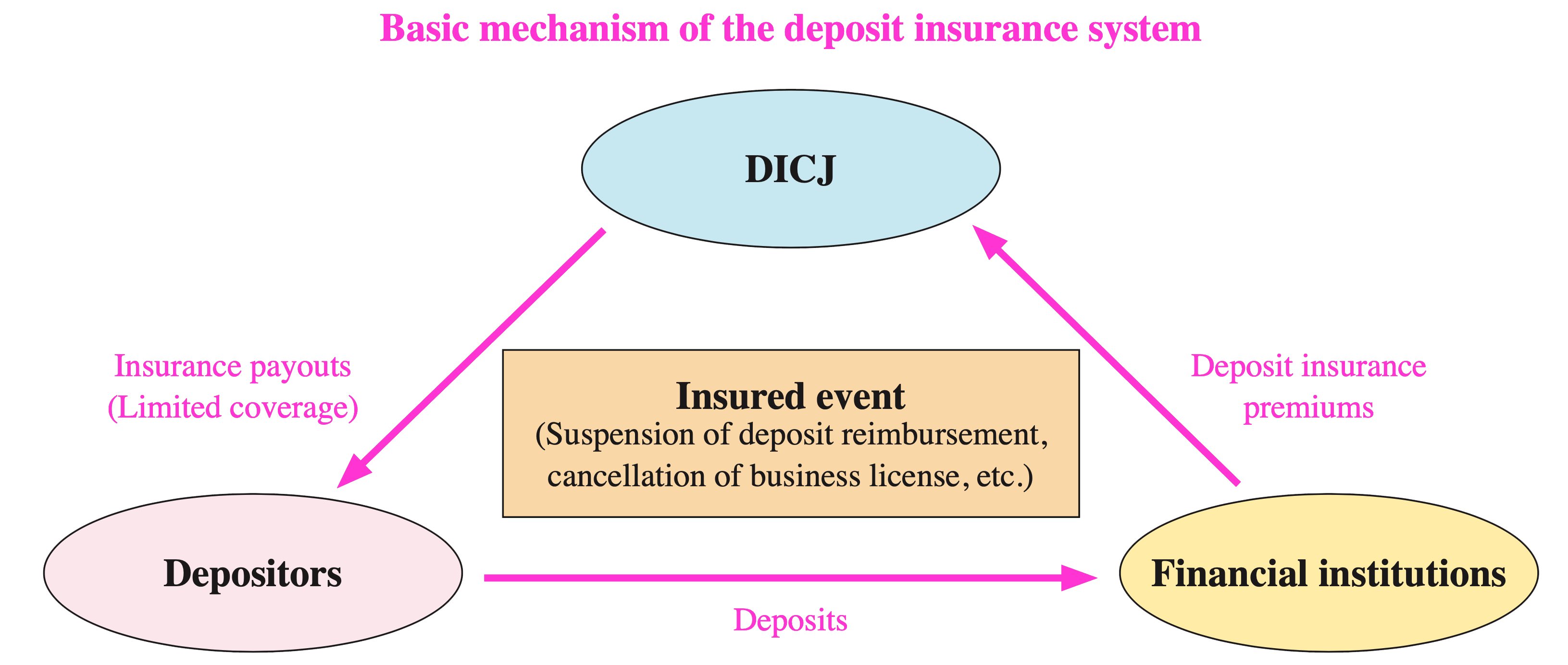

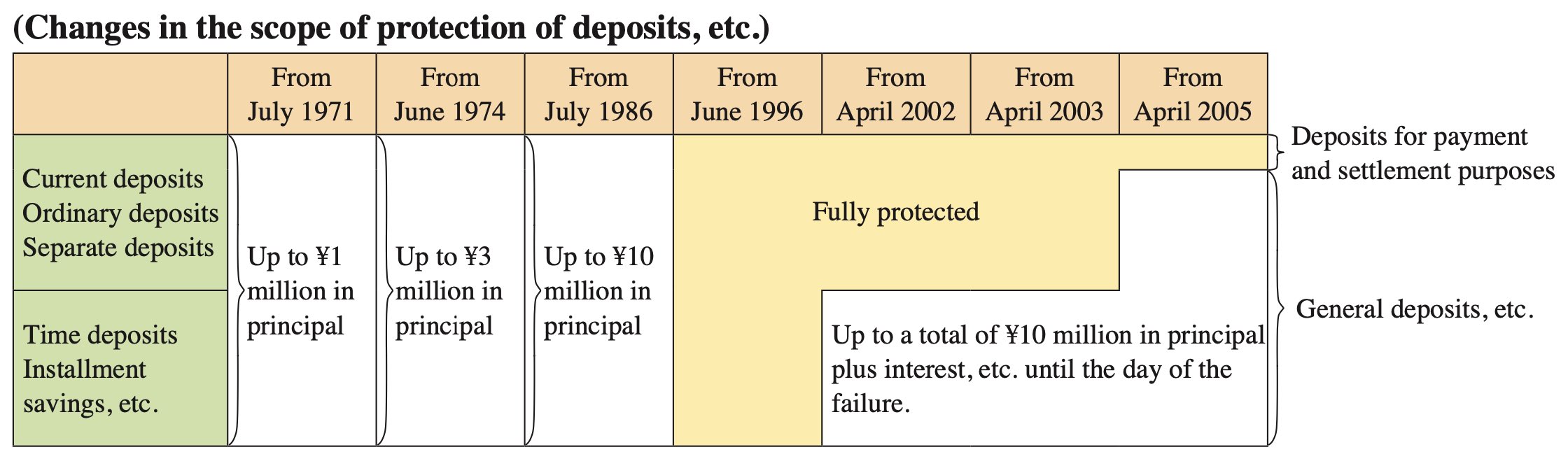

🇯🇵 How does Japan protect bank deposits when banks fail?

