Illya Gerasymchuk

Entrepreneur / Engineer

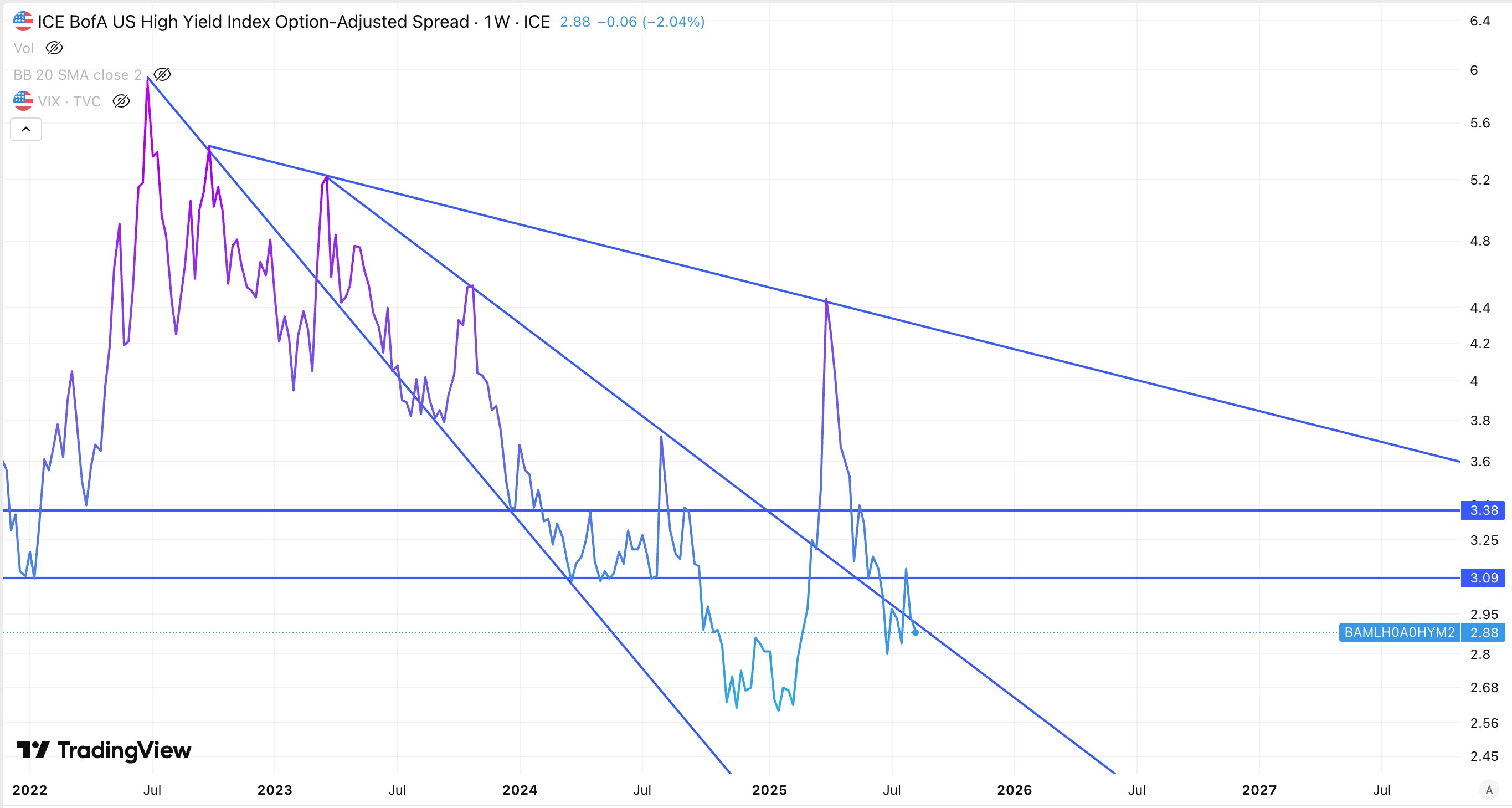

cryptocurrency prices perform well when yield spreads are low/decreasing and bad when yield spreads are high/increasing this is specifically true when you analyze it at a higher timeframe - think monthly timescale instead of daily one. and the larger the spike/change

eventually this carry trade unwinds, and yield spreads soar. balance sheet constrains, existing positions get too expensive too roll-over/re-finance that’s where you get the big(er) financial crisis and then you get more QE/lower rates to address that