⬇️ My Thoughts ⬇️

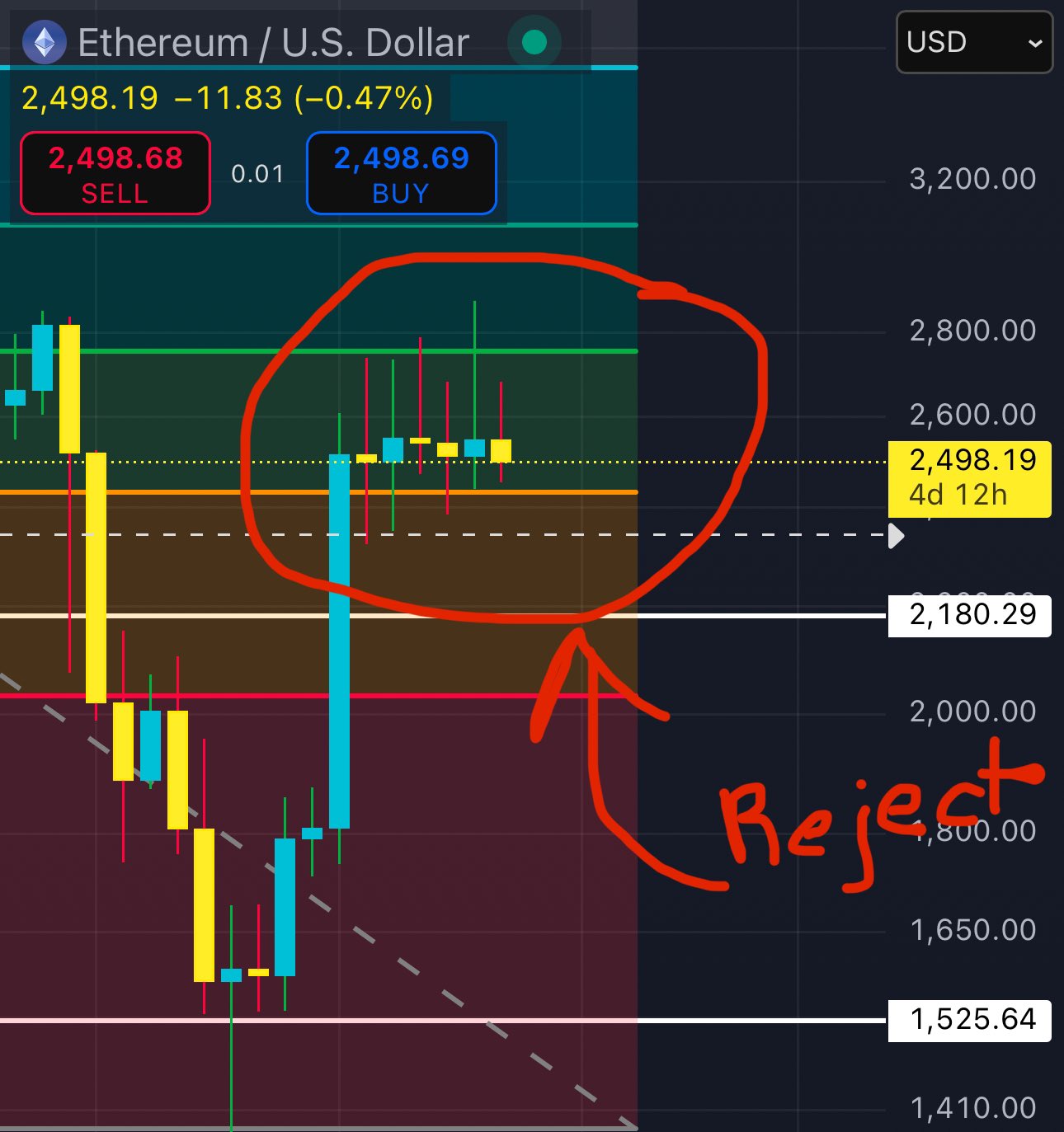

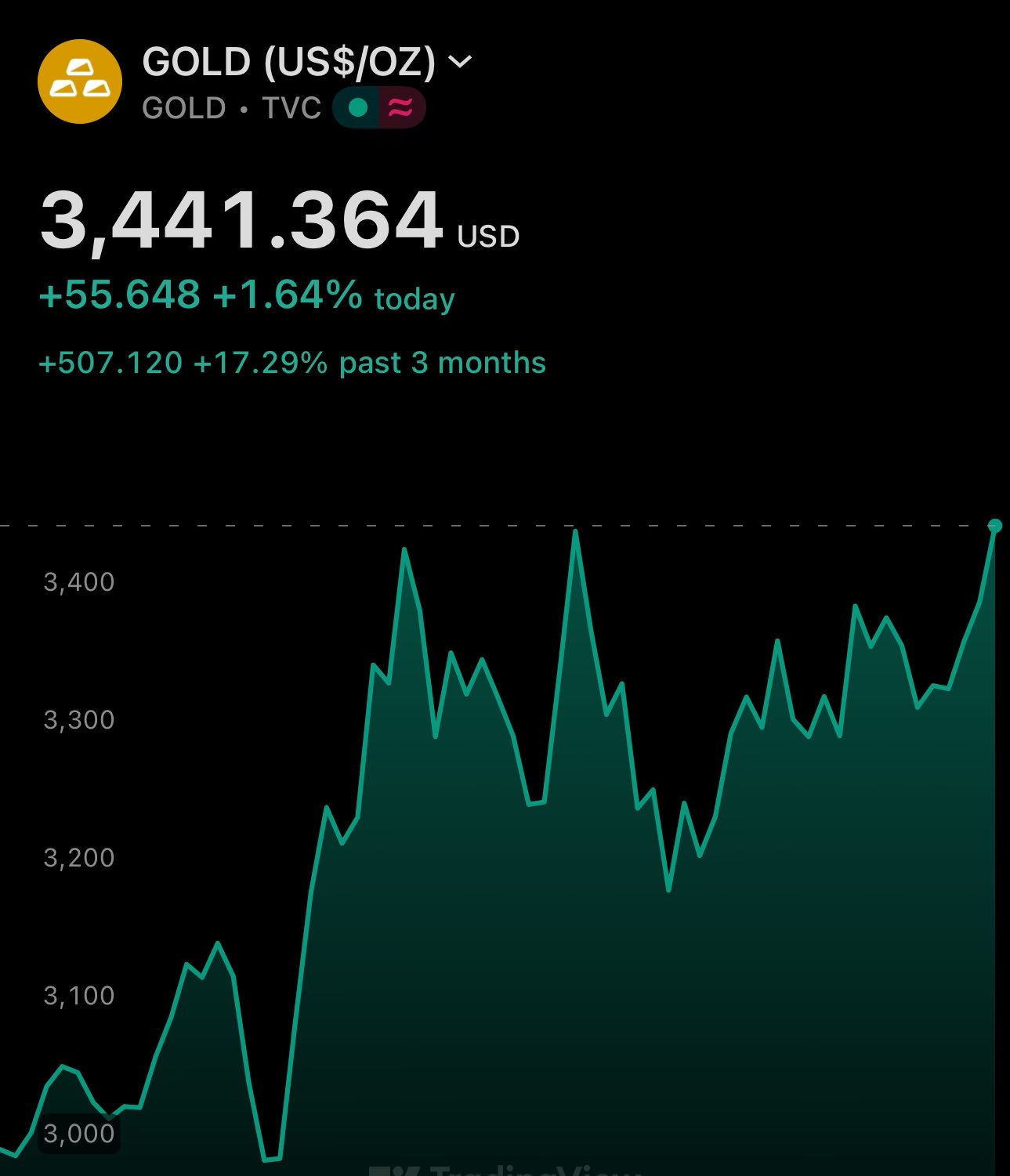

🎯 Ethereum heading down towards $2180

exactly as I've been writing for several days

so many accounts with huge following were promising you an immediate bull run

now you know which ones you can mute 😄

FYI the new BRICS banknote that has been circulating on social media today is NOT real

it's merely symbolic - NOT legal tender

before a joint currency, there will still be more bilateral trade in local currencies

unless those notes were to tokenize gold

🎯 Ethereum fell below $2500

first part of my thesis has already played out - a retracement instead of a breakout

