US Treasury yields & curve analysis

Ongoing commentary on the yield curve, auction results, duration risk and what Treasuries signal about macro conditions.

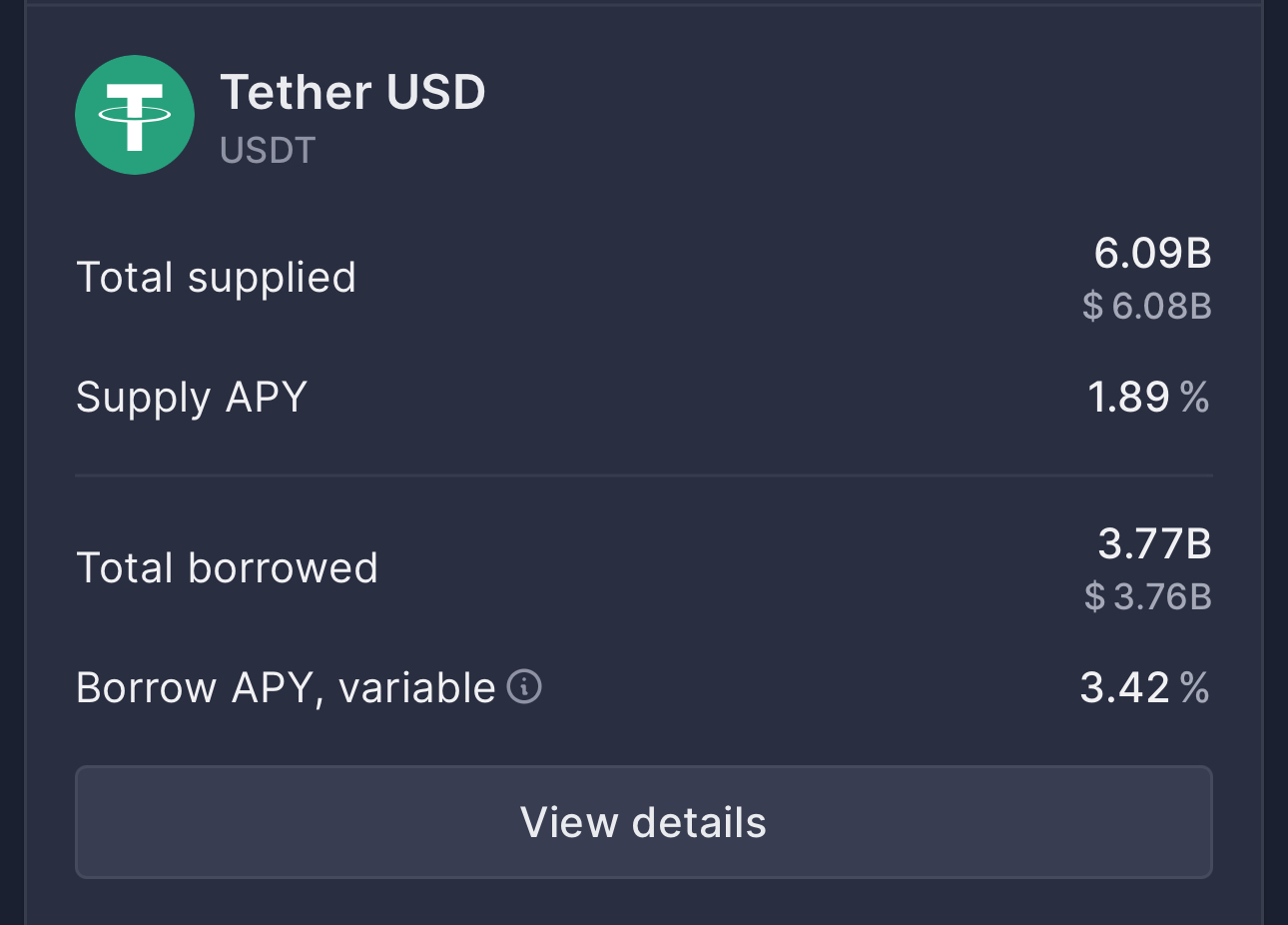

So the yield on USDT on AAVE is below 2%. USD Money markets currently yield ≈3.5%

Why would you take on much more risk on-chain for a smaller return?

