Illya Gerasymchuk

Entrepreneur / Engineer

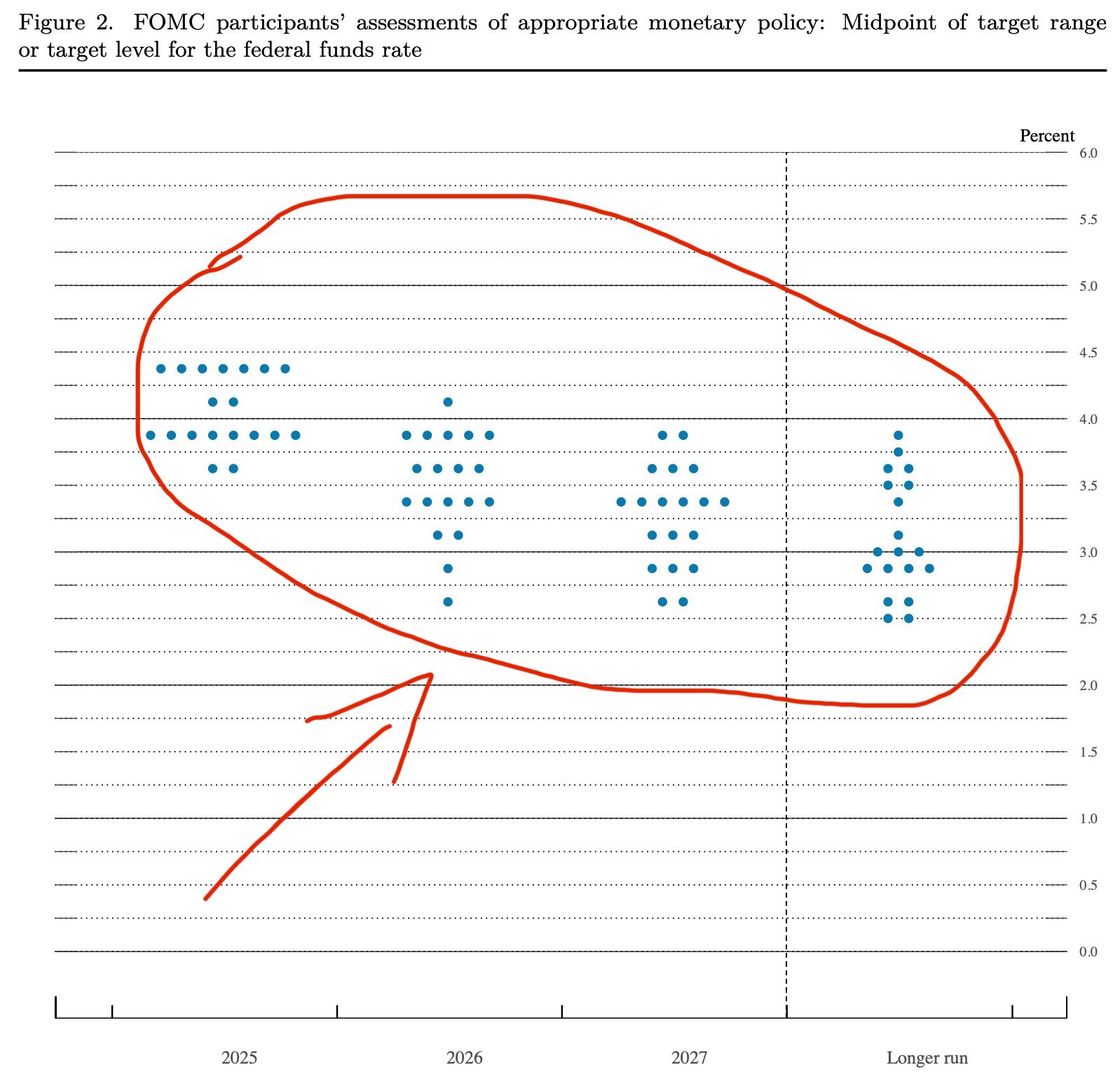

watch the Fed's projection dot plot, not the Fed Funds rate

based on the current Fed policy guidance available since June 2025, by the end of 2025 the Fed Funds rate should be ≈3.9% current one is 4.25%-4.50%, so we either get a larger than 25bp cut or several rate cuts this year

