duration matching protects solvency and liquidity when yields shift

when liabilities become due you must ensure that assets can cover them this means ensuring that cashflow and asset monetization provides enough liquidity to settle the debt, plus a desired spread

most of financial institution's assets have an expiration date these assets are mostly composed of loans, debt securities and money market instruments still, all come with an expiration date

a bank may buy a US Treasury bond (UST) and hold it as an asset. at some point, that bond matures, thus terminating its existence

this newly acquired UST bond was financed with some liability of the bank let's say the bank itself issued bonds with a smaller coupon than UST’s thus, the bank used a liability to finance and asset and earns a spread

let's develop on this simple bank example assume a brand-new bank with an empty balance sheet, no revenue, no deposits, no cashflow and no regulations the bank is about to finance its first asset - a UST bond with a liability - bonds issued by the bank

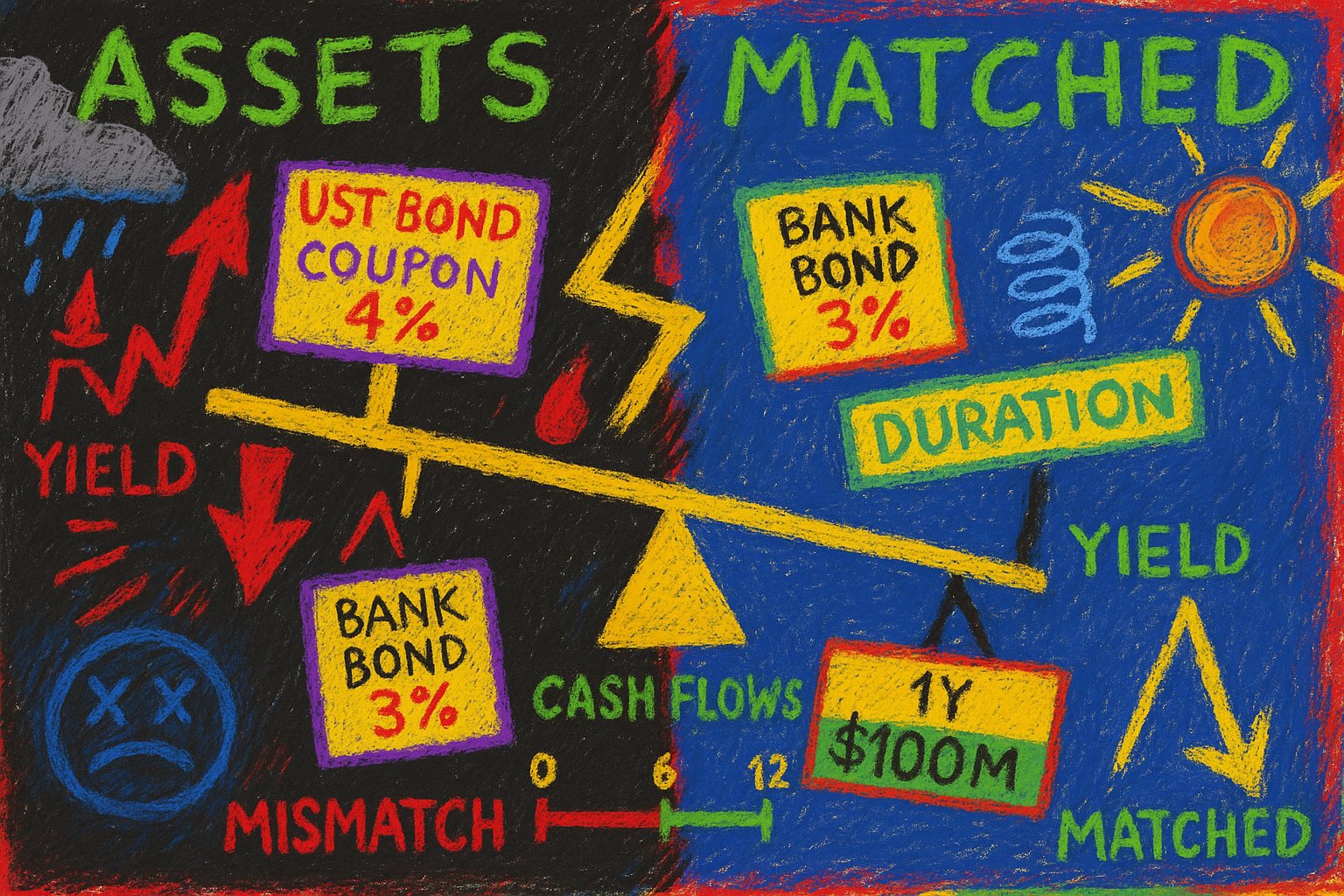

let's say the bank issued bonds (liability) at 3% and acquired UST bonds (asset) with a 4% yield both assets and liabilities have a transaction amount of $100 million the bank uses the loan (issued bond) to purchase higher yield UST bonds, thus profiting a ≈1% spread

assume that both start simultaneously and mature in 1 year without any periodic payments this means that today the bank borrows $100M at 3% APY and invests it at 4% in exactly 1 year the bank receives $104M from the UST bond, repays $103M to bondholders and keeps $1M profit

what would happen if the bank issued bonds with a semi-annual coupon instead? semi-anual coupon means that bondholders get 2 ≈1.5% interest payments in the year: at 6 months, and maturity remember: the UST bond only has one payment - at maturity in 1 year (think zero-coupon)

now the bank has an issue - the 1.5% liability payment is in 6 months, while 4% yield from the asset financed by that liability only gets paid in 1 year while the bank will have the money to pay in the future - it doesn't have it now

the bank's only option now is to sell the UST bond they hold at the market price, and use the proceeds to settle the 1.5% semiannual coupon liability

that's a problem because the market price of the bond may have fallen significantly and the rest of the bond payment - 1.5% coupon + principal needs to be re-financed at potentially unfavorable rates

modified duration quantifies how much a bond’s price will change for a 1% change in bond yields while the bond pays fix sums - its market value/price varies, so its yield is not fixed

larger modified duration value means that the bond's price is more sensitive to changes in bond yields this makes sense. the longer the time to maturity - the longer the risk and term premia comes into play

the longer the bond's time to maturity - the more compounding of unfavorable yields the bond's price must incorporate the more technical term is discounting, but compounding of unfavorable yields may help in bulging the mental model for what happens

regarding 1 year vs 30 year bond - imagine yields rise by 2%: ➖ the price of the bond maturing in 1 year declines by discounting those 2% from 1 year of cashflows ➖ a 30 year bond discounts for 30 years of cashflows

since a 30 year bond discounts 30 years of cashflows and those cashflows directly incorporate this compounding yield - its price moves more with yields than a comparable, shorter time to maturity bond

duration matching protects liquidity and solvency by modulating yield shift effects on the value of assets and liabilities

duration matching protects: ➖ liquidity via cashflow modulation, by helping liability cashflows match asset cashflows ➖ solvency via asset and liability value modulation, by reducing asset value loss when yields fall and reducing liability value loss when yields raise

this is why duration matching is key for financial institutions this is also the reason why it's generally not a good idea for governments to refinance long-term debt with short-term debt this shortens the duration of both - government liabilities and market's assets