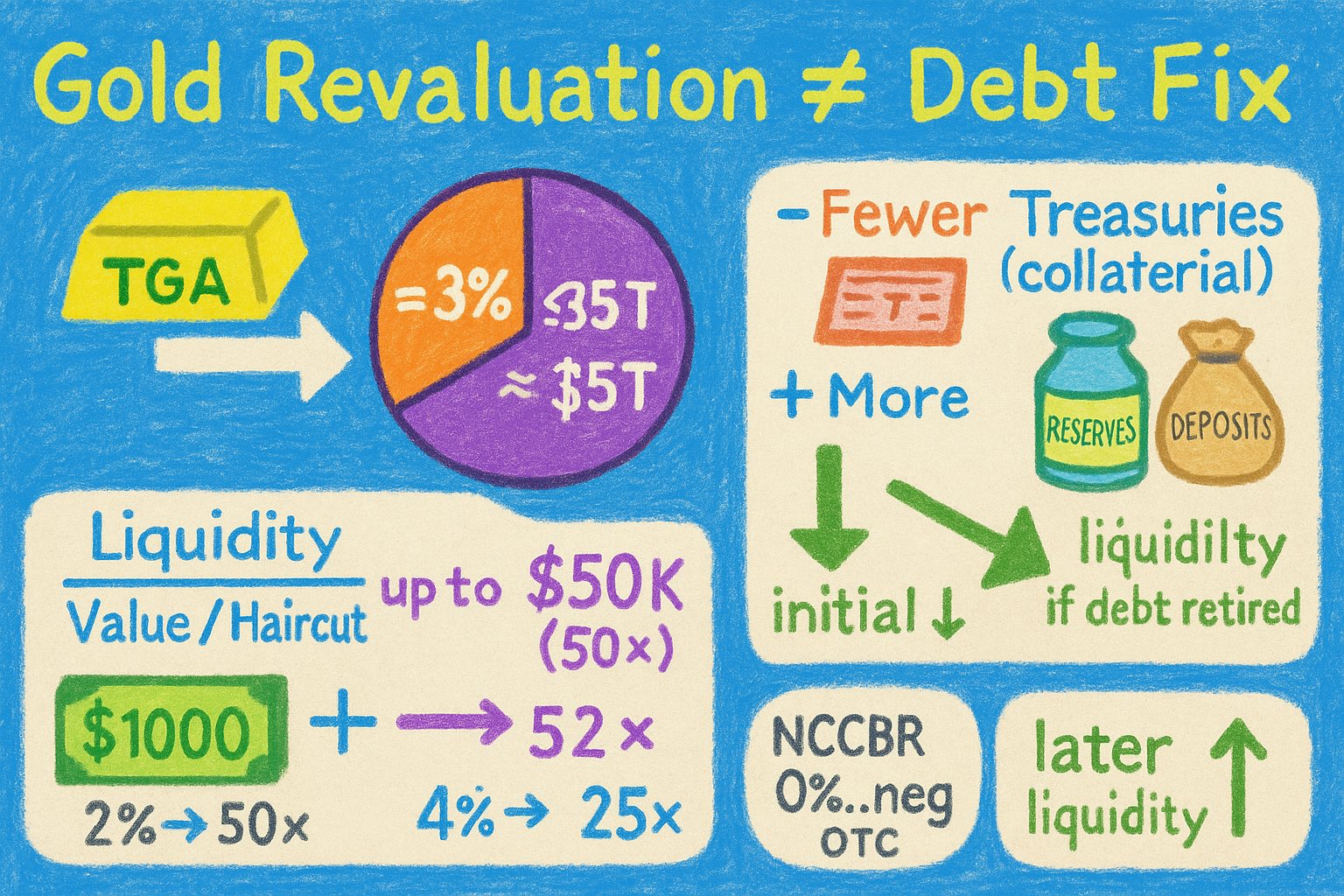

gold revaluation will NOT solve the US debt problem

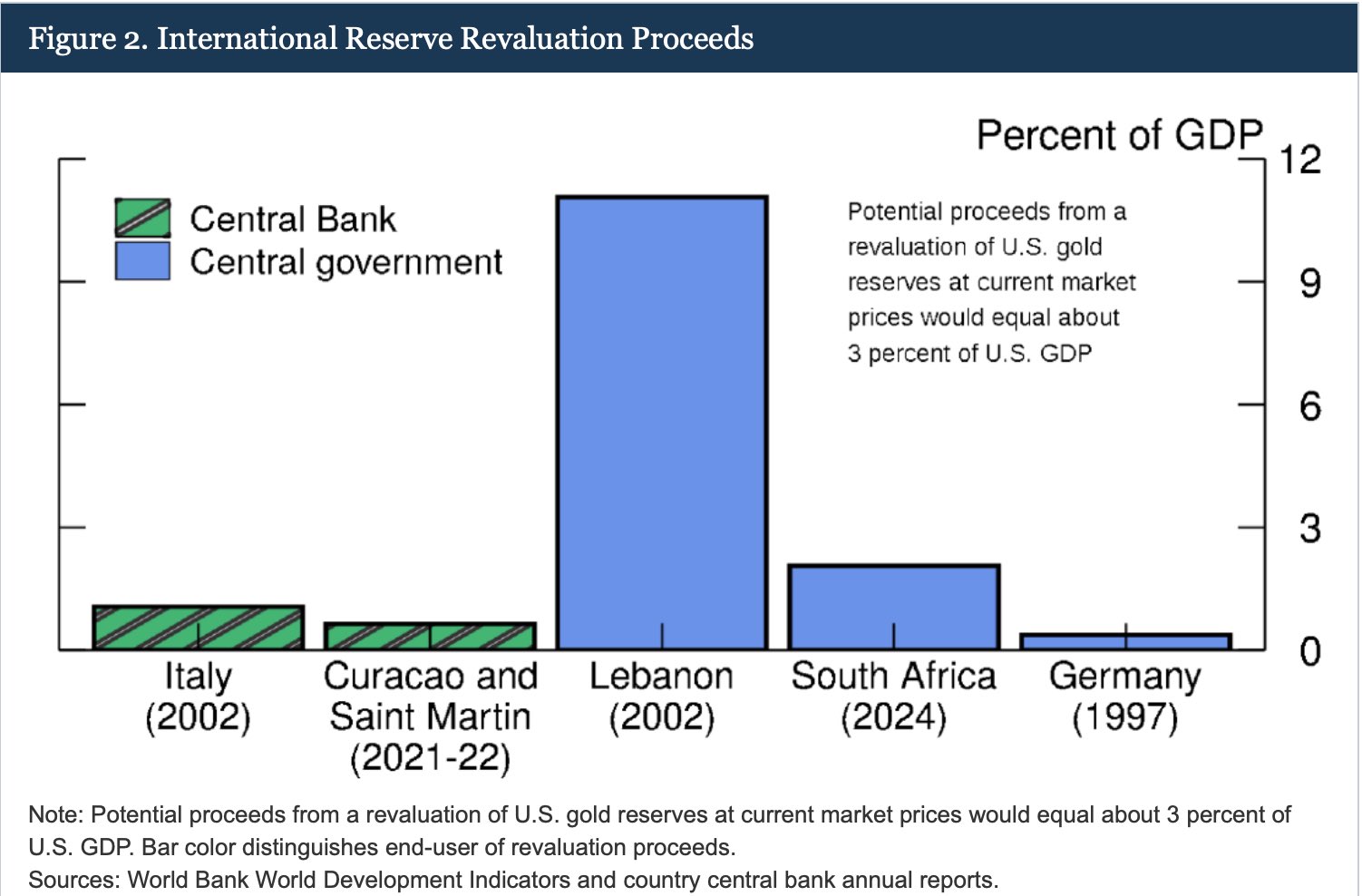

assuming all of the gold revaluation gains get credited to the Treasury's general account to retire government debt (e.g. by re-purchasing US Treasury bonds from the market) - that would cover a mere ≈3% of outstanding US government debt

persistent deficits & refinancing needs will add $1 trillion of new debt in less than a year so gold revaluation is insignificant for US federal government's debt problem

retiring debt with gold revaluation would change the composition of liquidity: ➖ less US government bonds (safe collateral) ➕ more base money (reserves) and/or broad money (deposits) so the end result is more base and/or broad money, but less prime/repo-eligible collateral

