US Treasury yields & curve analysis

Ongoing commentary on the yield curve, auction results, duration risk and what Treasuries signal about macro conditions.

since a 30 year bond discounts 30 years of cashflows and those cashflows directly incorporate this compounding yield - its price moves more with yields than a comparable, shorter time to maturity bond

regarding 1 year vs 30 year bond - imagine yields rise by 2%:

➖ the price of the bond maturing in 1 year declines by discounting those 2% from 1 year of cashflows

➖ a 30 year bond discounts for 30 years of cashflows

regarding 1 year vs 30 year bond - imagine yields rise by 2%:

➖ the price of the bond maturing in 1 year declines by discounting those 2% from 1 year of cashflows

➖ a 30 year bond discounts for 30 years of cashflows

the longer the bond's time to maturity - the more compounding of unfavorable yields the bond's price must incorporate

the more technical term is discounting, but compounding of unfavorable yields may help in bulging the mental model for what happens

a bank may buy a US Treasury bond (UST) and hold it as an asset. at some point, that bond matures, thus terminating its existence

most of financial institution's assets have an expiration date

these assets are mostly composed of loans, debt securities and money market instruments

still, all come with an expiration date

i also wrote a thread explaining the importance of USD-denominated government debt for short-term funding/credit markets

remember that most of credit is issued to refinance existing debt and not for new financing

you can read it here:

https://illya.sh/threads/@1751726431-1

i wrote about how reverse repurchase agreements work and their importance in the global financial system in this thread:

