⬇️ My Thoughts ⬇️

Bank of International Settlements (BIS) has a lot of interesting papers, articles and data on global liquidity and financial system

it's bank-focused, but connected to the broader scope, like the non-bank financial institution (NBFI) credit flows i posted about earlier

i wrote a thread explaining why weaker USD means more credit/loans issued in USD, thus driving up global liquidity

you can read it here: https://illya.sh/threads/@1755216337-1.html

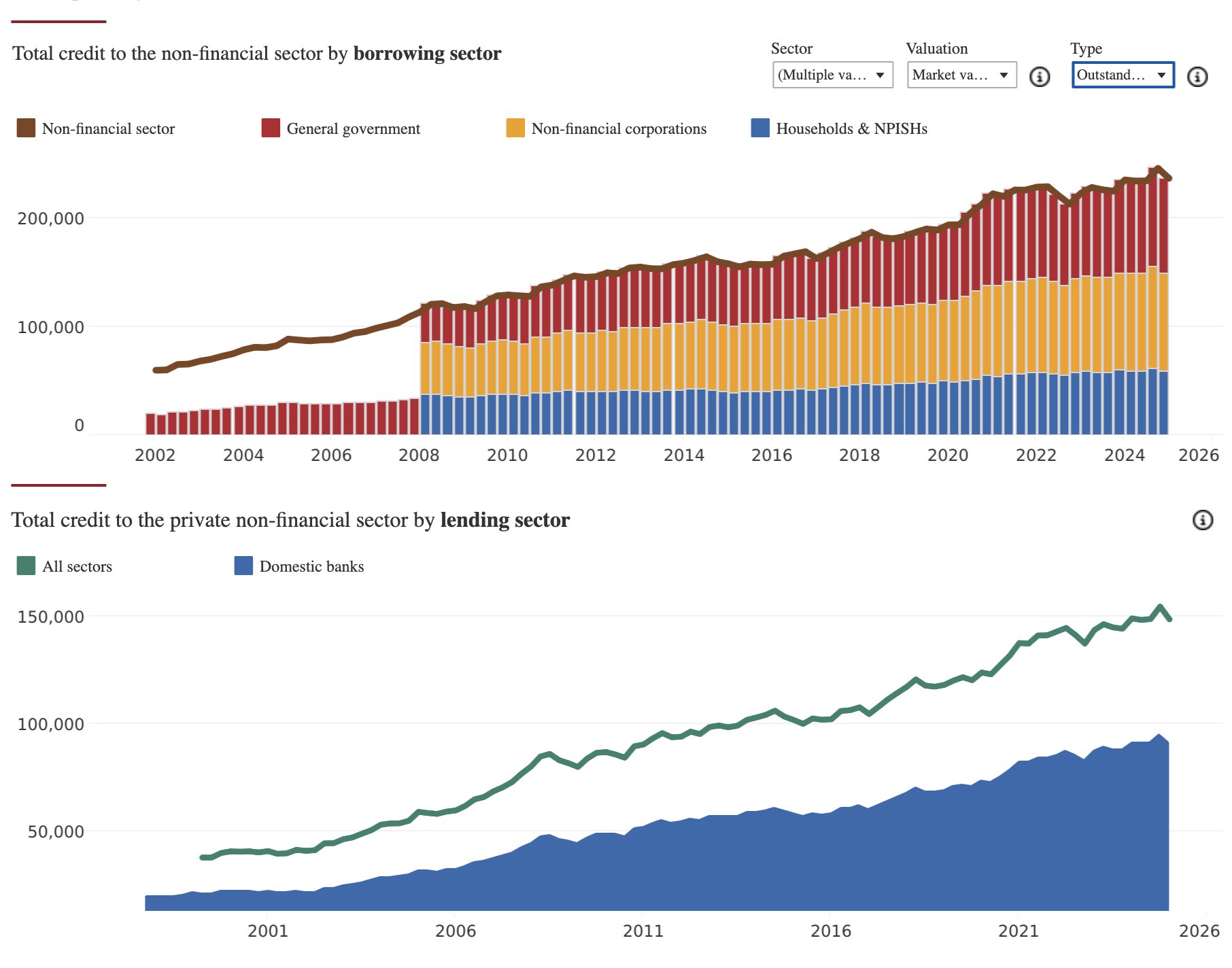

it's not just the governments and financial institutions who are dependent on debt refinancing - the private non-financial sector as well

remember than more than 70% of credit issuance is for servicing/refinancing of existing debt

credit continues to expand in the non-financial sector as well

the attached graph also shows a turning point in 2008 - that's how the GFC was handled - by issuing more credit 😁

