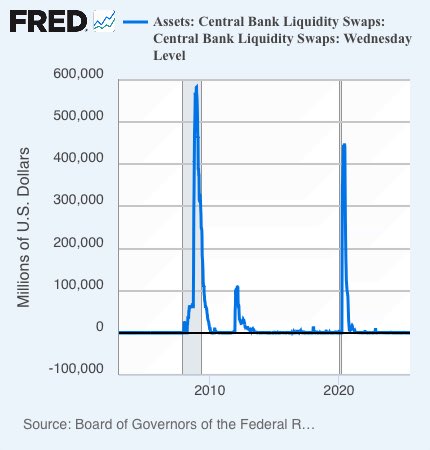

💧FED swap lines = infinite liquidity pool

FED swap line operations reach ≈$600 bn

while the swaps are closed/repaid in less than a year, ≈80% of the repayment comes from newly issued wholesale debt

thus, ≈80% of the swap volume eventually becomes new currency in circulation

and then you wonder about inflation 😄

new currency in circulation is just one of the side-effects

and that transition is neither direct, nor instant

before these funds effectively become new currency, they flow into financial markets - that's why you see the stock market going up first

the same for risky assets

check the correlation between FED swap line volumes and Bitcoin price

large spikes in swap volume trigger an uptrend in Bitcoin

understanding these global liquidity flows helps to visualize them as a part of the larger system and understand where it's likely to move next