Bitcoin market, cycles & ETF flows

Timeline of BTC price action, halving-cycle milestones, ETF flows and correlations with macro liquidity.

my vibe meter on Bitcoin is off the charts 📈*

the algorithm on X has been pushing a lot of pro-BTC content over the past month, and it's becoming more and more irrational:

accounts with millions of followers recycling 2024 news about "new" gold reserves in China, false news about China legalizing Bitcoin and calls for gold going down to $2000

every pro-Bitcoin account seems to be calling a long-term gold top (LOL!) and heavy rotation into Bitcoin. actually a lot of BTC shill content is about BTC being better than gold - and the arguments for it aren't very sound. i've written several posts explaining this. BTC crowd seems very obsessed about gold - especially when it comes to showing how it's inferior to Bitcoin. Bitcoin is not gold - and it will never be gold - they're very different assets. that doesn't mean that BTC ownership is a bad idea - but it's important important to approach it rationally

a large part of this seems coordinated/paid campaigns. liquidity always needs an exit

so Bitcoin should continue with some more downside in the near future

* this sentiment is based on vibes, but it's backed by technicals & fundamentals at its base. you can find in-depth explanations in my past posts and threads

sell your gold and buy Bitcoin

dealers/market makers need exit liquidity

central banks need a lower purchase price

you've been warned! 😄

BTC went from $0.004 to $110,000 USD in 16 years, but gold was never this cheap in over 5000 years

Going back to the start of recorded price systems - gold's starting price per gram is ≈100 days of labor! This was in 2112 BCE, which was ≈4K years ago

So using earliest records of starting price - 1g of gold would cost ≈25K$ is today's USD 🤯 NOTE: this is an imprecise estimation - but it's useful to bring the gold vs bitcoin price increase argument in perspective. During most of gold's USD history its price has been fixed by the government/law.

Will Bitcoin be here in 5K years? No - not in its current form. Gold (Au) hasn't changed in 13 billion years

Bitcoin promo accounts love to compare BTC to gold, and they frequently cite that BTC is up much more than gold over the last 16 years. The number is big - from its inception Bitcoin is up millionth of percent

What the pro-crypto accounts fail to point out is that mathematically their conclusions are misleading. They almost always use USD as the base currency for comparison, but ignore the fact that gold was used as money several millennia before U.S. was even conceived. As such, such comparisons fail short

They also seem to selectively omit the massive volatility - gold doesn't go down 80% every other day/cycle top

The gold prices here I computed are estimates - don't take them as hard quantitive data. Read this in the context of comparing the price of gold and Bitcoin. If someone's argument is that Bitcoin is better than gold because it had a higher percentual return in 16 years - it likely lacks substance

1. Bitcoin is not money. Calling it money won't make it money

2. Digital currency designs existed before bitcoin - and double spending wasn't an unsolvable problem

3. Again, bitcoin is not money and all it takes is for your government to declare it illicit to censor it. Bitcoin is not private - you will be tracked if needed & in many ways it's much easier than with banks

I'm a big fan of Bitcoin, DeFi & crypto in general, but that doesn't mean reality should be skewed

Remember that lot of accounts posting non-stop pro-BTC/crypto content are paid for it - directly or indirectly. Another large portion of them are automated/bots.

Keep it real 😎

now crypto twitter seems to think that gold & silver have topped 😂

i don't think CT understands what gold & silver are

people are calling Christine Lagarde ignorant on Bitcoin, but don't explain how

how exactly are her statements on Bitcoin ignorant? it's not nice to insult someone, and it certainly doesn't explain how Bitcoin has the same amount and class of intrinsic value as gold - a commodity that has been money for over 5K years

