⬇️ My Thoughts ⬇️

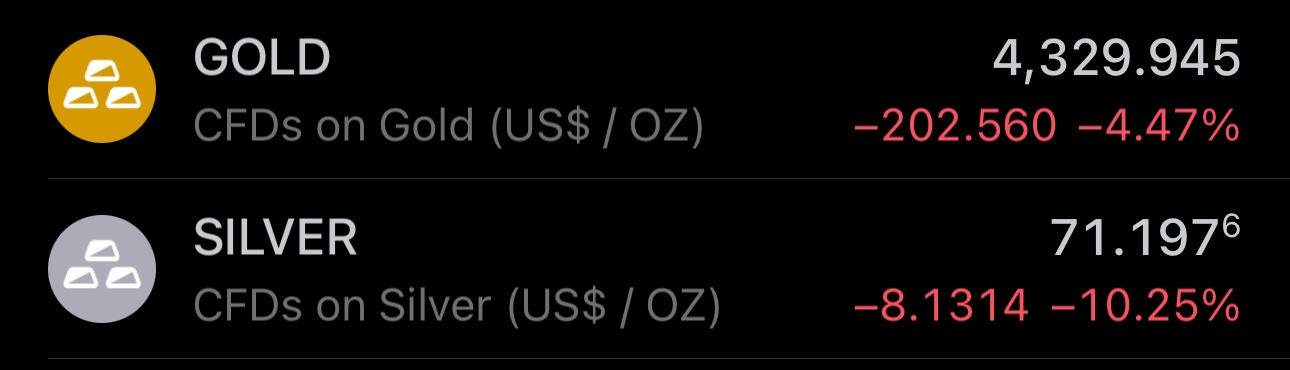

Today's gold, silver and their miners sell-off is a buying opportunity

Treat it as an early new year's gift for 2026 🥳

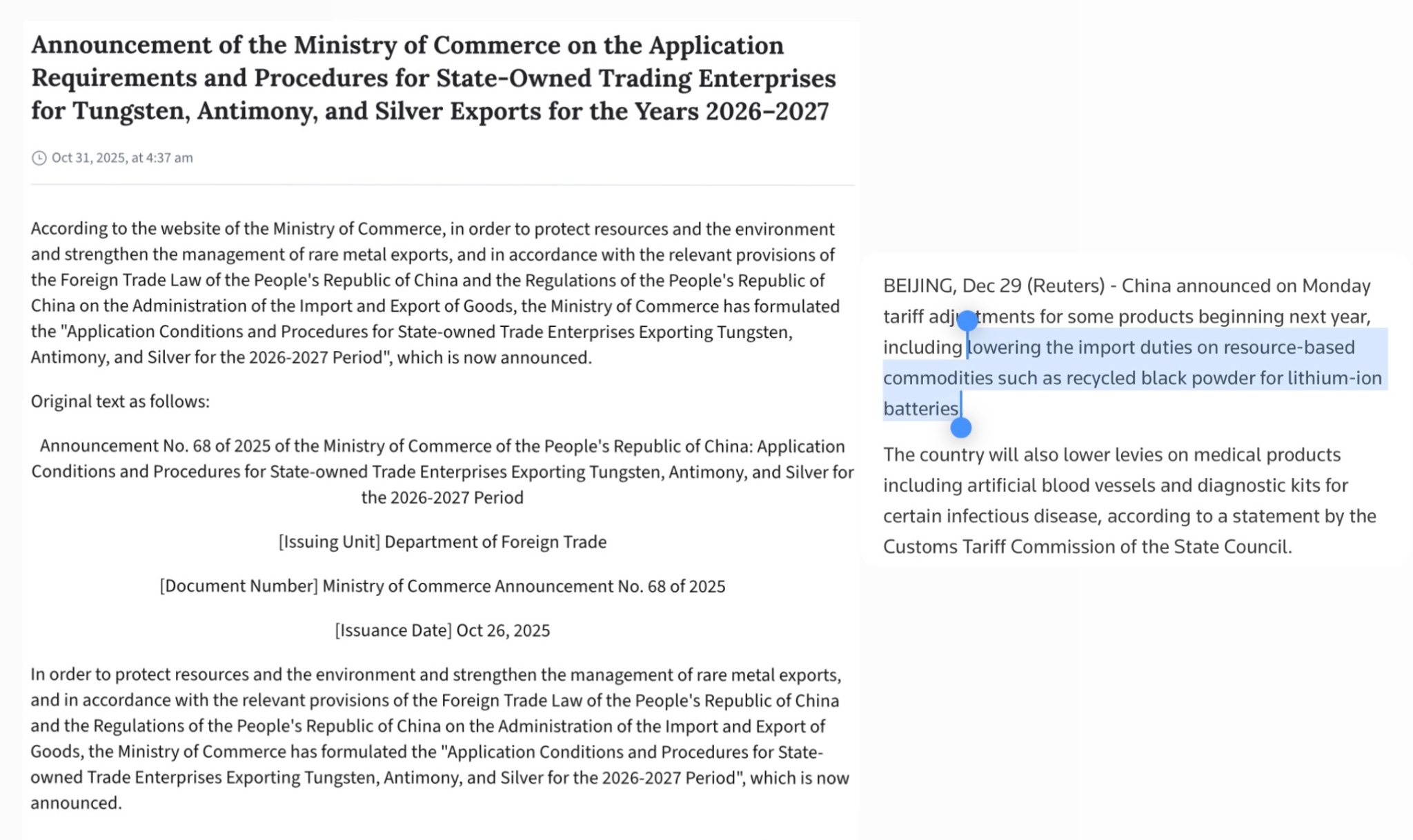

China Is Hoarding Commodities

While the U.S. is pumping a crypto & AI bubble, China is pumping their commodity reserves.

Not only PRC is limiting silver exports, but they're also lowering the cost of commodity-related imports.

The net result will be more positive commodity import/export ratio, i.e. more physical commodities within China, which will be used for strategic and industrial needs (China is the world's number one producer).

It also means that there will be less commodities available outside of PRC, and since the global demand won't decrease - that's further positive price pressure on the commodity sector.

I have been writing about gold, silver and other commodities for over 2 years. The same bullish narrative remains valid. These geopolitical developments provide further confirmation.