you can also see a steeper increase during COVID

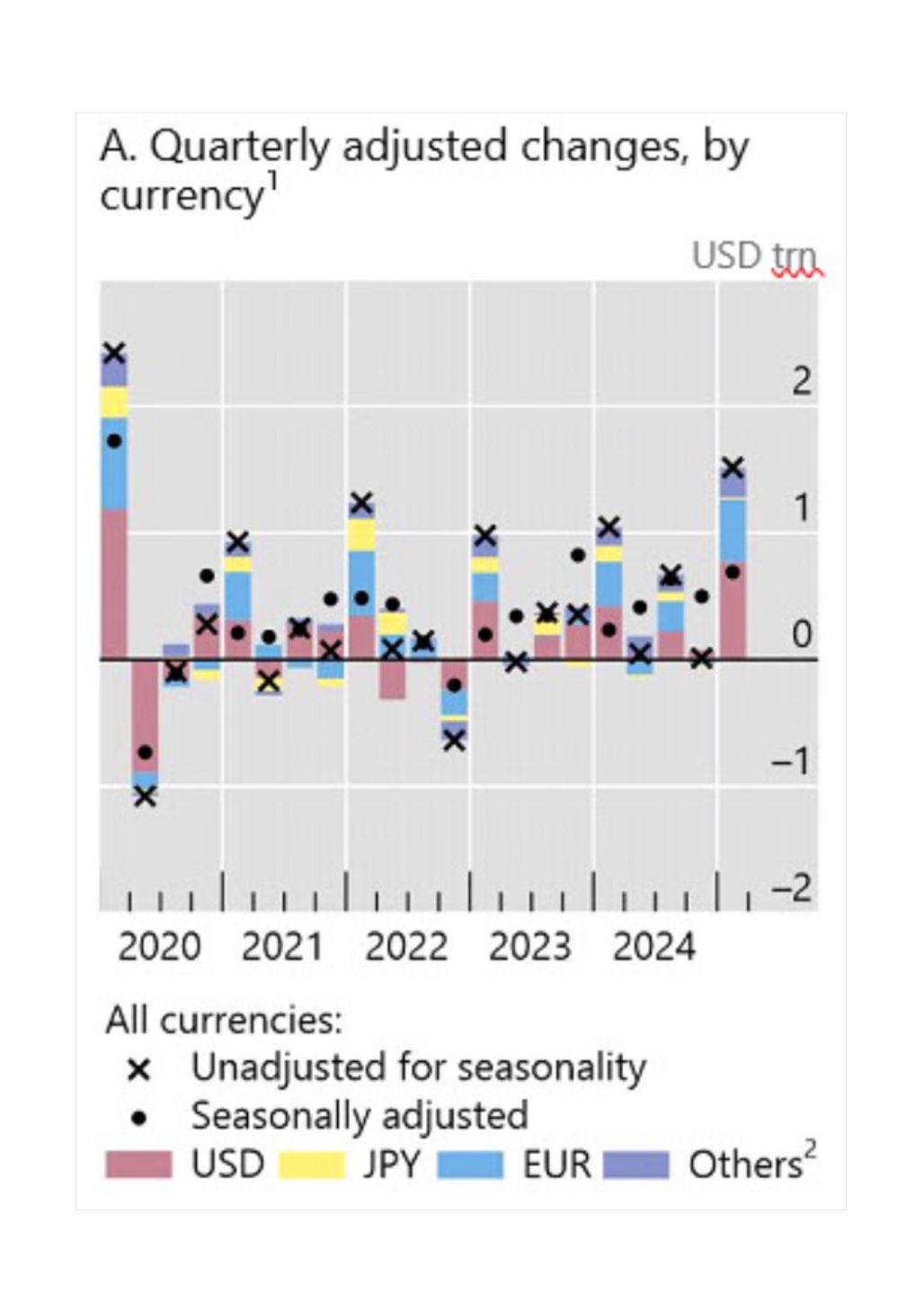

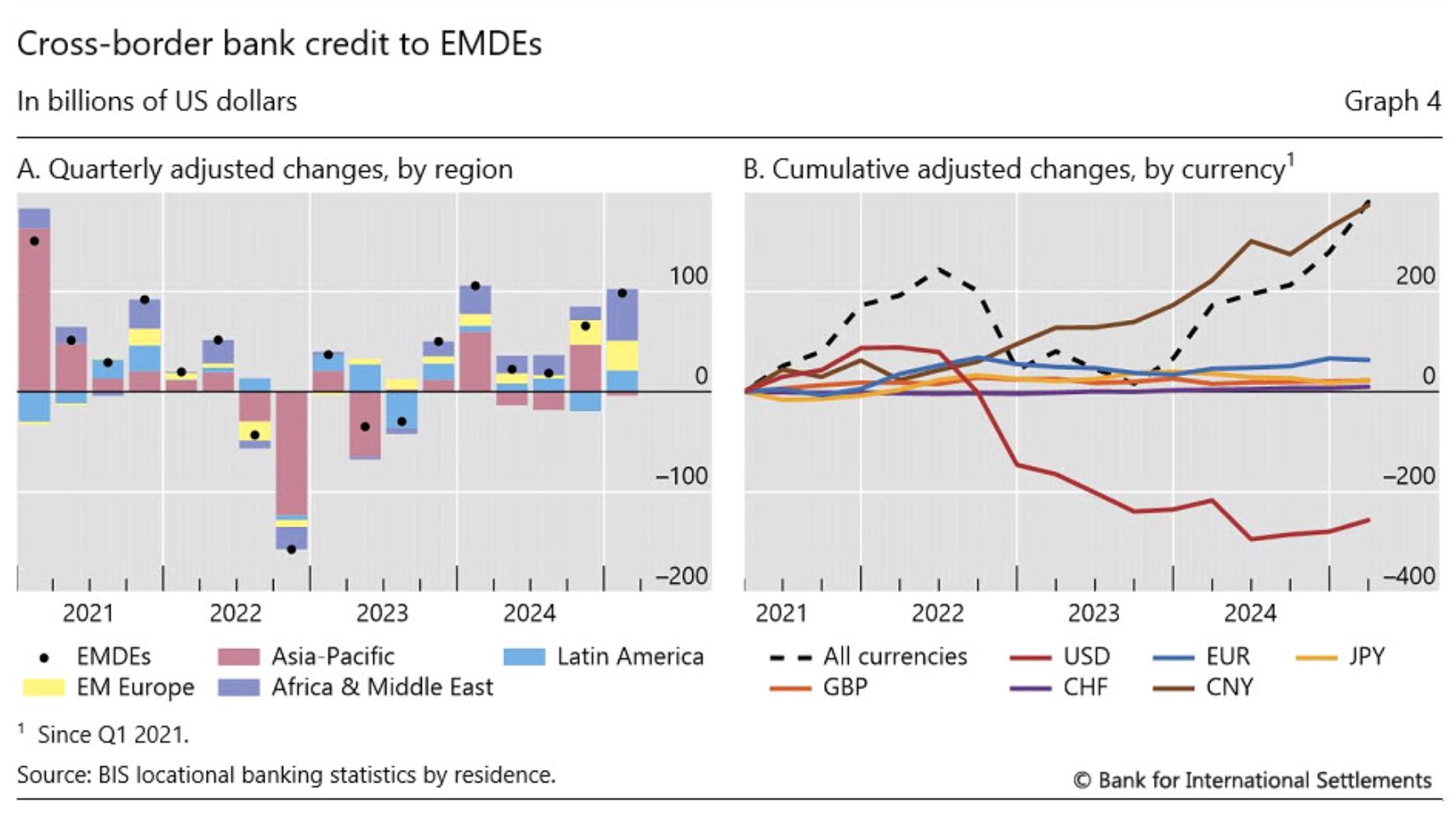

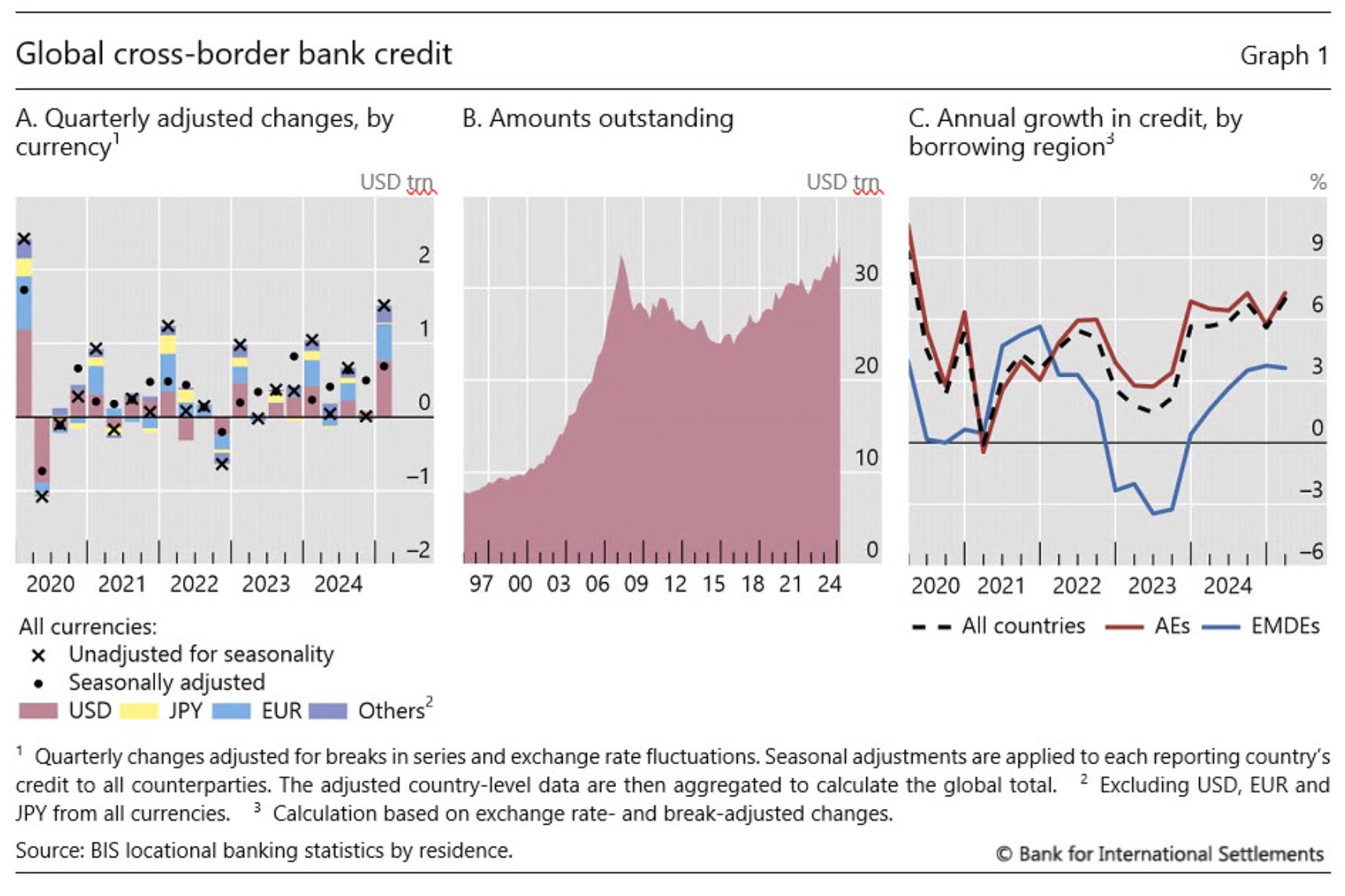

USD cross-border bank credit grew by $800 billion in Q1 2025

