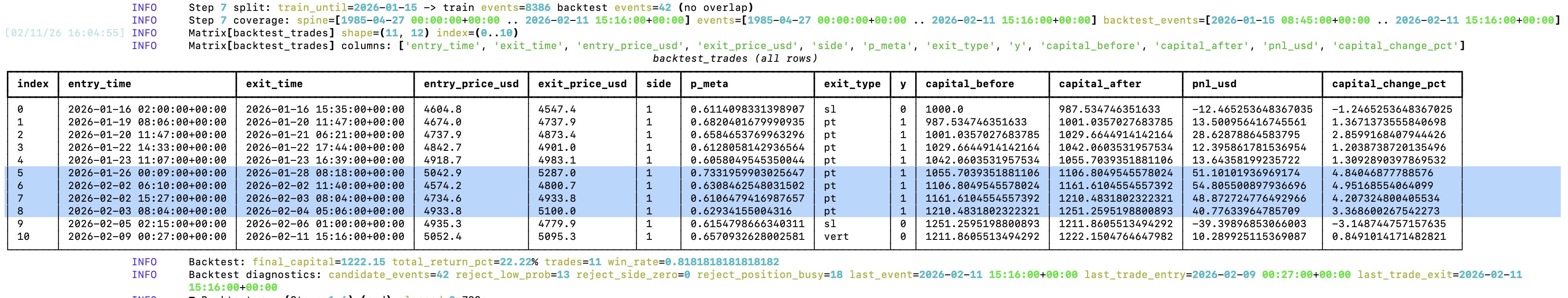

My trading ML factory yielded ≈22% return on gold on a daily timeframe, which is almost a double of gold's return in the same time period (≈12%)

This was after running in on price data of gold futures most recent drawdown from ≈$5600. The model yielded its largest returns by longing the pullbacks during the correction and closing the positions at the right time (the exit logic is based on deviations from price returns). This is very interesting, as it could be an indication of model's utility during drawdowns. Its largest loss was also during the same event frame, but I believe that can be greatly optimized with model parameters and thresholds (which I haven’t optimized at all yet).

The entry/exit times are imprecise, because the strategy is based on volume dollar bars sampling, which I'm extracting/approximating from OCHLV data from TradingView.

Entry/exit decisions are driven by a random forest, which learns from the signals of various "experts”, and a tripple-barrier outcome of those signals. In practice, the experts are just Python functions which perform statistical analysis on the dollar volume feature matrix containing combined price history from various timeframes, and output a buy(1), sell(-1) or do nothing(0) signal. Then, the buy and sell signals from experts are passed to a random forest in a matrix, which then “learns” which combination of expert calls yields the most correct returns. The experts only produce position entry signals, each position is then closed based on standard deviation of price returns (intuitively: the position is closed when the price exhibits an “unusual” perceptual move, either up or down).

This trading ML factory was designed to work under significant constraints of historical price data. I limited it to the one available for export in TradingView. For example, 1 hour candle data only goes back a little over 2 years. In principle, there is little alpha to be extracted from here, but I was able to mitigate it by following a “hybrid spine” approach, where multiple timeframes are combined statistically and made available in the matrix passed to the random forest. More granular OCHLV data is scarce (e.g. the 1 minute OCHLV data that I have available for gold futures, goes back less than a month, and there are some continuity gaps in it), however it is still useful to provide some micromarket structure int terms of volume that the random forest can rely on. As such, the factory performs best on higher timeframes (4h and above).

The ML factory learns and predicts based on the prices of multiple assets (and the ratios between them). At the moment, it computes our to gold, silver and copper futures OCHLV data. But it’s designed to be dynamically extendable by adding CSVs with new asset price data.

Currently, I’m very much at the prototyping/exploratory phase with this project, so I don’t have the code publicly available yet. If you want access to the code, just reach out to me. I’m not claiming in any way that it will consistently yield >20% returns, and I understand that the trade count, trading data set granularity and backtesting timeframe are not sufficient for a strong statistical confidence in evaluating the quality of the model factory, but I am claiming that it provides a starting point for directing the factory’s approach. Also, trading costs, slippage, position sizing are not accounted for. Even with limited historical data, I believe that a careful selection of experts can yield profitable automated strategies.