weekly candles show constant rejection

now await for what comes next ⏰

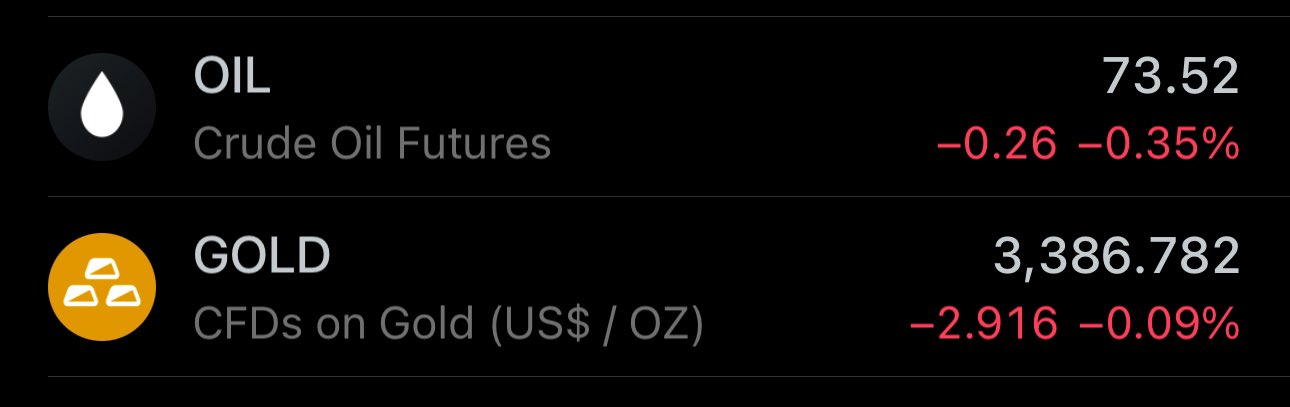

everybody has been so focused on oil price, that they largely ignored the decrease in US bond yields across the curve

this trend has been consistent throughout the month

interpretation 🧠:

