⬇️ My Thoughts ⬇️

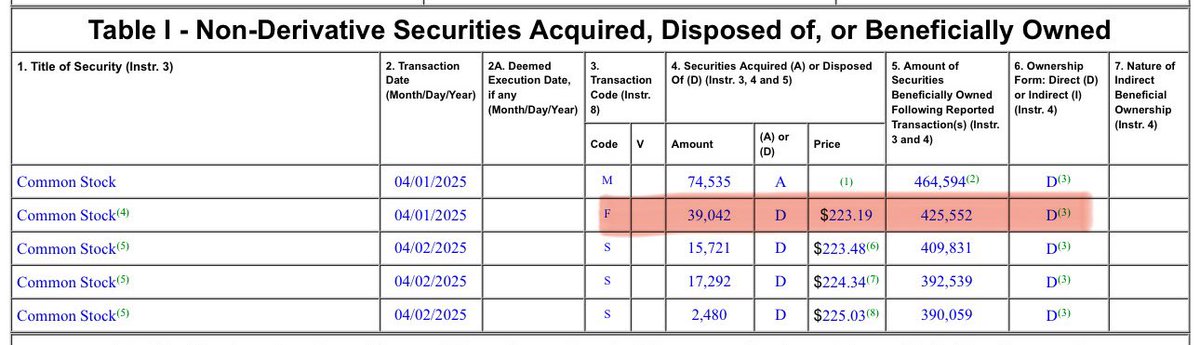

TIL that you can pay taxes on vested securities/equities directly with that security

Code F on Form 4

Insider Trading Before Tariffs

If you're curious about how insiders were buying/selling their equity positions, head over to @SECGov's EDGAR & check for Form 4 & 3 filings

Here's the latest one from $AAPL

🚨BREAKING: S&P 500 Fell to 2021 Prices

#SPX futures / #US500 is down almost 5% since open

≈4 years of gains have been lost

🇷🇺 #MOEX down 22% since Feb

Expect it to bounce back very soon - as capital is moved away from USA & USD into alt currencies, which includes Ruble

Once the sanctions against Russia are dropped - that's where Moscow Exchange Index will skyrocket 📈 http

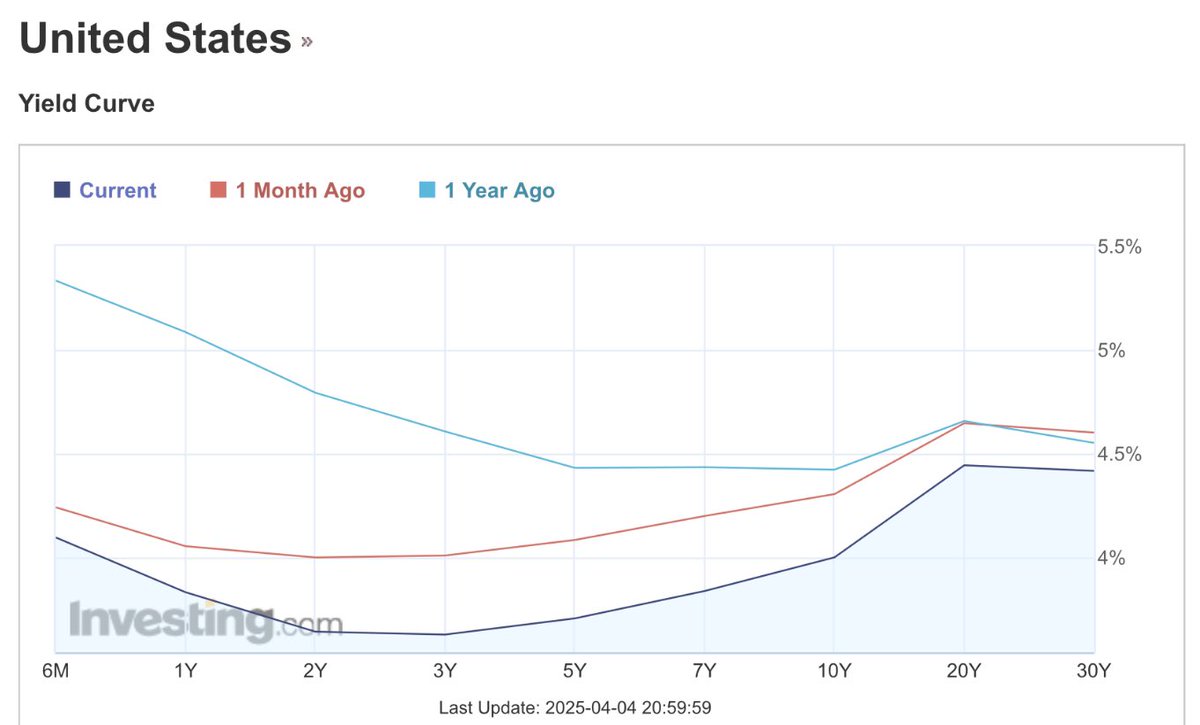

🚨 US Yield Curve UPDATE

Despite the falling $DXY, the yield curve is better (less inverted) than a 1y ago, but worse than 1 month ago

Expect a steeper inversion soon

This tariffs-induced volatility is the dream of every trader

Clearing houses are banking from fees & comissions

Finally, risky-assets/DeFi/crypto volatility coming to your favorite regulated exchange

What's even the point of all the regulations in TradFi?

