Monetary policy and central bank updates

Meeting-by-meeting coverage of Fed, ECB, BOJ and other central banks, focusing on rates, balance sheets and forward guidance.

Even As Central Banks Bought Gold, The Market Analysts Remained Bearish

* This goes to the list of "things that are obvious in hindsight"

In 2014 Forbes published an opinion saying that increased gold buying by Central Bank of Russia (CBR) isn't an indicator of positive price pressures for gold.

Gold's price has more than quadrupled since then, going from ≈$1600/oz in November 2014 to ≈$4600/oz as of January 19th 2026.

The article frames the purchase as "forced", when commenting the fact that CBR decided to increase the share of gold in the "gold and foreign exchange reserve assets" item in their balance sheet. It is not by chance that this central bank accounting item explicitly includes "gold" in its name.

The Forbes article also seems to assume that miner profit margins don't spread cross-border.

Another thing that the article omits is that a central bank can buy gold without expanding the base monetary base (i.e. "printing" new currency), for example by swapping FX reserves for gold via a single or multi-leg sale.

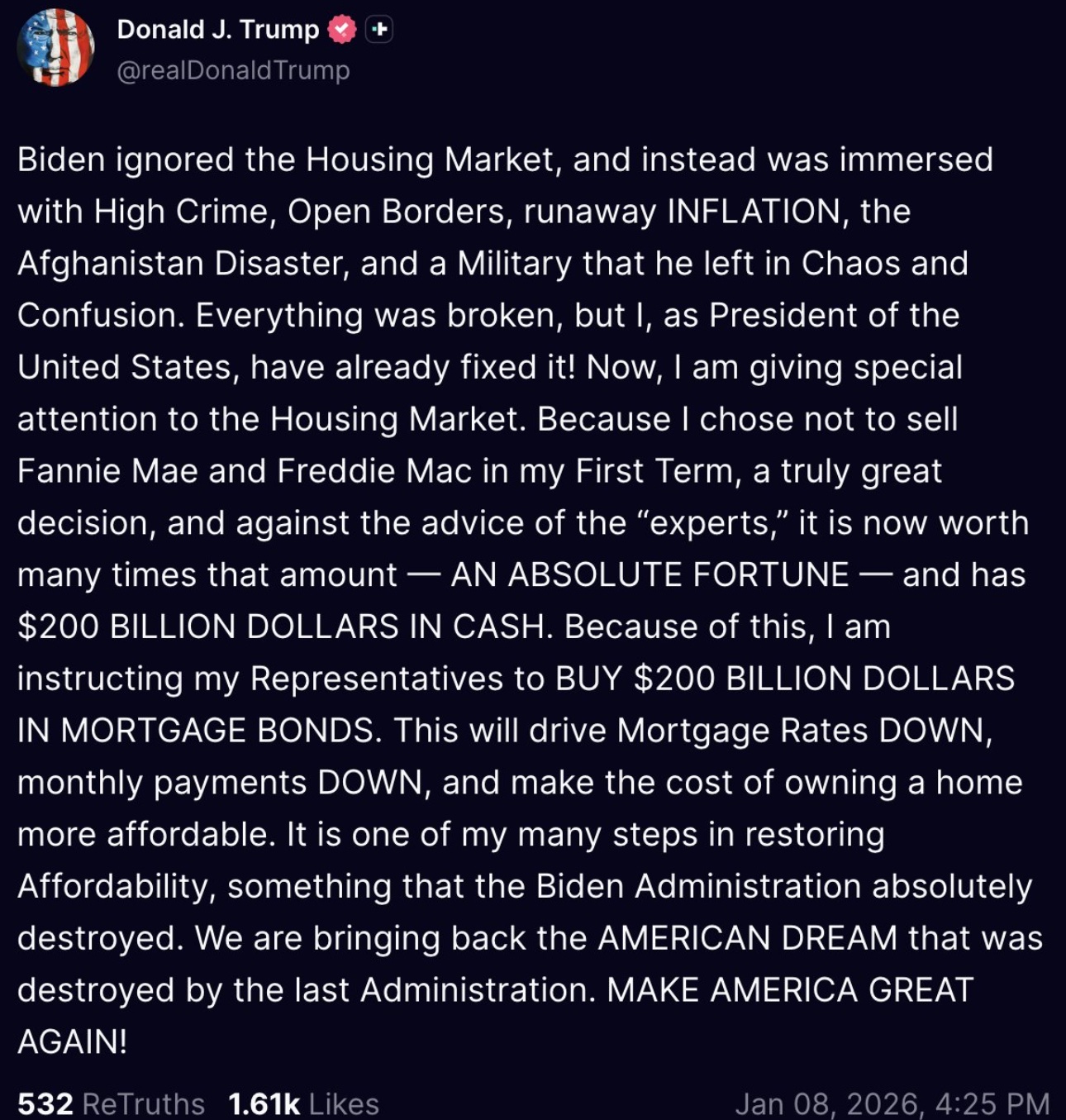

Congratulations to Freddie Mac & Fannie Mae in their first steps at becoming a central bank

Looks like it's not just the Fed doing MBS-targeted QE now. Why control the Fed, when you can just move the Fed? 😆

Central Banks were more influenced by farming than you probably think

Historically interest, collateral, liquidity, inflation and monetary policies were shaped by the needs, risks and patterns of agricultural economies