https://illya.sh/threads/@1751561045-2

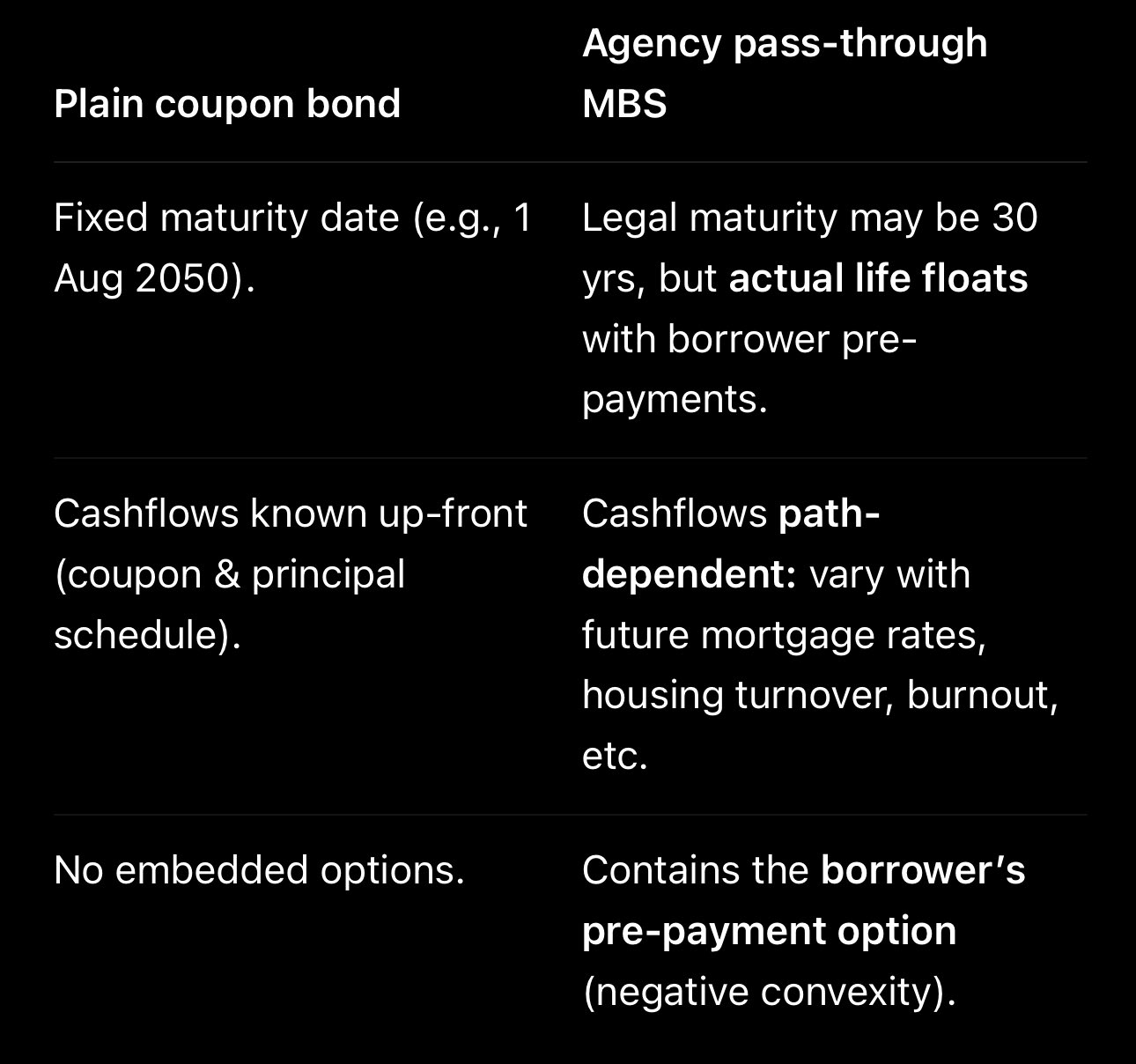

legally mortgage backed securities are bonds since they are tradable debt securities

but they're not a plain bond, due to the option of borrower's early repayment

Macaulay or modified duration used for Treasuries doesn't work - you need effective/option-adjusted duration