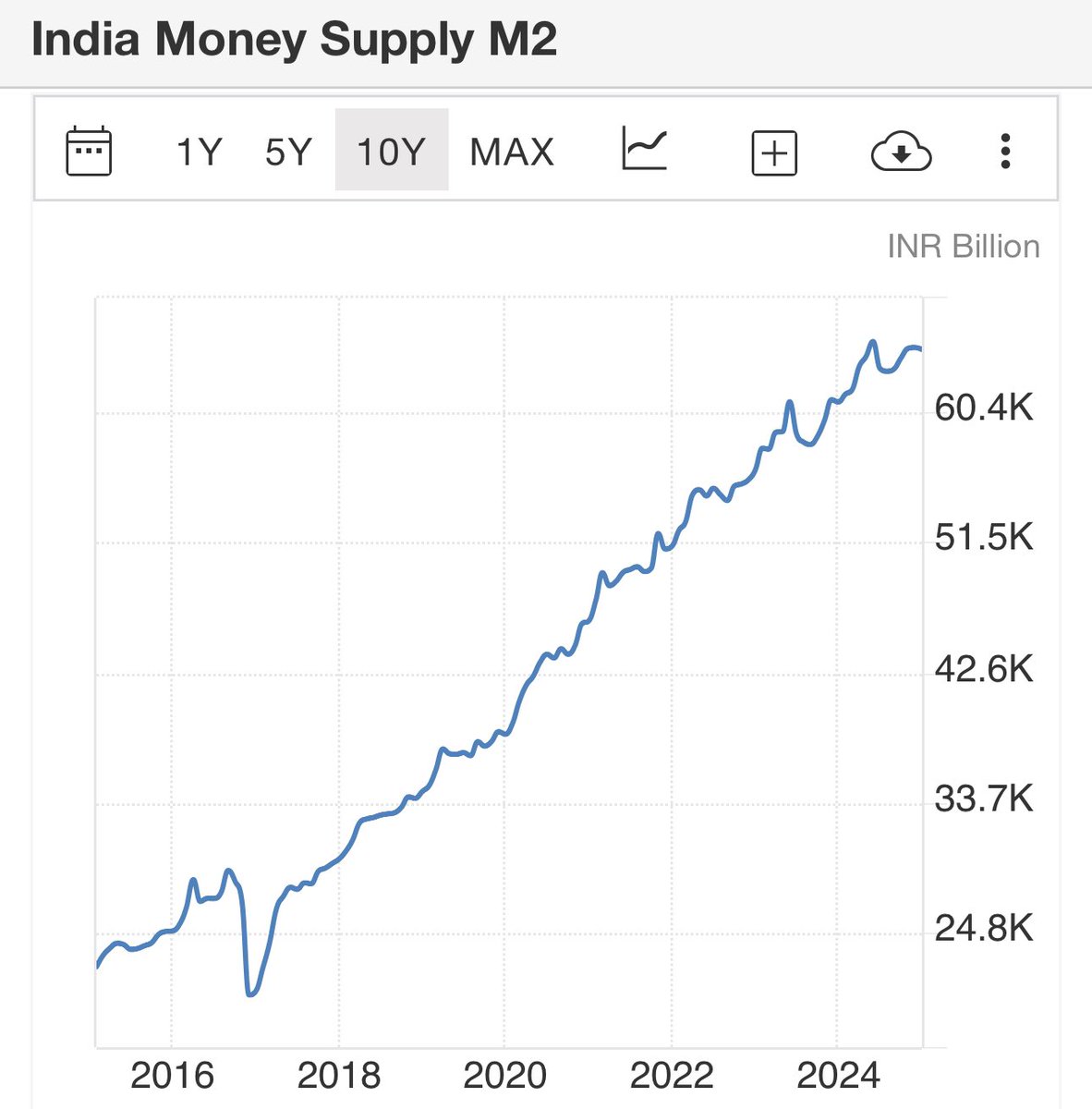

🇮🇳 Indian Rupee's M2 supply makes it even worse

Net importer + currency inflation is a recipe for depreciation and external dependence

🇧🇷🇷🇺🇮🇳🇨🇳🇿🇦 BRICS & Tariffs

Amid the collective chaos there is a group of nations set to benefit from President Trump's tariffs

