Russia & ruble macro updates

Regular insights on RUB moves, CBR policy, sanctions, reserves and broader Russian macro developments.

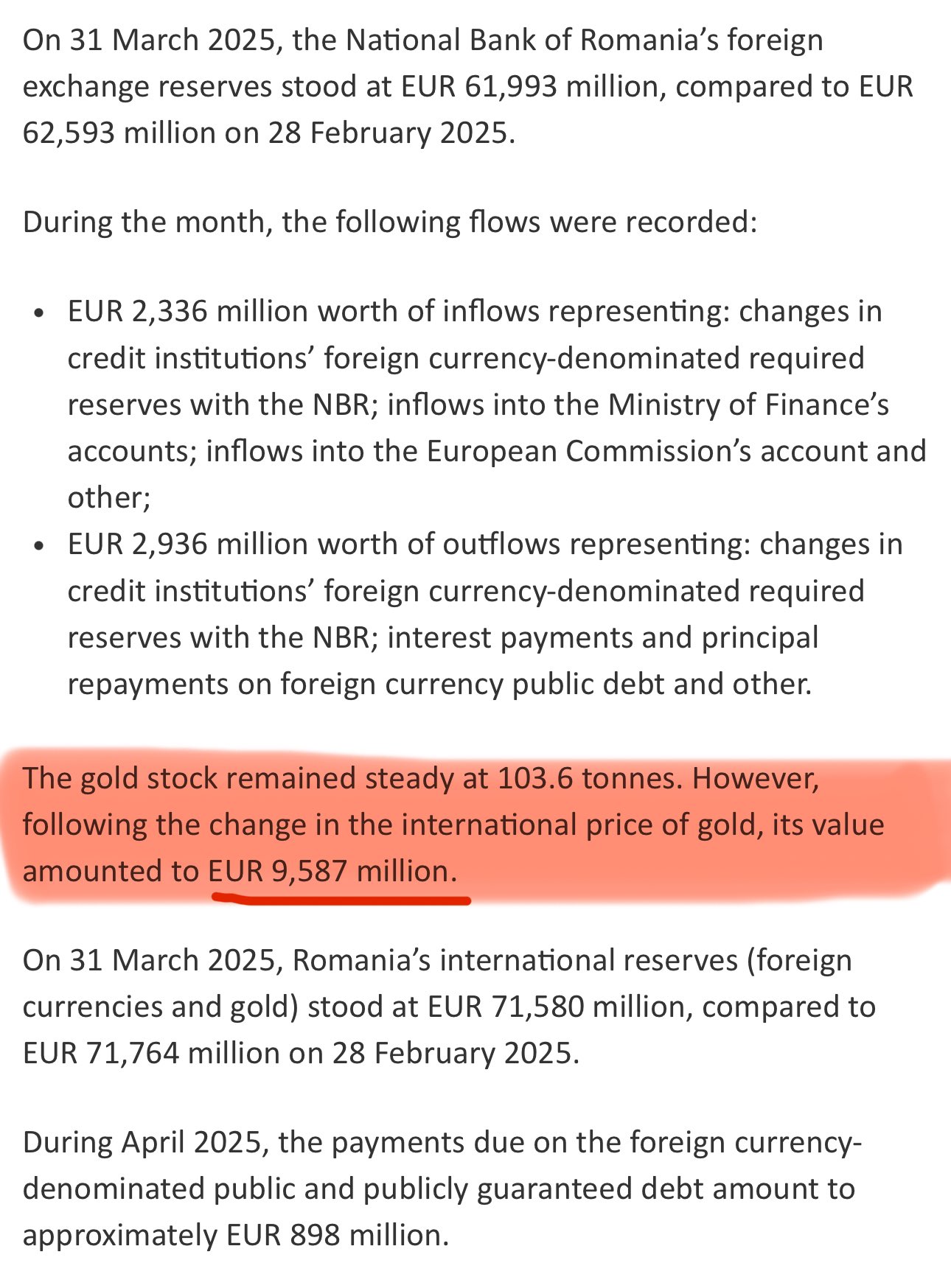

🇷🇴 National Bank of Romania's gold reserves are ≈13% of their international reserves as of March 2025

