Global liquidity indicators & flows

Short-form analysis of TGA, RRP, money aggregates, credit growth and cross-border USD flows that drive risk assets.

initially QE may only increase base money supply - as commercial banks reserve balances get credited by the Central Bank

if the Central Bank purchases assets from non-bank financial institutions, then broad money increases directly as well, as deposits increase

the US Treasury may also issue more debt to increase the supply of safe assets, thus offsetting the compression shock

end result: more safe assets/prime collateral provided to markets. remember that the newly issued treasuries are likely to be rehypothecated several times

the US Treasury may also issue more debt to increase the supply of safe assets, thus offsetting the compression shock

end result: more safe assets/prime collateral provided to markets. remember that the newly issued treasuries are likely to be rehypothecated several times

the global financial system depends on the abundance of this collateral, otherwise - defaults, margin calls, etc

i wrote a thread/article explaining how US Treasuries are the dominant collateral in short-term wholesale debt markets (e.g. repo). read here: https://illya.sh/threads/@1751726431-1.html

the global financial system depends on the abundance of this collateral, otherwise - defaults, margin calls, etc

i wrote a thread/article explaining how US Treasuries are the dominant collateral in short-term wholesale debt markets (e.g. repo). read here: https://illya.sh/threads/@1751726431-1.html

QE also removes safe collateral from the market, mainly US Treasury bills, notes and bonds. this safe collateral is the backbone of wholesale debt markets, where financial institutions, including commercial and central banks finance and re-finance their positions

since all dealers are subject to functionally similar regulatory constraints, they're also subject to functionally similar set of balance sheet constraints

this is important to remember in the context of global liquidity, especially in terms of pro-cyclical effects

bank dealers are subject to Basel III, non-bank dealers to other similar regulations

non-bank dealers don't have HQLA or leverage ratio (Basel), but they have net capital haircuts and other leverage/margin requirements

so all dealers are subject to a similar set of regulations

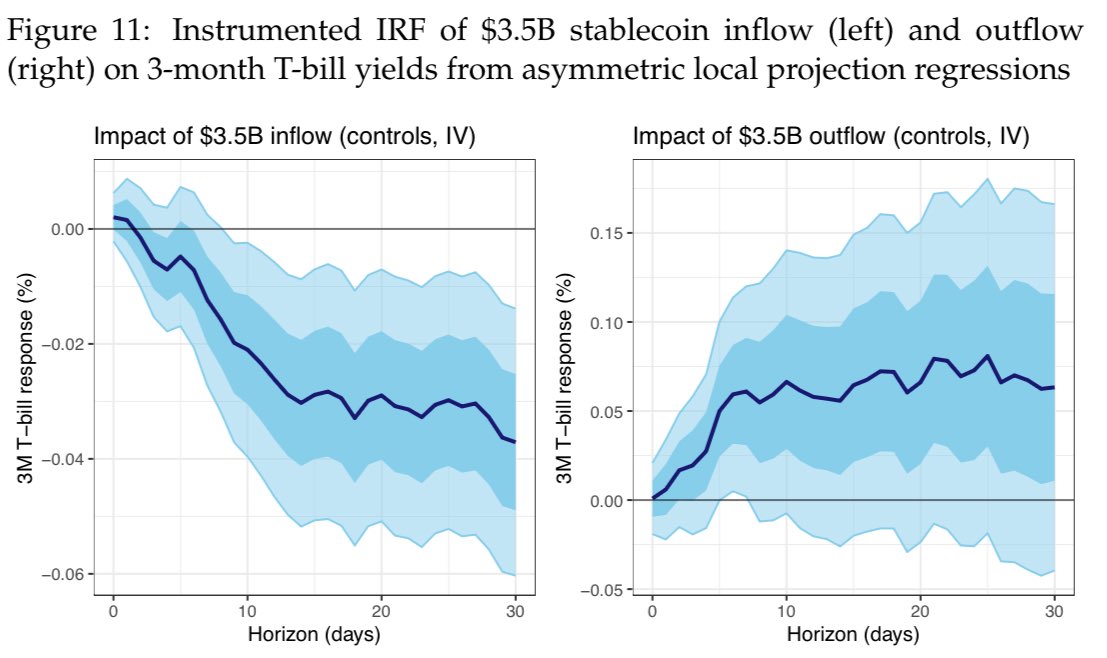

essentially many T-bill sales flood the market at once, so their price falls, thus causing a yield increase

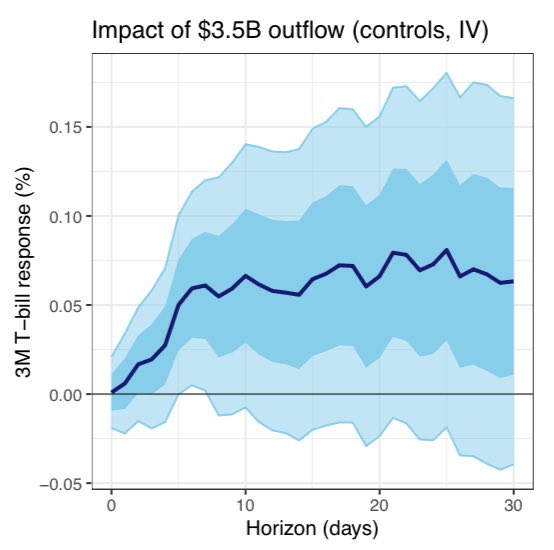

selling T-bills is more urgent than buying - the stablecoin issuer cannot split it across auctions & dealers as easily, so the market yield change is larger on outflows

stablecoin outflows proxy T-bill sales or reduced rolling

redemption/burn requires the stablecoin issuer to sell NOW, so large volumes means dealers/market makers will require a yield concession to warehouse those T-bills, as they are subject to balance sheet constraints

