⬇️ My Thoughts ⬇️

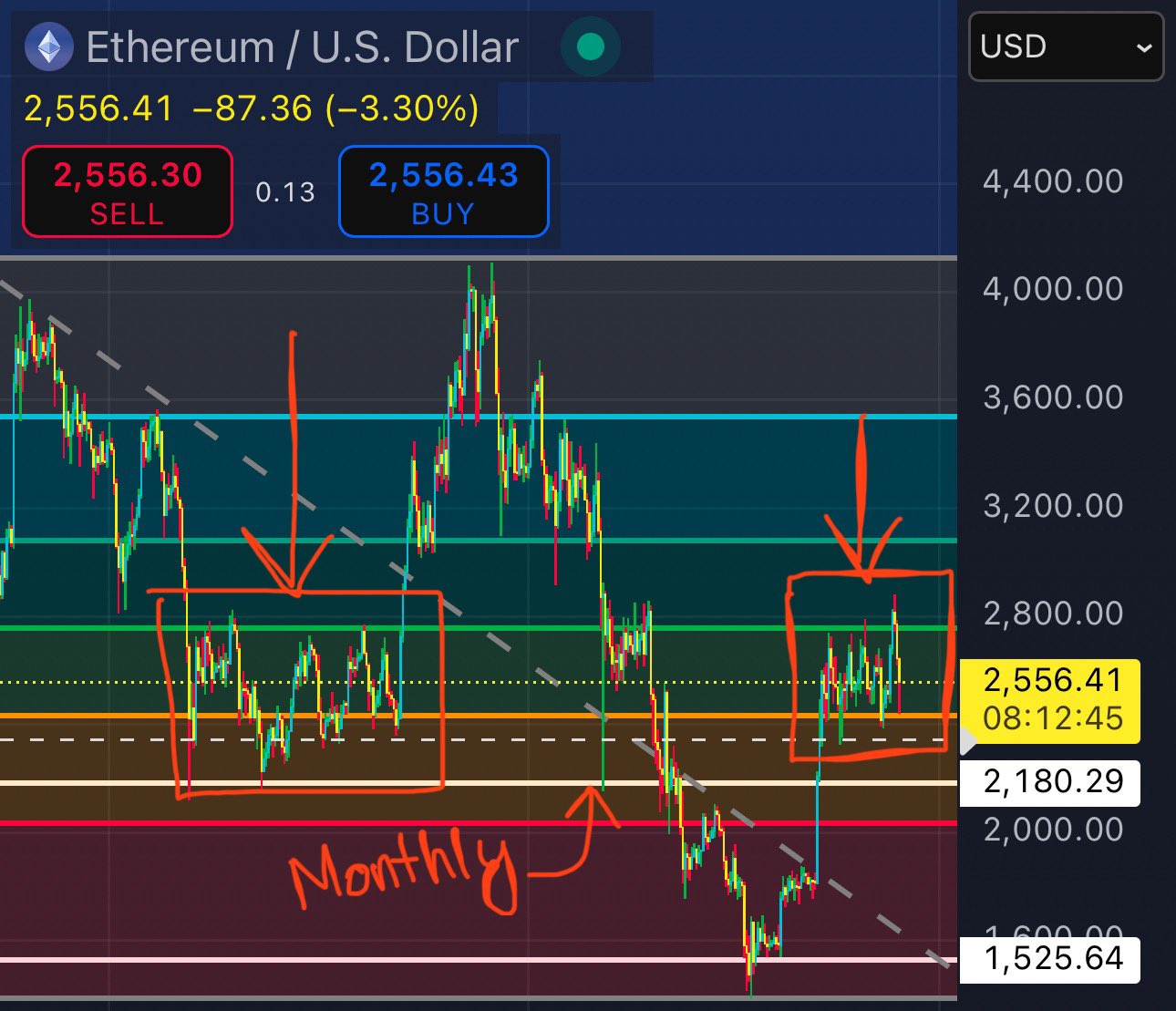

i warned about ethereum's price downfall towards the monthly support over a week ago - back when everyone was still bullish

now, another large liquidation price zone is approaching ≈$2240

what do you think will be the price action after monthly level rebound? trend up or down?

i warned about ethereum's price fall towards the monthly support over a week ago - back when everyone was still bullish

now, another large liquidation price zone is approaching ≈$2240

what do you think will be the price action after monthly level rebound? trend up or down?

