Illya Gerasymchuk

Entrepreneur / Engineer

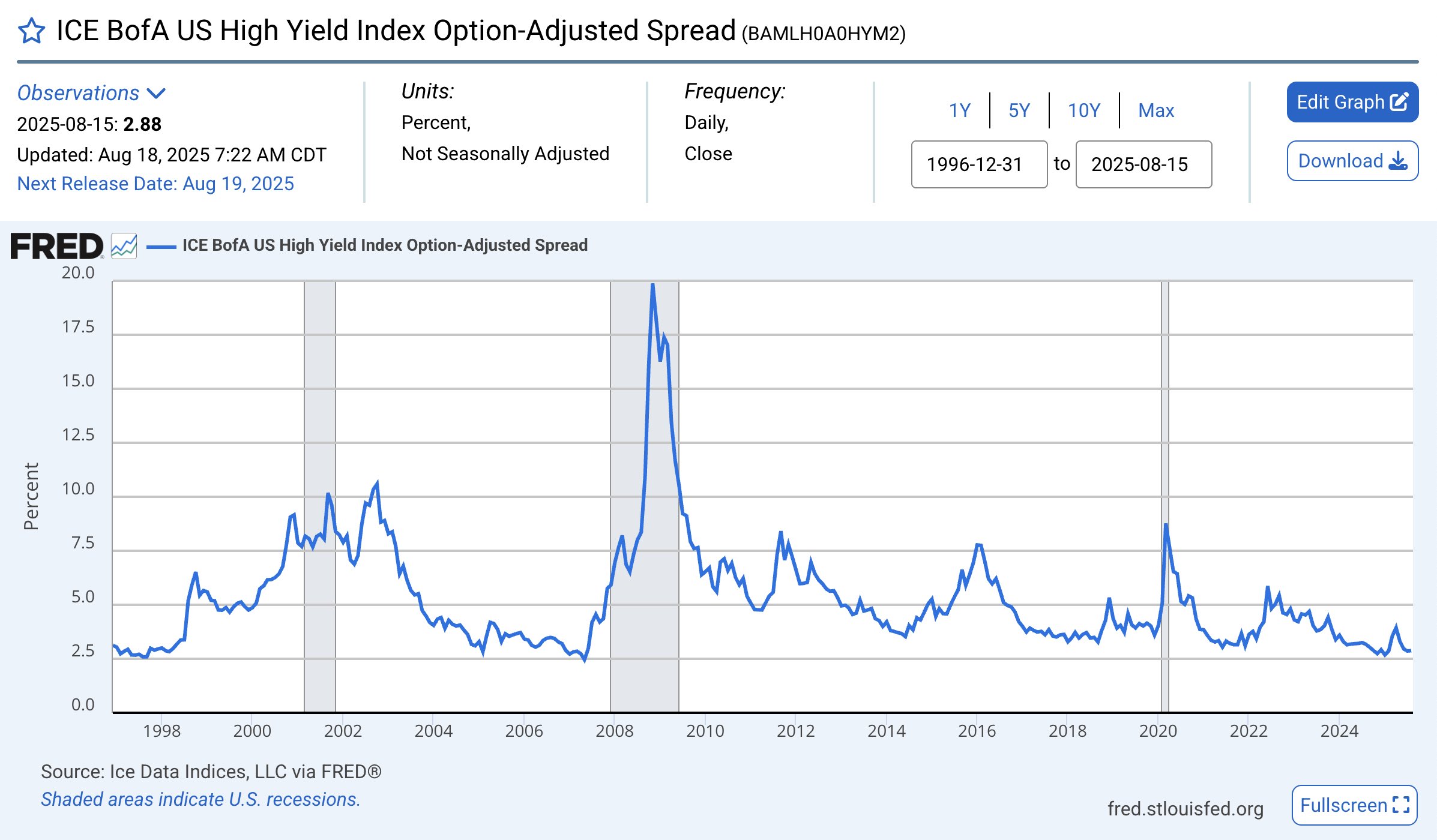

yield spread between a safe asset and a riskier one is an expression of the required return per unit of risk higher yield spreads, means risker bonds are significantly cheaper than US Treasury bonds, thus the market is valuing safe assets with a premium - a "risk-off" signal