I like how they added the paragraph in red 😁

Gold reserves unchanged - value raising. Get used to this trend

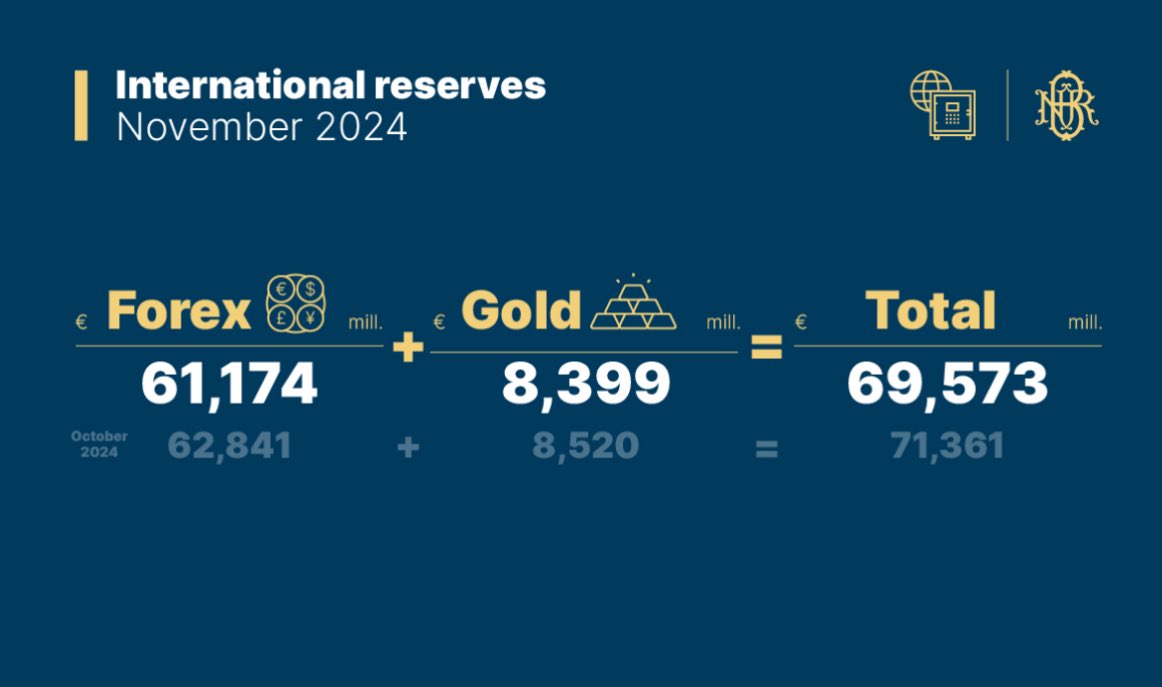

🇷🇴 I like how Romania's Central Bank has this image breaking down their international reserves on their homepage

However, I didn't understand why it links to November 2024 data, when March 2025 data is already available 😁

