reducing the cost of capital by 25bps wouldn't affect mortgage that much - as it doesn't eliminate the existing risk in the market (i.e. existing mortgages)

reducing the cost of capital by 25bps wouldn't affect mortgage that much - as it doesn't eliminate the existing risk in the market (i.e. existing mortgages) to lower mortgage rates the Fed will likely do a mortgage-targeted QE, like with MBS in 2008 QE1

in the longer-term mortgage rates in the US will likely increase, but not because of interest rate cuts

in the US, there's been a real estate bubble in the building since 1990's (pun intended). it was about to burst/de-leverage several times, but it was refueled via QE and government guarantees among others, thus delaying it

so expect a 2008 QE-1 style balance sheet expansion by the Fed targeting mortgage securities via OMO there will also likely be additional government policies and programs, such as increasing the scope and volume of explicit government guarantees on mortgage securities

mortgage-rates targeted QE, such as the mass purchase of mortgage backed securities (MBS) by the Fed will drive the mortgage yields down short-term, but also further leverage that market sector in the process

the same is true for government policies or programs - those are also likely to push mortgage rates lower short-term at the very least, extended government guarantees synthetically reduce the risk - the US government is a more trusted backer than the issuer of the MBS

of course, that doesn't resolve the underlying supply/demand imbalance at the risk level implied by the leverage so the bubble is still there, and eventually it will eventually pop

the US mortgage bubble will likely pop alongside other bubbles, due to a high degree of interdependence and correlation within the financial sector the mortgage bubble can both, trigger and be triggered by burst of other bubbles so you'll see a cross-border systemic downturn

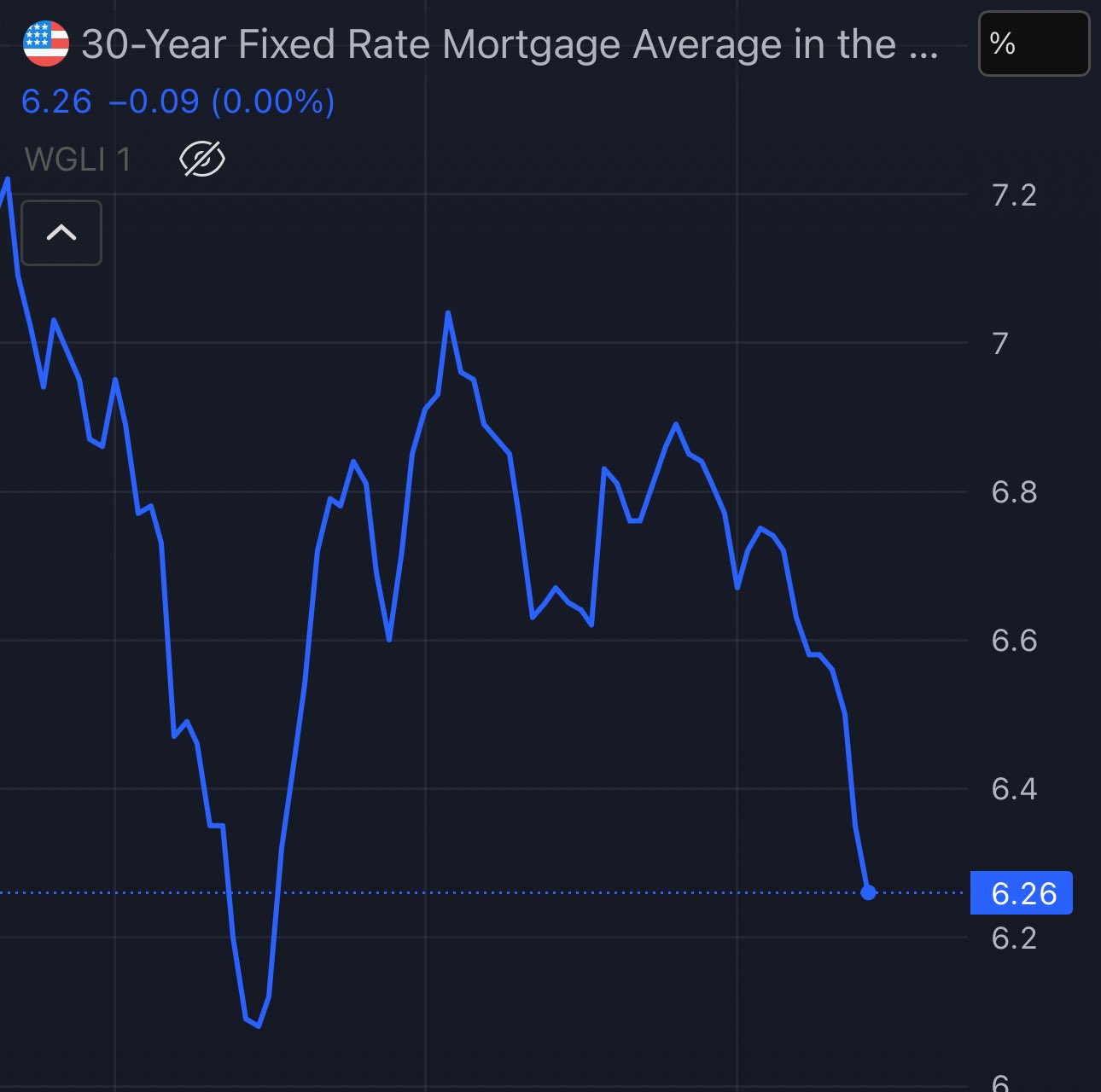

so as a takeaway: expect volatility within the mortgage rates in the US ➖ upwards pressure: financial downturns in other sectors, organic de-leveraging ➖ downwards pressure: QE, Fed facilities, government policies

while the mortgage will eventually bubble pop/de-leverage to a significantly lower level, it's unlikely to happen within the next year or two, as many seem to suggest as I've written here - there are still many tools that can push mortgage rates down shorter-term

but definitely expect volatility 😄