expect further increases for Q2 2025, due to the weak US dollar

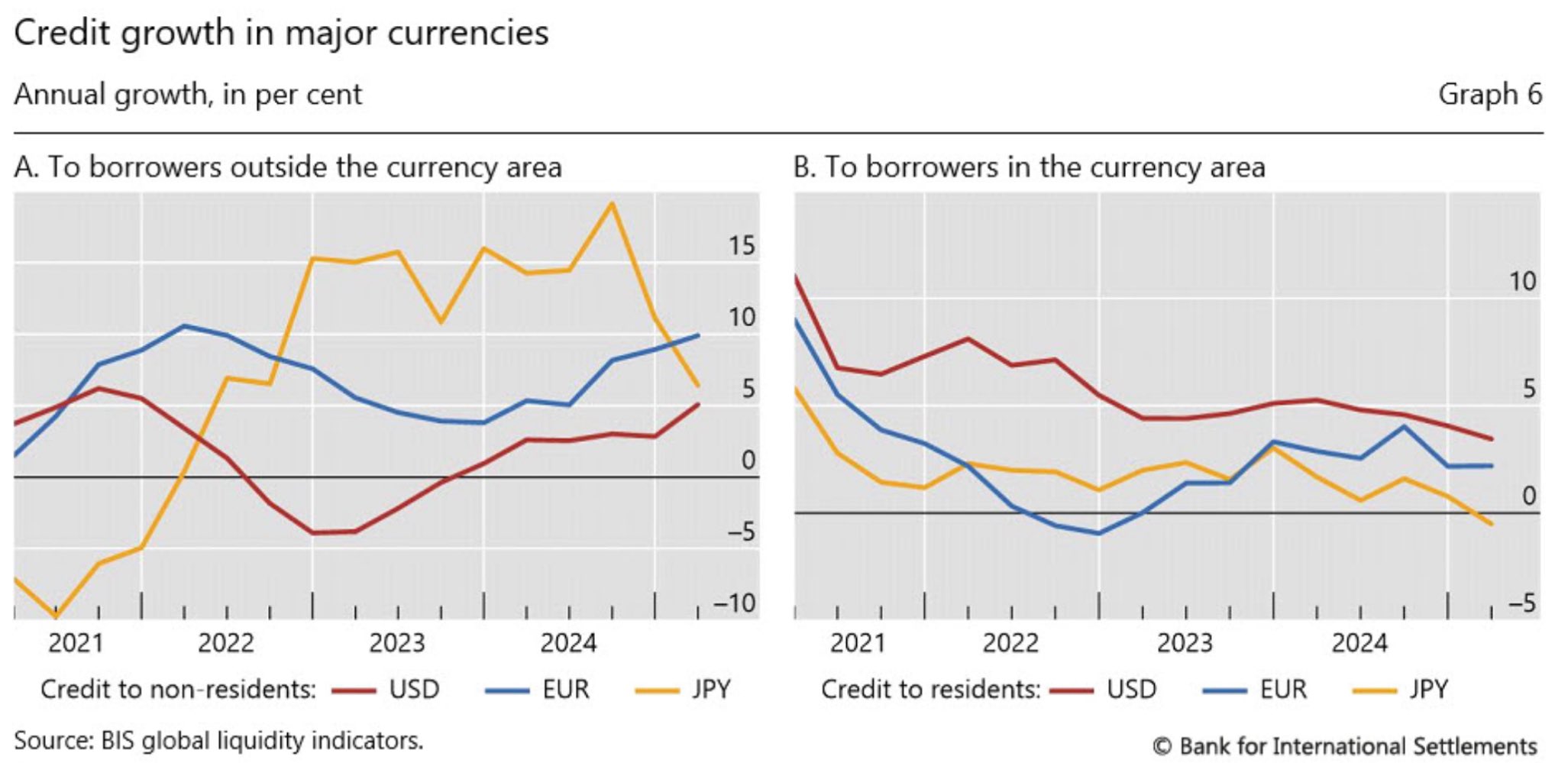

renminbi has become dominant in credit growth since 2022

a move from US dollar & Euro denominated credit to Chinese Yuan-denominated credit

