US Treasury yields & curve analysis

Ongoing commentary on the yield curve, auction results, duration risk and what Treasuries signal about macro conditions.

🚨🇺🇸 30Y bond yield is up 132 bp in 1h

30 year US bond is not only trading above 5%, but had its price fall by ≈1.34% in the short span of 60 minutes

And you thought crypto & meme coins were volatile 😂

🇺🇸 US bond yields are at their ≈2006 levels

🏦 Current FED Funds rate is about the same as it was in '06

💰 The US Dollar Index is significantly higher today than in '06

High volatility in the bond market became a norm. Volatility & risk go hand-in-hand

Concerning!

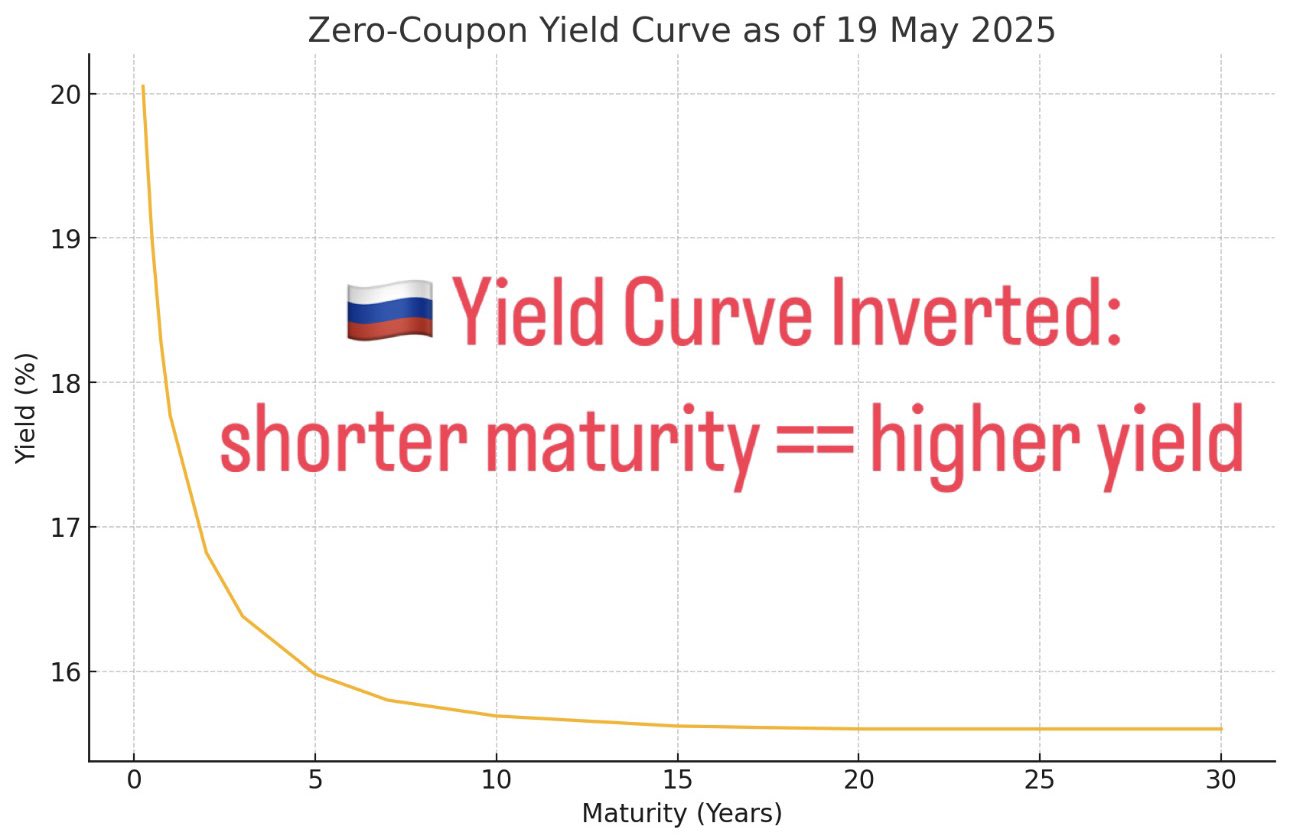

🇷🇺 Russian Bond Yield Curve Is Inverted

An inverted yield curve is usually a bad sign (e.g. recession)