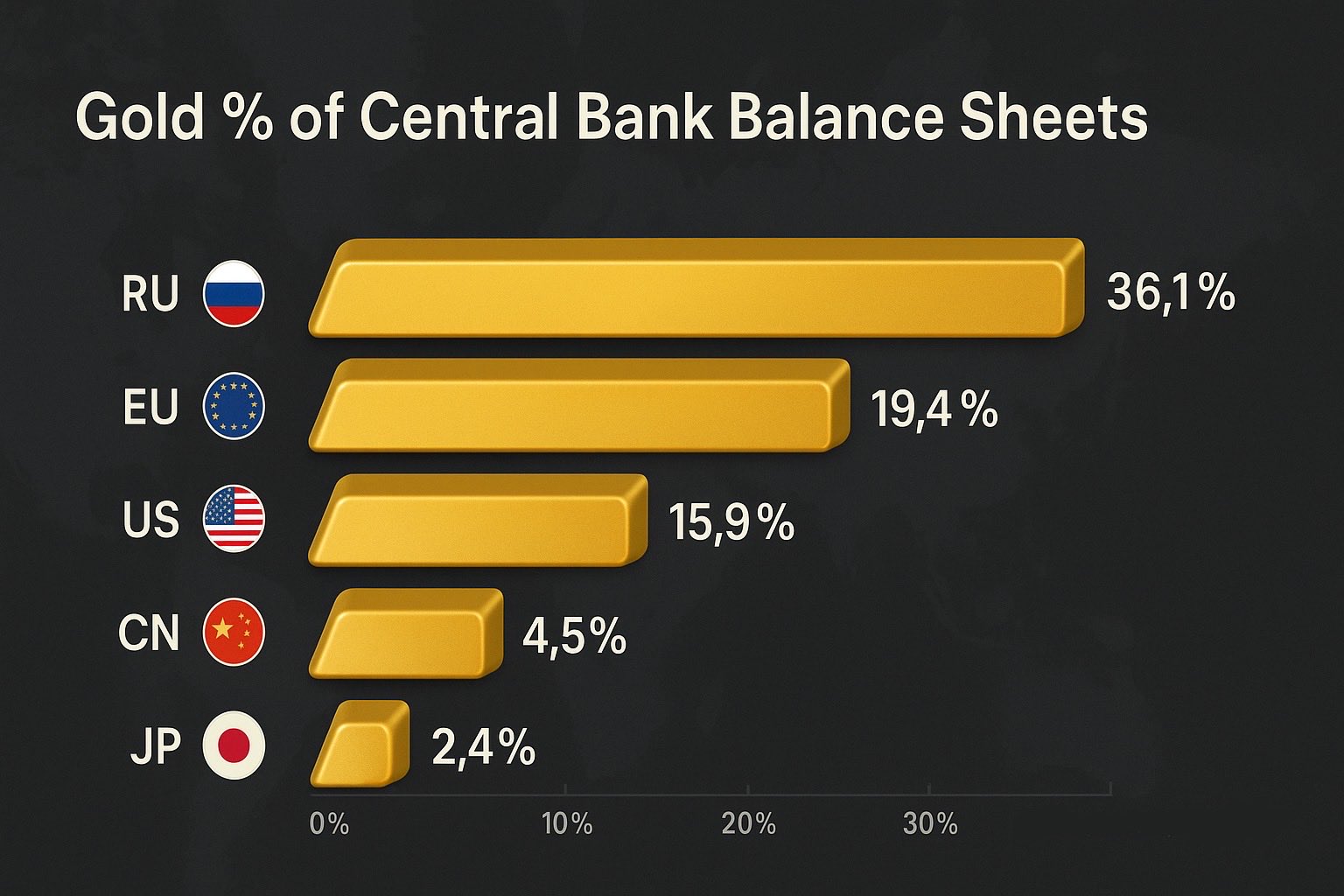

In my post ranking gold as a percentage of central bank balance sheet size I wrote renminbi/yen, when I meant renminbi/yuan

Yen is, of course, the Japanese, not PRC's local currency. I will correct this under threads & thoughts on my website, but it will remain with this typo on X (you can't update the post after 1 hour)