the duration formula for MBS assumes for some pre-payments

if those happen at a smaller rate - the duration increases

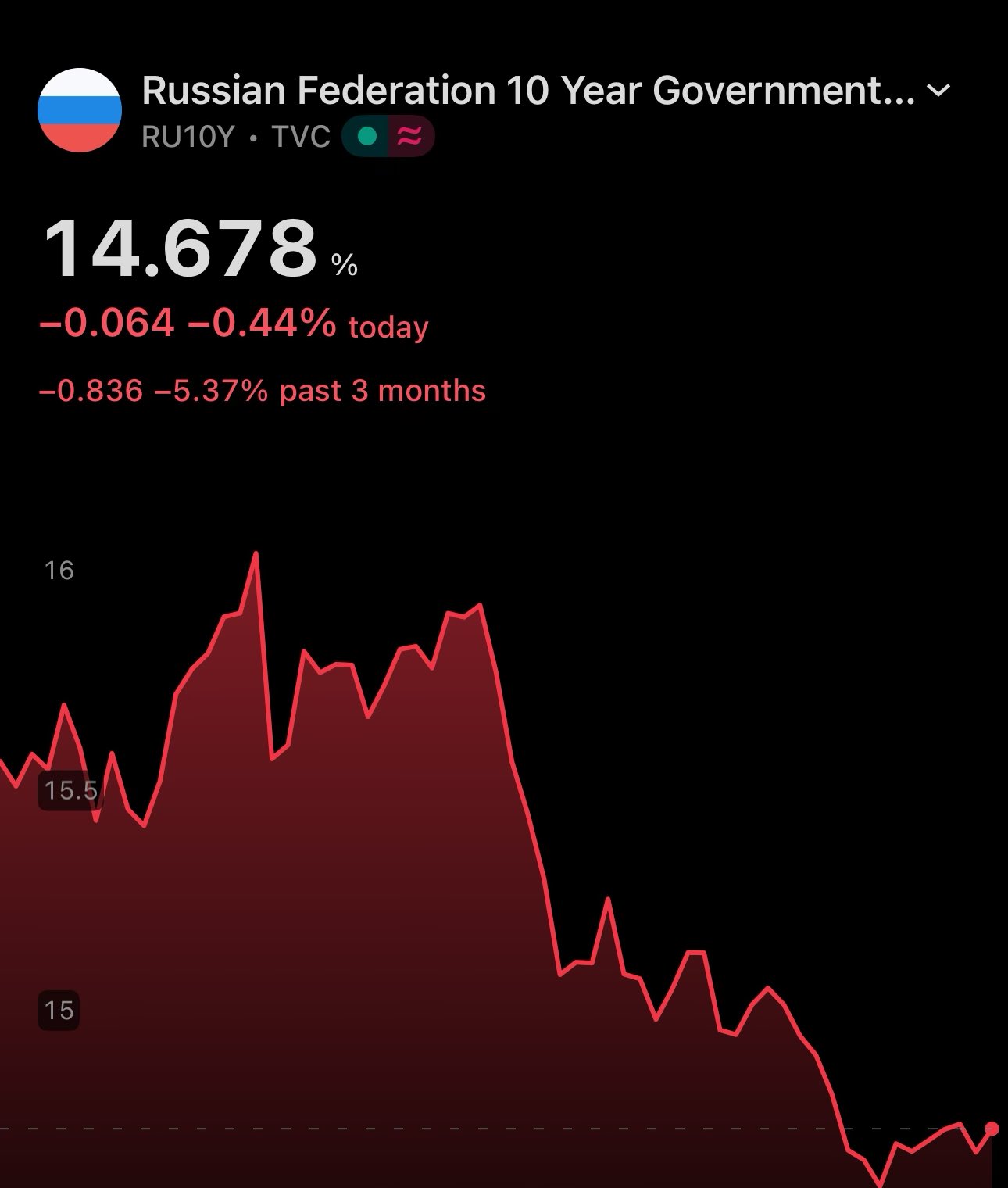

🇷🇺 Russian 3Y bond yield is down ≈20% over the last 3 months 😳

of course - this isn't a surprise to you if you've been following my posts. i wrote extensively about this

the biggest reason behind the sharp drop today is the recent 200bp key interest rate cut down to 18%

not all bonds are the same 🇺🇸🇯🇵🇪🇺🇷🇺

while US, EU & Japan yields are soaring 📈

Russian bond yields are falling 📉

🇷🇺 10Y bond yield down 8% since March

just like i wrote more than 3 months ago

check my posts for a detailed expiation & what's coming next

👇

shorter-term US bonds yields react IMMEDIATELY to repo funding rate

notice the huge green candle on June 30th - the same day of FED's SRF $11B volume

June 30th is when the FED SRF volume recorded ≈$11B

this is a 1 month treasury bill ⬇️

persistently high(er) funding repo rates will push the treasury yields up

eventually, the bonds would be sold for cash

again - think of the timescale: funding rates refer to much shorter periods

persistently high(er) funding repo rates will push the treasury yields up

eventually, the bonds would be sold for cash

again - think of the timescale: funding rates refer to much shorter periods

repo funding rates don't affect US treasury yields immediately due to time scale

treasury bond yield expectation is over 10 years, and repo rates are a short-term debt funding mechanism

so the rates shock would need to be prolonged/pronounced to affect treasury rates

repo funding rates don't affect US treasury yields immediately due to time scale

treasury bond yield expectation is over 10 years, and repo rates are a short-term debt funding mechanism

so the rates shock would need to be prolonged/pronounced to affect treasury rates

funding rates on repo markets & bond yields are not the same

different timescales:

1️⃣ repo - short-term / ≈day(s),week(s)

2️⃣ treasury bonds - ≈10 years

so even if a funding rate raises for a few days, the longer-term bond yields may not be affected

funding rates on repo markets & bond yields are not the same

different timescales:

1️⃣ repo - short-term / ≈day(s),week(s)

