Illya Gerasymchuk

Entrepreneur / Engineer

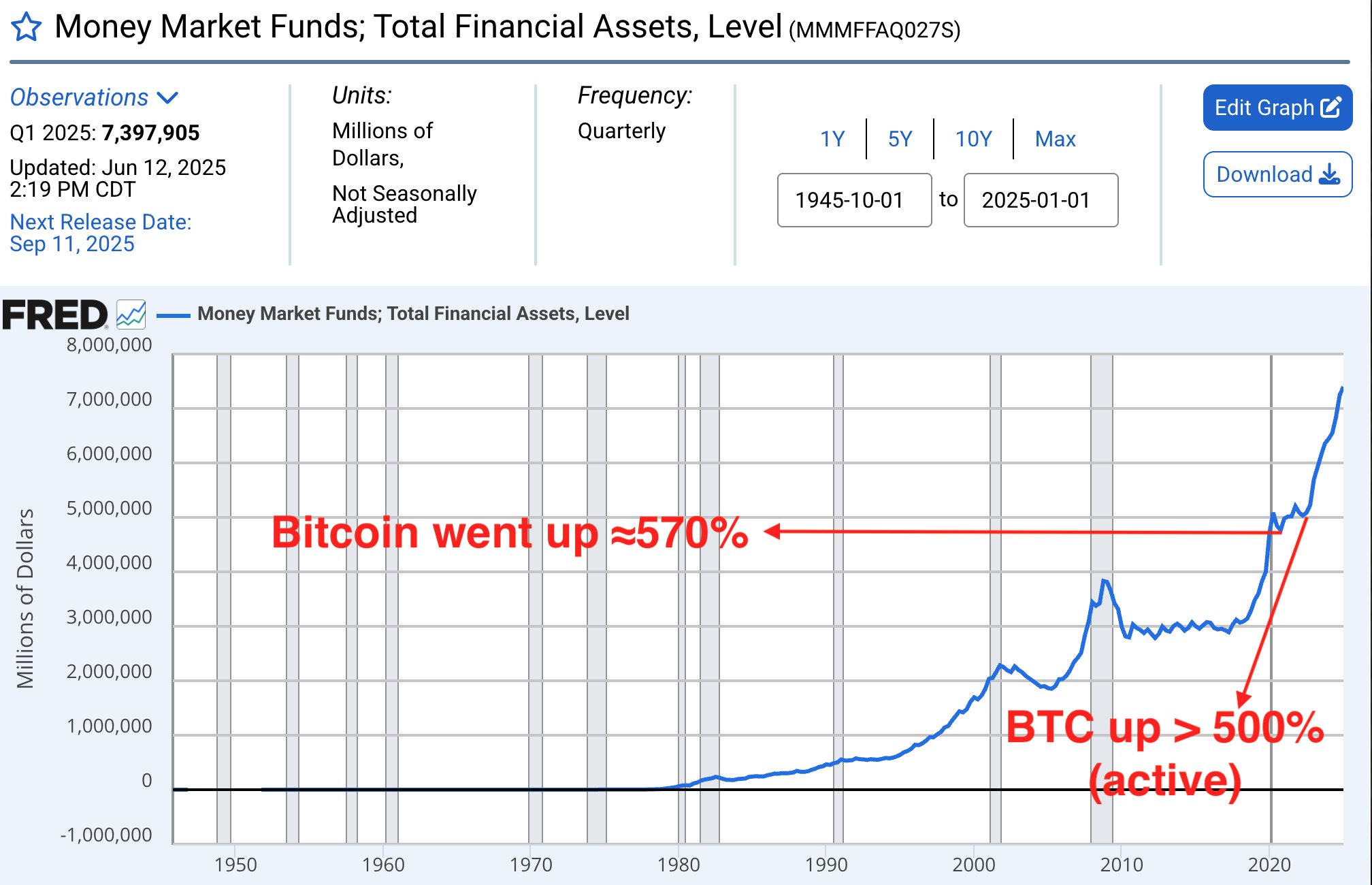

record $7 trillion USD in money market funds (mmf)

money market funds yield close to the risk free rate (think of FED funds rate in the US, or ECB deposit rate in the EU), while offering less risk due to shorter maturity essentially, you provide a collateral (highly liquid - usually sovereign debt) and get a loan against it