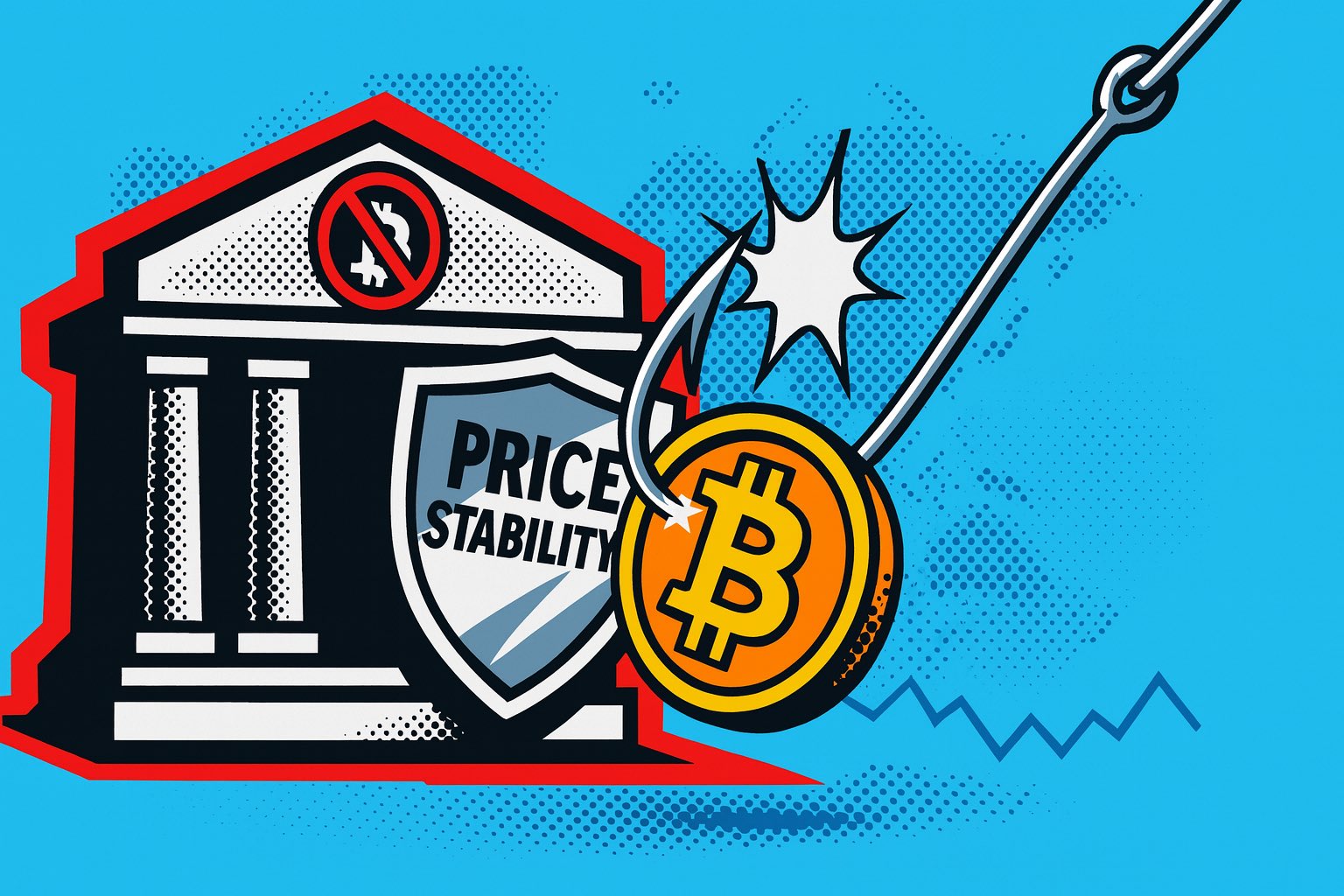

what is even the purpose of a central bank holding BTC in their balance sheet today? speculative investments are not a part of their mandates and moving in that direction would be contradictory to their legally established goals

commercial banking is not the same as central banking

central banks have rejected holding Bitcoin in their reserves including Fed, ECB, PBoC and many others

what would even be the purpose of a central bank holding BTC on their balance sheet? so that they can stabilize the value of the currency against Bitcoin? what would be the practical benefit from it now?

cross-border crypto trade in non-stablecoins is negligible. Bitcoin is extremely volatile, which would make central-bank issued currency more volatile - this goes exactly against the direct mandate of most central banks - price stability.

a more volatile currency will also lead to a more volatile bond market, which will make government funding more volatile, and thus a high risk/uncertain economy

and i'm not even going to touch on the security risks. okay, maybe briefly 😄:

➖ governments are one of the only entities that can realistically perform a successful 51% attack on Bitcoin. well, with central banks owning BTC will make such attacks much more attractive - including at the geopolitical level. the same goes for denial of service family of attacks