However, 🇷🇺's fundamentals are healthy

Why inverted? 🇷🇺 Central Bank's 21% key interest rate, or rather the expectation of it going down, is what's pushing this shape

Here's why bond yields skyrocketing worldwide ⬇️

Countries own a lot of US debt (bonds)

Moody's downgraded the US credit rating

Now, countries are at a higher risk of default, because the US debt they own is now less valuable = higher chance of country's default

(simplified)

Ever since I wrote this about Japan's easing monetary policy - the yields on 🇯🇵 30 year bonds are up more than x2

Japan heavily relies on debt. Today, Japan has to pay 123% more for that debt than they did 2 years ago

Solutions:

1️⃣ Default

2️⃣ Inflate Yen

Hello inflation 👋

Regarding global skyrocketing bond yields - it depends where you're looking 😄

Sovereign bond yields up: 🇺🇸🇯🇵🇬🇧🇪🇺

Sovereign bond yields down: 🇷🇺🇨🇳

I've been posting numerous explanations for of this - all very expected

30Y US bond yield just crossed 5% 😳

Scraping the ≈5.22% from 2023

👉(Soon) highest yield in >17 years!

Last time yields were consistently this high was 2007. But a lot of QE policies came in force after the 2007-2011 crisis, so rates were naturally higher back then

It's a mystery why US bond yields are skyrocketing

Higher yield = higher risk, BUT the US has been doing nothing, but irradiating confidence, respect & cooperation 🤯

🇷🇺 Budget deficit financing through the National Reserve Fund instead of bond issuance is one of the reasons why Ruble and the Russian bond yields have been doing so good

