if you buy a car with Bitcoin, you're still subject to capital gains tax

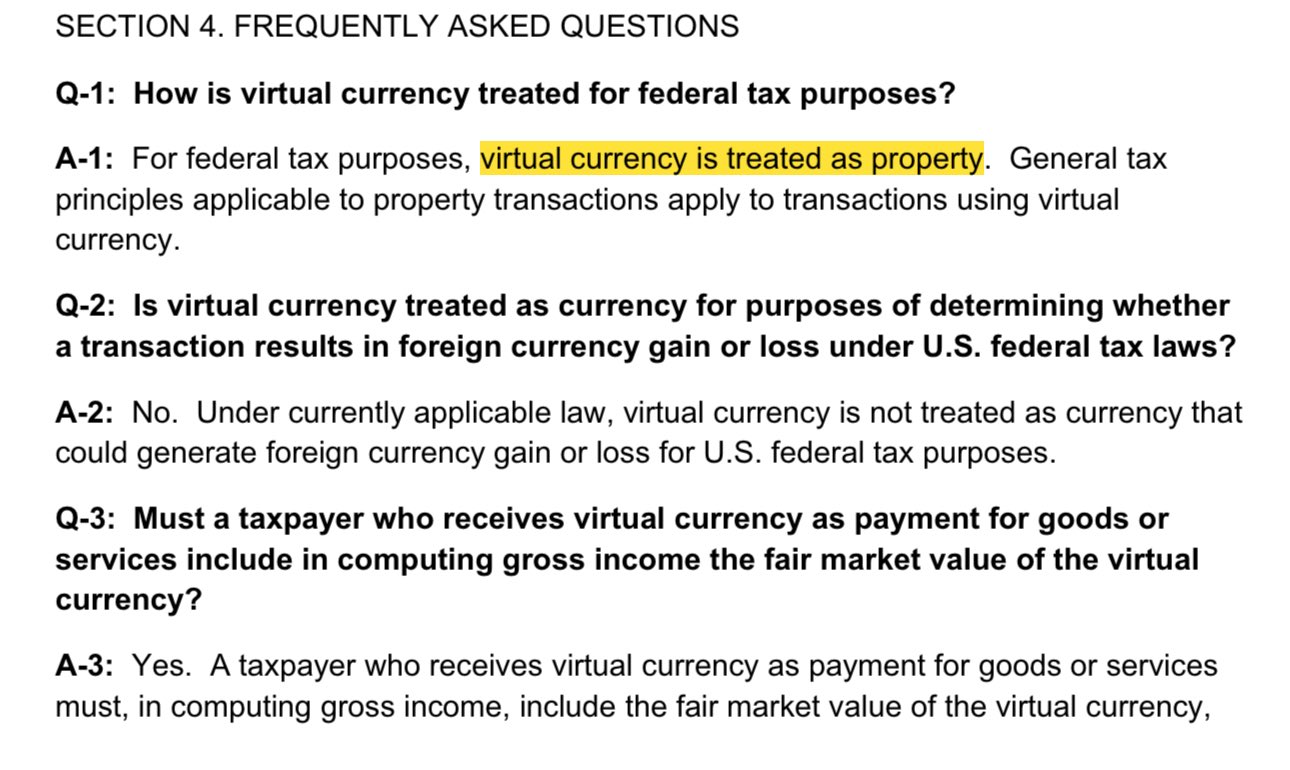

if you buy a car with Bitcoin, you're still subject to capital gains tax under the US law cryptocurrencies are property - so you're taxed on the USD value of the car at the time of purchase minus the cost of your original crypto purchase (so you're only taxed on the gain/profit) so if the processing fee of a payment with Ethereum is larger than it would be by selling Ethereum for USD first (e.g. transfer ETH to an exchange --> sell --> transfer to your bank account), then you end up paying more with Ethereum than you would with USD. it make sense, because you'd be removing an intermediary (i.e. you sell ETH for USD yourself) in either case, the seller receives USD for the car, not ETH or BTC. the intermediary most likely doesn't keep ETH/BTC on their balance sheet either, they just proxy your order to the market and charge a spread