HINT: it's not the USA ❌🇺🇸

BRICS got geopolitical justification for their existence

Tariff-free zone + local currency trade acts as insurance http

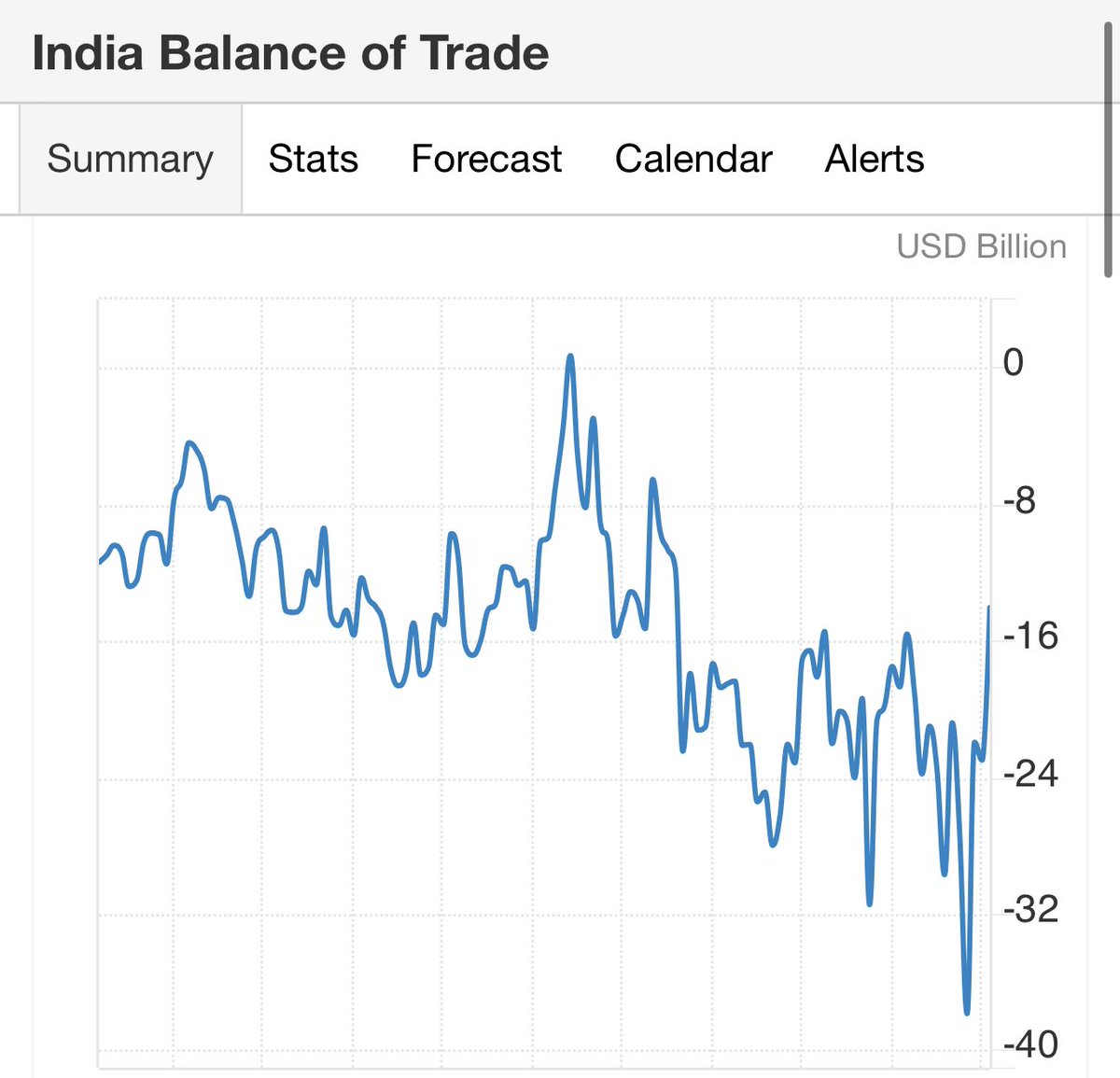

🇮🇳 India has accumulated a massive trade deficit

India imports from China, Russia & then exports to USA & UAE. The imports are also similar to exports & a lot of it is re-exports

This deficit isn't sustainable of course https://t.co

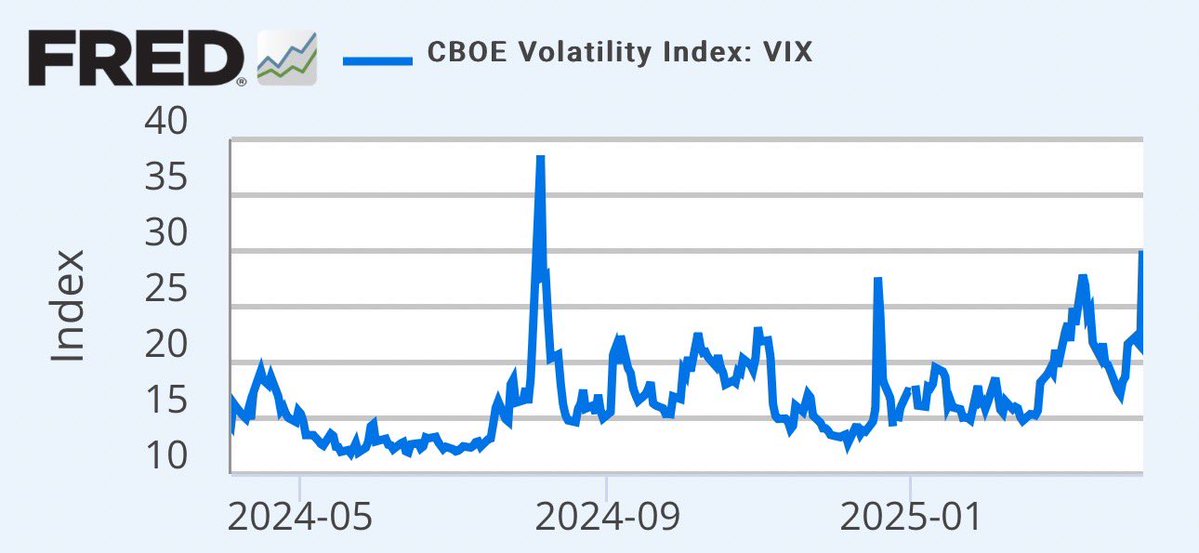

$VIX is a measure of expected volatility

It's computed from option prices. The price of the option is the insurance/premium that the option seller/short charges