short-term sign of run to safety, specially when combined with gold price

🛢️ Crude oil back above $72 per barrel

Just as I wrote yesterday

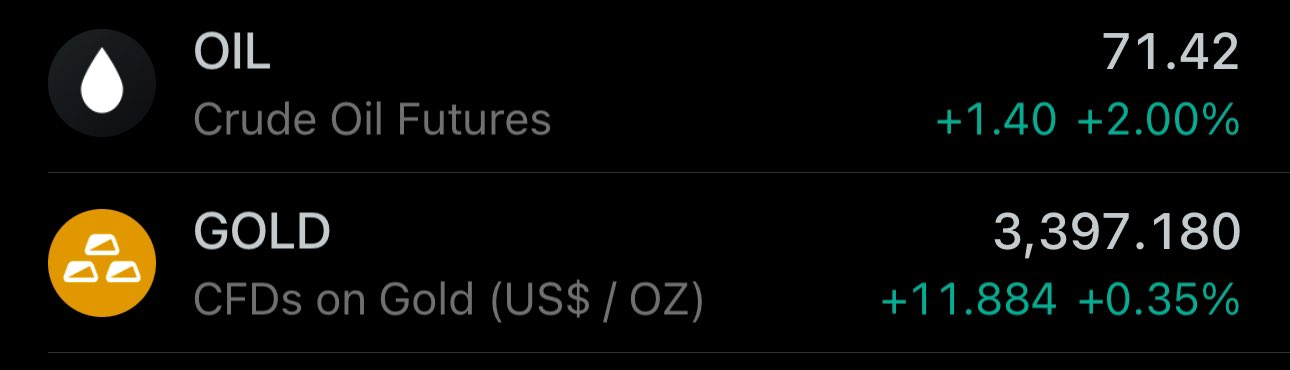

Oil & Gold back on the rise

Just as I wrote earlier today

aaand crude oil futures are back above $70

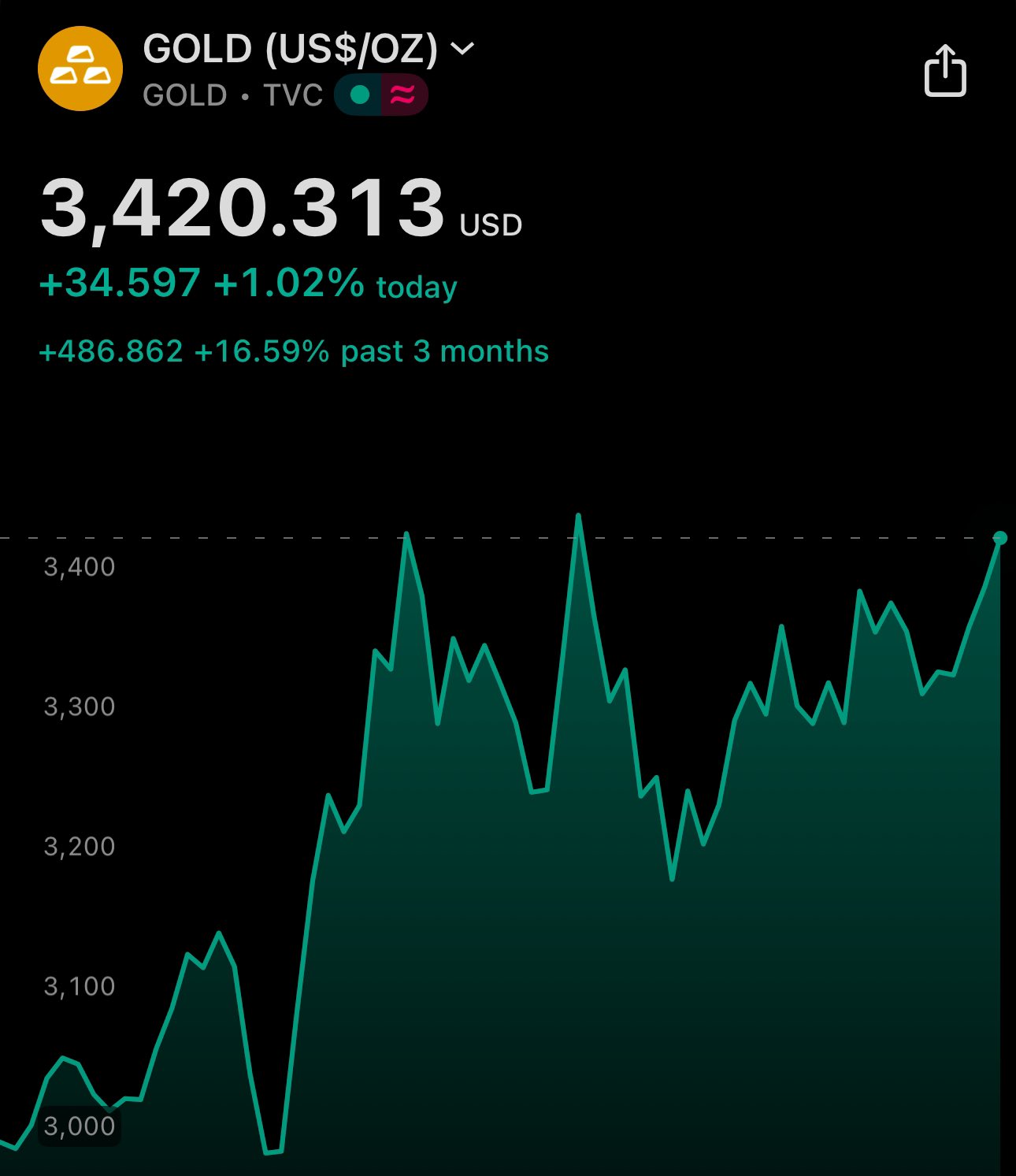

BTW I soon realized this wasn't an actual ATH for gold yet - but it is coming

The historical chart is showing closing prices, not maximum

So I inadvertently compared current price with closing historical price

Good news - more time for you to accumulate gold before new ATH 😄