🇺🇸 $DXY is up - but not against $RUB 🇷🇺

Fundamentals speak louder than words

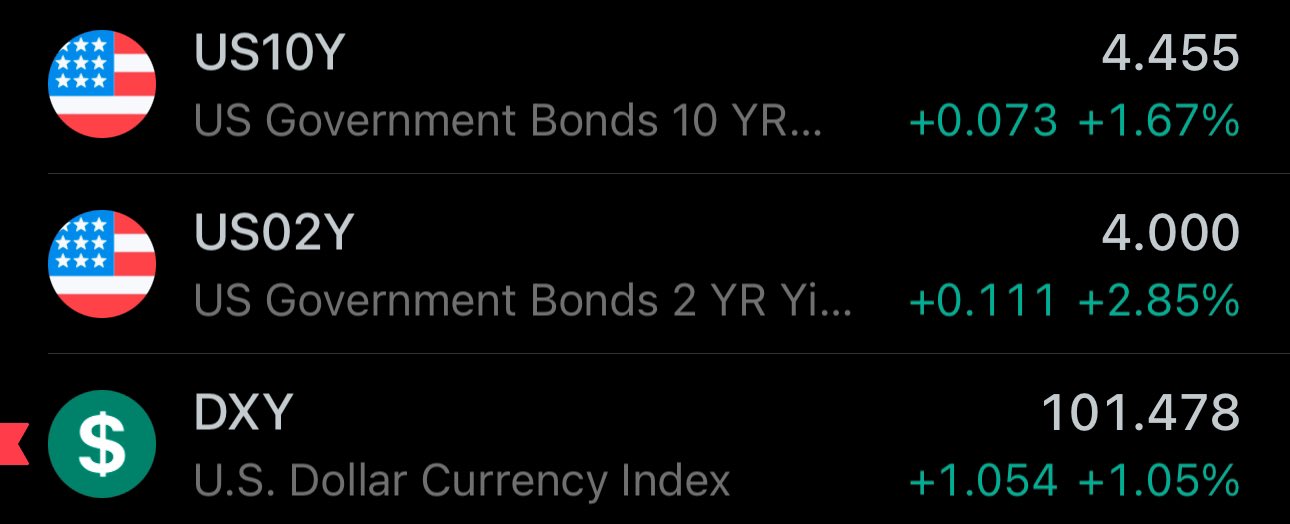

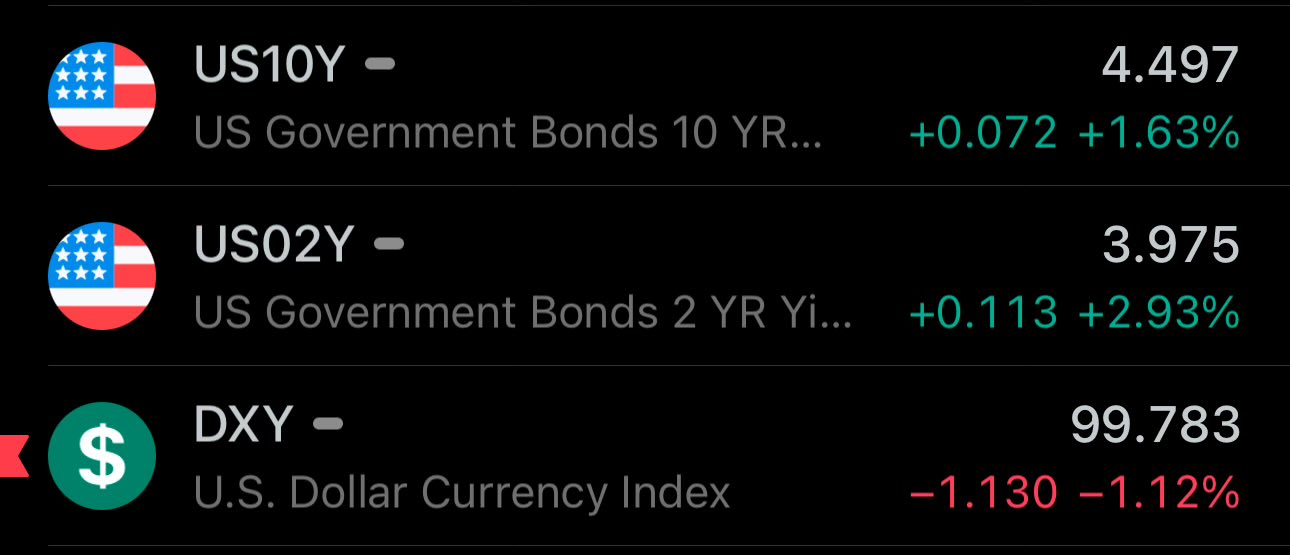

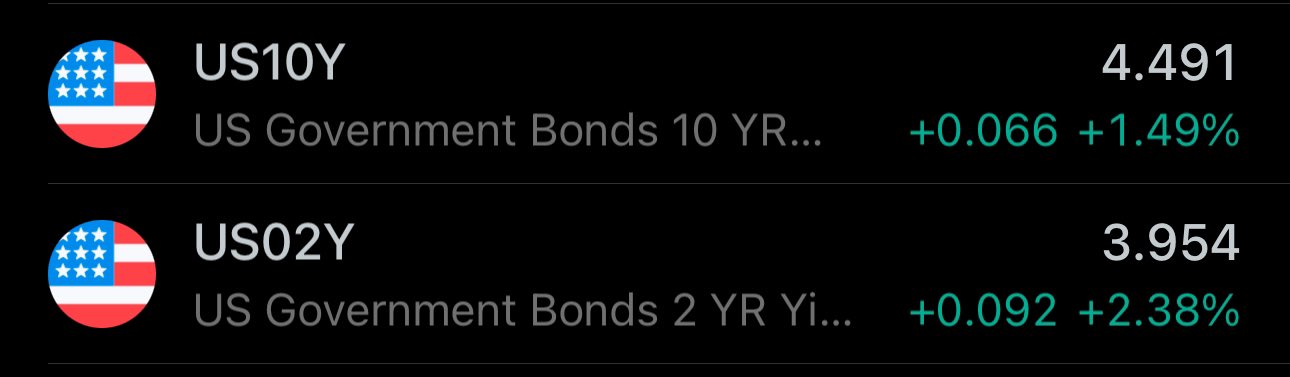

🇺🇸 2Y bond up 3% percent to a 4% yield 😳

10Y yield also up & approaching 4.5%

