Today's Commodity Miners Sell-Off Is A Buying Opportunity

I've made numerous such calls in the past, and they were correct 100% of the time. Today, I'm making one of such calls again.

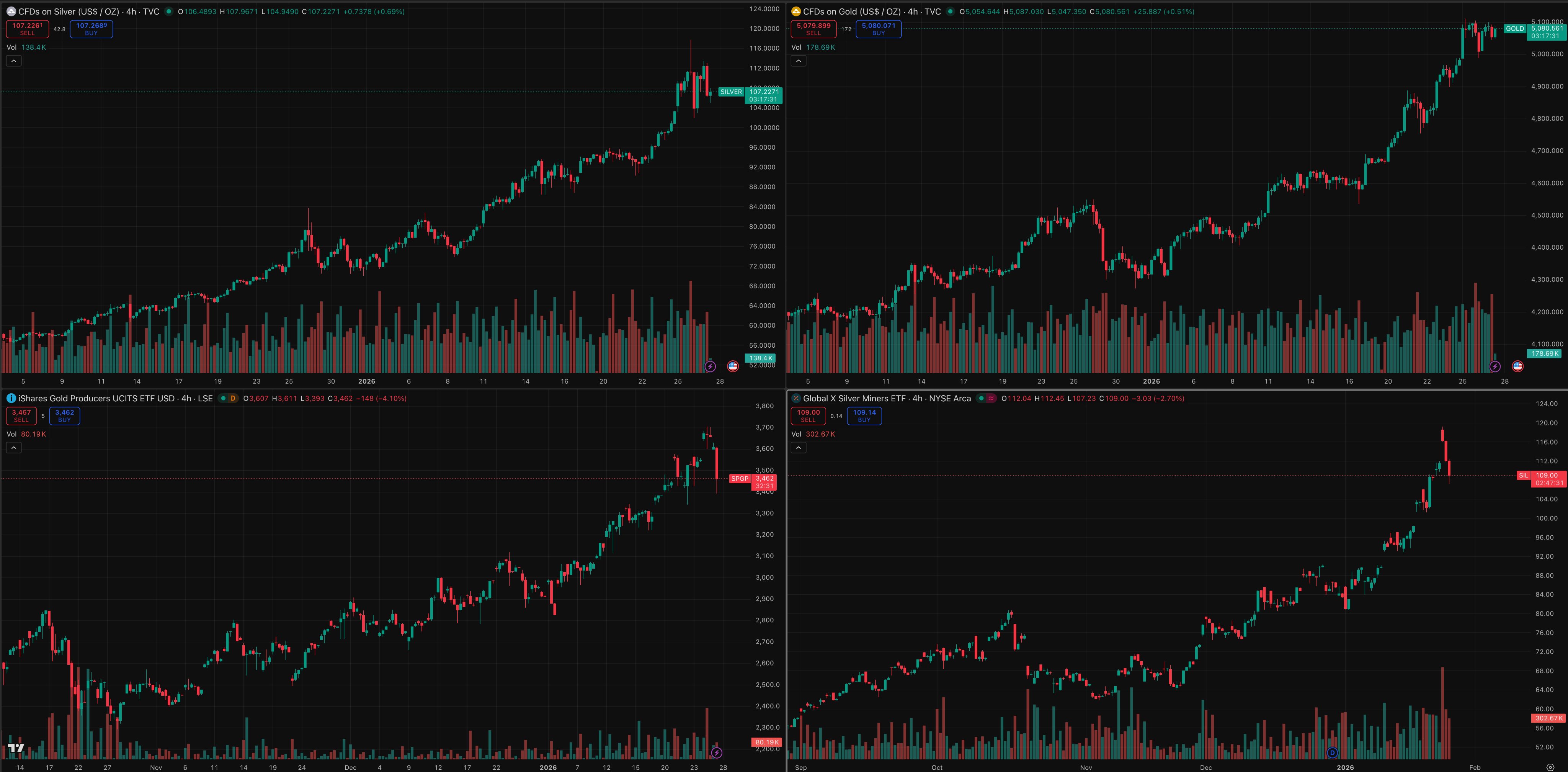

Gold, silver and copper miners are down today, with indices and individual large caps falling by as much as ≈8%, despite the underlying metals remaining in the green. This is exactly the situation where you can leverage the increased volatility in the mining sector to increase your exposure to the underlying metals during an uptrend.

I expect the prices of gold and silver miners indices to increase by ≈30% from current levels within roughly 10 trading weeks from now. It may happen sooner than though - pay close attention to the price action.

It's also possible for the price to dip lower than the current levels before the upwards move described above materializes. This mainly depends on the price action of the precious and industrial metals in the next few weeks, but I don't believe that either one of them has topped for the cycle, thus uptrend resumption is imminent.

I've written several articles explaining why commodities and commodity miners are a great investment for 2026. I suggest you to read them if you haven't done so yet.