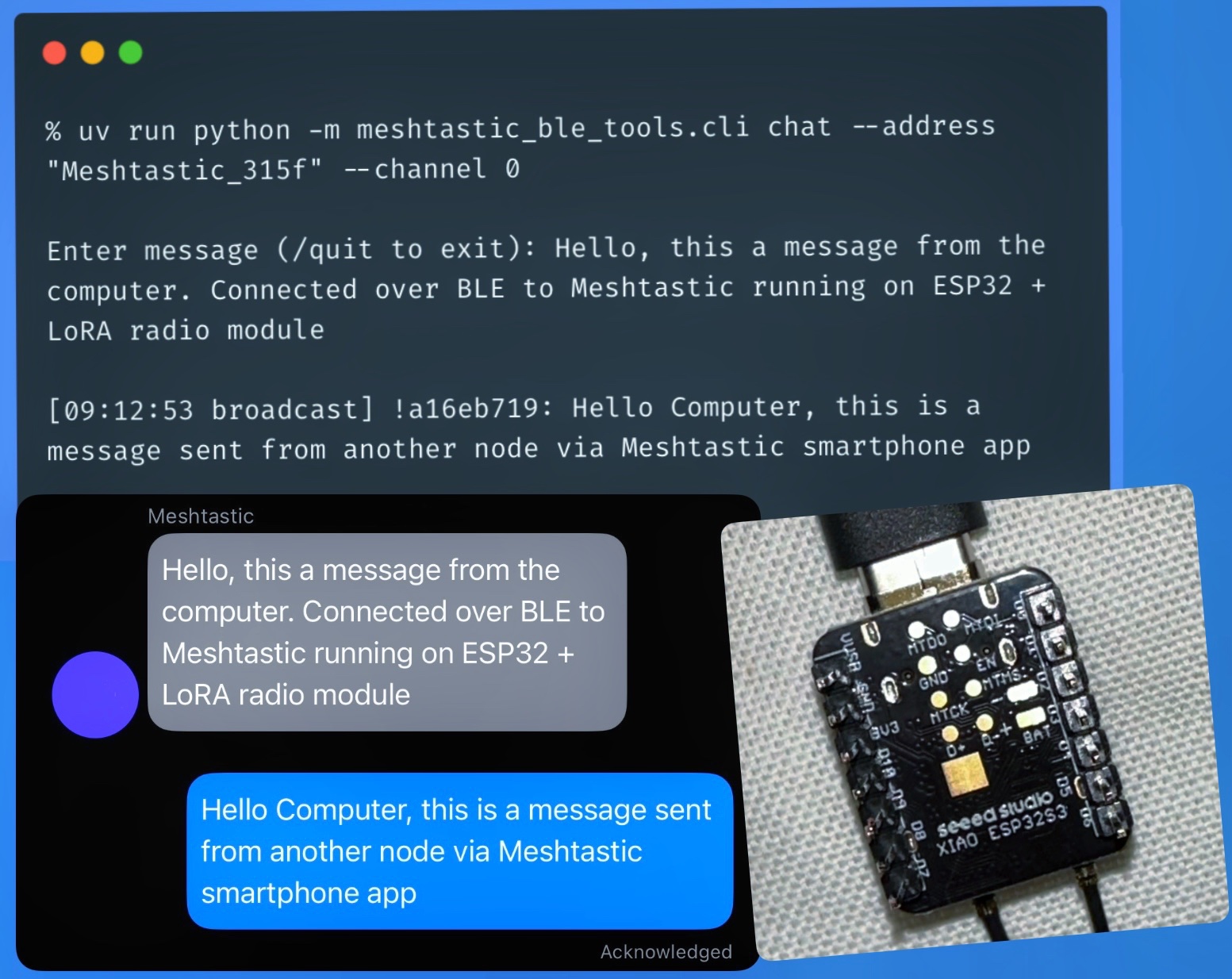

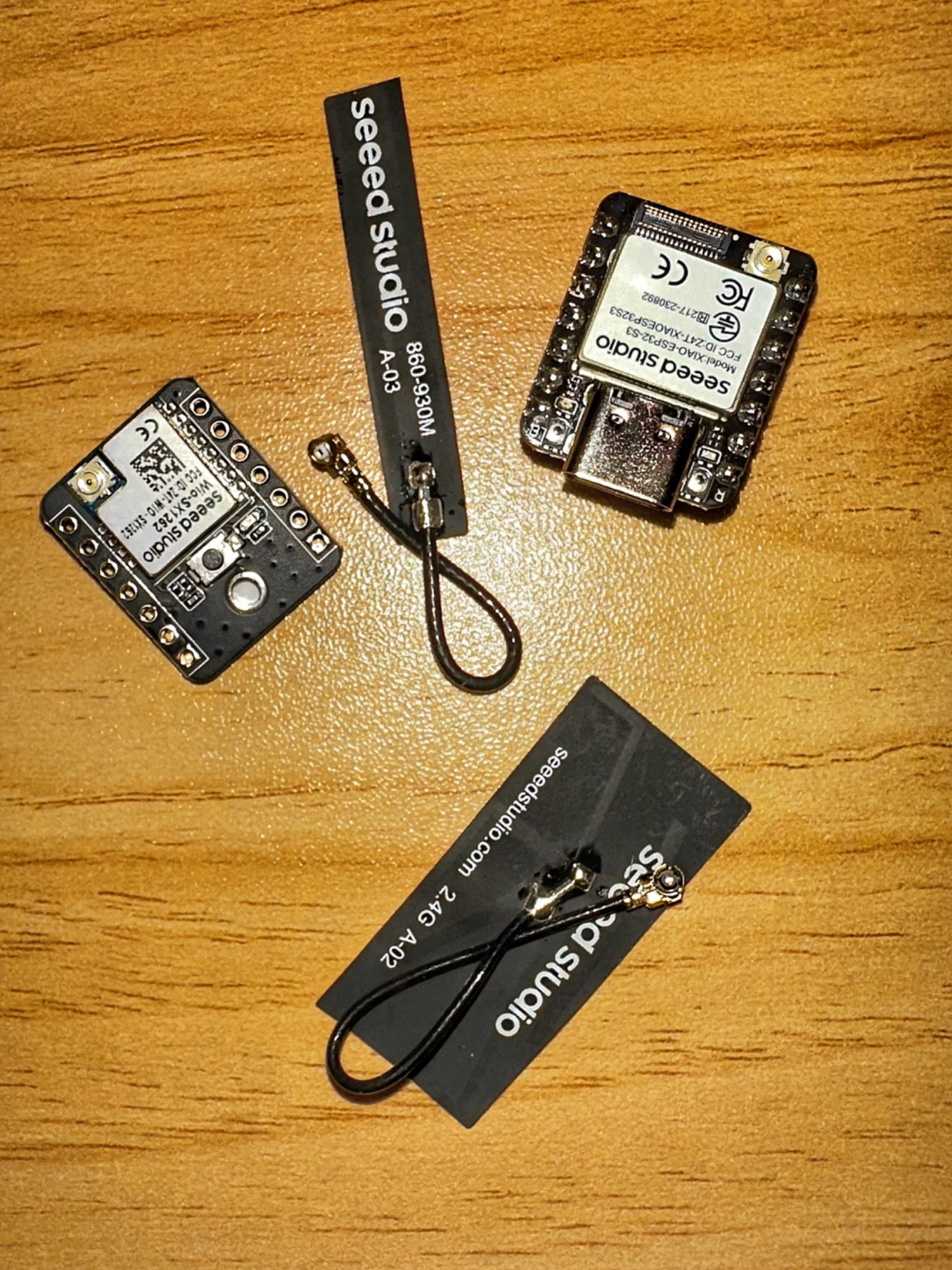

Laptop as a Meshtastic LoRa Node Using ESP32, BLE and Python

Meshtastic exposes a BLE interface and comes with a nice Python library. So I connected to the ESP32 with a LoRA module over bluetooth, and was able to send and receive messages from a Python script running on a laptop.

Essentially, the laptop uses the microcontroller as a proxy for the sub-GHz antenna (EU_868/≈868 MHz in Europe), enabling it to send and receive LoRa messages via Meshtastic's firmware. So effectively Bluetooth Low Energy is used as a proxy protocol for LoRa.

