Gold: macro, inflation, miners and price

Ongoing updates on gold price action, central-bank demand, miners and macro drivers in the precious-metals market.

Gold is within the fabric of money, not just Central Banks

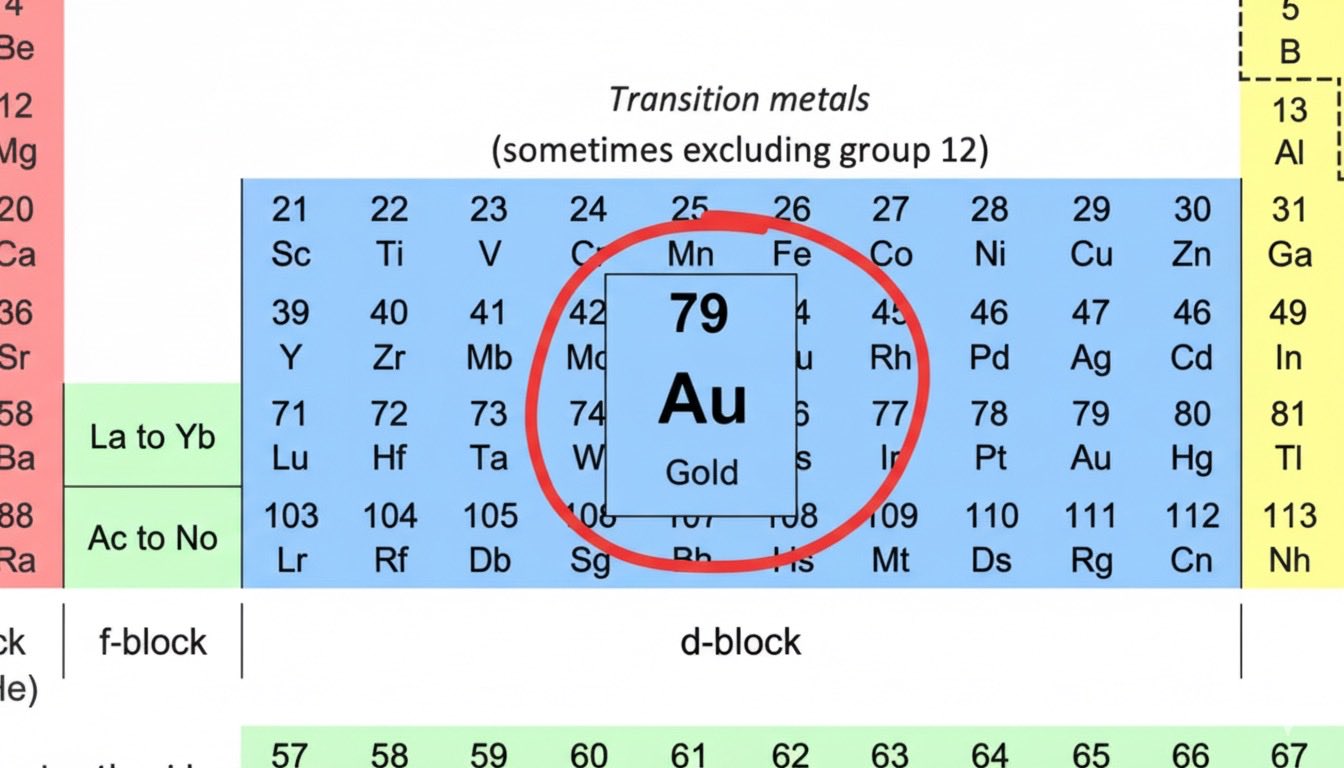

A lot of posts on X frame Central Banks as malevolent institutions, and by some form of conspiracy they hold gold in their reserve accounts. And apparently not holding gold is a step towards monetary freedom - even more if you forego an atomic element (Au) for a cryptographic computer algorithm (Bitcoin).

A more productive approach is asking why do Central Banks chose gold over all other commodities and assets. Every single world reserve currency, without exception, started on a gold and/or silver standard. Gold has been used as money for over 5000 years.