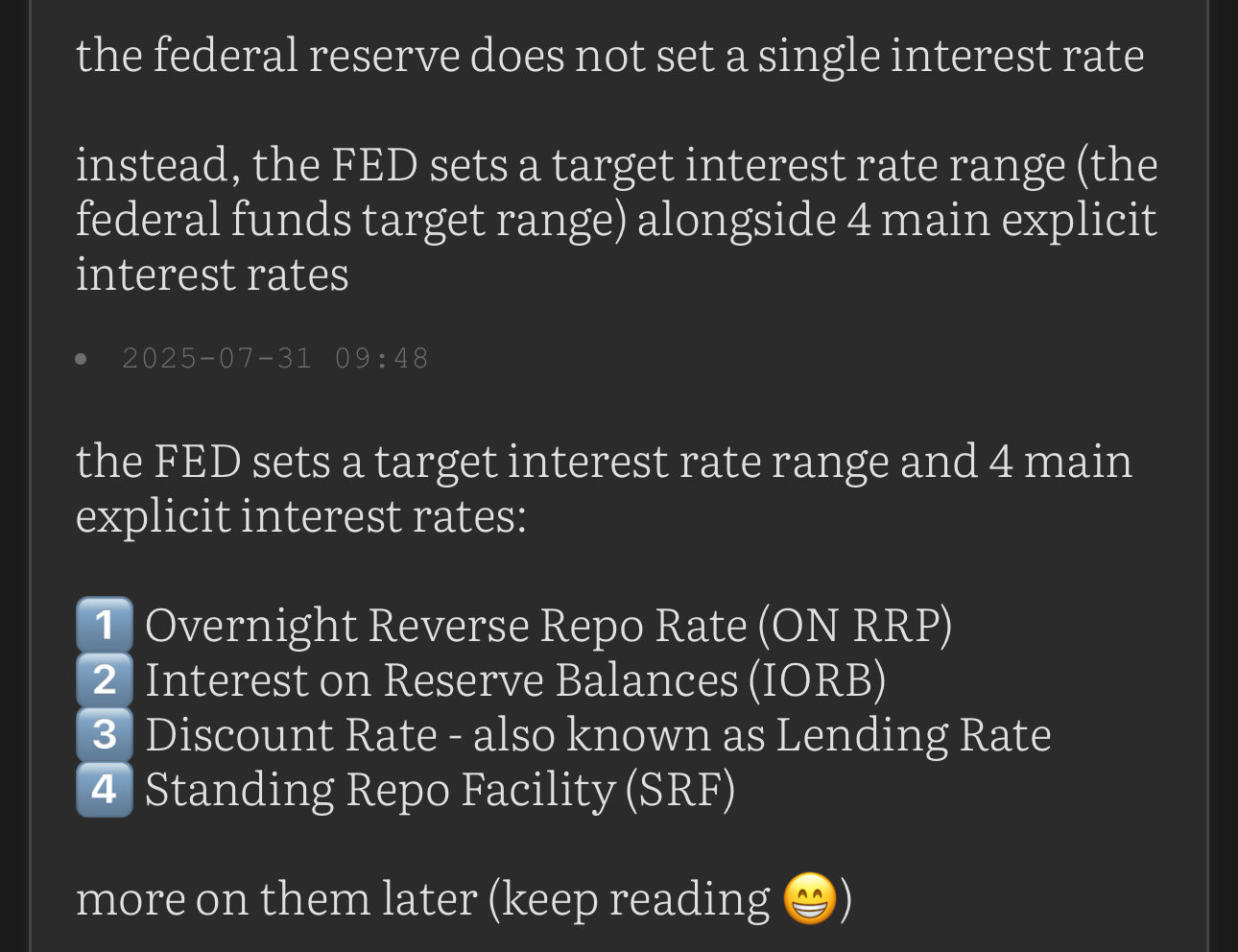

You can read the article here: https://illya.sh/threads/how-does-the-federal-reserve-set-interest-rates

In July I wrote a primer on the mechanics by which the Fed steers the prevailing interest rates in the economy.

It covers the ON RRP, IORB, Discount Rate and SRF channels, explaining how together they set a corridor with upper and lower limits for the effective rate.

Prior to today the article reading experience was subpar, due to the amount of supporting images - the thread is composed of several shorter posts, and each one came with an image.

I've made it a lot more readable by removing most of the images

In July I wrote a primer on the mechanics by which the Fed steers the prevailing interest rates in the economy.

It covers the ON RRP, IORB, Discount Rate and SRF channels, explaining how together they set a corridor with upper and lower limits for the effective rate.

Prior to today the article reading experience was subpar, due to the amount of supporting images - the thread is composed of several shorter posts, and each one came with an image.

I've made it a lot more readable by removing most of the images

Gold as a percentage of balance sheet size in Central Banks (ranked):

🇯🇵 Japan (MoF + BoJ): ≈2.4%

🇨🇳 China (PBoC): ≈4.5%

🇺🇸 U.S. (Fed gold certificates): ≈15.9%

🇪🇺 European Union (ECB + Eurosystem): ≈19.4%

🇷🇺 Russia (BoR): ≈36.1%

All of the above will expand their balance sheets, but it's mostly China & Russia actively buying more gold.

Conclusions you can take from here:

➖ China's gold holdings are relatively small when compared to their Central Bank's balance sheet size, and given their efforts to promote renminbi as the invoice currency worldwide, you can expect PBoC to continue their gold purchases for the medium-long term. The gold share must at least double to come close to the current reserve currency - the U.S. dollar. All reserve currencies started on a gold and/or silver standard - and the pressure towards this direction won't be different for renminbi/yuan. When the USD became the world reserve currency with the Bretton-Woods agreement - gold certificates accounted for ≈40% of the Fed's balance sheet.

➖ Russia has built up a massive balance sheet capacity for the future. Once the international trade markets with Russia re-open, there will be a plenty of reserves to back-up a massive wave of Ruble credit. Expect Russian capital markets to rally then.

➖ European Union has a healthy relative position. Given that the Euro is currently the closest alternative to the U.S. Dollar - it's a good idea to both, expand gold reserves and promote capital markets. The latter is an explicit goal via the Capital Markets Union (CMU). Given that EU will further expand the balance sheet, it's necessary to increase the gold reserves - repricing won't be enough. Gold will make Euro more attractive, and with it the FX holdings of Euro by sovereigns.

So the Fed will fully resume Treasury purchasing, as a part of their balance sheet expansion starting December 1st 2025

Not only all maturing Treasuries will be rolled over at auctions, but also all Mortgage Backed Securities (MBS) principal will be reinvested into Treasury bills (<1 year duration)

This will lower the duration of the assets on the Fed's balance sheet and contribute to debt monetization

But that's not a surprise. 3 months ago I explained why interest rate cuts and the end of QT/start of QE is imminent

