Illya Gerasymchuk

Entrepreneur / Engineer

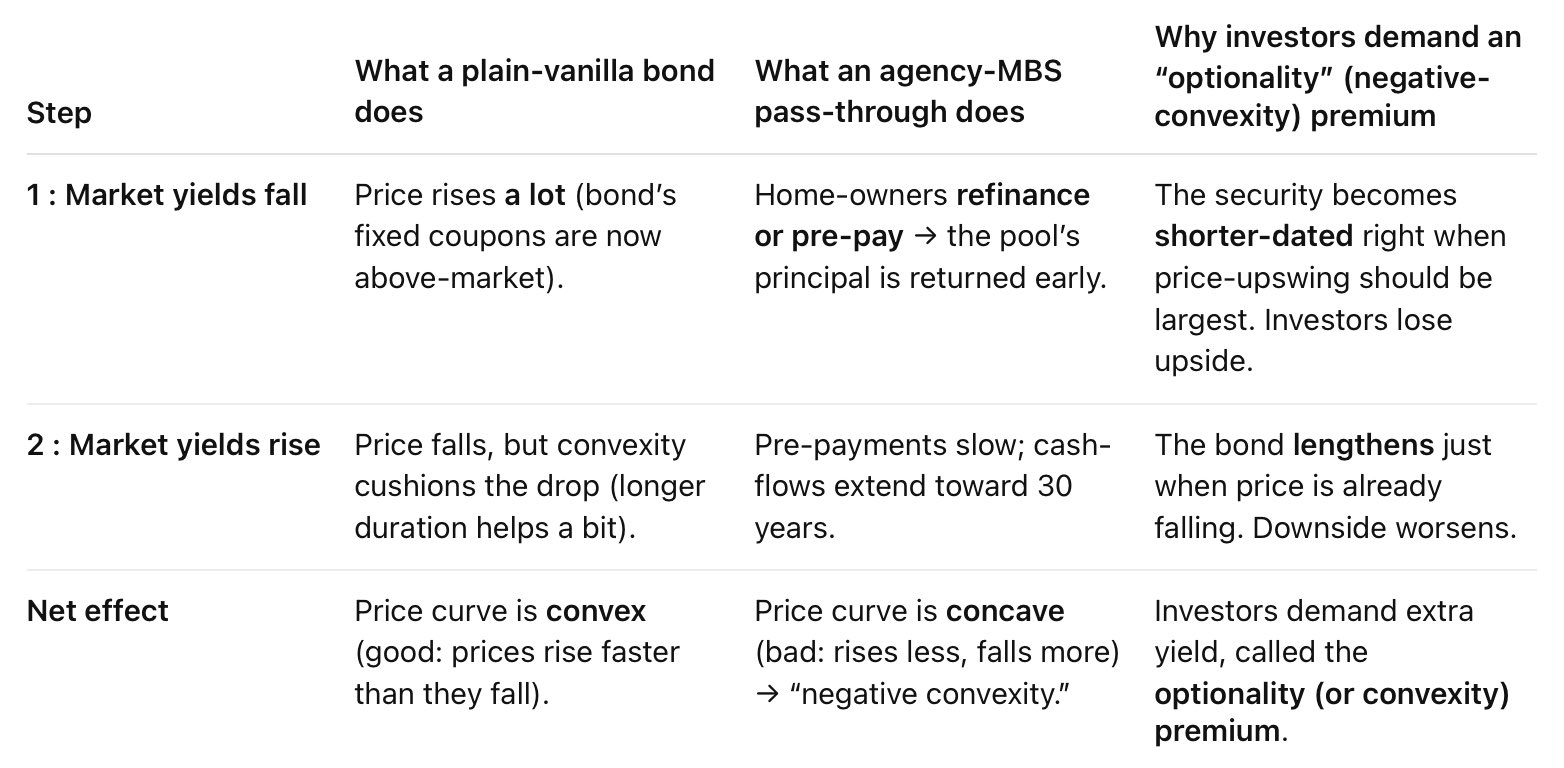

optionality/convexity premium in mortgage backed securities is interesting when market yields fall the price should rise, but since borrowers take advantage of lower mortgage rates to make early payments - the price does not raise as much, due to lowered duration

Fed's balance sheet expansion with agency MBS reduced risks in liquidity, market depth and optionality/convexity this is a crucial point to understand - it wasn't just the Fed buying agency MBS, but the explicit government guarantee that accompanied it thus, the yields fell