💾⏰ Just like with my post about the price of gold a few months ago - feel free to save & set a reminder for this one

The prediction will be correct once again

Shekel is headed down - to sub 4₪/€

Inflation will be a huge problem soon as well

There's always gold 🤷♀️

'The market is never wrong'

A lot of big accounts posting about how the market knows everything & prices accordingly - even before the official news

Okay.

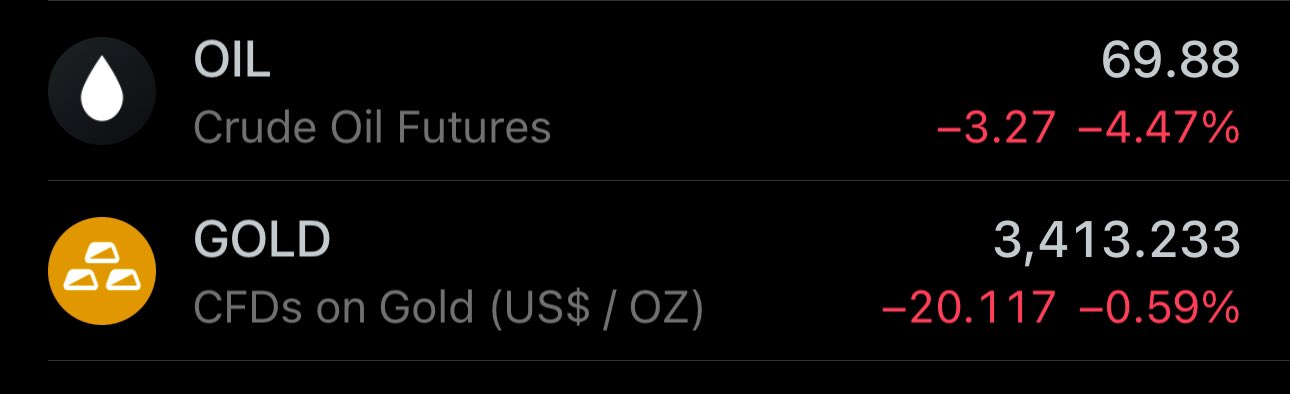

Now wait & watch crude oil & gold raise up even more in price very soon

This isn't a joke

While Ethereum has built a strong-ish support in the current area, it currently looks more likely to fall towards the ≈$2180 monthly support