Gold reserves are ≈12% here

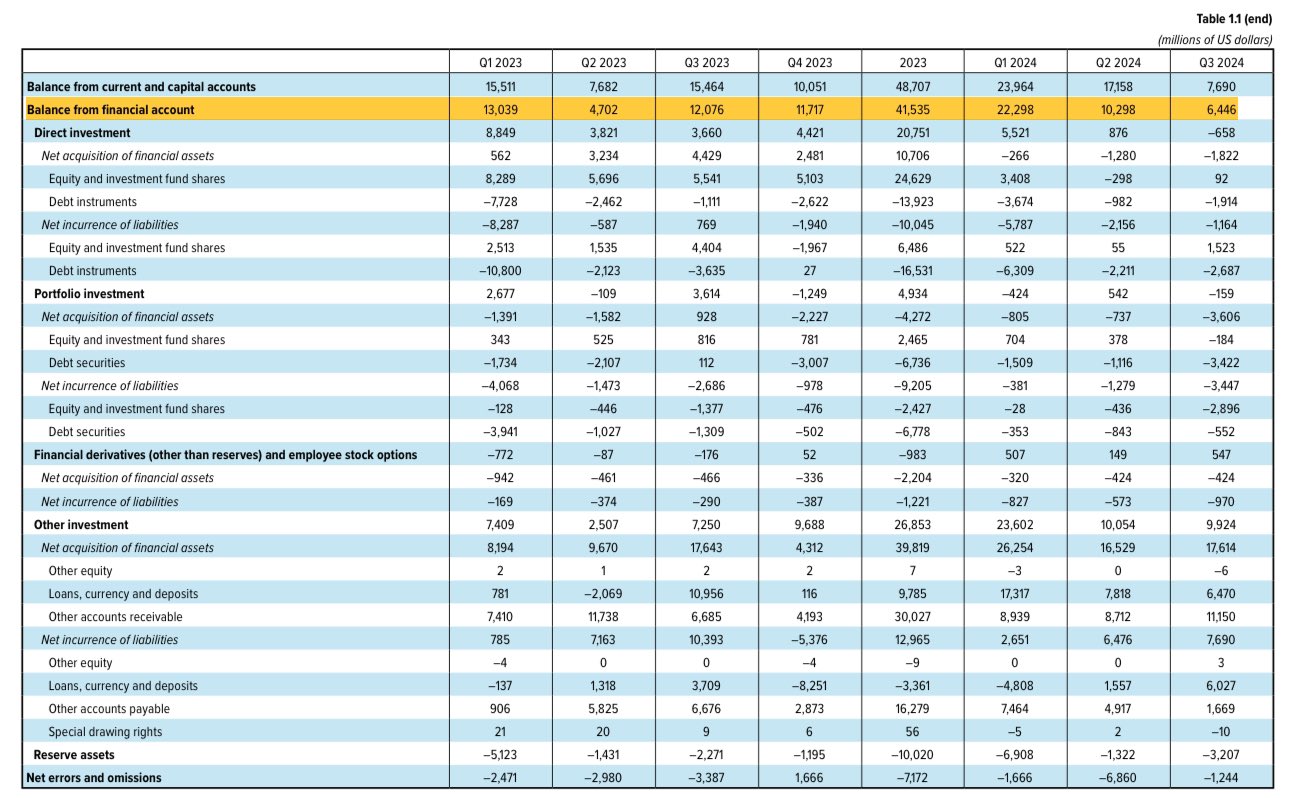

🇷🇺 Russian residents are net creditors to the world

In Balance of Payments, financial account tracks transactions involving financial assets and liabilities

Positive value = more capital leaving country than entering

Sanctions make it almost impossible to invest in Russia

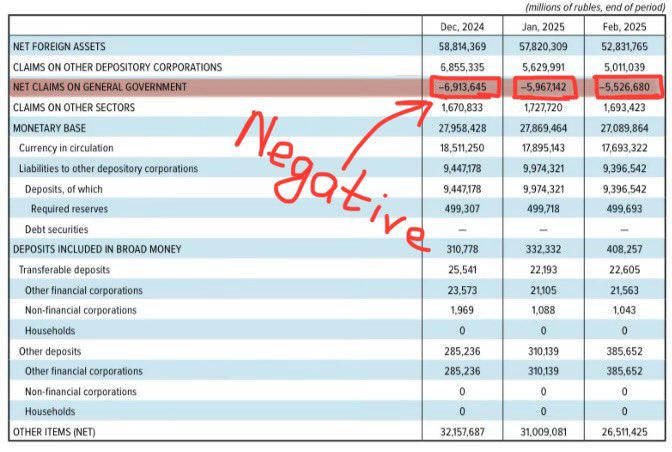

🇷🇺 Russian government gets a lot of revenue from natural resource exports, such as oil and gas

This means the government has a lot of Rubles to deposit at the Central Bank

👉A big help towards the CBR maintaining negative net claims on the government

Result = strong Ruble 📈

🇷🇺 Another reason for a strong Ruble is the consistent negative net claims on general government on the balance sheet of Russian Central Bank

Russian government deposited more in the central bank than borrowed from it - meaning NO monetary financing of budget deficit

