⬇️ My Thoughts ⬇️

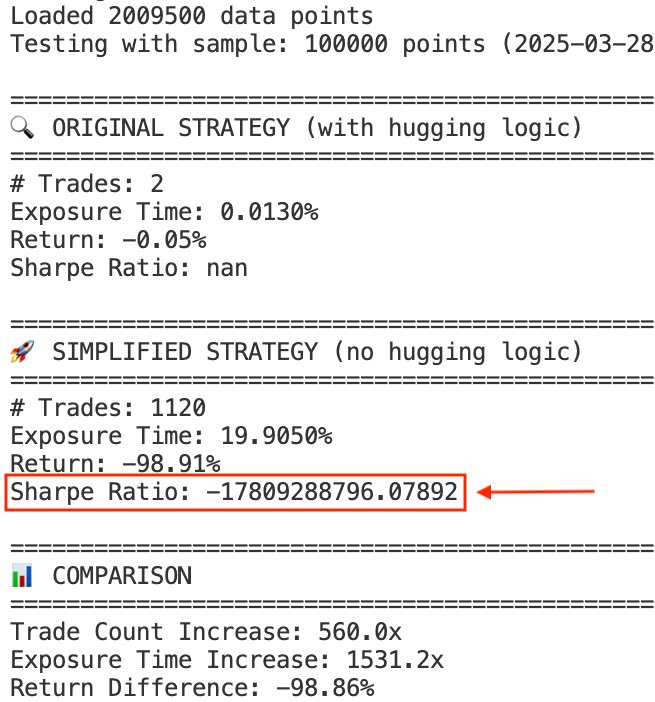

🤯👉 Quant trading secrets they don't want you to know

On the bright side - the Sharpe Ratio may soon underflow, thus turning it very positive

