Illya Gerasymchuk

Entrepreneur / Engineer

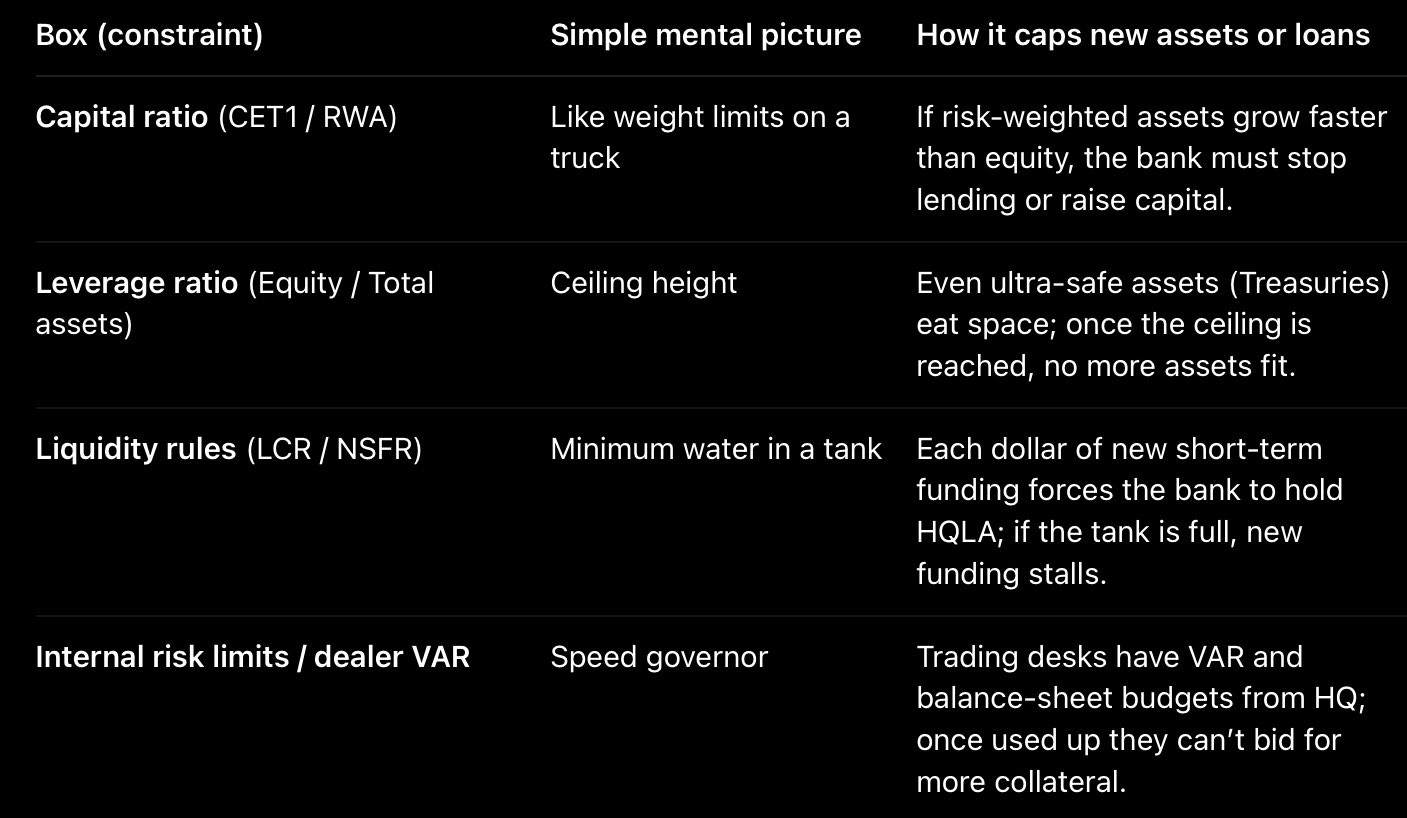

balance sheet capacity is defined by regulations in a world dominated by debt refinancing rather than new credit issuance - the ability to take on more assets and liabilities is more important than interest rates 👉 debt rollover capacity is more important than cost of capital

NOTE: Basel III is legally non-binding so for a step 2 you'd want to look into the transposed legislations 🇪🇺 EU: Capital Requirements Regulation & Capital Requirements Directive 🇺🇸 USA: split throughout Code of Federal Regulations (just ask ChatGPT/LLM & read from there 😄)