Illya Gerasymchuk

Financial & Software Engineer

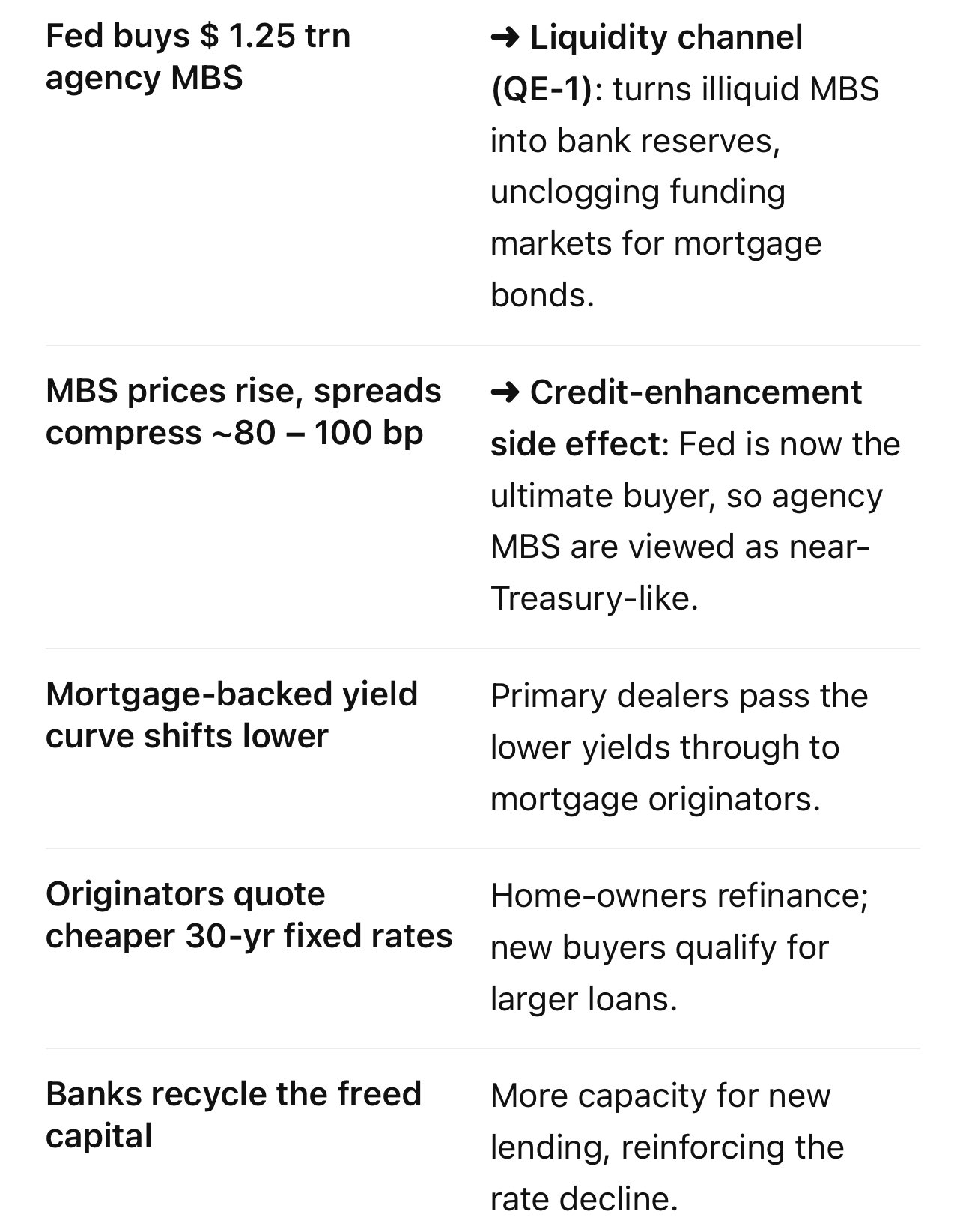

to lower the mortgage rates the Fed can purchase agency MBS - likely they did in QE 1 2008

Fed's balance sheet expansion with agency MBS reduced risks in liquidity, market depth and optionality/convexity