Still counts, right? 😂

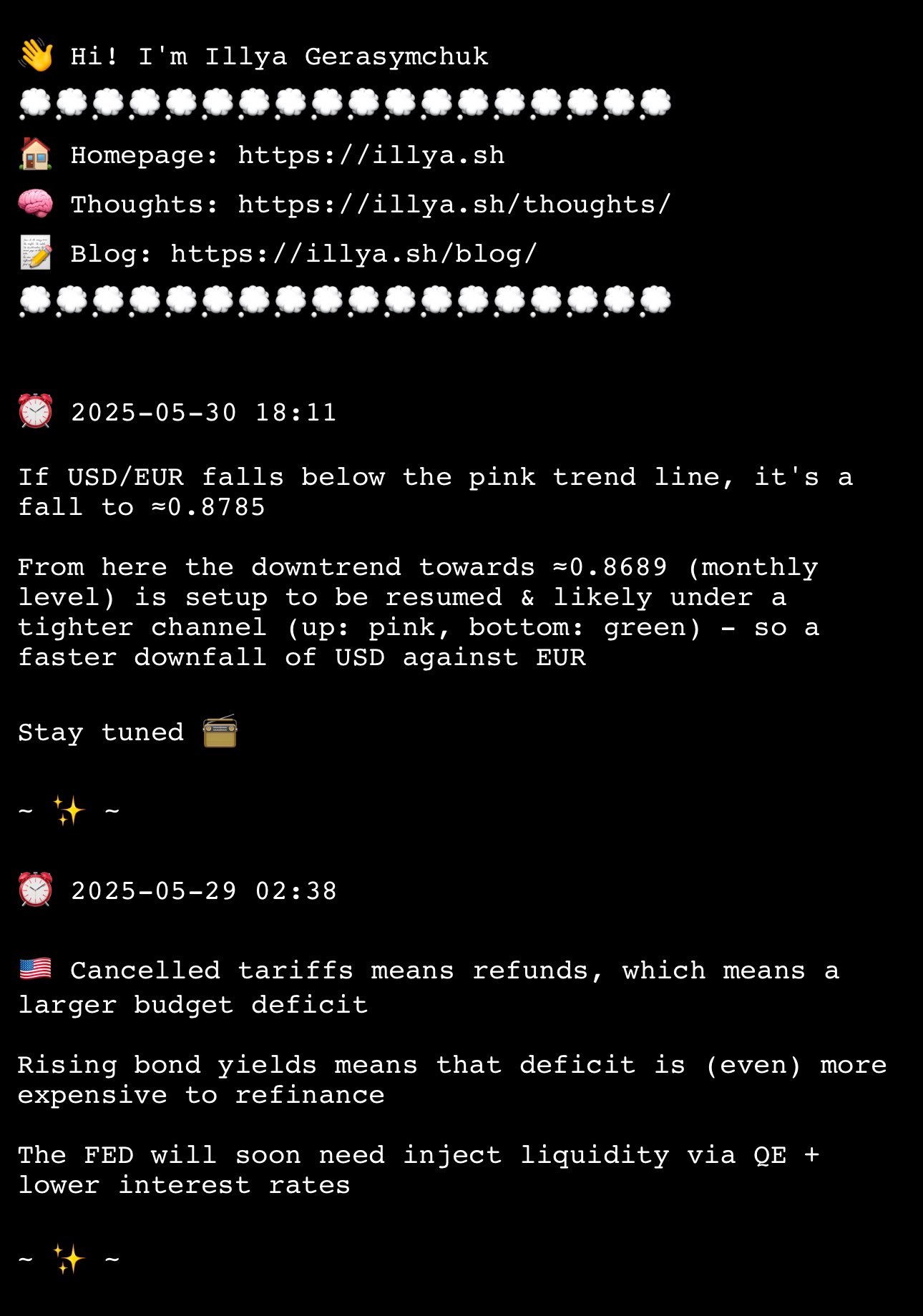

USD/EUR price action is developing exactly as described 😄

Once price went below the pink trend support line it fell through to 0.8785 exactly, before resuming a steeper downtrend after a failed breakout

🚀 .txt mirror for my X tweets/posts:

https://illya.sh/thoughts/thoughts.txt

TL;DR:

👉 plaintext version of my thoughts/tweets

👉 accessible on every device - even smart watch & IoT

👉 LLM-friendly format

👉 UTF-8 encoded text with emojis

UI looks like this:

If USD/EUR falls below the pink trend line, it's a fall to ≈0.8785

From here the downtrend towards ≈0.8689 (monthly level) is setup to be resumed & likely under a tighter channel (up: pink, bottom: green) - so a faster downfall of USD against EUR

Stay tuned 📻

🇺🇸 Cancelled tariffs means refunds, which means a larger budget deficit

Rising bond yields means that deficit is (even) more expensive to refinance

The FED will soon need inject liquidity via QE + lower interest rates

90% of all newly issued debt is for refinancing of existing debt, not new debt/financing

Thus, new debt is extremely inflationary & asset bubble-nurturing

The financial system is extremely leveraged at a high risk

We need to fix this. DeFi is the tool

Michael Saylor doesn't need to expose MSTR's wallets for a proof of reserves

All you need is Zero Knowledge Proof attesting that MicroStrategy has access to private key(s) holding a total of X BTC