There were two nodes in the mesh - one connected to the laptop and another to a smartphone. Both nodes had the same channel name, Pre-Shared Key (PSK) and ordering (channel id) setup. The laptop node was using Python to connect to the mesh via BLE and exchange messages. The smartphone was connected to the other node, and the official Meshtastic app was used to send and receive messages.

The setup is as follows:

💻 Laptop (Python)

⇅ BLE

📡 Node A (ESP32 + LoRa)

≈≈≈ 868 MHz LoRa mesh ≈≈≈

📡 Node B (ESP32 + LoRa)

⇅ BLE

📱 Phone (Meshtastic app)

So you don't really need to program the ESP32 to make it a "smart" LoRa node. You can program all of the logic on your usual dev machine, and use BLE as a proxy for LoRa packets over Meshtastic. This is a great approach for iterative development, prototyping, proof of concepts and even final products. Of course, you can also put the smart node code on a Raspberry Pi, Arduino or even the microcontroller itself.

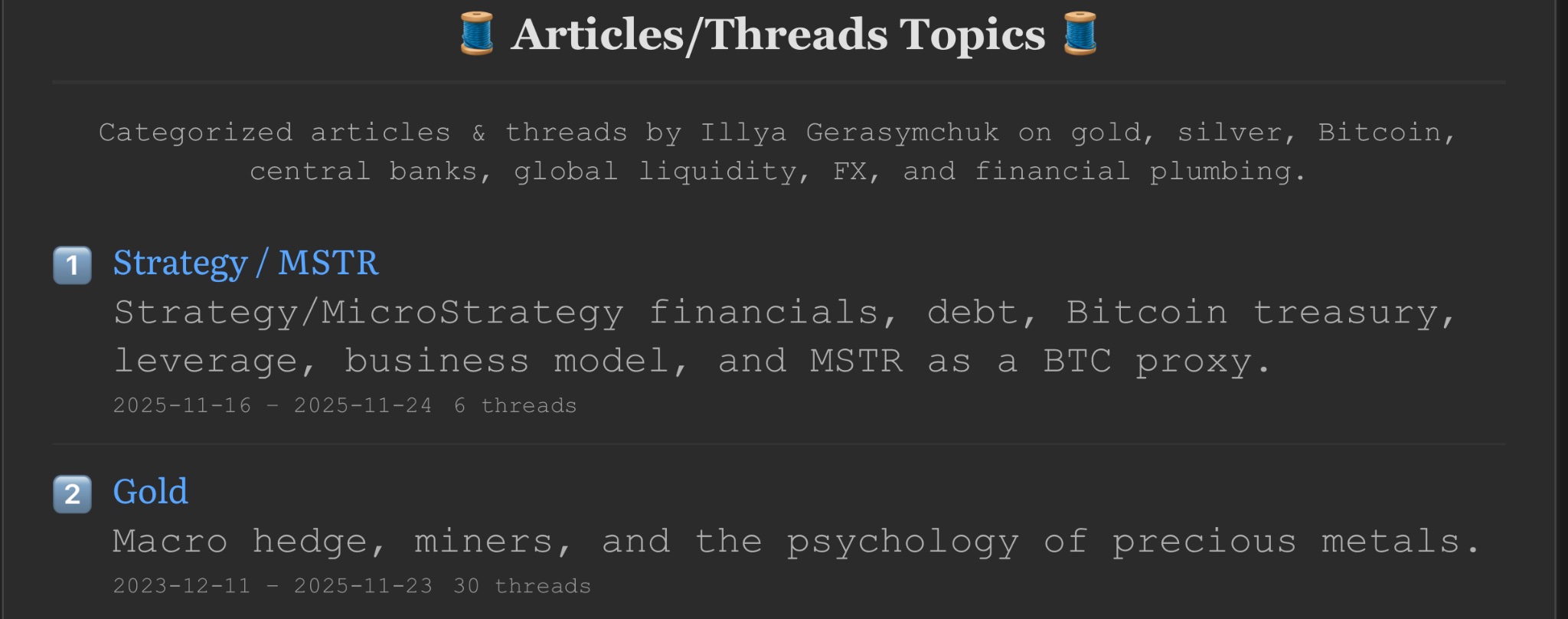

Added Semantic Categorization Via Embeddings To Articles/Threads On My Website

You can now filter my articles by topic at https://illya.sh/threads/topics/

Qwen3-Embedding-0.6B is used to vectorize and embed all of the articles/threads, which are then tagged/categorized based on natural language tags for the category.

This allows me to define a new category by defining a new Python class with the topic/category name, description, URL path, and the query sting to embed and query against the thread embeddings. From there, all of the content is generated statically.

Everything runs 100% locally/offline. Model weights are pre-downloaded once - that's the most time-consuming part.

The motivation for implementing this has to with the content's volume. I have written over 180 articles/threads, but until now there was no categorization. So if you wanted to read an article on a particular topic, you'd either have to google it, ask an LLM or go through the list manually yourself. Now, there is an index with topics, which help navigating the content semantically.

Navigate to https://t.co/bXb1JWKD4d, select a topic, and you will be presented paginated list of all threads/articles matching that topic.

A few months ago I wrote about LoRA meshes

So I got a pair of ESP32 devices with a LoRA radio module. They already came pre-flashed with Meshtastic

Took minutes to setup the mesh and send/receive messages.

In my tests, the range was Impressive for such a small device at ≈$10

Central Banks were more influenced by farming than you probably think

Historically interest, collateral, liquidity, inflation and monetary policies were shaped by the needs, risks and patterns of agricultural economies