➖ what if the central bank's wallets get hacked/compromised? i'm not talking about quantum computers breaking RSA, but operational level mistake or compromise

so for the next 10 years, I view central banks holding Bitcoin on their balance sheet as a negative sign for their currency. of course, the protocol and the bitcoin network will evolve/change over time, and with so may my stance

i believe cryptocurrencies, and more specifically distributed layer technologies/blockchain architectures can bring immense value to our financial system as a whole, but that doesn't mean that we should have central banks speculating on that today. it makes much more sense to increase gold reserves instead

virtually every corporation that accepts Ethereum/Bitcoin for payments doesn't actually process the payment in crypto

they immediately covert it to USD or another FIAT, and not actually hold the BTC, ETH, etc

the convertion is generally done via an intermediary, so the company you're buying never even touch or care about the crypto asset. they want the same government-backed currencies that we use now

the intermediary will also generally charge a fee, around ≈1% of the transaction value. so buying directly with crypto is likely to be more expensive than directly with FIAT. if you just sell the crypto for FIAT and pay directly in USD, EUR, etc it will likely be cheaper. so what's the point of paying more?

don't be fooled by headlines or articles that suggest otherwise

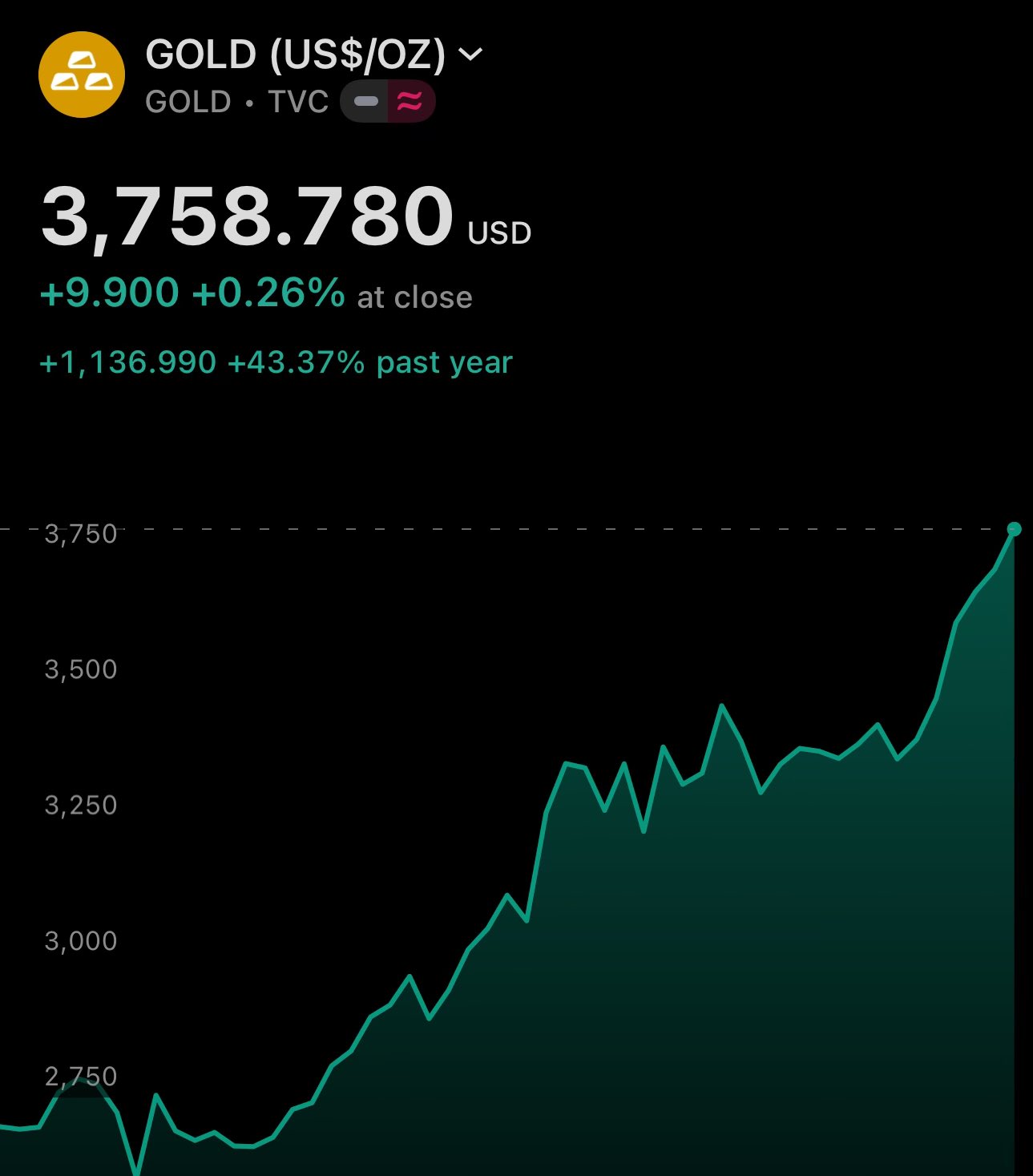

when mega caps like gold explode by ≈50% in a year and you don't think that that's a warning sign for US equities/risk asset - you probably should look back at history 😄