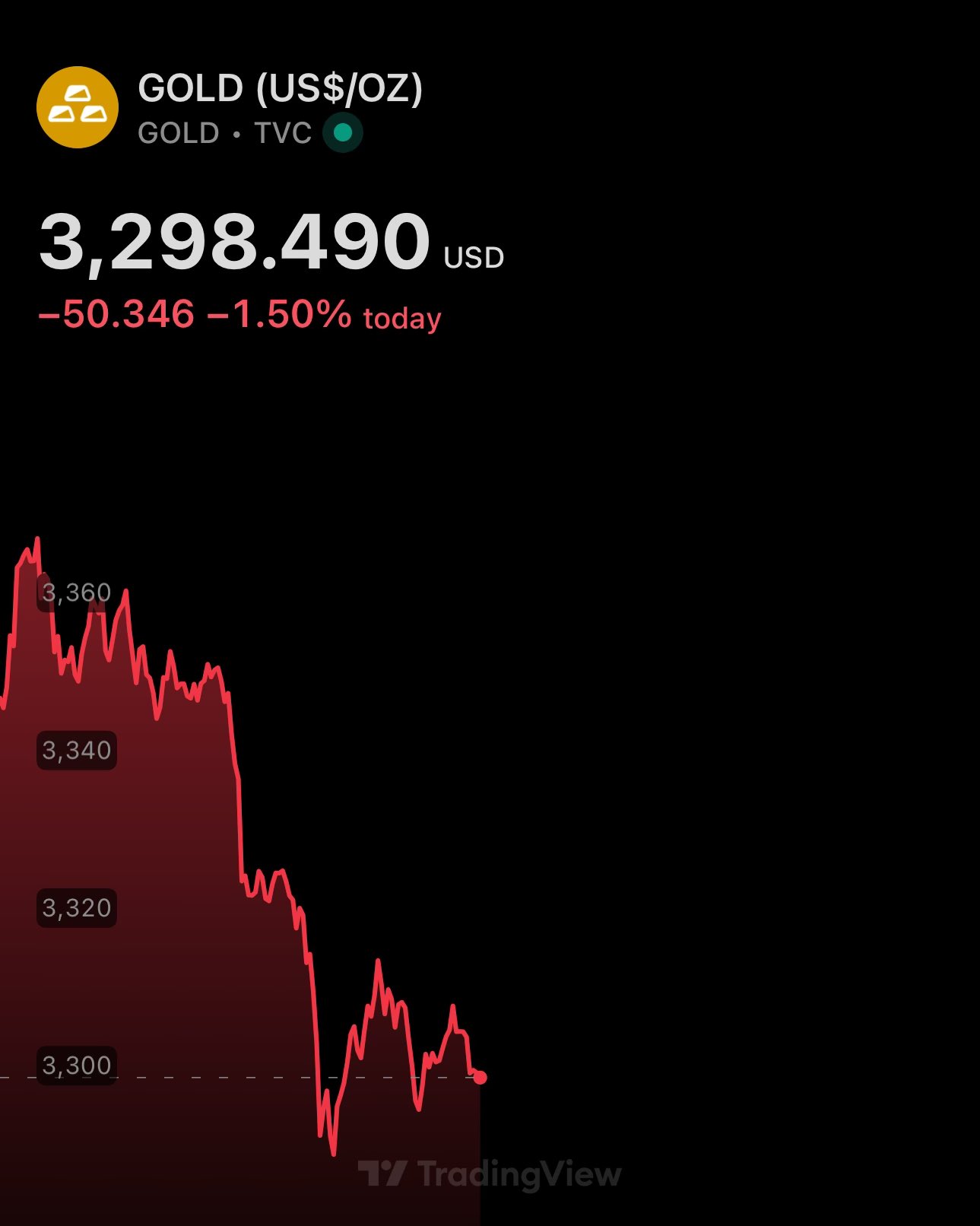

Do not underestimate what the new all time highs in gold are telling you

Falling US Dollar index played out exactly as expected

2 months later and it's down another full point

Interestingly, the yields on US bonds are up across the yield curve - for both, short & long-term maturities

The market - understandably - associated gold, rather than government debt with safety