the market reacted exactly as I anticipated in a prior post

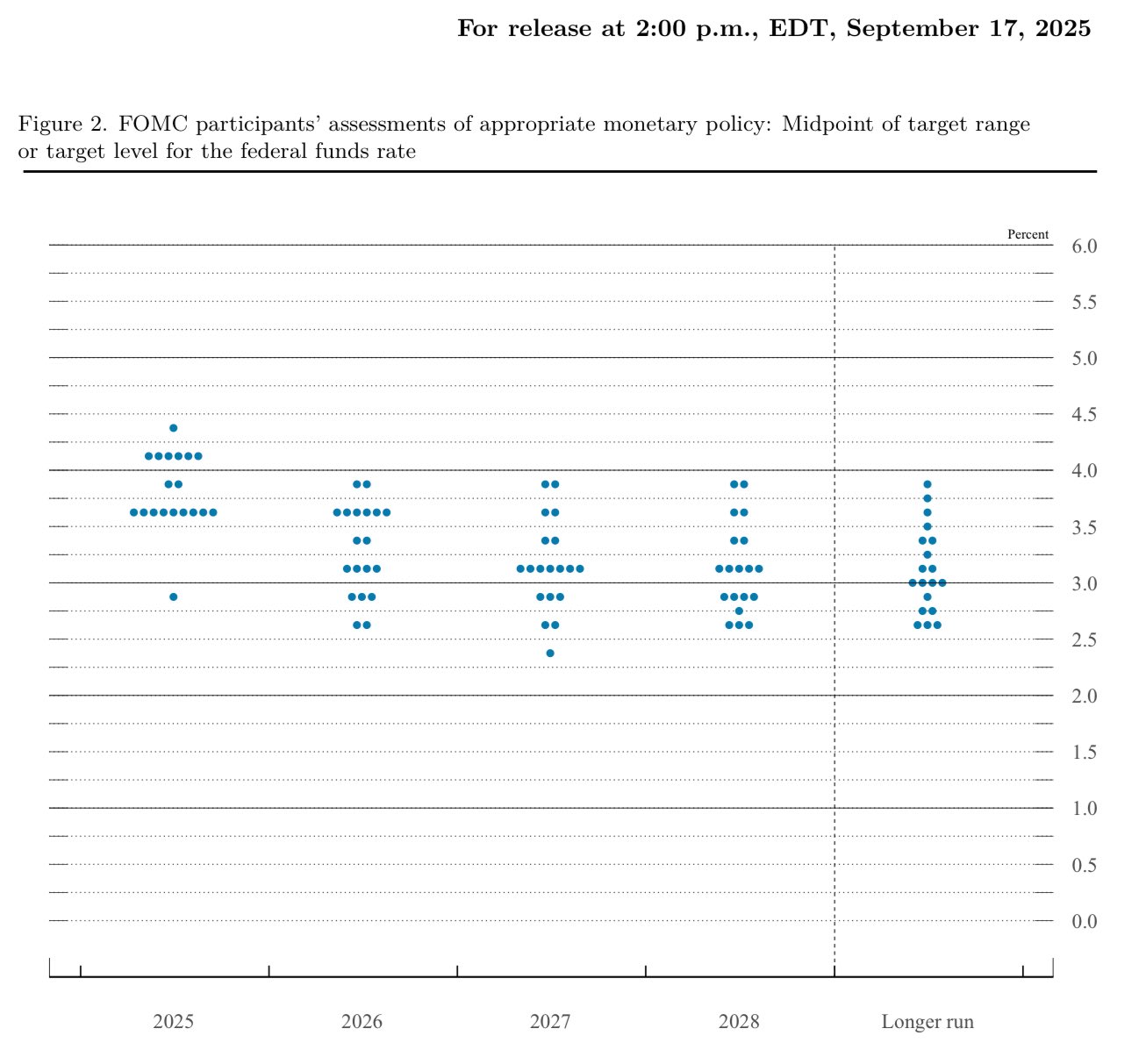

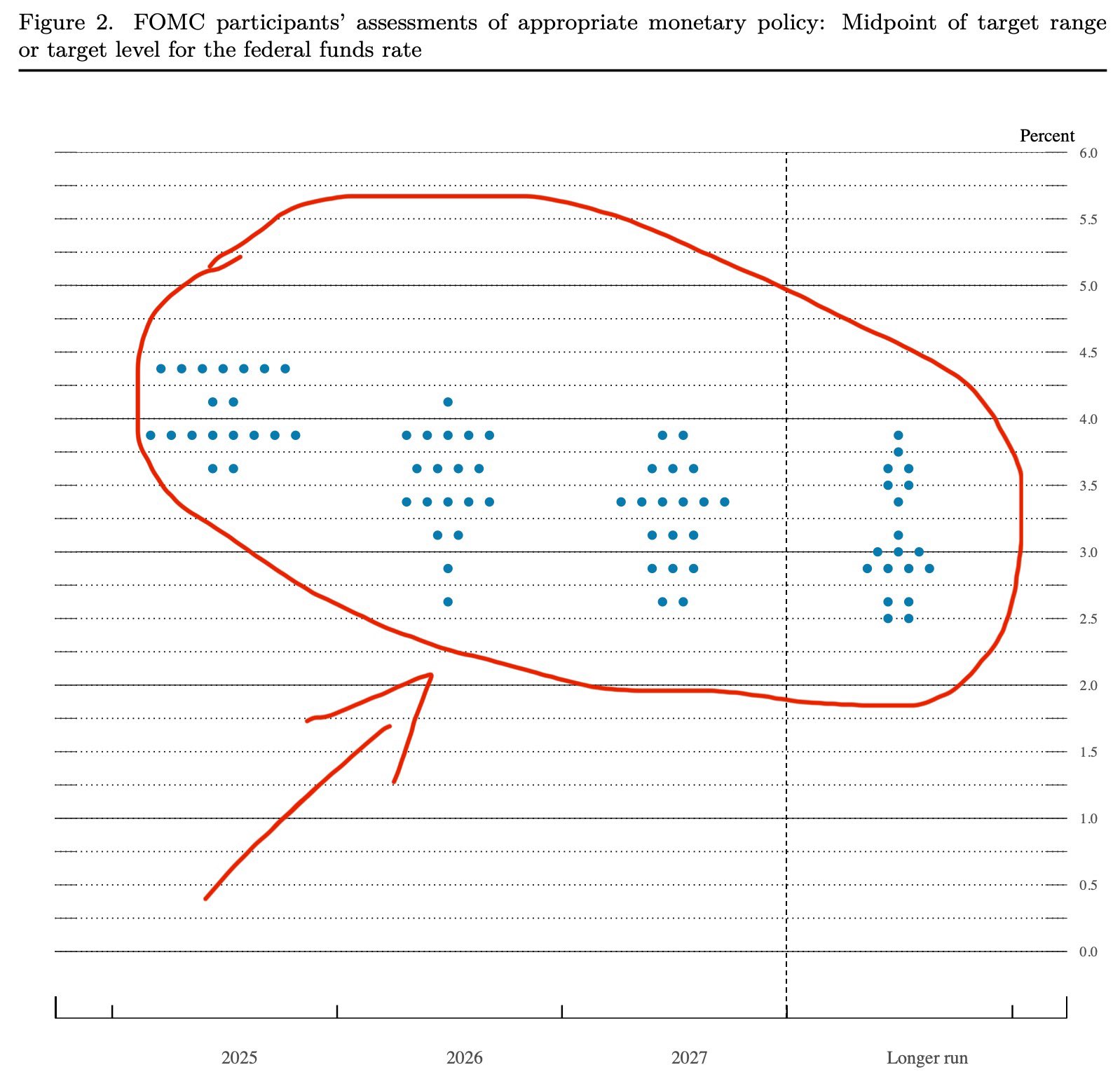

a lower median in the FOMC dot plot indeed pushed asset prices up. and you had plenty of time after the Fed's dot plot was published to enter into that leg

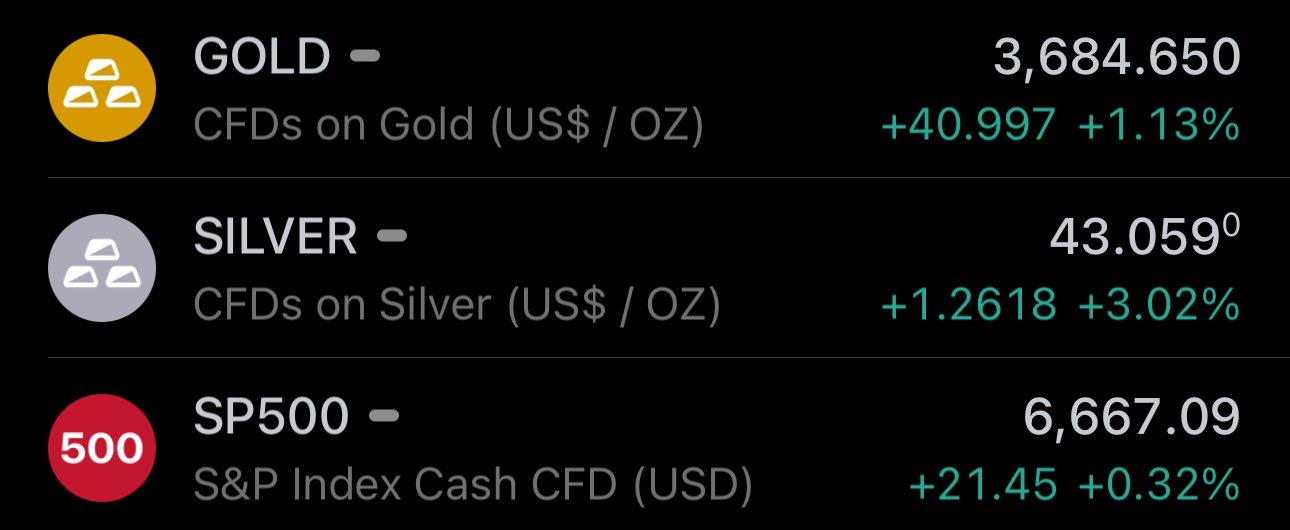

look at gold, silver and S&P500 😄

September 2025 FOMC dot plot suggests lower rates than in June 2025

the new implied median for end of 2025 is ≈3.6%, which is lower than the ≈3.9% June figure

this means you should expect the Fed to cut another 50 bps/0.5% in the next 3 months - likely in two 25bps iterations

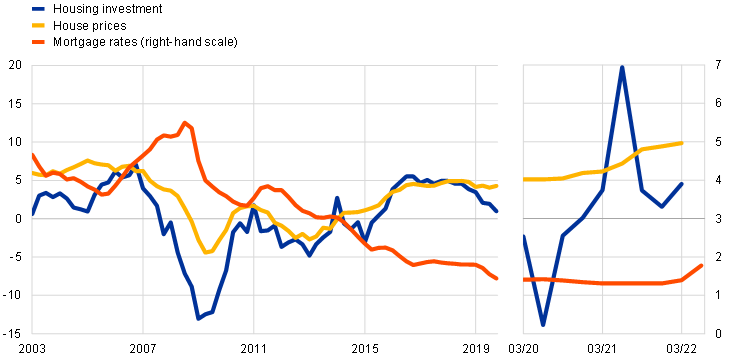

mortgage-rates targeted QE, such as the mass purchase of mortgage backed securities (MBS) by the Fed will drive the mortgage yields down short-term, but also further leverage that market sector in the process

so expect a 2008 QE-1 style balance sheet expansion by the Fed targeting mortgage securities via OMO

there will also likely be additional government policies and programs, such as increasing the scope and volume of explicit government guarantees on mortgage securities

so expect a 2008 QE-1 style balance sheet expansion by the Fed targeting mortgage securities via OMO

there will also likely be additional government policies and programs, such as increasing the scope and volume of explicit government guarantees on mortgage securities

in the US, there's been a real estate bubble in the building since 1990's (pun intended). it was about to burst/de-leverage several times, but it was refueled via QE and government guarantees among others, thus delaying it