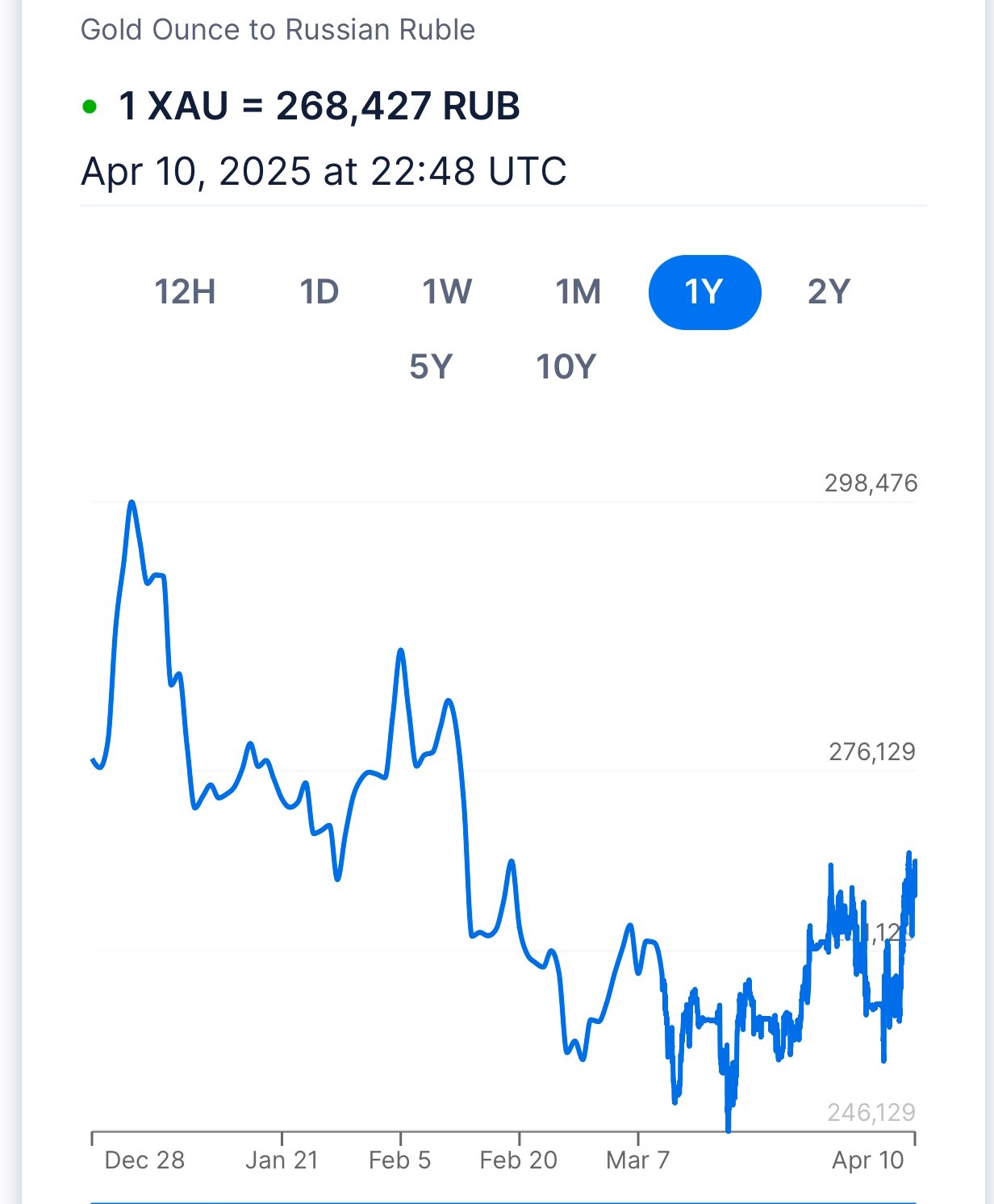

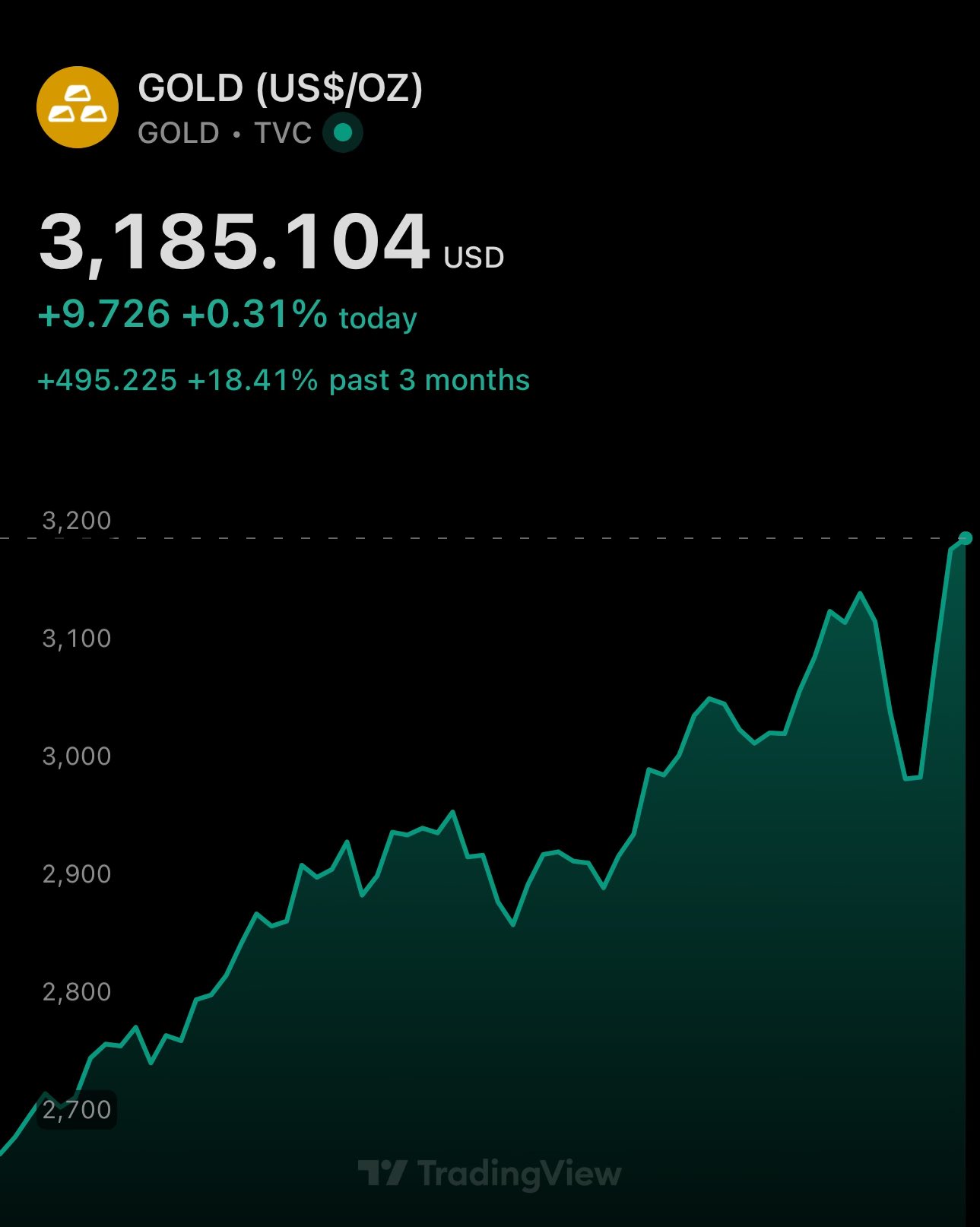

🇷🇺 Ruble correlates with gold, becoming a hedge against USD

USD falls against both, Ruble & gold

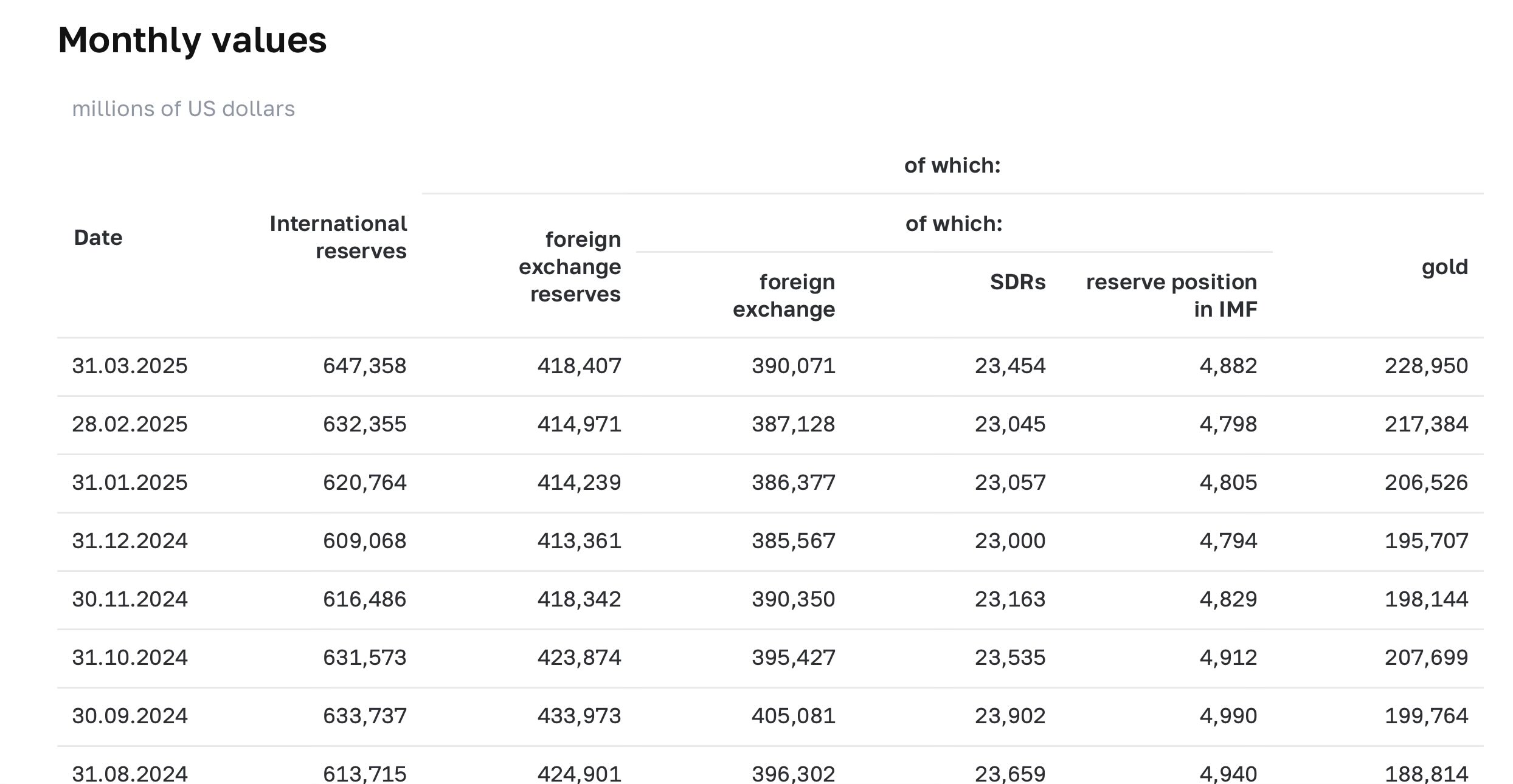

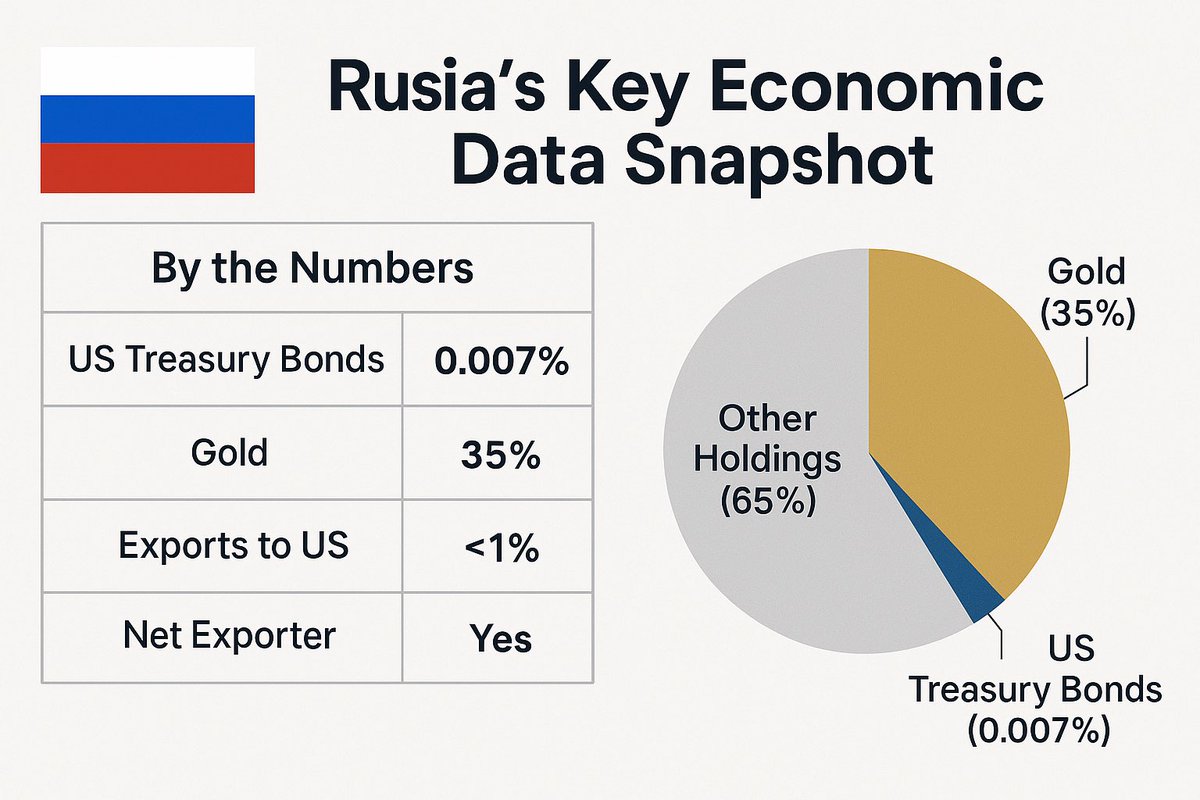

Russian Central Bank has been continuously increasing their gold holdings, which are currently more than 1/2 the size of their foreign currency reserves & 35% of int'l reserves

I've referred to gold being 35% of Russian Central Bank's foreign currency reserves, when I in fact meant international reserves

The core idea is unchanged - this is a technicality. Central Bank of Russia reports:

International Reserves = Foreign Exchange Reserves + Gold

🇺🇸🇷🇺 USD is TANKING against Ruble