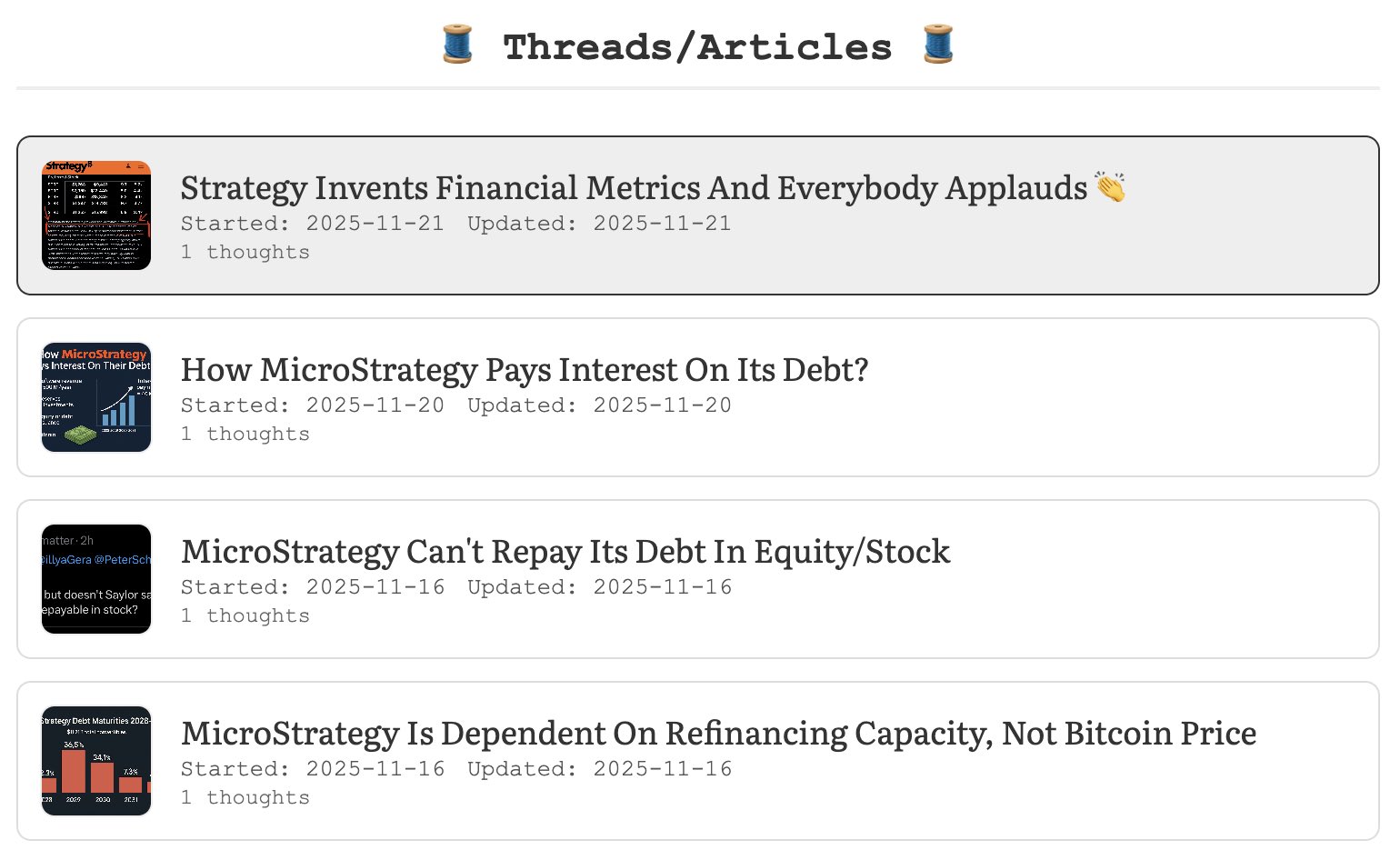

A Primer On Strategy/MSTR Business, Financials, Liquidity and Solvency

There's a lot of misinformation how Strategy/MicroStrategy operates, its business model and what MSTR can and can't do.

This served as a motivation for me to write 4 short, primer-style articles on MSTR:

1️⃣ MSTR’s business model, describing how the company operates as a "Bitcoin treasury" and what does it mean for its solvency. You can read it here: https://illya.sh/threads/microstrategy-is-dependent-on-refinancing-capacity-not

2️⃣ Why MicroStrategy can’t replay its debt using equity/stock. You can read it here: https://illya.sh/threads/microstrategy-cant-repay-its-debt-in-equity-stock

3️⃣ How Strategy pays for its interest, which currently accounts to ≈$40M/year. You can read it here: https://illya.sh/threads/how-microstrategy-pays-interest-on-its-debt

4️⃣ How Strategy's marketing is misleading regarding MSTR’s risk, liquidity and solvency. You can read it here: https://illya.sh/threads/strategy-invents-financial-metrics-and-everybody-applauds

I suggest reading them in the same order as above, but they're self-isolated. It's a short read, and together they will give you a good understanding on how Strategy operates (its business model), what are its main risks, what MSTR can and cannot do regarding debt repayments, and why you probably shouldn’t trust their marketing campaigns, including the statements made by Michael Saylor on X and various podcasts/videos where he appears.

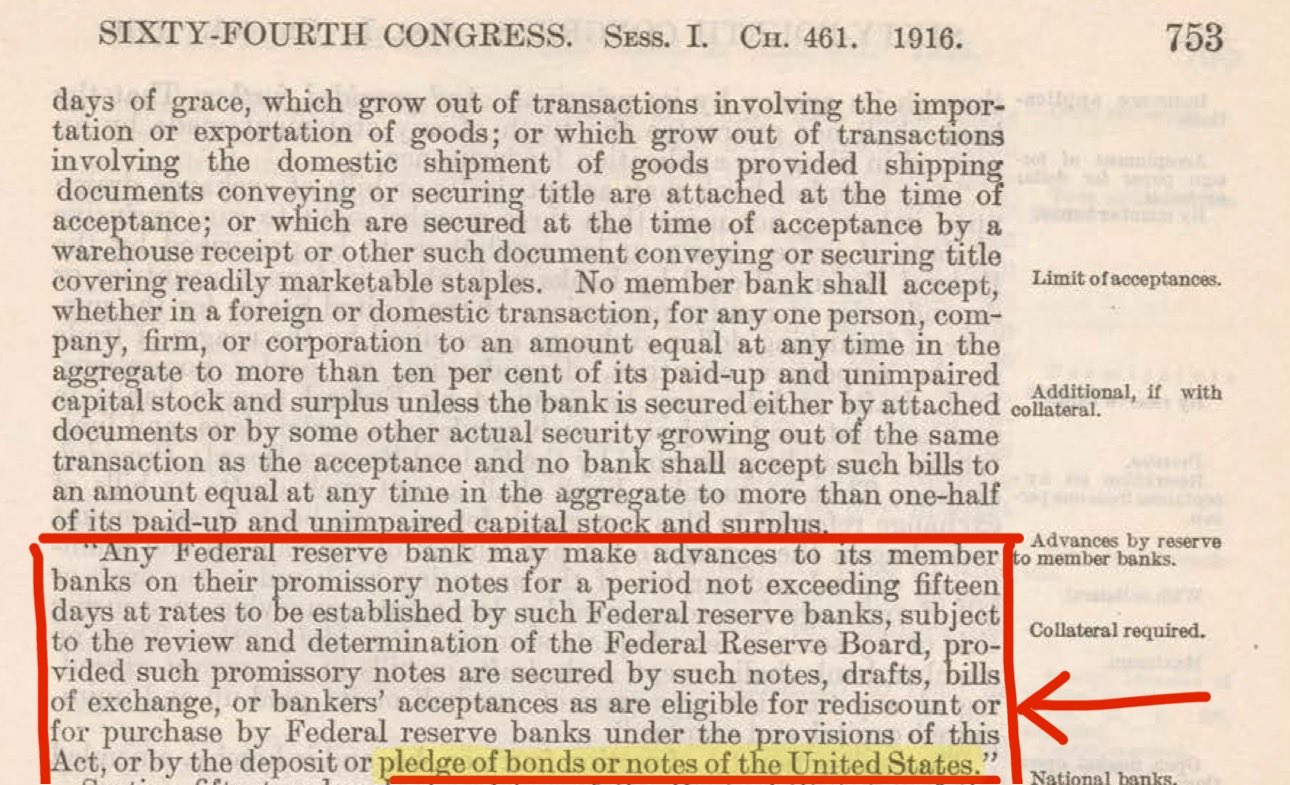

How the 1916 Fed Act Made Treasuries Prime Collateral

Before 1916, the Fed would only lend to banks against "eligible paper", which included self-liquidating commercial loans and agricultural loans.