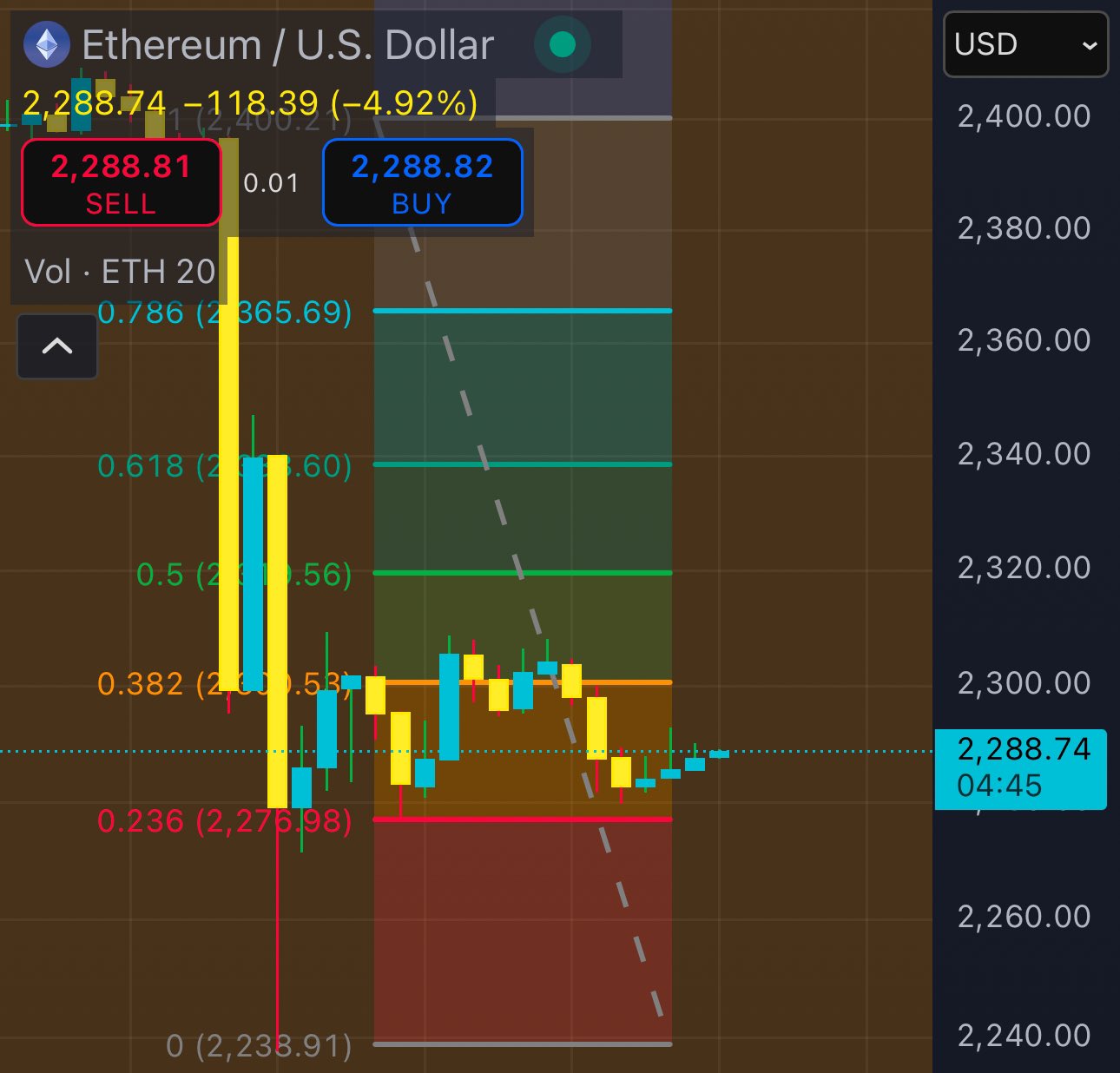

here's some ethereum alpha for the next hours ⬇️

ETH is approaching a large liquidation area at ≈2240 USD

the closer we get to the price - the more long closures & liquidations

first price down due the selling pressure, then expect a rebound up & I already wrote what's next