At least USD index is back above 100 for now

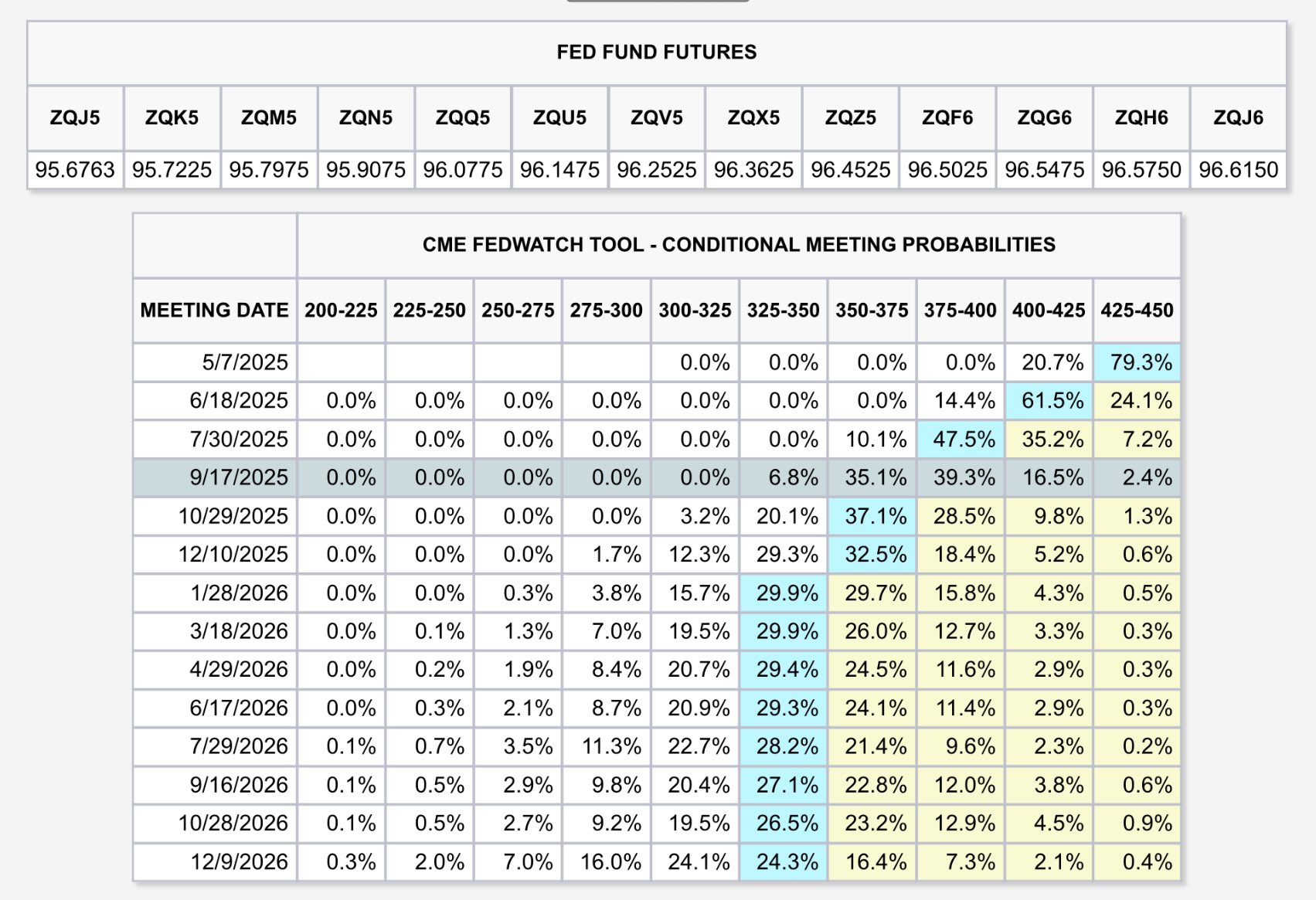

2Y US Bond is a good factor/signal of FED funds rate, but there's an even better one!

CME's 30-day FED Funds futures is a derivative for this exact purpose. The market prices them according to the expectations of upcoming FED Funds Rates

