market makers and other dealers are also subject to regulatory balance sheet constraints

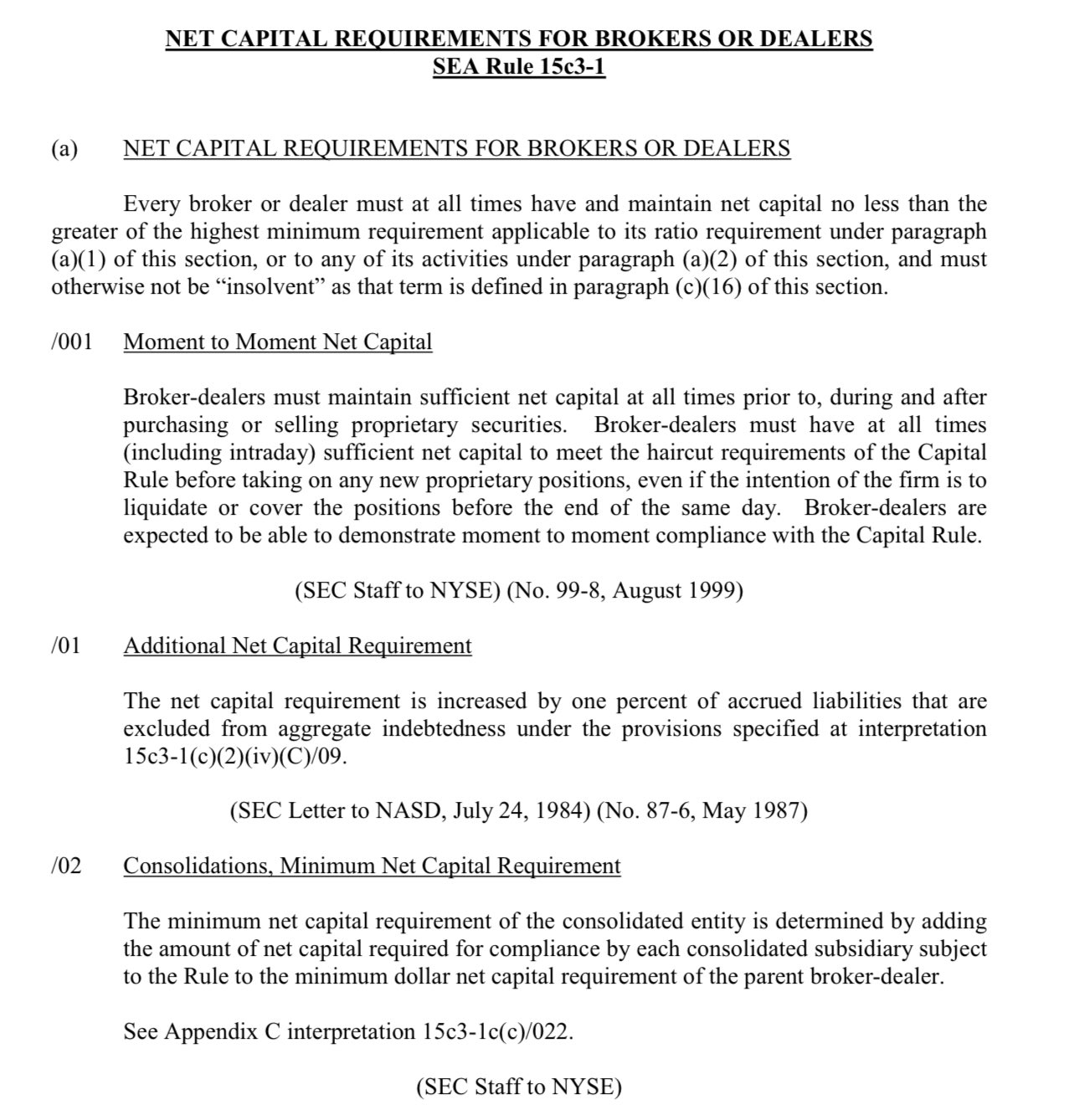

bank dealers are subject to Basel III, non-bank dealers to other similar regulations non-bank dealers don't have HQLA or leverage ratio (Basel), but they have net capital haircuts and other leverage/margin requirements so all dealers are subject to a similar set of regulations

since all dealers are subject to functionally similar regulatory constraints, they're also subject to functionally similar set of balance sheet constraints this is important to remember in the context of global liquidity, especially in terms of pro-cyclical effects

these regulatory constraints are synchronized to a significant degree across all jurisdictions this means that the financial regulations in EU & USA will have an analogous functional effect (although not the same!). so you can expect similar frameworks across several countries