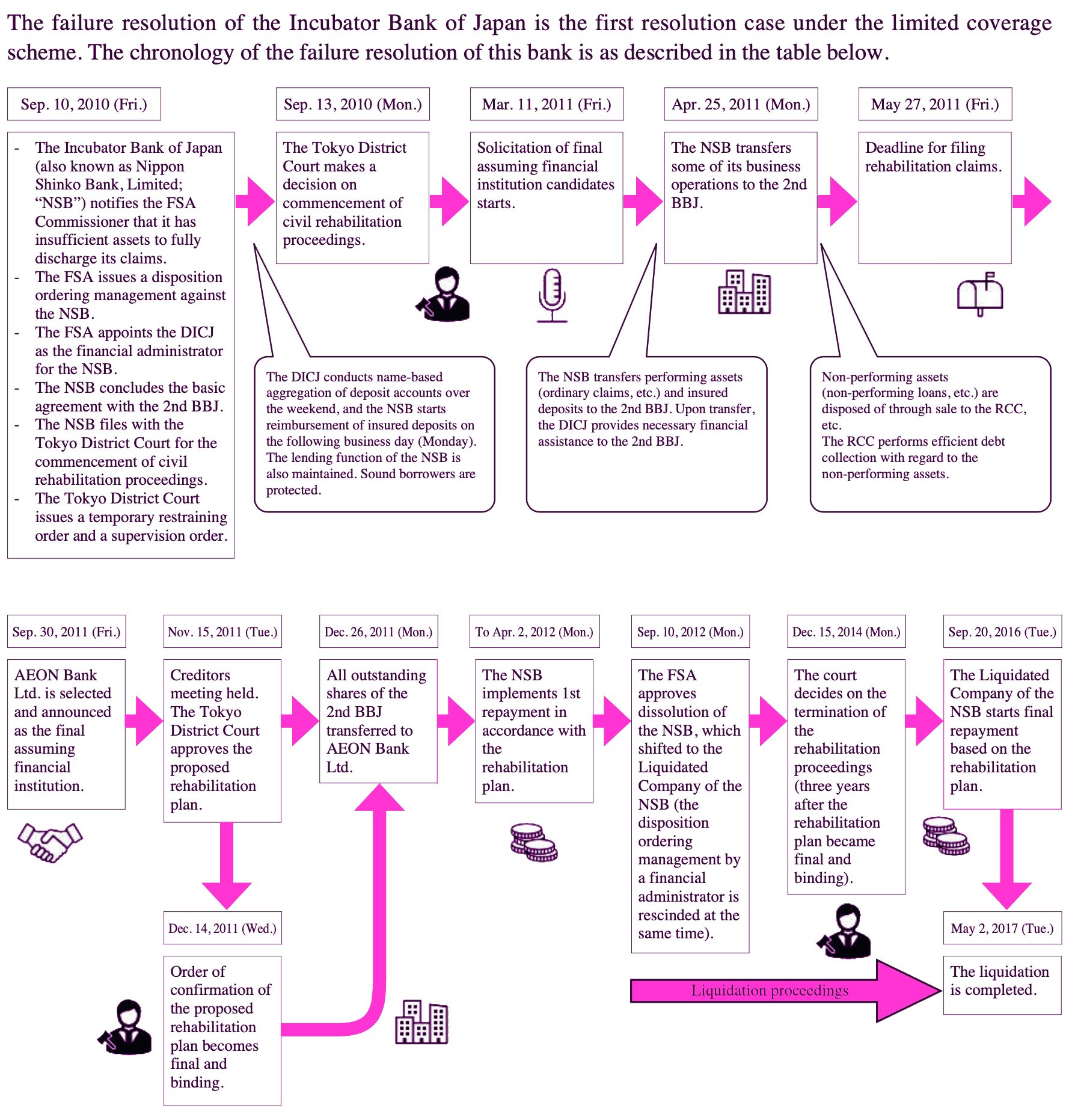

🤯 Their deposit insurance system handled 180+ financial institution failures, including the massive 90's banking crisis

👉 Here's how Japan's ¥10M deposit guarantee scheme works: https://illya.sh/blog/posts/deposit-guarantee-scheme-japan-dia-dicj/

🧵

🚨 The system faced its biggest test during the 90s banking crisis:

• 110 financial institutions resolved

• Full deposit protection implemented

• Massive debt-based interventions

DICJ has met its insurance obligations, but at what cost? 🤔

🇯🇵⚠️ Current risks:

• Heavy reliance on debt

• Large US Dollar & Securities exposure

• Currency devaluation, leading to inflation

These could trigger a 90s-style crisis 2.0 📉

🇯🇵🧠 For a deeper dive into Japan's deposit insurance system, read or listen my article at https://illya.sh/blog/posts/deposit-guarantee-scheme-japan-dia-dicj/

It covers Japan's deposit insurance's:

• Legal framework

• Historical cases

• Risk analysis

• EU comparison

Got questions? Ask me! 👇