🔗

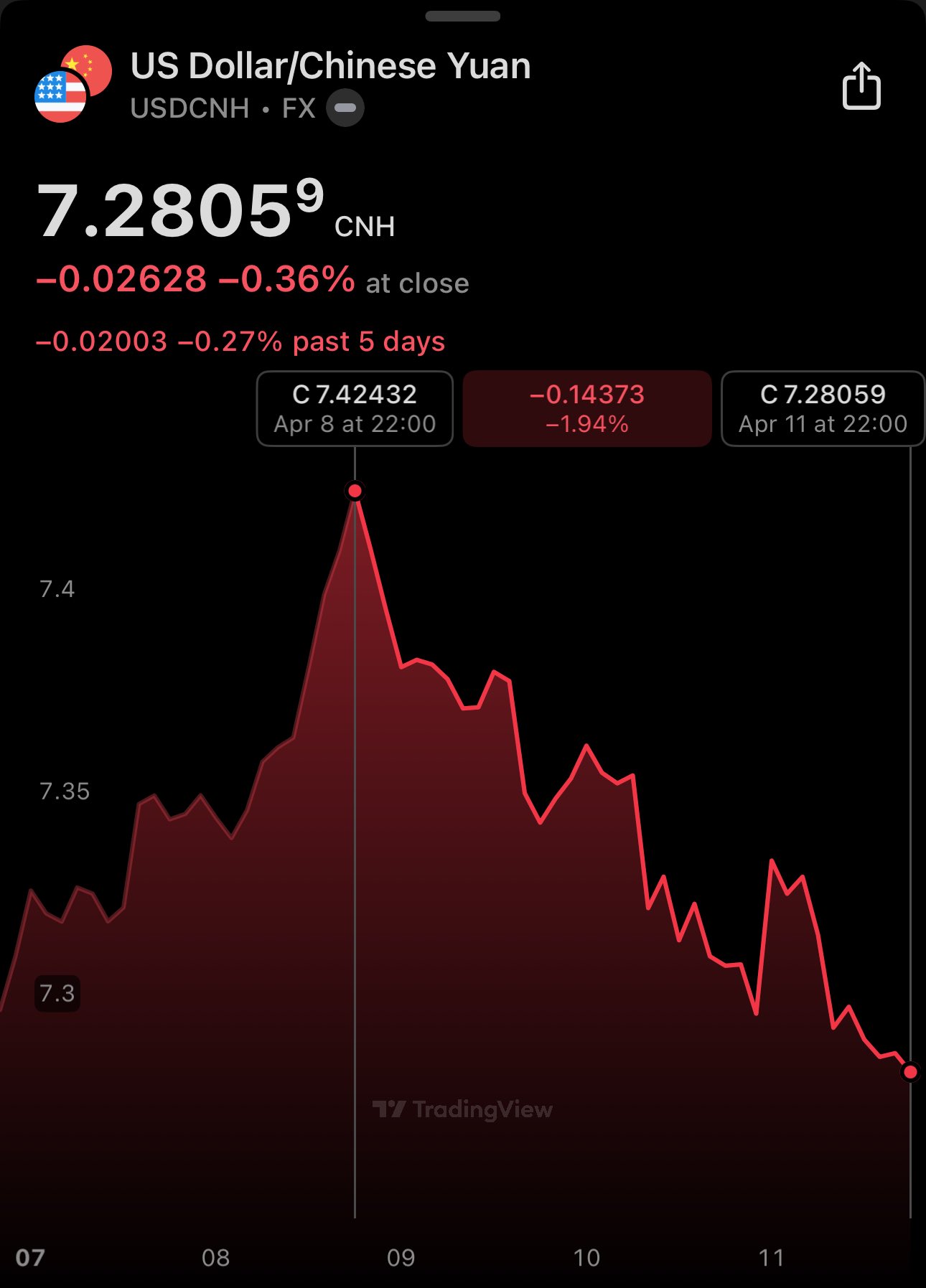

Look at that liquidity moving from short-term Chinese bonds(CN01Y), to short-term US bonds(US02Y) 👀

The market liked the removal of tariffs, however, you can't undo the massive volatility over the past 2 weeks

Moreover, US Dollar index is still below 100

🚨US 10 Year Bond yield spikes above 4.5% at open

I previously posted about the move of liquidity towards the Chinese bonds

The USD is facing an increased perceived risk, which in addition to the public debt puts questions on its role as the reserve currency

Yuan downside party really didn't last 😳

It went up just as fast as it went down

Yuan up + falling yields on Chinese bonds builds a positive outlook for renminbi

The hinted US securities liquidation/purchase pause by Chinese banks also contributed to this

All expected 🤷♀️

🚨 Chinese 1 year bond prices are up ≈6%

Two extremes:

🇺🇸Massive selling pressure on US Treasury securities

🇨🇳Massibe buying pressure on MoF Chinese securities

USD-denominated debt is being swapped for Yuan-denominated debt

Tariffs mainly hurt the US (unsurprisingly)

Regarding the bond market collapse ⬇️

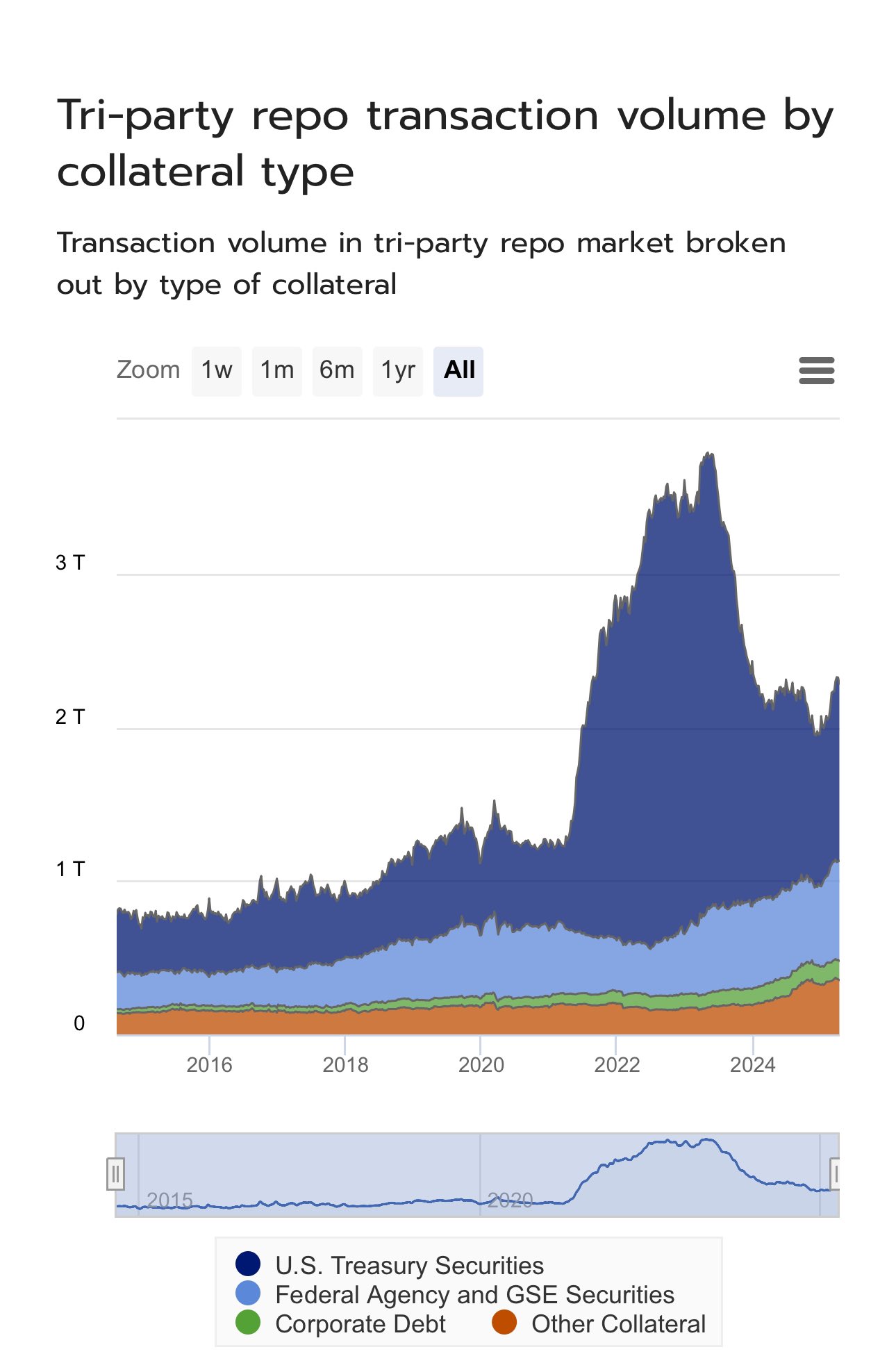

US Treasury Securities are the main collateral used in repurchase agreements. Given that these are short-term, the yield spike is unlikely to lead to defaults

However, the fall in bond prices will reduce credit, adding to liquidity crunch

Lower USD Index = USD Devaluation = Higher premium for USD loans = Lower bond prices = Higher bond yields

It's all connected

🇺🇸 US Treasury bond yields are acting as a risky asset

Over 2% daily moves is something you see in crypto 👀

And I don't believe the FED will be raising rates - so it's a market-driven US debt premium increase

Lower rates incoming, but sovereign premium will still increase

Of course, this also gives China leverage - if The People Bank's of China (China's Central Bank) dumps their US Securities in the market, it will skyrocket bond yields, by reducing their prices