So higher option price = protection against more volatility

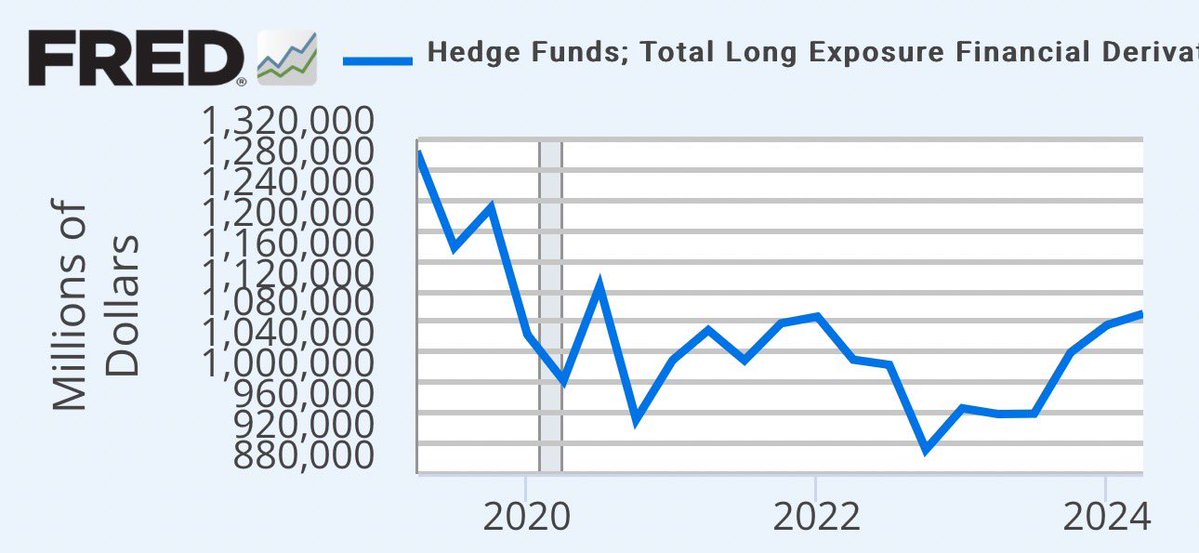

Institutional longs were just reaching 2022 levels at Q2 2024

How do you think Q2 2025 will look like?

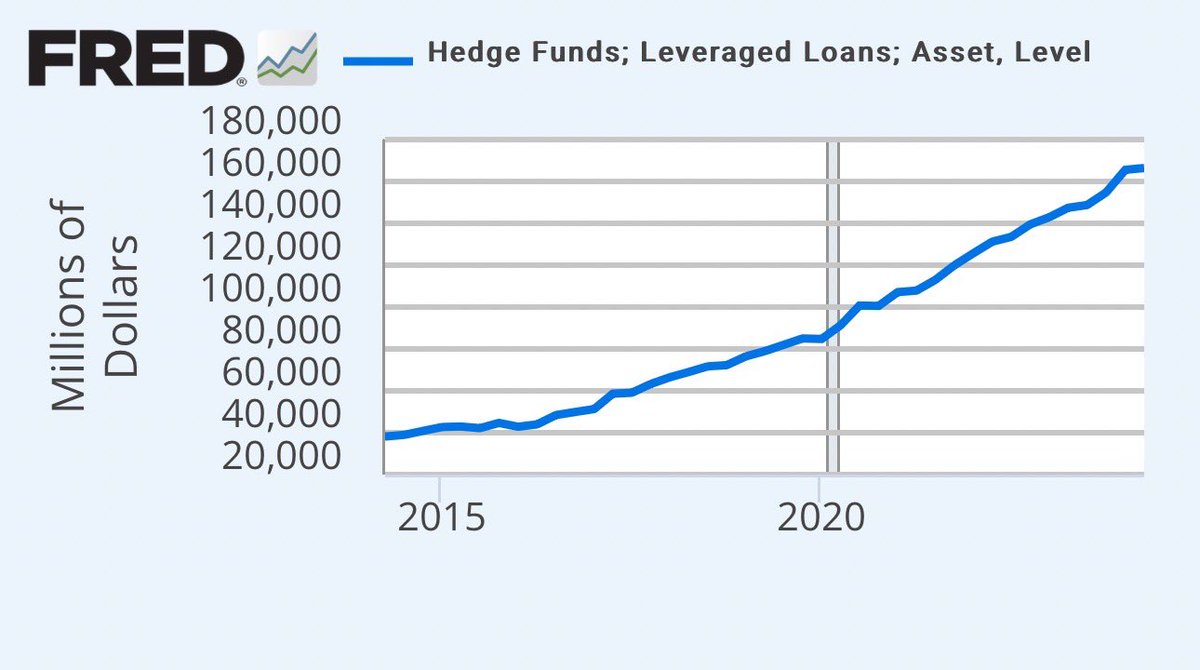

Hedge Funds & High-Risk Loans

Leveraged loans are loans issued to high debt/risk entities - akin to subprime loans

