Illya Gerasymchuk

Financial & Software Engineer

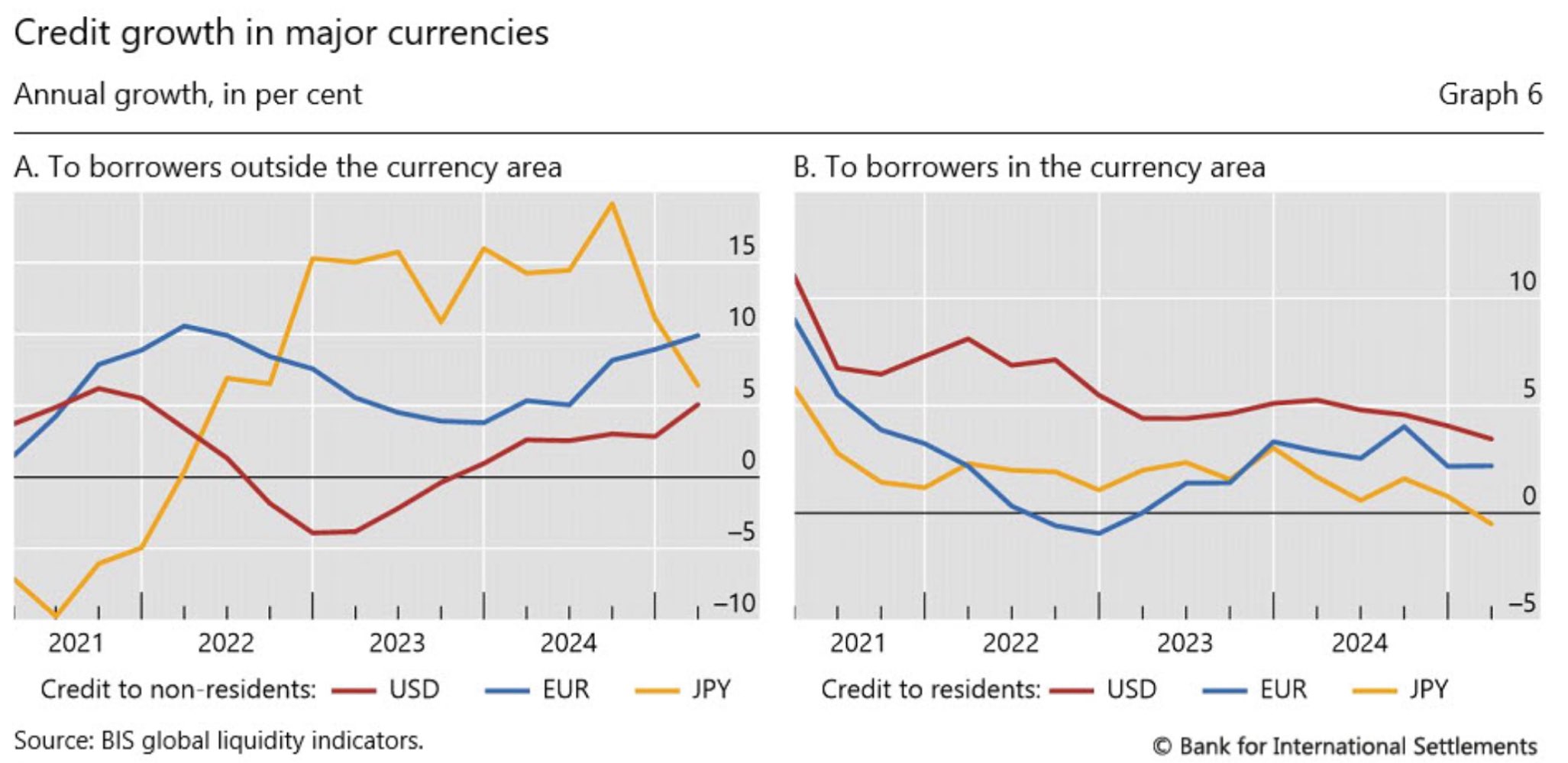

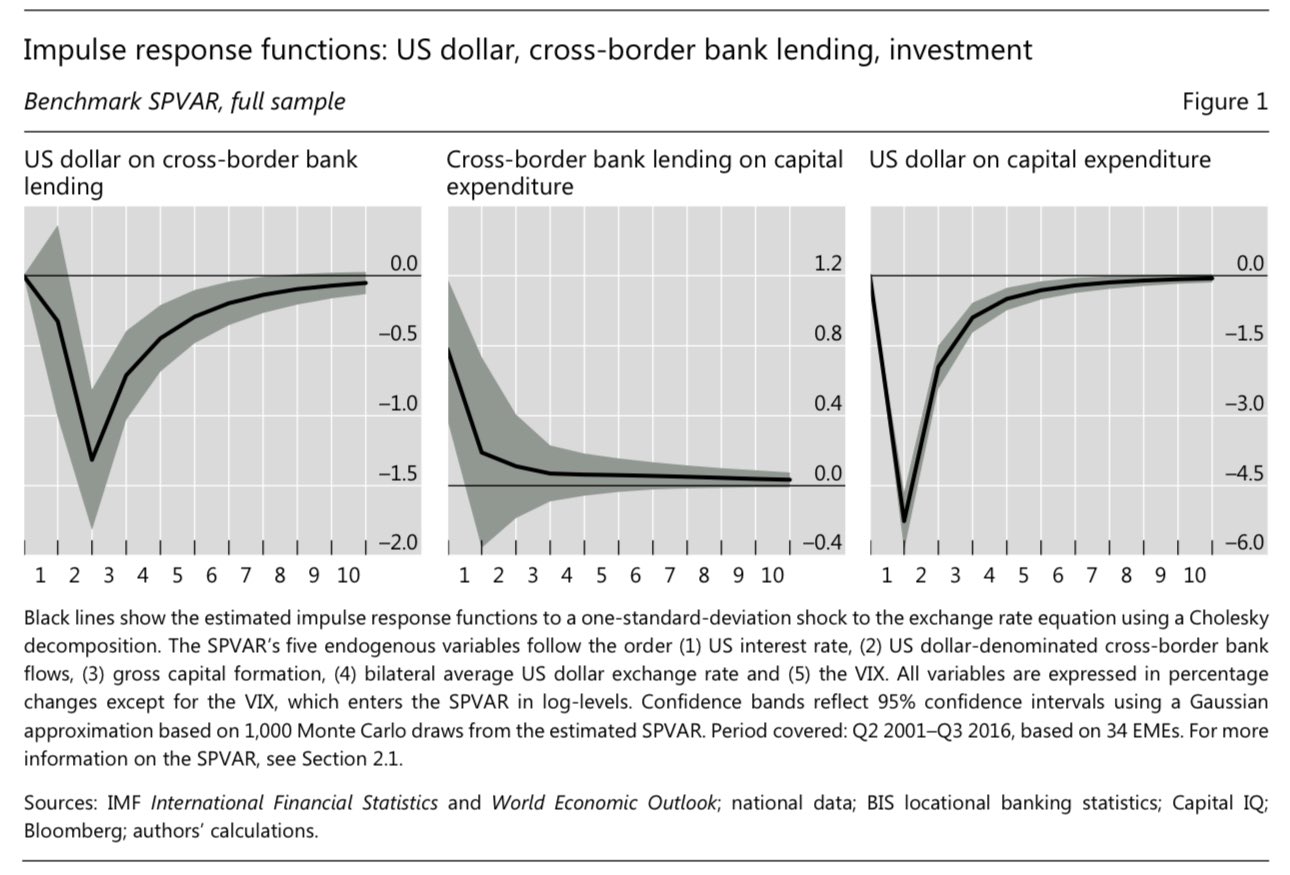

weaker US dollar means more USD credit issuance abroad - here's why

bank's leverage ratios improve due to collateral appreciation, thus allowing them to borrow more USD

collateral here is the non-USD local currency, such as Yuan