You are much less likely to lose your funds in a regulated venue than on an Ethereum-based derivative.

8 months later, Japan's 30 year bond yield is now ≈32% higher

The yields on the 30Y Japanese bonds is approaching 4%. The yields are up across the whole tenor curve.

Soon, BoJ will have little options left but to resume QE and lower interest rates, and thus expand the Yen monetary base in an effort to reduce government refinancing costs (A.K.A. government bond yields).

I first wrote about this almost a year ago. The thesis for 2026 and onwards remains the same.

So the Fed will fully resume Treasury purchasing, as a part of their balance sheet expansion starting December 1st 2025

Not only all maturing Treasuries will be rolled over at auctions, but also all Mortgage Backed Securities (MBS) principal will be reinvested into Treasury bills (<1 year duration)

This will lower the duration of the assets on the Fed's balance sheet and contribute to debt monetization

But that's not a surprise. 3 months ago I explained why interest rate cuts and the end of QT/start of QE is imminent

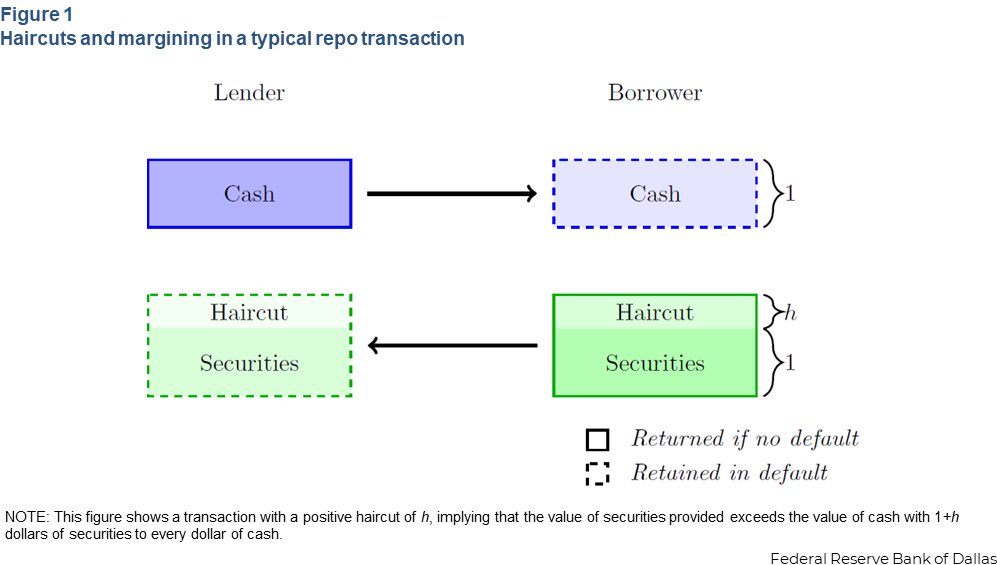

this is why a 7 day Treasury bill-backed repo agreement may have 2% haircut and a 0.1% spread, while a 20 year immovable property collateralized loan a 25% haircut and a 2% spread

the T-bill is more liquid, less volatile and the loan term is much shorter

collateralized lending comes with smaller interest rates/financing cost because it's low risk for the lender

if you default - the lender keeps your collateral

haircuts and spread are set sufficiently high to cover liquidity, term and market risks

so if the US Treasury revaluated gold and used all those proceeds to repurchase/retire debt it will likely have an initial negative effect on the liquidity, due to contraction in safe collateral

NCCBR participants are generally subject to regulations and balance sheet constraints - so don't think that null/negative haircuts means the collateral can be rehypothecated infinitely

these bilateral arrangements is where financial institutions manage their liquidity needs

thus, a 30 year Treasury bond trading at par (i.e. market value = face value = $1000) can create up to $50K of new liquidity/credit!

you cannot leverage as much with reserve money. so a $1000 bond can create more liquidity than $1000 cash/reserves

maximum liquidity added by bond = market value/haircut

so a Treasury security worth $1000 with a haircut of 2%, can create up to $50000 in new credit/liquidity

computed using the formula above: 1000/0.02=50000

moreover, currently the US Treasury is issuing debt and cash at ON RRP is running low. MMF, dealers and banks purchase those T-bills. if they do not have cash in ON RRP, it will be financed by outflows from bank reserve accounts into TGA

this is also why commercial banks purchasing government debt securities, such as Treasury bills may be effectively monetizing that debt

generally speaking:

