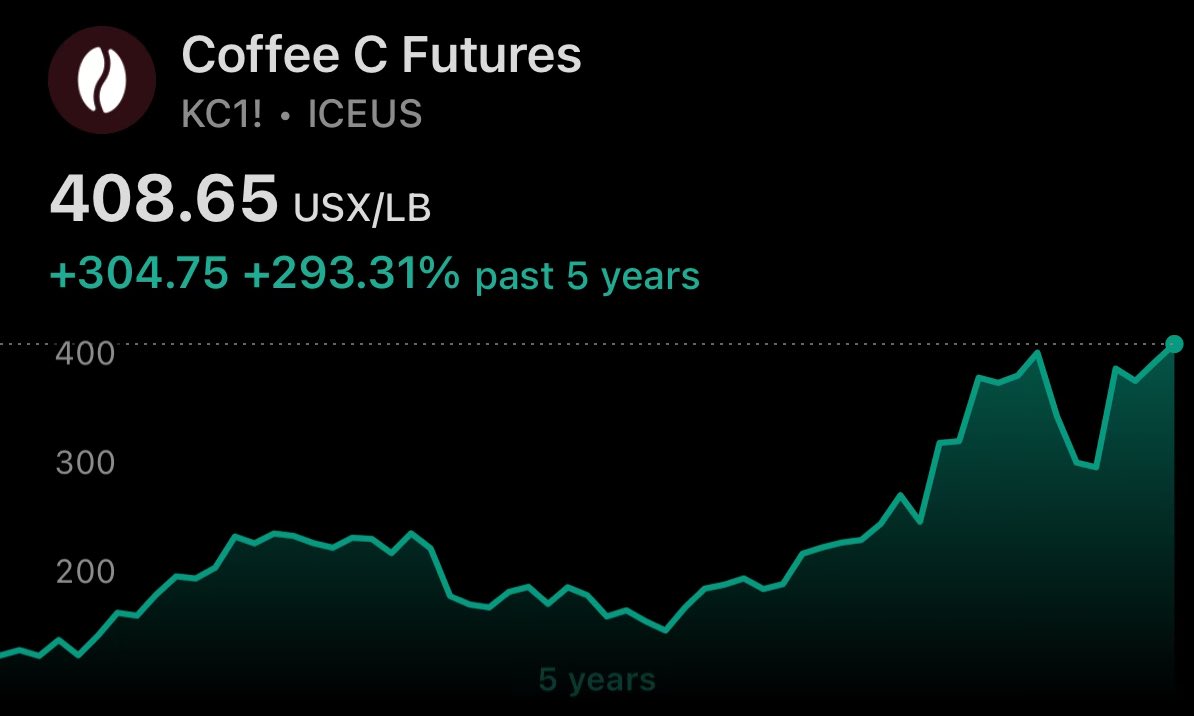

Coffee outperformed Gold in the last 5 years

Would it be sound to conclude that coffee beans are better money and investment than gold, and that Central Banks should hold coffee & its derivatives in reserve assets?

Bitcoin has less than 20 years of price action, and it started trading at a negligent price. Gold has been money for over 5000 years and its earliest recorded price per ounce is of ≈100 days of labor

A better question is whether Bitcoin will continue to consistently outperform gold over the next 20 years. *Consistency* is key - it must be at least a store of value, including shorter-term. If you get caught in the typical >50% price drops - you may pay a high opportunity cost.

It's not just whether Bitcoin will increase more in price than gold in the next 20 years, but also how severe and long-lasting Bitcoin's corrections are.

Imagine you buy Bitcoin today and it goes into a bear market with a significant value loss in the next 4 years. In those 4 years - many investment opportunities may arise, such as in real estate, equities, commodities or bonds. If your capital is locked in Bitcoin throughout that period - that's an opportunity cost.

Gold doesn't come with those shortcomings. There is a reason why all world reserve currencies started on a gold and/or silver standards.

There is no free lunch in the markets. Higher return is almost unanimously correlated with higher risk. Quantitatively Bitcoin is high risk- it's not a matter of opinion.

This doesn't mean that Bitcoin is a bad idea, but it also doesn't mean that Bitcoin is a better idea than gold. It does, however mean, that Bitcoin isn't a replacement for gold.

And now you understand what makes gold so special. You don't have to believe me - believe centuries of price action and human history.