The Federal Reserve Act 1916 amendment expanded the Fed's legal power to allow for lending to commercial banks against U.S. Treasuries (government bonds).

This effectively turned U.S. government debt into collateral backing Fed's liabilities. This paved the way for the U.S. Treasuries to become the most used form of collateral in short-term wholesale debt markets (e.g. repo/repurchase agreements) today.

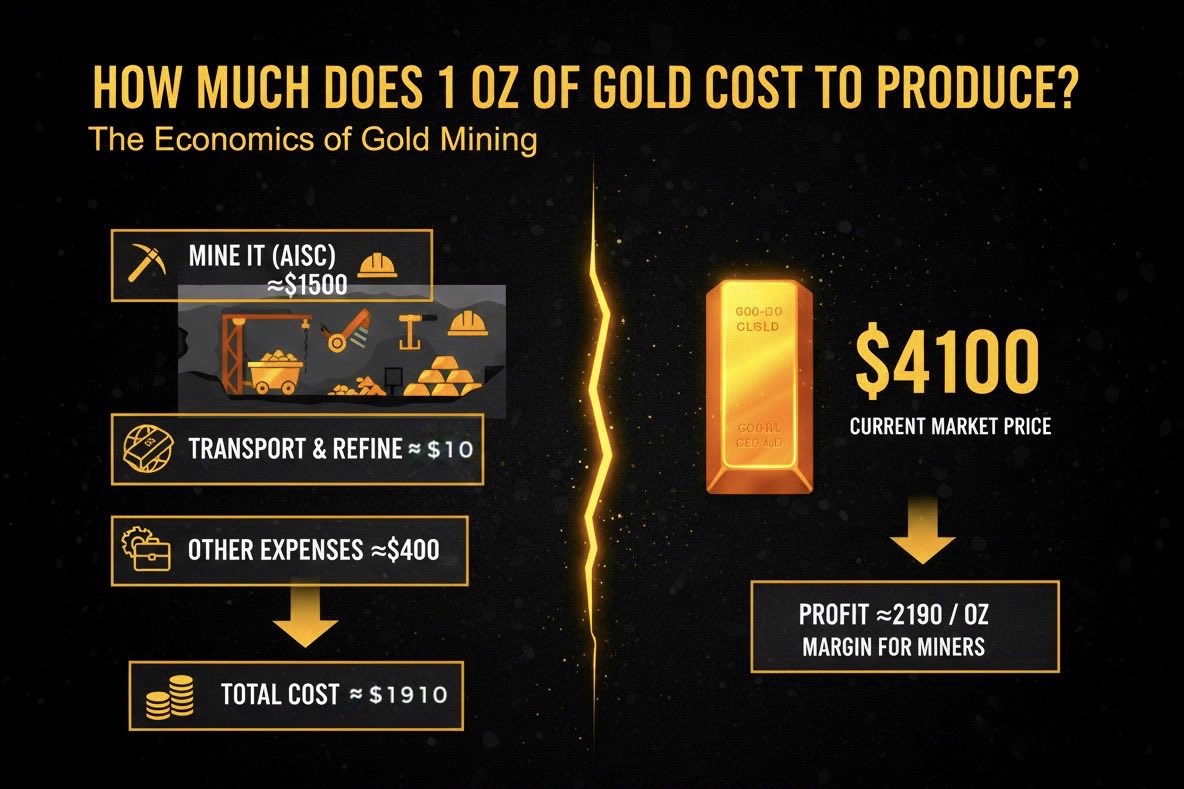

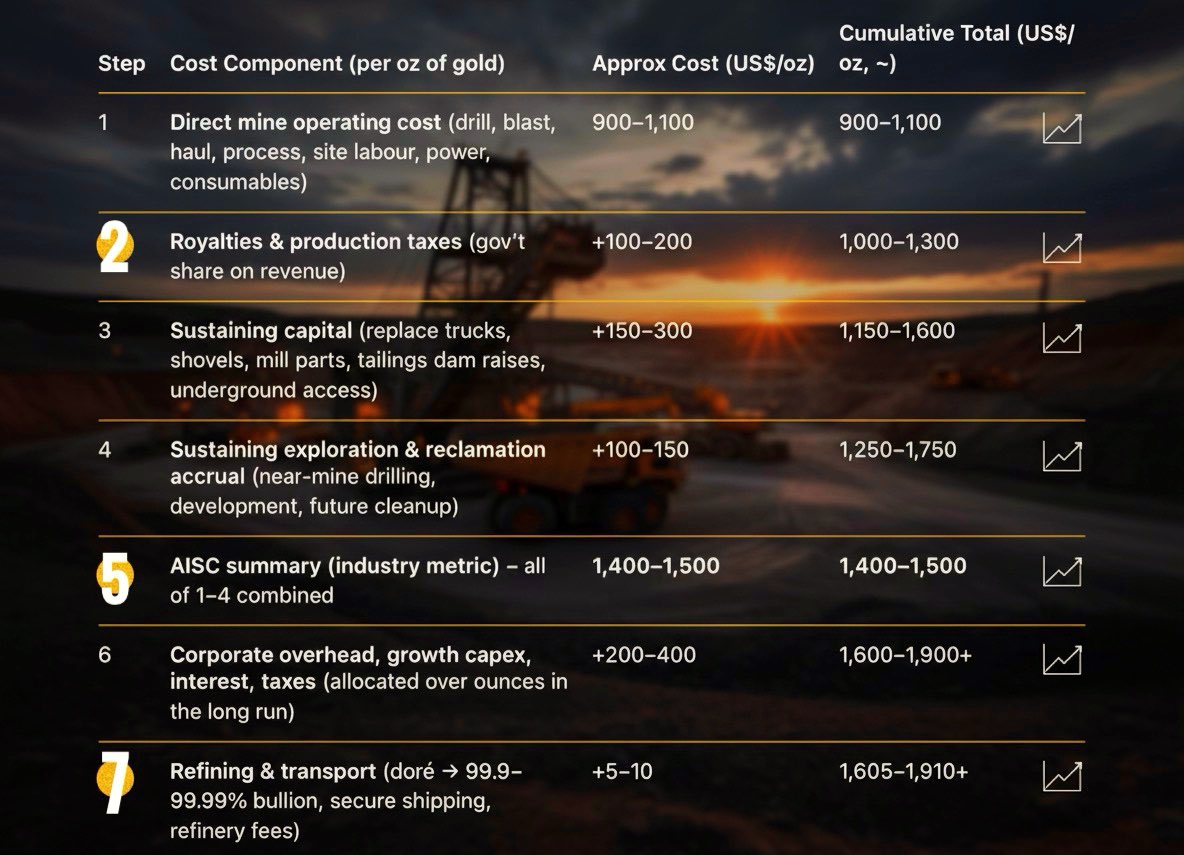

1 oz of Gold: Production Cost and Miner Profit

1 oz of gold costs ≈$1500 to mine (AISC), ≈10$ to transport and refine and another ≈$400 in various other expenses.

In total, that sums to about ≈$1910 to get 1 ounce of gold from the ground to bullion gold bar.

Currently, gold trades at ≈$4100/oz (when you're reading this it's probably much higher 😄). This means there is about $4100-$1910=$2190 of margin on each ounce of refined gold. Almost all of this margin on the sale of an ounce of gold is pocketed by gold miners.

