🚀 Exploring Tokenized Liquid Futures Contracts

Futures contracts serve crucial roles in finance: 1️⃣ Hedging against price volatility 2️⃣ Speculation on future asset prices 3️⃣ Price discovery for underlying assets Smart contracts on the blockchain will disrupt this $1T+ market. Here's how ⬇️

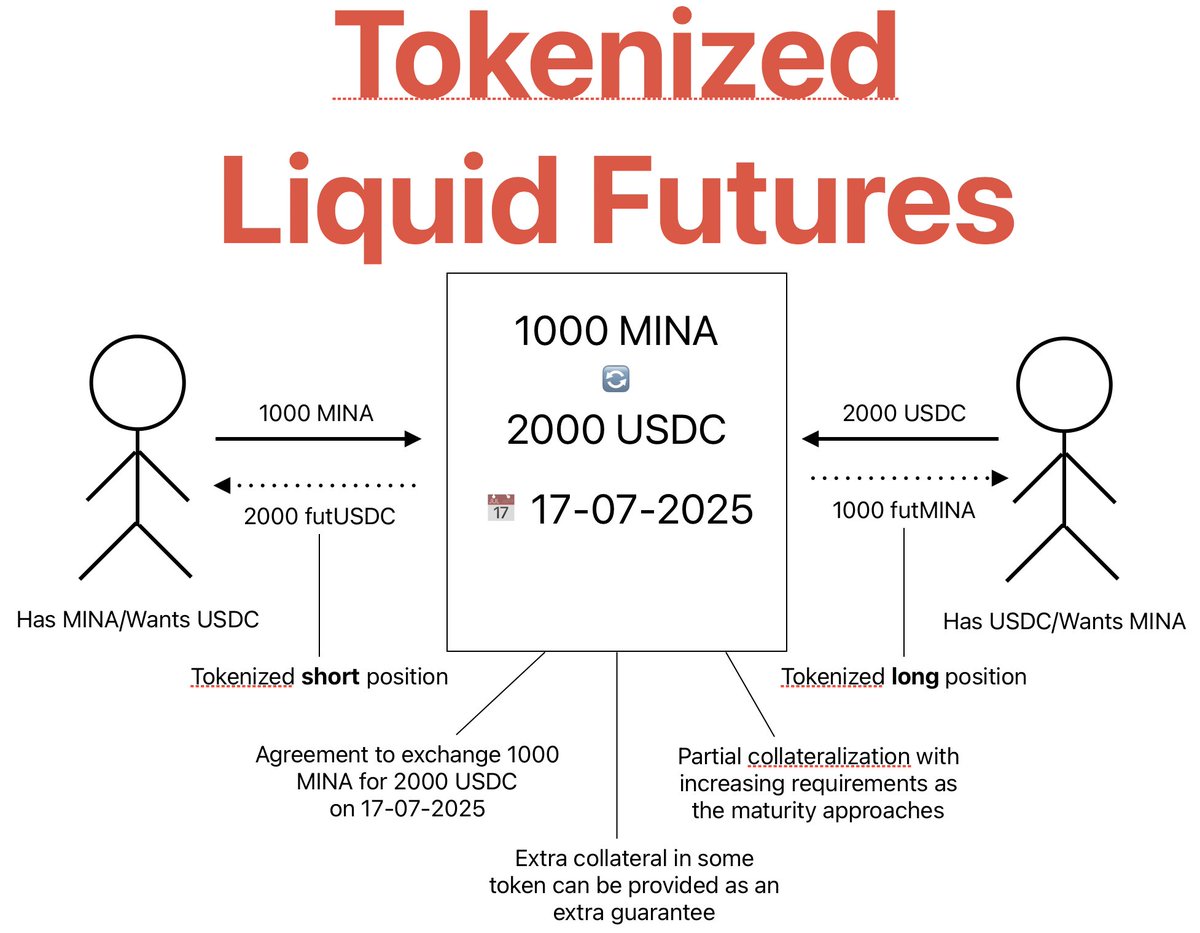

🏦 Traditional futures require centralized clearing houses On the blockchain, smart contracts eliminate intermediaries, enabling decentralized peer-to-peer agreements Example: A contract to trade 1000 $MINA for 2000 $USDC in 1 year, regardless of future $MINA price 📊

Futures pricing is deterministic, and its main goal is to prevent arbitrage: 💰 Futures Price = Spot Price * e^(rT) - r: risk-free rate (e.g., $MINA staking yield) - T: time to maturity This formula approximates pricing at maturity in both TradFi and DeFi 🧮

🔐 Smart contracts on the blockchain enable full tokenization of futures contracts 📈 Both long and short positions become tokens, representing a "promise of future asset or money" This allows partial selling of positions, increasing liquidity, flexibility and reducing risk 💧

Each position (long and short) is subdivided into several fungible tokens, which can be traded independently The native token support of Mina Protocol blockchain means that a smart contract encodes both: the futures agreement, and its tokenization 🪙

The DeFi margin for futures contracts differs from TradFi margins, by: 1️⃣ Gradually increasing over time 2️⃣ Ensuring full collateralization by maturity 3️⃣ Delaying full payment TradFi margin's main goal is to cover daily settlement gains/losses of the futures position

📈 The margin requirements increase algorithmically over the contract's lifespan This ensurer both parties deposit their obligation in full by maturity, while allowing for partial collaterization Thus leveraging the time value of money, without the need for a trusted party

Example of gradually increasing margin: - Day 1: 10% deposit required - Month 1: 25% required - Month 2: 50% required - Month 3 (Maturity): 100% required This flexibility allows parties to structure payments based on future cash flows 💰

The margin in DeFi futures acts as: 1️⃣ Traditional margin, as in TradFi 2️⃣ Collateral hedging the counterparty risk 3️⃣ Under-collateralized assurance for a futures contract delivery Daily/periodic settlement can be incorporated into the dynamic margin requirements

Smart contract on the blockchain tracks: 1️⃣ Deposited amounts for each party 2️⃣ Required deposits at each checkpoint 3️⃣ Maturity date It uses this data to automatically enforce the increasing margin schedule 🔐

If a party fails to meet margin requirements, the smart contract: 1️⃣ Terminates the agreement 2️⃣ Transfers deposited assets to the compliant party 3️⃣ Applies penalties to the defaulting party This liquidation process is executed automatically on-chain 🤖

🛟 The liquidation logic makes the initial required margin a collateral for all of the parties Failure to meet the obligations means a loss of the deposited margin/collateral, either in full or in part

🕑 The later this default occurs, the higher this loss is to the offending party This aligns with the principle of the time value of money

The tokenization of the long and the short positions of the futures contact allows for trading of the positions in a fully decentralized manner, without the need for need for a clearing house This means no trusted entity or oracles are required, ensuring full decentralization

The smart contract automates risk management on-chain by: 1️⃣ Enforcing margin requirements 2️⃣ Handling liquidations 3️⃣ Ensuring contract settlement Removing the need for trusted third parties and ensuring transparency 🛡️

In summary, blockchain-based Tokenized Liquid Futures: - Eliminate intermediaries - Increase transparency - Enhance liquidity - Automate risk management - Provide flexible capital deployment Thus enabling a disruptive #DeFi use-case over its #TradFi equivalent