Russia & ruble macro updates

Regular insights on RUB moves, CBR policy, sanctions, reserves and broader Russian macro developments.

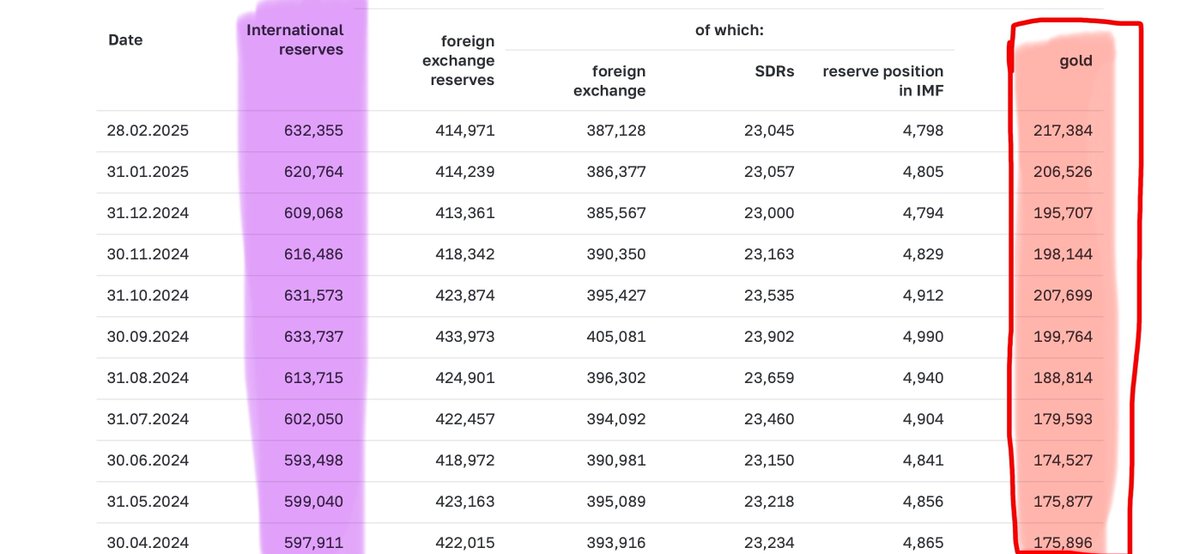

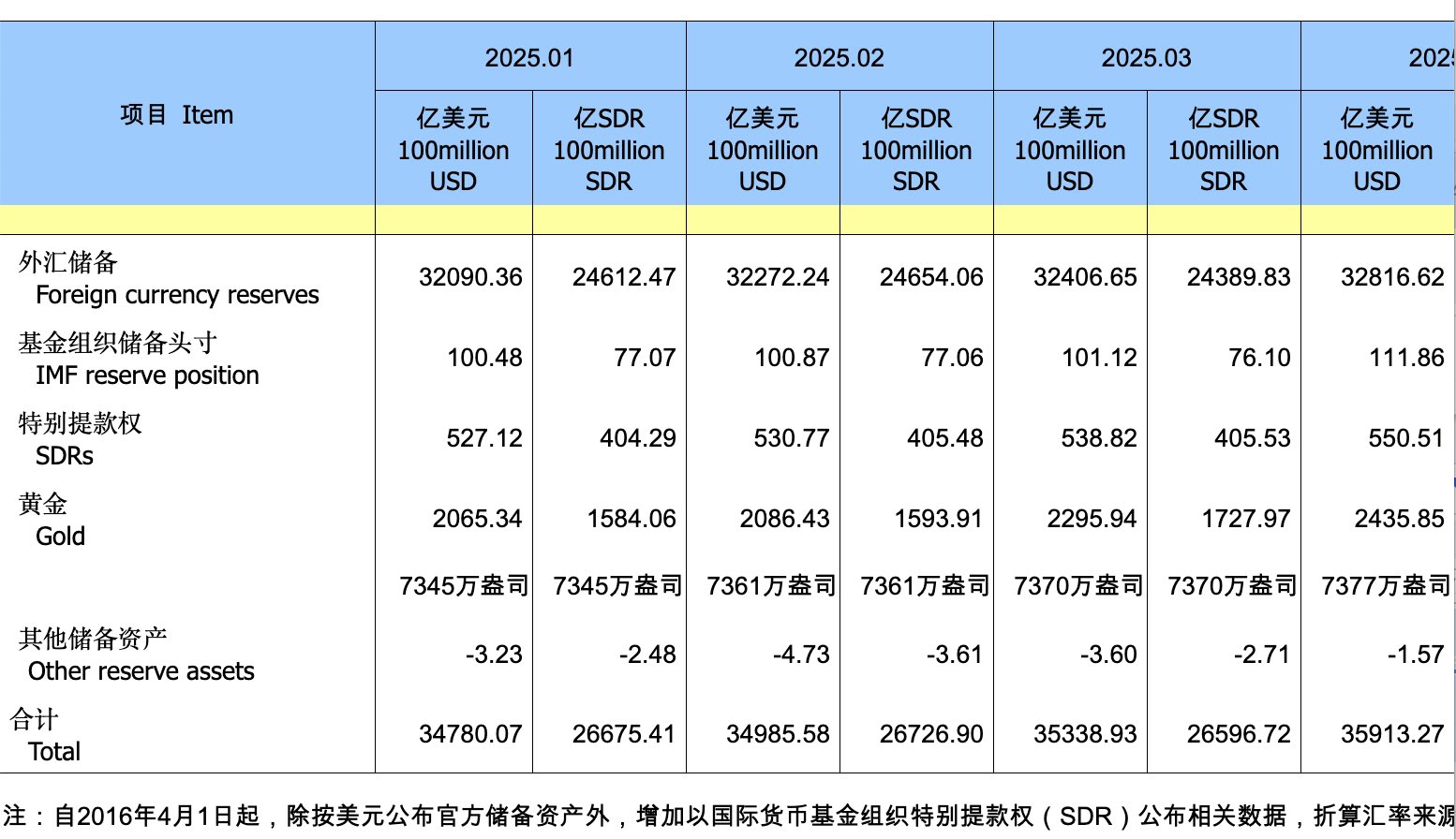

(re)monetization of gold is already in progress

central banks have been consistently buying gold for many years

this is especially true for Russia & China

central bank balance sheets are an underrated resource for understanding the global liquidity moves