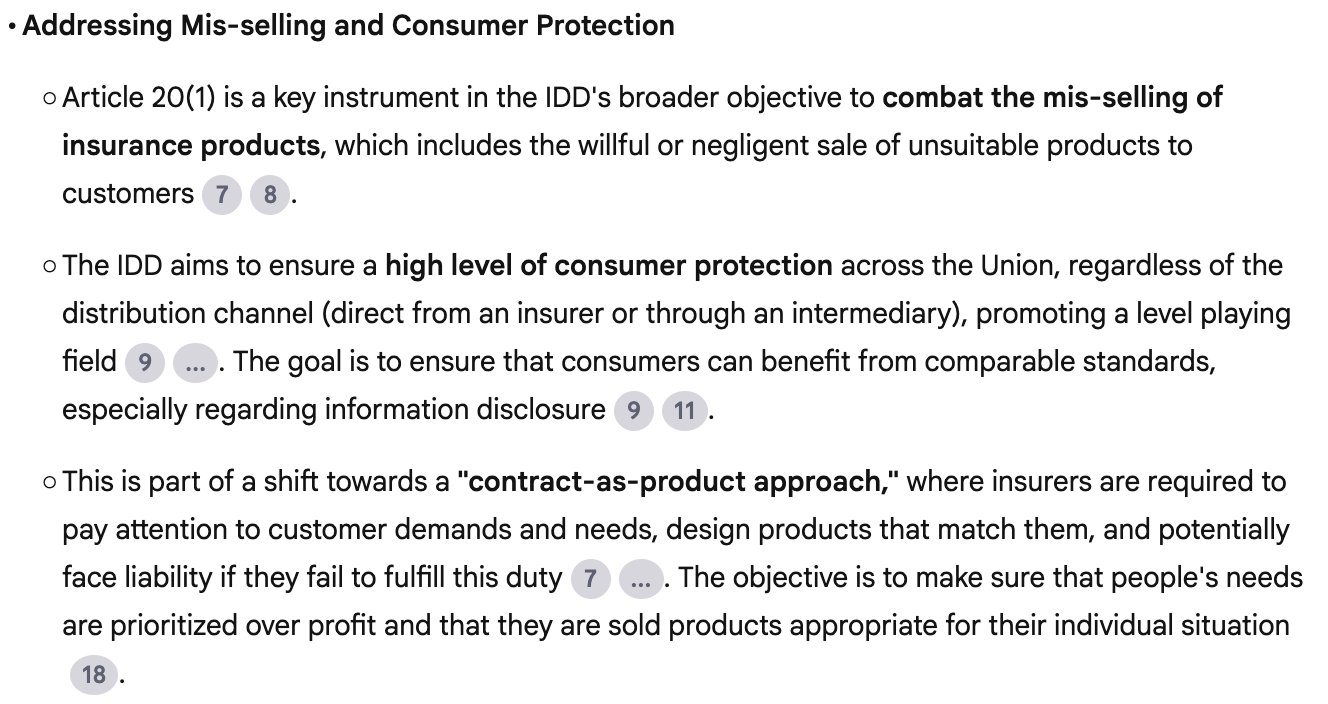

🤯 Gold may just go straight to $3500 in the next few hours

Look at this 15-minute timeframe momentum ⬇️

🚀📈 NEW Gold ATH is in - $3440 per oz

I've been warning about this for a while

You had a little over a month since my original post to load up

I hope you used the earlier advice to prepare for a new gold ATH

The turn around the corner has begun

As expected - 3 months was all that crude oil needed to spike back up

Other commodities like gold, silver & others are up since as well

While Gold & Oil are up, Ethereum and Bitcoin are down

As expected. A practical reminder that BTC, ETH & altcoins are NOT reserve assets

I am big believer in crypto & DeFi - but it's important to remain rational, even if you are entertained