in Russia, besides the Bank of Russia there's also the National Wealth Fund (NWF), which is operated by the Ministry of Finance

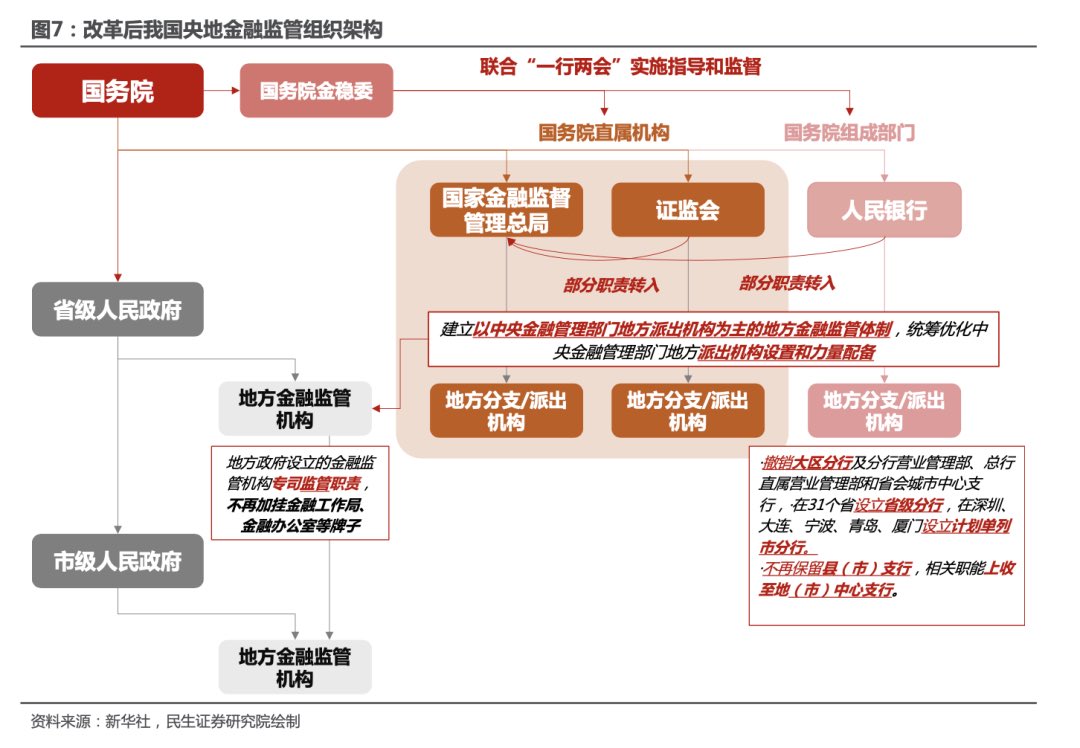

in China, there's policy banks, such as China Development Bank which are supported by PBoC's facilities

this collateral (US Treasury bonds) can then be used on wholesale debt markets to issue more credit

moreover, this collateral can be leveraged/rehypothecated, thus increasing liquidity

