Primary Dealers Failures To Settle Implications For Risk Assets

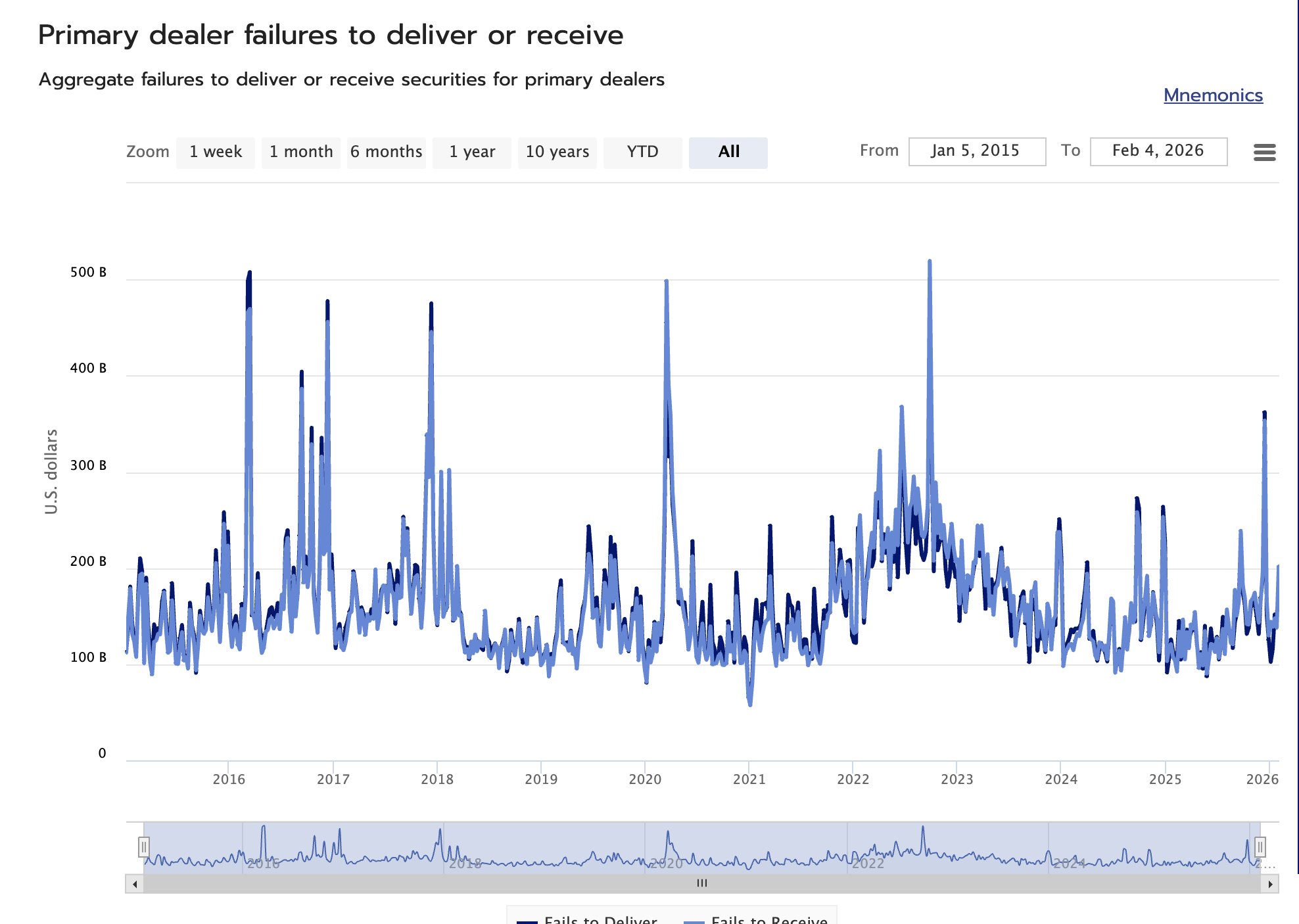

Security settlement failures on the dealer side are a signal of liquidity stress. In short, it signals that either collateral (securities) or USD liquidity are short. Generally, this is bearish for risk assets.

Dealers exercise a key liquidity role in the financial markets microstructure, so a significant stress on their operations will propagate throughout the market.

You can anecdotally visualize this correlation in Bitcoin by noticing that the peaks of failures to receive/deliver by dealers coincide with at least short-term tops for Bitcoin prices.

This weekly set of data is made freely available by Office of Financial Research (OFR), and you can download it CSV or JSON formats. If you are incorporating this data into your machine-learning trading models, beware of the look-ahead bias, as this OFR data is released with about a week of delay.