if you're following my posts - you already know that

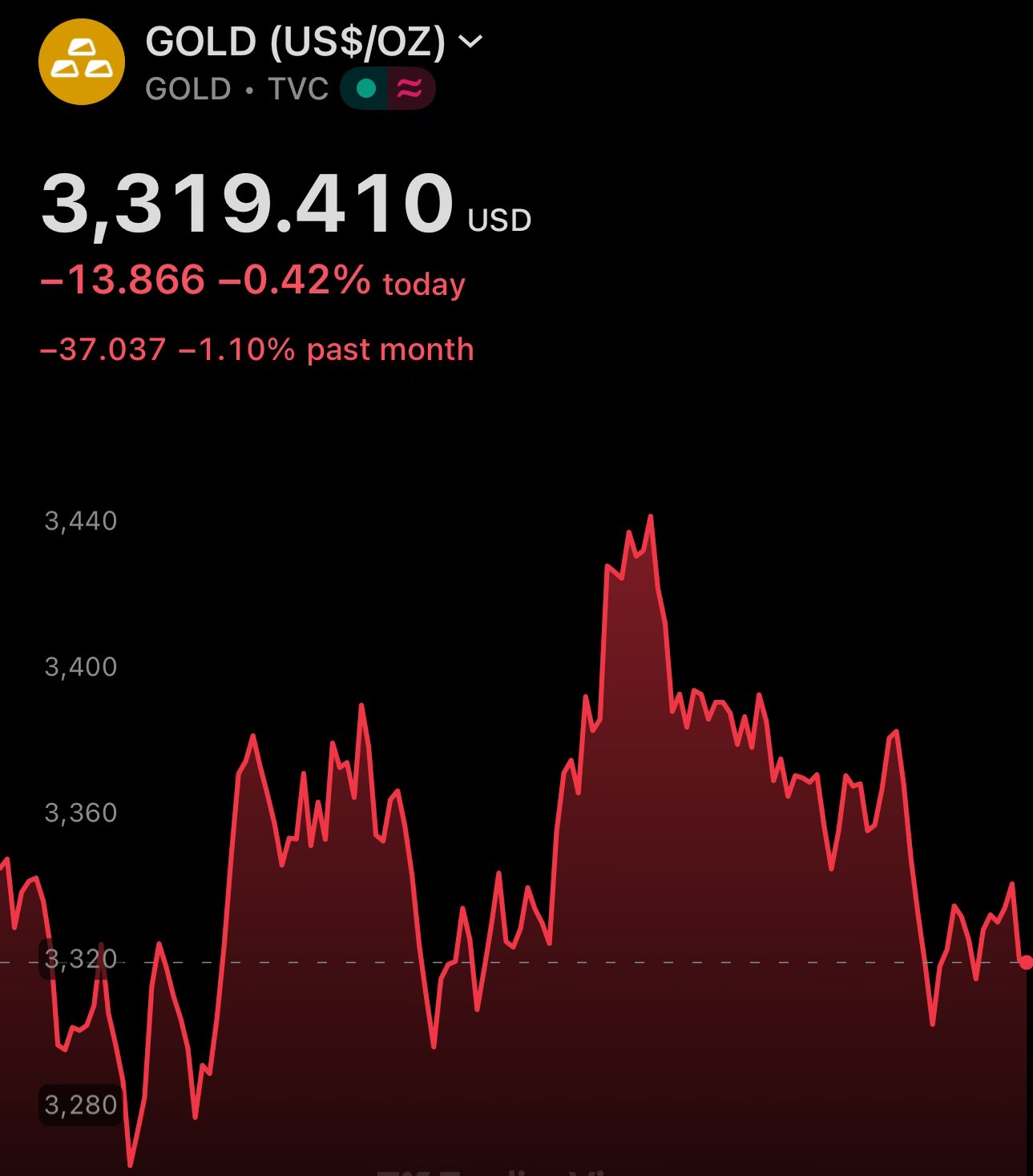

rising US bond yields, ruble & gold

falling USD

i've been warning about it for months

90's style data = massive alpha 😂⬇️

central banks will continue to buy gold

you'll be able to confirm that in their upcoming balance sheets reports. pay special attention to China & Russia

enjoy the dip, because smart money is!