➖ transaction between central bank accounts = base money reallocated, decreased or increased

➖ transaction between non-central bank accounts = broad money reallocated, decreased or increased

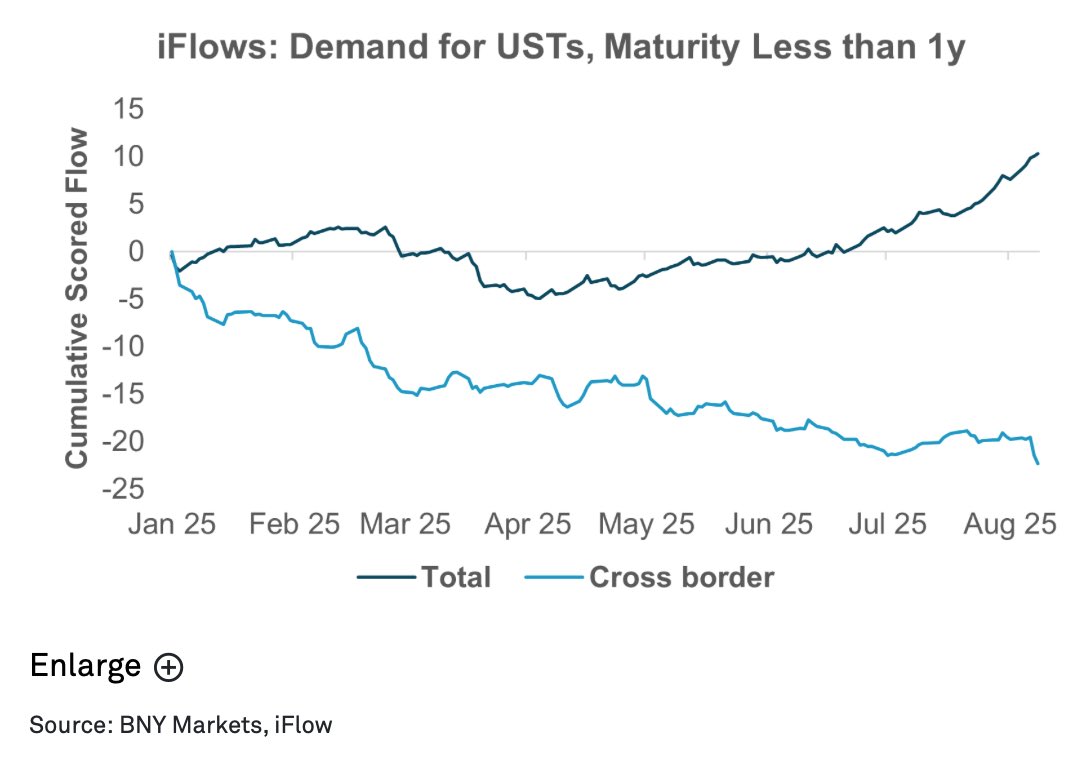

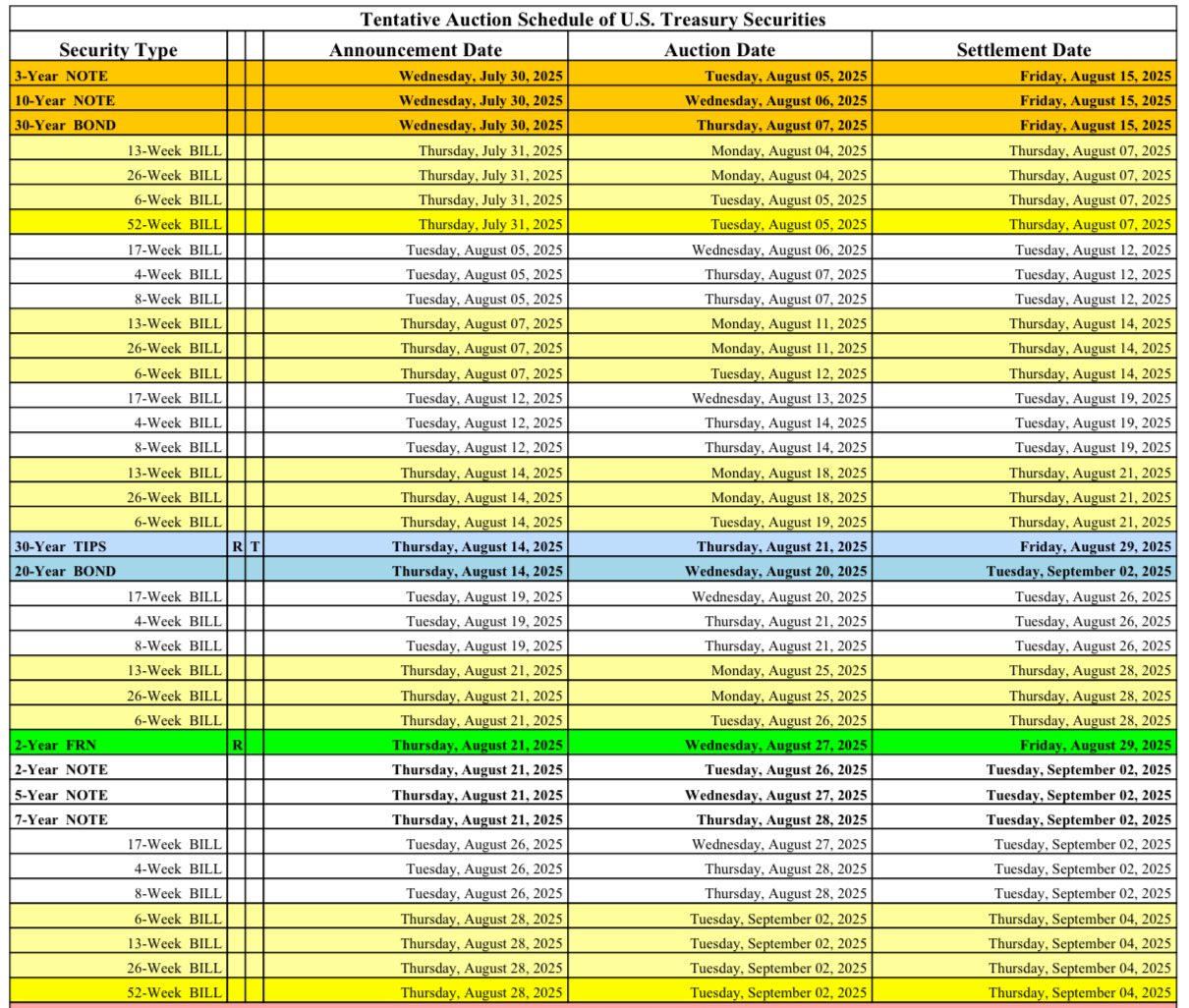

most of auctioned Treasury bills in 2025 are bought domestically

foreign investors are net sellers, so the new T-bill supply is being absorbed by US-based institutions

so most of short-term US debt is being absorbed by the US economy and not by foreign investors

a lot of these US treasury purchases will be financed with short-term rolling debt (e.g. repo)

the newly issued Treasuries themselves will be used as collateral to borrow cash, many times over via rehypothecation

US Treasury debt is likely to be among the assets purchased by those same banks that received QE funds from the central bank. so central bank's QE injection may be used to purchase US Treasury debt at auctions, thus effectively monetizing the government debt 😁

even if it doesn't happen directly at the start - eventually QE also increases broad money, due to reduced balance sheet constraints and an increase in cash reserves, which needs to be invested ASAP. this leads to more lending and asset purchases

the US Treasury may also issue more debt to increase the supply of safe assets, thus offsetting the compression shock

end result: more safe assets/prime collateral provided to markets. remember that the newly issued treasuries are likely to be rehypothecated several times

the global financial system depends on the abundance of this collateral, otherwise - defaults, margin calls, etc

i wrote a thread/article explaining how US Treasuries are the dominant collateral in short-term wholesale debt markets (e.g. repo). read here: https://illya.sh/threads/@1751726431-1.html

QE also removes safe collateral from the market, mainly US Treasury bills, notes and bonds. this safe collateral is the backbone of wholesale debt markets, where financial institutions, including commercial and central banks finance and re-finance their positions