Bitcoin and Intel have do have one thing in common - direct monetary intervention from the US government

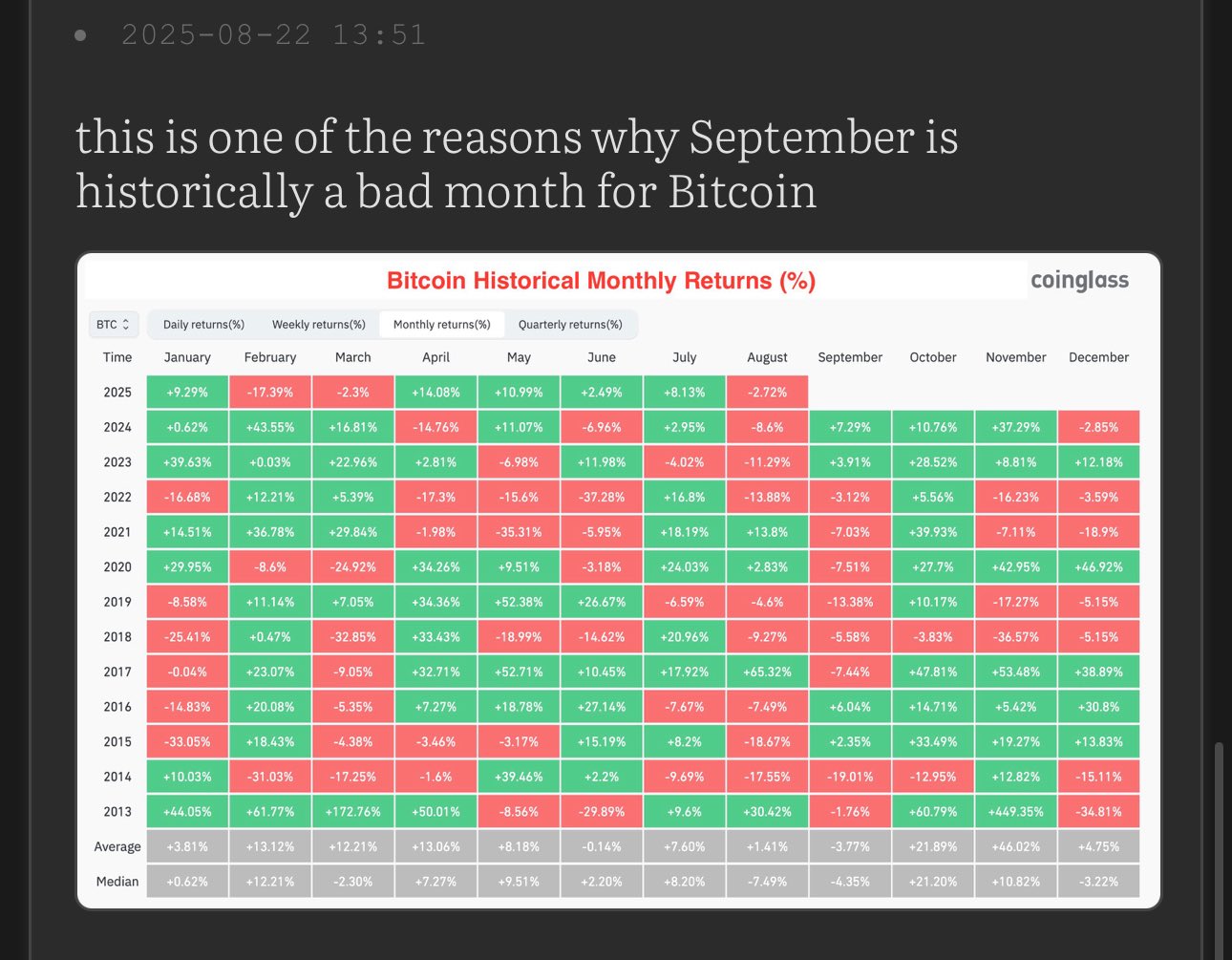

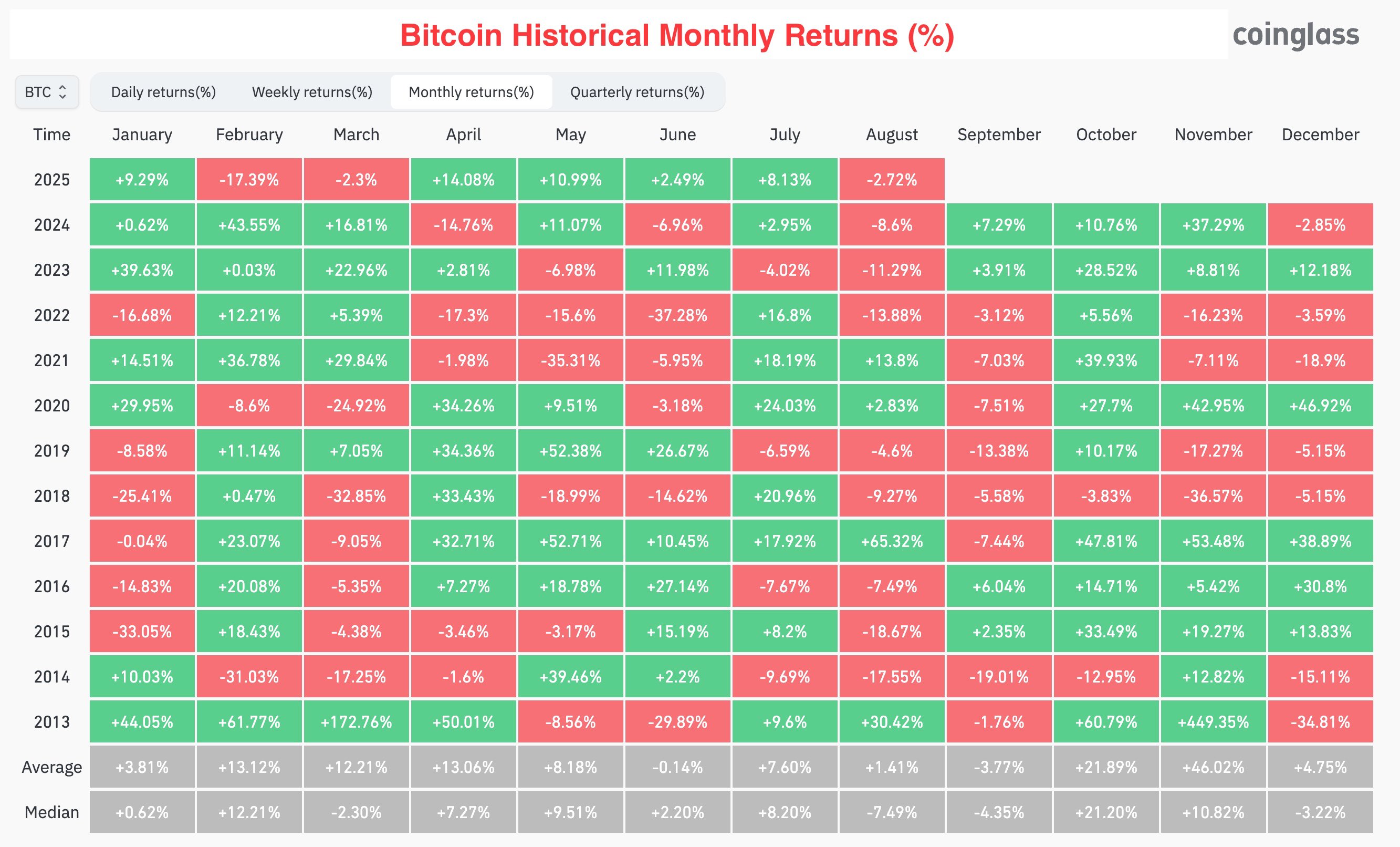

you can read the full article/thread explaining why September is generally a bad month for Bitcoin and other cryptocurrencies here: https://illya.sh/threads/@1755867104-1.html