Tariffs will hurt solvency. Only way out is FED lowering interest rates, so the debt can be refinanced cheaper

Otherwise the house of cards falls

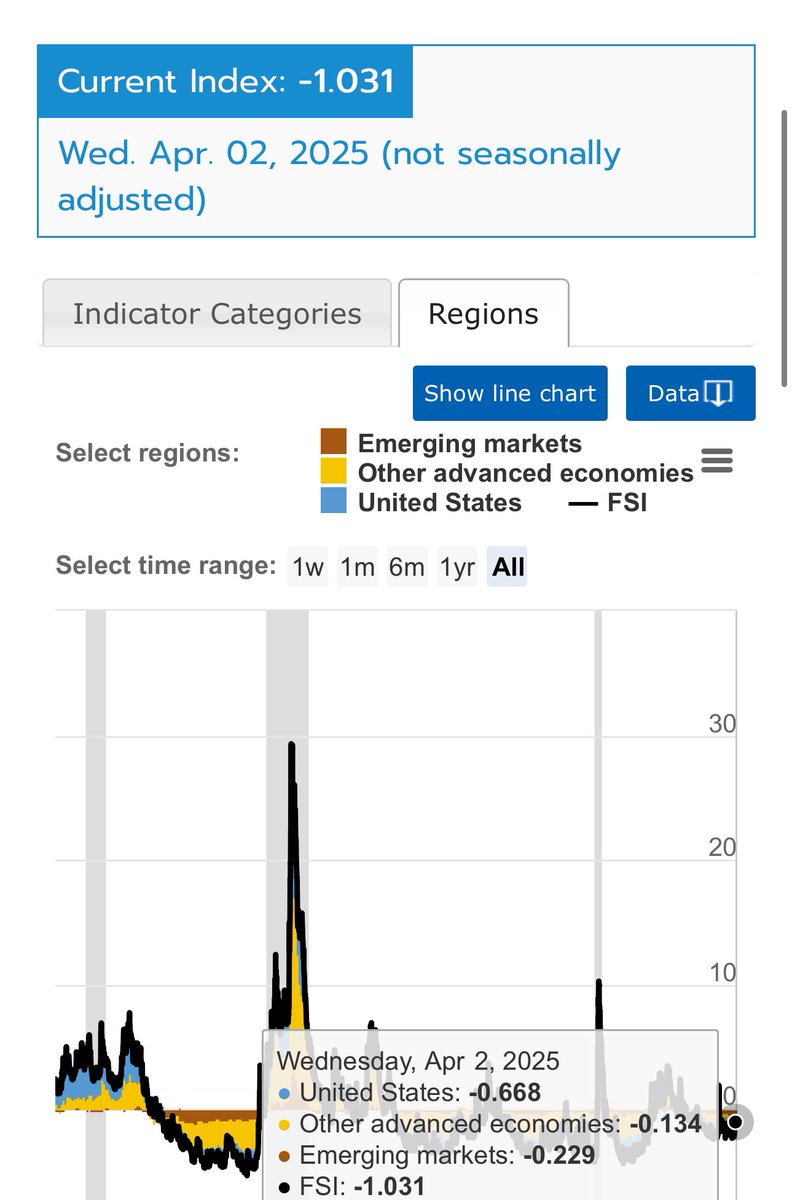

Financial Stress Index (FSI) UPDATE

as expected, the risk is increasing