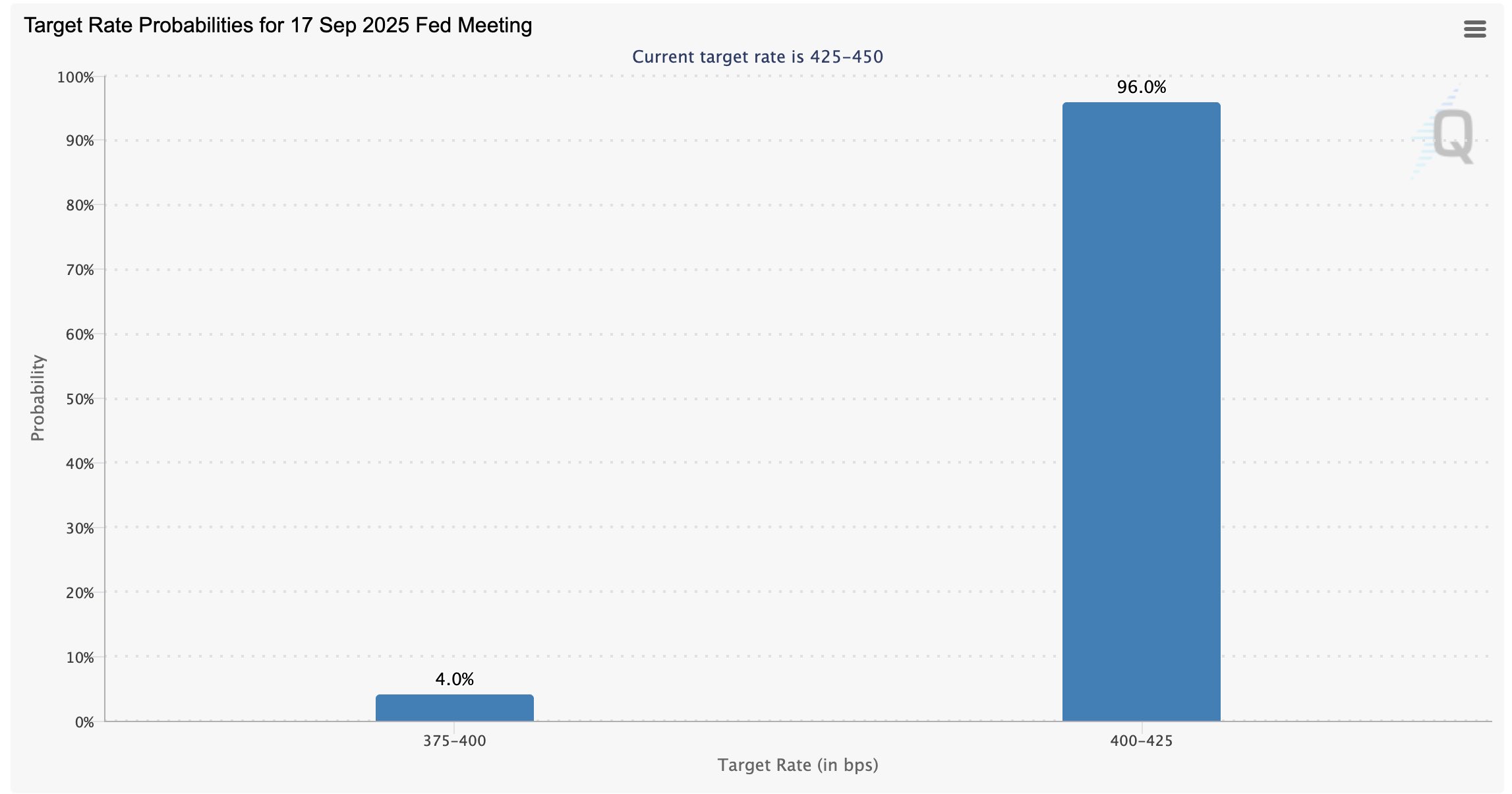

so the most likely outcome is a 25bp/0.25% rate cut on September 17th 2025, and then at least one more cut in 2025