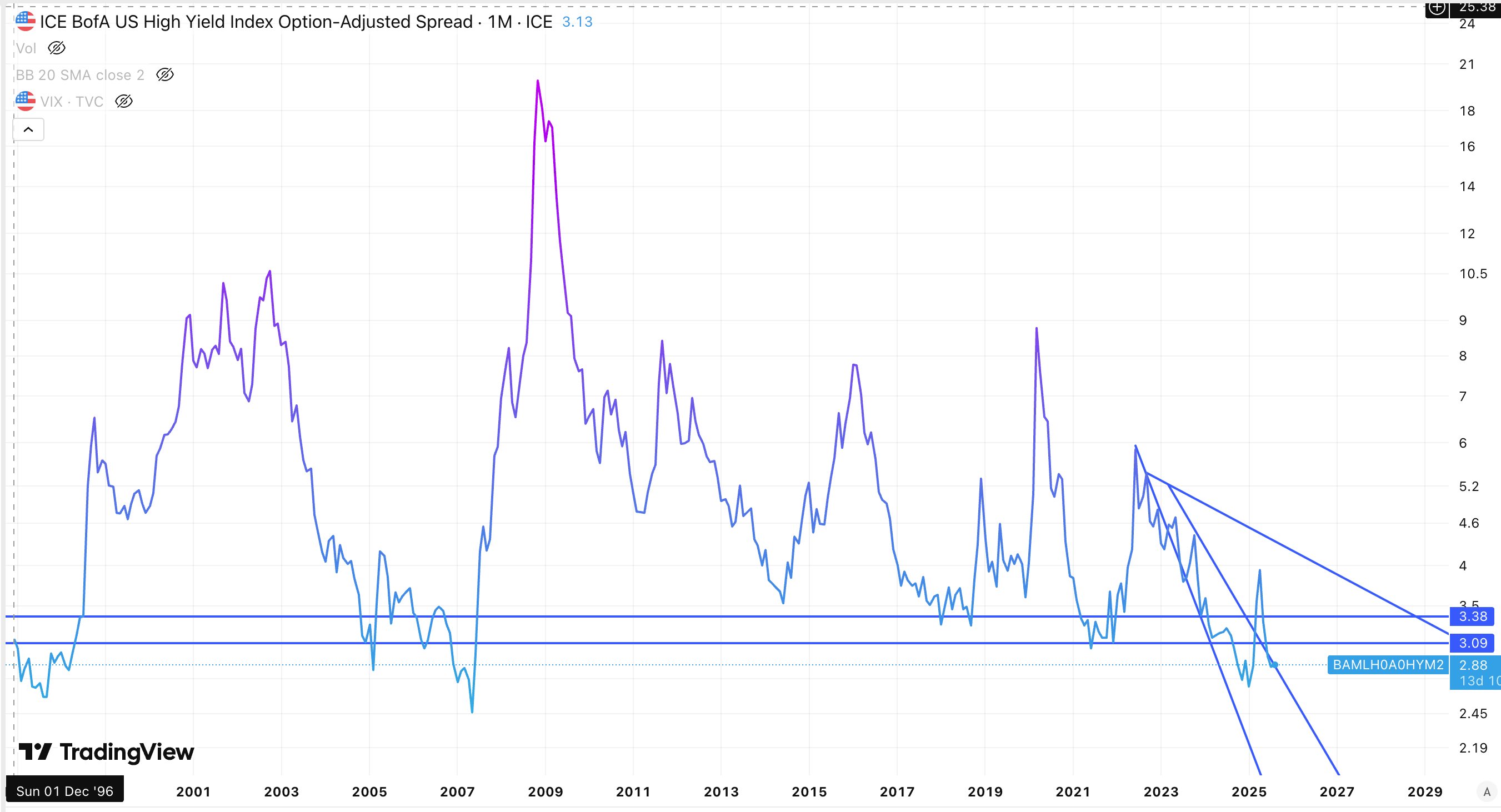

however, eventually yield spreads will raise with high velocity. this is the larger financial crisis part of the cycle. there you will also see lower rates and more QE

the yield spreads may also start an almost vertical uptrend on a monthly timescale - this usually means a financial crisis to some degree

that's probably not happening in the next 3 months though, as you can expect Federal Reserve to decrease interest rates and/or employ QE

here's what yield spreads are saying about Bitcoin

≈3-3.40 is an important historical band which served as support bottom several times, including during COVID, and partly during the 2008 GFC

so far it looks like a trend-reversal in the short-term, with the spreads heading up

thus, you interpret yield spreads between US Treasuries and riskier bonds as:

📈 increasing/high yield spread = risk-off

📉 lowering/low yield spread = risk-on

a lower yield spread means that the market requires less return per unit of risk

lower yield spreads means that US Treasuries have a small premium over riskier bonds, thus the market is attributing a smaller premium to safe assets - a "risk-on" signal

a lower yield spread means that the market requires less return per unit of risk

lower yield spreads means that US Treasuries have a small premium over riskier bonds, thus the market is attributing a smaller premium to safe assets - a "risk-on" signal

yield spread between a safe asset and a riskier one is an expression of the required return per unit of risk

higher yield spreads, means risker bonds are significantly cheaper than US Treasury bonds, thus the market is valuing safe assets with a premium - a "risk-off" signal

yield spread between a safe asset and a riskier one is an expression of the required return per unit of risk

higher yield spreads, means risker bonds are significantly cheaper than US Treasury bonds, thus the market is valuing safe assets with a premium - a "risk-off" signal

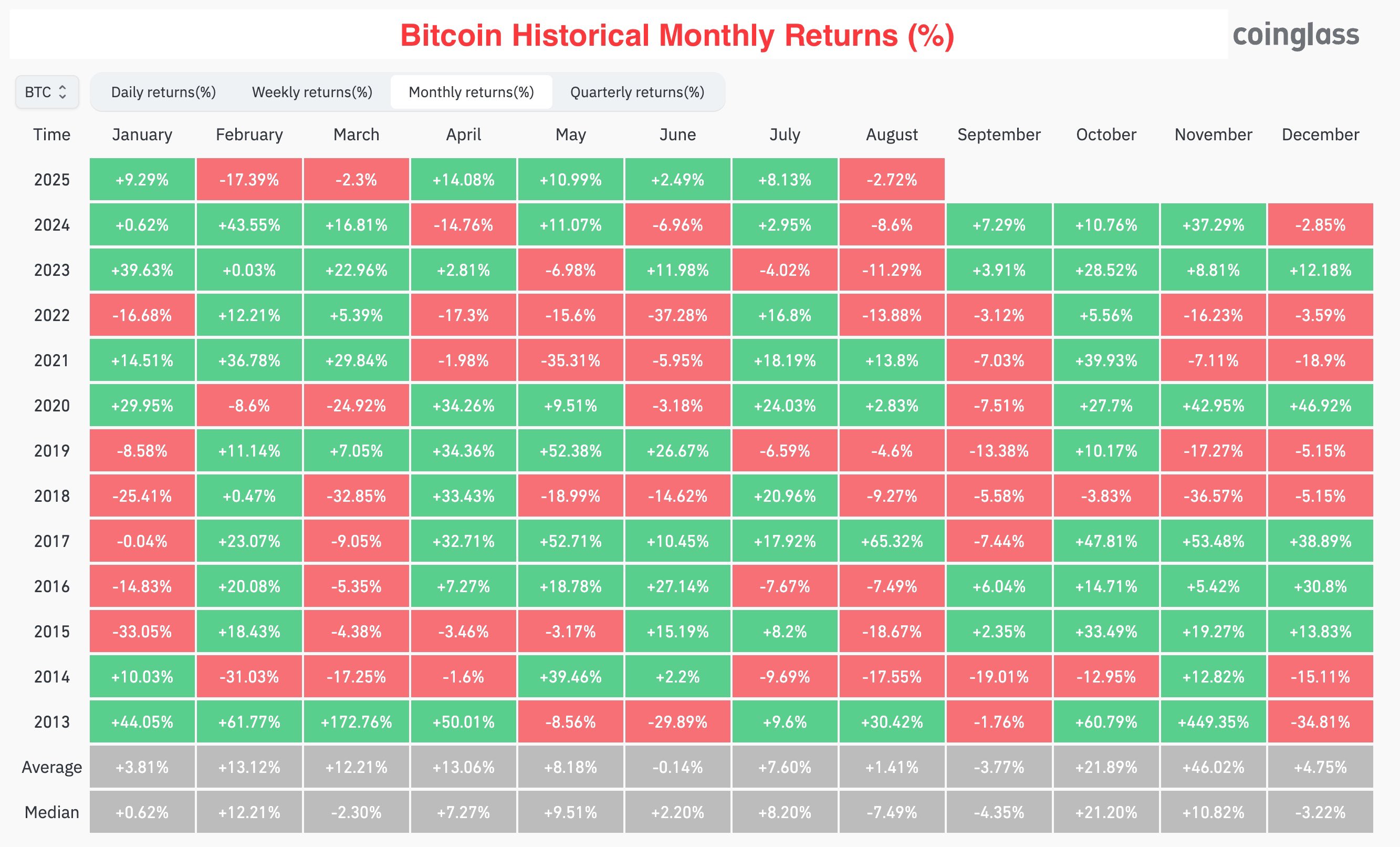

yield spreads between US Treasuries and riskier bonds mirror the price of Bitcoin

in practice, there is a correlation between them:

📈 yield spreads up = ⬇️ BTC down

📉 yield spreads down = ⬆️ BTC up

why? because those spreads are proxy for market's risk appetite

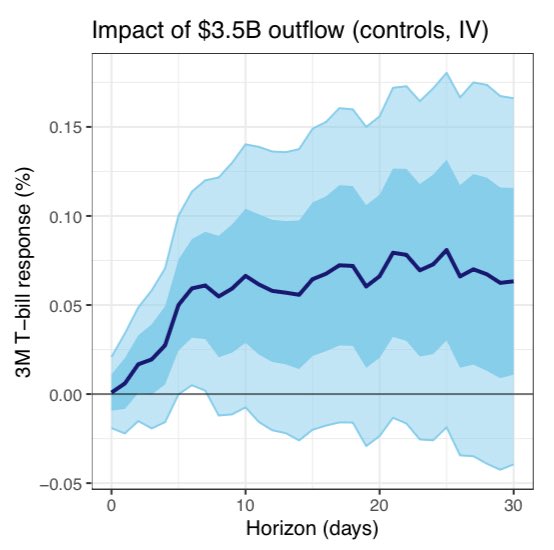

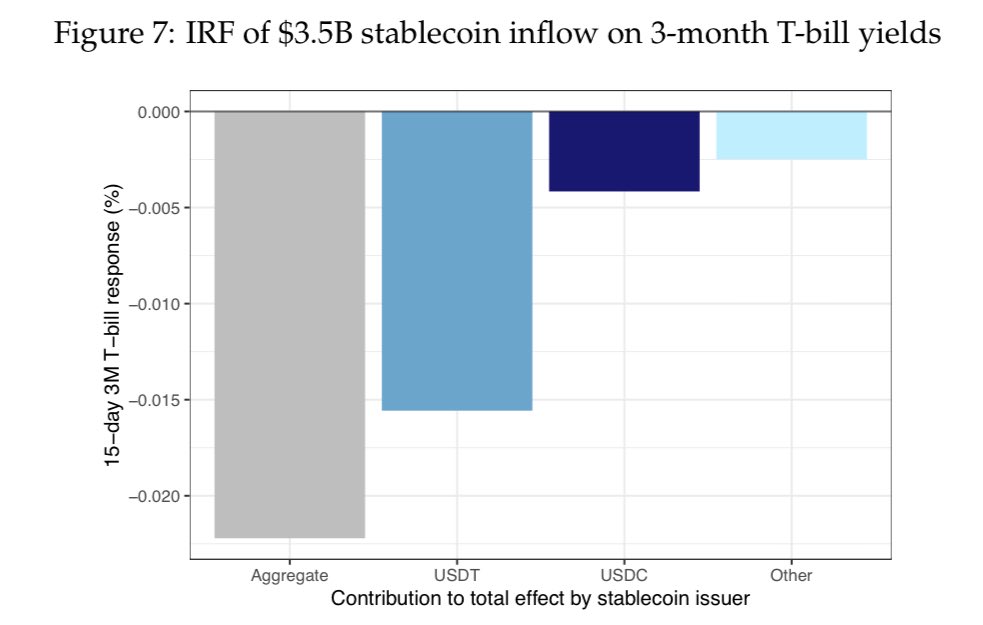

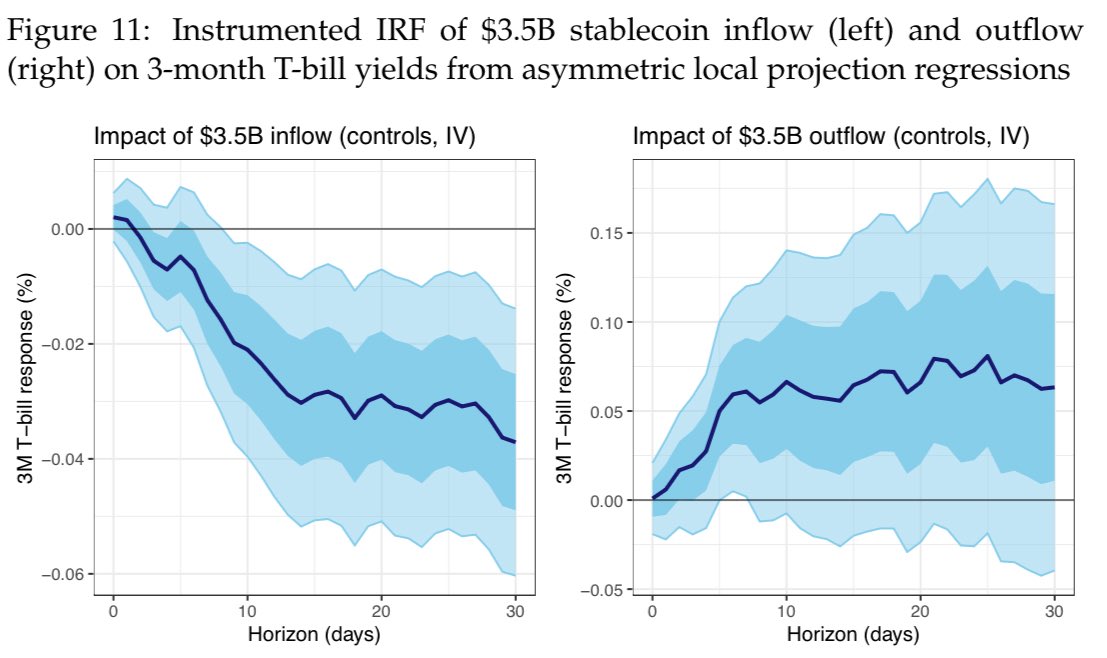

essentially many T-bill sales flood the market at once, so their price falls, thus causing a yield increase

selling T-bills is more urgent than buying - the stablecoin issuer cannot split it across auctions & dealers as easily, so the market yield change is larger on outflows

stablecoin outflows proxy T-bill sales or reduced rolling

redemption/burn requires the stablecoin issuer to sell NOW, so large volumes means dealers/market makers will require a yield concession to warehouse those T-bills, as they are subject to balance sheet constraints

stablecoin inflows lower 3M Treasury bill yields, while outflows raise yields by a larger amount

LP-IV estimates:

⏩ $3.5B inflows lower yields by ≈3 bp

⏪ $3.5B outflows raise the yields by ≈8 bp

inflow = mint

outflow = redemption/burn

this collateral (US Treasury bonds) can then be used on wholesale debt markets to issue more credit

moreover, this collateral can be leveraged/rehypothecated, thus increasing liquidity

still, in the USA the Fed continues to dominate in importance

so it may not only be central bank setting the rates and affecting liquidity

for example, when US Treasury auctions bonds, they're both, temporarily reducing the effective amount of USD in circulation and providing more high-quanlity collateral

so according to this, since Treasuries yield more than ON RRP the wholesale cash moved from ON RRP into Treasuries

when the US Treasury spends them - they flow right back into broad money

indeed, currently T bills yield from 4.29%, while ON RRP is at 4.25%

interesting take!

the US treasury is doing exactly that - issuing short-term debt to retire/repurchased long-term debt

that's effectively refinancing longer-term debt with shorter-term debt. this shorter-term debt will also need to be refinanced, but now much sooner

this is why duration matching is key for financial institutions

this is also the reason why it's generally not a good idea for governments to refinance long-term debt with short-term debt

this shortens the duration of both - government liabilities and market's assets