Sustained volatility will drive the rest up

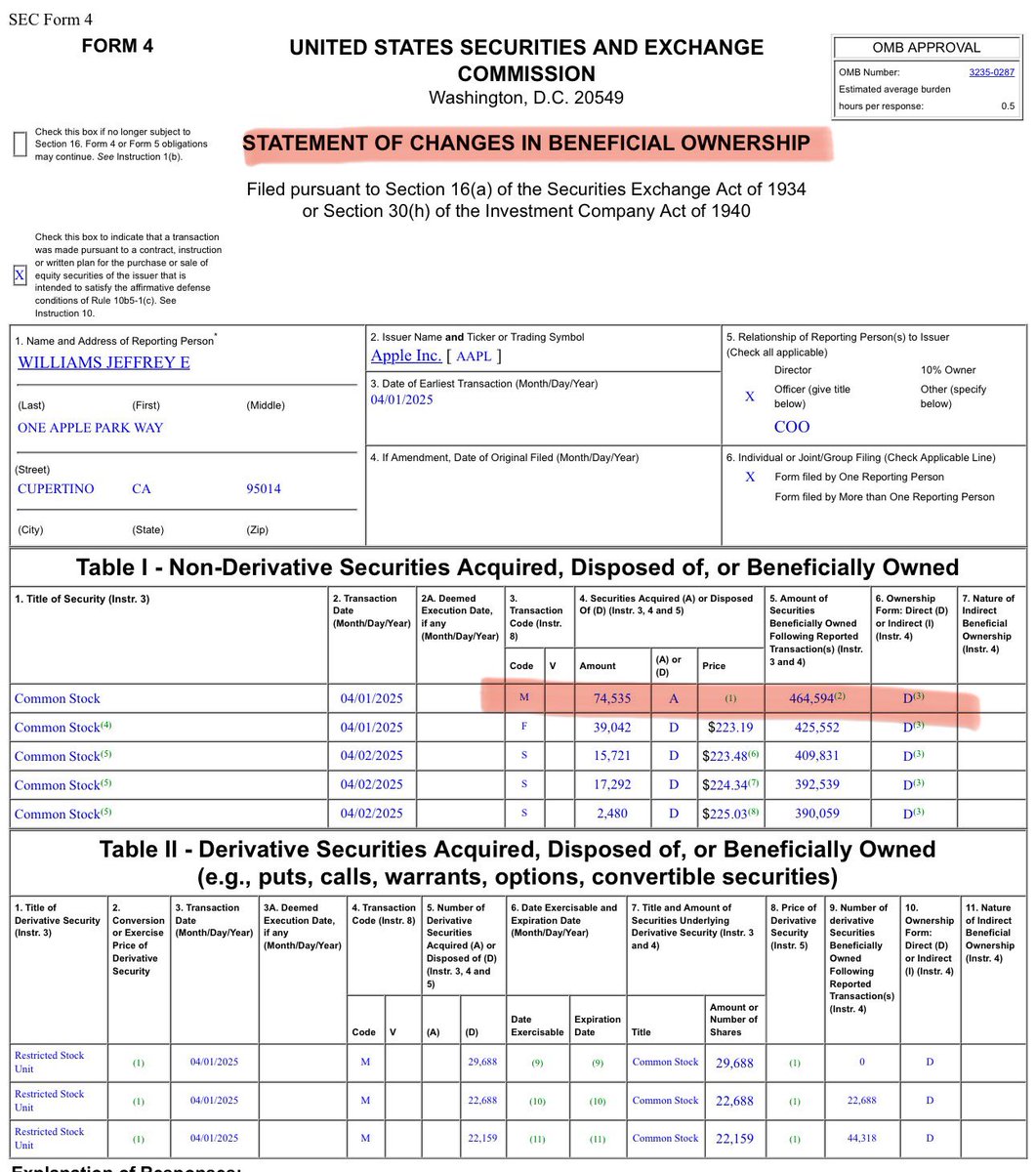

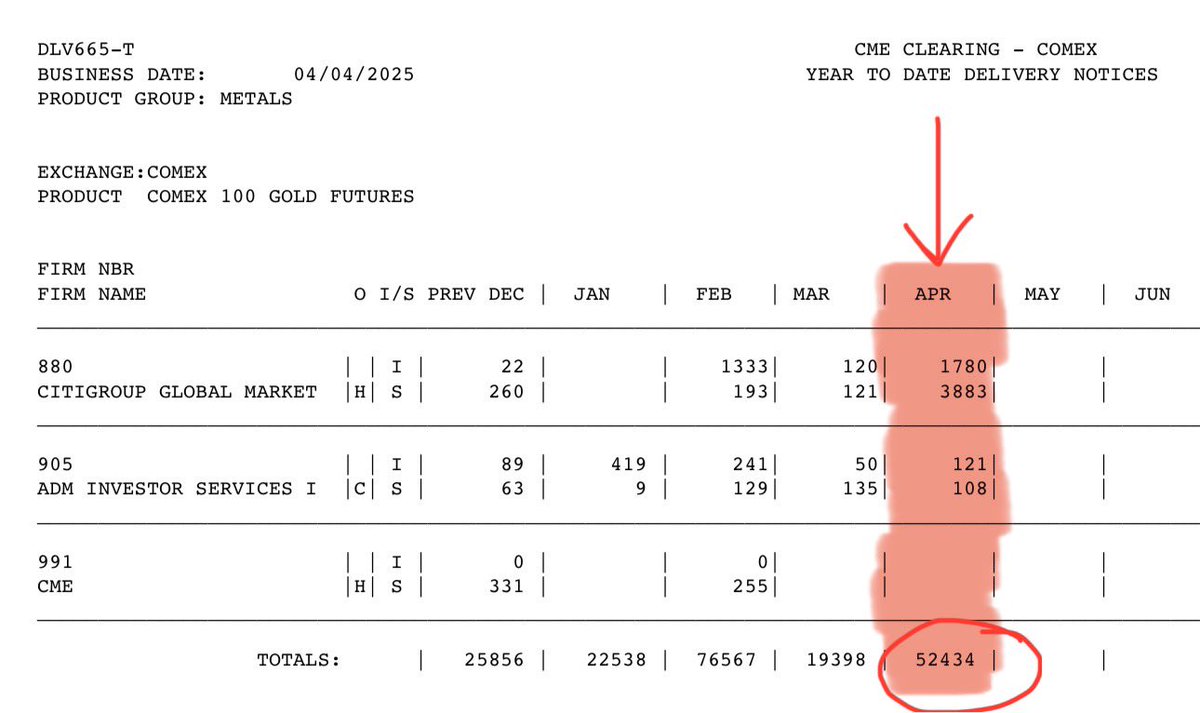

PHYSICAL GOLD RUSH

It's not just Central Banks anymore

In the first 4 days of April 2025, over 52K COMEX 100 Gold Futures contracts have been requested for physical delivery

