Illya Gerasymchuk

Engineering & Finance

How the 1916 Fed Act Made Treasuries Prime Collateral

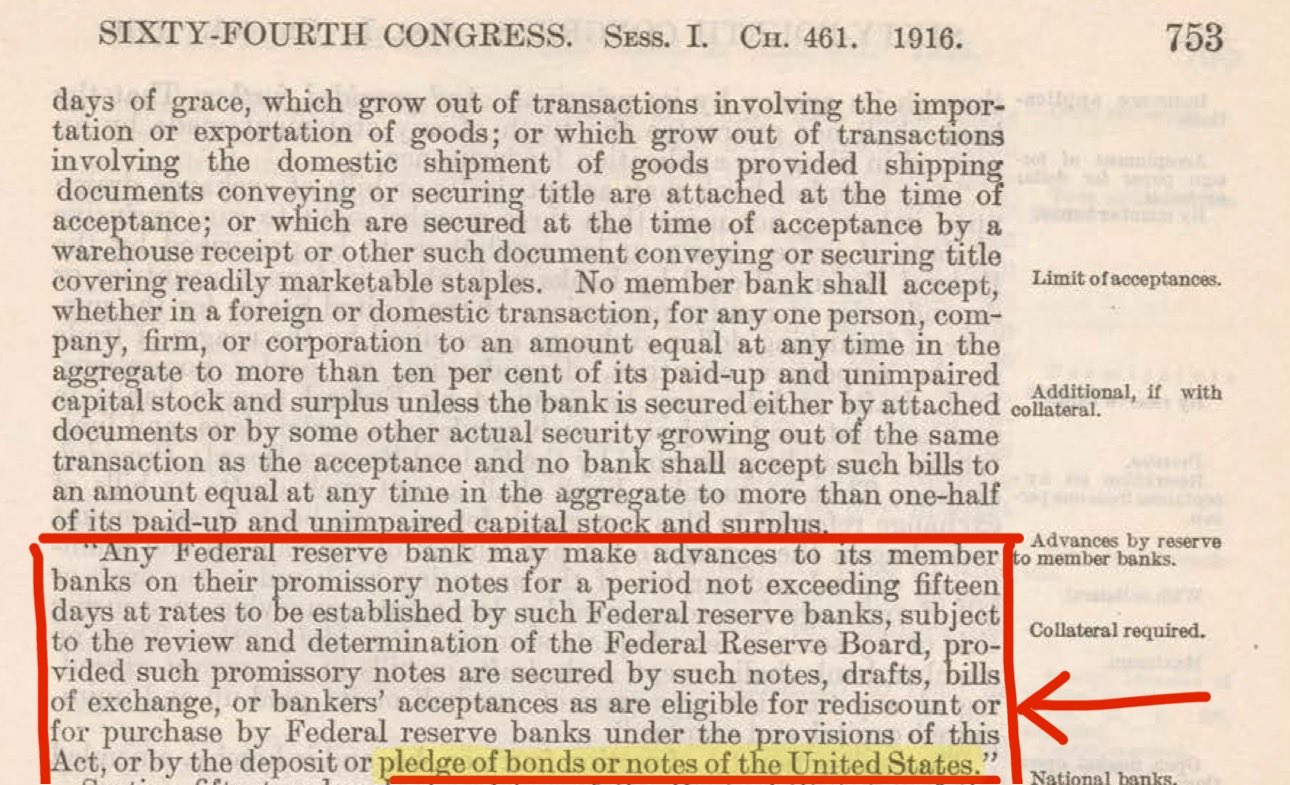

Before 1916, the Fed would only lend to banks against "eligible paper", which included self-liquidating commercial loans and agricultural loans.

The Federal Reserve Act 1916 amendment expanded the Fed's legal power to allow for lending to commercial banks against U.S. Treasuries (government bonds).

This effectively turned U.S. government debt into collateral backing Fed's liabilities. This paved the way for the U.S. Treasuries to become the most used form of collateral in short-term wholesale debt markets (e.g. repo/repurchase agreements) today.