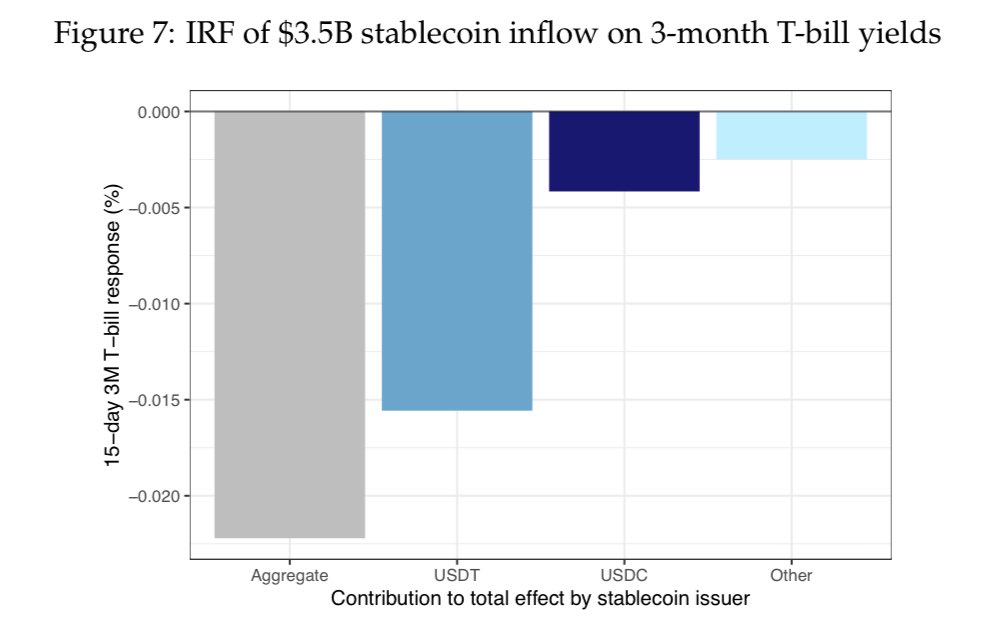

this is because a stablecoin mint/creation on-chain is the proxy for a T-bill purchase by the company issuing that stablecoin (e.g. Circle, Tether)

so stablecoin inflows proxy T-bill purchases, which raises their price and lowers the yield

stablecoin inflows lower 3M Treasury bill yields, while outflows raise yields by a larger amount

LP-IV estimates:

⏩ $3.5B inflows lower yields by ≈3 bp

⏪ $3.5B outflows raise the yields by ≈8 bp

inflow = mint

outflow = redemption/burn

Bank of International Settlements (BIS) has a lot of interesting papers, articles and data on global liquidity and financial system

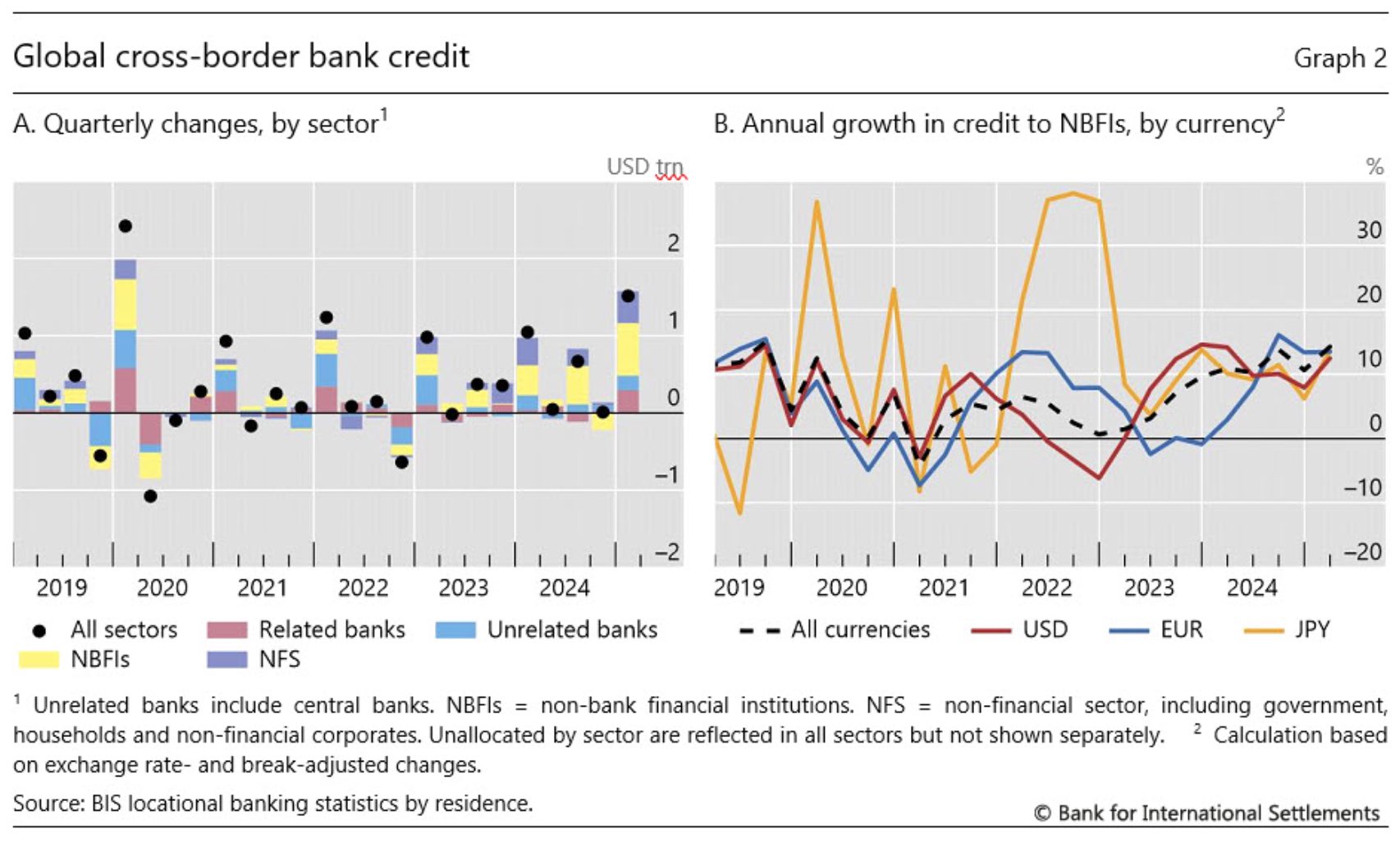

it's bank-focused, but connected to the broader scope, like the non-bank financial institution (NBFI) credit flows i posted about earlier