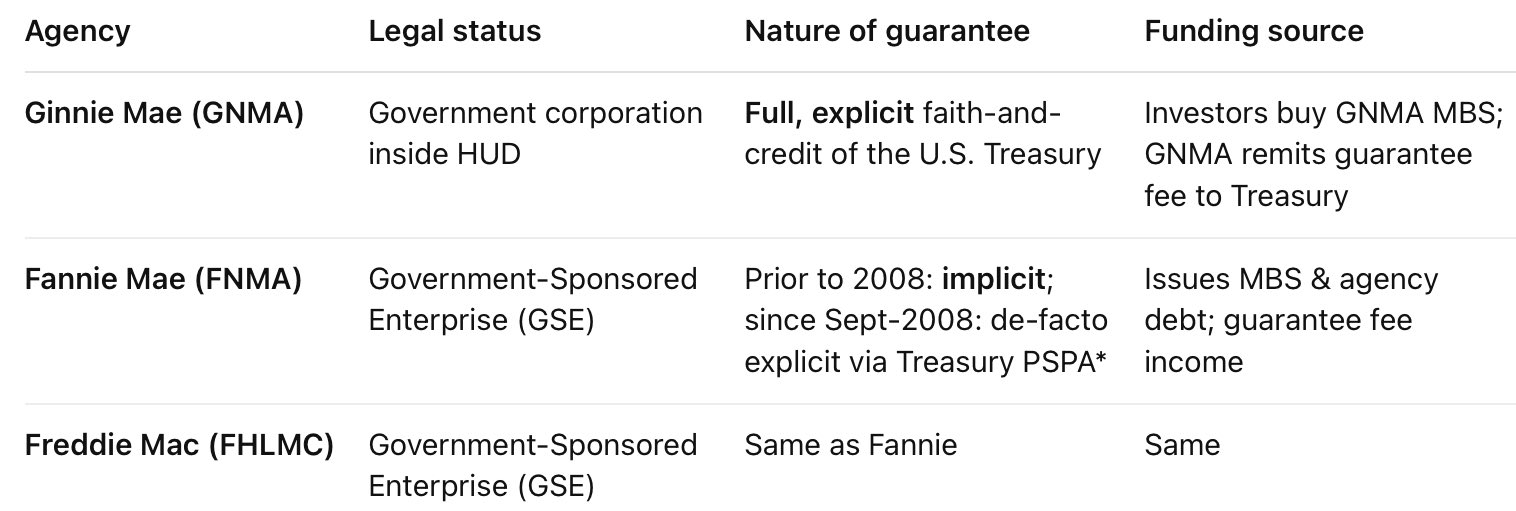

this is a crucial point to understand - it wasn't just the Fed buying agency MBS, but the explicit government guarantee that accompanied it