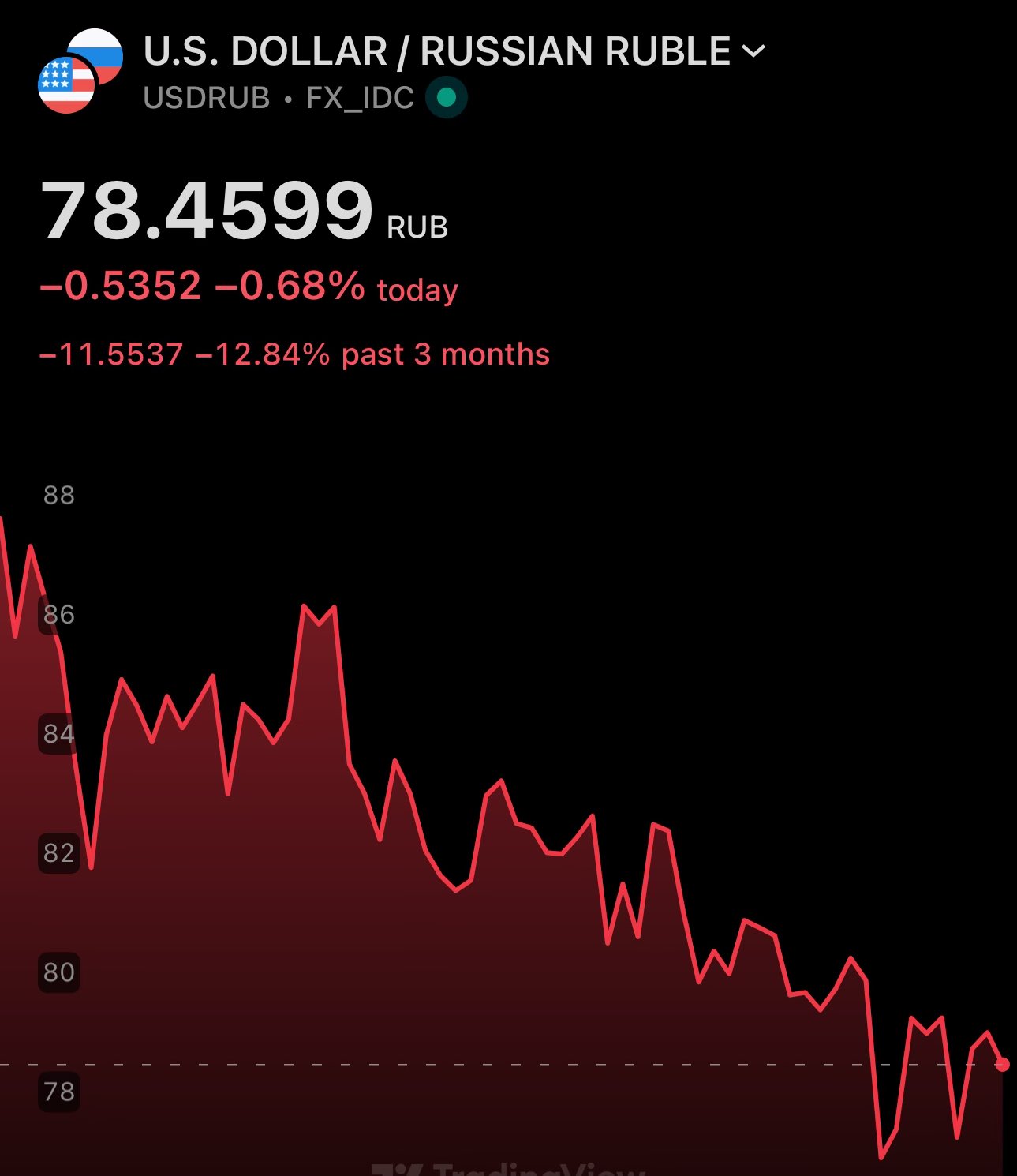

The Ruble thesis remains valid

Up ≈13% on the USD in the past quarter

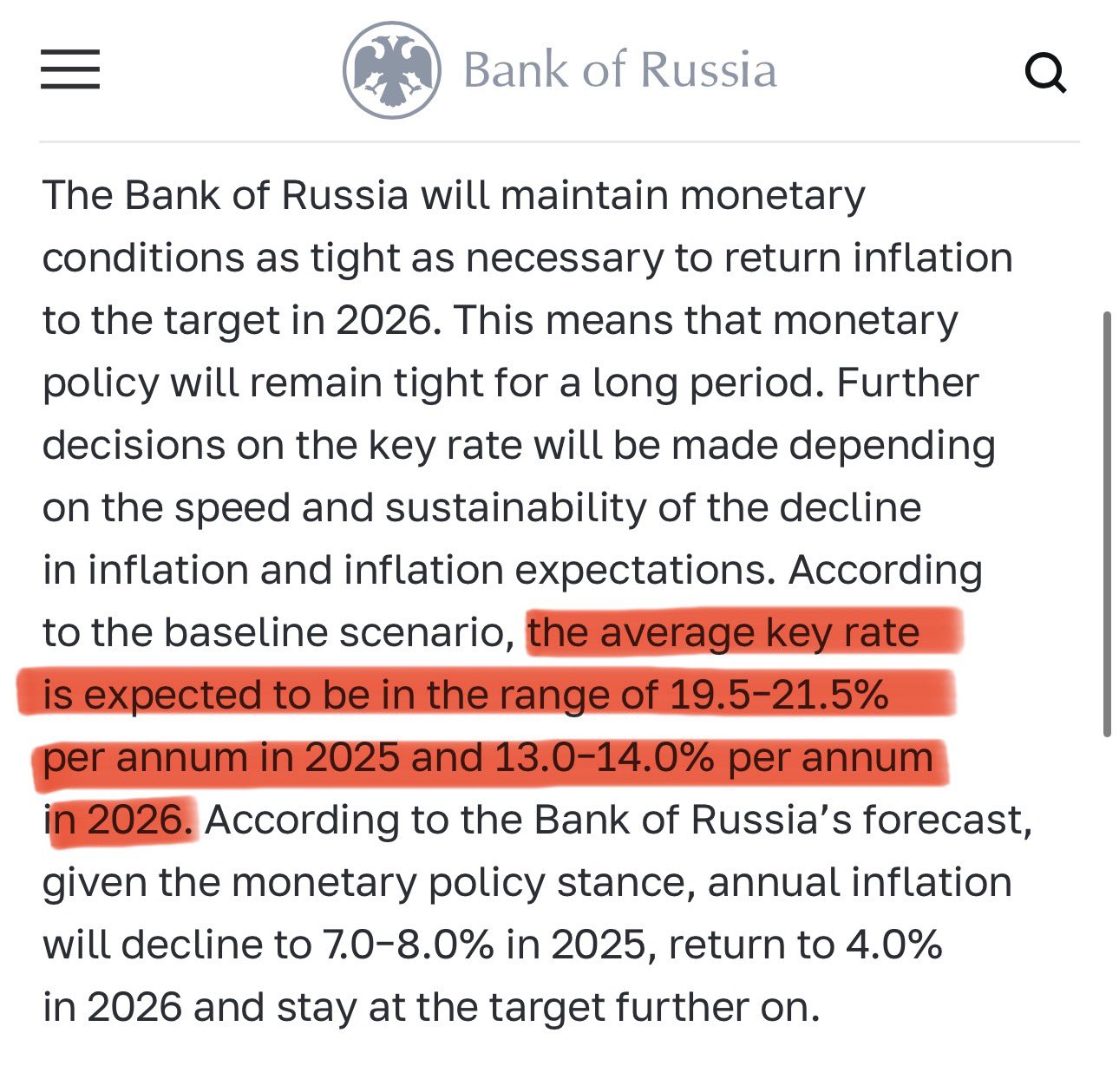

🇷🇺 Russian Central Bank currently has interest rates at 21%

Yet the yield on a 10Y bond is 15.6%

I've previously written that the market is both, pricing in upcoming low(er) rates & paying a premium to stay in Ruble

Today, I found the targets for 2025 & 2026

🇷🇺 Budget deficit financing through the National Reserve Fund instead of bond issuance is one of the reasons why Ruble and the Russian bond yields have been doing so good

🇺🇸 $DXY is up - but not against $RUB 🇷🇺

Fundamentals speak louder than words

🇷🇺 Russia announced that they will cover their 2025 budget deficit not through the issuance of debt via government bonds, but via the National Reserve Fund - funded by natural resource surpluses

👉 Good news for the Ruble, of course

👉 Bond yields went down - 10Y is down ≈-3%

🇷🇺 TIL Russia has a National Wealth Fund

Excess oil & gas profits are credited to NWF

NWF funds are used to finance government deficit, instead of relying on debt issuance of Ruble (government bonds). Inflation-free deficit financing

🇪🇺 We need this in the EU for Euro

Correlation between Ruble & Gold 🇷🇺🥇:

Gold up ➡️ Ruble up

Gold down ➡️ Ruble down

Gold sideways ➡️ Ruble sideways

Russia could make RUB gold-backed, make RUB convertible to gold on demand & position RUB as a 'trustless'/money-backed currency

Already halfway through there

🇷🇺 Ruble is correlating with gold

This also explains the recent fall in price. Gold went down against USD & so did RUB

Such a retracement after multiple consecutive ATHs is expected

Fundamentals are still on the side of gold

🧠 Remember: gold is 35% of Russia's int'l reserves

🇷🇺 Ruble outflows into USD 🇺🇸

A lot of liquidity moved from RUB back into USD. This is also telling by the rebounded USD index

But gold will appreciate further. Russian Central Bank's massive gold reserves will pay off

🇷🇺 Russian Central Bank key interest rate is at 21%

3Y Russian Federation bonds are at ≈16.5% yield

The market is pricing in upcoming rate cuts

@AskPerplexity and @grok will tell you that Ruble & Russian economy are in a bad state. The reality is different