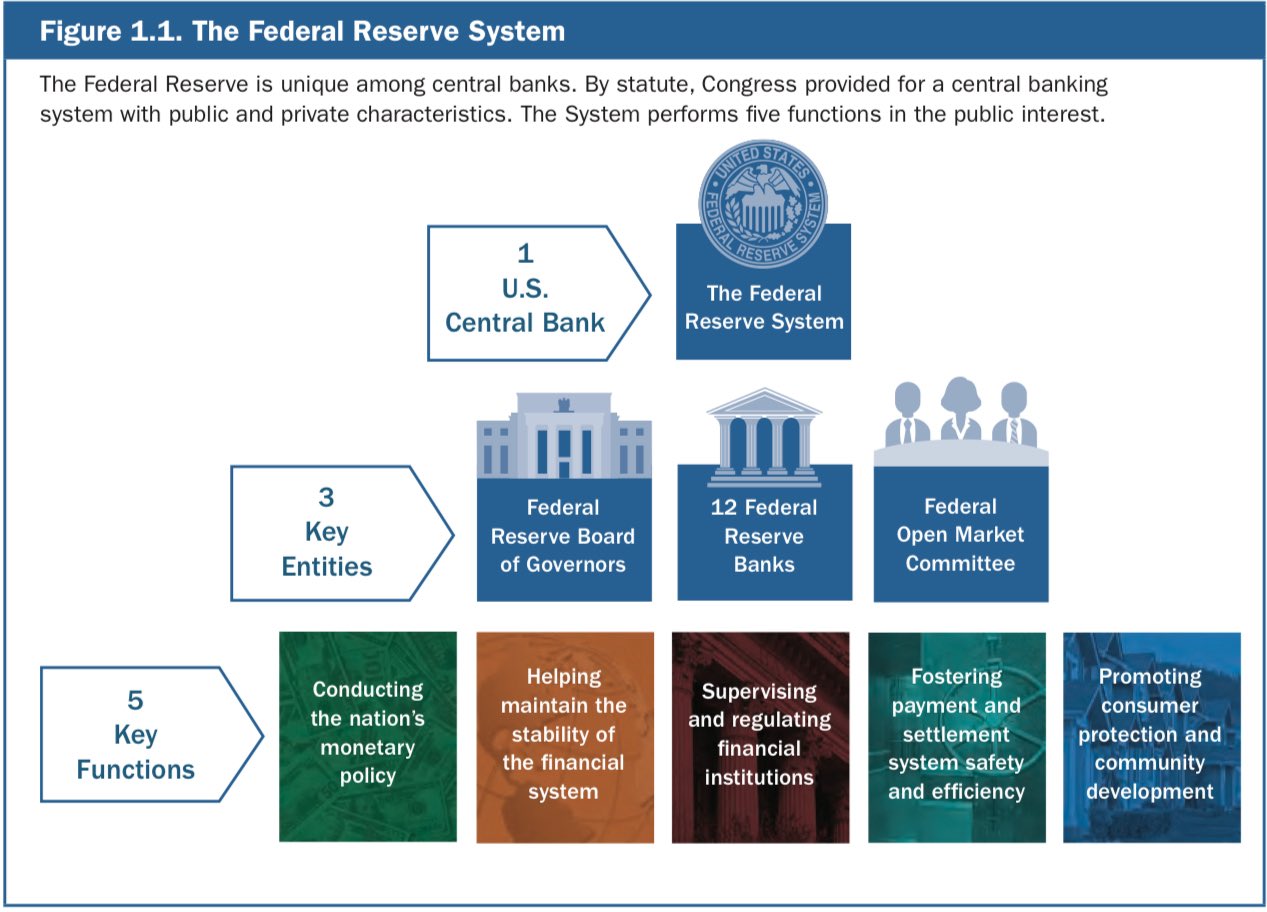

still, in the USA the Fed continues to dominate in importance

this collateral (US Treasury bonds) can then be used on wholesale debt markets to issue more credit

moreover, this collateral can be leveraged/rehypothecated, thus increasing liquidity

still, in the USA the Fed continues to dominate in importance

so it may not only be central bank setting the rates and affecting liquidity

for example, when US Treasury auctions bonds, they're both, temporarily reducing the effective amount of USD in circulation and providing more high-quanlity collateral

so it may not only be central bank setting the rates and affecting liquidity

for example, when US Treasury auctions bonds, they're both, temporarily reducing the effective amount of USD in circulation and providing more high-quanlity collateral

by "central bank" I'm frequently referring to the broader set of the legal framework behind the macro monetary policy

in most countries central banks plays a key role, but they frequently co-exist in a larger network of institutions

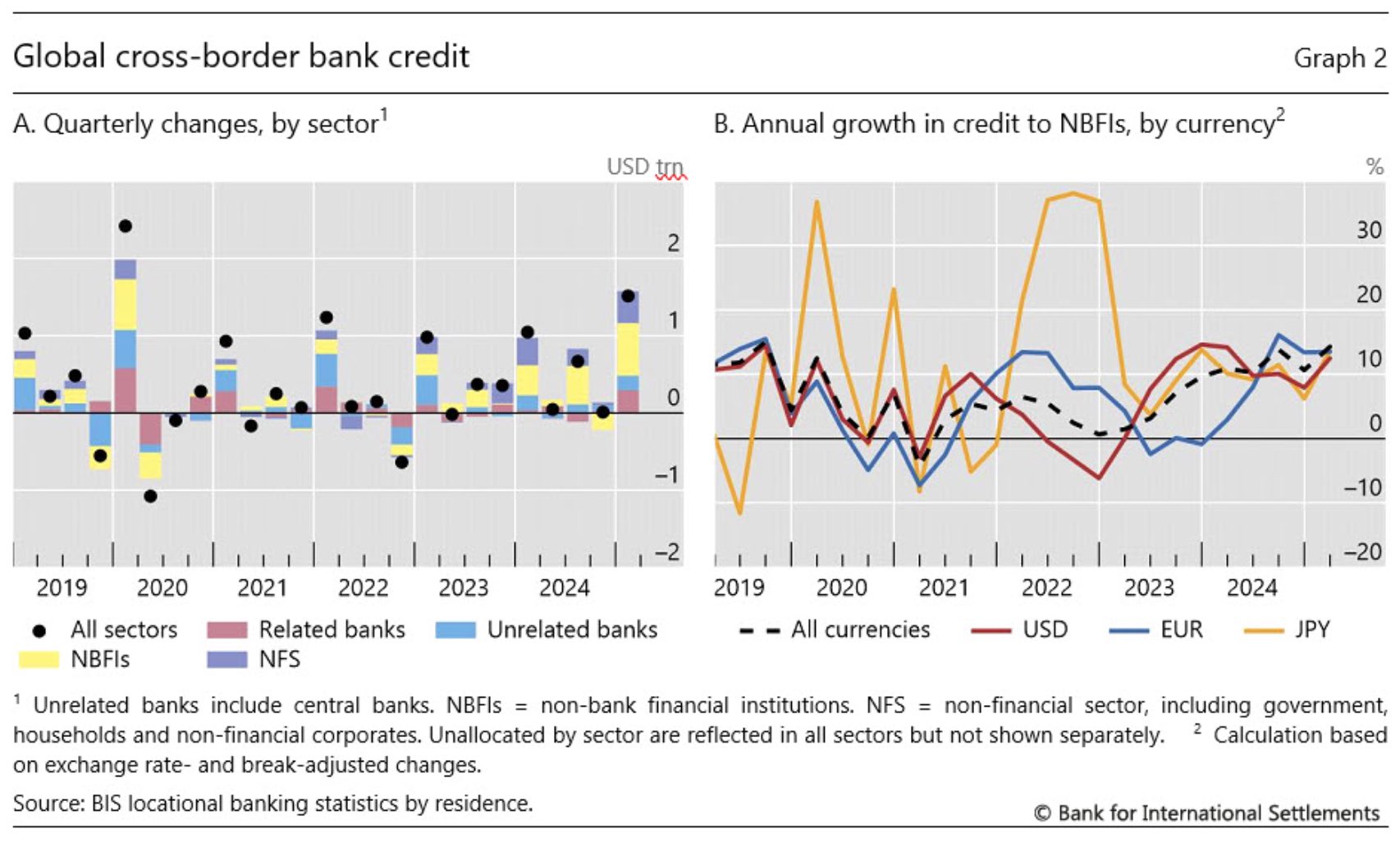

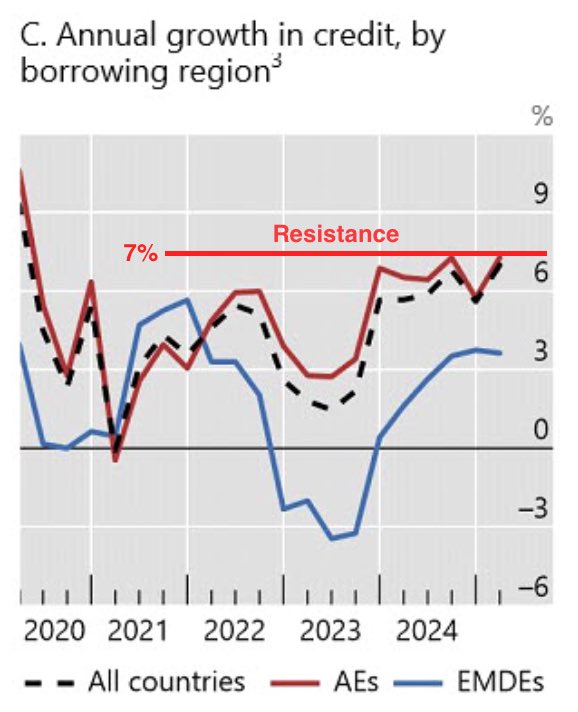

bank credit continues to grow, and it will continue to grow

it will almost certainly break the 7% annual growth resistance

central banks will expand balance sheets and lower interest rates to refinance the existing public and private debt