With ZKPs - no Bitcoin addresses are exposed ✨

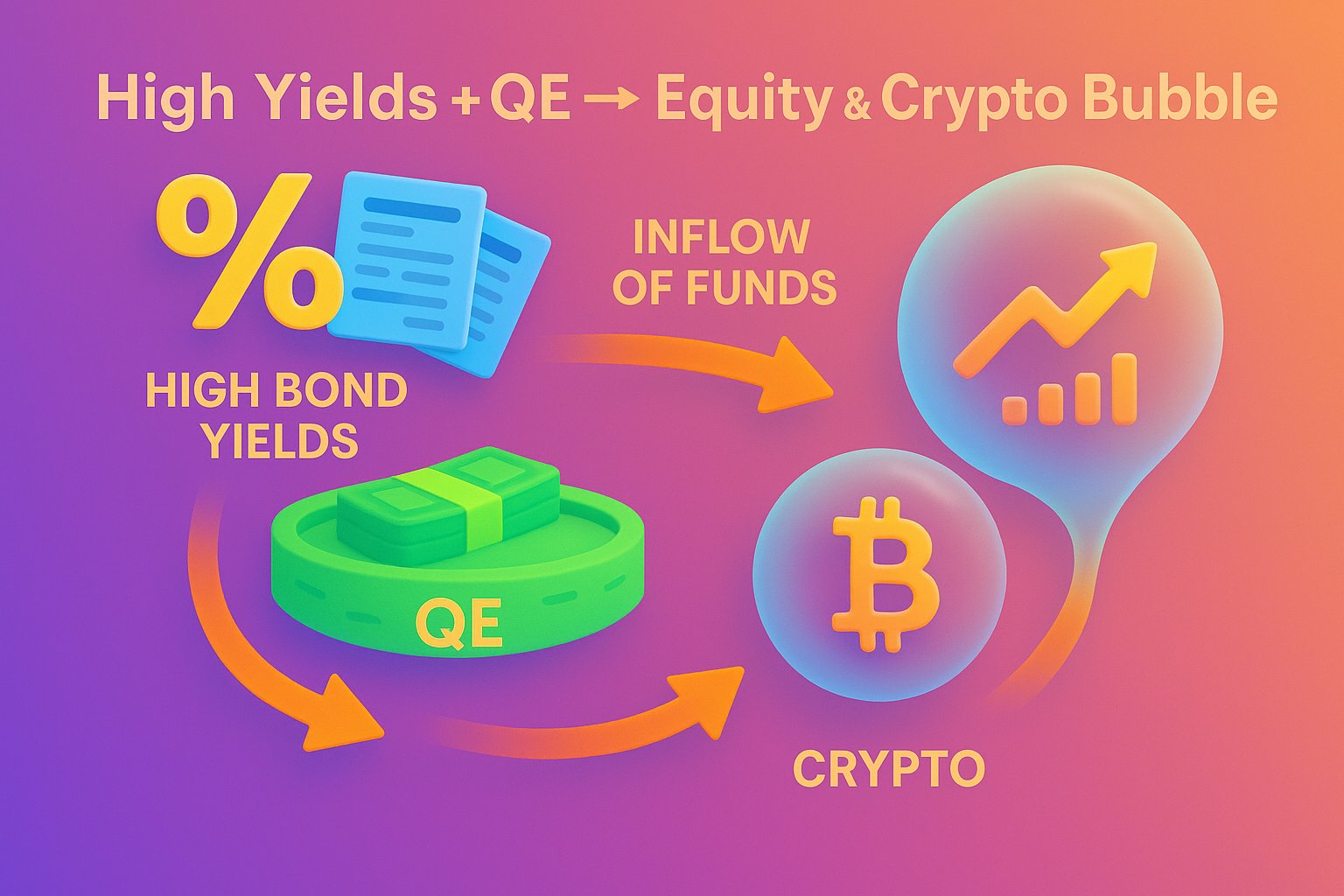

Sustained high bond yields combined with QE will lead to an inflation of equity and risk asset prices

