Multiple governments have seized Bitcoin

In fact, more Bitcoin has been seized than gold in the U.S. It's really not hard to google this, but here are some examples:

- Silk Road takedown (2013–2015) - ≈175K BTC

- "Individual X" Silk Road stash (2020) - ≈75K BTC

- Bitfinex-hack recovery (2022) - >94K BTC

- Movie2K piracy case - ≈50K BTC

- Finland Customs seizures - ≈2K BTC

- Netherlands money-laundering case - ≈2.5K BTC

- China PlusToken crackdown ≈200K BTC

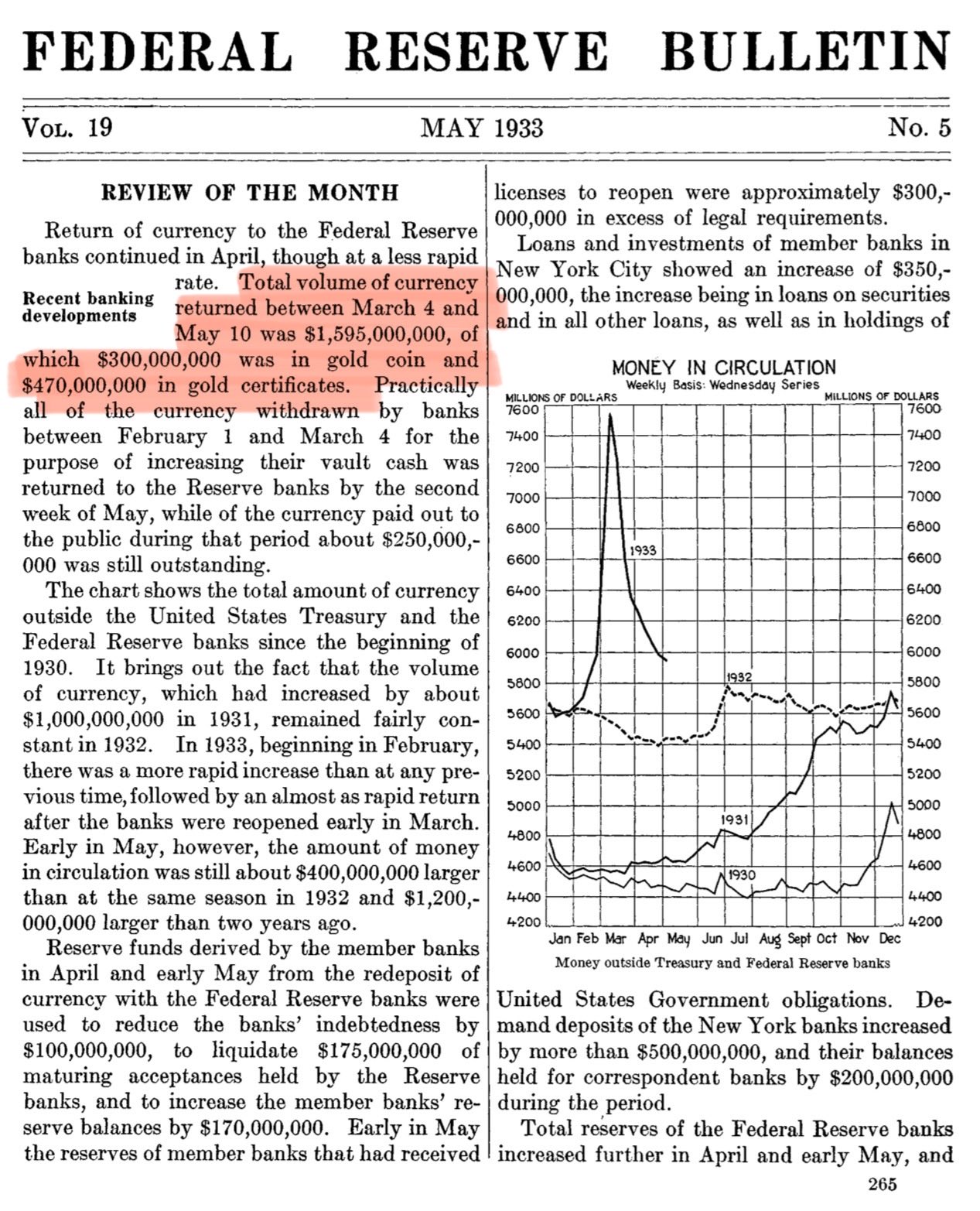

Regarding gold - yes, it was seized in the past in the US, but it was at a much smaller scale than you imagine.

The publicly documented, conservative floor for government-seized BTC is ≈700K BTC (≈$77B today), which is already above the $58–110B value range for U.S. public gold coin surrendered in 1933–34.

If your argument is that Bitcoin is better than gold, because it's more private/seizure resistant - you are wrong.

If you think that by holding Bitcoin you're immune to U.S. government policies you're also wrong, as more than 90% of all Bitcoin buying volume comes from USD or USD derivatives (including stablecoins).