Let's compute the profit per ounce of gold from the perspective of a miner. Gold miners generally sell gold to refineries at a fixed haircut over the spot price. This haircut is generally very small, ≈$10 which accounts mainly for refining and treatment costs. So with the numbers above (also see attached image), gold miners are making a profit of $4100-$(1500+400+10)=$2190 (the same number we computed above).

The larger the premium/gap of gold's spot price over its production costs, the larger is the profit for the miners. As the cost of labor and industrial production increases due to global monetary debasement, so will gold production costs. The same monetary debasement, combined with strong demand for gold will push its price further up.

In the next 2-3 years, I expect gold price to increase by a larger proportion than gold mining costs, as gold is under several positive price pressure points (central banks, USD alternatives, monetary debasement, etc). Thus, the margin over mining costs should remain high, leading to a sustained high profit per ounce of gold for miners.

This is why gold mining stocks are currently a great investment. The same is true for other miners, such as silver.

1 oz of Bullion Gold Costs ≈$1910 to Produce

Gold's current spot price is ≈$4100. There's a ≈$2190 price gap between what gold costs to buy and what it costs to mine & refine.

The majority of that $2190 profit per 1 ounce of gold goes to the miners. Gold refiners earn just a few dollars per ounce in profit.

This is why mining stocks are currently such a good investment idea.

Updated OpenGraph Images On Thoughts & Threads At My Website

Before the OG image was always a "screenshot" of the starting text. Now, if the post or article has an attached image (most of them do), it gets used instead.

Here's an example:

https://illya.sh/threads/how-microstrategy-pays-interest-on-its-debt

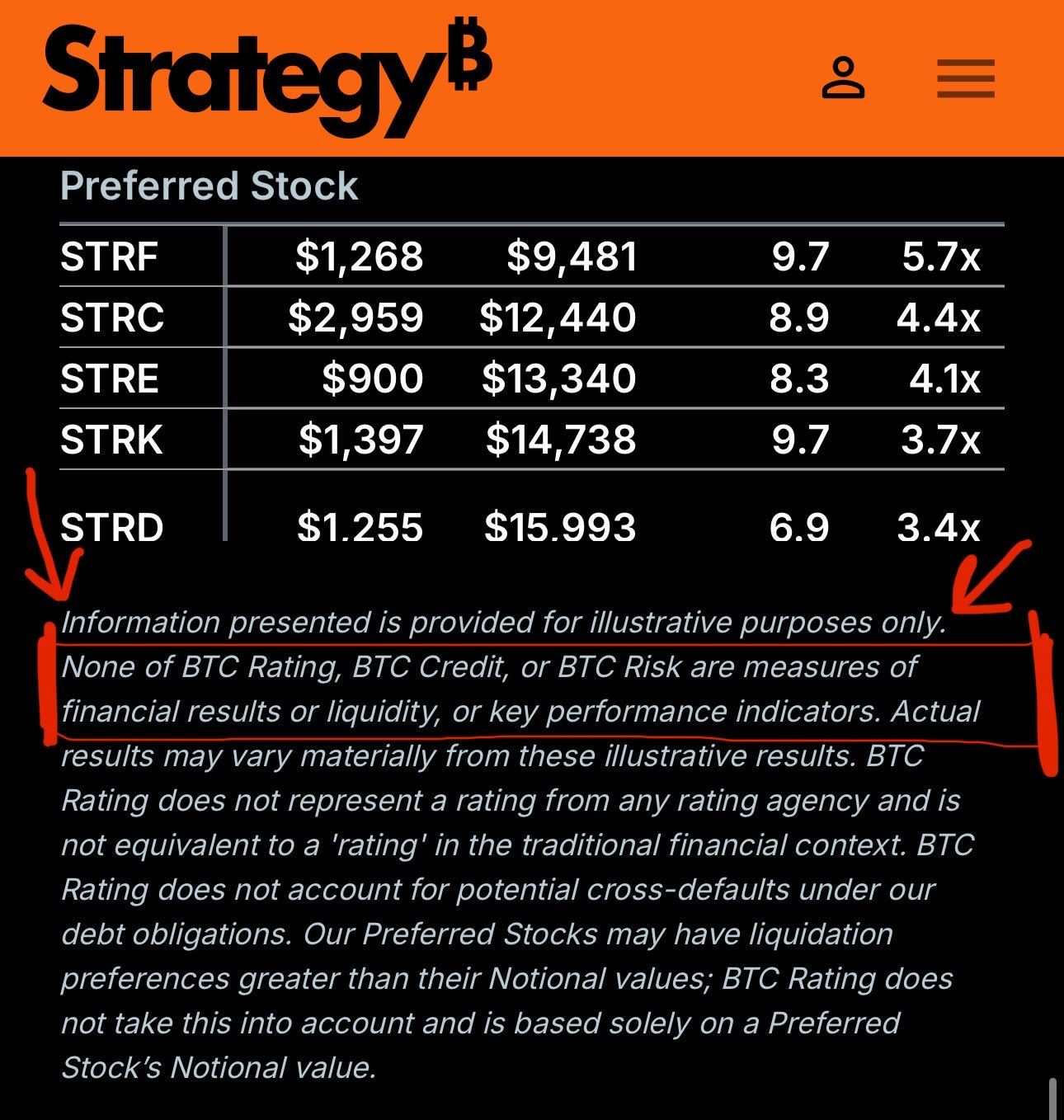

Strategy Invents Financial Metrics And Everybody Applauds 👏

MSTR's own website states that their reports do not reflect the financial reality:

"None of BTC Rating, BTC Credit, or BTC Risk are measures of financial results or liquidity, or key performance indicators."

Strategy's software business also operates at a ≈$60M loss, but on their website and socials they decide to ignore a part of expenses and market it as profit. So they create their own non-standard accounting and credit metrics and advertise those.

Strategy has a consistent pattern of misrepresenting their financials to look more favorable in their public marketing campaigns. A lot of it is in the form of Michael Saylor's videos, podcast appearances and posts on X. A lot seem to think that just because someone says something in a video or a social media post it must be true.

Words can be deceiving, numbers not so much.

In Net Terms, Bitcoin is a Geopolitical Liability, Not an Asset

This is because Bitcoin is vulnerable to attacks targeting its consensus and network availability. A sufficiently resourceful adversary can yield the Bitcoin network inoperable and/or untrustable

A nation state adversary can take the Bitcoin network down, at least a significant portion of it. And it doesn't require them having access to quantum computers or compromising the underlying cryptographic primitives in other manner.

This is why sovereign strategic Bitcoin reserves, including BTC as a Central Bank reserve asset is not a good idea, at least in the current state and design of the Bitcoin protocol.

How MicroStrategy Pays Interest On Its Debt?

The short answer is that MSTR finances its debt service via a mixture of:

➖ Software business cashflow

➖ Existing reserves & short-term investments

➖ Capital market instruments, such as issuing new equity or debt

➖ Asset liquidation (Bitcoin sales)

MSTR's annual coupon payments sum up to ≈$34.6M/year. Currently, virtually all of MSTR's financial debt is in convertible bonds/senior notes. Those bonds come with small coupons, so relatively small interest payments.