2️⃣ treasury bonds - ≈10 years

so even if a funding rate raises for a few days, the longer-term bond yields may not be affected

note that FED's SFR doesn't lower the treasury yields per se

it's more correct to say that it puts downward pressure on them, in the form of a $500B buffer

& note that treasuries probably wouldn't be the first in line for liquidation

note that FED's SFR doesn't lower the treasury yields per se

it's more correct to say that it puts downward pressure on them, in the form of a $500B buffer

& note that treasuries probably wouldn't be the first in line for liquidation

how does SRF lower UST bond yields?

if you have a US bond and you need cash, your options are:

1️⃣ borrow cash against bond in repo markets

2️⃣ sell the bond

this $500B liquidity pool for US bonds prevents their sell-off in the open market, which would raise their yields

how does SRF lower UST bond yields?

if you have a US bond and you need cash, your options are:

1️⃣ borrow cash against bond in repo markets

2️⃣ sell the bond

this $500B liquidity pool for US bonds prevents their sell-off in the open market, which would raise their yields

with SRF the FED sets an upper limit on repo market rates

most of the collateral is US Treasury bonds

this exerts downward pressure on bond yields - by preventing sell-offs

with SRF the FED sets an upper limit on repo market rates

most of the collateral is US Treasury bonds

this exerts downward pressure on bond yields - by preventing sell-offs

once FED lowers interest rates, it's likely to put downward pressure on yields - assuming term premia doesn't increase by more

in the end, the yields will be higher than in the last 20 years, for the same FED funds rate

QE/liquidity injections will further devalue USD

liquidity abundance leads to the narrowing of spread between riskier and safe assets (mostly government bonds)

safe assets fall in price, with their yields increasing towards the riskier ones

US bond yields are high under tighter monetary conditions - liquidity is pro cyclical

the higher use of lower quality collateral has pro-cyclical effects

if the price of collateral falls during economic downturn - you'll get a lot of margin calls & insolvencies. this will further put pressure on short-term funding mechanisms, which already lack HQ collateral