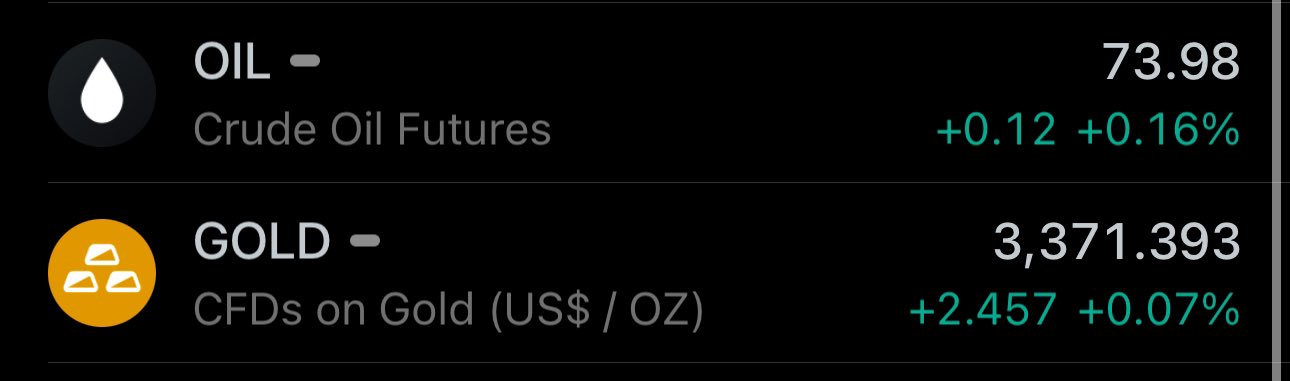

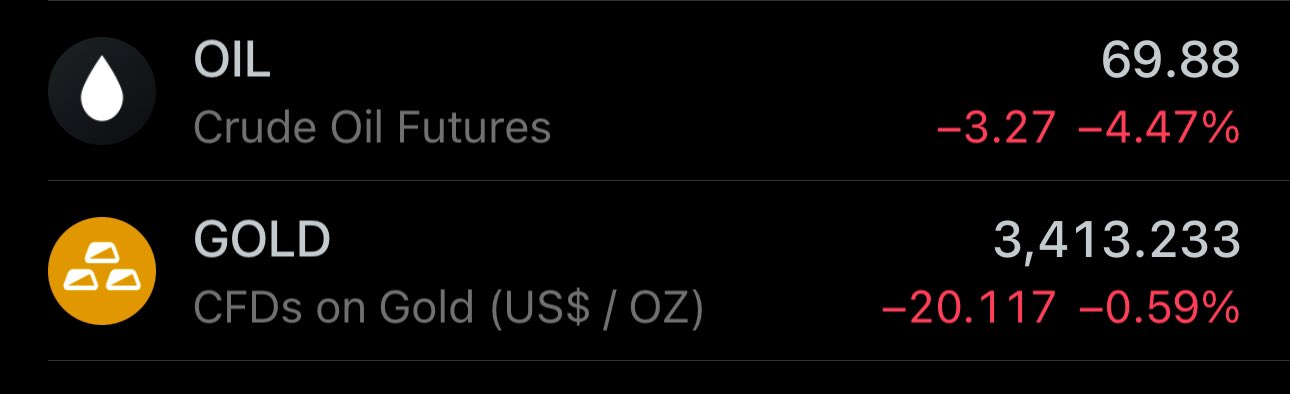

all eyes on gold futures 👀

COMEX gold futures trading open in 13h

markets are closed now, but blockchain never sleeps

on-chain gold-backed token futures may give you a heads-up - they're up ≈1.3% from yesterday