data source: BIS

outstanding cross-border bank credit reached a record of $34.7 trillion

the latest increase was driven by increased lending to non-bank financial institutions (NBIFs), with most of the credit being issued in USD or EUR

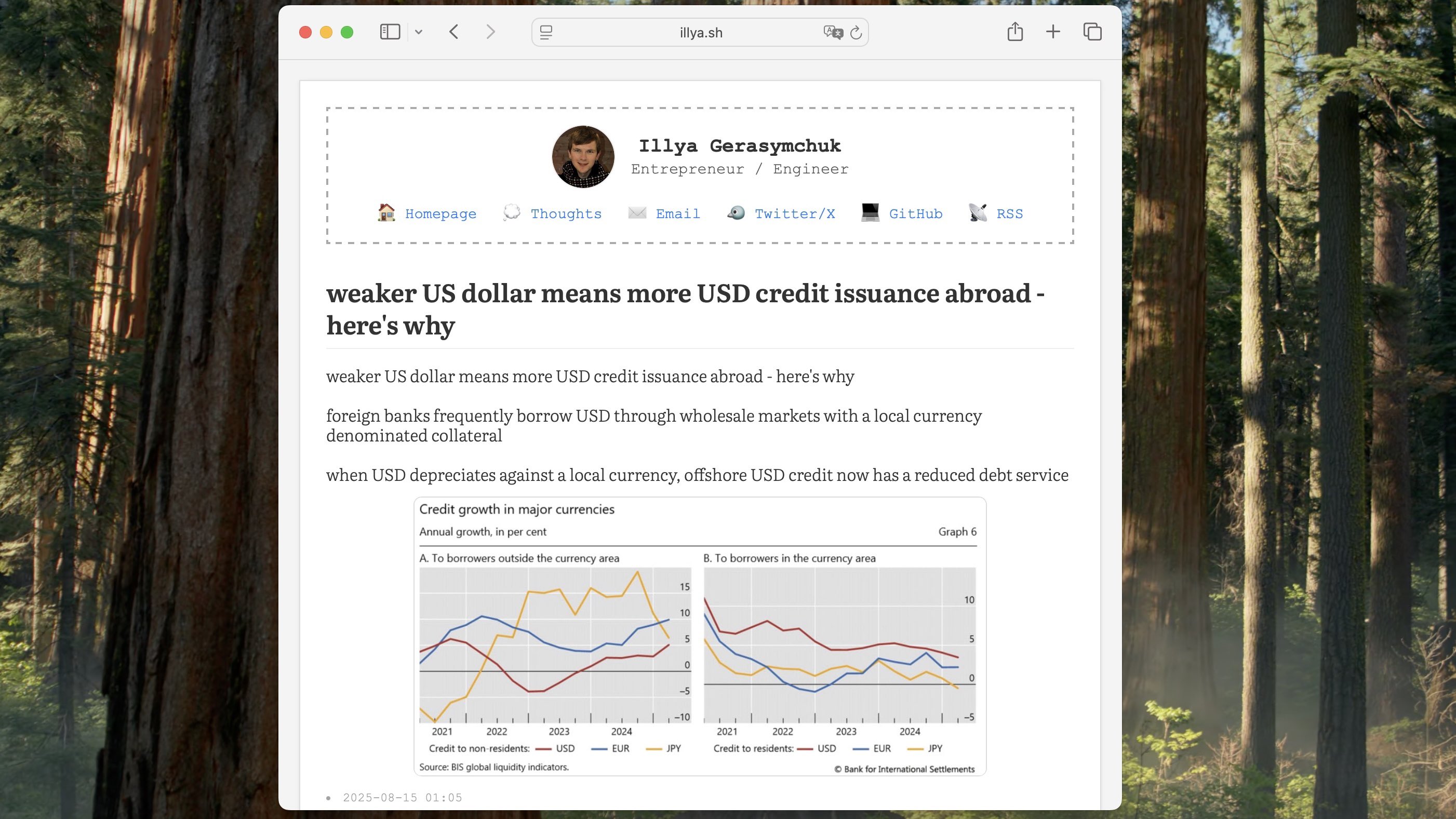

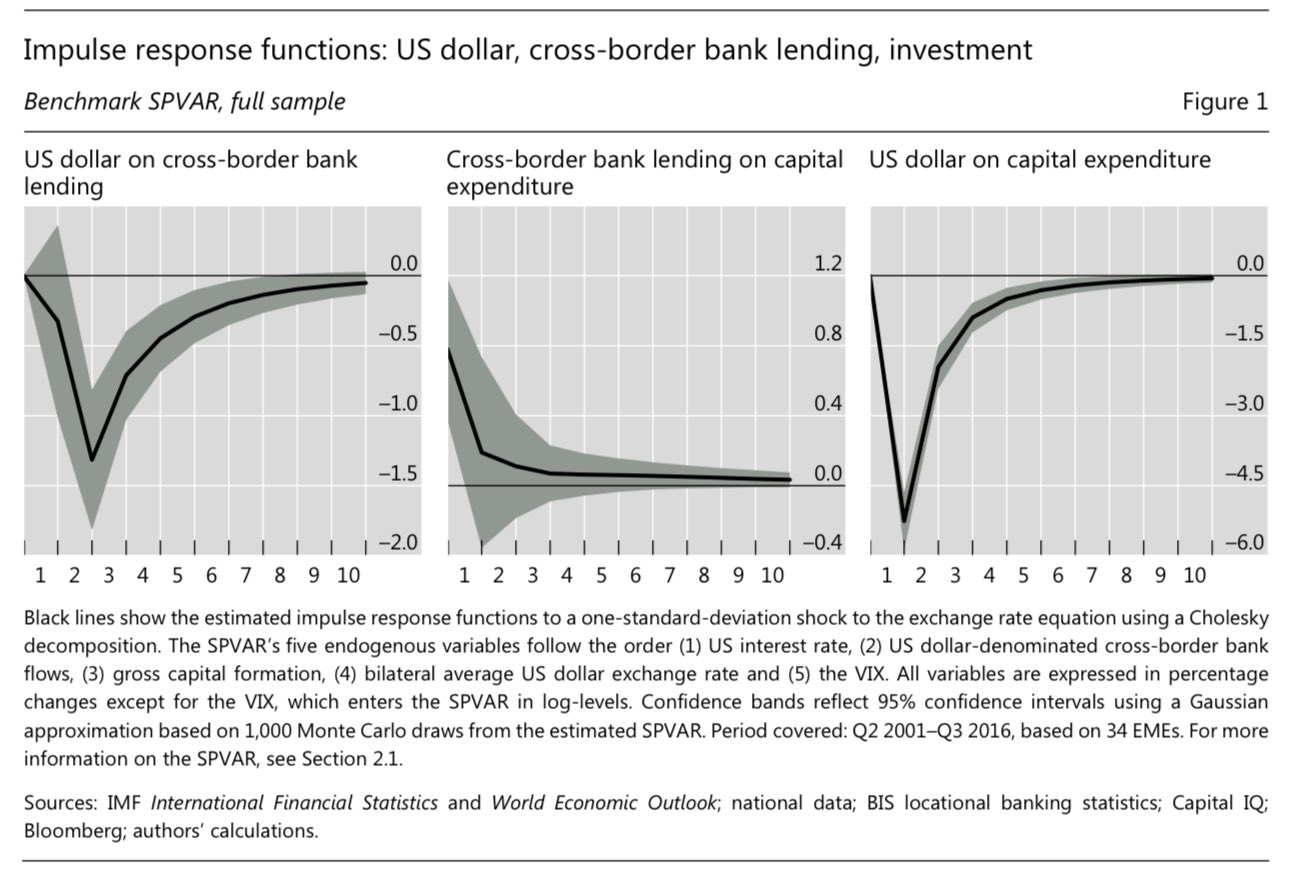

so a weaker US dollar tends to increase global USD liquidity

in the SVAR, one standard deviation of US dollar's appreciation leads to a fall in cross-border USD lending. it reaches its bottom after 6 months and then eventually recovers after 2.5 years if no new shocks arrive

bank's leverage ratios improve due to collateral appreciation, thus allowing them to borrow more USD

collateral here is the non-USD local currency, such as Yuan

bank's leverage ratios improve due to collateral appreciation, thus allowing them to borrow more USD