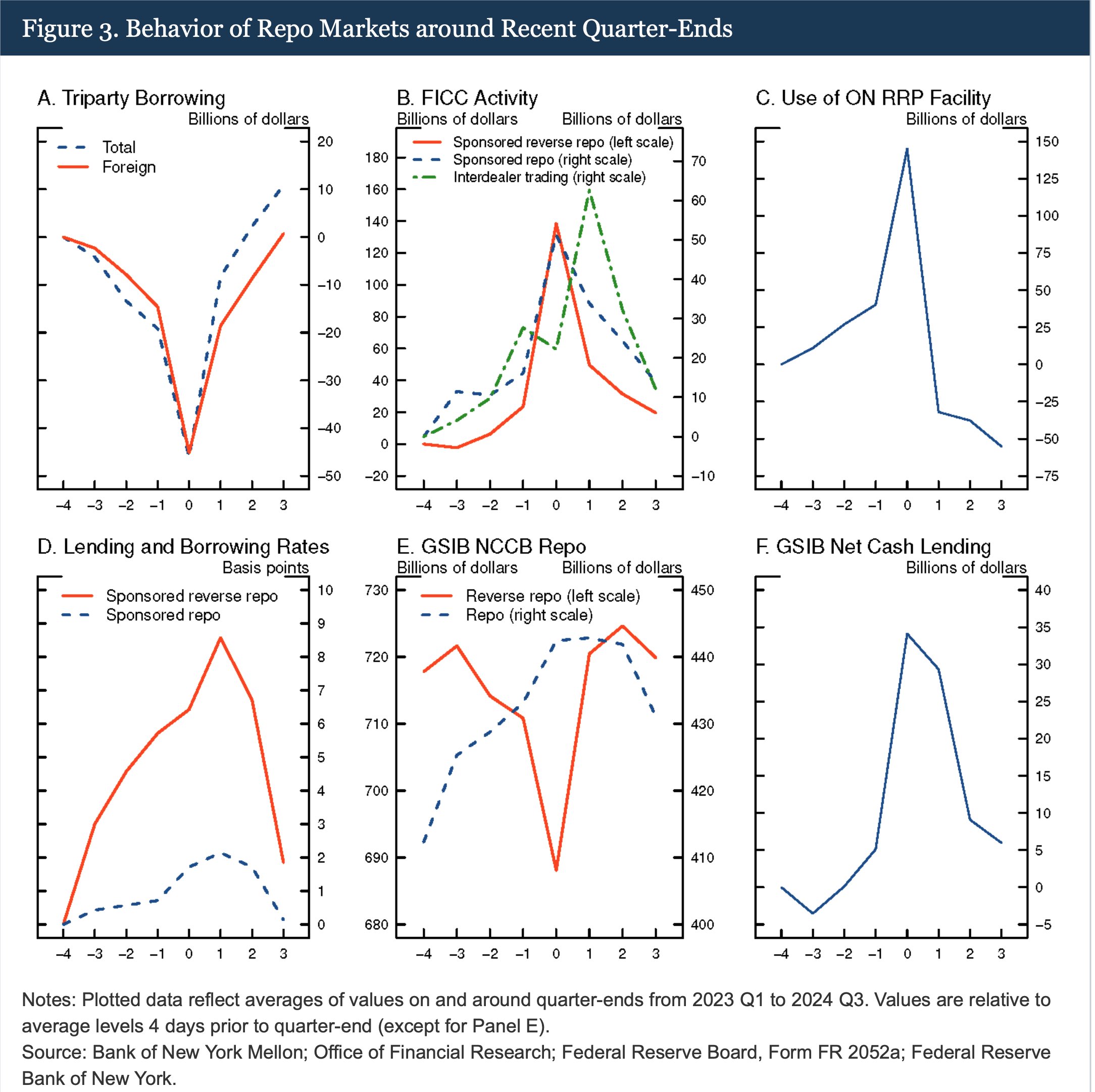

my article on repo rates and BTC price was referenced on bitcoin.com

apparently it's been there for a month, but i only noticed now

it's a short read - and explains the negative price pressure that quarter-ends, and especially September bring on the price of liquidity sensitive assets like Bitcoin

it give you a concrete perspective on the current cryptocurrency price dump, even with decreasing funding rates

my article on repo rates and BTC price was referenced on bitcoin.com

apparently it's been there for a month, but i only noticed now

it's a short read - and explains the negative price pressure that quarter-ends, and especially September bring on the price of liquidity sensitive assets like Bitcoin

it give you a concrete perspective on the current cryptocurrency price dump, even with decreasing funding rates

this is one of the reasons why September is historically a bad month for Bitcoin