… on a daily basis 😳

It's only partially tariffs. This has been a trend even prior to them

Russia loaded up on Gold & sold off their US securities. Trade with US is negligible

Russia self-administered an immunity shot

🇵🇹 Portugal's Central Bank is LOADED with gold

👉 Gold reserves are >80% of total assets

Props to @bancodeportugal for a healthy balance sheet ratio

From now on - only gold-sprinkled pastéis de nata!

🇺🇸🇷🇺 USD/RUB dipped under 82 😳

Combine that with $DXY downtrend & a concerning picture for USD emerges

🚨68-82 is the next range for USD/RUB

A lot of liquidity in that area & expect selling pressure. But there is also selling pressure on the USD

RUB is already up 30% YTD, so expect some pullbacks in the white box region

🚨 Ruble falls below 82 against USD

I've been writing for a long time about Ruble & the Russian economy, but it's still crazy to watch it play out live

REMEMBER: Russia is still under heavy sanctions, and it's virtually impossible to purchase RUB. Once they're dropped: 📈

🇪🇺🇷🇺 So how can you buy Russian securities in the EU?

Since 2022 it's unfeasible. IBKR & KIT Finance suspended trading

Deep researching with LLMs now, but it hasn't been very fruitful so far 🤔

Once the sanctions are lifted you'll see the prices explode

🚨 Ruble is up 30% on USD 2025 YTD

82-68 is a strong support - including pre-Ukraine war liquidity

A small pullback is very likely to happen, but in the medium-long term it's heading towards the 68