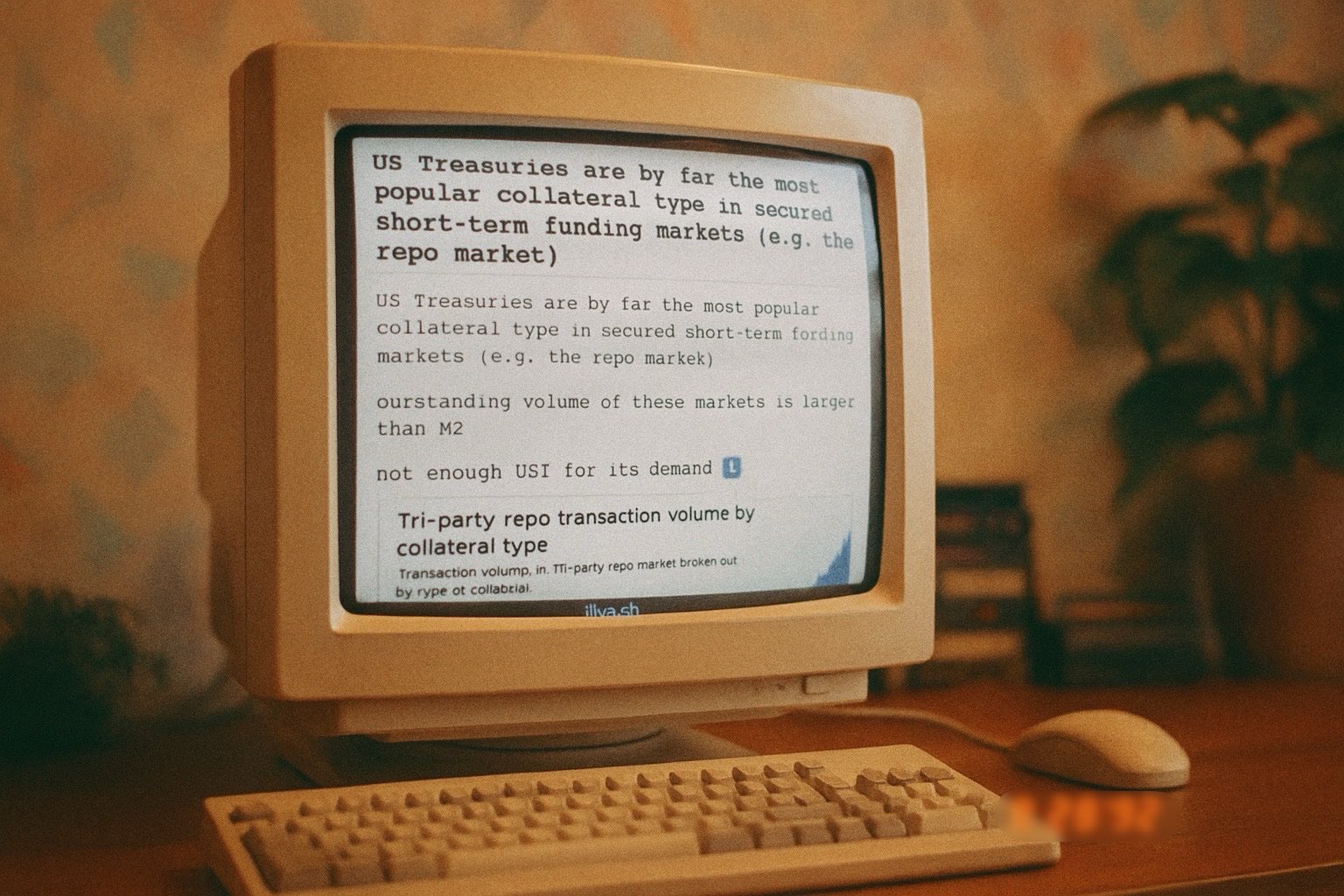

US Treasuries are by far the most popular collateral type in secured short-term funding markets (e.g. the repo market)

outstanding volume of these markets is larger than M2

notice the increase in usage of less safe assets as a collateral

not enough UST for its demand ⬇️

in the end, you get your UST bond back

and it makes sense for you to repurchase the bond (collateral) even if the price falls

as long as the price fall is < ≈haircut (2% in our case)

so if you have a UST bond worth $100:

lender applies a haircut (e.g. 2%) - 100*(1-0.02)=$98

lender sets a repurchase price (e.g. $98.013)

so you use your $100 bond to get a $98 loan, for which you must repay with a fee (interest) $98.013

everybody has been so focused on oil price, that they largely ignored the decrease in US bond yields across the curve

this trend has been consistent throughout the month

interpretation 🧠:

short-term sign of run to safety, specially when combined with gold price

Interestingly, the yields on US bonds are up across the yield curve - for both, short & long-term maturities

The market - understandably - associated gold, rather than government debt with safety