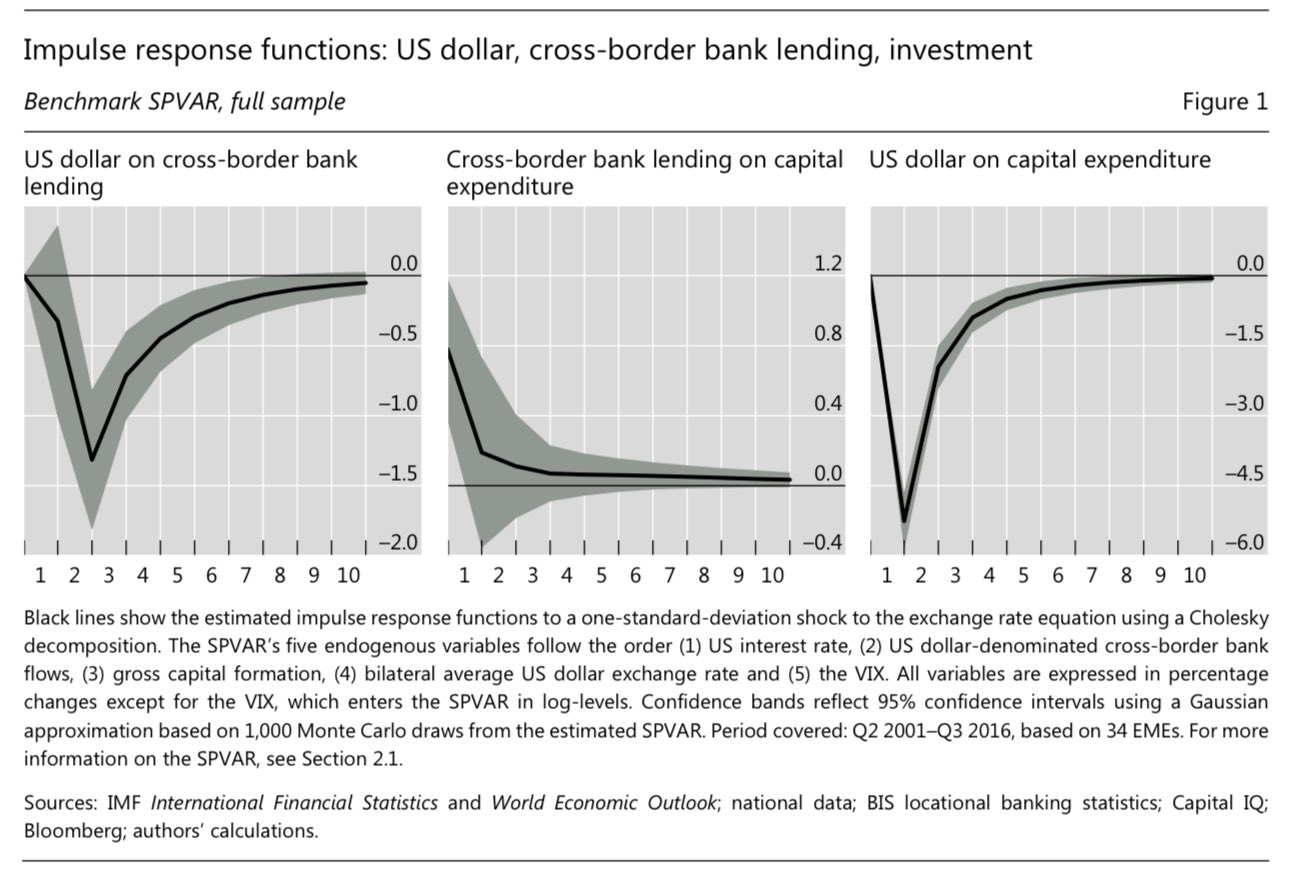

i wrote a thread explaining why weaker USD means more credit/loans issued in USD, thus driving up global liquidity