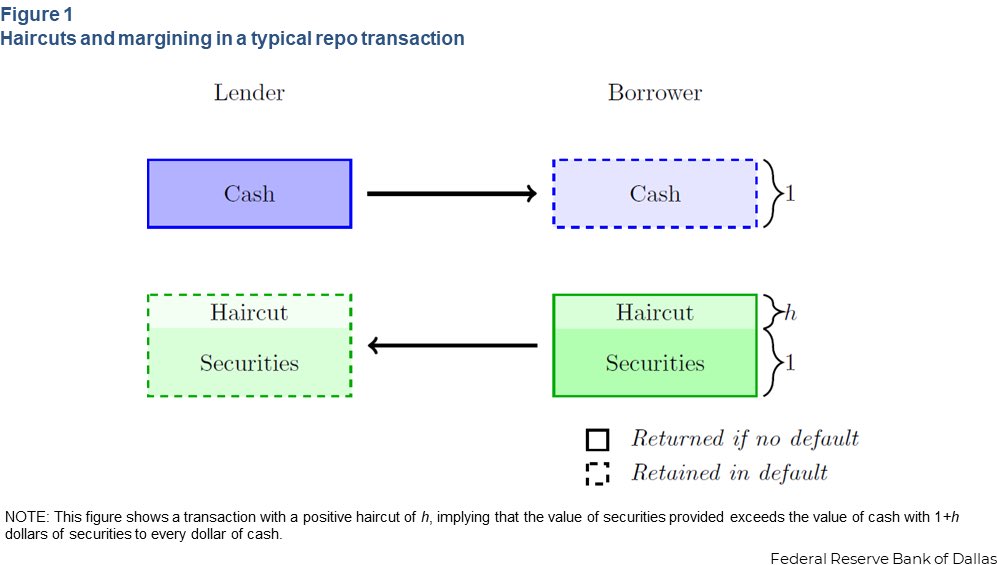

collateral gets reused/rehypothecated, reserves don't dealers re-pledge/re-use Treasuries, e.g. through repo and reverse repo. thus, the financing capacity of Treasury bills, notes and bonds exceeds their market value

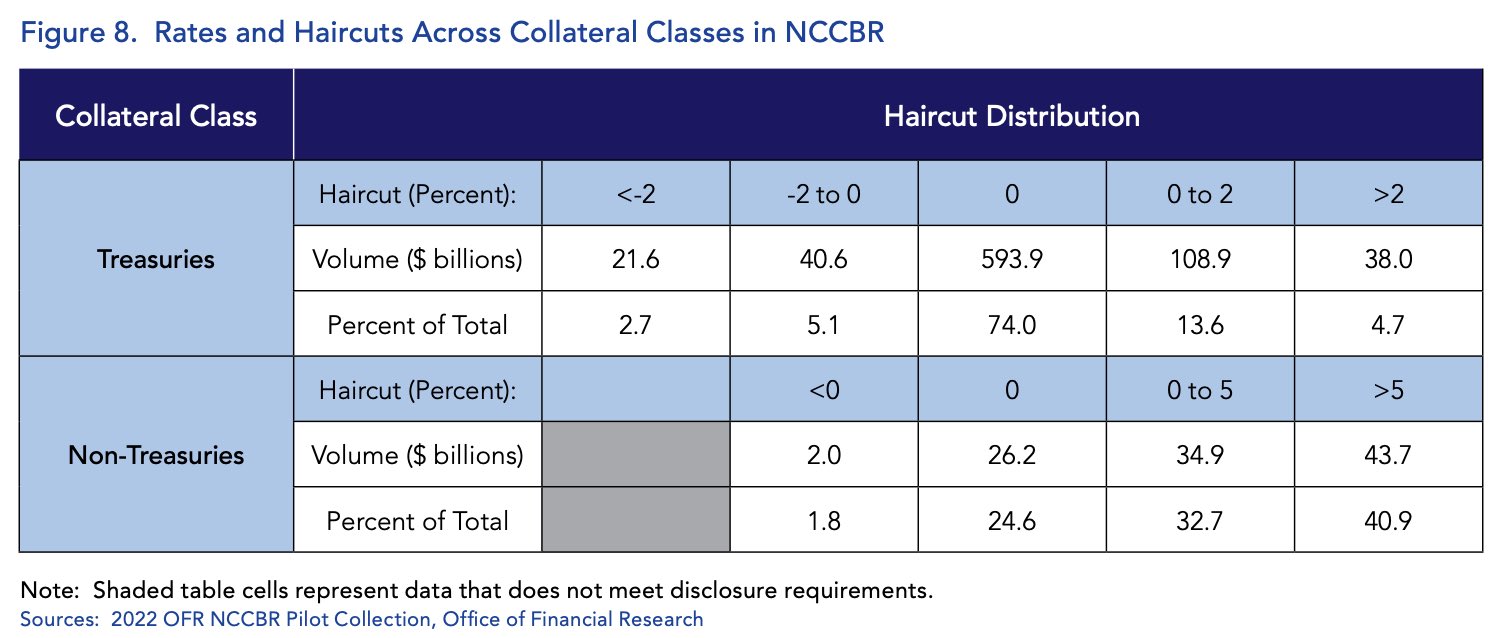

to estimate the maximum liquidity that can be added by a bond divide the market value by its haircut (e.g. effective repo haircut on that bond)

maximum liquidity added by bond = market value/haircut so a Treasury security worth $1000 with a haircut of 2%, can create up to $50000 in new credit/liquidity computed using the formula above: 1000/0.02=50000