I've written several articles on what makes gold so special and how Bitcoin is not a replacement for gold. I'll leave them linked below

GOLD: look for rejection at ≈$4155

if gold's price get rejected at that price level again - you'll likely see the fall to ≈$3900 target I described in my previous post

it's a good idea to have the limit buy orders ready 😄

gold's lowest possible bottom for current correction is ≈$3900 (area)

the uptrend will resume soon. given the FOMC meeting next week - if that bottom arrives it should be very soon - within the next week

* this is trend analysis done in 5 mins, but likely a correct one 😄

it's over for gold

i've already contacted central banks to dump it too

it's not a store of value or safe haven anymore

gold is only up 12% in the last month...

clear bear market.................

😄

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

don't forget to set your limit buy orders

maximum bottom is around early September 2025 prices

it's getting closer

the promised gold & silver sale is here

if you didn't set your limit buy orders for silver, gold & miners - it's not too late yet

currently in late-September price ranges for many. it's also a good idea to position some buy targets below the current price levels

keep watching the gold price - it's the main driver for all

FOMC meeting is next week

⏰ don't forget to setup your buy limit orders for gold, silver and their miners

⏰ don't forget to setup your buy limit orders for gold, silver and their miners

looks like crypto twitter has not discovered Mendeleev's periodic table yet 😂

gold has existed for ≈13 billion years

for at least 5,000 of those 13,000,000 years it has been money

authenticity of gold bars can be tested easily. no need to make up problems that don't exist

hope you enjoyed Friday's gold, silver & miners sell-off

now await for the markets to re-open

it begins in a few hours 👀

BTC went from $0.004 to $110,000 USD in 16 years, but gold was never this cheap in over 5000 years

