Illya Gerasymchuk

Engineering & Finance

M2 Money Supply Is A Bad Measure of Global Liquidity

If you're using M2/M3 as a measure of global liquidity, you're under accounting for at least half of "global money supply".

Here's some USD-centric data:

➖ U.S. M2 supply: ≈$23T

➖ U.S. Money Market Funds: ≈$8T

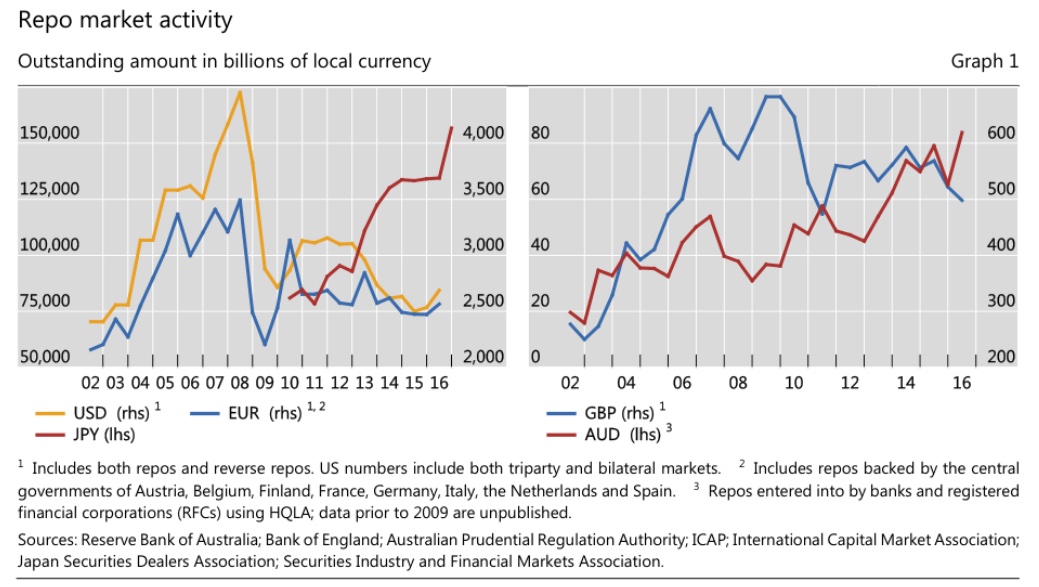

➖ U.S. Repo Markets: ≈$13T

These are USD/U.S. focused figures, so they don't account for global liquidity per se (e.g. PBoC's balance sheet is larger than Fed's), but they do show how M2 falls short of being an accurate proxy for the measure of global monetary/currency supply.

I've written several articles on global liquidity and how to measure it. You can read them free of cost in the threads section of my website.