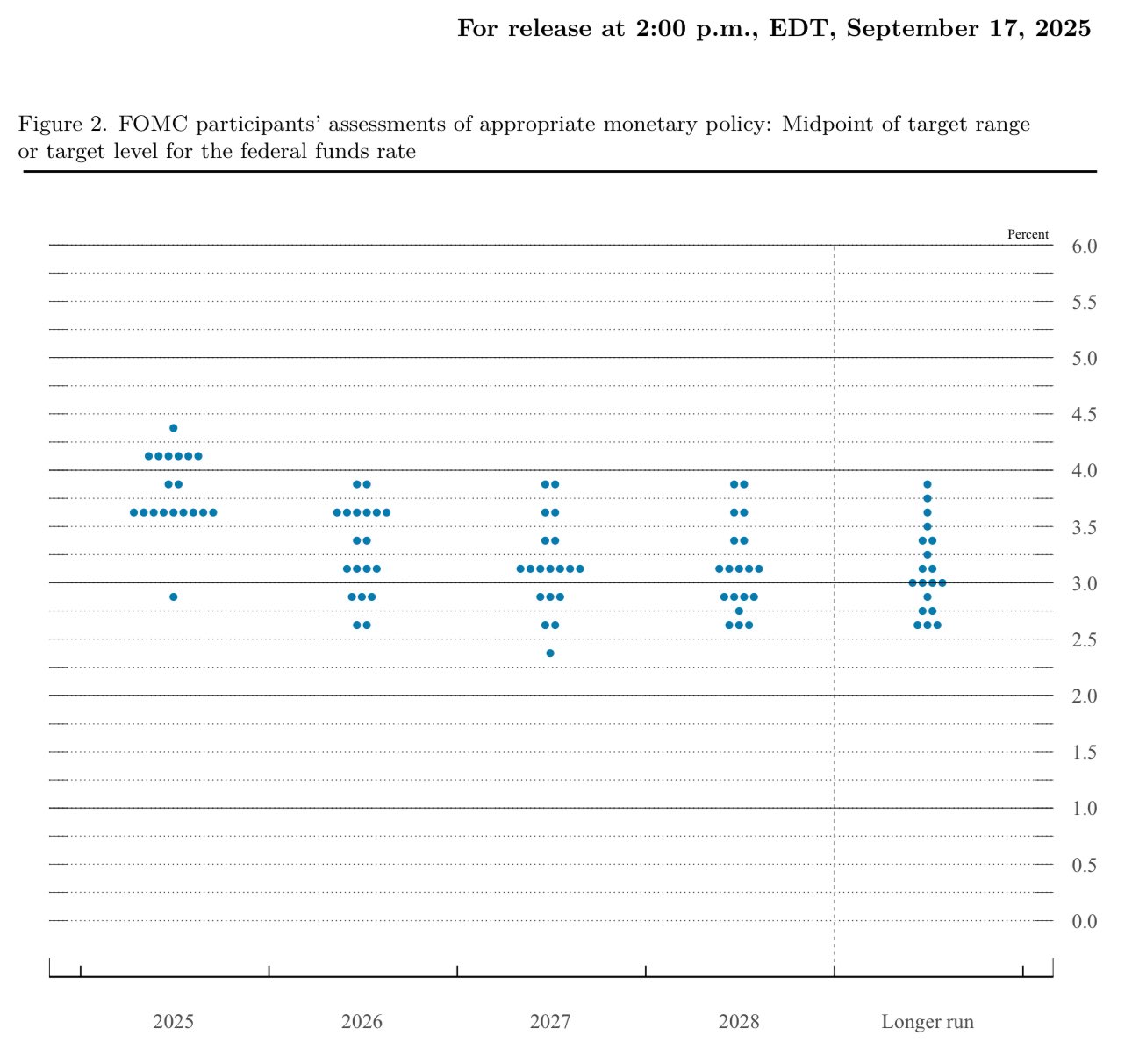

during the Sept 17th 2025 FOMC meeting, the Fed will publish a new dot plot with the suggested interest rates for 2025, 2026, 2027 and longer-term