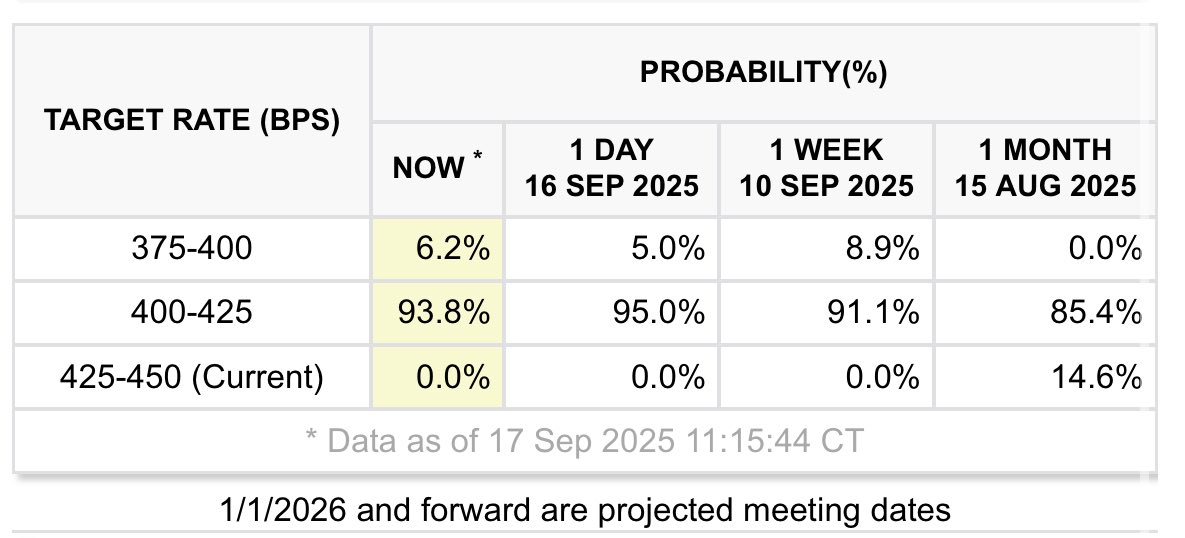

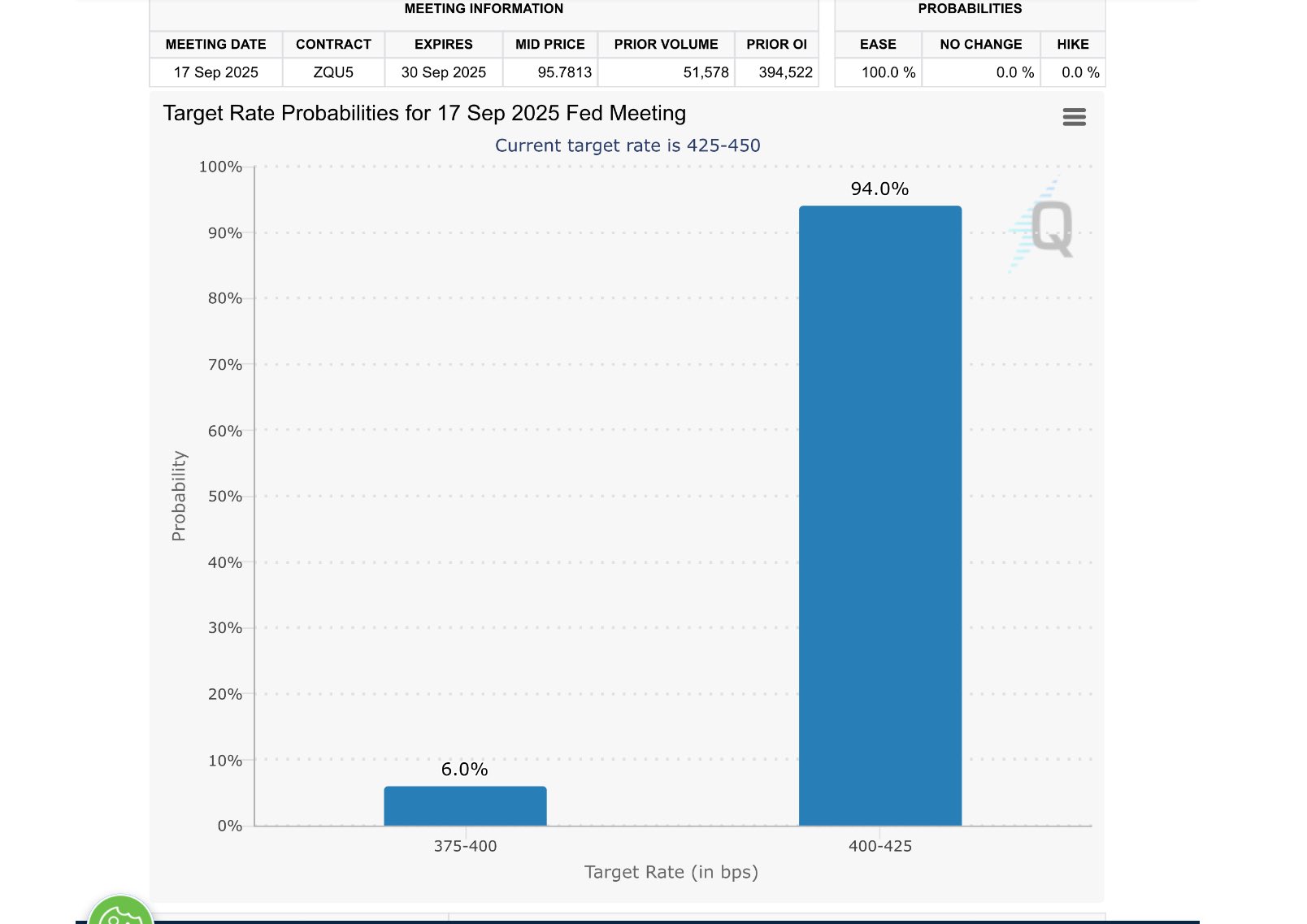

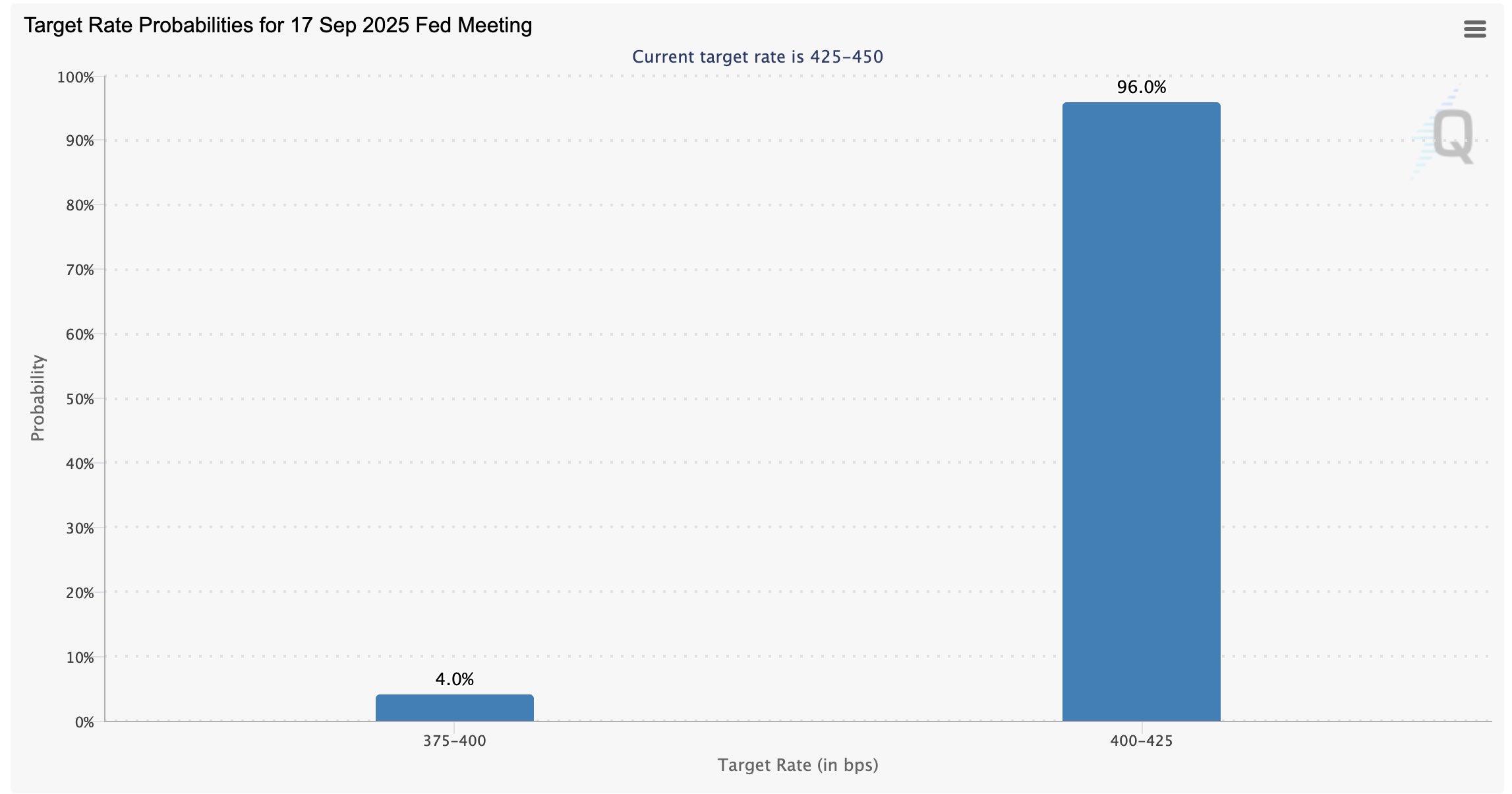

and there you go - the Fed cut the rates by 25 bps

there will NOT be a 50 bps rate cut

there is nothing to predict or speculate:

1. open FedWatch

2. observe

that's where institutions are hedging

30 day FedFunds futures implied target rate will NOT be wrong

you'll see in a bit 😉

what's up with the "urging" the Fed to cut by 50 bps today?

the rate cut is known NOW - and it will be no more & no less than 25 bps/0.25%. there is absolutely nothing to speculate about here

i assure you that your urges won't affect what the market already priced in 😄

it's not just the Fed, the ECB is also lowering rates into higher inflation

this puts upwards pressure on both, real estate purchase and rent prices

so you can expect both - house prices and rents - to increase throughout the next 2 years

how will asset prices react to Fed's interest rate decision?

if the FOMC members suggest rates lower than in the June 2025 - expect an upwards rally in assets

if the FOMC members suggest higher or non-decreasing near future rates - expect a downward rally/profit taking in assets

during the Sept 17th 2025 FOMC meeting, the Fed will publish a new dot plot with the suggested interest rates for 2025, 2026, 2027 and longer-term

during the Sept 17th 2025 FOMC meeting, the Fed will publish a new dot plot with the suggested interest rates for 2025, 2026, 2027 and longer-term

so the most likely outcome is a 25bp/0.25% rate cut on September 17th 2025, and then at least one more cut in 2025

a cut larger than 25bp is highly unlikely, since the current CME's 30 Day Federal Funds Futures price strongly implies a 4.0%-4.25% target rate

this is 25bp/0.25% below the current target rate of 4.25%-4.5%

based on the current Fed policy guidance available since June 2025, by the end of 2025 the Fed Funds rate should be ≈3.9%