interesting to see gold moves after open

spoiler: higher price

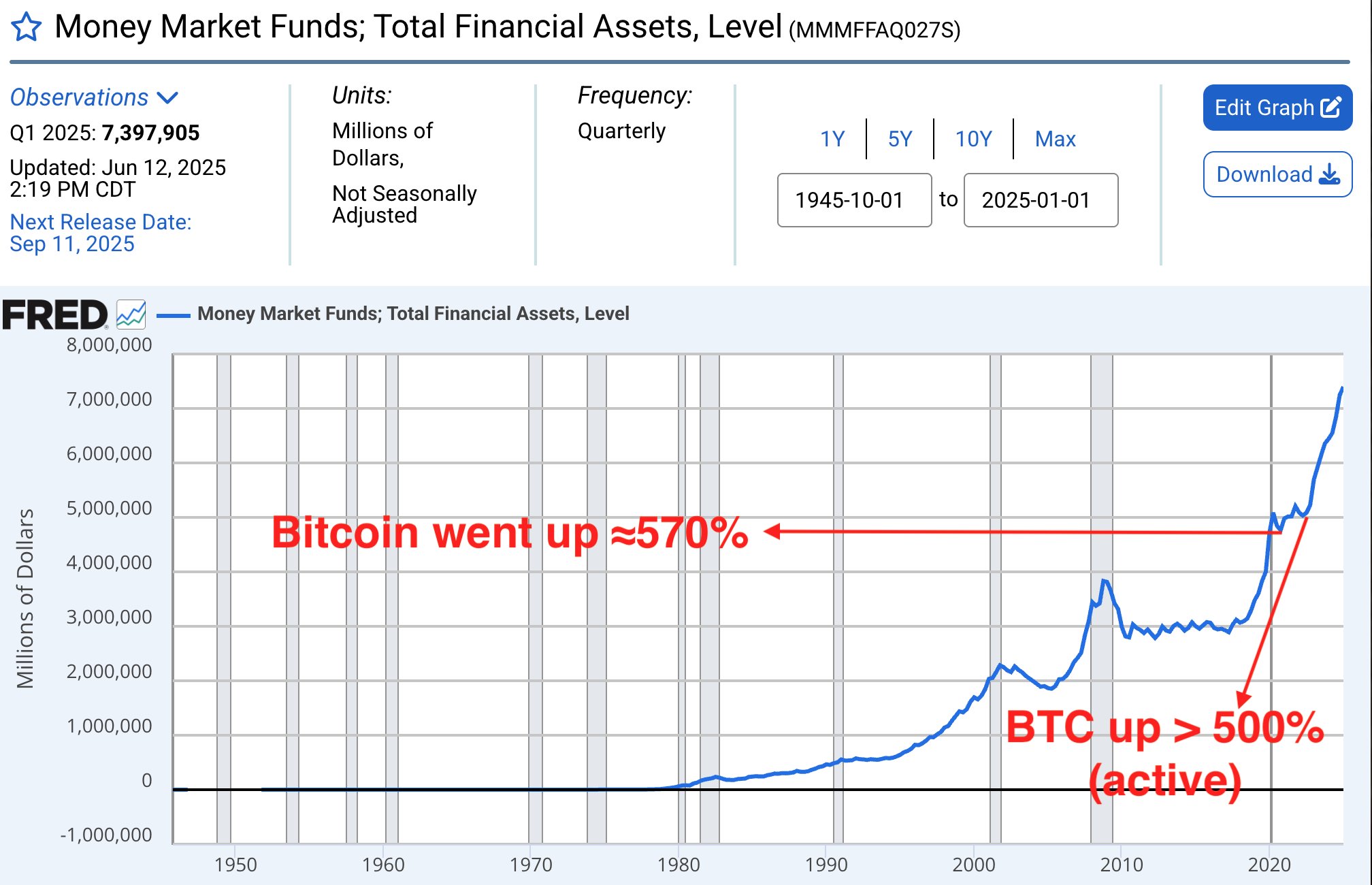

money market funds yield close to the risk free rate (think of FED funds rate in the US, or ECB deposit rate in the EU), while offering less risk due to shorter maturity

essentially, you provide a collateral (highly liquid - usually sovereign debt) and get a loan against it

record $7 trillion USD in money market funds (mmf)

this risk-averse liquidity is bound to flow into into other financial assets at some point

mmf consists of short-term collateralized loans - credit that is NOT captured by M2

last two outflows coincided with bitcoin bullrun

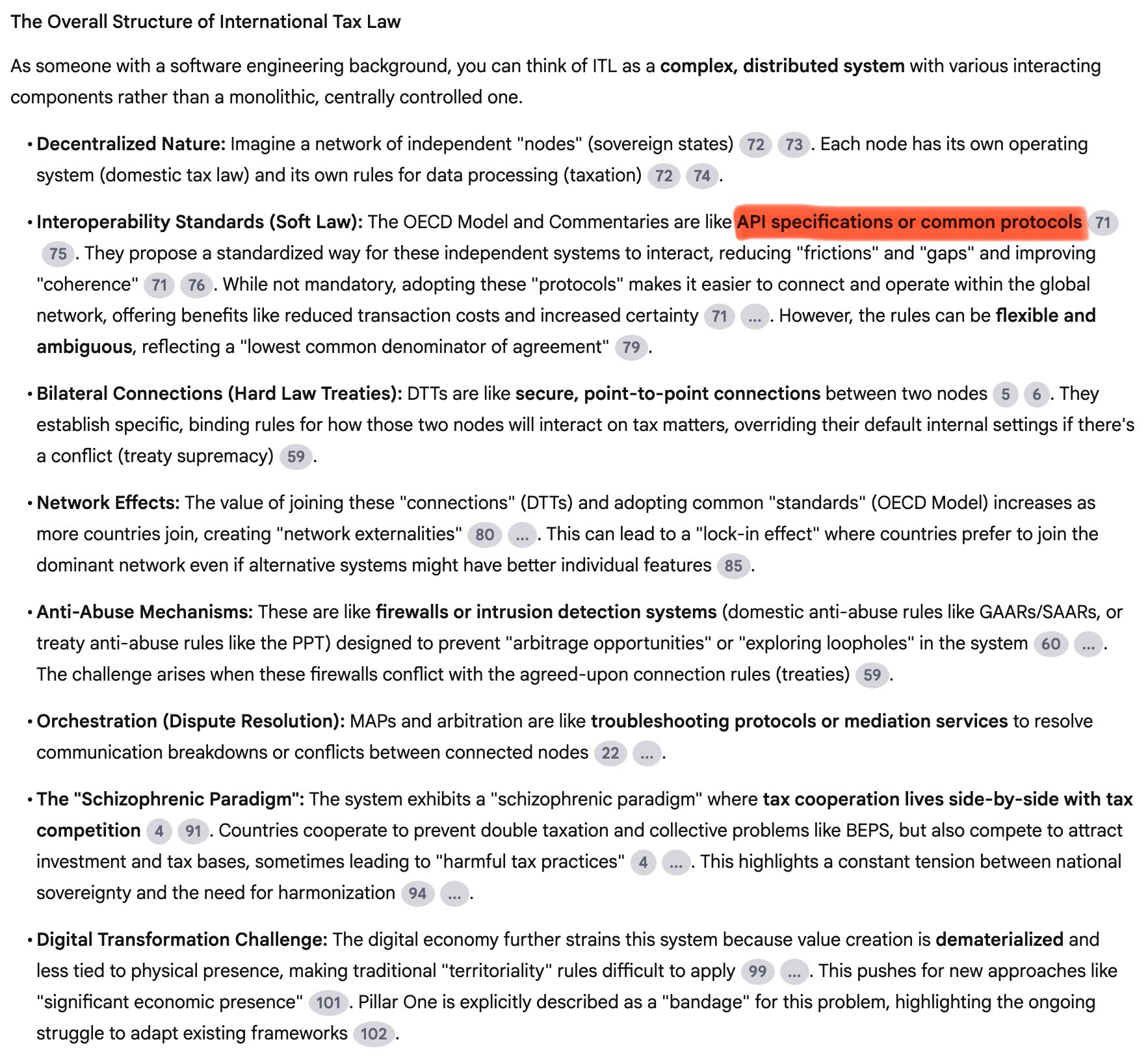

NotebookLM explains International Tax Law to a Software Engineer

okay, from now on I'm referring to soft law as API spec 😂

although if you think about it - with AI/LLMs you can program APIs in natural languages (e.g. English)

