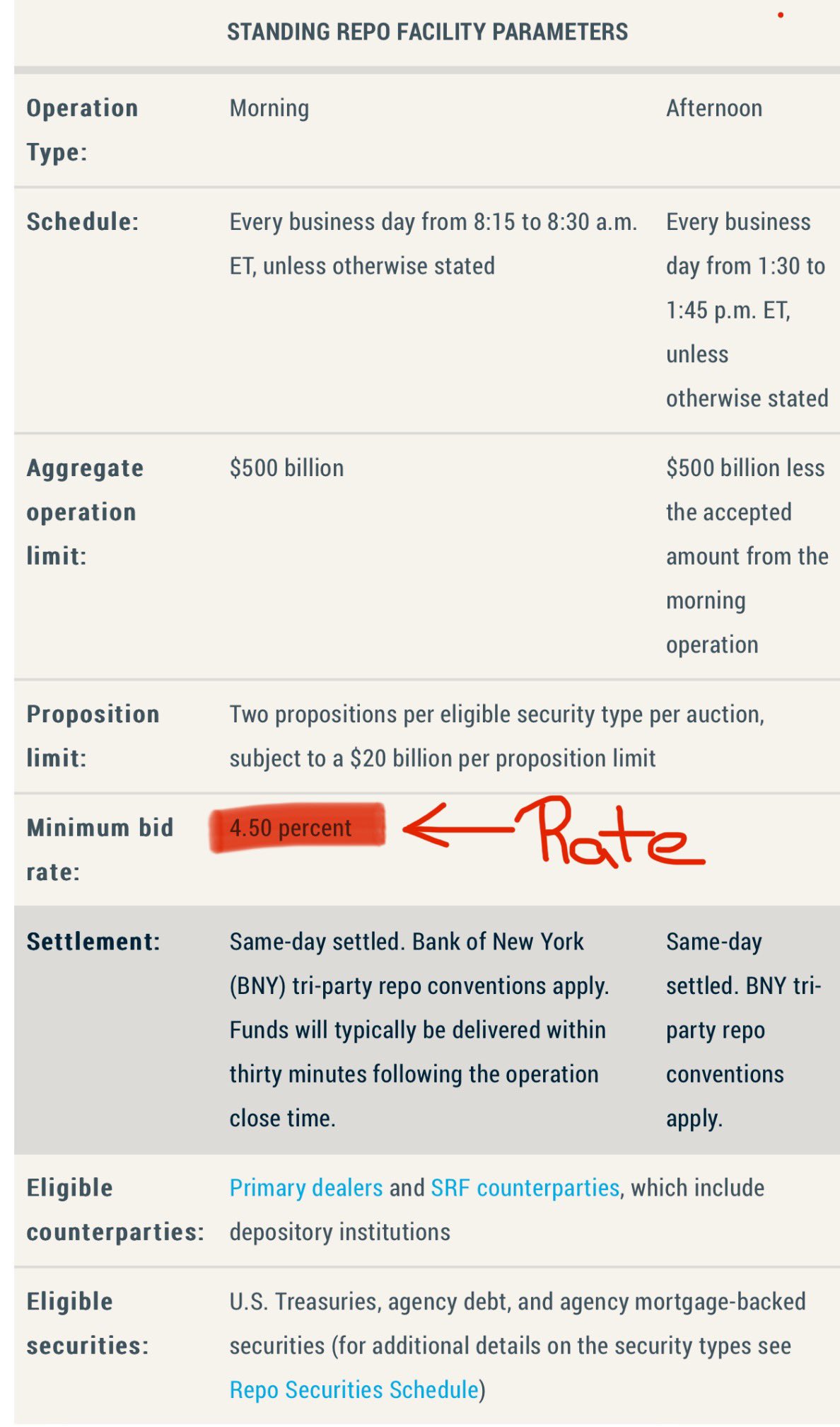

in practice, FED's SRF is used when there is a scarcity of liquidity/cash the market has US bonds & needs cash, so lenders increase rates SRF sets a daily rate. if that rate is smaller than in the smaller repo market - the dealers instead borrow USD directly from the FED

with SRF the FED sets an upper limit on repo market rates most of the collateral is US Treasury bonds this exerts downward pressure on bond yields - by preventing sell-offs