current one is 4.25%-4.50%, so we either get a larger than 25bp cut or several rate cuts this year

based on the current Fed policy guidance available since June 2025, by the end of 2025 the Fed Funds rate should be ≈3.9%

current one is 4.25%-4.50%, so we either get a larger than 25bp cut or several rate cuts this year

watch the Fed's projection dot plot, not the Fed Funds rate

the 25bp/0.25% cut on September 17th 2025 will happen, and it's mostly priced in

it's the future interest rate policy guidance that can amplify a market move either way

soon i'll write a thread on how central banks/governments reevaluate gold and how the monetary gains can be used to cover central bank and/or government debt

i'll add a link to it in this thread once it’s ready

in practice, some level of sanitization (direct or indirect) will occur, and that Treasury debt/safe collateral would likely be reintroduced back via Treasury issuance and/or Fed facilities within a year

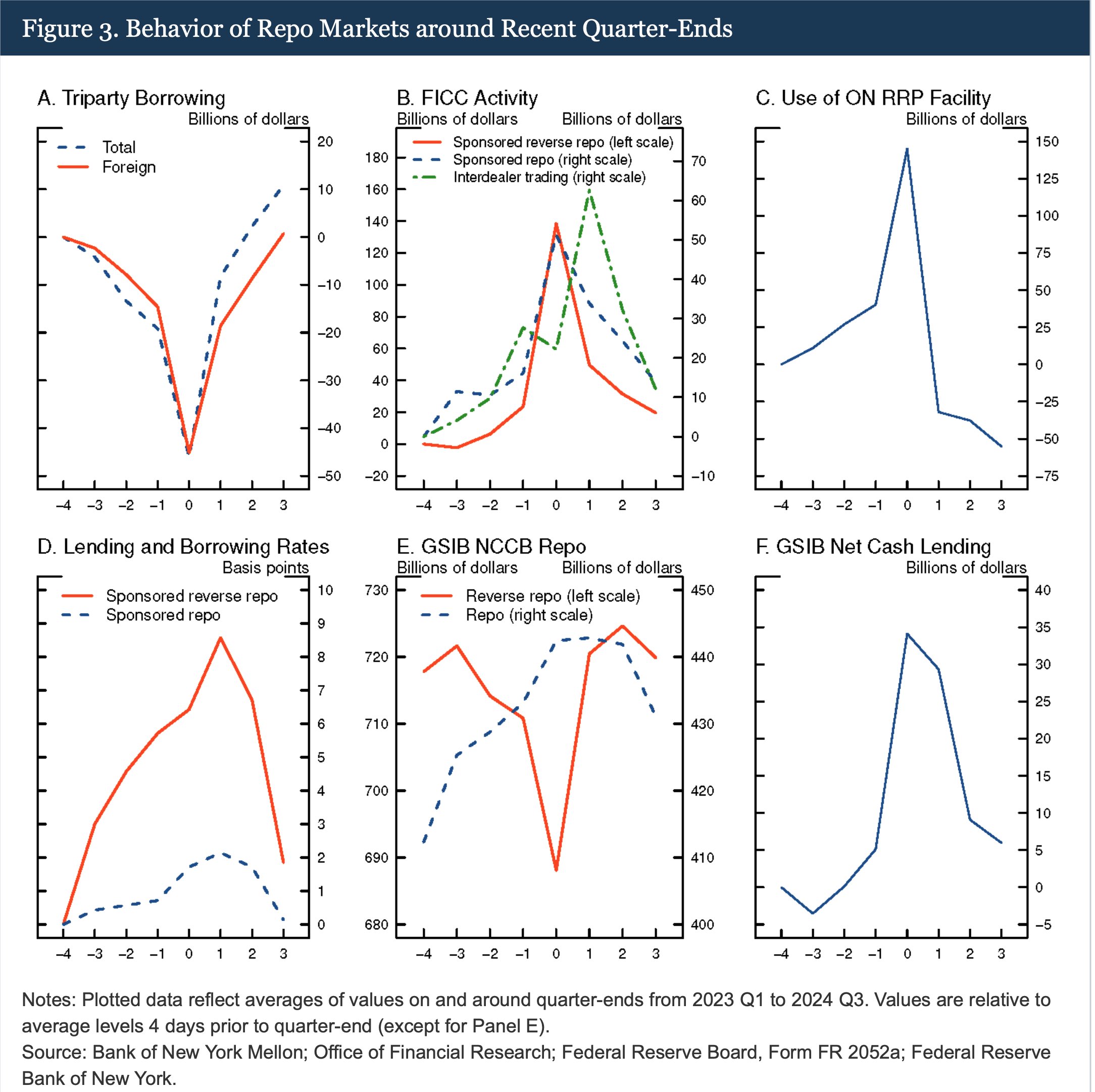

Standing Repo Facility (SRF) is a policy rate set by the Fed, according to the target rate. so unless the target rate is decreased, SRF rate is unlikely to be reduced

this situation is putting pressure on the Fed to decrease interest rates and start QE soon

the funding could also come from Fed’s facilities, like the SRF or OMO

however, current SRF rate is 4.5%, which is above the yield on T-bills, and Fed is still officially in QT, so no large-scale, longer-term liquidity injections via open market operations

repo rates increase and borrowing decreases in quarter-ends

this includes the upcoming month of September. in addition, September 15th the corporate tax limit in the US

this reduces global liquidity, so asset prices tend to fall

generally speaking:

➖ transaction between central bank accounts = base money reallocated, decreased or increased

➖ transaction between non-central bank accounts = broad money reallocated, decreased or increased

effectively this means that if both parties involved in the transaction have an account at the central bank, they will will use it to settle payments