Here's how 👇

1️⃣ High yields = high required base return

2️⃣ Inflow of QE funds into equities & crypto

3️⃣ Equities & cryptocurrency prices increase

Further fuel for the bubble

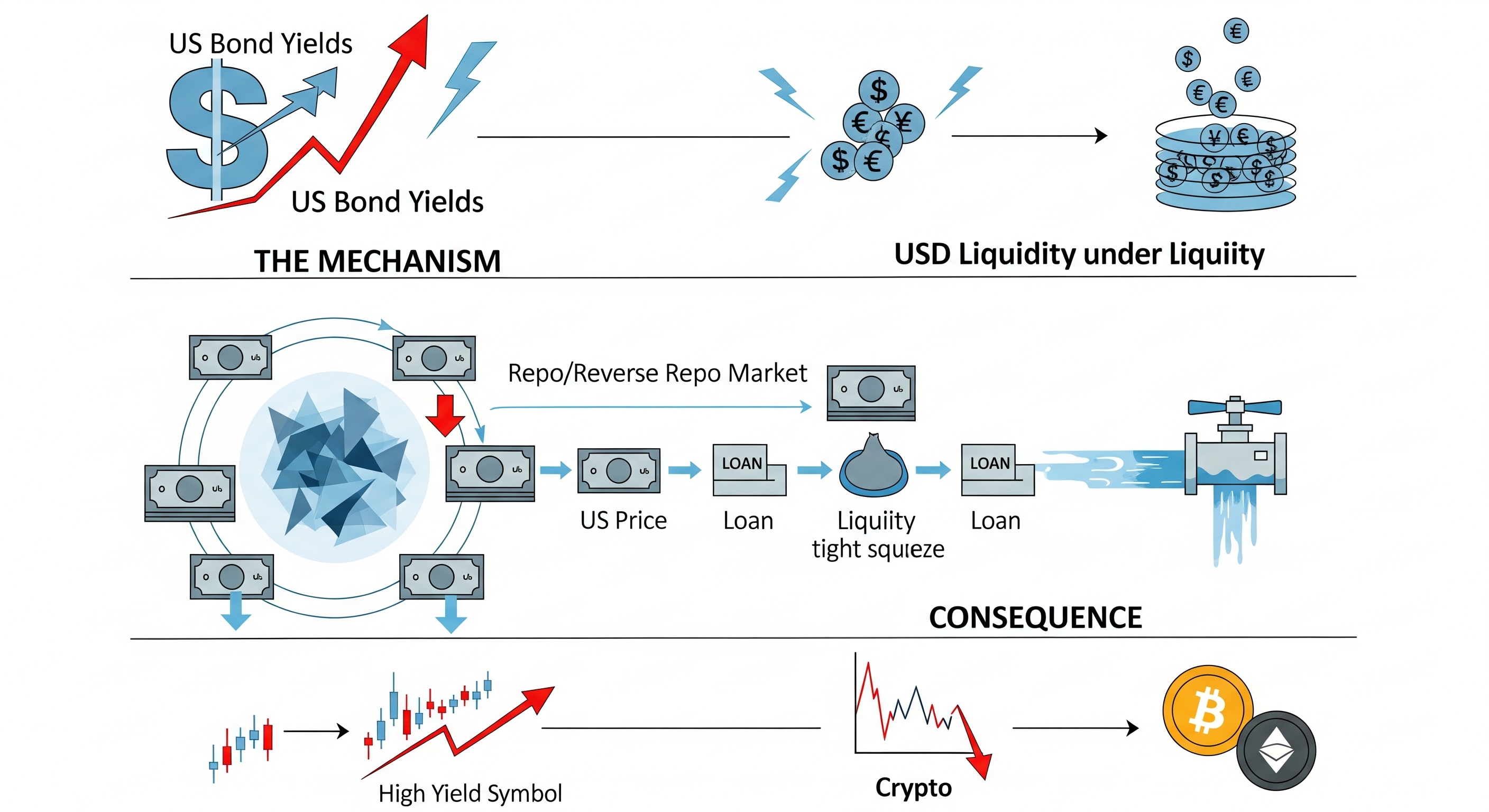

⚡️ US Bond yields directly affect USD liquidity

Here's how 👇

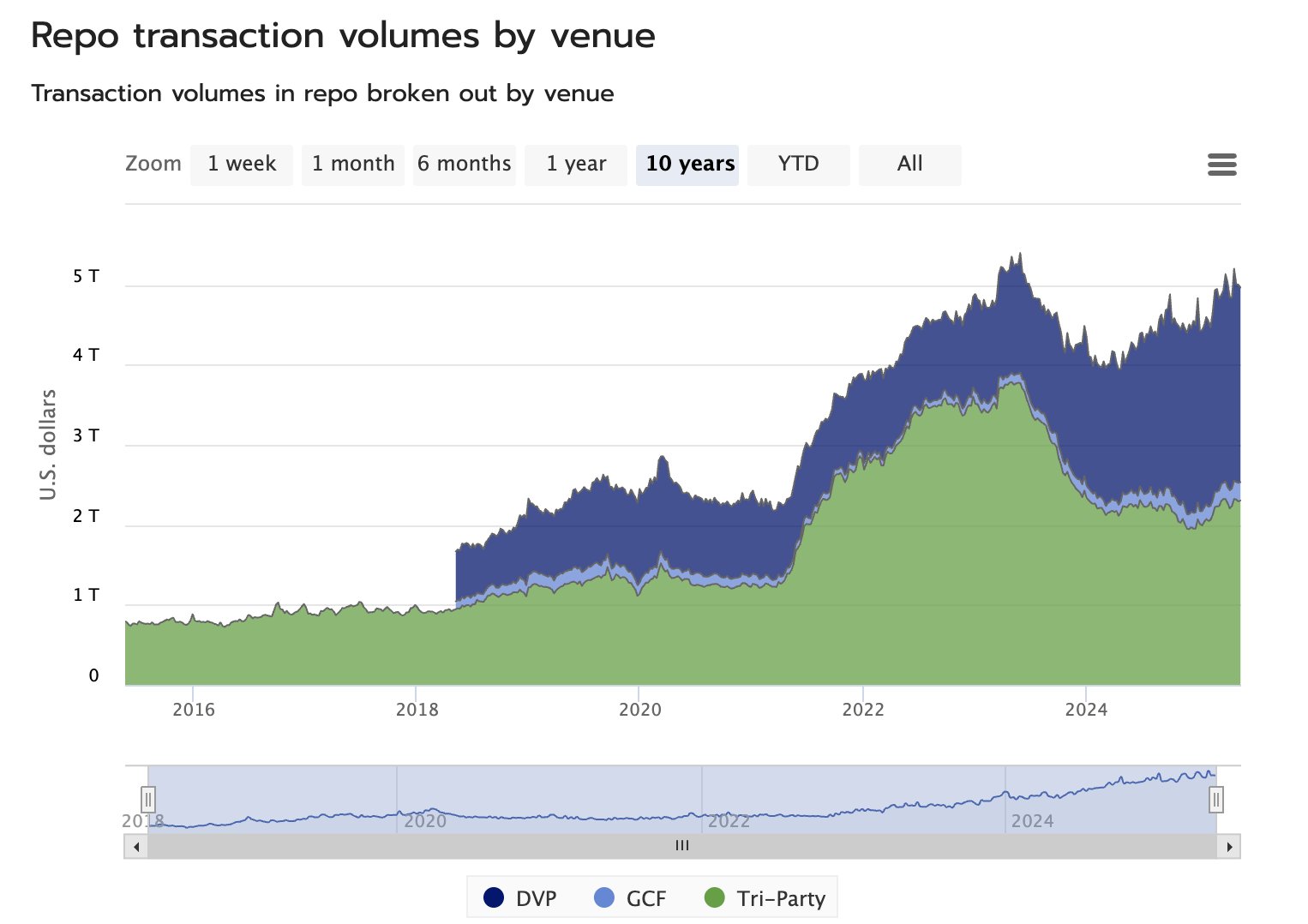

1️⃣ Repo + reverse repo market provides $5 trillion of liquidity

2️⃣ US bonds represent ≈70% of collateral

3️⃣ Lower bond prices means smaller loans, leading to a liquidity squeeze

🏦 Quantitative Easing (QE) by a Central Bank (CB) increase both - its assets & liabilities

👇

QE = CB buys securities from commercial banks

👆

This involves:

1️⃣ Transfer of securities to CB (asset UP)

2️⃣ Credit the bank's reserve account (liability UP)

👉 M2 Supply ≠ Liquidity 👈

M2 is only a part of the total liquidity

🔎 Here's an example:

Repurchase agreements market adds ≈$17T in the form of security-backed short-term credit, thus increasing available currency

M2 does not account for the repo market

⚡️ Crypto market cap down 2.6% today

Explains the overall pullback across prices. Some went into gold & bonds (yields are down today)

Could head a little lower - but definitely temporary. Expect inflows/increase soon

🚀📚 Learn ANYTHING with AI fast:

1️⃣ Screenshot what you don't understand (e.g. book page)

2️⃣ Open ChatGPT*, attach screenshot & dictate your question - no matter how vague/unclear it is

3️⃣ Recurse & iterate until you understand

Always validate your understanding

* any LLM

Gold is having its 'calm before the storm' moment 😄

New all time high is coming very soon to all markets close to you

Of course - context is always needed

In 2002 Fed Funds Rate was x3 smaller

At that time, rates were higher overall

To find rates as small as in 2002, you'd need to go back to the 1960's 😳

For 15 years now, US had effectively been under QE financing - cheap debt

🏦🫧

🤯 The year is 2002…

US bond yields are at the same high levels as they were in 2002… That's 23 years ago

In 2002 US national debt was x6 SMALLER than now

5.1% now is not the same as 5.1% before - it's worse. Much more debt to refinance & pay interest

Who's ready for a new gold ATH? 🙋

You don't have to guess - just look at the systemic raising bond yields across all maturities & multiple sovereigns