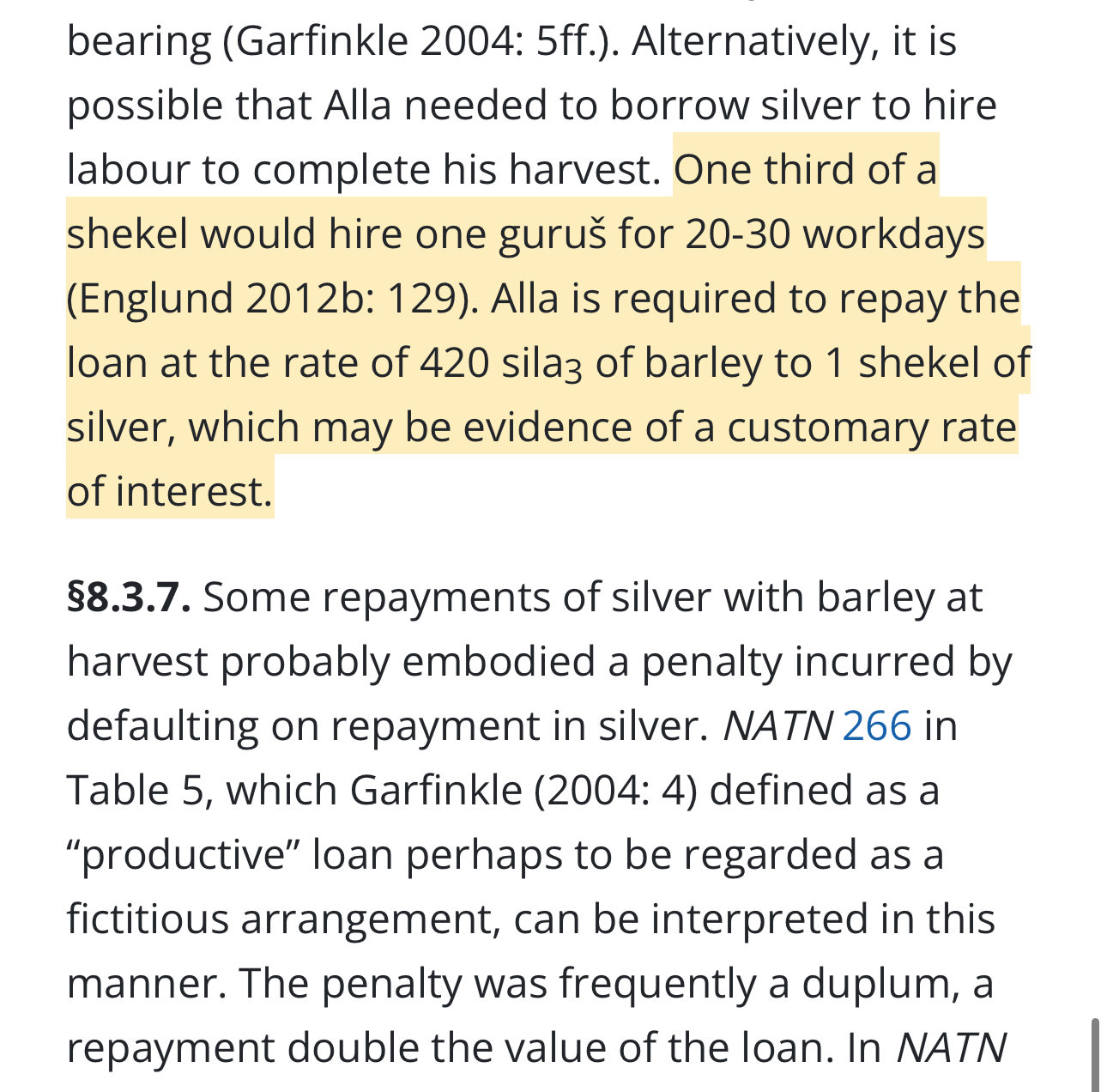

Going back to the start of recorded price systems - gold's starting price per gram is ≈100 days of labor! This was in 2112 BCE, which was ≈4K years ago

So using earliest records of starting price - 1g of gold would cost ≈25K$ is today's USD 🤯 NOTE: this is an imprecise estimation - but it's useful to bring the gold vs bitcoin price increase argument in perspective. During most of gold's USD history its price has been fixed by the government/law.

Will Bitcoin be here in 5K years? No - not in its current form. Gold (Au) hasn't changed in 13 billion years

Bitcoin promo accounts love to compare BTC to gold, and they frequently cite that BTC is up much more than gold over the last 16 years. The number is big - from its inception Bitcoin is up millionth of percent

What the pro-crypto accounts fail to point out is that mathematically their conclusions are misleading. They almost always use USD as the base currency for comparison, but ignore the fact that gold was used as money several millennia before U.S. was even conceived. As such, such comparisons fail short

They also seem to selectively omit the massive volatility - gold doesn't go down 80% every other day/cycle top

The gold prices here I computed are estimates - don't take them as hard quantitive data. Read this in the context of comparing the price of gold and Bitcoin. If someone's argument is that Bitcoin is better than gold because it had a higher percentual return in 16 years - it likely lacks substance

no, "The West" is not manipulating gold and silver prices

silver and gold had retracements many times before, but I guess when it falls on Chinese holidays it becomes "western manipulation"?

≈32% of global gold demand in 2025 comes from China (estimate for jewelry + bar & coin). China is a major buyer of gold - so a lot of demand there

a more reasonable explanation is a demand dip, due to the holiday in PRC. also the US government shutdown. although I agree the idea of a magic red button saying DUMP GOLD located somewhere in the west is more exciting 😄

it's also not clear what would be the purpose of manipulating the price of gold down, as that would be benefiting China - they can buy it cheaper!

PBoC has been buying gold for years, and they will continue to do so. PBoC doesn't announce targets publicly - and they're flexible on their purchases, so again, lowering the gold price would likely allow them to buy it at a cheaper price

gold moves up by ≈13% on breakouts, thus ≈$4000/oz gold in November 2025

this means that the current move would bring the gold price up to ≈$3978, which should happen at the start of November, around November 4th 2025

so far, gold has completed ≈6% of the current move - which means there's another ≈7% to move up from the current gold price of ≈$3715

this makes ≈$4000 the top of the next consolidation range. once that price is approached - expect a larger pullback, and potentially a longer consolidation phase, which could last ≈90 days. this means that after the top of the current move is hit (≈$4000) you may have to wait for another ≈3 months before a new all time high

it's important to note that the top of the target range is close to $4000, so gold may not cross $4K before the aforementioned pullback. this means that it may take gold another 4 months before gold firmly sits over $4000/oz