Once sanctions are dropped by US & EU - RUB will skyrocket

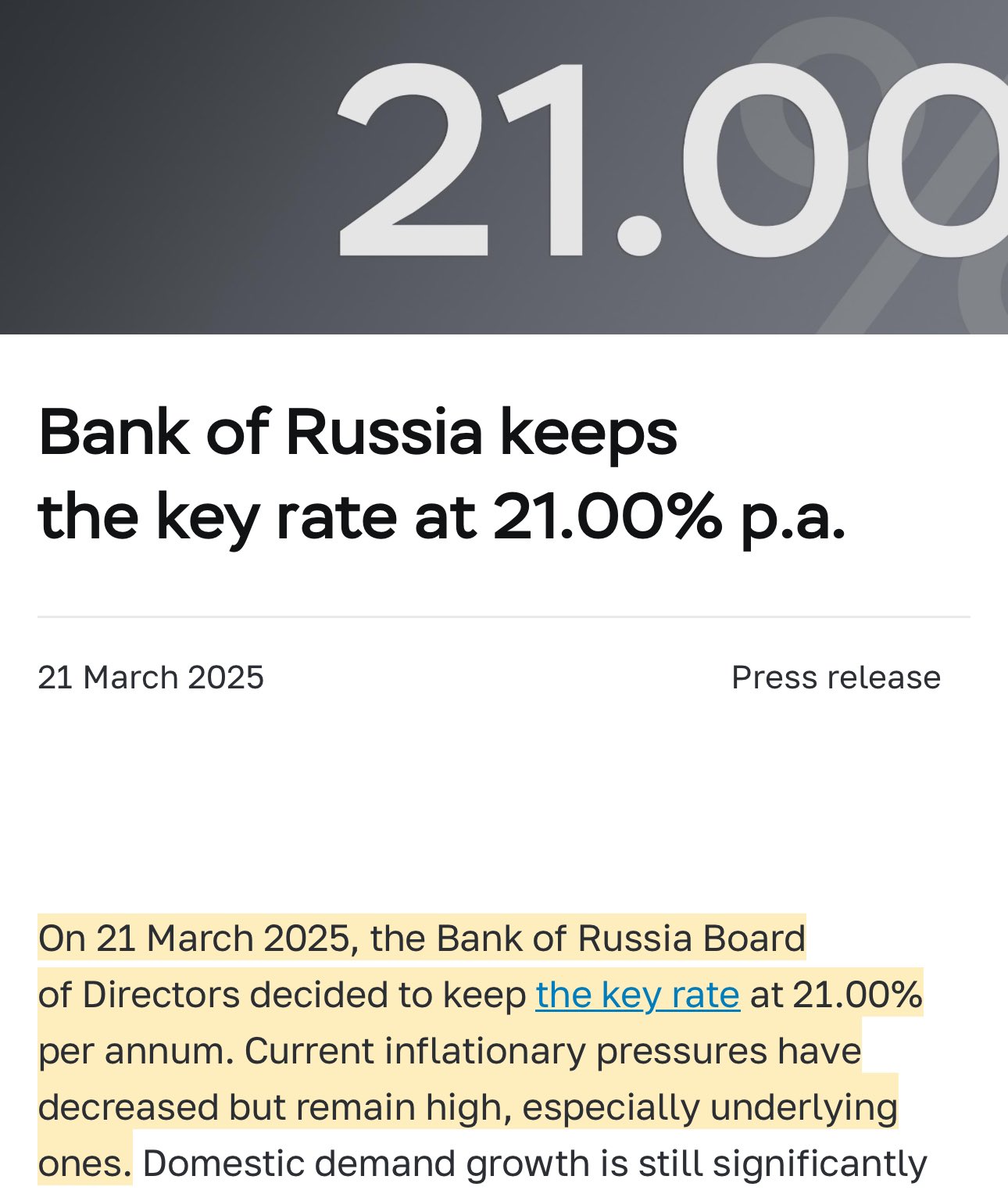

Another important fact to mention regarding Russia, is that on top of sell-off of US securities & loading up on gold in record numbers, throughout 2025 Central Bank of Russia has kept interest rates at 21% 🤯

Result = massive savings

However, if EU or US did the same - their economies would collapse overnight

To clarify - here you're stating with US Dollar and then buying either Ruble or Gold. It's in this scenario that both investments have a similar yield

If you start with EUR, Ruble actually yields more than Gold - 9.3 vs 11% (in the past 3 months)

And Ruble is up on Gold since January 🤯

All while Gold is at ATH & it's extremely difficult to buy ruble or any Russia-issued financial instruments due to sanctions

Loading up foreign reserves with gold & selling US Treasury securities worked ✅

It gets crazier 🤯

In the past 3 months, amids the tariff madness - at the time of rush into safe assets - Ruble & Gold head-to-head

You could've either bought gold or Ruble & gained 18% in both cases

And buying ruble isn't easy due to sanctions. Imagine when it opens up

Ruble is a gold success story ✨

Sanctions, tariffs, raising M2 - it doesn't care

Central Bank Of Russia sold off their US bonds & loaded up on gold

⬇️ US bond prices are down

⬆️ Gold is up

⬆️ Ruble is up against USD

Expect this playbook to be repeated by others

🇷🇺 Russia is immune to US tariffs

Russia's international reserves are as follows:

- 0.007% US Treasury bonds

- 35% Gold

Russia exports <1% to the US. Russia is a net exporter

This makes them protected from US sovereign risk (USD devaluation) & trade risk

🇷🇺 #MOEX down 22% since Feb

Expect it to bounce back very soon - as capital is moved away from USA & USD into alt currencies, which includes Ruble

Once the sanctions against Russia are dropped - that's where Moscow Exchange Index will skyrocket 📈 http

Russian Ruble vs Euro

Past 6 months #RUB up against #EUR by 13%

Ruble is up 34% on Euro since January 2025 (YTD)

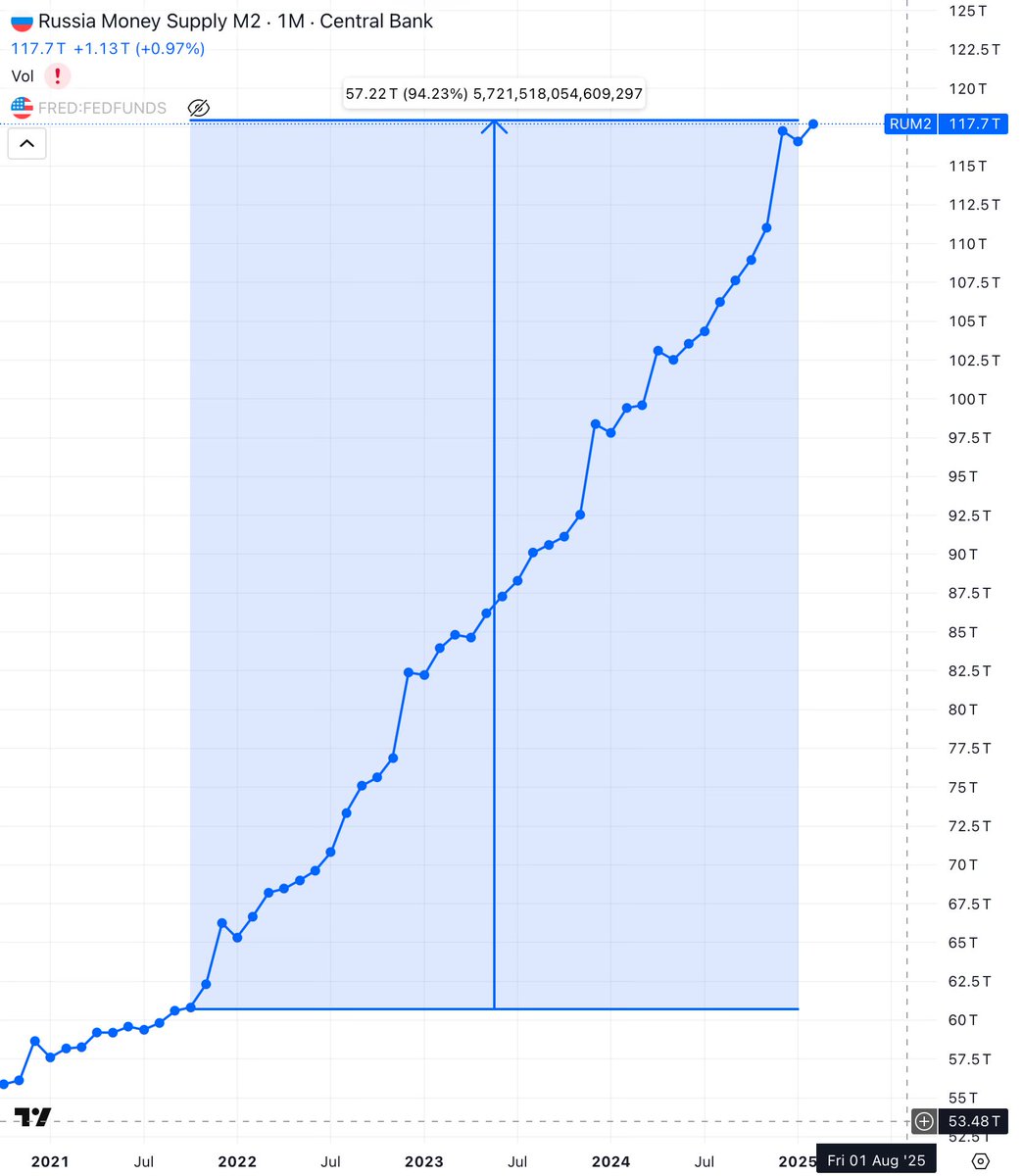

If you think 🇺🇸USD M2 is bad, look at 🇷🇺Russia's

In 3 years, Ruble DOUBLED in supply. Up by a 100%

How come despite this, Ruble maintained its value in FOREX?

The answer is GOLD, more specifically its expansion in the balance sheet of Central Bank of Russia

It works 🤷♀️

Over 10 years the Russian Central Bank has increased gold holdings by x4.5

🇷🇺 Gold is now 35% of all international reserves held by Russia 🤯

🇺🇸 Comparatively, for USA the number is 5%

This is why Russia and Ruble have been so resilient to sanctions