Only 4 days in & it's already x2 of January interest

Physical gold in high demand

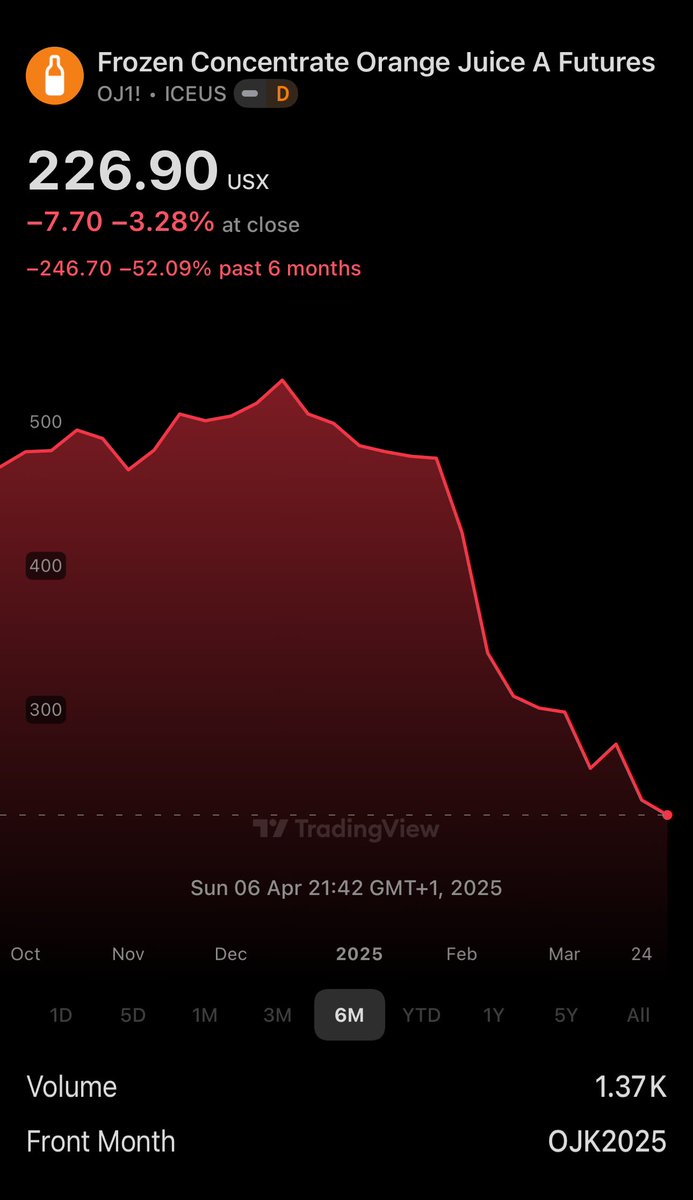

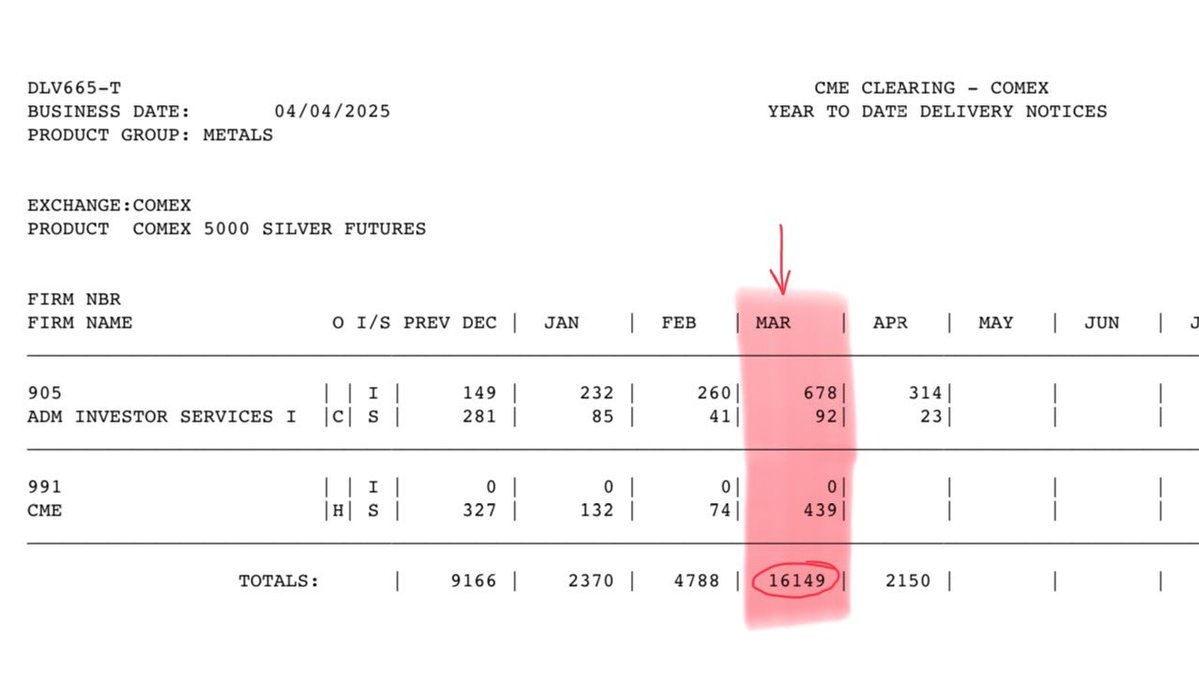

Silver Physcial Delivery Demand HIGH

CME's COMEX & NYMEX Metal Delivery Notices show a MASSIVE demand for physical silver

16.1K futures contract for delivery/physical settlement, up x3 from a year ago

A.K.A. tariffs effect on silver

Investors are HOARDING silver

Switzerland 2 year bond yield went negative

Swiss Frank appreciates against major currencies like #EUR & #USD, so investors accept lower (sometimes even negative!) yields