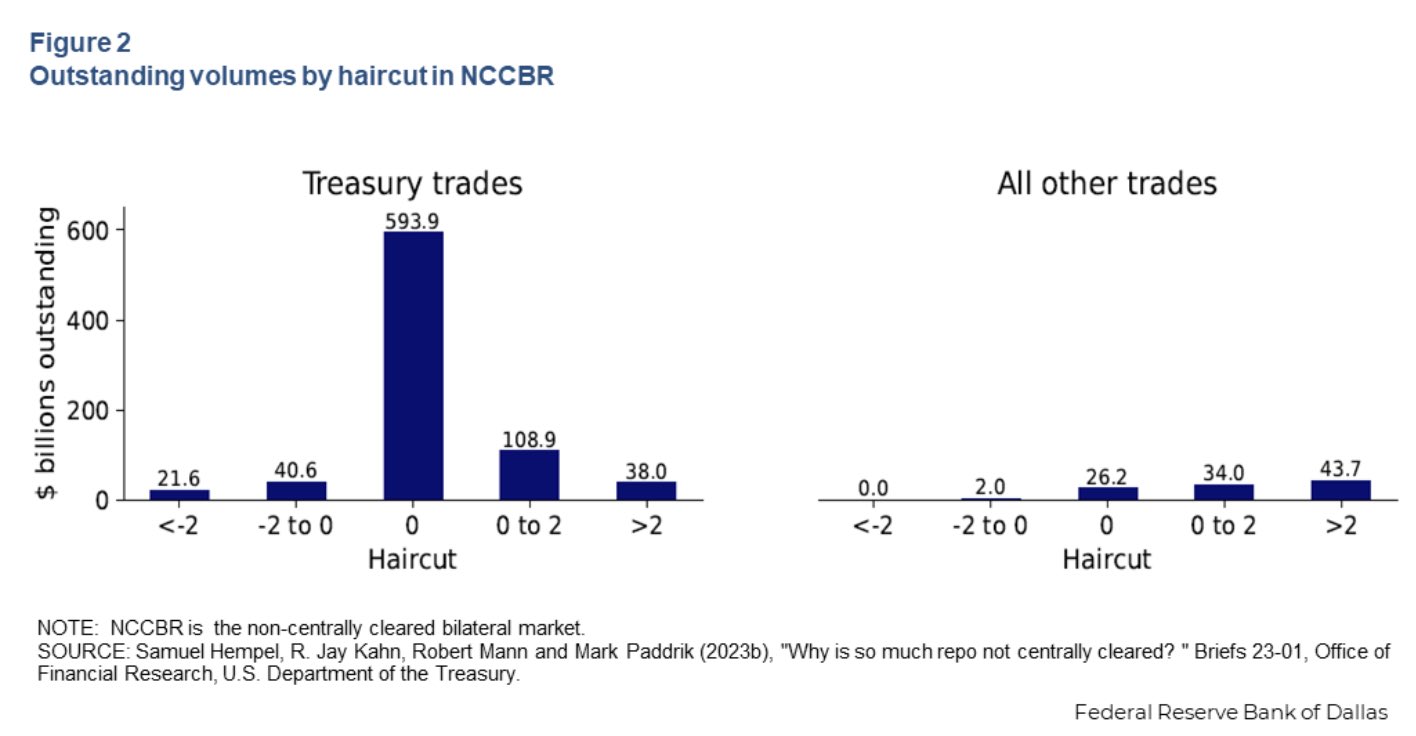

NCCBR are essentially bilateral OTC agreements - no central counterparty or tri-party custodian

NCCBR users are mostly institutions part of the financial market infrastructure - such as dealers and hedge funds they use NCCBR to manage their balance sheets and regulatory obligations. so a high need for Treasury collateral may drive the the haircuts negative

NCCBR participants are generally subject to regulations and balance sheet constraints - so don't think that null/negative haircuts means the collateral can be rehypothecated infinitely these bilateral arrangements is where financial institutions manage their liquidity needs

so if the US Treasury revaluated gold and used all those proceeds to repurchase/retire debt it will likely have an initial negative effect on the liquidity, due to contraction in safe collateral

while the haircut may also fall (upward pressure on liquidity), the volume reduction (downward pressure on liquidity) is likely to have more weight, due to global refinancing/liquidity needs

so assuming no sanitization - an initial reduction of liquidity may occur

in practice, some level of sanitization (direct or indirect) will occur, and that Treasury debt/safe collateral would likely be reintroduced back via Treasury issuance and/or Fed facilities within a year

soon i'll write a thread on how central banks/governments reevaluate gold and how the monetary gains can be used to cover central bank and/or government debt i'll add a link to it in this thread once it’s ready

in order to understand the mechanics of gold revaluation - it's important to understand the unique legal position of banks to issue broad money, and that their mode of operation differs greatly from non-credit issuance businesses

i wrote a thread explaining the business model of banks here: https://illya.sh/threads/@1755863018-1.html the information in it is important to understand the balance sheet dynamics of gold reevaluation