≈$3515 is a great price area to long gold during the pullback

you'll need to adjust the exact price to your ticker/derivative, but in the chart you can see how to find the relevant support (assuming your asset mirrors gold spot/futures)

and remember the strong support below

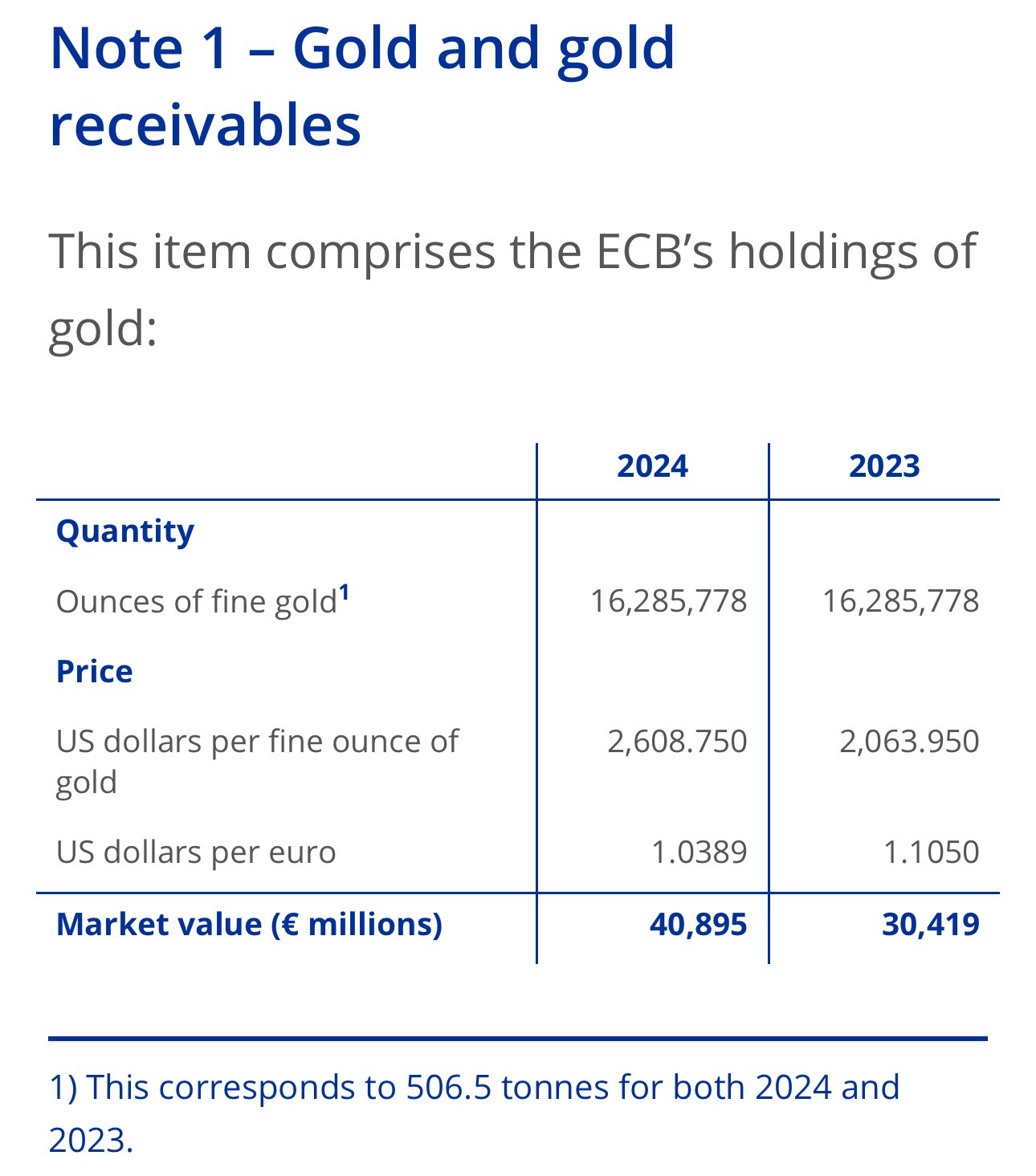

to clarify: European Central Bank didn't increase its gold holdings, but the gold that ECB already owns (≈506 tonnes) increased in value, since gold's market price increased

ECB reevaluates gold at the end of every year and credits or debits the revelation account accordingly