Massive demand for #CHF

Russian Ruble vs Euro

Past 6 months #RUB up against #EUR by 13%

Ruble is up 34% on Euro since January 2025 (YTD)

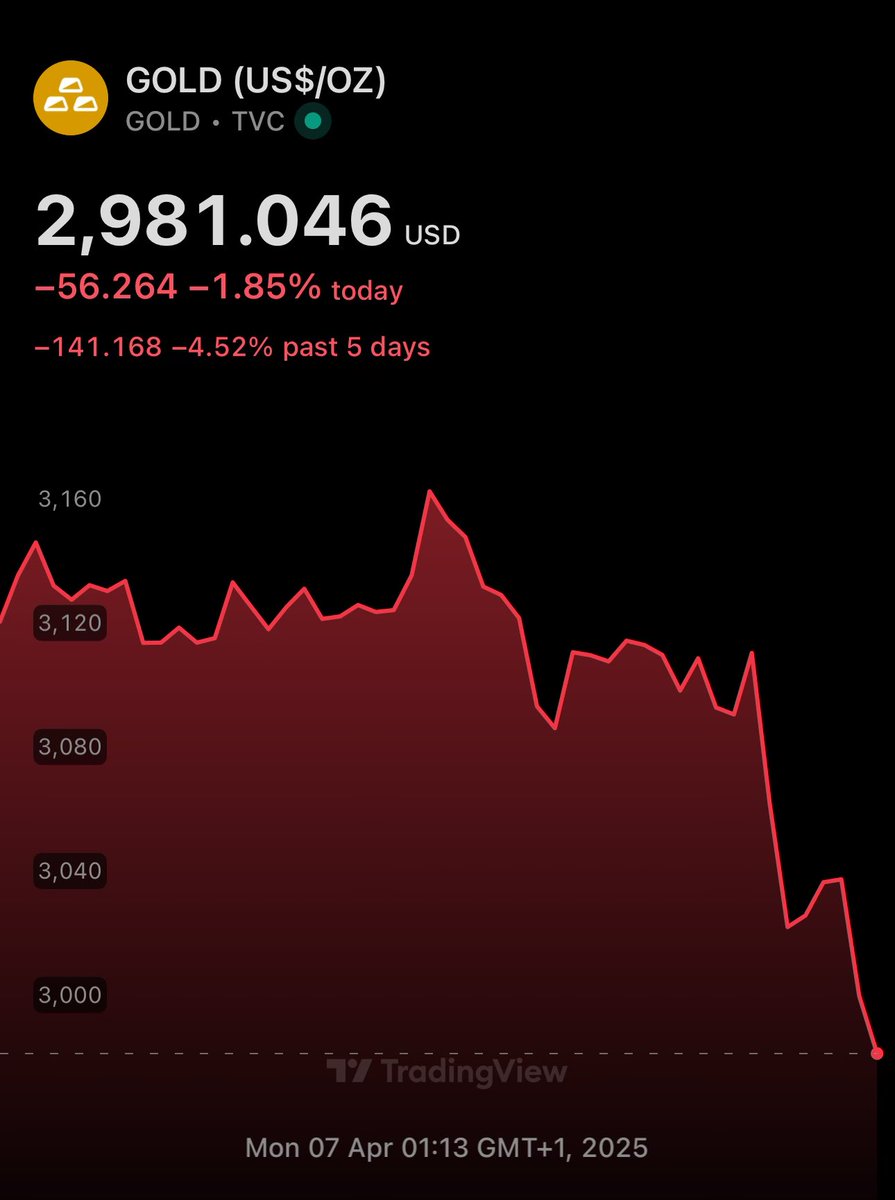

Silver back to August 2020 price

After a tariffs-induced pullback of 15% today, silver is now at start of COVID prices

So much inflation that still isn't priced in

It will recover. And a lot!

🤖 I asked Grok 3 why silver is down today

DeepSearch said that this is likely due to a stronger USD

But #DXY is also down 😂