collateral here is the non-USD local currency, such as Yuan

weaker US dollar means more USD credit issuance abroad - here's why

foreign banks frequently borrow USD through wholesale markets with a local currency denominated collateral

when USD depreciates against a local currency, offshore USD credit now has a reduced debt service

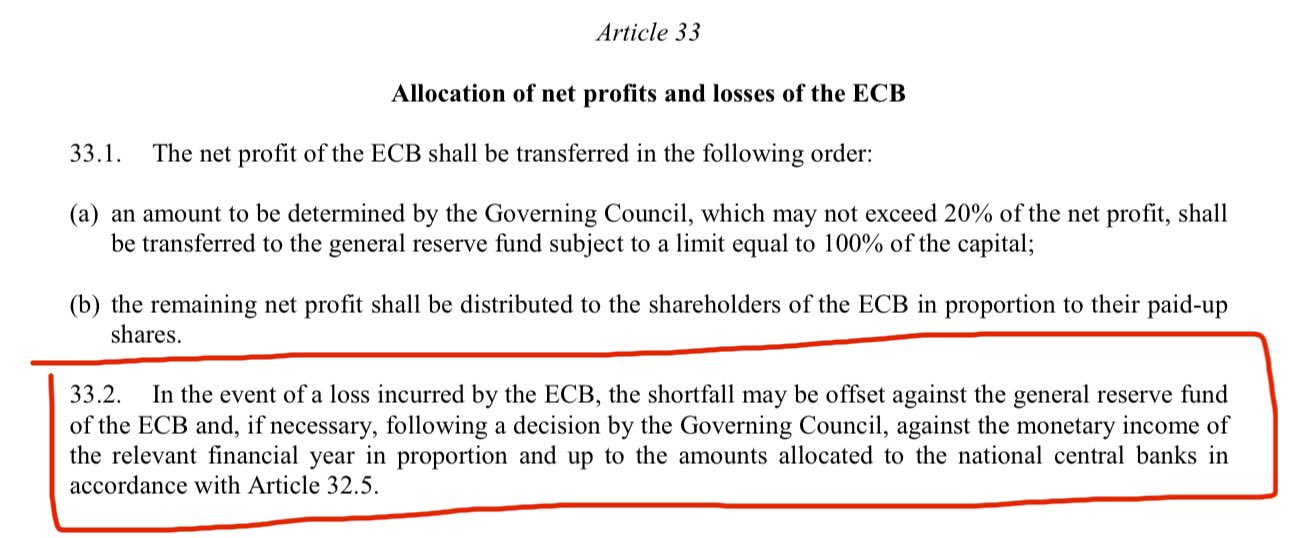

offsetting losses with future profits is explicitly allowed under Article 33 of Statute of ESCB & ECB

ESCB = ECB + EU National Central Banks (NCBs)

so this applies to both, the European Central Bank, and all EU National Central Banks

equity is the residual claim on assets after all liabilities are paid

equity = assets - liabilities

so the ECB just covers the loss with their equity. this equity reduction is carried forward to be offset by future profits