you can read it here: https://illya.sh/threads/@1755216337-1.html

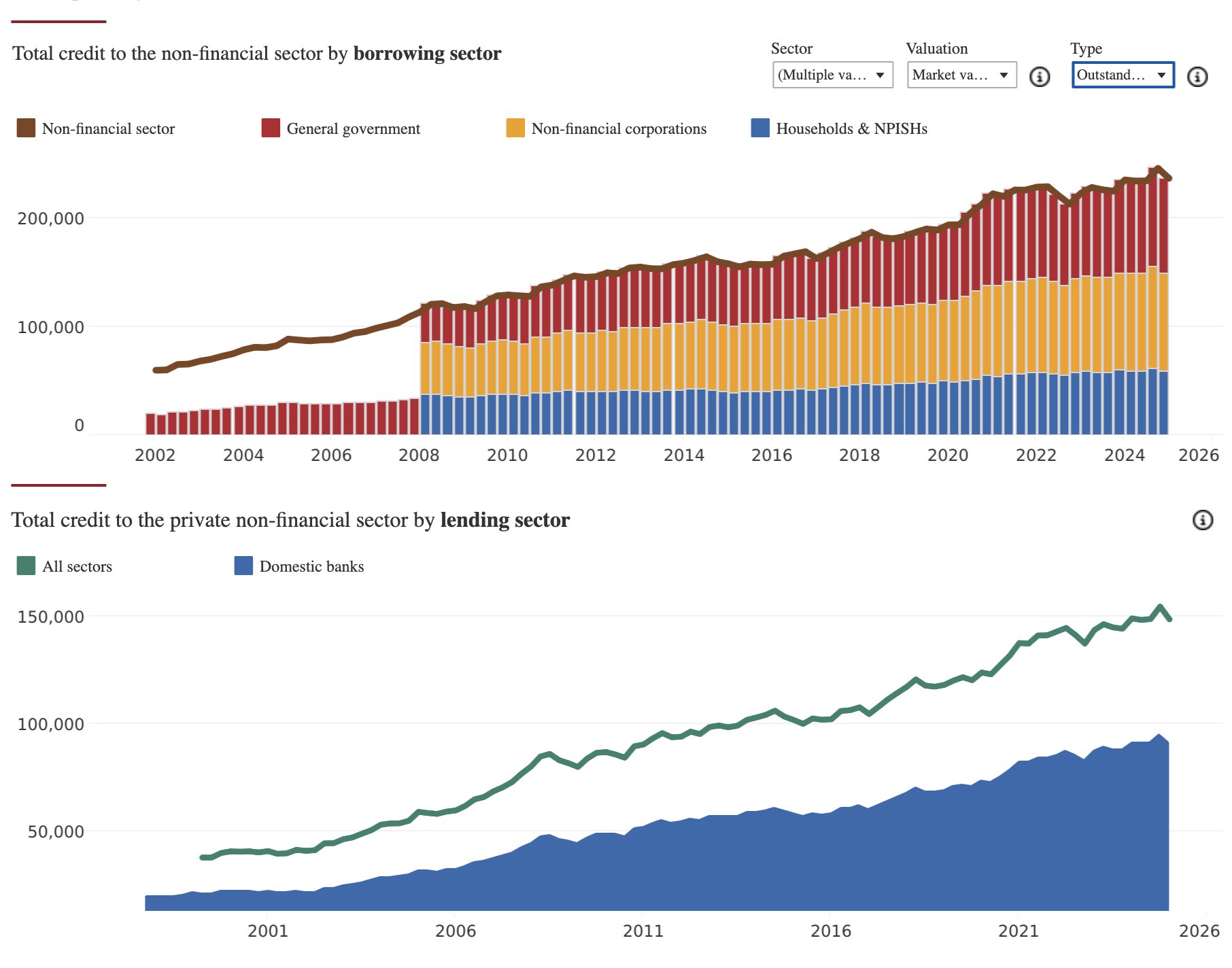

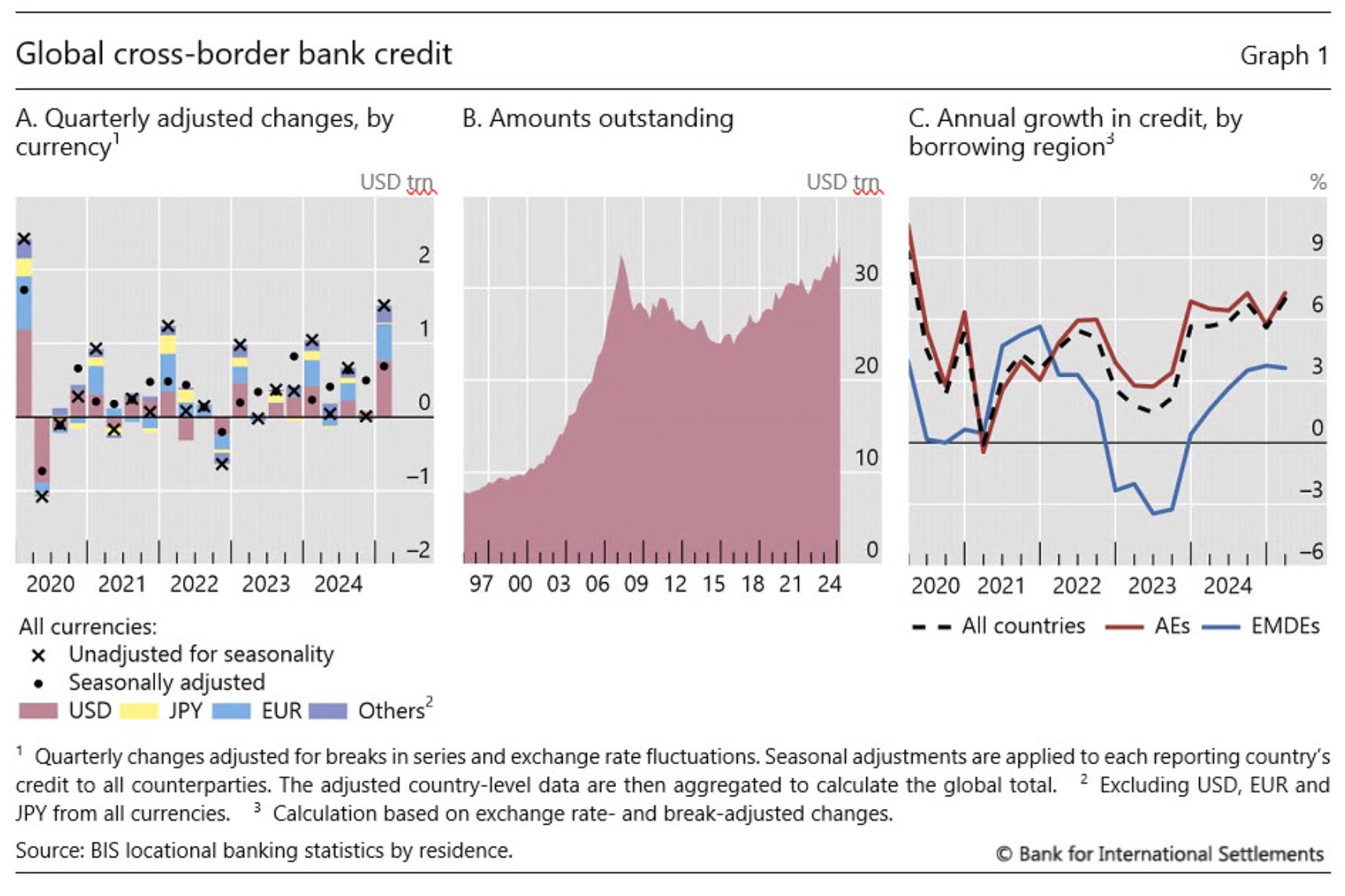

credit continues to expand in the non-financial sector as well

the attached graph also shows a turning point in 2008 - that's how the GFC was handled - by issuing more credit 😁