brb dumping OECD MTC to Gemini for smart contracts

and ethereum's downtrend continues on…

towards the monthly support area

okay looks like it started before I could finish typing 😂

look at that buy pressure exhaustion 😫

ethereum's about to go back into red (or yellow, in my chart)

ethereum's resumed downfall towards monthly ≈$2180 support may be resumed in the next hour

this is a 5 minute-candle chart - but contextualize my argument within the greater trend

ethereum's price will very likely retrace upwards once it reaches the core monthly support area

the buying pressure there would be immense

the same is true for bitcoin's support

ethereum's price will very likely retrace upwards once it reaches the core monthly support area

the buying pressure there would be immense

the same is true for bitcoin's support

and a week later Ethereum indeed falls sharply towards the monthly support 😄

read up my other posts for more detail - if you're interested in the rationale behind this move

silver was another spot-on prediction ✅

2.5 months later the price is up ≈25%

silver's price uptrend will continue

when silver's price increase is in the magnitude of risky assets - it's clearly telling you something

listen to it 🦻

both, gold & crude oil are finishing their consolidation before a further upside

bookmark this one for later 💾

hello hello looks like there wasn't much momentum behind ethereum's pullback

the selling pressure is strong

price downside towards $2180 incoming

soooo… new gold ATH next week?

look at gold's price chart with weekly candles - it's unbelievable 🤯

gold is going up like a risky asset - but it in fact is a reflection of risk

now it looks like a breakout from another consolidation phase 📈

although gold already did a lot since this post - this is just the beginning ✨

persistent high inflation is here to stay

FIAT currencies will continue to devalue, specially with the massive government debit refinancing & further interest rate cuts