🇺🇸 Cancelled tariffs means refunds, which means a larger budget deficit

Rising bond yields means that deficit is (even) more expensive to refinance

The FED will soon need inject liquidity via QE + lower interest rates

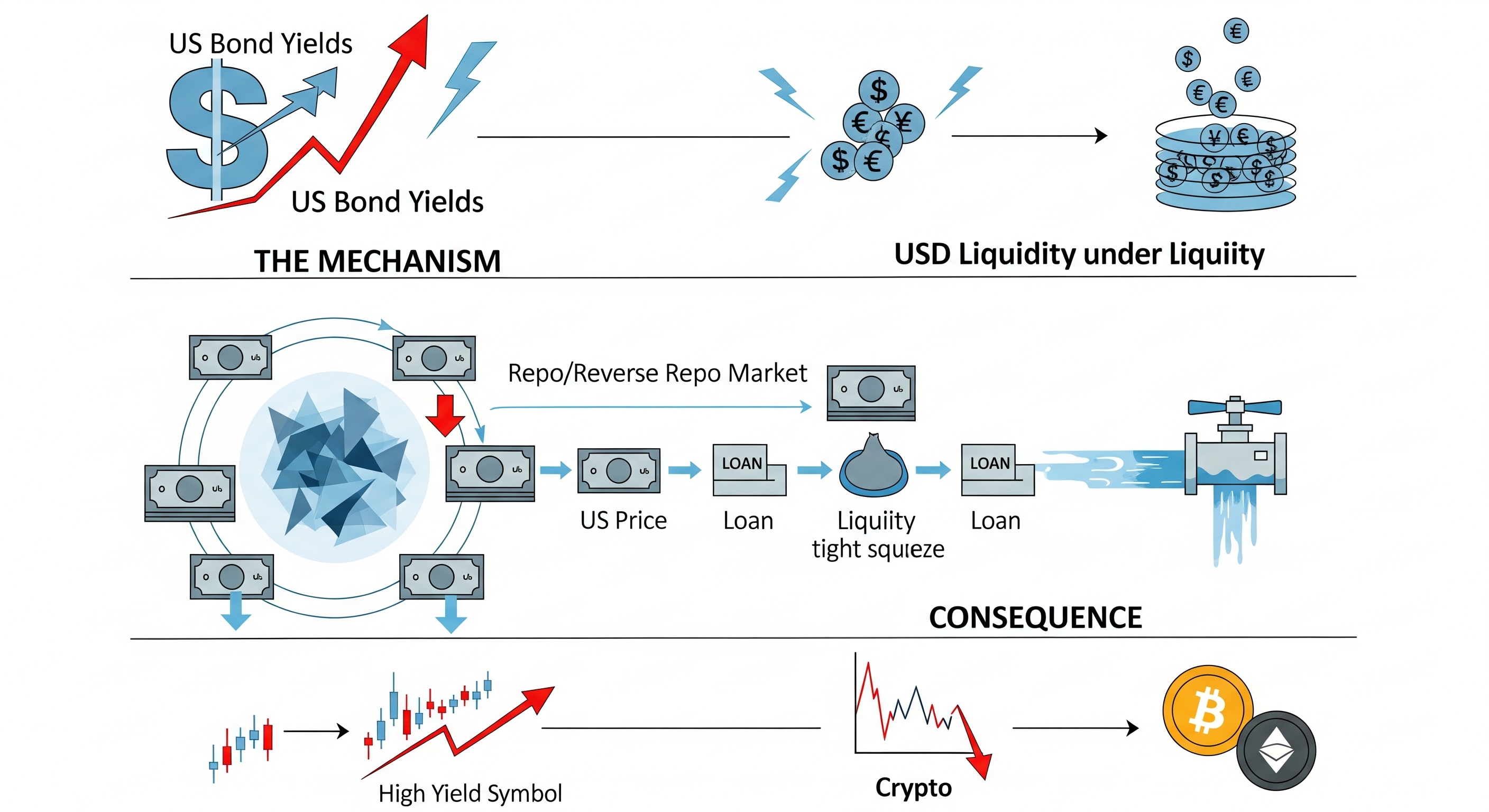

⚡️ US Bond yields directly affect USD liquidity

Here's how 👇

1️⃣ Repo + reverse repo market provides $5 trillion of liquidity

2️⃣ US bonds represent ≈70% of collateral

3️⃣ Lower bond prices means smaller loans, leading to a liquidity squeeze

🤯 The year is 2002…

US bond yields are at the same high levels as they were in 2002… That's 23 years ago

In 2002 US national debt was x6 SMALLER than now

5.1% now is not the same as 5.1% before - it's worse. Much more debt to refinance & pay interest

Who's ready for a new gold ATH? 🙋

You don't have to guess - just look at the systemic raising bond yields across all maturities & multiple sovereigns