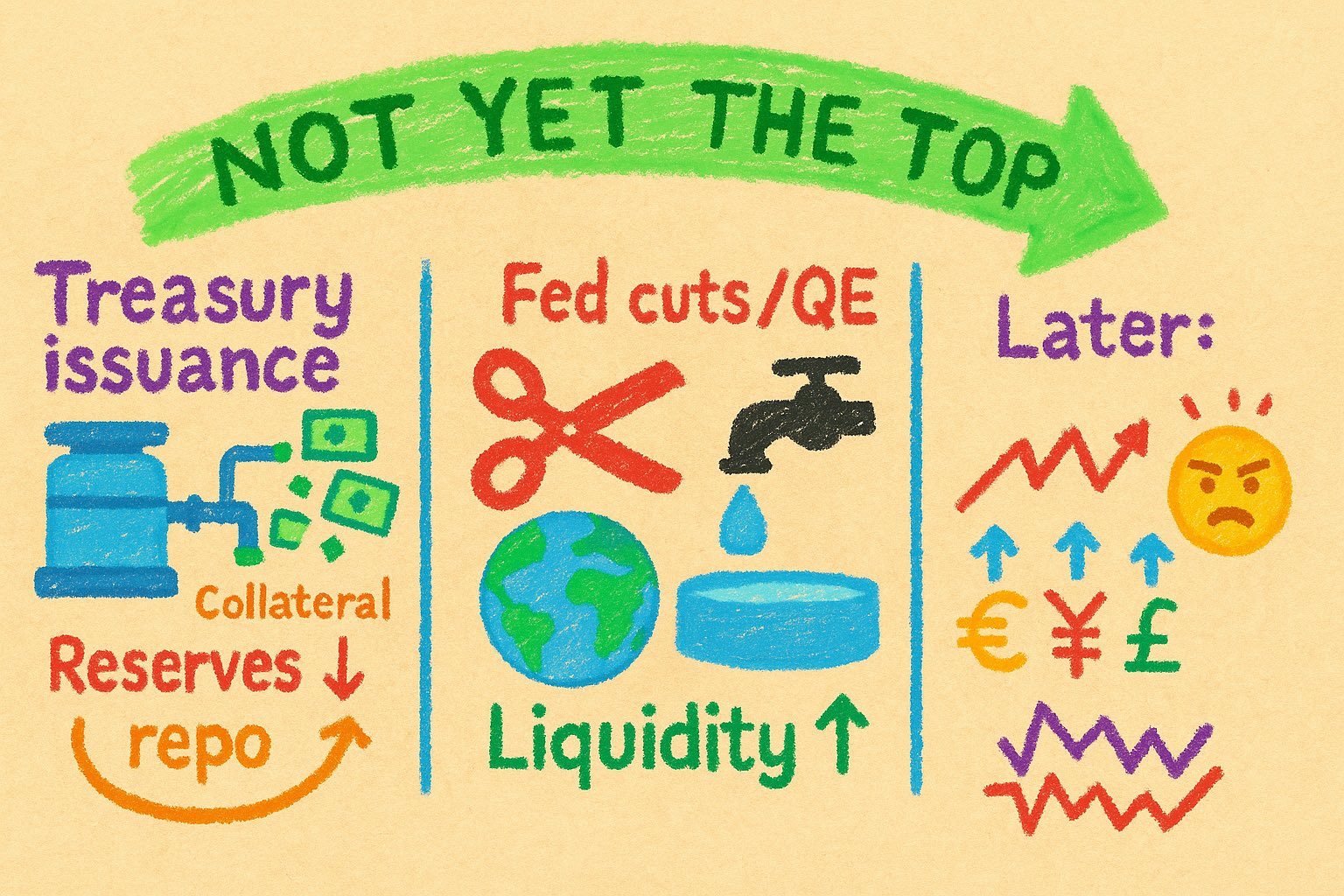

it's NOT yet the top of the cycle for equities, cryptocurrencies and other risk assets. here’s why

a lot of these US treasury purchases will be financed with short-term rolling debt (e.g. repo) the newly issued Treasuries themselves will be used as collateral to borrow cash, many times over via rehypothecation

once Fed cuts interest rates, more borrowing will occur, thus expanding broad money it will also lower T-bill yields short-term, as the prices are bid up due to a lower risk-free rate

once Fed does QE, reserve account balances increase, thus directly increasing base money broad money either increases indirectly or directly if the Fed credits a non-bank institution

i covered more this aspect of QE in my thread about how to use yield spreads to reason about future Bitcoin price and cycles you can read it here: https://illya.sh/threads/@1755595543-1.html

weaker USD, means appreciation of FX currencies and since many cross-border bank loans are collateralized with a local currency - solvency ratios improve, thus increasing balance sheet capacity for more USD credit this means an increase in broad money

i explained how weaker US dollar increases cross-border USD liquidity in this thread: https://illya.sh/threads/@1755216337-1.html

in conjunction, this creates an upward pressure in the global liquidity for the near future of course, this also builds up on leverage in the form of market-wide carry trades, and duration mismatching in the form of rolling over of debt by the Treasury

eventually, the carry will unwind and debt needs to be refinanced more QE-like measures will be taken, but eventually it won't be enough to prevent deleveraging/burst. this means defaults, margin calls, etc. the latter will likely be addressed by another form of QE

still, at some point QE's won't be able to prevent a prolonged negative impact on the market - the top of the cycle or close to it we're not there yet

the next burst in global liquidity/larger financial crisis will only happen after several more rounds of QE the next round of QE is close, but hasn’t even started yet and rates were not cut. however, the next big debt refinancing is underway

the specific QE policies will vary, but it will probably include an MBS-style QE like in QE1 2008. this will lower mortgage rates short-term I explained why in this thread: https://illya.sh/threads/@1754148538-1.html