Illya Gerasymchuk

Entrepreneur / Engineer

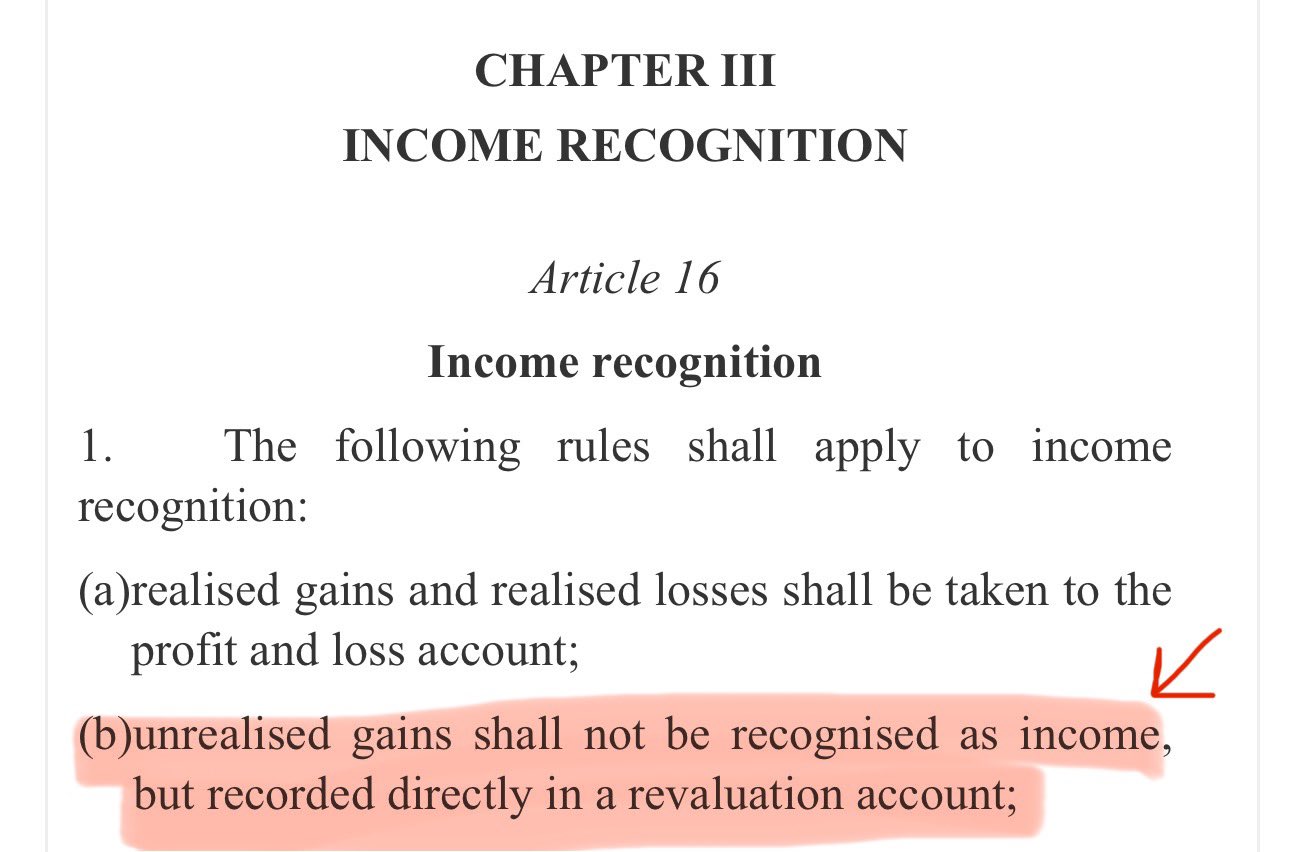

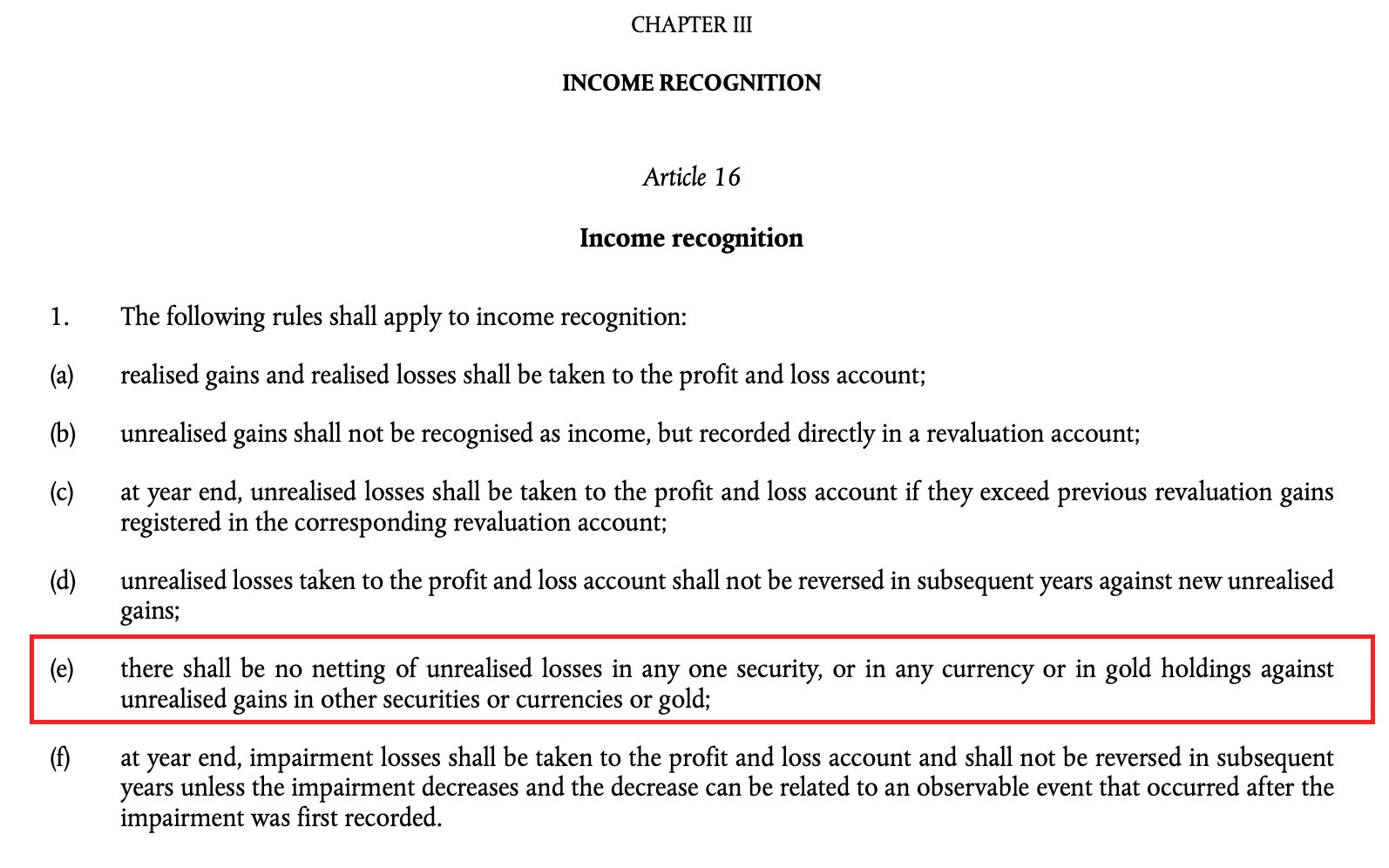

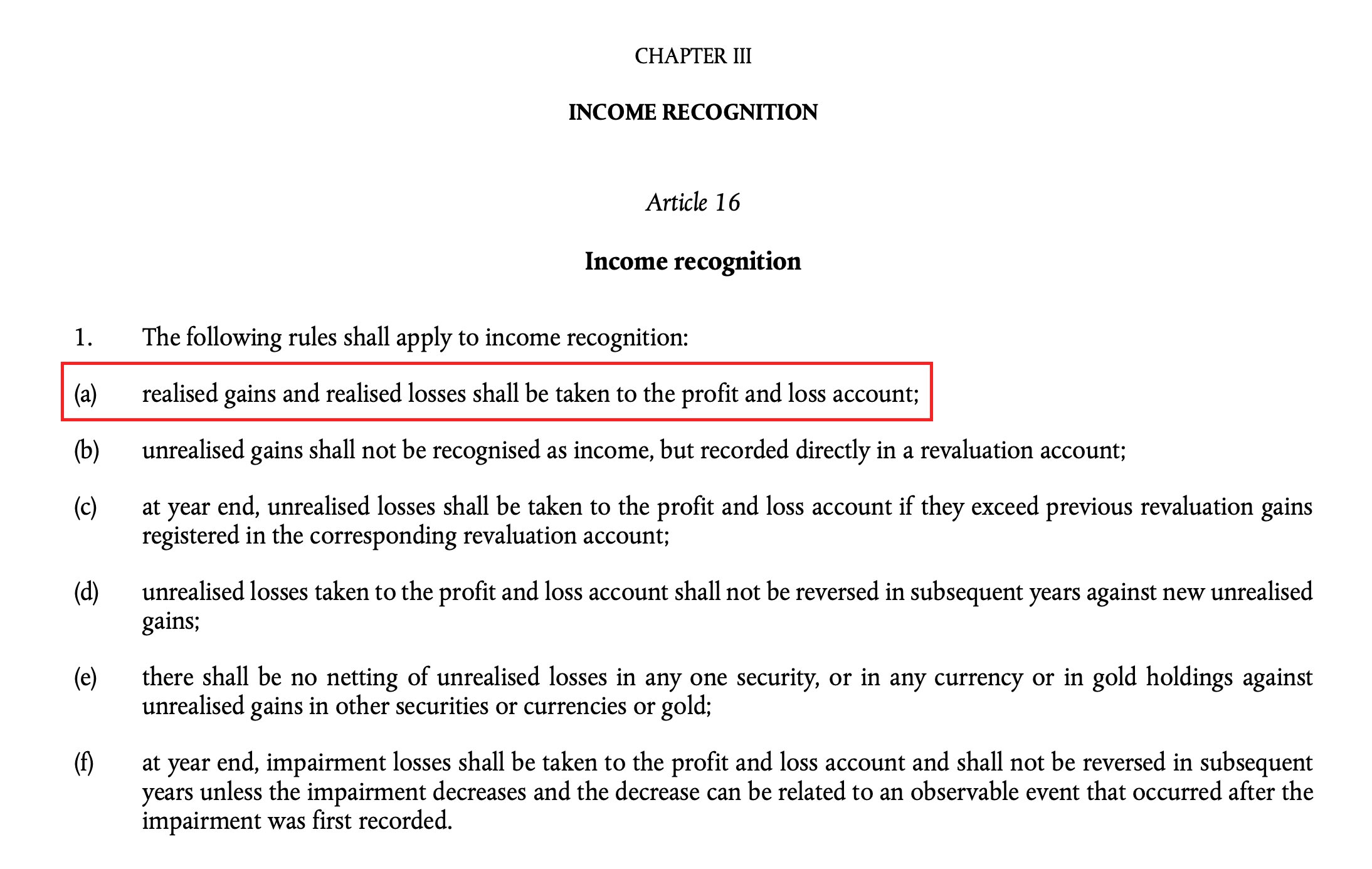

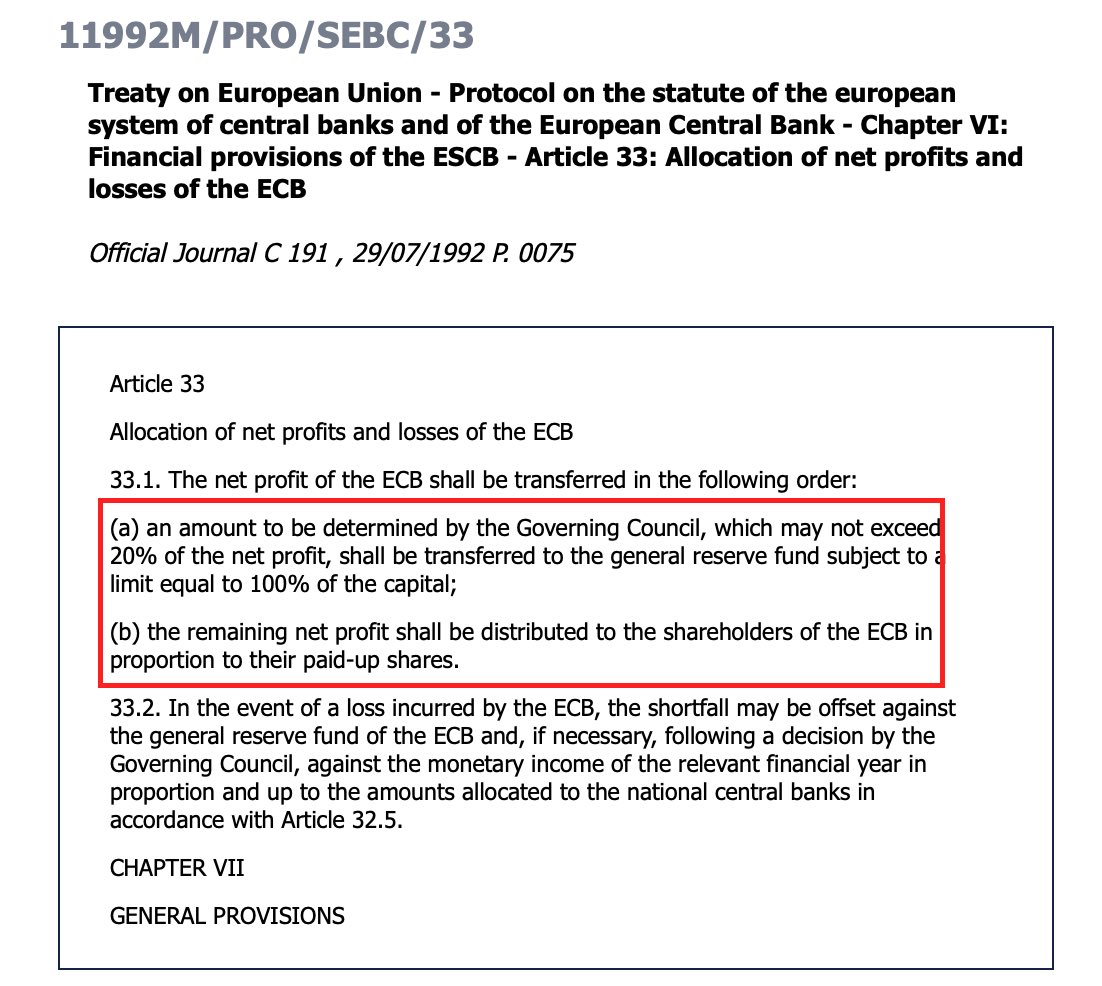

ECB's legal framework forbids the use of gold revaluation proceeds to pay expenses or operating losses

this means the ECB can only use unrealized gold gains to cover/offset future unrealized losses on gold these unrealized gains can neither offset an operational, nor a loss in another security bucket, such as FX

thus, unrealized gold gains accumulate on the ECB's liability side, under the revaluation account, and the only way they can be debited (e.g. to cover expenses, or credit an NCB's reserve account) is: 1️⃣ when the ECB sells the gold, thus turning an unrealized gain into a realized one 2️⃣ offset future losses in the gold bucket