Illya Gerasymchuk

Entrepreneur / Engineer

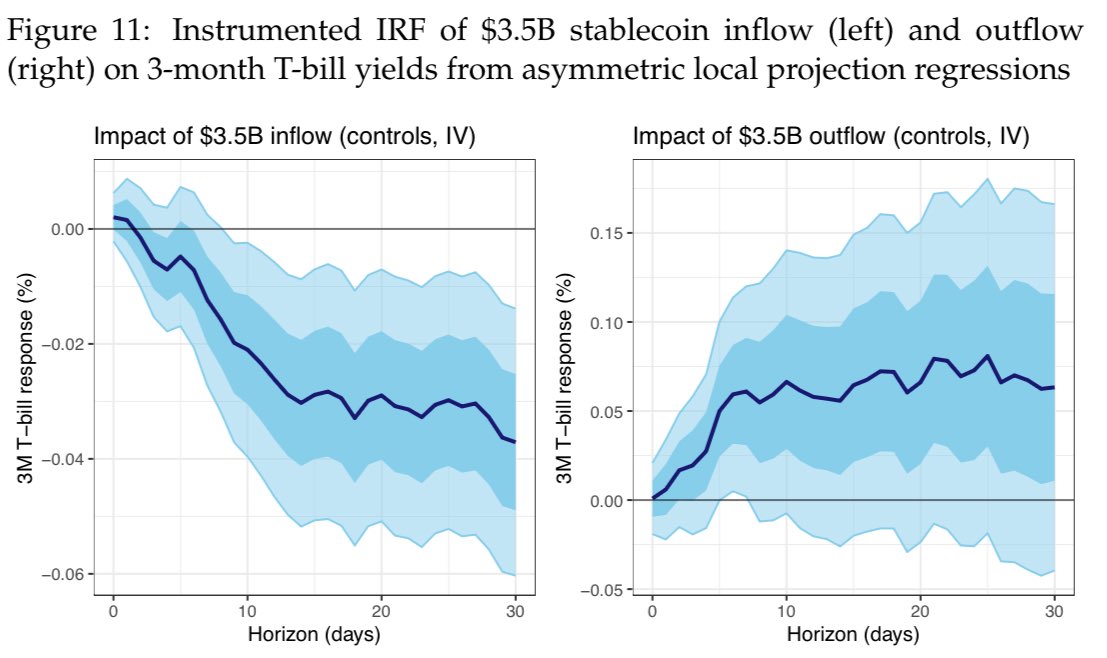

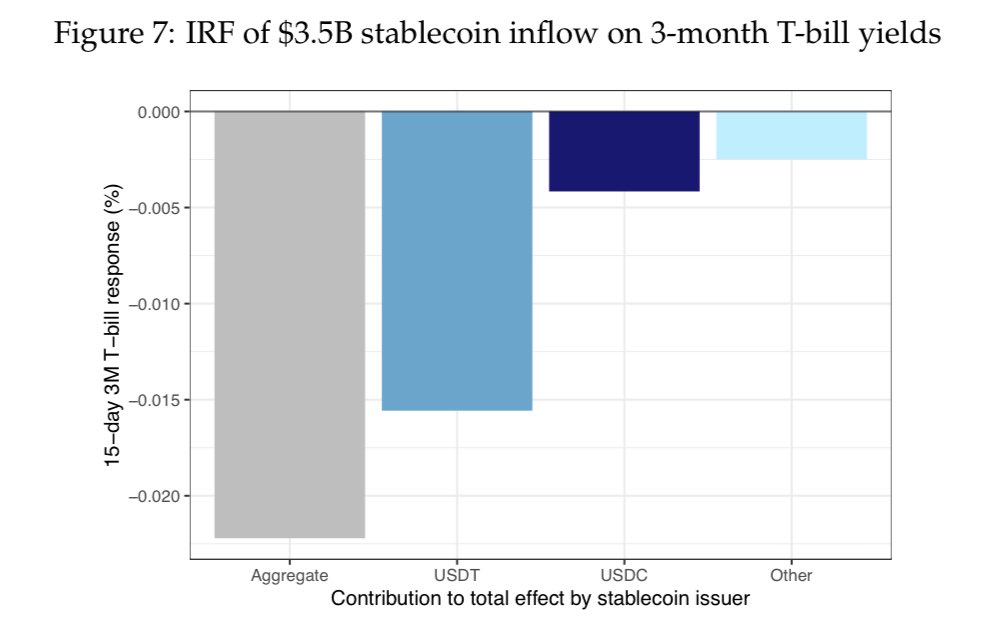

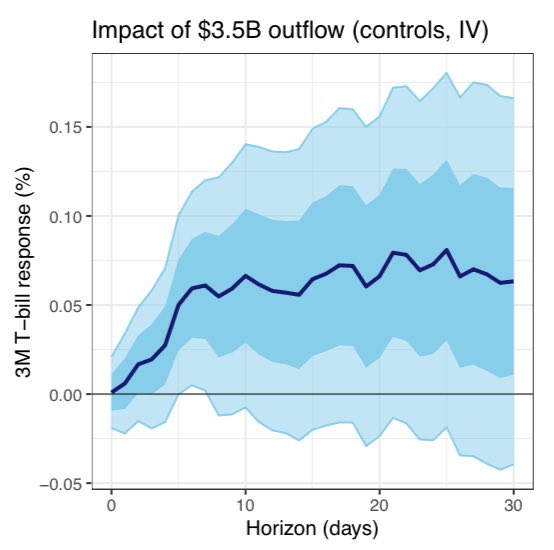

stablecoin inflows lower 3M Treasury bill yields, while outflows raise yields by a larger amount

essentially many T-bill sales flood the market at once, so their price falls, thus causing a yield increase selling T-bills is more urgent than buying - the stablecoin issuer cannot split it across auctions & dealers as easily, so the market yield change is larger on outflows