you can also see a steeper increase during COVID

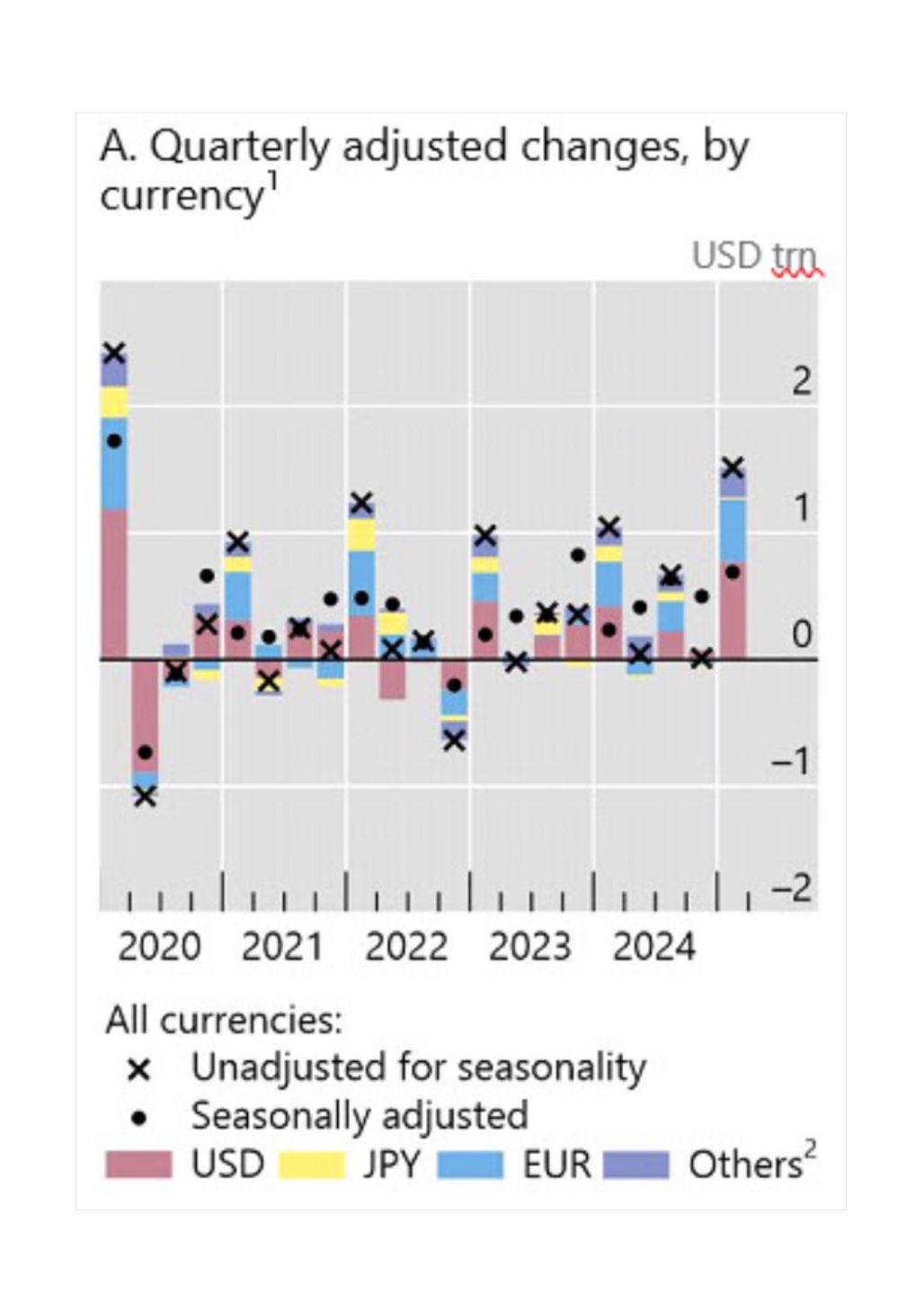

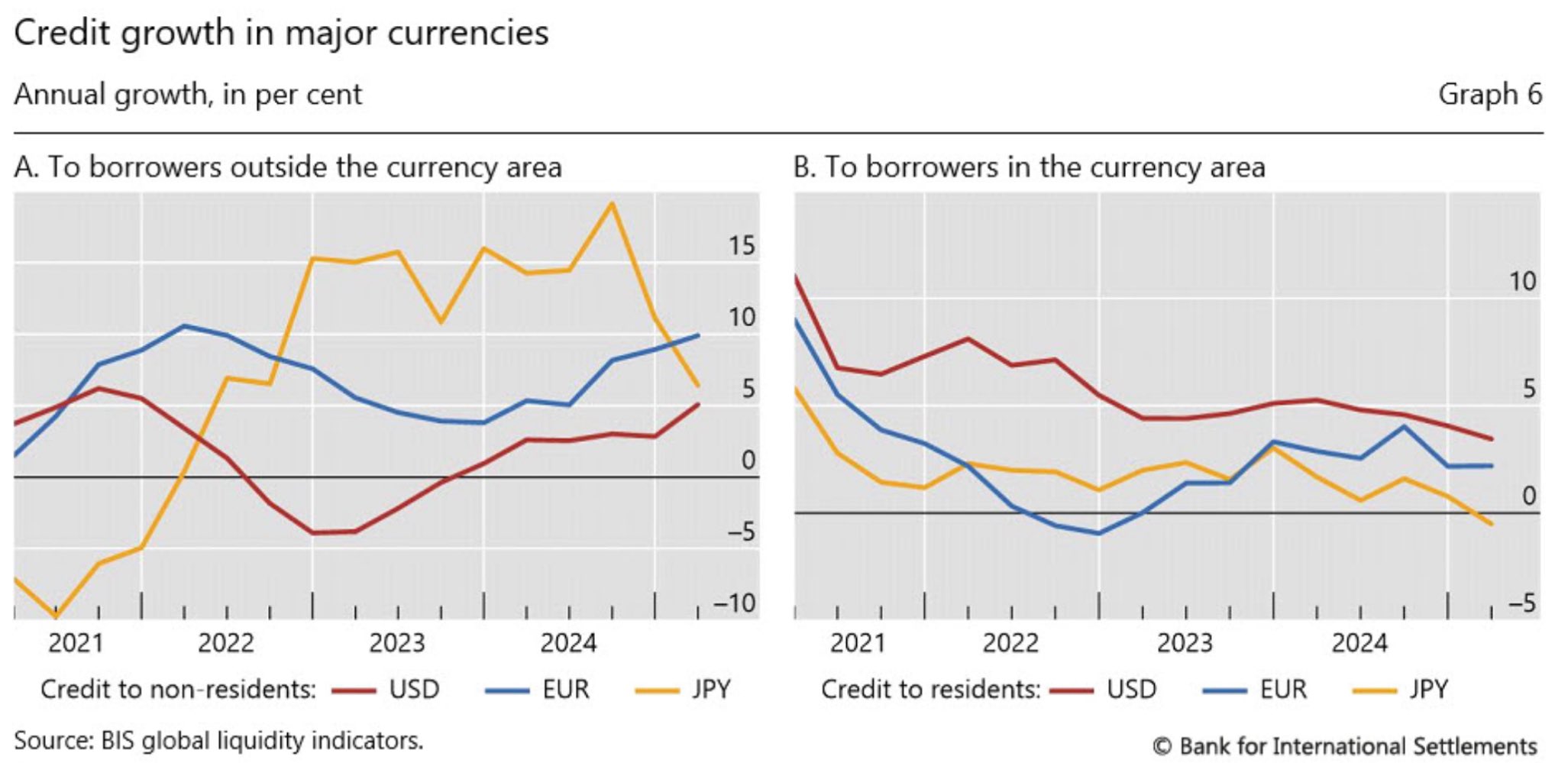

USD cross-border bank credit grew by $800 billion in Q1 2025

expect further increases for Q2 2025, due to the weak US dollar

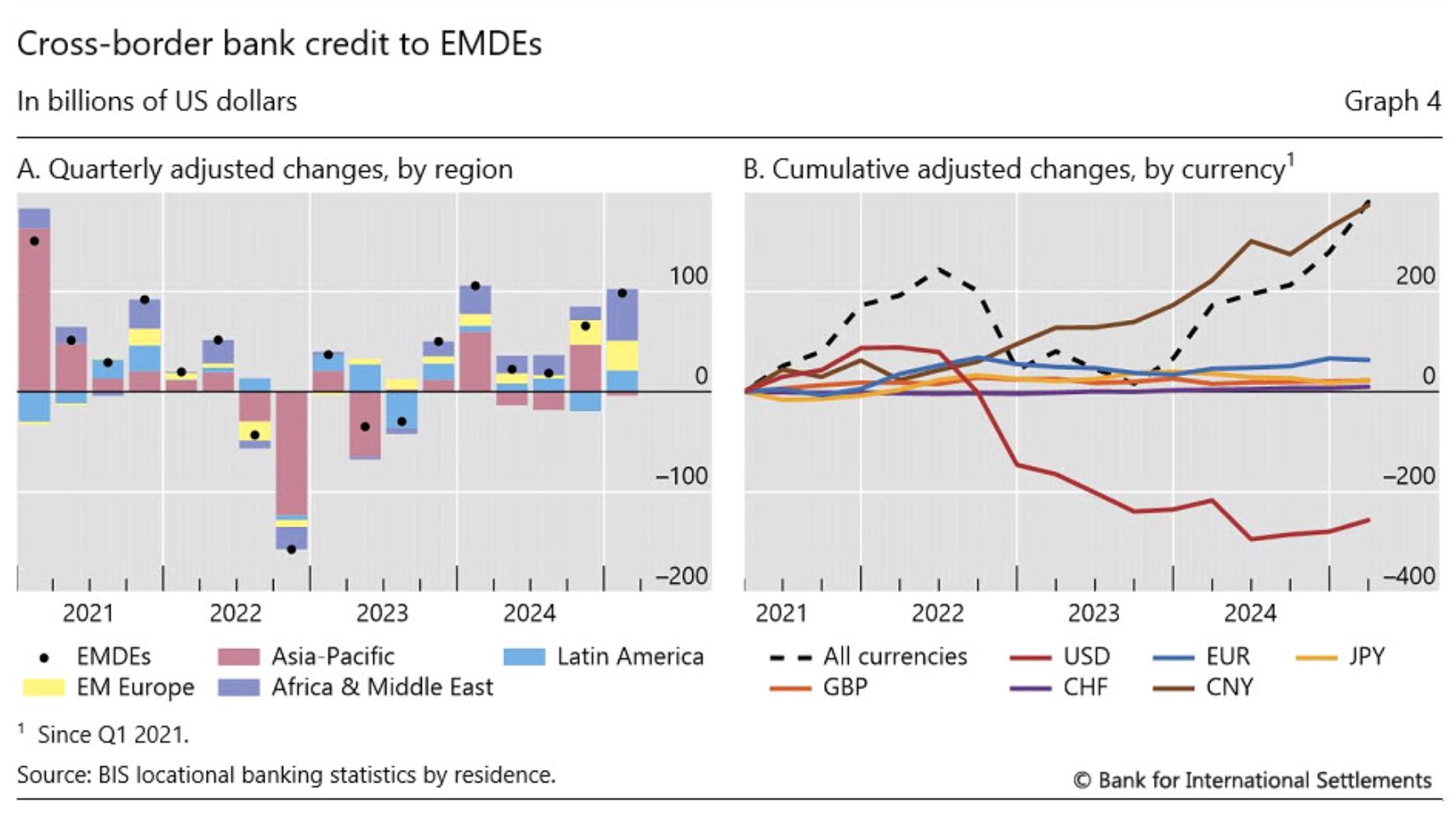

renminbi has become dominant in credit growth since 2022

a move from US dollar & Euro denominated credit to Chinese Yuan-denominated credit

this collateral (US Treasury bonds) can then be used on wholesale debt markets to issue more credit

moreover, this collateral can be leveraged/rehypothecated, thus increasing liquidity

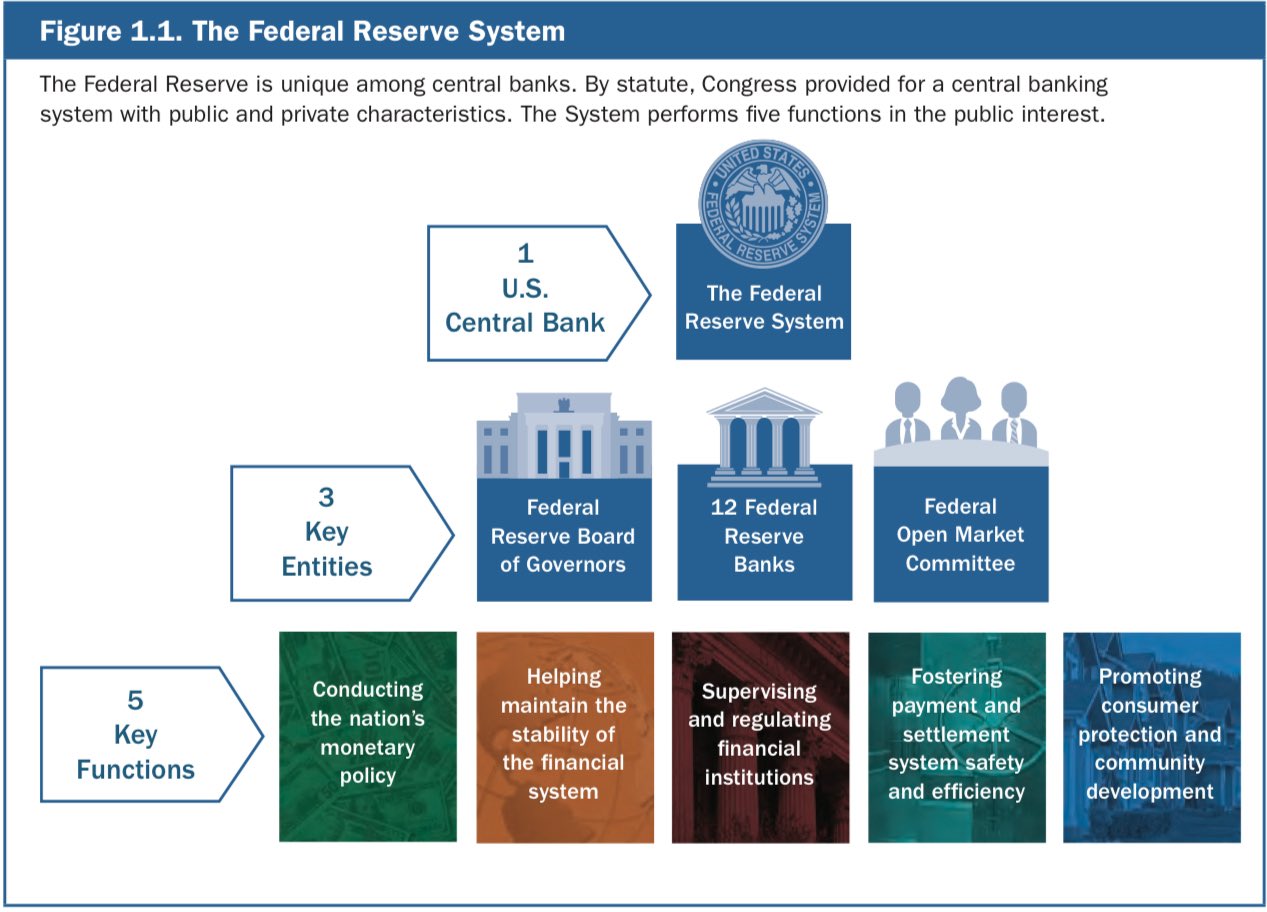

still, in the USA the Fed continues to dominate in importance

so it may not only be central bank setting the rates and affecting liquidity

for example, when US Treasury auctions bonds, they're both, temporarily reducing the effective amount of USD in circulation and providing more high-quanlity collateral

so it may not only be central bank setting the rates and affecting liquidity

for example, when US Treasury auctions bonds, they're both, temporarily reducing the effective amount of USD in circulation and providing more high-quanlity collateral

outstanding cross-border bank credit reached a record of $34.7 trillion

the latest increase was driven by increased lending to non-bank financial institutions (NBIFs), with most of the credit being issued in USD or EUR

so a weaker US dollar tends to increase global USD liquidity

in the SVAR, one standard deviation of US dollar's appreciation leads to a fall in cross-border USD lending. it reaches its bottom after 6 months and then eventually recovers after 2.5 years if no new shocks arrive

bank's leverage ratios improve due to collateral appreciation, thus allowing them to borrow more USD

collateral here is the non-USD local currency, such as Yuan

bank's leverage ratios improve due to collateral appreciation, thus allowing them to borrow more USD

collateral here is the non-USD local currency, such as Yuan

weaker US dollar means more USD credit issuance abroad - here's why

foreign banks frequently borrow USD through wholesale markets with a local currency denominated collateral

when USD depreciates against a local currency, offshore USD credit now has a reduced debt service