Who will lend to the US then, and at what premium? And at 125% debt to GDP 😬

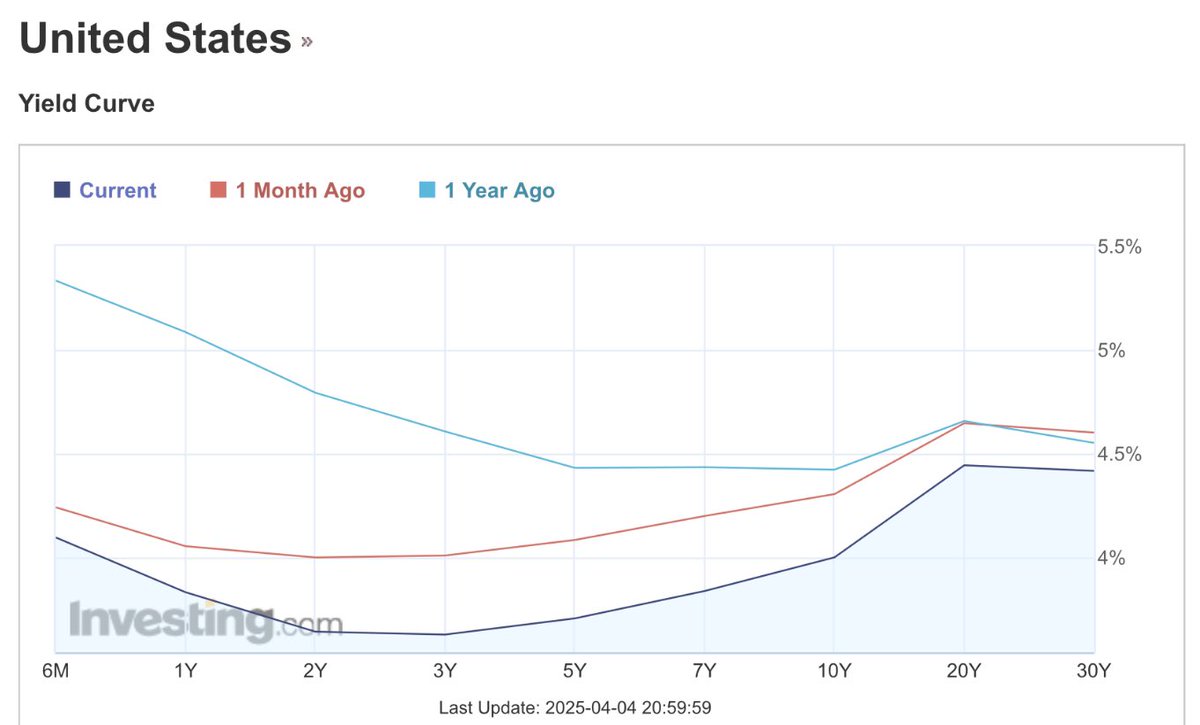

🚨 US Yield Curve UPDATE

Despite the falling $DXY, the yield curve is better (less inverted) than a 1y ago, but worse than 1 month ago

Expect a steeper inversion soon

Switzerland 2 year bond yield went negative

Swiss Frank appreciates against major currencies like #EUR & #USD, so investors accept lower (sometimes even negative!) yields