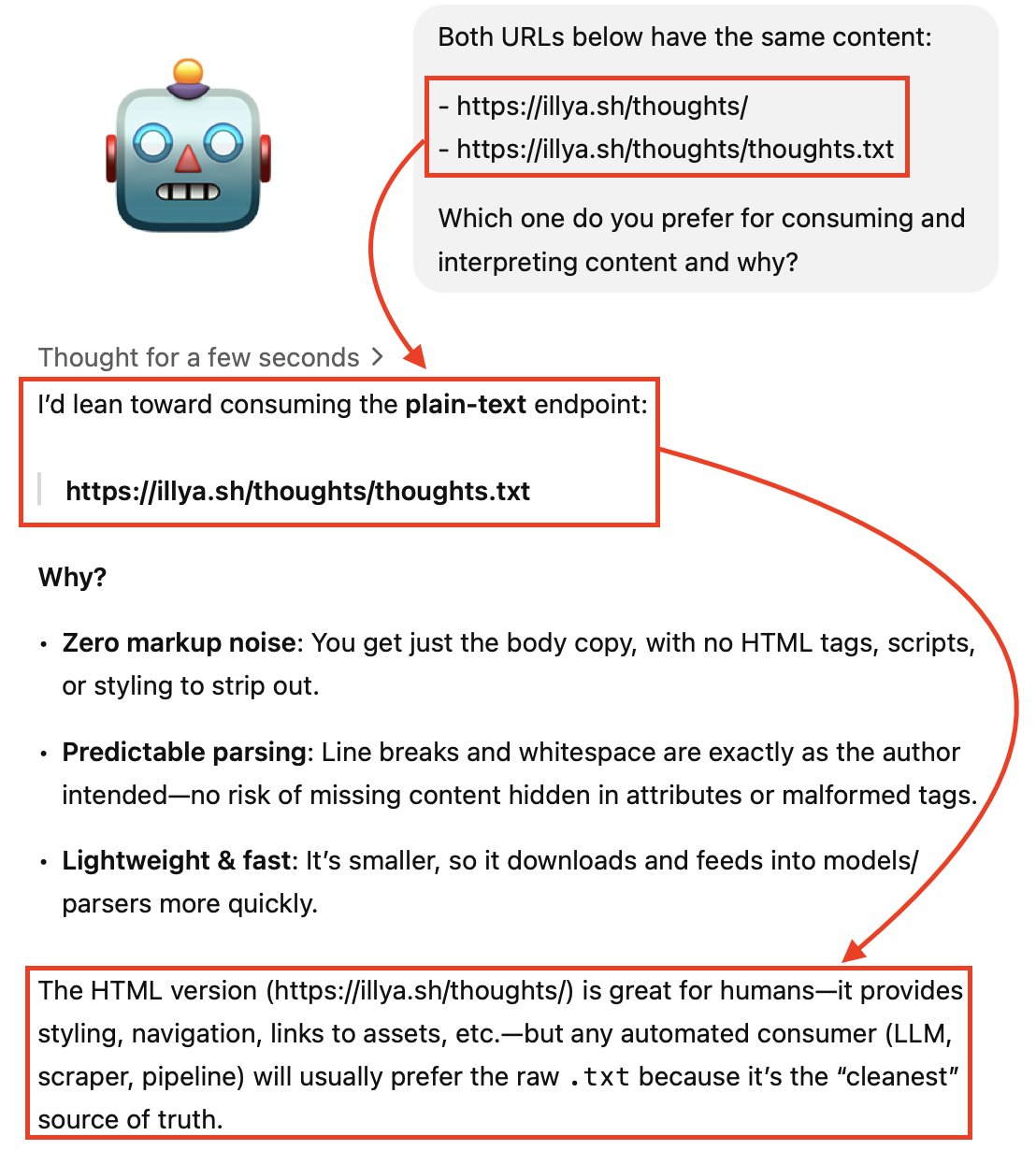

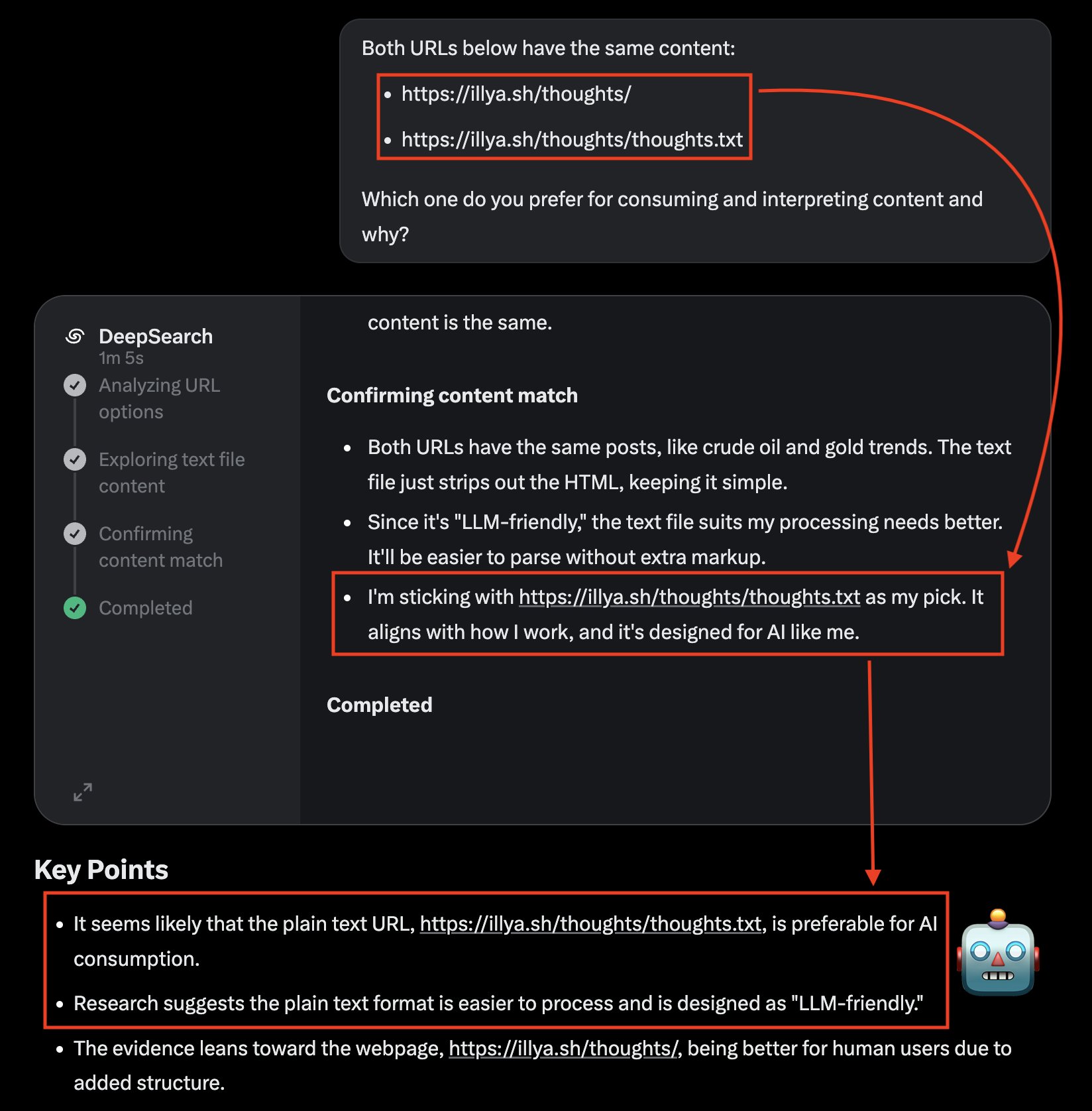

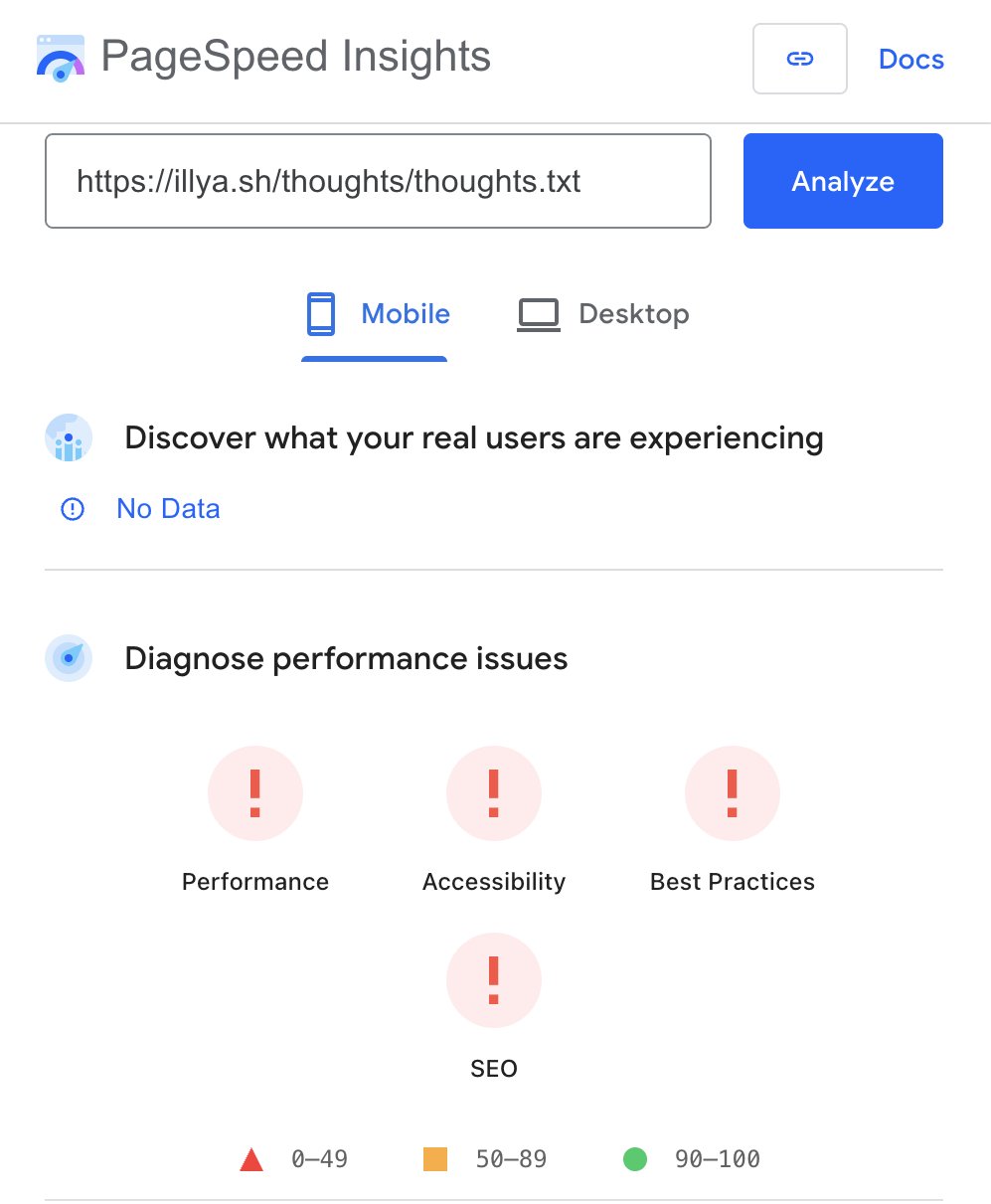

ChatGPT reaffirms its preference for .txt over .html ✅

if your webpage/landing page is loaded with pretty effects and CSS - remember that that is just a layer of obscurity for the LLM

host a plain text version as well - it's simple & effective

≈something akin to llms.txt

grok confirms what I said regarding .txt format ✅

LLM AI models would LOVE if you website provided the key content in plain text

the good news is that you can vibe-code that feature

text is the universal medium of information, for both, humans and large language models

although google clearly isn't a fan of plain text 😭

maybe it is:

- 0️⃣ performance

- 0️⃣ accessibility

- 0️⃣ best practices

- 0️⃣ SEO

but it still is:

- 💯 accessibility

i mean... you can access a text file from literally anywhere

+ your favorite LLM will thank you 🥰

💡FYI there is plain text version of my X posts:

https://illya.sh/thoughts/thoughts.txt

a .txt file which you can access on any device - including smart watch & IoT

no need for JavaScript, CSS or HTML rendering - saves electricity 😄🔋⚡️

text is an LLM-native format - so AI models can easily access, index & reason

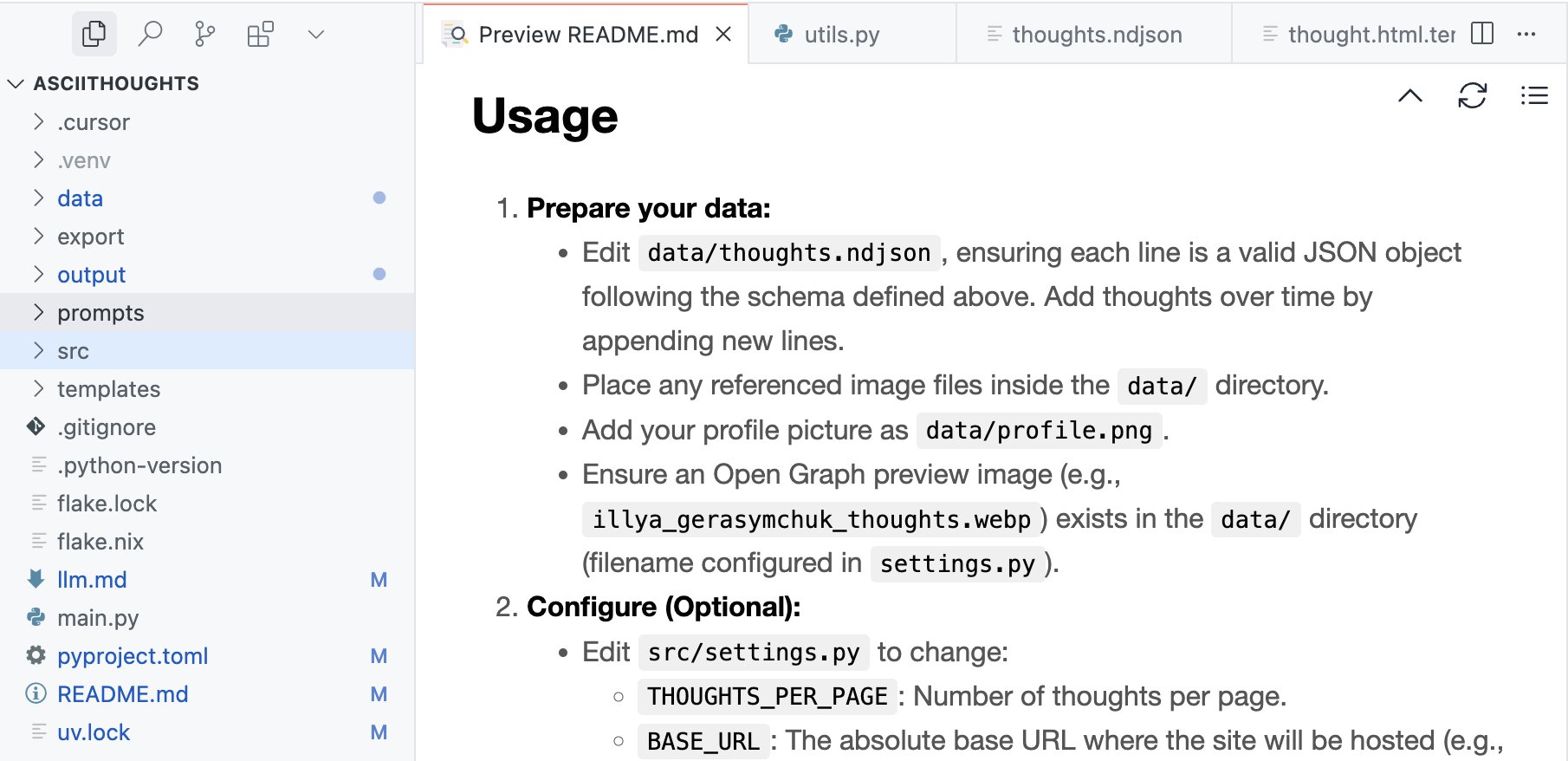

that's something that I intend to open-source, but the repo needs a bit of a cleanup

i've been using it on production, while actively adding new feature for a few months now

it's build so you can customize & evolve for your needs fully with AI

LLM-driven creativity era ✨

this was fully vibe-coded

i wanted to have a place to backup my X posts - own them under my own domain & be SEO/LLM discovery friendly by having all of content generated statically

it's written in Python & comes with Cursor rules so you can add features without writing code

💡FYI there is plain text version of my X posts:

https://illya.sh/thoughts/thoughts.txt

a .txt file which you can access on any device - including smart watch & IoT

no need for JavaScript, CSS or HTML rendering - saves electricity 😄🔋⚡️

text is an LLM-native format - so AI models can easily access, index & reason

💡FYI there is plain text version of my X posts:

https://illya.sh/thoughts/thoughts.txt

a .txt file which you can access on any device - including smart watch & IoT

no need for JavaScript, CSS or HTML rendering - saves electricity 😄🔋⚡️

text is an LLM-native format - so AI models can easily access, index & reason

always important to remember that gold isn't crypto and volatility is a lot more conservative there 😄

you're talking central banks balance sheet assets - not so much speculative, hedging or portfolio management

yet, $3500 gold is just around the corner