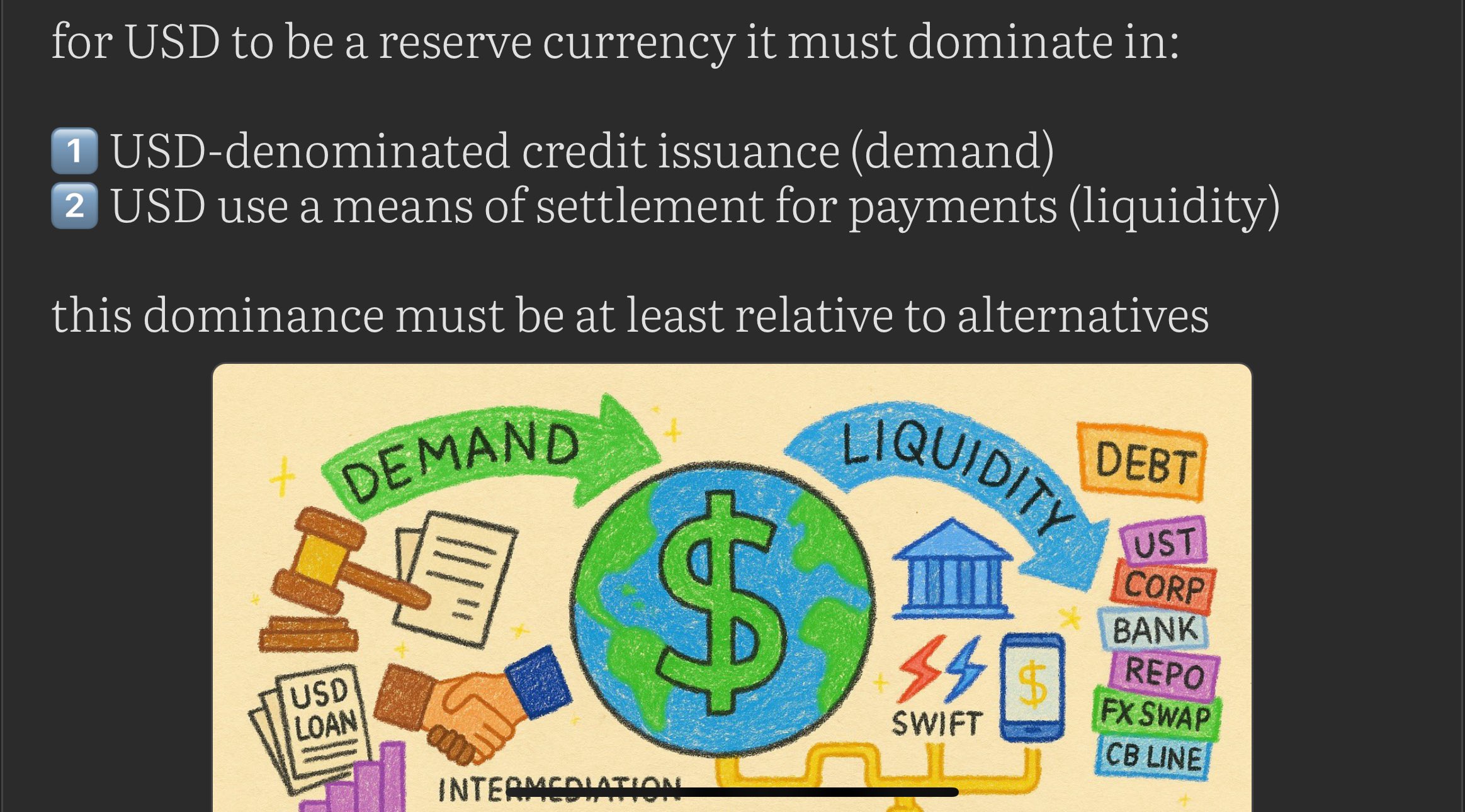

i wrote a thread about what it means for the US dollar to be the reserve currency from the perspective of demand and liquidity

you can read it here:

https://illya.sh/threads/@1754940239-1.html

this is nothing unusual though - many governments do this, and it's mostly towards stabilizing the exchange rate with USD

to a large extent this is a result US dollar's reserve currency status and its dominance in use for all sorts of financial transactions