More specifically, here is how MicroStrategy's/Strategy's outstanding outstanding convertible bond maturity, principal, coupon rate and total yearly interest look like:

2028 | $1.01B @ 0.625% | $6.3M

2029 | $3.0B @ 0% | $0M

2030A | $0.8B @ 0.625% | $5M

2030B | $2.0B @ 0% | $0M

2031 | $0.604B @ 0.875% | $5.3M

2032 | $0.8B @ 2.25% | $18M

(Format: <year> | <principal> @ <coupon> | <anual interest>)

If you sum up the interest payments you’ll get ≈$34.6M/year in total.

The yearly revenue of MSTR's software services business is almost ≈$500M/year. However, their software portion of the business actually operates at ≈60M/year loss, when using U.S. Generally Accepted Accounting Principles (GAAP).

Strategy advertises their software portion of the business as being in profit, but they "manipulate" those numbers a little. This "manipulation" involves MSTR not counting stock-based compensation as expenses.

So when you hear Strategy advertising profit from their software business - they're not using a legally recognized and standardized measure of profit (in the U.S. it's GAAP). So they take the GAAP software profit and then add some things back at their discretion (i.e. they don't count some expenses), thus turning a negative profit (loss) into a positive one.

This means that while their software business revenue can help them with having liquidity for interest payments - it doesn't cover those costs (since they operate at loss, it actually increases the total cost!).

Thus, Strategy finances their interest rate payments with a mixture of:

➖ Existing reserves & short-term investments

➖ Capital market instruments, such as issuing new equity or debt (main source)

➖ Asset liquidation

The software revenue provides significant cashflow (compared to interest rate costs), so it can help with having cash readily available to make an interest payment (liquidity), but it doesn't effectively cover them, thus requiring financing from other sources.

Strategy (MSTR) pays interest on its debt via a mixture of capital markets, software business cashflow, existing reserves & investments and Bitcoin sales.

MSTR's annual coupon payments are not that high - ≈$40M/year. The convertible bonds that they issue come with small coupons (e.g. 0%, 0.625%, %0.875, 2.25%)

Given MSTR's software business revenue of ≈$500M/year, but it actually operates at a ≈$60M loss after expenses are accounted for.

So effectively, strategy pays interest expenses from the same corporate funds bucket that they rase to purchase Bitcoin in capital markets.

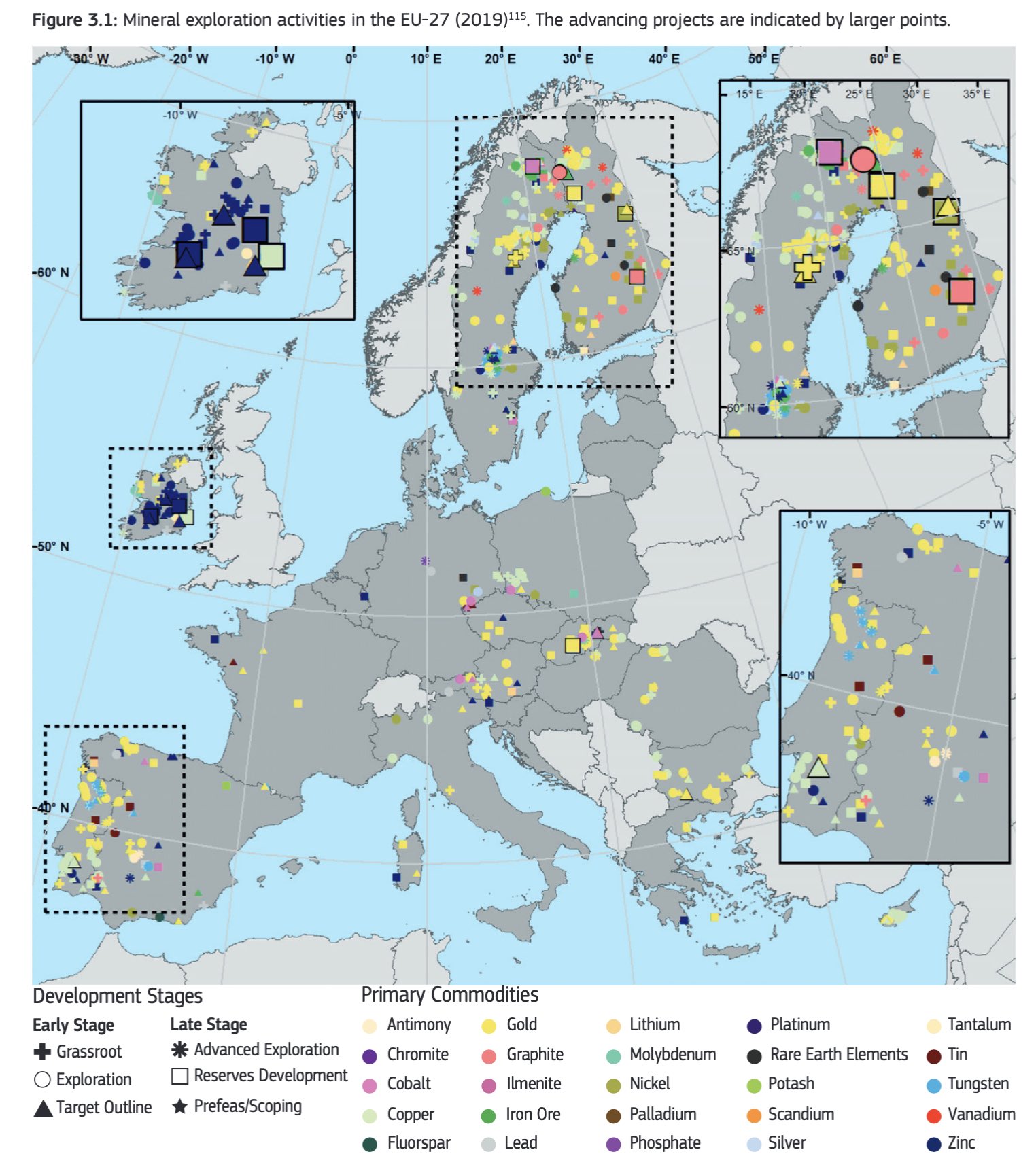

Europe's Gold Imports and Exports Explained

Europe has gold mines in Finland, Sweden, Türkiye and Romania among others.

Together they account for <2% of world output (≈70 tones of gold/year). Europe is heavily dependent on gold imports, with >90% of the gold for its needs being imported.

Switzerland is the world's largest gold refining and transit hub, with at least ≈50% of all of the newly minted gold passing through Swiss refineries. Refining and re-exporting is by far the largest driver of European gold imports.

Europe imports ≈3900 tones of gold per year, but only keeps 10% of it.

MicroStrategy Can't Repay Its Debt In Equity/Stock

Most of MicroStrategy's debt is in the form of convertible bonds, meaning that by default the principal and the coupons get repaid the cash.

The "convertible" part means the bondholder can choose to convert the bond into shares/equity instead, and then MSTR chooses how settle the conversion of the bond's value in cash, equity or mix.

So MSTR cannot force the debt settlement/repayment in stock/equity - that's simply an option that the bondholders/investors have.