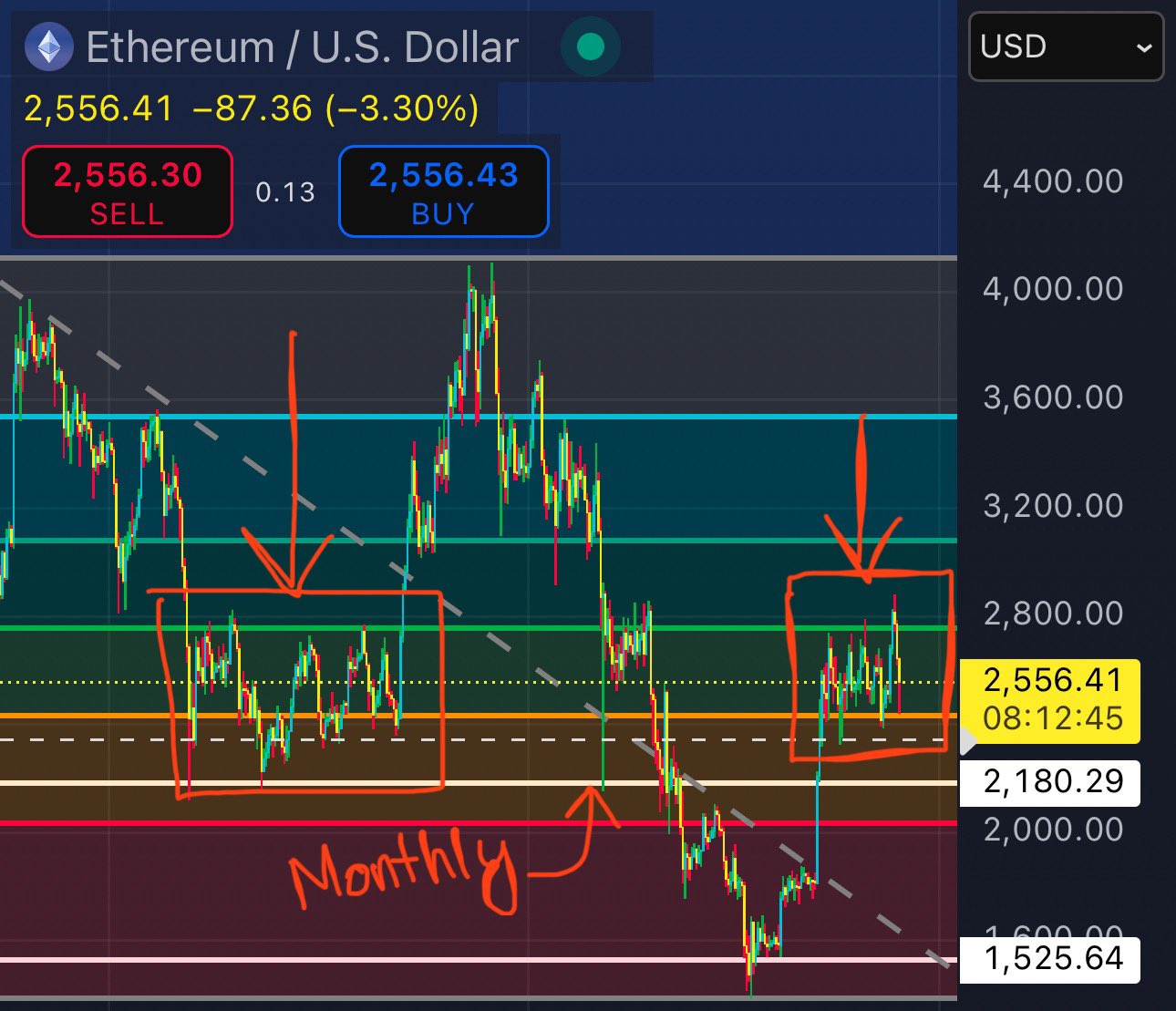

🚀 Are you ready?

New all time high for gold is just around the corner

And there will already be a strong resistance in the ≈$3300 area, due to the recent accumulation

Low(er) interest rates + high(er) CPI will then push it up even further

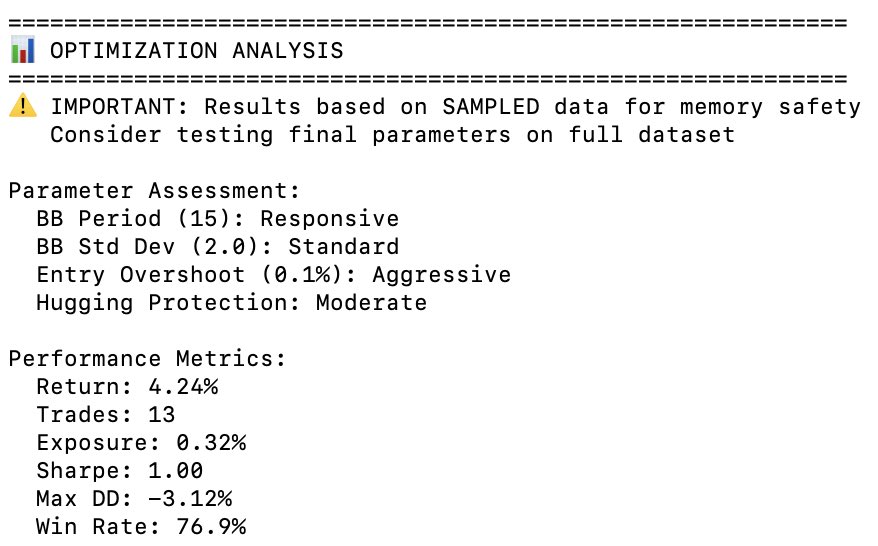

Risk-free rate returns with quant trading strategies may be fairly easy to achieve even with parameter-optimized Bollinger Bands

Not surprising, but unless the return can beat the mid/long-term bond yields - it's also not very useful 😄

Unless… leverage, of course

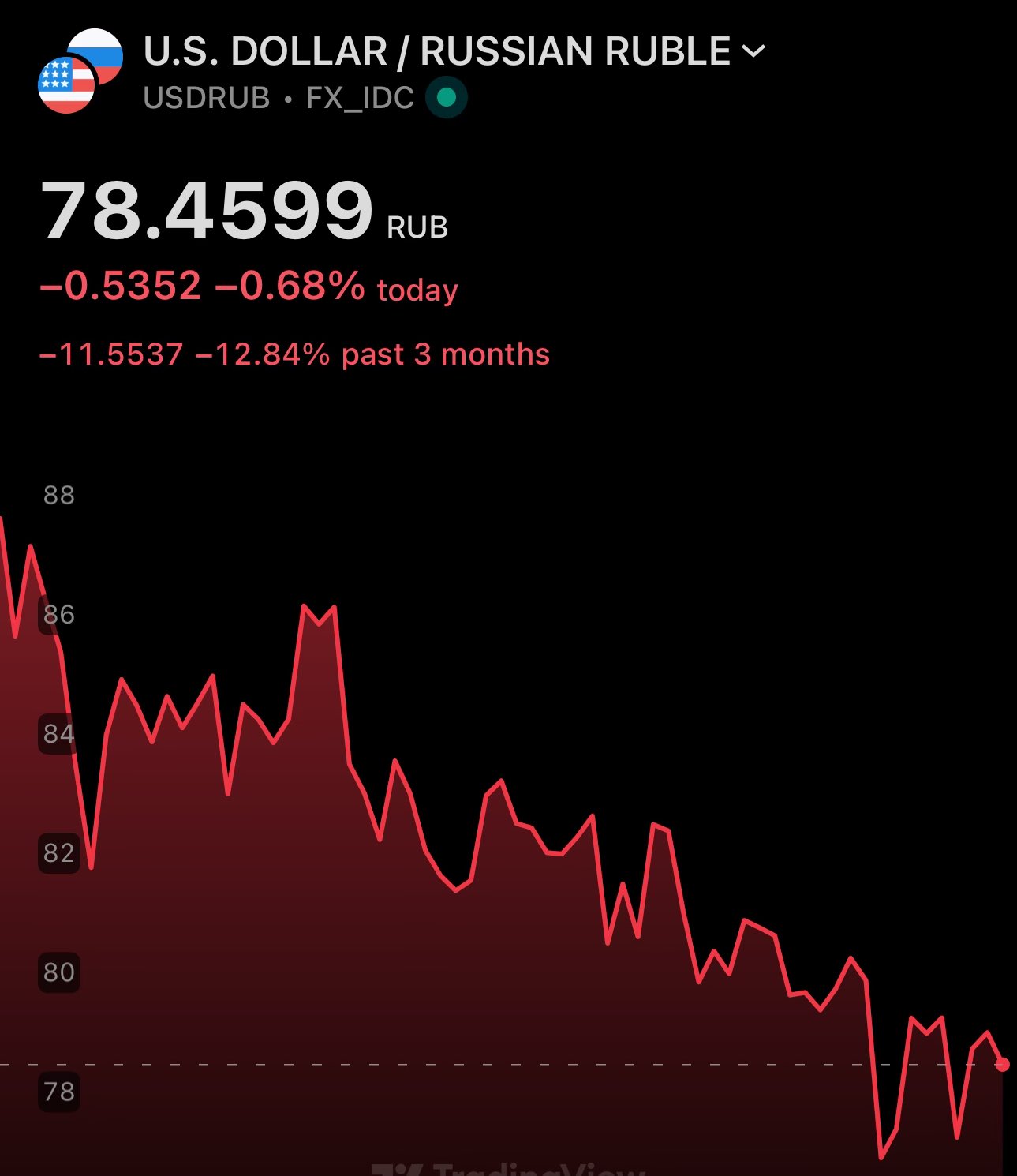

The Ruble thesis remains valid

Up ≈13% on the USD in the past quarter