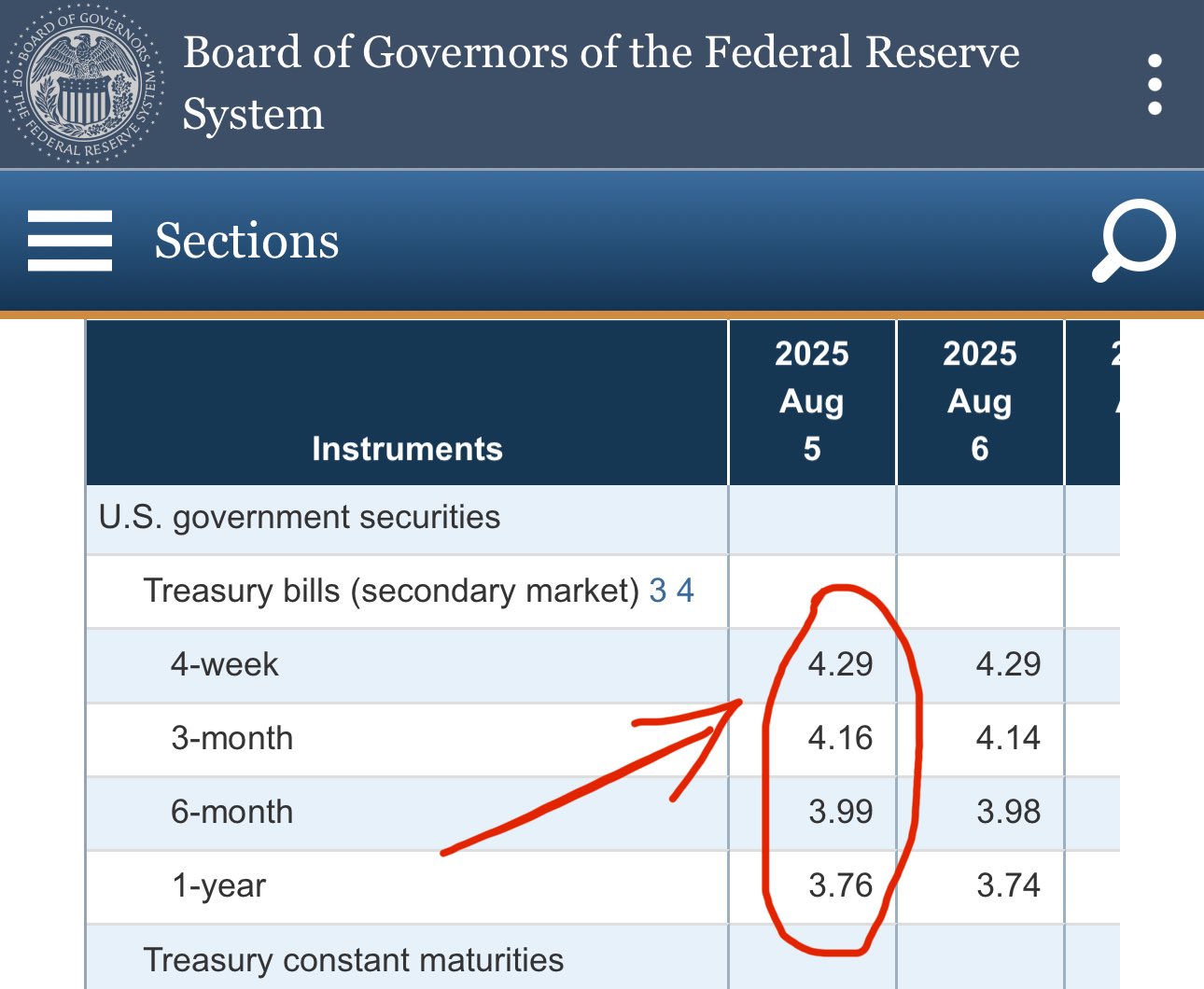

so according to this, since Treasuries yield more than ON RRP the wholesale cash moved from ON RRP into Treasuries

when the US Treasury spends them - they flow right back into broad money

indeed, currently T bills yield from 4.29%, while ON RRP is at 4.25%

interesting take!

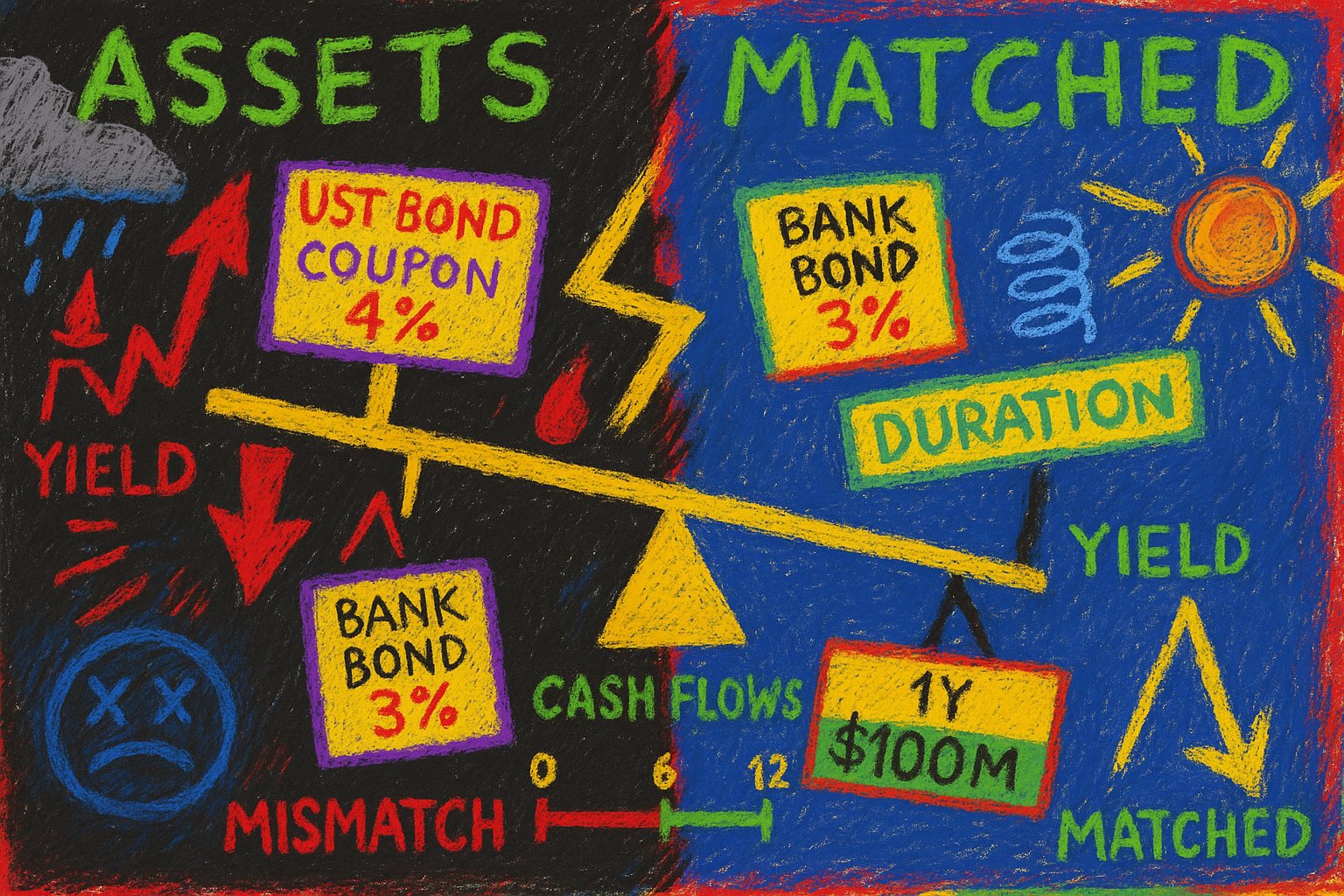

duration matching protects:

➖ liquidity via cashflow modulation, by helping liability cashflows match asset cashflows

➖ solvency via asset and liability value modulation, by reducing asset value loss when yields fall and reducing liability value loss when yields raise

duration matching protects liquidity and solvency by modulating yield shift effects on the value of assets and liabilities

duration matching protects liquidity and solvency by modulating yield shift effects on the value of assets and liabilities

since a 30 year bond discounts 30 years of cashflows and those cashflows directly incorporate this compounding yield - its price moves more with yields than a comparable, shorter time to maturity bond

when liabilities become due you must ensure that assets can cover them

this means ensuring that cashflow and asset monetization provides enough liquidity to settle the debt, plus a desired spread