The repayment can always be in cash assuming that MSTR is solvent, as most of the debt is unsecured, meaning that there is no specific collateral pledged against that debt. In case of insolvency, unsecured debt holders are treated as general creditors of the company, and are repaid out of the remaining assets only after secured debt holders are repaid, but before equity holders.

MicroStrategy Is Dependent On Refinancing Capacity, Not Bitcoin Price

MSTR won't have to sell Bitcoin if BTC price goes down, they'll have to sell Bitcoin if they're unable to acquire funding along the maturity of their debt wall.

MicroStrategy is essentially a leveraged trade on Bitcoin, based on the following cycle:

1️⃣ Acquire funding via debt or equity

2️⃣ Buy Bitcoin

3️⃣ Repeat

This cycle works for as long as MSTR is able to obtain funding. Once funding becomes unavailable (i.e. market isn't willing to lend at favorable interest rates), funding must come from asset liquidation (i.e. the sale of Bitcoin).

The availability of funding is mostly dependent on Bitcoin's price. As long as Bitcoin price and trend is favorable around the dates when the debt wall matures - MSTR should be able to continue their leveraged trade. MSTR share price vs Bitcoin NAV is also important. If MSTR trades a premium over Bitcoin's NAV it allows Microstrategy to short their own equity and long Bitcoin.

However, an unfavorable Bitcoin price action environment (e.g. during a bear market) that coincides with debt repayment obligations may trigger the unwinding of this leveraged position, forcing MSTR to sell Bitcoin, thus putting further downwards price pressure on Bitcoin, which lowers Microstrategy's equity even more, which makes lender even less likely to lend. The end result is an even more degraded funding capacity, which at the limit leads to bankruptcy.

Debt starts maturing from 2028 (≈$1B), but the most significant portion of ≈70%/$5.8B matures in 2029-2030. This is where the price of Bitcoin is of great importance for Microstrategy's solvency.

So don't expect Microstrategy to have pressure to sell significant amounts of Bitcoin before at least 2027, even if the Bitcoin price stays low.

Just wait until Bitcoin hype accounts find out that Czechia has not adapted the Euro, so it's not a part of the Eurozone.

Thus, the Czech National Bank (CNB) is a part of European System of Central Banks (ESCB), but not a full Eurosystem central bank, so it's not represented in and not bound by the ECB Governing Council's monetary policy decisions.

No Eurozone National Central Bank (NCB) is holding Bitcoin in their reserves, and ECB's current policy rejects the idea of BTC as a reserve asset.

Watch what they do, not what Bitcoin hype media says.

In my post ranking gold as a percentage of central bank balance sheet size I wrote renminbi/yen, when I meant renminbi/yuan

Yen is, of course, the Japanese, not PRC's local currency. I will correct this under threads & thoughts on my website, but it will remain with this typo on X (you can't update the post after 1 hour)

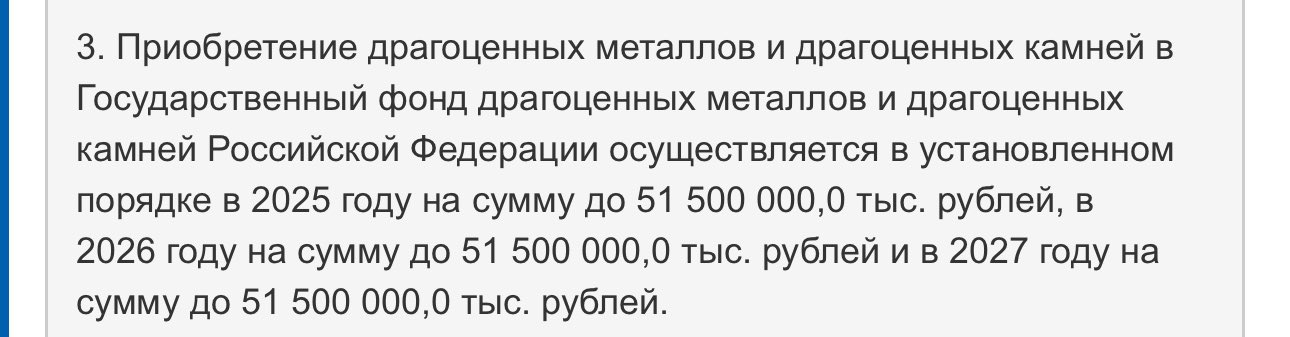

Russia will buy Silver as a strategic reserve until 2027

I'm not speculating on anything, this comes directly from the Russian legislation, namely the Federal Law № 419-ФЗ (in Russian/cyrilic: Федеральный закон от 30 ноября 2024 г. № 419-ФЗ) whose budget tables for 2025–2027 allocate ≈51.5 billion rubles (≈$640M) per year as budget for the "acquisition of state reserves of precious metals and precious stones".

Silver falls explicitly under the definition of "precious metals". More specifically, under Russian framework law № 41-ФЗ the term "precious metals" ("драгоценные металлы") is explicitly defined as gold, silver, platinum and the metals of the platinum group.

In addition to the above, in the official explanatory note (пояснительная записка) to the draft of Federal Law № 419-ФЗ the Russian Ministry of Finance explicitly states that the plan is to acquire refined gold, refined silver, refined platinum and refined palladium for strategic goals. More specifically, the aim is to increase the share of "highly liquid valuables" in the State Fund of Precious Metals and Precious Stones of the Russian Federation (Госфонд России).

You can read the article here: https://illya.sh/threads/how-does-the-federal-reserve-set-interest-rates

In July I wrote a primer on the mechanics by which the Fed steers the prevailing interest rates in the economy.

It covers the ON RRP, IORB, Discount Rate and SRF channels, explaining how together they set a corridor with upper and lower limits for the effective rate.

Prior to today the article reading experience was subpar, due to the amount of supporting images - the thread is composed of several shorter posts, and each one came with an image.

I've made it a lot more readable by removing most of the images

This is how The Soviet Union kickstarted Eurodollar markets in the 1950's

Eurodollars are USD deposits held at banks outside the U.S. Originally, they were held mostly in European jurisdictions, thus the "Euro" in the name.

URSS needed U.S. dollars for international trade, but they didn't trust keeping balances directly in New York, as they feared that U.S. would freeze or seize those deposits.

So URSS placed their USD deposits in European banks, often via Soviet-linked banks. Those European banks then re-deposited or lent out those dollars to other banks and institutions.

I've written extensively how the policies of the current U.S. administration are a negative for the USD. Asian countries have been progressively moving away from USD, and this is a sign from Europe in that direction (but don't expect heavy de-dollarization in the near future).

Overall, I view this as a net positive for the sovereignty of EU/Europe as a whole. A more developed financial system infrastructure is crucial for attracting the use of Euro, which is already the 2nd most used currency in the world.

As I've written earlier today, Silver will encounter corrections

These are all buying opportunities - as is the whole price range within current larger pullback. The price bottoms I written about remain unchanged. The uptrend will resume

The same is true for gold

In July I wrote a primer on the mechanics by which the Fed steers the prevailing interest rates in the economy.

It covers the ON RRP, IORB, Discount Rate and SRF channels, explaining how together they set a corridor with upper and lower limits for the effective rate.

Prior to today the article reading experience was subpar, due to the amount of supporting images - the thread is composed of several shorter posts, and each one came with an image.

I've made it a lot more readable by removing most of the images