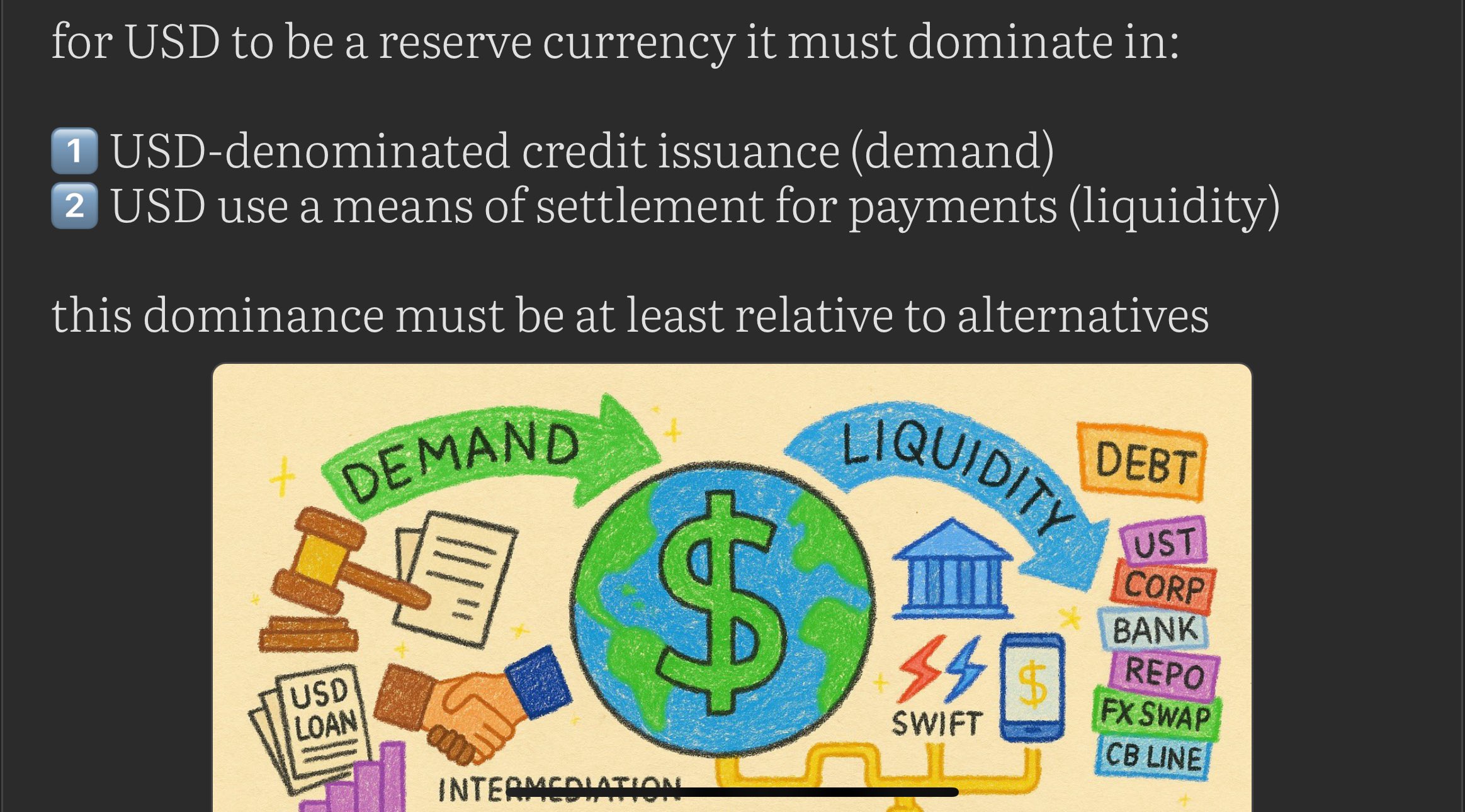

i wrote a thread about what it means for the US dollar to be the reserve currency from the perspective of demand and liquidity

you can read it here:

https://illya.sh/threads/@1754940239-1.html

this is nothing unusual though - many governments do this, and it's mostly towards stabilizing the exchange rate with USD

to a large extent this is a result US dollar's reserve currency status and its dominance in use for all sorts of financial transactions

equity is the residual claim on assets after all liabilities are paid

equity = assets - liabilities

so the ECB just covers the loss with their equity. this equity reduction is carried forward to be offset by future profits

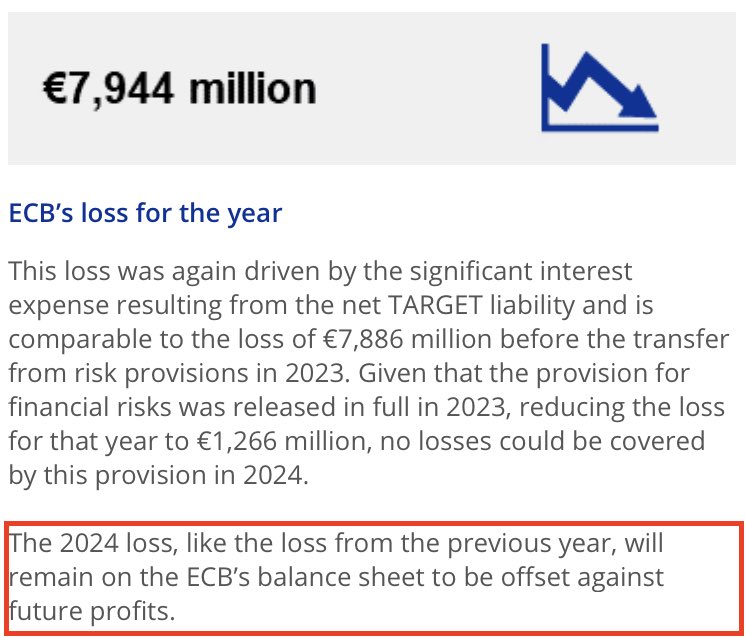

ECB says that the loss will remain on the balance sheet and will be offset by future profits

the loss happened because ECB spent more than earned. they did so by using cash, selling assets or increasing liabilities

the net effect is the same: reduction in equity

🇪🇺 ECB's "business model" is as follows:

➕ income: ECB creates money and invests it into financial assets (e.g.: FX, bonds, funds)

➖expenses, such as operational expanses (e.g. staff), facility and open market operation expenses (e.g. TARGET)

profit/loss = income - expenses

🇪🇺 ECB's "business model" is as follows:

➕ income: ECB creates money and invests it into financial assets (e.g.: FX, bonds, funds)

➖expenses, such as operational expanses (e.g. staff), facility and open market operation expenses (e.g. TARGET)

profit/loss = income - expenses

ECB recorded an €8 billion loss in 2024 - what happens in that case?

that's a balance sheet question. to understand what happens we need to look into the operational or "business" model of the European Central Bank

this is nothing unusual though - many governments do this, and it's mostly towards stabilizing the exchange rate with USD

to a large extent this is a result US dollar's reserve currency status and its dominance in use for all sorts of financial transactions

🇯🇵 Yen's exchange rate stabilization is a responsibility of the Minister of Finance (MoF)

MoF is also the holder of Japan's international reserves - not the Bank of Japan

so in Japan the government has significant responsibility for USD/JPY

and there it is - a new BTC all time high in Euro 🇪🇺🥳