thus, the yields fell

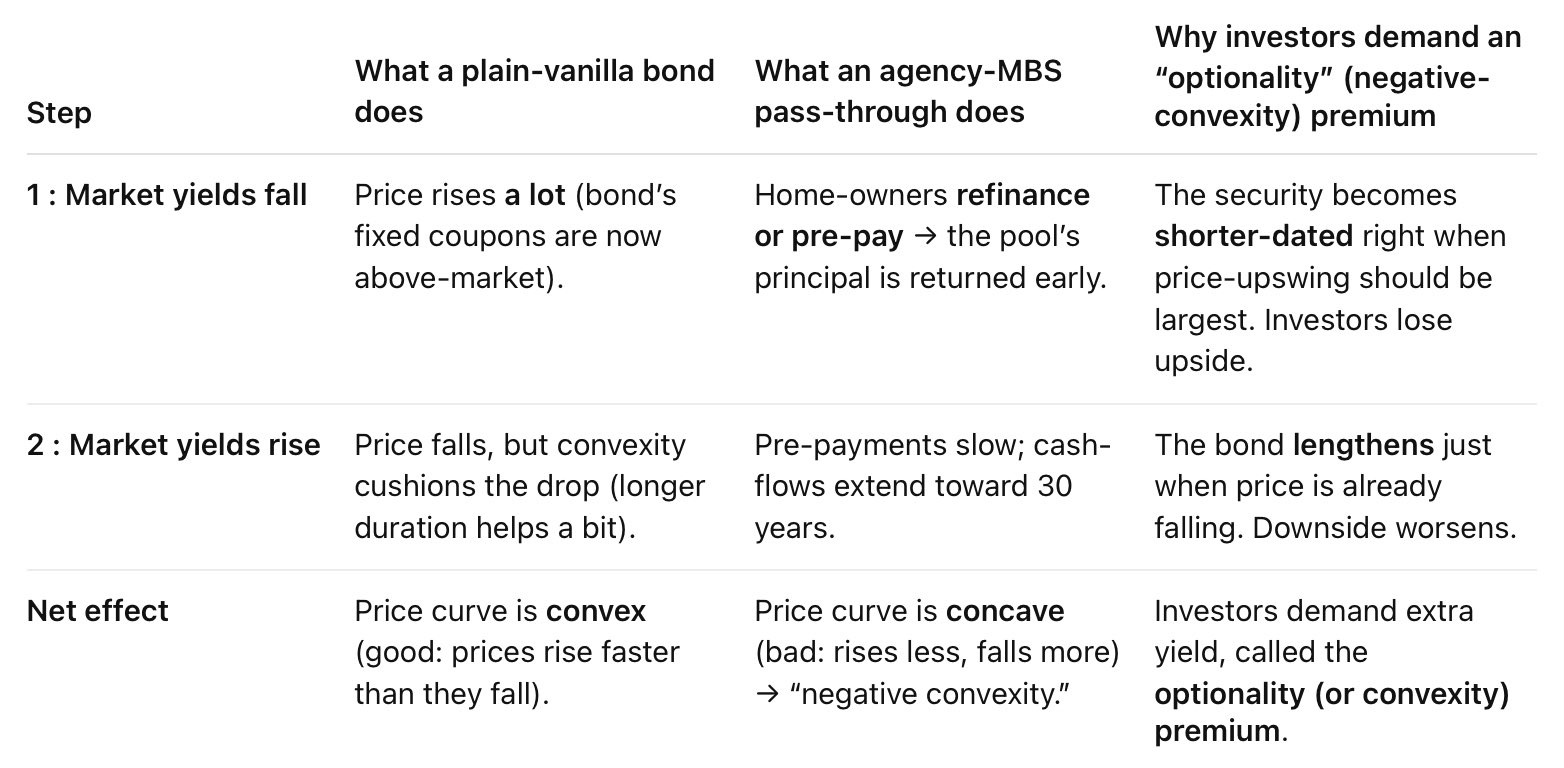

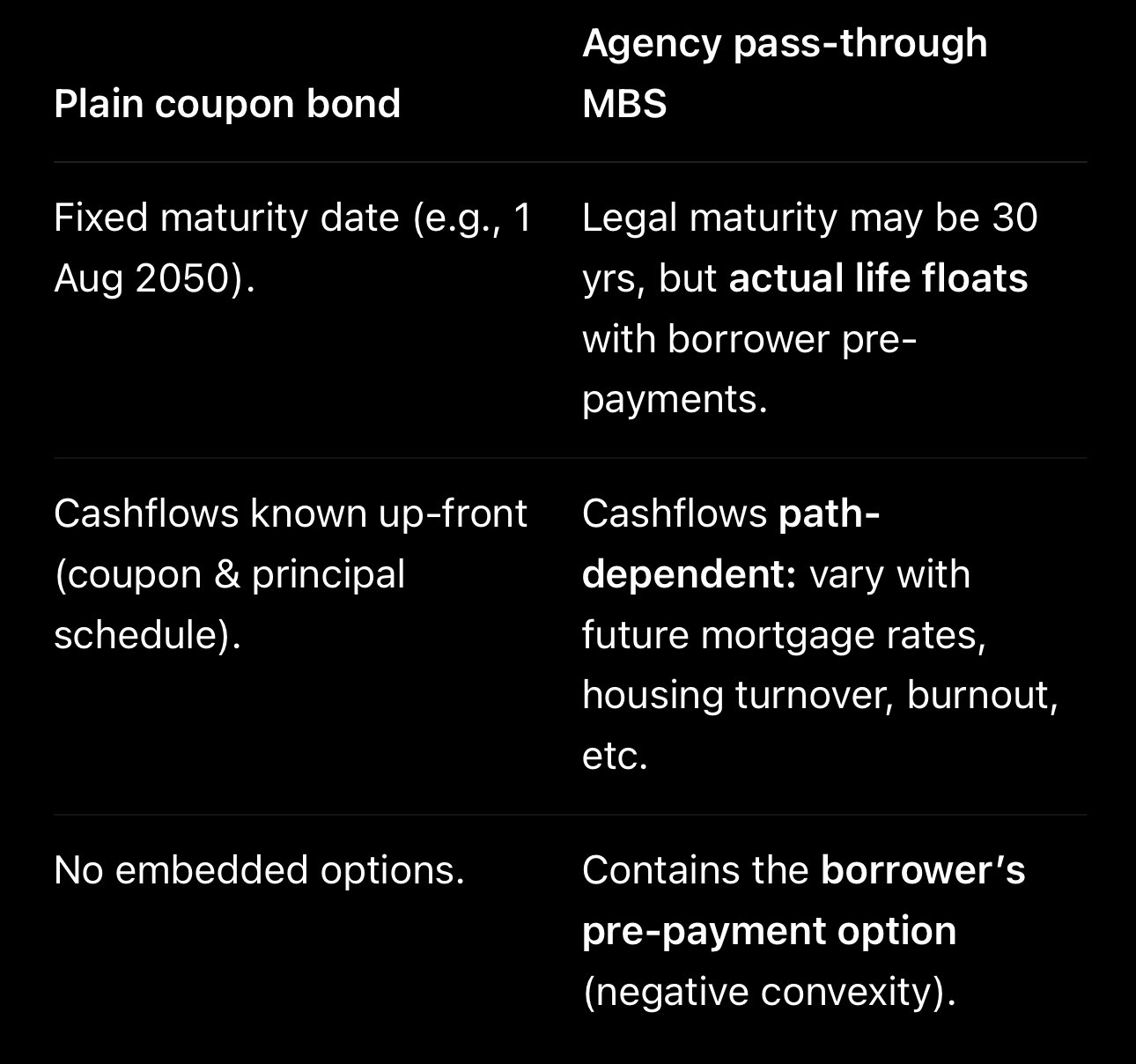

raising yields means lower incentives to re-finance mortgages which reduces the amount of pre-payments

thus, the duration increases when yields are raising - so even a higher price decrease

the duration formula for MBS assumes for some pre-payments

if those happen at a smaller rate - the duration increases