Massive demand for #CHF

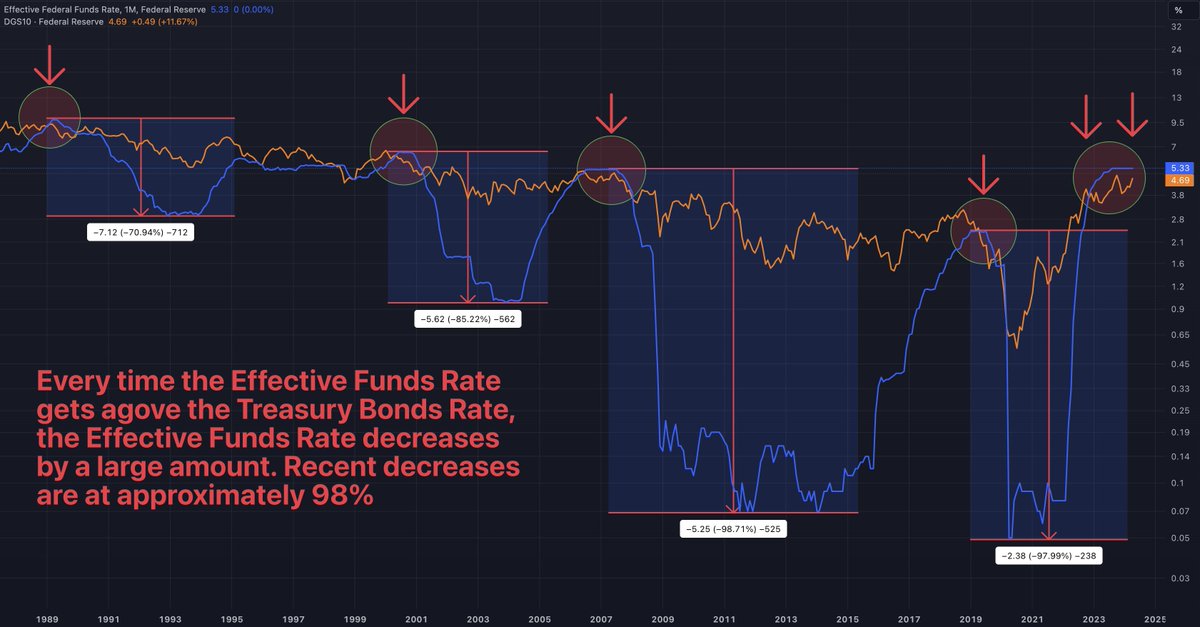

🔴 Every time the Treasury Bond rate (#DGS10 / #US10Y) raises above the Fed Funds Rate (#FEDFUNDS / #EFFR), the Fed Funds Rate decreases dramatically

Historically, this has always been the case

and this is exactly what's happening now

Expect a rate cut from the #FED very soon

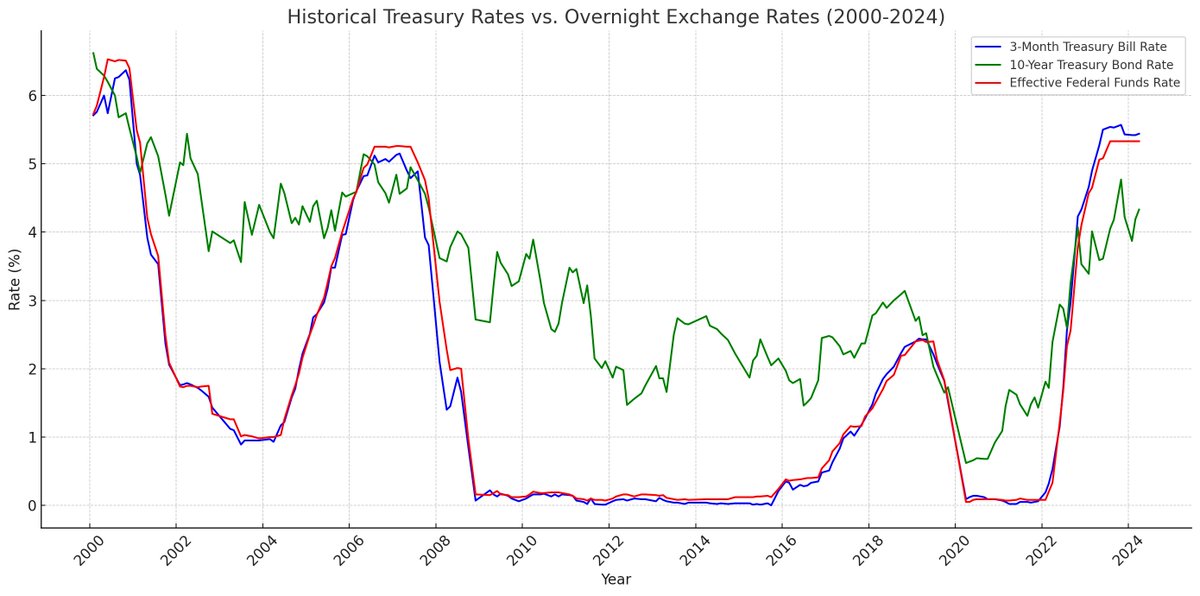

Treasury rates (Treasury Bills & Bonds) are risk-free, but they do not represent the risk-free rate, as they have artificial incentives. The risk-free rate must represent the true cost of borrowing money. Overnight exchange rates are a much better measure of the risk-free rate. http