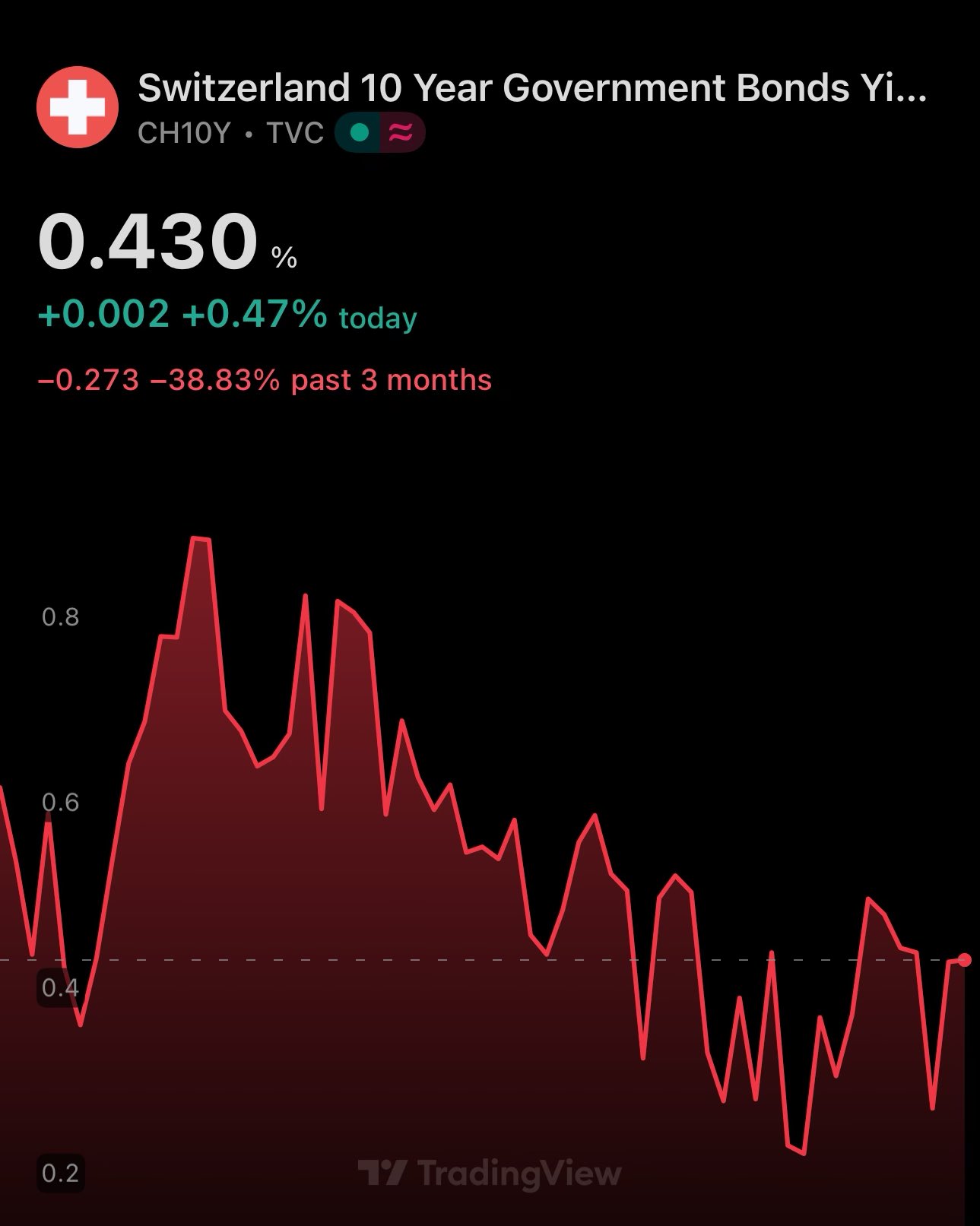

🇨🇭Not all European bonds are crashing

The yields on the 10 year Swiss bond is actually down ≈40% over the past 3 months, although up ≈12% over 6 months

🚨🇺🇸 30Y bond yield is up 132 bp in 1h

30 year US bond is not only trading above 5%, but had its price fall by ≈1.34% in the short span of 60 minutes

And you thought crypto & meme coins were volatile 😂

A month ago me and Gemini 2.5 Pro Deep Research had a disagreement

🇯🇵 Gemini said Japan will continue with QT, while I think they will be back to QE soon

With Japanese bond yields at ATHs - which one of the scenarios do you find more likely? 😁

🇺🇸 US bond yields are at their ≈2006 levels

🏦 Current FED Funds rate is about the same as it was in '06

💰 The US Dollar Index is significantly higher today than in '06

High volatility in the bond market became a norm. Volatility & risk go hand-in-hand

Concerning!

🚀 Updated My Thoughts Section

Now, each thought has:

👉 A unique shareable page/link

👉 OpenGraph images with the exact text of the thought

So you don't even need to open the page when reading the thought - it's in the link's preview

Example: